Key Insights

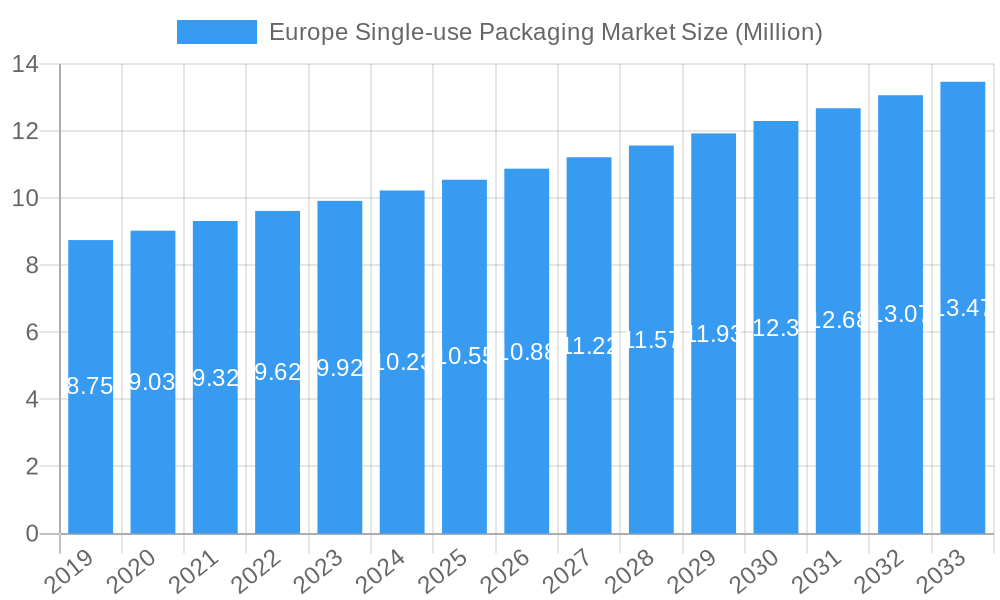

The Europe Single-use Packaging Market is poised for significant expansion, projected to reach an estimated $10.07 million by 2025. This growth is underpinned by a robust compound annual growth rate (CAGR) of 4.76% throughout the forecast period of 2025-2033. Key drivers fueling this expansion include the increasing demand for convenience, the escalating consumption of packaged food and beverages, and the persistent need for hygienic and protective packaging solutions across various industries. The food and beverage sector stands out as the dominant end-user industry, driven by evolving consumer lifestyles and a growing preference for ready-to-eat and on-the-go options. Similarly, the personal care and pharmaceutical sectors are contributing substantially to market growth, owing to stringent hygiene standards and the widespread use of single-use packaging for product protection and consumer safety.

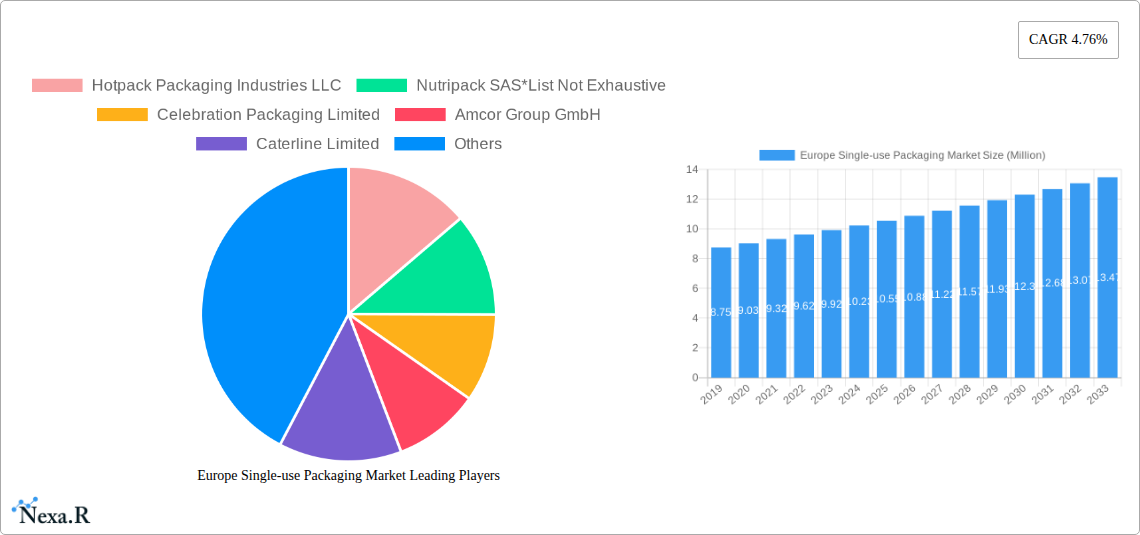

Europe Single-use Packaging Market Market Size (In Million)

The market's trajectory is further shaped by evolving consumer preferences and regulatory landscapes. While the convenience and cost-effectiveness of single-use packaging remain primary drivers, growing environmental concerns and regulatory pressures aimed at reducing plastic waste are introducing complexities. This has led to an increased focus on the development and adoption of sustainable materials. Paper and paperboard packaging, alongside advancements in biodegradable and recyclable plastics, are gaining traction as alternatives to traditional materials. However, the inherent challenges associated with waste management and the search for truly circular solutions continue to present restraints. Geographically, Europe, with key markets like the United Kingdom, Germany, France, and Italy, is a significant contributor, characterized by established industries and a conscious consumer base pushing for more sustainable packaging options. The competitive landscape features prominent players such as Amcor Group GmbH, Huhtamaki Oyj, and Berry Global Inc., who are actively investing in innovation and sustainable solutions to cater to market demands and navigate regulatory shifts.

Europe Single-use Packaging Market Company Market Share

Europe Single-use Packaging Market Report: Trends, Opportunities, and Key Player Analysis (2019-2033)

This comprehensive report provides an in-depth analysis of the Europe single-use packaging market, offering crucial insights for industry stakeholders. Spanning from 2019 to 2033, with a base and estimated year of 2025, this study delves into market dynamics, growth trends, dominant segments, product innovations, and key players shaping the future of disposable packaging solutions across Europe. The report meticulously examines material types, end-user industries, and critical industry developments, presenting all values in Million units.

Europe Single-use Packaging Market Market Dynamics & Structure

The Europe single-use packaging market is characterized by a moderately concentrated landscape, with a few dominant players holding significant market share, alongside a growing number of specialized and regional manufacturers. Technological innovation is a primary driver, fueled by advancements in material science, sustainable alternatives, and efficient manufacturing processes, aiming to reduce environmental impact and enhance functionality. Regulatory frameworks, particularly those driven by the European Union's circular economy initiatives and single-use plastic directives, play a pivotal role in shaping market trends, pushing for recyclability, biodegradability, and the reduction of virgin plastic use. Competitive product substitutes are continuously emerging, ranging from compostable bio-plastics to reusable packaging systems, forcing manufacturers to innovate and adapt. End-user demographics are shifting, with increasing consumer awareness regarding environmental sustainability influencing purchasing decisions and demanding eco-friendly packaging options. Mergers and acquisitions (M&A) are an ongoing trend, with larger companies acquiring innovative startups or smaller competitors to expand their product portfolios, geographical reach, and technological capabilities. For instance, the acquisition of innovative material producers or companies with strong recycling infrastructure is a strategic move to strengthen market positions. Barriers to innovation include the cost of developing and implementing new sustainable materials, the need for significant investment in new manufacturing technologies, and the challenge of achieving economies of scale for novel solutions. Market share for key players varies significantly, with Amcor Group GmbH and Berry Global Inc. often holding substantial portions in specific segments. M&A deal volumes in the packaging sector have seen a steady increase, reflecting consolidation and strategic growth objectives.

Europe Single-use Packaging Market Growth Trends & Insights

The Europe single-use packaging market is poised for robust growth, driven by a confluence of economic, societal, and technological factors. Market size evolution is projected to witness a consistent upward trajectory, propelled by the persistent demand for convenient and hygienic packaging solutions across various sectors. The adoption rates of advanced materials, particularly those with enhanced recyclability and biodegradability, are on the rise, reflecting both regulatory push and evolving consumer preferences. Technological disruptions are at the forefront of this evolution, with ongoing research and development yielding innovative solutions that address environmental concerns without compromising product integrity or cost-effectiveness. This includes advancements in barrier technologies, lightweighting of materials, and the development of intelligent packaging features. Consumer behavior shifts are a significant catalyst, as European consumers demonstrate a growing preference for brands that exhibit environmental responsibility, actively seeking products packaged in sustainable materials and opting for convenient, single-use formats for hygiene and portability. The report anticipates a compound annual growth rate (CAGR) of approximately 4.5% for the forecast period, indicating a healthy expansion of the market. Market penetration of sustainable single-use packaging options is projected to increase from roughly 30% in 2024 to over 50% by 2033. This growth is underpinned by the increasing awareness of hygiene standards, particularly in the food and beverage sectors, and the convenience offered by single-use formats in busy lifestyles. The demand for optimized packaging that minimizes material usage while maintaining performance is also a key trend.

Dominant Regions, Countries, or Segments in Europe Single-use Packaging Market

Within the Europe single-use packaging market, the Plastic segment, particularly Polyethylene Terephthalate (PET) and Polypropylene (PP) based packaging, currently dominates in terms of volume and revenue. This dominance is driven by the material's versatility, cost-effectiveness, and excellent barrier properties, making it a preferred choice for a vast array of applications, especially in the Food and Beverage end-user industries. Geographically, Germany consistently emerges as a leading country in the European single-use packaging market, owing to its strong industrial base, high consumer spending, and stringent environmental regulations that paradoxically drive innovation in compliant packaging solutions. Other significant markets include the United Kingdom, France, and Italy, each contributing substantially due to their large populations and developed economies.

Material Type Dominance:

- Plastic: Holds the largest market share, estimated at 65%, due to its widespread use in food, beverage, and personal care packaging. PET and PP are key polymers driving this segment.

- Paper and Paperboard: Showing significant growth, driven by sustainability trends and its recyclability. Estimated market share at 25%.

- Glass: Holds a smaller but stable market share, primarily for premium beverages and pharmaceuticals, estimated at 7%.

- Other Material Types (Metals and Wood): Represent a niche segment, accounting for approximately 3%, used in specific applications like aerosols or certain luxury goods.

End-user Industry Dominance:

- Food: The largest end-user industry, accounting for an estimated 45% of the market. This includes ready-to-eat meals, snacks, dairy products, and fresh produce packaging.

- Beverage: The second-largest segment, with an estimated 30% market share, encompassing bottled water, soft drinks, juices, and alcoholic beverages.

- Personal Care: Significant demand for single-use packaging for items like wet wipes, sanitary products, and cosmetics, estimated at 15%.

- Pharmaceutical: Crucial for sterile packaging and single-dose medications, representing an estimated 8%.

- Other End-user Industries: Includes applications in retail, healthcare, and industrial sectors, accounting for approximately 2%.

The dominance of plastic is being challenged by increasing regulatory pressure and consumer demand for sustainable alternatives. Consequently, paper and paperboard packaging is experiencing accelerated growth, driven by advancements in coating technologies that enhance its barrier properties. Economic policies supporting recycling infrastructure and initiatives promoting a circular economy further bolster the growth of these alternative materials. Infrastructure development, such as advanced sorting and recycling facilities across key European countries, plays a critical role in enabling the widespread adoption of recyclable single-use packaging. The growth potential within the paper and paperboard segment is substantial, projected to outpace plastic growth in the coming years.

Europe Single-use Packaging Market Product Landscape

The Europe single-use packaging market is witnessing a surge in innovative product developments focused on sustainability, functionality, and consumer convenience. Innovations in material science are yielding advanced bio-plastics derived from renewable sources, offering biodegradability and compostability without compromising on strength and shelf-life. Paper-based packaging solutions are evolving with enhanced barrier coatings, making them suitable for a wider range of food products previously dominated by plastic. Lightweighting initiatives continue to reduce material consumption and associated environmental impact. The focus is on mono-material solutions that simplify recycling processes and enhance the recyclability of complex packaging structures. Unique selling propositions for new products often revolve around achieving a lower carbon footprint, improved recyclability rates, and enhanced user experience through features like easy-open mechanisms or portion control. Technological advancements are also enabling the integration of smart features, such as temperature indicators or tamper-evident seals, adding value beyond basic containment.

Key Drivers, Barriers & Challenges in Europe Single-use Packaging Market

The Europe single-use packaging market is primarily propelled by several key drivers. The relentless demand for convenience and hygiene across food, beverage, and healthcare sectors remains a significant force. Growing consumer awareness regarding environmental sustainability is pushing manufacturers to develop and adopt eco-friendlier alternatives, such as recyclable, compostable, and biodegradable packaging. Stringent government regulations and policies, particularly those aimed at reducing plastic waste and promoting a circular economy, are acting as powerful catalysts for innovation and the adoption of sustainable materials. Technological advancements in material science and manufacturing processes are enabling the creation of high-performance, eco-conscious packaging solutions at competitive costs.

However, the market faces substantial barriers and challenges. The cost of developing and implementing new sustainable materials can be significantly higher than traditional plastics, impacting price competitiveness. Establishing robust and widespread recycling and composting infrastructure across all European regions remains a significant hurdle. Consumer education and engagement are crucial for the successful adoption of new packaging formats, as confusion about disposal methods can hinder recycling efforts. Supply chain disruptions, influenced by global events and the availability of raw materials, can impact production and pricing. Furthermore, intense competitive pressures from established players and emerging material suppliers necessitate continuous innovation and cost optimization. The regulatory landscape, while a driver, also presents challenges in navigating complex and evolving directives.

Emerging Opportunities in Europe Single-use Packaging Market

Emerging opportunities in the Europe single-use packaging market are abundant and diverse. The growing demand for sustainable packaging in e-commerce logistics presents a significant untapped market, with opportunities for lightweight, protective, and easily recyclable shipping solutions. Innovative applications of biodegradable and compostable materials in food service and takeaway segments are expanding rapidly, driven by a desire to reduce landfill waste. The personal care sector offers potential for refillable and returnable single-use packaging systems, blending convenience with reduced environmental impact. Furthermore, advancements in the circular economy are creating opportunities for closed-loop recycling systems, where used packaging is effectively collected, reprocessed, and reintroduced into the manufacturing stream, fostering a more sustainable future for single-use packaging. The development of advanced sorting technologies to improve the efficiency of recycling mixed materials also presents a notable opportunity.

Growth Accelerators in the Europe Single-use Packaging Market Industry

Several catalysts are accelerating long-term growth in the Europe single-use packaging market industry. Technological breakthroughs in chemical and mechanical recycling are enabling higher recovery rates and the production of high-quality recycled materials, making them more attractive alternatives to virgin plastics. Strategic partnerships between packaging manufacturers, material suppliers, and waste management companies are crucial for building robust circular economy models. Market expansion strategies, particularly into emerging European economies with developing waste management infrastructure, offer significant growth potential. The continuous drive for innovation in areas like edible coatings and smart packaging will further enhance the value proposition of single-use solutions, driving adoption across new applications. Investment in advanced automation and AI-driven manufacturing processes is also contributing to improved efficiency and cost reduction, thereby accelerating growth.

Key Players Shaping the Europe Single-use Packaging Market Market

- Hotpack Packaging Industries LLC

- Nutripack SAS

- Celebration Packaging Limited

- Amcor Group GmbH

- Caterline Limited

- Graphic Packaging International LLC

- Novolex

- Berry Global Inc

- Huhtamaki Oyj

- Dart Container Corporation

Notable Milestones in Europe Single-use Packaging Market Sector

- August 2023: AMB Spa, a European provider of sustainable rigid and flexible food packaging solutions, partnered with Indorama Ventures, a leading sustainable chemical company. This collaboration aims to develop new technology for enhancing the recycling of polyethylene terephthalate (PET) food trays, utilizing recycled PET flakes to create film suitable for food packaging.

- April 2023: Seal Packaging launched Infinity TopSeal, a recyclable, mono-material packaging solution designed for food service applications and delivery. This innovative product features a polypropylene expandable lid that can be heat-sealed.

In-Depth Europe Single-use Packaging Market Market Outlook

The future outlook for the Europe single-use packaging market is exceptionally promising, driven by a potent combination of innovation and evolving market demands. Growth accelerators such as advanced recycling technologies and the increasing adoption of bio-based and compostable materials will continue to redefine the landscape. Strategic collaborations between industry players and a proactive approach to regulatory compliance will be paramount for sustained success. The market is set to witness a greater integration of circular economy principles, with a focus on designing packaging for end-of-life management and maximizing resource efficiency. Opportunities lie in developing solutions that meet the stringent environmental targets of the EU while catering to the ever-present need for convenience, safety, and functionality across diverse end-user industries. The trend towards sophisticated, high-barrier, and lightweight single-use packaging solutions, especially those with a clear sustainability narrative, will dominate market strategies.

Europe Single-use Packaging Market Segmentation

-

1. Material Type

- 1.1. Paper and Paperboard

- 1.2. Plastic

- 1.3. Glass

- 1.4. Other Material Types (Metals and Wood)

-

2. End-user Industry

- 2.1. Food

- 2.2. Beverage

- 2.3. Personal Care

- 2.4. Pharmaceutical

- 2.5. Other End-user Industries

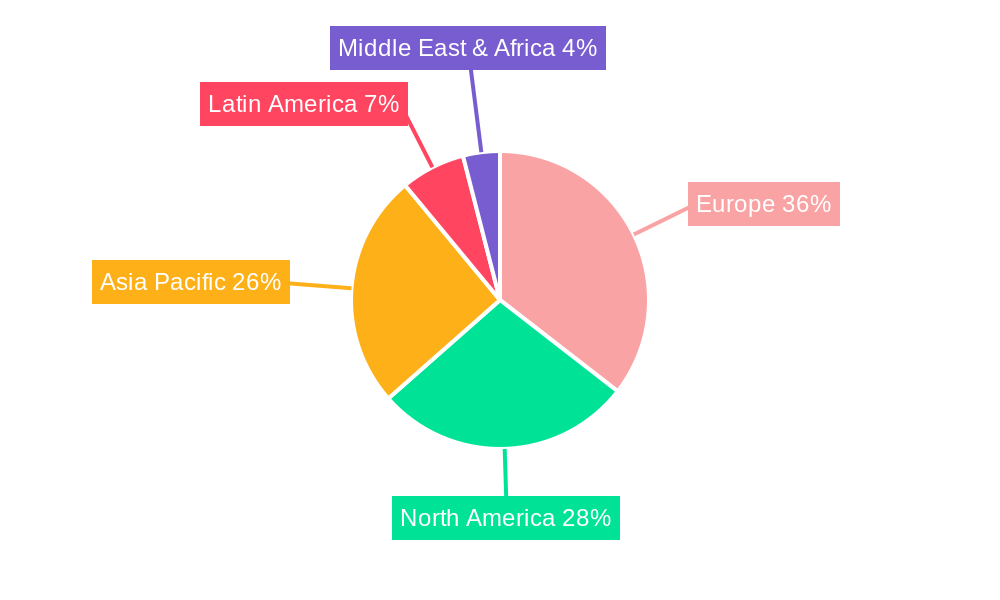

Europe Single-use Packaging Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Single-use Packaging Market Regional Market Share

Geographic Coverage of Europe Single-use Packaging Market

Europe Single-use Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.76% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Number of QSRs in the Region

- 3.3. Market Restrains

- 3.3.1. Ban on Single use Plastic Products by European Union

- 3.4. Market Trends

- 3.4.1. Rising number of QSRs in the region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Single-use Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Paper and Paperboard

- 5.1.2. Plastic

- 5.1.3. Glass

- 5.1.4. Other Material Types (Metals and Wood)

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Food

- 5.2.2. Beverage

- 5.2.3. Personal Care

- 5.2.4. Pharmaceutical

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Hotpack Packaging Industries LLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Nutripack SAS*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Celebration Packaging Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Amcor Group GmbH

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Caterline Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Graphic Packaging International LLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Novolex

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Berry Global Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Huhtamaki Oyj

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Dart Container Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Hotpack Packaging Industries LLC

List of Figures

- Figure 1: Europe Single-use Packaging Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Single-use Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Single-use Packaging Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 2: Europe Single-use Packaging Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 3: Europe Single-use Packaging Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Europe Single-use Packaging Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 5: Europe Single-use Packaging Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Europe Single-use Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United Kingdom Europe Single-use Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Germany Europe Single-use Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: France Europe Single-use Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Italy Europe Single-use Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Spain Europe Single-use Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Netherlands Europe Single-use Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Belgium Europe Single-use Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Sweden Europe Single-use Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Norway Europe Single-use Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Poland Europe Single-use Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Denmark Europe Single-use Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Single-use Packaging Market?

The projected CAGR is approximately 4.76%.

2. Which companies are prominent players in the Europe Single-use Packaging Market?

Key companies in the market include Hotpack Packaging Industries LLC, Nutripack SAS*List Not Exhaustive, Celebration Packaging Limited, Amcor Group GmbH, Caterline Limited, Graphic Packaging International LLC, Novolex, Berry Global Inc, Huhtamaki Oyj, Dart Container Corporation.

3. What are the main segments of the Europe Single-use Packaging Market?

The market segments include Material Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.07 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Number of QSRs in the Region.

6. What are the notable trends driving market growth?

Rising number of QSRs in the region.

7. Are there any restraints impacting market growth?

Ban on Single use Plastic Products by European Union.

8. Can you provide examples of recent developments in the market?

August 2023: AMB Spa is one of the European providers of sustainable rigid and flexible solutions for food packaging and has joined forces with the leading sustainable chemical company, Indorama Ventures. Through their partnership, AMB Spa and Indorama Ventures are working together to develop new technology to enhance the recycling of polyethylene terephthalate (PET) food trays. This technology, which involves using recycled PET flakes from recycled trays, is intended to create film suitable for using PET trays in food packaging.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Single-use Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Single-use Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Single-use Packaging Market?

To stay informed about further developments, trends, and reports in the Europe Single-use Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence