Key Insights

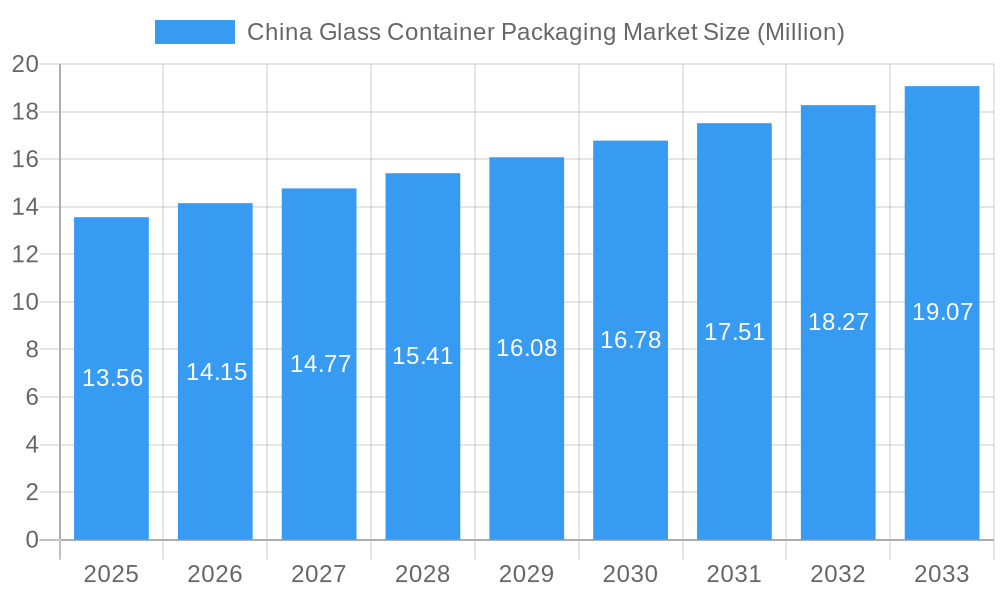

The China Glass Container Packaging Market is experiencing robust growth, projected to reach USD 13.56 million by 2025 and continue its upward trajectory with a Compound Annual Growth Rate (CAGR) of 4.46% through 2033. This expansion is primarily fueled by the increasing demand across key end-user verticals, most notably the Food and Beverages sector, which benefits from China's vast consumer base and growing disposable incomes. The Pharmaceutical industry also presents a significant driver, owing to stringent packaging requirements for medication and a burgeoning healthcare sector. Furthermore, the Cosmetics segment is witnessing heightened demand for premium and aesthetically appealing glass packaging, reflecting evolving consumer preferences for sustainable and high-quality products. The "Other End User Verticals" category likely encompasses a diverse range of applications, from home décor to specialty industrial uses, contributing to the overall market dynamism.

China Glass Container Packaging Market Market Size (In Million)

While the market enjoys substantial growth, certain factors could influence its pace. Key drivers include the increasing emphasis on sustainability and recyclability, with glass emerging as a preferred eco-friendly packaging material. The ongoing modernization of China's manufacturing capabilities and a focus on product differentiation by brands are also pushing the adoption of innovative glass container designs. However, potential restraints might include fluctuating raw material costs for glass production and competition from alternative packaging materials such as plastic and metal, especially in cost-sensitive segments. Despite these challenges, the strong underlying demand from major industries and a consumer shift towards premium and sustainable options position the China Glass Container Packaging Market for sustained and significant growth in the coming years.

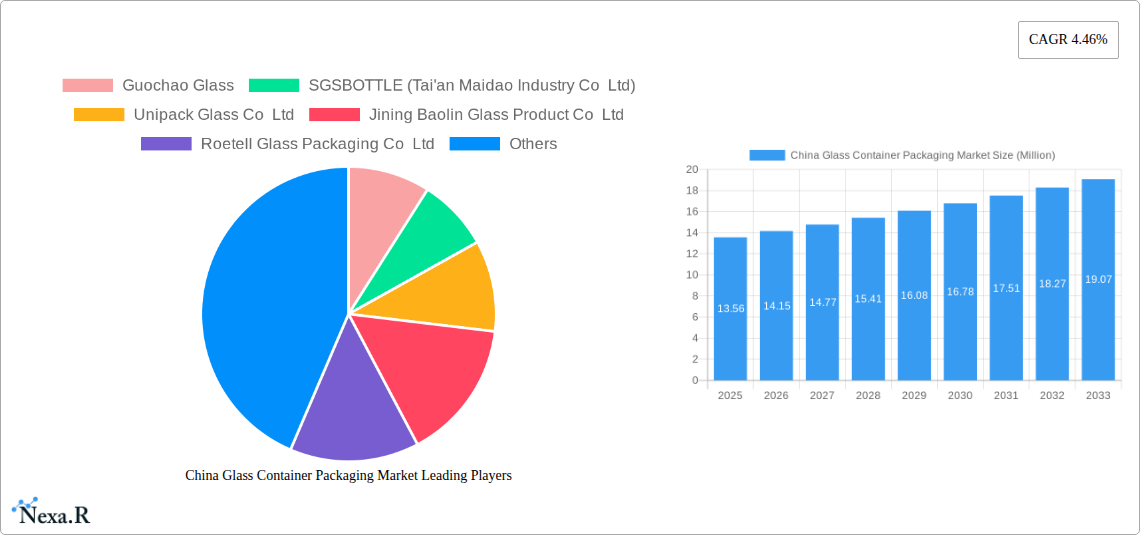

China Glass Container Packaging Market Company Market Share

Unveiling the China Glass Container Packaging Market: A Comprehensive Report

Unlock the immense potential of the China Glass Container Packaging Market with this in-depth analysis. Covering a comprehensive study period from 2019 to 2033, with a base year of 2025, this report delves into market dynamics, growth trends, dominant segments, product landscape, key drivers, emerging opportunities, and leading players. Utilizing high-traffic keywords like "China glass packaging," "glass bottles China," "pharmaceutical glass containers," "cosmetic glass packaging," and "food and beverage glass bottles," this SEO-optimized report is designed to maximize visibility and engage industry professionals. Discover the intricate details of this rapidly evolving market, including quantitative insights, qualitative factors, and detailed forecasts, all presented in a clear, concise, and actionable format. This report focuses on the parent market of Glass Container Packaging in China and explores its child markets such as Food Glass Container Packaging, Beverage Glass Container Packaging, Pharmaceutical Glass Container Packaging, Cosmetics Glass Container Packaging, and Other End User Verticals. All values are presented in Million units.

China Glass Container Packaging Market Dynamics & Structure

The China glass container packaging market is characterized by a moderately consolidated structure, with a blend of large established manufacturers and a significant number of smaller, regional players. Technological innovation is primarily driven by advancements in manufacturing efficiency, automation, and the development of specialized glass formulations to meet evolving end-user demands, particularly for barrier properties and aesthetic appeal. The regulatory framework, while evolving, emphasizes product safety, environmental sustainability, and quality control standards. Competitive product substitutes, such as plastic, metal, and carton packaging, exert pressure on the market, necessitating continuous innovation and cost-competitiveness from glass container manufacturers. End-user demographics, driven by China's burgeoning middle class and increasing disposable income, are key influencers, demanding premium and safe packaging solutions. Mergers and acquisitions (M&A) trends, while not overtly dominant, are observed as companies seek to expand production capacity, enhance technological capabilities, or gain market share.

- Market Concentration: Moderate, with top players holding an estimated 30-40% market share.

- Technological Innovation Drivers: Automation in glass manufacturing, energy-efficient production processes, advanced coating technologies for enhanced barrier properties, and decorative techniques for premium appeal.

- Regulatory Frameworks: GB standards for food and drug safety, environmental protection laws related to industrial waste and emissions.

- Competitive Product Substitutes: Plastic bottles (PET, HDPE), aluminum cans, cartons, and flexible packaging.

- End-User Demographics: Growing demand for premium food & beverage, pharmaceutical, and cosmetic products among a young, urbanized population.

- M&A Trends: Strategic acquisitions for capacity expansion and technology integration; xx number of significant M&A deals observed in the historical period.

China Glass Container Packaging Market Growth Trends & Insights

The China glass container packaging market is poised for robust growth, driven by a confluence of factors including increasing domestic consumption, a rising preference for sustainable packaging, and the premium perception associated with glass. The market size is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 5-7% from 2025 to 2033. Adoption rates of glass packaging are steadily increasing across various end-user verticals, spurred by enhanced product preservation capabilities and consumer trust in glass as a safe and inert material. Technological disruptions are focusing on lightweighting glass containers, improving their shatter resistance, and developing eco-friendly manufacturing processes to reduce carbon footprints. Consumer behavior shifts are prominently displaying a preference for aesthetically pleasing, high-quality packaging that conveys product integrity and brand value. This is particularly evident in the premium food, beverage, and cosmetic segments.

The Food Glass Container Packaging Market is a significant contributor, driven by the demand for preserved foods, sauces, jams, and condiments. The Beverage Glass Container Packaging Market is experiencing sustained growth due to the popularity of beer, wine, spirits, and functional beverages, with consumers increasingly valuing the taste and freshness preservation offered by glass. The Pharmaceutical Glass Container Packaging Market is expanding due to stringent regulatory requirements for drug safety and stability, making glass the preferred choice for vials, ampoules, and syrup bottles. The Cosmetic Glass Container Packaging Market is witnessing a surge driven by the demand for luxury and natural beauty products, where the elegance and perceived purity of glass enhance brand image. The "Other End User Verticals" segment, encompassing sectors like household chemicals and personal care, also contributes to the overall market expansion.

Specific metrics highlight this growth trajectory. The market size in the base year (2025) is estimated to be xx Million units, with a projected increase to over xx Million units by 2033. Market penetration of glass packaging in key segments is expected to rise, with pharmaceuticals and premium beverages leading the adoption curve. Technological advancements in glass production, such as increased use of recycled glass (cullet) and energy-efficient furnaces, are contributing to a more sustainable and cost-effective market. Consumer awareness regarding the recyclability and inert nature of glass is further bolstering its demand over less environmentally friendly alternatives.

Dominant Regions, Countries, or Segments in China Glass Container Packaging Market

The Beverage Glass Container Packaging Market stands out as a dominant and high-growth segment within the broader China glass container packaging landscape. This dominance is propelled by a confluence of economic policies, robust infrastructure development, and evolving consumer preferences. China's vast population and increasing disposable income have fueled a significant surge in demand for alcoholic beverages, including beer, wine, and spirits, as well as a growing market for non-alcoholic beverages like premium juices, functional drinks, and specialty teas, all of which heavily rely on glass packaging for their perceived quality and freshness.

Key drivers contributing to the beverage segment's leadership include government initiatives promoting domestic consumption and the growth of the middle class, leading to increased purchasing power for premium and specialty beverages. The infrastructure for beverage production, distribution, and retail is well-established across major economic hubs, facilitating the widespread availability of bottled beverages. Furthermore, consumer behavior plays a crucial role; there is a strong cultural association of glass with purity, quality, and a superior drinking experience, particularly for traditional Chinese spirits and imported wines. The aesthetic appeal of glass bottles also contributes to brand positioning and shelf appeal in a competitive market.

In terms of market share, the beverage segment is estimated to hold approximately 35-40% of the total China glass container packaging market in 2025, with a projected growth rate that outpaces other segments. Regions such as Shandong, Hebei, and Guangdong provinces, being major production and consumption centers for beverages, lead in the demand for glass containers. Economic policies that support the food and beverage industry, including tax incentives and trade agreements, further bolster this segment.

- Dominant Segment: Beverage Glass Container Packaging

- Market Share (2025): Estimated at 35-40% of the total China Glass Container Packaging Market.

- Growth Potential: High, driven by sustained demand for alcoholic and non-alcoholic beverages.

- Key Drivers:

- Rising disposable income and middle-class consumption.

- Growing popularity of premium and specialty beverages.

- Cultural preference for glass packaging for taste and quality perception.

- Well-developed beverage production and distribution infrastructure.

- Supportive government policies for the food and beverage industry.

- Key Regions for Beverage Glass Container Demand: Shandong, Hebei, Guangdong.

- Child Market Dominance: Within the beverage segment, beer bottles and spirit bottles represent the largest sub-segments, followed by wine bottles and then specialty beverage bottles.

China Glass Container Packaging Market Product Landscape

The China glass container packaging product landscape is defined by continuous innovation aimed at enhancing functionality, aesthetics, and sustainability. Manufacturers are actively developing lightweight glass bottles to reduce transportation costs and environmental impact, while also improving their strength and durability. Advanced coating technologies are being employed to create superior barrier properties, extending product shelf life and preserving freshness, particularly for food and beverage applications. The market also sees a rise in decorative glass packaging, with sophisticated printing, frosting, and embossing techniques employed to create premium appeal for cosmetics, spirits, and high-end food products. Customization is a key trend, with manufacturers offering a wide range of shapes, sizes, and closures to meet the unique branding requirements of diverse end-user verticals.

Key Drivers, Barriers & Challenges in China Glass Container Packaging Market

Key Drivers:

- Growing Domestic Consumption: China's expanding middle class and urbanization are fueling demand for packaged goods across food, beverage, pharmaceutical, and cosmetic sectors.

- Sustainability and Health Consciousness: Increasing consumer awareness regarding environmental impact and health safety drives preference for recyclable and inert glass packaging over plastics.

- Premiumization Trend: Consumers are increasingly willing to pay a premium for products packaged in aesthetically pleasing and high-quality glass, enhancing brand perception.

- Technological Advancements: Innovations in manufacturing efficiency, lightweighting, and decorative techniques make glass packaging more competitive and appealing.

- Regulatory Support: Government emphasis on food safety and environmental protection favors the use of compliant and sustainable packaging solutions like glass.

Barriers & Challenges:

- High Energy Consumption in Production: Traditional glass manufacturing is energy-intensive, leading to higher operational costs and environmental concerns.

- Weight and Fragility: The inherent weight and fragility of glass can lead to higher transportation costs and increased breakage rates during handling and transit.

- Competition from Alternative Materials: Plastic, metal, and composite packaging offer cost advantages and lighter weight, posing significant competition.

- Recycling Infrastructure and Efficiency: While glass is recyclable, the efficiency and widespread availability of effective recycling infrastructure can be a challenge in certain regions.

- Price Sensitivity in Certain Segments: For lower-margin products, the higher cost of glass packaging compared to alternatives can be a deterrent.

Emerging Opportunities in China Glass Container Packaging Market

Emerging opportunities in the China glass container packaging market lie in the growing demand for sustainable packaging solutions, particularly from environmentally conscious consumers and corporations. The rise of e-commerce presents opportunities for innovative, durable, and lightweight glass packaging designs that can withstand the rigors of online shipping. The increasing popularity of craft beverages, organic foods, and premium artisanal products also fuels demand for specialized, aesthetically appealing glass containers that highlight product quality and origin. Furthermore, advancements in smart packaging technologies, such as embedded RFID tags or temperature indicators within glass containers, offer new avenues for product tracking, authentication, and consumer engagement, especially in the pharmaceutical and high-value food sectors.

Growth Accelerators in the China Glass Container Packaging Market Industry

Several key catalysts are accelerating the growth of the China glass container packaging industry. Technological breakthroughs in furnace efficiency, increased use of recycled cullet, and automation in manufacturing are driving down production costs and environmental impact, making glass more competitive. Strategic partnerships between glass manufacturers and their end-users, particularly in the food, beverage, and pharmaceutical sectors, are fostering innovation and tailor-made solutions that meet specific product requirements. Market expansion strategies, including investment in new production facilities in high-demand regions and the development of export markets, are also contributing significantly to the industry's upward trajectory.

Key Players Shaping the China Glass Container Packaging Market Market

- Guochao Glass

- SGSBOTTLE (Tai'an Maidao Industry Co Ltd)

- Unipack Glass Co Ltd

- Jining Baolin Glass Product Co Ltd

- Roetell Glass Packaging Co Ltd

- East Asia Glass Limited

- Hualian Glass Manufacturers Co Ltd

- Shanghai Misa Glass Co Ltd

- Shanghai Vista Packaging Co Ltd

- Xuzhou Huihe International Trade Co Ltd

- Huaxing Glas

Notable Milestones in China Glass Container Packaging Market Sector

- March 2020: Shanghai Fosun Pharmaceutical Group Co. collaborated with BioNTech to develop and market the mRNA shot in China, making an advance payment of EUR 250 million (USD 300 million) for an initial 50 million doses. The German vaccine maker would supply no fewer than 100 million doses for China by the end of 2021. This significantly boosted demand for pharmaceutical glass vials and ampoules.

- January 2020: Itron, Inc. announced a sales and integration collaboration with Innowatts, a provider of AMI-enabled predictive analytics and AI-based solutions. While not directly glass packaging, such collaborations highlight broader industry trends towards smart solutions and efficiency improvements that can indirectly influence packaging demand through better supply chain management and product tracking.

In-Depth China Glass Container Packaging Market Market Outlook

The future market outlook for China's glass container packaging is exceptionally promising, driven by the sustained growth in demand for premium and sustainable packaging solutions. Continued investment in technological advancements, particularly in lightweighting and eco-friendly production, will enhance glass's competitive edge. Strategic collaborations between manufacturers and end-users, focusing on customized solutions for evolving consumer preferences in food, beverages, pharmaceuticals, and cosmetics, will be crucial for market penetration. The increasing global emphasis on circular economy principles and the recyclability of glass positions it favorably against less sustainable alternatives, paving the way for significant market expansion and continued innovation in the coming years.

China Glass Container Packaging Market Segmentation

-

1. End-user Vertical

- 1.1. Food

- 1.2. Beverages

- 1.3. Pharmaceuticals

- 1.4. Cosmetics

- 1.5. Other End User Verticals

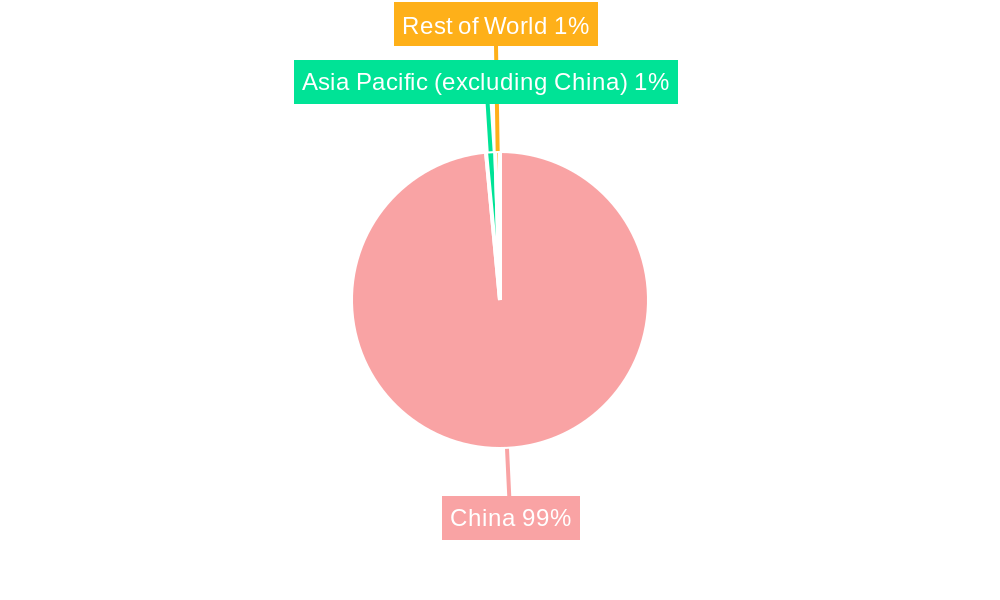

China Glass Container Packaging Market Segmentation By Geography

- 1. China

China Glass Container Packaging Market Regional Market Share

Geographic Coverage of China Glass Container Packaging Market

China Glass Container Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.46% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Higher Disposable Income and Integration in Premium Packaging; Improved Technology Offering Better Solutions

- 3.3. Market Restrains

- 3.3.1. High Competition from Substitute Packaging Solutions; Improved Technology Offering Better Solutions

- 3.4. Market Trends

- 3.4.1. Higher Disposable Income and Integration in Premium Packaging to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Glass Container Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.1.1. Food

- 5.1.2. Beverages

- 5.1.3. Pharmaceuticals

- 5.1.4. Cosmetics

- 5.1.5. Other End User Verticals

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. China

- 5.1. Market Analysis, Insights and Forecast - by End-user Vertical

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Guochao Glass

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 SGSBOTTLE (Tai'an Maidao Industry Co Ltd)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Unipack Glass Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Jining Baolin Glass Product Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Roetell Glass Packaging Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 East Asia Glass Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Hualian Glass Manufacturers Co Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Shanghai Misa Glass Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Shanghai Vista Packaging Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Xuzhou Huihe International Trade Co Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Huaxing Glas

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Guochao Glass

List of Figures

- Figure 1: China Glass Container Packaging Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: China Glass Container Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: China Glass Container Packaging Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 2: China Glass Container Packaging Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: China Glass Container Packaging Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 4: China Glass Container Packaging Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Glass Container Packaging Market?

The projected CAGR is approximately 4.46%.

2. Which companies are prominent players in the China Glass Container Packaging Market?

Key companies in the market include Guochao Glass, SGSBOTTLE (Tai'an Maidao Industry Co Ltd), Unipack Glass Co Ltd, Jining Baolin Glass Product Co Ltd, Roetell Glass Packaging Co Ltd, East Asia Glass Limited, Hualian Glass Manufacturers Co Ltd, Shanghai Misa Glass Co Ltd, Shanghai Vista Packaging Co Ltd, Xuzhou Huihe International Trade Co Ltd, Huaxing Glas.

3. What are the main segments of the China Glass Container Packaging Market?

The market segments include End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 13.56 Million as of 2022.

5. What are some drivers contributing to market growth?

Higher Disposable Income and Integration in Premium Packaging; Improved Technology Offering Better Solutions.

6. What are the notable trends driving market growth?

Higher Disposable Income and Integration in Premium Packaging to Drive the Market.

7. Are there any restraints impacting market growth?

High Competition from Substitute Packaging Solutions; Improved Technology Offering Better Solutions.

8. Can you provide examples of recent developments in the market?

March 2020 - Shanghai Fosun Pharmaceutical Group Co. collaborated with BioNTech to develop and market the mRNA shot in China and made an advance payment of EUR 250 million (USD 300 million) for an initial 50 million doses. The German vaccine maker would supply no fewer than 100 million doses for China by the end of 2021.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Glass Container Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Glass Container Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Glass Container Packaging Market?

To stay informed about further developments, trends, and reports in the China Glass Container Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence