Key Insights

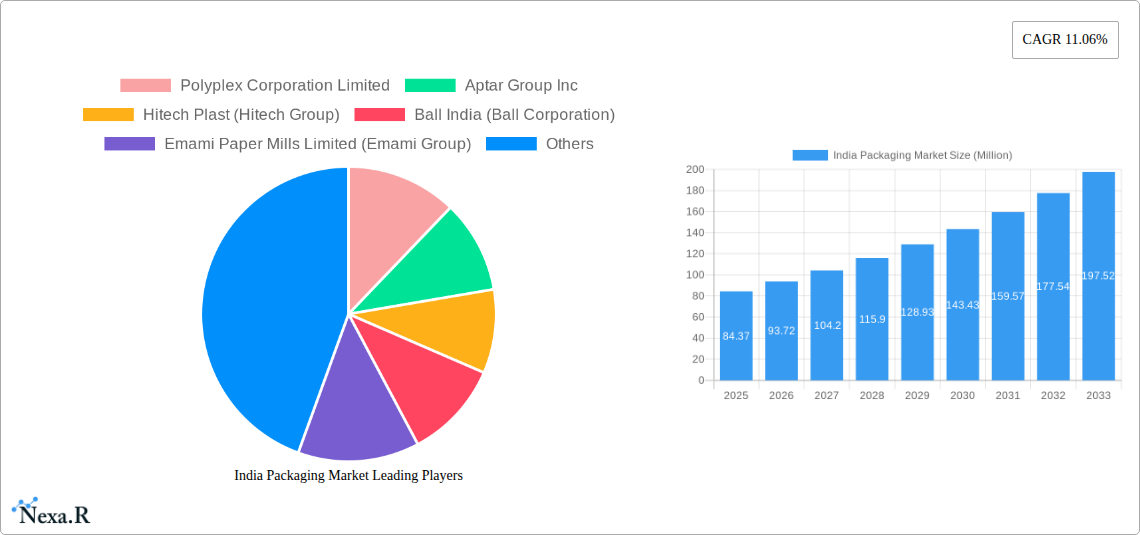

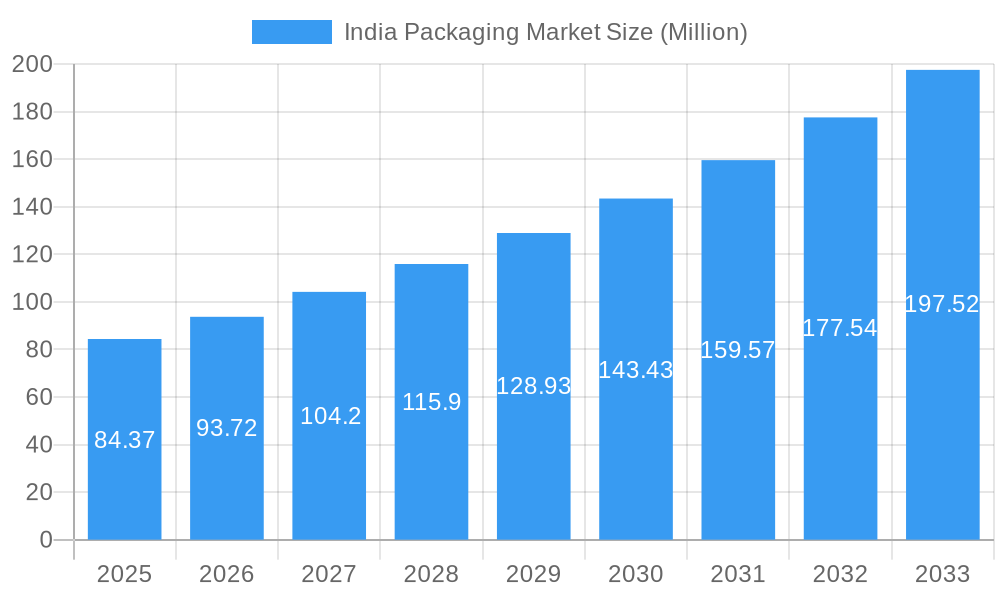

The Indian packaging market is poised for robust expansion, with an estimated USD 84.37 million market size in 2025. The industry is projected to experience a significant Compound Annual Growth Rate (CAGR) of 11.06% during the forecast period of 2025-2033, indicating a dynamic and evolving landscape. This impressive growth is primarily fueled by escalating consumer demand for packaged goods across various sectors, including food and beverages, personal care, and pharmaceuticals. The increasing urbanization and rising disposable incomes are further contributing to a higher consumption of convenience and ready-to-eat products, necessitating sophisticated and appealing packaging solutions. Furthermore, the burgeoning e-commerce sector is a pivotal driver, demanding efficient, protective, and often customized packaging to ensure product integrity during transit and delivery. The government's focus on "Make in India" initiatives and investments in manufacturing infrastructure are also bolstering the domestic packaging industry, encouraging innovation and production scalability.

India Packaging Market Market Size (In Million)

The market segmentation reveals a diverse range of materials and end-user applications driving this growth. Plastic packaging, encompassing both rigid and flexible formats, is expected to maintain a dominant position due to its versatility, cost-effectiveness, and protective properties, particularly in the food and beverage, and personal care segments. Paper-based packaging, including folding cartons and corrugated boxes, is witnessing a surge in demand, especially from the retail and e-commerce sectors, driven by sustainability concerns and the preference for recyclable materials. Container glass, though facing competition, remains crucial for alcoholic and non-alcoholic beverages, as well as certain cosmetic products, while metal cans and containers cater to the paints, chemicals, and food industries. Key players like Polyplex Corporation Limited, Uflex Limited, and TCPL Packaging Limited are actively investing in R&D and capacity expansion to capitalize on these opportunities, with a strong focus on sustainable packaging solutions and technological advancements to meet the evolving needs of the Indian market.

India Packaging Market Company Market Share

Unlock actionable insights into the dynamic India Packaging Market, a crucial sector for the nation's economic growth. This comprehensive report, spanning 2019-2033, offers an in-depth analysis of packaging solutions in India, covering plastic packaging, paper packaging, glass packaging, and metal packaging. With a detailed breakdown of segments like rigid plastic packaging, flexible plastic packaging, folding cartons, corrugated boxes, and container glass, this report is an indispensable resource for stakeholders seeking to navigate the evolving Indian packaging industry. Dive into market size, growth trends, key players, and emerging opportunities for informed strategic decision-making.

India Packaging Market Market Dynamics & Structure

The India Packaging Market is characterized by a moderately concentrated structure, with a mix of large integrated players and numerous smaller regional manufacturers. Technological innovation is a significant driver, fueled by increasing demand for sustainable and advanced packaging solutions. Regulatory frameworks, such as extended producer responsibility (EPR) and plastic waste management rules, are shaping market practices and pushing for greater recyclability and reusability. Competitive product substitutes are abundant, particularly with the ongoing shift towards eco-friendly alternatives. End-user demographics, driven by a burgeoning middle class and evolving consumer lifestyles, are increasingly influencing packaging design and functionality, with a rising demand for convenience and premiumization. Merger and acquisition (M&A) trends are evident as larger players seek to consolidate market share, expand product portfolios, and gain access to new technologies and distribution networks.

- Market Concentration: Dominated by a few large corporations alongside a fragmented base of SMEs.

- Technological Innovation: Driven by sustainability, smart packaging, and advanced material science.

- Regulatory Frameworks: EPR, waste management rules, and single-use plastic bans are key influencing factors.

- Competitive Substitutes: Growing demand for bio-based and recycled materials.

- End-User Demographics: Urbanization, rising disposable incomes, and e-commerce growth are shaping demand.

- M&A Trends: Strategic acquisitions to enhance capabilities and market reach.

India Packaging Market Growth Trends & Insights

The India Packaging Market is poised for robust growth, projected to witness a significant expansion over the forecast period. Driven by an escalating food packaging market, a booming beverage packaging industry, and the ever-growing demand from the cosmetics and personal care packaging segment, the overall market size is set to escalate. The pharmaceutical and healthcare packaging sector also contributes substantially, supported by an aging population and increased healthcare expenditure. The retail and e-commerce packaging segment is experiencing an unprecedented surge, propelled by the rapid adoption of online shopping across India. Technological disruptions, including the adoption of advanced printing techniques, smart packaging solutions, and the development of novel materials, are reshaping the competitive landscape. Consumer behavior shifts, such as a preference for smaller, single-serve packs and an increasing awareness of environmental impact, are directly influencing packaging choices. The market penetration of sustainable packaging options is expected to rise, reflecting a broader societal commitment to environmental stewardship.

- Market Size Evolution: Consistent upward trajectory driven by diverse end-user industries.

- Adoption Rates: High adoption rates for innovative and sustainable packaging solutions.

- Technological Disruptions: Automation, AI, and advanced material science are transforming production.

- Consumer Behavior Shifts: Growing demand for convenience, sustainability, and premiumization.

- CAGR Projection: Expected to be in the range of X-Y% over the forecast period.

Dominant Regions, Countries, or Segments in India Packaging Market

The India Packaging Market is experiencing significant growth, with the Plastic packaging segment emerging as the dominant force. Within this segment, Flexible Plastic Packaging is leading the charge due to its versatility, cost-effectiveness, and suitability for a wide range of applications, particularly in the Food and Beverage and Cosmetics and Personal Care industries. The rigid plastic packaging sub-segment also holds substantial market share, catering to needs in Industrial, Pharmaceutical and Healthcare, and Other End-users. The rapid expansion of India's consumer goods sector, coupled with increasing disposable incomes and urbanization, fuels the demand for packaged products, thereby driving the growth of plastic packaging. The Paper packaging segment, especially Corrugated Boxes and Folding Cartons, is a strong contender, witnessing significant growth fueled by the Retail and E-commerce boom and the increasing need for shipping and secondary packaging. Paper Bags are also gaining traction as a sustainable alternative. The Container Glass segment, driven by the Alcoholic and Non-alcoholic beverage sectors, as well as Personal Care and Cosmetics, demonstrates consistent growth. The Metal Cans and Containers segment, with applications in Paints and Chemicals and beverages, maintains a steady presence. Economically vibrant regions with a strong manufacturing base and a large consumer population, such as Western India (Maharashtra, Gujarat) and Southern India (Tamil Nadu, Karnataka), are key drivers of this dominance, benefiting from robust infrastructure, a skilled workforce, and extensive distribution networks.

- Dominant Segment: Plastic Packaging, with Flexible Plastic Packaging leading.

- Key End-Users: Food & Beverage, Cosmetics & Personal Care, Retail & E-commerce, Pharmaceutical & Healthcare.

- Leading Sub-Segments: Corrugated Boxes, Folding Cartons, Rigid Plastic Packaging.

- Regional Dominance: Western and Southern India, driven by economic activity and consumer base.

- Market Share: Plastic packaging accounts for approximately XX% of the total market share.

India Packaging Market Product Landscape

The India Packaging Market showcases a diverse and innovative product landscape. Innovations are concentrated on enhancing functionality, sustainability, and consumer appeal. Key advancements include the development of advanced barrier properties in flexible plastic packaging for extended shelf life of food products, and the introduction of lightweight yet durable rigid plastic packaging solutions. In the paper sector, enhanced graphics capabilities on folding cartons and specialized coatings for liquid paperboard are notable. The container glass sector is seeing innovations in thinner, lighter designs without compromising strength. The metal cans and containers market is witnessing improvements in recyclability and the adoption of advanced lining technologies. Applications span across nearly every consumer and industrial sector, from sophisticated multi-layer films for snacks to robust protection for industrial goods. Performance metrics like puncture resistance, tear strength, thermal stability, and UV protection are critical differentiators across various packaging types.

Key Drivers, Barriers & Challenges in India Packaging Market

Key Drivers:

- Growing Consumer Base & Disposable Income: An expanding middle class with increased purchasing power drives demand for packaged goods.

- E-commerce Boom: The surge in online retail necessitates robust and efficient packaging solutions for logistics and product protection.

- Government Initiatives & Make in India: Policies promoting domestic manufacturing and investment in the packaging sector.

- Technological Advancements: Development of sustainable, smart, and high-performance packaging materials.

- Rising Demand for Convenience: Single-serve packs, easy-open features, and on-the-go packaging solutions.

Barriers & Challenges:

- Raw Material Price Volatility: Fluctuations in the cost of polymers, paper pulp, and metals impact profitability.

- Environmental Concerns & Regulations: Stringent regulations regarding plastic waste and the push for sustainability create compliance challenges.

- Infrastructure Deficiencies: Logistical challenges and underdeveloped supply chains in certain regions.

- Competition from Informal Sector: The presence of unorganized players can lead to price wars and quality concerns.

- Consumer Awareness Gap: Inconsistent adoption of recycling practices and awareness of sustainable packaging options.

Emerging Opportunities in India Packaging Market

Emerging opportunities in the India Packaging Market lie in the burgeoning demand for sustainable and eco-friendly packaging solutions. This includes the widespread adoption of biodegradable and compostable plastics, recycled content in paper and plastic packaging, and innovative reusable packaging systems. The growth of the quick-commerce sector presents an opportunity for specialized, fast-turnaround packaging. Furthermore, the increasing focus on health and wellness is driving demand for specialized pharmaceutical and nutraceutical packaging with enhanced safety and tamper-evident features. The integration of smart technologies, such as QR codes for traceability and IoT-enabled sensors for product monitoring, represents another significant growth avenue, particularly in the food and beverage and pharmaceutical sectors.

Growth Accelerators in the India Packaging Market Industry

The India Packaging Market is set to be accelerated by several key factors. Technological breakthroughs in material science, leading to the development of lighter, stronger, and more sustainable packaging, will be crucial. Strategic partnerships and collaborations between packaging manufacturers, raw material suppliers, and end-user industries will foster innovation and market penetration. Market expansion strategies, including the development of localized packaging solutions for diverse regional needs and tapping into Tier 2 and Tier 3 cities, will unlock new growth avenues. The increasing adoption of circular economy principles and the development of robust recycling infrastructure will further propel sustainable packaging solutions.

Key Players Shaping the India Packaging Market Market

- Polyplex Corporation Limited

- Aptar Group Inc

- Hitech Plast (Hitech Group)

- Ball India (Ball Corporation)

- Emami Paper Mills Limited (Emami Group)

- Schott Poonawalla Private Limited

- KCL Limited

- The Bag Smith

- Uflex Limited

- Trident Paper Box Industries

- Hindustan Tin Works Ltd

- OJI India Packaging Pvt Ltd

- Canpac SA

- TCPL Packaging Limited

- Tetra-pak India Private Limited

- JK Paper Ltd

- PGP Glass Private Limited (Piramal Glass)

- Agi Glaspac (HSIL Limited)

- Zenith Tins Pvt Ltd

- AI Packaging Limited

- Bag Master

- Jindal Poly Films Limited

- Megaplast India Pvt Ltd

- Asepto (Uflex Limited)

- Schoeller Allibert

- Berry Global Inc

- Westrock India

- ITC Limited

- Gerresheimer AG

Notable Milestones in India Packaging Market Sector

- February 2023: Cosmetics and hair care brand Revlon developed a new package for its 'Top Speed' hair color range exclusively for the Indian market, unveiling a new visual identity for products across India in the coming years.

- May 2022: Huhtamaki set up its first recycling plant in Maharashtra, India, as part of its CloseTheLoop initiative. The site, spread across 2,000 square meters, has been recycling around 1,600 kg of post-consumer-used flexible plastic waste daily since becoming fully operational. The recycling plant was set up with an investment of USD 1.18 million as part of the Huhtamaki Foundation's CloseTheLoop initiative to tackle post-consumer waste and deliver a valuable secondary resource material. It was expected to process post-consumer waste to create resin to produce refined compounds for use in household products for consumers in India.

In-Depth India Packaging Market Market Outlook

The India Packaging Market is on a robust growth trajectory, driven by an insatiable consumer demand and a dynamic industrial landscape. Future market potential is significantly amplified by the ongoing digitalization of retail and the increasing penetration of e-commerce, necessitating advanced logistics and protective packaging. Strategic opportunities abound in the development and scaling of sustainable packaging alternatives, aligning with global environmental consciousness and stricter regulatory mandates. The market's outlook is further brightened by advancements in smart packaging, offering traceability, authentication, and enhanced consumer engagement. This evolving ecosystem presents a fertile ground for innovation, investment, and long-term sustainable growth for all stakeholders.

India Packaging Market Segmentation

-

1. Material Type

-

1.1. Plastic

-

1.1.1. Plastic Type - Summary

- 1.1.1.1. Rigid Plastic Packaging

- 1.1.1.2. Flexible Plastic Packaging

-

1.1.2. End-user

- 1.1.2.1. Food

- 1.1.2.2. Beverage

- 1.1.2.3. Cosmetics and Personal Care

- 1.1.2.4. Industrial

- 1.1.2.5. Pharmaceutical and Healthcare

- 1.1.2.6. Other End-users

-

1.1.1. Plastic Type - Summary

-

1.2. Paper

-

1.2.1. Paper Type - Summary

- 1.2.1.1. Folding Carton

- 1.2.1.2. Corrugated Boxes

- 1.2.1.3. Paper Bags and Liquid Paperboard

- 1.2.2. Food and Beverage

- 1.2.3. Retail and E-commerce

- 1.2.4. Personal Care & Cosmetics

-

1.2.1. Paper Type - Summary

-

1.3. Container Glass

- 1.3.1. Container Glass - Summary

- 1.3.2. Alcoholic

- 1.3.3. Non-alcoholic

- 1.3.4. Personal Care and Cosmetics

-

1.4. Metal Cans and Containers

- 1.4.1. Metal Cans and Containers - Summary

- 1.4.2. Paints and Chemicals

-

1.1. Plastic

India Packaging Market Segmentation By Geography

- 1. India

India Packaging Market Regional Market Share

Geographic Coverage of India Packaging Market

India Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.06% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise of the Organized Retail and E-commerce Sector; Increasing Demand for Sustainable and Recyclable Packaging

- 3.3. Market Restrains

- 3.3.1. Alternative Packaging Options such as Aluminum and Plastic

- 3.4. Market Trends

- 3.4.1. Food Industry is Expected to Hold the Largest Share in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Plastic

- 5.1.1.1. Plastic Type - Summary

- 5.1.1.1.1. Rigid Plastic Packaging

- 5.1.1.1.2. Flexible Plastic Packaging

- 5.1.1.2. End-user

- 5.1.1.2.1. Food

- 5.1.1.2.2. Beverage

- 5.1.1.2.3. Cosmetics and Personal Care

- 5.1.1.2.4. Industrial

- 5.1.1.2.5. Pharmaceutical and Healthcare

- 5.1.1.2.6. Other End-users

- 5.1.1.1. Plastic Type - Summary

- 5.1.2. Paper

- 5.1.2.1. Paper Type - Summary

- 5.1.2.1.1. Folding Carton

- 5.1.2.1.2. Corrugated Boxes

- 5.1.2.1.3. Paper Bags and Liquid Paperboard

- 5.1.2.2. Food and Beverage

- 5.1.2.3. Retail and E-commerce

- 5.1.2.4. Personal Care & Cosmetics

- 5.1.2.1. Paper Type - Summary

- 5.1.3. Container Glass

- 5.1.3.1. Container Glass - Summary

- 5.1.3.2. Alcoholic

- 5.1.3.3. Non-alcoholic

- 5.1.3.4. Personal Care and Cosmetics

- 5.1.4. Metal Cans and Containers

- 5.1.4.1. Metal Cans and Containers - Summary

- 5.1.4.2. Paints and Chemicals

- 5.1.1. Plastic

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. India

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Polyplex Corporation Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Aptar Group Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hitech Plast (Hitech Group)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Ball India (Ball Corporation)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Emami Paper Mills Limited (Emami Group)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Schott Poonawalla Private Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 KCL Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 The Bag Smith

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Uflex Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Trident Paper Box Industries

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Hindustan Tin Works Ltd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 OJI India Packaging Pvt Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Canpac SA

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 TCPL Packaging Limited

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Tetra-pak India Private Limited

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 JK Paper Ltd

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 PGP Glass Private Limited (Piramal Glass)

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.18 Agi Glaspac (HSIL Limited)

- 6.2.18.1. Overview

- 6.2.18.2. Products

- 6.2.18.3. SWOT Analysis

- 6.2.18.4. Recent Developments

- 6.2.18.5. Financials (Based on Availability)

- 6.2.19 Zenith Tins Pvt Ltd

- 6.2.19.1. Overview

- 6.2.19.2. Products

- 6.2.19.3. SWOT Analysis

- 6.2.19.4. Recent Developments

- 6.2.19.5. Financials (Based on Availability)

- 6.2.20 AI Packaging Limited

- 6.2.20.1. Overview

- 6.2.20.2. Products

- 6.2.20.3. SWOT Analysis

- 6.2.20.4. Recent Developments

- 6.2.20.5. Financials (Based on Availability)

- 6.2.21 Bag Master

- 6.2.21.1. Overview

- 6.2.21.2. Products

- 6.2.21.3. SWOT Analysis

- 6.2.21.4. Recent Developments

- 6.2.21.5. Financials (Based on Availability)

- 6.2.22 Jindal Poly Films Limited

- 6.2.22.1. Overview

- 6.2.22.2. Products

- 6.2.22.3. SWOT Analysis

- 6.2.22.4. Recent Developments

- 6.2.22.5. Financials (Based on Availability)

- 6.2.23 Megaplast India Pvt Ltd

- 6.2.23.1. Overview

- 6.2.23.2. Products

- 6.2.23.3. SWOT Analysis

- 6.2.23.4. Recent Developments

- 6.2.23.5. Financials (Based on Availability)

- 6.2.24 Asepto (Uflex Limited)

- 6.2.24.1. Overview

- 6.2.24.2. Products

- 6.2.24.3. SWOT Analysis

- 6.2.24.4. Recent Developments

- 6.2.24.5. Financials (Based on Availability)

- 6.2.25 Schoeller Allibert

- 6.2.25.1. Overview

- 6.2.25.2. Products

- 6.2.25.3. SWOT Analysis

- 6.2.25.4. Recent Developments

- 6.2.25.5. Financials (Based on Availability)

- 6.2.26 Berry Global Inc

- 6.2.26.1. Overview

- 6.2.26.2. Products

- 6.2.26.3. SWOT Analysis

- 6.2.26.4. Recent Developments

- 6.2.26.5. Financials (Based on Availability)

- 6.2.27 Westrock India

- 6.2.27.1. Overview

- 6.2.27.2. Products

- 6.2.27.3. SWOT Analysis

- 6.2.27.4. Recent Developments

- 6.2.27.5. Financials (Based on Availability)

- 6.2.28 ITC Limited

- 6.2.28.1. Overview

- 6.2.28.2. Products

- 6.2.28.3. SWOT Analysis

- 6.2.28.4. Recent Developments

- 6.2.28.5. Financials (Based on Availability)

- 6.2.29 Gerresheimer AG

- 6.2.29.1. Overview

- 6.2.29.2. Products

- 6.2.29.3. SWOT Analysis

- 6.2.29.4. Recent Developments

- 6.2.29.5. Financials (Based on Availability)

- 6.2.1 Polyplex Corporation Limited

List of Figures

- Figure 1: India Packaging Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: India Packaging Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 2: India Packaging Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: India Packaging Market Revenue Million Forecast, by Material Type 2020 & 2033

- Table 4: India Packaging Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Packaging Market?

The projected CAGR is approximately 11.06%.

2. Which companies are prominent players in the India Packaging Market?

Key companies in the market include Polyplex Corporation Limited, Aptar Group Inc, Hitech Plast (Hitech Group), Ball India (Ball Corporation), Emami Paper Mills Limited (Emami Group), Schott Poonawalla Private Limited, KCL Limited, The Bag Smith, Uflex Limited, Trident Paper Box Industries, Hindustan Tin Works Ltd, OJI India Packaging Pvt Ltd, Canpac SA, TCPL Packaging Limited, Tetra-pak India Private Limited, JK Paper Ltd, PGP Glass Private Limited (Piramal Glass), Agi Glaspac (HSIL Limited), Zenith Tins Pvt Ltd, AI Packaging Limited, Bag Master, Jindal Poly Films Limited, Megaplast India Pvt Ltd, Asepto (Uflex Limited), Schoeller Allibert, Berry Global Inc, Westrock India, ITC Limited, Gerresheimer AG.

3. What are the main segments of the India Packaging Market?

The market segments include Material Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 84.37 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise of the Organized Retail and E-commerce Sector; Increasing Demand for Sustainable and Recyclable Packaging.

6. What are the notable trends driving market growth?

Food Industry is Expected to Hold the Largest Share in the Market.

7. Are there any restraints impacting market growth?

Alternative Packaging Options such as Aluminum and Plastic.

8. Can you provide examples of recent developments in the market?

February 2023: Cosmetics and hair care brand Revlon developed a new package for its 'Top Speed' hair color range exclusively for the Indian market. The brand unveiled a new visual identity for products across India in the coming years.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Packaging Market?

To stay informed about further developments, trends, and reports in the India Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence