Key Insights

The global metal cans market is projected for substantial growth, anticipated to reach 62.23 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 4.8% from the base year 2025. This expansion is primarily driven by escalating consumer demand for convenient packaging solutions and the inherent sustainability of metal packaging, aligning with growing environmental concerns. The beverage sector remains a dominant force, fueled by the popularity of ready-to-drink options and craft beverages. The food segment also shows consistent demand from manufacturers prioritizing durable and secure packaging. Additionally, the cosmetics and personal care industry is increasingly adopting metal cans for their premium aesthetic and perceived durability, significantly contributing to market value.

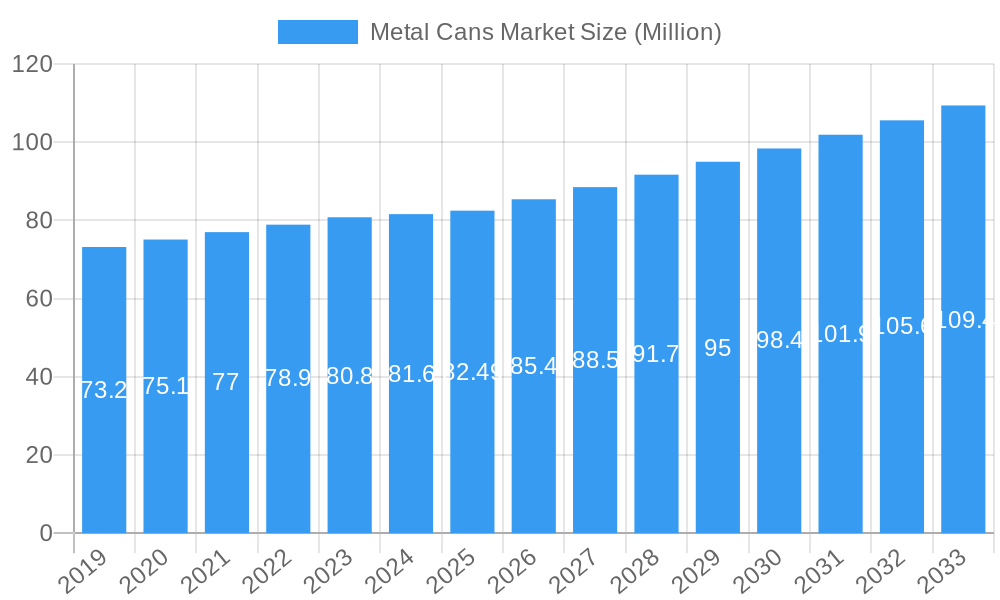

Metal Cans Market Market Size (In Billion)

Key market trends include technological advancements in can manufacturing, yielding lighter, more sustainable, and visually diverse products. Innovations in printing and finishing techniques are enhancing brand appeal, particularly in consumer-focused industries. However, the market confronts challenges such as volatile raw material costs for aluminum and steel, and competition from alternative packaging materials like flexible plastics and glass. Notwithstanding these obstacles, the inherent advantages of metal cans – superior barrier properties, extended shelf-life, and high recyclability – are expected to sustain their market presence and growth across various end-use sectors, including pharmaceuticals and paints, over the forecast period.

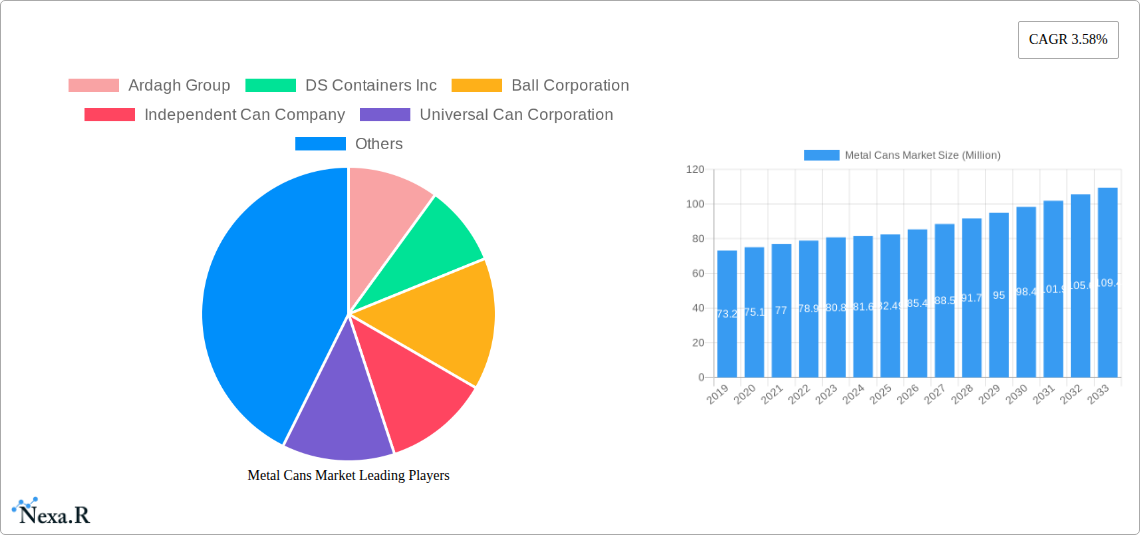

Metal Cans Market Company Market Share

Metal Cans Market: Comprehensive Report (2019-2033)

This comprehensive report delves into the global Metal Cans Market, offering a detailed analysis of market dynamics, growth trends, regional dominance, and key players. With a study period spanning 2019–2033, this research provides crucial insights for industry stakeholders navigating the evolving landscape of food cans, beverage cans, cosmetic cans, and pharmaceutical cans. The report utilizes a base year of 2025 and a forecast period of 2025–2033, building upon historical data from 2019–2024. All values are presented in Million units.

Metal Cans Market Dynamics & Structure

The global Metal Cans Market is characterized by a moderate to high concentration, with leading players like Ball Corporation, Crown Holdings Inc., and Ardagh Group holding significant market shares. Technological innovation is a primary driver, focusing on enhanced barrier properties, lighter-weight designs, and improved recyclability for both aluminum cans and steel cans. Regulatory frameworks, particularly concerning food safety, environmental sustainability, and packaging waste reduction, are increasingly shaping market strategies and product development. Competitive product substitutes, such as glass bottles and flexible packaging, exert pressure, necessitating continuous innovation in metal can technology. End-user demographics are shifting towards younger, environmentally conscious consumers who favor sustainable packaging options. Mergers and acquisitions (M&A) trends are observed as companies seek to expand their geographical reach, diversify their product portfolios, and achieve economies of scale. The market is segmented by material type (Aluminum, Steel) and can type (Food, Beverage, Cosmetics and Personal Care, Pharmaceuticals, Paint, Other End user Industry). Key M&A deals have involved significant investments to increase production capacity and acquire innovative technologies. Barriers to innovation include high capital investment for new manufacturing lines and the stringent testing required for food and beverage applications.

Metal Cans Market Growth Trends & Insights

The Metal Cans Market is projected for substantial growth, driven by an escalating global demand for convenient, durable, and sustainable packaging solutions. Market size evolution is directly linked to the expansion of the food and beverage industries, particularly the ready-to-drink (RTD) beverage segment and the processed food sector. Adoption rates for metal cans are increasing due to their excellent recyclability, contributing to circular economy initiatives. Technological disruptions are centered around advancements in aluminum can manufacturing, leading to thinner and lighter yet stronger cans, reducing material usage and transportation costs. Developments in steel can technology focus on improved corrosion resistance and decorative printing capabilities for enhanced product appeal. Consumer behavior shifts are a significant growth catalyst, with a pronounced preference for brands that demonstrate a commitment to environmental responsibility. The convenience factor offered by metal cans, especially in the beverage sector for on-the-go consumption, further fuels market penetration. The market penetration of aluminum cans in the beverage segment is particularly robust, estimated at over 60%, while steel cans maintain a strong hold in the food and paint industries. The CAGR for the forecast period is projected to be between 4.5% and 5.8%, reflecting consistent and healthy expansion. Innovations in can coatings and liners are enhancing product shelf-life and safety, appealing to a broader range of food applications. The growing disposable income in emerging economies is also contributing to increased consumption of packaged goods, thereby boosting the demand for metal cans.

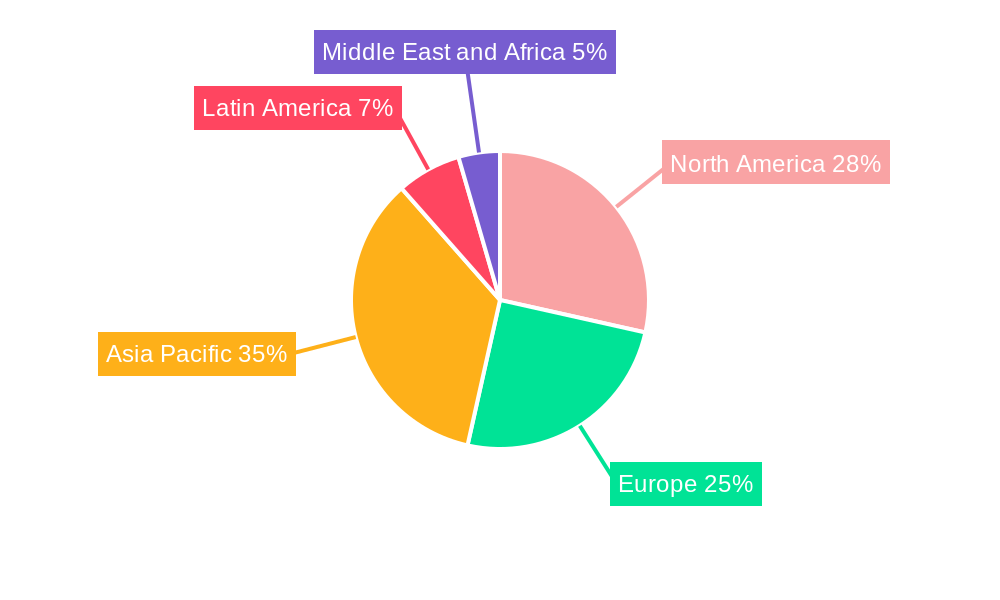

Dominant Regions, Countries, or Segments in Metal Cans Market

The Beverage segment, particularly within the Aluminum material type, is the dominant force driving growth in the global Metal Cans Market. North America and Europe currently lead in market share, driven by established beverage industries and a strong consumer preference for canned beverages, including beer, carbonated soft drinks, and RTD cocktails. The increasing popularity of energy drinks and sparkling water, predominantly packaged in aluminum cans, further solidifies this segment's dominance.

- North America: This region exhibits high per capita consumption of canned beverages. Favorable economic policies supporting the beverage industry and robust retail infrastructure contribute to its leadership. The widespread adoption of aluminum cans for their recyclability and lightweight properties makes it a preferred choice.

- Europe: Stringent environmental regulations promoting recycling and a growing demand for sustainable packaging solutions are key drivers in Europe. The rise of craft breweries and the expansion of the RTD cocktail market have significantly boosted aluminum can demand. Germany, the UK, and France are key markets.

- Asia Pacific: This region presents the fastest growth potential, fueled by a burgeoning middle class, rapid urbanization, and the expansion of the food and beverage processing sectors. Government initiatives to promote domestic manufacturing and investments in new production facilities are accelerating market growth. China and India are emerging as significant consumers of both aluminum and steel cans for food and beverage applications.

While the beverage segment leads, the Food segment, utilizing both aluminum and steel cans, also represents a substantial and growing market. The demand for preserved foods, convenience meals, and pet food packaged in metal cans remains strong globally. The Cosmetics and Personal Care segment, while smaller, is showing increasing adoption of aluminum cans for premium product offerings due to their aesthetic appeal and perceived luxury. The Pharmaceuticals segment, though highly regulated, sees consistent demand for small-format steel cans for certain drug formulations and medical supplies. The Paint industry, primarily reliant on steel cans, continues to be a steady consumer.

Metal Cans Market Product Landscape

The product landscape of the Metal Cans Market is marked by continuous innovation aimed at enhancing functionality, sustainability, and consumer appeal. Advances in aluminum alloys have led to the development of thinner, lighter cans with superior strength, reducing material usage and environmental impact. For steel cans, innovations focus on improved internal coatings to enhance chemical compatibility with a wider range of food products and extended shelf life. The development of easy-open ends, sophisticated printing technologies for vibrant branding, and integrated resealable features are key product advancements. Applications are expanding beyond traditional food and beverage to include a growing array of personal care items, specialized industrial lubricants, and even small electronic components, showcasing the versatility of metal packaging. Unique selling propositions include the 100% infinite recyclability of aluminum and steel, superior barrier properties against light and oxygen, and durability during transportation and handling. Technological advancements also include the introduction of advanced manufacturing processes that improve efficiency and reduce waste during can production.

Key Drivers, Barriers & Challenges in Metal Cans Market

The Metal Cans Market is propelled by several key drivers. The increasing global population and urbanization lead to higher demand for packaged food and beverages. The growing consumer preference for sustainable and recyclable packaging materials, with aluminum and steel being highly favored due to their infinite recyclability, is a significant growth accelerator. Technological advancements in can manufacturing, resulting in lighter-weight and more cost-effective cans, also fuel market expansion. Economic growth in emerging markets boosts disposable incomes, leading to increased consumption of packaged goods.

- Technological Drivers: Innovations in material science for lighter alloys, advanced coating technologies for improved product protection, and energy-efficient manufacturing processes.

- Economic Drivers: Rising middle class in developing economies, increasing demand for convenience foods and beverages.

- Policy-Driven Factors: Government initiatives promoting recycling and circular economy principles, regulations favoring sustainable packaging.

Key challenges and restraints impacting the market include volatility in raw material prices, particularly aluminum and steel, which can affect production costs and profitability. The ongoing competition from alternative packaging materials such as glass, plastic, and cartons, each offering unique advantages, poses a persistent challenge. Regulatory hurdles related to food contact materials, safety standards, and environmental compliance can also add complexity and cost to operations. Supply chain disruptions, exacerbated by geopolitical events and logistical challenges, can impact the timely availability of raw materials and finished goods.

- Supply Chain Issues: Fluctuations in raw material availability and pricing, logistical complexities.

- Regulatory Hurdles: Stringent food safety regulations, environmental compliance mandates.

- Competitive Pressures: Intense competition from glass, plastic, and flexible packaging alternatives.

Emerging Opportunities in Metal Cans Market

Emerging opportunities in the Metal Cans Market are largely driven by evolving consumer preferences and technological advancements. The burgeoning demand for plant-based beverages, functional drinks, and premium spirits presents significant opportunities for specialized can designs and sizes. The growing trend of sustainable and eco-friendly packaging is pushing innovation in recycled content integration and lighter-weight can constructions, creating a niche for manufacturers focused on sustainability. Furthermore, the expansion of e-commerce for food and beverage products is creating a need for robust and transport-efficient packaging, where metal cans excel. Untapped markets in developing regions with a growing middle class and increasing demand for packaged goods also represent substantial growth potential. The development of smart packaging solutions with integrated features for traceability and authentication is another area of emerging opportunity.

Growth Accelerators in the Metal Cans Market Industry

Several catalysts are accelerating long-term growth in the Metal Cans Market. Technological breakthroughs in metal forming and finishing processes are enabling the production of more complex and aesthetically pleasing cans, catering to premium product segments. Strategic partnerships between can manufacturers and beverage or food brands, focusing on co-development of innovative packaging solutions, are driving market penetration and brand loyalty. Market expansion strategies, including investments in new production facilities in high-growth regions and acquisitions to strengthen market position, are further fueling growth. The increasing adoption of aluminum cans for a wider range of products, including non-traditional beverage categories, and the development of advanced barrier technologies for extended shelf life in food applications are critical growth accelerators.

Key Players Shaping the Metal Cans Market Market

The Metal Cans Market is shaped by a formidable list of global leaders and specialized manufacturers:

- Ardagh Group

- DS Containers Inc

- Ball Corporation

- Independent Can Company

- Universal Can Corporation

- Hindustan Tin Works Ltd

- Pacific Can China Holdings Limited

- Crown Holdings Inc

- CPMC HOLDINGS Limited (COFCO Group)

- Silgan Containers LLC

- CCL Container Inc

- Toyo Seikan Group Holdings Ltd

- Showa Denko KK

- Mauser Packaging Solutions

- Saudi Arabian Packaging Industry WLL (SAPIN)

Notable Milestones in Metal Cans Market Sector

- October 2022: Ardagh Metal Packaging (AMP) supplied the aluminum cans for Casa Azul Tequila Soda, a new US tequila-based ready-to-drink (RTD) cocktails vying for the premium on-the-go market.

- October 2022: Two beverage entrepreneurs partnered to launch Los Angeles, California-based Casa Azul featuring a recyclable metal packaging can. Packaged in Ardagh metal packaging and infinitely recyclable beverage cans, Casa Azul is available in Lime Margarita, Peach Mango, Strawberry Margarita, and Watermelon. The gluten-free products include 5 percent alcohol with 100 calories per serving.

In-Depth Metal Cans Market Market Outlook

The Metal Cans Market outlook remains robust, driven by sustained demand for convenient, durable, and environmentally conscious packaging. Growth accelerators, including ongoing technological innovation in material science and manufacturing efficiency, will continue to enhance the competitiveness of metal cans. The increasing integration of recycled content in aluminum and steel cans aligns with global sustainability trends and consumer preferences, creating a strong market advantage. Strategic collaborations between key players and end-user industries will foster the development of tailored packaging solutions for emerging product categories. Expansion into rapidly developing economies, coupled with evolving consumer lifestyles, will unlock significant market potential. The market's ability to adapt to new product formats and deliver superior barrier protection ensures its continued relevance and growth.

Metal Cans Market Segmentation

-

1. Material Type

- 1.1. Aluminum

- 1.2. Steel

-

2. Can Type

- 2.1. Food

- 2.2. Beverage

- 2.3. Cosmetics and Personal Care

- 2.4. Pharmaceuticals

- 2.5. Paint

- 2.6. Other End user Industry

Metal Cans Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Spain

- 2.5. Italy

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Australia

- 3.5. Rest of Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Metal Cans Market Regional Market Share

Geographic Coverage of Metal Cans Market

Metal Cans Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. High Recyclability of the Packaging Due to Less Usage of Energy; Increasing Consumption of both Alcoholic and Non-Alcoholic Beverages

- 3.3. Market Restrains

- 3.3.1. Presence of Alternate Packaging Solutions as Polyethylene Terephthalate

- 3.4. Market Trends

- 3.4.1. Canned Food Consumption to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Metal Cans Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Aluminum

- 5.1.2. Steel

- 5.2. Market Analysis, Insights and Forecast - by Can Type

- 5.2.1. Food

- 5.2.2. Beverage

- 5.2.3. Cosmetics and Personal Care

- 5.2.4. Pharmaceuticals

- 5.2.5. Paint

- 5.2.6. Other End user Industry

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. North America Metal Cans Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Material Type

- 6.1.1. Aluminum

- 6.1.2. Steel

- 6.2. Market Analysis, Insights and Forecast - by Can Type

- 6.2.1. Food

- 6.2.2. Beverage

- 6.2.3. Cosmetics and Personal Care

- 6.2.4. Pharmaceuticals

- 6.2.5. Paint

- 6.2.6. Other End user Industry

- 6.1. Market Analysis, Insights and Forecast - by Material Type

- 7. Europe Metal Cans Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Material Type

- 7.1.1. Aluminum

- 7.1.2. Steel

- 7.2. Market Analysis, Insights and Forecast - by Can Type

- 7.2.1. Food

- 7.2.2. Beverage

- 7.2.3. Cosmetics and Personal Care

- 7.2.4. Pharmaceuticals

- 7.2.5. Paint

- 7.2.6. Other End user Industry

- 7.1. Market Analysis, Insights and Forecast - by Material Type

- 8. Asia Pacific Metal Cans Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Material Type

- 8.1.1. Aluminum

- 8.1.2. Steel

- 8.2. Market Analysis, Insights and Forecast - by Can Type

- 8.2.1. Food

- 8.2.2. Beverage

- 8.2.3. Cosmetics and Personal Care

- 8.2.4. Pharmaceuticals

- 8.2.5. Paint

- 8.2.6. Other End user Industry

- 8.1. Market Analysis, Insights and Forecast - by Material Type

- 9. Latin America Metal Cans Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Material Type

- 9.1.1. Aluminum

- 9.1.2. Steel

- 9.2. Market Analysis, Insights and Forecast - by Can Type

- 9.2.1. Food

- 9.2.2. Beverage

- 9.2.3. Cosmetics and Personal Care

- 9.2.4. Pharmaceuticals

- 9.2.5. Paint

- 9.2.6. Other End user Industry

- 9.1. Market Analysis, Insights and Forecast - by Material Type

- 10. Middle East and Africa Metal Cans Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Material Type

- 10.1.1. Aluminum

- 10.1.2. Steel

- 10.2. Market Analysis, Insights and Forecast - by Can Type

- 10.2.1. Food

- 10.2.2. Beverage

- 10.2.3. Cosmetics and Personal Care

- 10.2.4. Pharmaceuticals

- 10.2.5. Paint

- 10.2.6. Other End user Industry

- 10.1. Market Analysis, Insights and Forecast - by Material Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Ardagh Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 DS Containers Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Ball Corporation

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Independent Can Company

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Universal Can Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Hindustan Tin Works Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Pacific Can China Holdings Limited

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Crown Holdings Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 CPMC HOLDINGS Limited (COFCO Group)

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Silgan Containers LLC

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 CCL Container Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Toyo Seikan Group Holdings Ltd

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Showa Denko KK

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Mauser Packaging Solutions

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Saudi Arabian Packaging Industry WLL (SAPIN

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Ardagh Group

List of Figures

- Figure 1: Global Metal Cans Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Metal Cans Market Revenue (billion), by Material Type 2025 & 2033

- Figure 3: North America Metal Cans Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 4: North America Metal Cans Market Revenue (billion), by Can Type 2025 & 2033

- Figure 5: North America Metal Cans Market Revenue Share (%), by Can Type 2025 & 2033

- Figure 6: North America Metal Cans Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Metal Cans Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Metal Cans Market Revenue (billion), by Material Type 2025 & 2033

- Figure 9: Europe Metal Cans Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 10: Europe Metal Cans Market Revenue (billion), by Can Type 2025 & 2033

- Figure 11: Europe Metal Cans Market Revenue Share (%), by Can Type 2025 & 2033

- Figure 12: Europe Metal Cans Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Metal Cans Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Metal Cans Market Revenue (billion), by Material Type 2025 & 2033

- Figure 15: Asia Pacific Metal Cans Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 16: Asia Pacific Metal Cans Market Revenue (billion), by Can Type 2025 & 2033

- Figure 17: Asia Pacific Metal Cans Market Revenue Share (%), by Can Type 2025 & 2033

- Figure 18: Asia Pacific Metal Cans Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Metal Cans Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Metal Cans Market Revenue (billion), by Material Type 2025 & 2033

- Figure 21: Latin America Metal Cans Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 22: Latin America Metal Cans Market Revenue (billion), by Can Type 2025 & 2033

- Figure 23: Latin America Metal Cans Market Revenue Share (%), by Can Type 2025 & 2033

- Figure 24: Latin America Metal Cans Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Latin America Metal Cans Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Metal Cans Market Revenue (billion), by Material Type 2025 & 2033

- Figure 27: Middle East and Africa Metal Cans Market Revenue Share (%), by Material Type 2025 & 2033

- Figure 28: Middle East and Africa Metal Cans Market Revenue (billion), by Can Type 2025 & 2033

- Figure 29: Middle East and Africa Metal Cans Market Revenue Share (%), by Can Type 2025 & 2033

- Figure 30: Middle East and Africa Metal Cans Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East and Africa Metal Cans Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Metal Cans Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 2: Global Metal Cans Market Revenue billion Forecast, by Can Type 2020 & 2033

- Table 3: Global Metal Cans Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Metal Cans Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 5: Global Metal Cans Market Revenue billion Forecast, by Can Type 2020 & 2033

- Table 6: Global Metal Cans Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Metal Cans Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Metal Cans Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Global Metal Cans Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 10: Global Metal Cans Market Revenue billion Forecast, by Can Type 2020 & 2033

- Table 11: Global Metal Cans Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: United Kingdom Metal Cans Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Germany Metal Cans Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: France Metal Cans Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Spain Metal Cans Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Italy Metal Cans Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Rest of Europe Metal Cans Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Global Metal Cans Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 19: Global Metal Cans Market Revenue billion Forecast, by Can Type 2020 & 2033

- Table 20: Global Metal Cans Market Revenue billion Forecast, by Country 2020 & 2033

- Table 21: China Metal Cans Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: India Metal Cans Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Japan Metal Cans Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Australia Metal Cans Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Rest of Asia Pacific Metal Cans Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Global Metal Cans Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 27: Global Metal Cans Market Revenue billion Forecast, by Can Type 2020 & 2033

- Table 28: Global Metal Cans Market Revenue billion Forecast, by Country 2020 & 2033

- Table 29: Global Metal Cans Market Revenue billion Forecast, by Material Type 2020 & 2033

- Table 30: Global Metal Cans Market Revenue billion Forecast, by Can Type 2020 & 2033

- Table 31: Global Metal Cans Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Metal Cans Market?

The projected CAGR is approximately 4.8%.

2. Which companies are prominent players in the Metal Cans Market?

Key companies in the market include Ardagh Group, DS Containers Inc, Ball Corporation, Independent Can Company, Universal Can Corporation, Hindustan Tin Works Ltd, Pacific Can China Holdings Limited, Crown Holdings Inc, CPMC HOLDINGS Limited (COFCO Group), Silgan Containers LLC, CCL Container Inc, Toyo Seikan Group Holdings Ltd, Showa Denko KK, Mauser Packaging Solutions, Saudi Arabian Packaging Industry WLL (SAPIN.

3. What are the main segments of the Metal Cans Market?

The market segments include Material Type, Can Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 62.23 billion as of 2022.

5. What are some drivers contributing to market growth?

High Recyclability of the Packaging Due to Less Usage of Energy; Increasing Consumption of both Alcoholic and Non-Alcoholic Beverages.

6. What are the notable trends driving market growth?

Canned Food Consumption to Drive the Market Growth.

7. Are there any restraints impacting market growth?

Presence of Alternate Packaging Solutions as Polyethylene Terephthalate.

8. Can you provide examples of recent developments in the market?

October 2022: Ardagh Metal Packaging (AMP) supplied the aluminum cans for Casa Azul Tequila Soda, a new US tequila-based ready-to-drink (RTD) cocktails vying for the premium on-the-go market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Metal Cans Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Metal Cans Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Metal Cans Market?

To stay informed about further developments, trends, and reports in the Metal Cans Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence