Key Insights

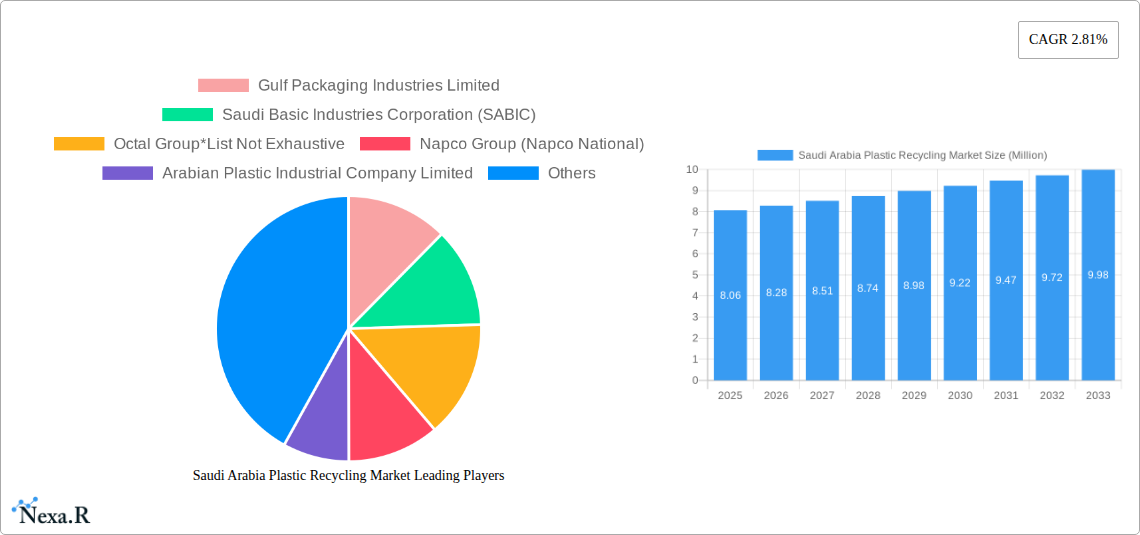

The Saudi Arabia plastic recycling market is poised for significant growth, with a current estimated market size of $8.06 million and a projected Compound Annual Growth Rate (CAGR) of 2.81% through 2033. This expansion is primarily driven by escalating environmental consciousness, stringent government regulations aimed at waste management and circular economy initiatives, and the increasing demand for recycled plastic materials across various end-user industries. The Kingdom's Vision 2030, with its focus on sustainability and economic diversification, provides a strong impetus for the development of a robust plastic recycling infrastructure. Key drivers include the growing awareness of plastic pollution's detrimental effects and the economic advantages of utilizing recycled materials, which can offer cost savings for manufacturers. The market is benefiting from advancements in recycling technologies and increased investment in recycling facilities.

Saudi Arabia Plastic Recycling Market Market Size (In Million)

The market's growth is further supported by evolving consumer preferences towards eco-friendly products and packaging. The demand for recycled plastics is particularly pronounced in the food and beverage, healthcare and pharmaceutical, and cosmetics and personal care sectors, all of which are substantial industries within Saudi Arabia. The flexible packaging segment, including plastic films and pouches, is expected to witness considerable traction due to its widespread application and the growing emphasis on reducing single-use plastics. While the market is propelled by these positive trends, potential restraints could include the initial capital investment required for advanced recycling technologies, fluctuations in the price of virgin plastics, and the need for consistent supply chains for post-consumer plastic waste. However, the long-term outlook remains exceptionally strong, with companies actively investing in capacity expansion and technological upgrades to meet the burgeoning demand for recycled plastic solutions.

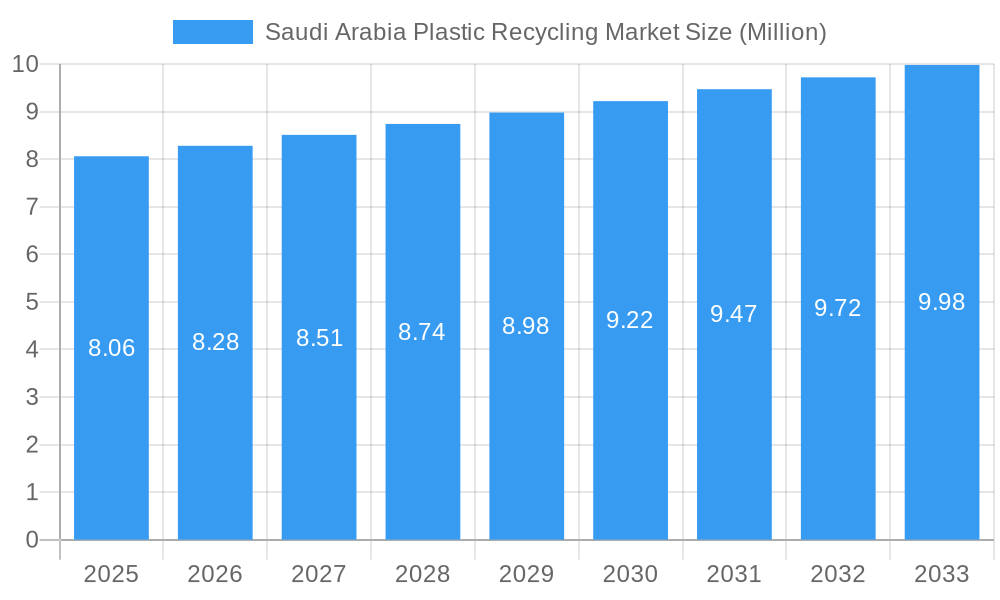

Saudi Arabia Plastic Recycling Market Company Market Share

This in-depth report provides a definitive analysis of the Saudi Arabia plastic recycling market, offering granular insights into its dynamics, growth trajectory, and future potential. Covering the period from 2019 to 2033, with a base year of 2025, this report is essential for stakeholders seeking to understand and capitalize on this burgeoning sector. We delve into intricate details of rigid and flexible plastic recycling, analyzing key materials like Polyethylene (PE), Polyethylene Terephthalate (PET), and Polypropylene (PP), alongside critical end-user industries such as Food, Beverage, Healthcare, and Cosmetics.

Saudi Arabia Plastic Recycling Market Dynamics & Structure

The Saudi Arabia plastic recycling market is characterized by a moderately concentrated structure, with key players like Saudi Basic Industries Corporation (SABIC), Gulf Packaging Industries Limited, and Napco Group (Napco National) holding significant influence. Technological innovation is a primary driver, with ongoing advancements in sorting, processing, and chemical recycling technologies enhancing efficiency and expanding the scope of recyclable materials. Robust regulatory frameworks, spearheaded by government initiatives promoting sustainability and circular economy principles, are actively shaping market growth. The competitive landscape features a growing array of domestic and international companies, each vying for market share through product differentiation and strategic partnerships. Substitutes for virgin plastics are increasingly being adopted due to environmental consciousness and evolving consumer preferences. End-user demographics are shifting towards greater demand for sustainable packaging solutions across all sectors. Mergers and acquisitions (M&A) are on the rise as companies seek to consolidate their market position and gain access to new technologies and capabilities. The market is projected to witness increased M&A activities, with an estimated 5-7 significant deals in the forecast period.

- Market Concentration: Moderate, with key players dominating specific segments.

- Technological Innovation: Focus on advanced sorting, chemical recycling, and material innovation.

- Regulatory Frameworks: Strong government support for sustainability and circular economy.

- Competitive Product Substitutes: Growing adoption of recycled content in packaging.

- End-User Demographics: Increasing demand for eco-friendly packaging solutions.

- M&A Trends: Increasing consolidation to enhance market reach and technological capabilities.

Saudi Arabia Plastic Recycling Market Growth Trends & Insights

The Saudi Arabia plastic recycling market is poised for substantial growth, driven by a confluence of factors including increasing environmental awareness, stringent government regulations, and the growing demand for sustainable packaging solutions. The market size is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 7.5% from 2025 to 2033, reaching an estimated XX Million units by the end of the forecast period. Adoption rates for recycled plastics are steadily increasing across various industries, particularly in the food and beverage sectors, where consumers are increasingly scrutinizing product packaging. Technological disruptions, such as the development of advanced chemical recycling techniques and improved mechanical recycling processes, are playing a pivotal role in enhancing the quality and applicability of recycled plastics. Consumer behavior shifts, influenced by global sustainability trends and a growing desire for responsible consumption, are further propelling the demand for products made from recycled materials. The market penetration of recycled plastics in packaging applications is expected to reach over 40% by 2030.

- Market Size Evolution: Significant expansion projected from 2025-2033.

- Adoption Rates: Steadily increasing across key end-user industries.

- Technological Disruptions: Advancements in chemical and mechanical recycling.

- Consumer Behavior Shifts: Growing demand for sustainable and eco-friendly products.

- Market Penetration: Increasing adoption of recycled content in packaging.

- CAGR: Estimated at 7.5% for the forecast period.

Dominant Regions, Countries, or Segments in Saudi Arabia Plastic Recycling Market

Within Saudi Arabia, the Packaging Type: Rigid segment, particularly Material: Polyethylene (PE), is emerging as a dominant force in the plastic recycling market. The robust demand from the End User Industry: Food and Beverage sectors, which heavily rely on rigid plastic packaging for product integrity and consumer appeal, is a primary growth driver. Polyethylene, being a versatile and widely used plastic, accounts for a substantial portion of the recyclable plastic waste generated, making its recycling infrastructure and processes highly developed.

- Key Drivers for Rigid Packaging Dominance:

- Food & Beverage Industry Demand: High consumption of rigid containers for perishables and beverages.

- Material Versatility: PE's wide range of applications and extensive production volumes.

- Regulatory Push for Food-Grade Recycled Content: Increasing incentives for using recycled PE in food packaging.

- Infrastructure Development: Established collection and processing facilities for rigid plastics.

The End User Industry: Healthcare and Pharmaceutical also contributes significantly to the demand for rigid plastic recycling due to the stringent requirements for sterile and secure packaging, where recycled materials are increasingly being explored for non-critical applications. The Cosmetics and Personal Care industry is also witnessing a growing trend towards sustainable packaging, further boosting the demand for recycled rigid plastics.

In the Flexible segment, Polyethene (PE) and Bi-orientated Polypropylene (BOPP) are key materials driving growth. The increasing popularity of flexible packaging solutions like pouches and bags across various consumer goods sectors, including food, personal care, and household products, fuels the demand for their recycling.

- Flexible Packaging Growth Factors:

- Convenience and Portability: Consumer preference for lightweight and easy-to-use packaging.

- Cost-Effectiveness: Often a more economical packaging solution.

- Product Innovation: Development of innovative pouch and bag designs.

- Sustainability Initiatives: Focus on developing recyclable flexible packaging solutions.

The Product Type: Pouches (Stand-up, Flat) are particularly experiencing a surge in demand, driven by their functionality and appeal in retail environments. The market share of rigid plastic recycling is estimated to be around 60% of the total plastic recycling market in Saudi Arabia.

Saudi Arabia Plastic Recycling Market Product Landscape

The Saudi Arabia plastic recycling market is witnessing a surge in product innovations aimed at enhancing the quality, functionality, and sustainability of recycled plastic materials. These include the development of advanced mechanical recycling processes that yield higher-grade recycled resins, suitable for demanding applications. Furthermore, advancements in chemical recycling are enabling the breakdown of plastics into their monomer components, allowing for the creation of virgin-quality recycled plastics that can be used in closed-loop systems. Innovations in composite materials and blended plastics are also expanding the application possibilities for recycled content. Applications range from everyday consumer goods and packaging to more specialized industrial uses, demonstrating the versatility and evolving capabilities of recycled plastics.

Key Drivers, Barriers & Challenges in Saudi Arabia Plastic Recycling Market

Key Drivers:

- Government Initiatives: Vision 2030, environmental regulations, and sustainability targets promoting the circular economy.

- Increasing Environmental Awareness: Growing public and corporate demand for eco-friendly practices and products.

- Technological Advancements: Innovations in sorting, recycling, and material science enhancing efficiency and output quality.

- Corporate Social Responsibility (CSR): Companies actively investing in recycling to meet sustainability goals and enhance brand image.

- Economic Incentives: Potential for cost savings from using recycled materials and government subsidies for recycling infrastructure.

Barriers & Challenges:

- Inconsistent Quality of Recycled Materials: Variability in the purity and consistency of collected plastic waste can impact its suitability for certain applications.

- Infrastructure Gaps: Need for expanded collection, sorting, and processing infrastructure across the nation.

- Consumer Behavior and Education: Lack of widespread awareness and participation in proper waste segregation and recycling practices.

- Cost Competitiveness: Initial investment costs for advanced recycling technologies and the fluctuating prices of virgin plastics can pose challenges.

- Regulatory Enforcement: Ensuring consistent enforcement of recycling regulations across all industries.

- Supply Chain Complexities: Efficiently collecting and transporting diverse plastic waste streams.

- Limited Chemical Recycling Capacity: While developing, chemical recycling capacity is still nascent.

Emerging Opportunities in Saudi Arabia Plastic Recycling Market

Emerging opportunities in the Saudi Arabia plastic recycling market lie in the development of advanced chemical recycling technologies capable of processing mixed plastic waste into high-value commodities. The untapped potential in specific niche applications, such as the automotive sector and construction materials, presents significant growth avenues. Evolving consumer preferences for sustainable products are creating demand for certified recycled content in various consumer goods. Furthermore, the growing focus on creating a circular economy for plastics presents opportunities for innovative business models, including product-as-a-service for packaging and advanced waste management solutions. The development of localized recycling hubs and advanced sorting facilities will further unlock market potential.

Growth Accelerators in the Saudi Arabia Plastic Recycling Market Industry

Several catalysts are accelerating the growth of the Saudi Arabia plastic recycling market. Technological breakthroughs in sorting, such as Artificial Intelligence (AI) and machine vision, are significantly improving the efficiency and accuracy of plastic waste separation. Strategic partnerships between waste management companies, recyclers, and manufacturers are crucial for establishing robust supply chains and ensuring consistent demand for recycled materials. Market expansion strategies, including the development of new recycling facilities and the adoption of international best practices, are also playing a vital role. The increasing investment by major corporations in developing their own recycling capabilities and securing recycled feedstock is a significant growth accelerator.

Key Players Shaping the Saudi Arabia Plastic Recycling Market Market

- Gulf Packaging Industries Limited

- Saudi Basic Industries Corporation (SABIC)

- Octal Group

- Napco Group (Napco National)

- Arabian Plastic Industrial Company Limited

- Zamil Plastic Industries Co

- Takween Advanced Industries

- Sealed Air Corporation (Sealed Air Saudi Arabia)

- ASPCO

- Advanced Flexible Packaging Company

- Printopack

- 3P Group

Notable Milestones in Saudi Arabia Plastic Recycling Market Sector

- April 2022: Mondi and Thimonnier launched a new recyclable mono-material berlingot sachet for liquid soap refills. Coextruded polyethylene, a recyclable mono-material, is used to create the berlingot sachet (PE). This innovation signals a move towards more sustainable and recyclable flexible packaging solutions.

- February 2022: ExxonMobil sold certified circular polymers to Berry. The circular polymers were created utilizing the business's Exxtend recycling technology, intended to broaden the selection of recyclable plastic materials and preserve product performance through many recycling cycles. Berry Global will create containers for food-grade packaging using polymers. This partnership highlights the growing importance of advanced recycling technologies in producing high-quality recycled plastics for sensitive applications.

In-Depth Saudi Arabia Plastic Recycling Market Market Outlook

The future of the Saudi Arabia plastic recycling market is exceptionally promising, driven by a clear commitment to sustainability and the circular economy. Growth accelerators such as ongoing technological advancements in both mechanical and chemical recycling, coupled with increasing investment in recycling infrastructure, will continue to bolster market expansion. Strategic partnerships between key industry players will foster greater collaboration and efficiency across the value chain. The evolving consumer preferences and stringent environmental regulations will further propel the demand for recycled plastic materials, creating significant opportunities for innovation and market penetration. The market is expected to witness sustained growth, transforming waste into valuable resources and contributing to a more sustainable future for Saudi Arabia.

Saudi Arabia Plastic Recycling Market Segmentation

-

1. Packaging Type

-

1.1. Rigid

-

1.1.1. Material

- 1.1.1.1. Polyethylene (PE)

- 1.1.1.2. Polyethylene Terephthalate (PET)

- 1.1.1.3. Polypropylene (PP)

- 1.1.1.4. Polystyrene (PS) and Expanded Polystyrene (EPS)

- 1.1.1.5. Polyvinyl Chloride (PVC)

-

1.1.2. End User Industry

- 1.1.2.1. Food

- 1.1.2.2. Beverage

- 1.1.2.3. Healthcare and Pharmaceutical

- 1.1.2.4. Cosmetics and Personal Care

- 1.1.2.5. Other End User Industries

-

1.1.1. Material

-

1.2. Flexible

- 1.2.1. Polyethene (PE)

- 1.2.2. Bi-orientated Polypropylene (BOPP)

- 1.2.3. Cast Polypropylene (CPP)

- 1.2.4. Other Flexible Plastic Packaging Materials

-

1.2.5. Product Type

- 1.2.5.1. Plastic Films

-

1.2.5.2. Pouches

- 1.2.5.2.1. Stand-up

- 1.2.5.2.2. Flat

- 1.2.5.3. Bags

- 1.2.5.4. Other Product Types

-

1.1. Rigid

Saudi Arabia Plastic Recycling Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Plastic Recycling Market Regional Market Share

Geographic Coverage of Saudi Arabia Plastic Recycling Market

Saudi Arabia Plastic Recycling Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.81% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand for Oxo-degradable Plastics is Expected to Increase with New Regulations Being Enforced; Increasing Flexible Plastic Packaging Solutions Demand across the End-user Industry

- 3.3. Market Restrains

- 3.3.1. Environmental Concerns over Recycling and Safe Disposal and Price Volatility of the Raw Materials

- 3.4. Market Trends

- 3.4.1. Polyethylene (PE) Expected To Witness Significant Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Plastic Recycling Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Packaging Type

- 5.1.1. Rigid

- 5.1.1.1. Material

- 5.1.1.1.1. Polyethylene (PE)

- 5.1.1.1.2. Polyethylene Terephthalate (PET)

- 5.1.1.1.3. Polypropylene (PP)

- 5.1.1.1.4. Polystyrene (PS) and Expanded Polystyrene (EPS)

- 5.1.1.1.5. Polyvinyl Chloride (PVC)

- 5.1.1.2. End User Industry

- 5.1.1.2.1. Food

- 5.1.1.2.2. Beverage

- 5.1.1.2.3. Healthcare and Pharmaceutical

- 5.1.1.2.4. Cosmetics and Personal Care

- 5.1.1.2.5. Other End User Industries

- 5.1.1.1. Material

- 5.1.2. Flexible

- 5.1.2.1. Polyethene (PE)

- 5.1.2.2. Bi-orientated Polypropylene (BOPP)

- 5.1.2.3. Cast Polypropylene (CPP)

- 5.1.2.4. Other Flexible Plastic Packaging Materials

- 5.1.2.5. Product Type

- 5.1.2.5.1. Plastic Films

- 5.1.2.5.2. Pouches

- 5.1.2.5.2.1. Stand-up

- 5.1.2.5.2.2. Flat

- 5.1.2.5.3. Bags

- 5.1.2.5.4. Other Product Types

- 5.1.1. Rigid

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Packaging Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Gulf Packaging Industries Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Saudi Basic Industries Corporation (SABIC)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Octal Group*List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Napco Group (Napco National)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Arabian Plastic Industrial Company Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Zamil Plastic Industries Co

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Takween Advanced Industries

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sealed Air Corporation (Sealed Air Saudi Arabia)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 ASPCO

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Advanced Flexible Packaging Company

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Printopack

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 3P Group

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Gulf Packaging Industries Limited

List of Figures

- Figure 1: Saudi Arabia Plastic Recycling Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia Plastic Recycling Market Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia Plastic Recycling Market Revenue Million Forecast, by Packaging Type 2020 & 2033

- Table 2: Saudi Arabia Plastic Recycling Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Saudi Arabia Plastic Recycling Market Revenue Million Forecast, by Packaging Type 2020 & 2033

- Table 4: Saudi Arabia Plastic Recycling Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Plastic Recycling Market?

The projected CAGR is approximately 2.81%.

2. Which companies are prominent players in the Saudi Arabia Plastic Recycling Market?

Key companies in the market include Gulf Packaging Industries Limited, Saudi Basic Industries Corporation (SABIC), Octal Group*List Not Exhaustive, Napco Group (Napco National), Arabian Plastic Industrial Company Limited, Zamil Plastic Industries Co, Takween Advanced Industries, Sealed Air Corporation (Sealed Air Saudi Arabia), ASPCO, Advanced Flexible Packaging Company, Printopack, 3P Group.

3. What are the main segments of the Saudi Arabia Plastic Recycling Market?

The market segments include Packaging Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.06 Million as of 2022.

5. What are some drivers contributing to market growth?

Demand for Oxo-degradable Plastics is Expected to Increase with New Regulations Being Enforced; Increasing Flexible Plastic Packaging Solutions Demand across the End-user Industry.

6. What are the notable trends driving market growth?

Polyethylene (PE) Expected To Witness Significant Market Growth.

7. Are there any restraints impacting market growth?

Environmental Concerns over Recycling and Safe Disposal and Price Volatility of the Raw Materials.

8. Can you provide examples of recent developments in the market?

April 2022: Mondi and Thimonnier launched a new recyclable mono-material berlingot sachet for liquid soap refills. Coextruded polyethylene, a recyclable mono-material, is used to create the berlingot sachet (PE).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Plastic Recycling Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Plastic Recycling Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Plastic Recycling Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Plastic Recycling Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence