Key Insights

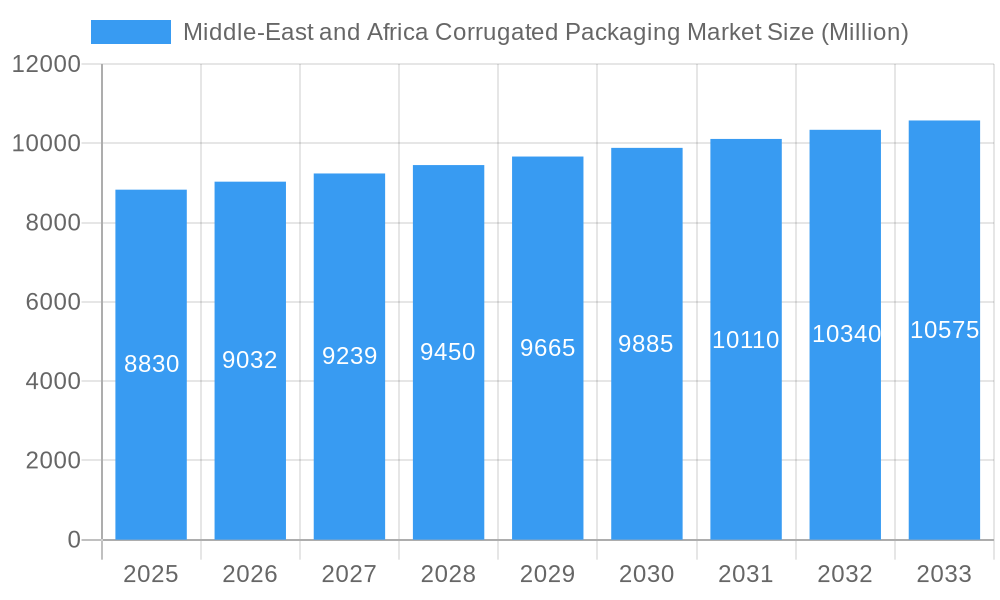

The Middle East and Africa (MEA) corrugated packaging market is poised for steady growth, projecting a market size of USD 8.83 Billion in 2025 with a Compound Annual Growth Rate (CAGR) of 2.28% through 2033. This expansion is underpinned by a confluence of favorable economic factors and evolving consumer demands across the region. The increasing disposable incomes and burgeoning middle class in countries like Saudi Arabia and the UAE are directly fueling demand for packaged goods, particularly in the food and beverages sector, which represents a significant end-user segment. Furthermore, the robust growth of e-commerce platforms across the MEA region is a key driver, necessitating efficient and protective corrugated packaging solutions for shipping and logistics. Investments in manufacturing infrastructure and a growing awareness of sustainable packaging alternatives are also contributing positively to market dynamics.

Middle-East and Africa Corrugated Packaging Market Market Size (In Billion)

While the market is experiencing a healthy CAGR, certain restraints need to be considered. Fluctuations in raw material prices, particularly for paper pulp, can impact profit margins for manufacturers and potentially influence packaging costs. Additionally, stringent environmental regulations regarding waste management and recycling in some parts of the MEA region could necessitate significant investments in adapting production processes and materials. However, these challenges also present opportunities for innovation in eco-friendly corrugated packaging. The diversification of end-user industries, including electric goods and personal care, alongside the consistent demand from food and beverages, ensures a resilient market outlook. The market's trajectory is also influenced by the adoption of advanced manufacturing techniques and a focus on customized packaging solutions to meet diverse client needs.

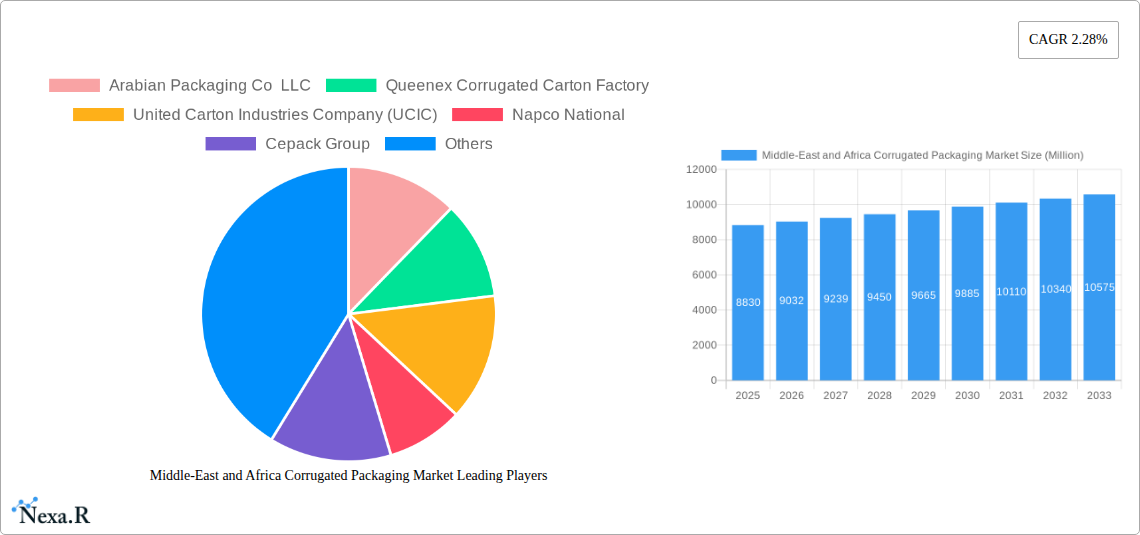

Middle-East and Africa Corrugated Packaging Market Company Market Share

Middle-East and Africa Corrugated Packaging Market: Comprehensive Report & Forecast 2019–2033

Unlock the potential of the burgeoning Middle-East and Africa (MEA) corrugated packaging market with this in-depth report. Delve into critical trends, market dynamics, and future projections for a sector poised for significant expansion. This report offers unparalleled insights into the corrugated packaging value chain, from raw material sourcing to end-user applications, crucial for strategic decision-making.

Report Covers:

- Study Period: 2019–2033

- Base Year: 2025

- Estimated Year: 2025

- Forecast Period: 2025–2033

- Historical Period: 2019–2024

Key Segments Analyzed:

- Packaging Type: Slotted Containers, Die-cut Containers, Five-panel Folder Boxes, Other Types

- End User: Food, Beverages, Electric Goods, Personal Care and Household Care, Other End Users

Featured Companies: Arabian Packaging Co LLC, Queenex Corrugated Carton Factory, United Carton Industries Company (UCIC), Napco National, Cepack Group, Falcon Pack, World Pack Industries LLC, Universal Carton Industries Group, Express Pack Print, Green Packaging Boxes IND LLC, Tarboosh Packaging Co LLC, Unipack Containers & Carton Products LLC, Al Rumanah Packaging, NBM Pack* (List Not Exhaustive)

Report Value Units: Million Units

Middle-East and Africa Corrugated Packaging Market Market Dynamics & Structure

The MEA corrugated packaging market exhibits a dynamic landscape shaped by evolving consumer behaviors, robust industrial growth, and increasing regulatory focus on sustainability. Market concentration varies across key players, with established entities like Napco National and United Carton Industries Company (UCIC) holding significant sway. Technological innovation drivers are primarily centered on enhancing packaging efficiency, durability, and eco-friendliness, driven by the growing demand for sustainable packaging solutions. Regulatory frameworks are progressively aligning with global environmental standards, influencing material choices and manufacturing processes. Competitive product substitutes, such as plastic packaging, remain a concern, though the inherent recyclability and cost-effectiveness of corrugated packaging offer a strong counter-argument. End-user demographics are shifting, with a rising middle class and expanding e-commerce penetration fueling demand across various sectors. Mergers and acquisitions (M&A) trends indicate a strategic consolidation within the industry, as companies seek to expand their geographical reach and product portfolios. For instance, the forecast period is anticipated to witness at least 5 major M&A activities, contributing to a more consolidated yet competitive market structure. Barriers to innovation often stem from the capital-intensive nature of upgrading manufacturing facilities and the challenge of sourcing consistent, high-quality recycled paperboard.

- Market Concentration: Moderate to High in key economies, with fragmented presence in emerging markets.

- Technological Innovation: Focus on lightweighting, improved barrier properties, and digital printing capabilities.

- Regulatory Frameworks: Increasing emphasis on Extended Producer Responsibility (EPR) and recycled content mandates.

- Competitive Substitutes: Plastics and rigid packaging, necessitating continuous innovation in corrugated solutions.

- End-User Demographics: Urbanization, rising disposable incomes, and e-commerce adoption are key influencers.

- M&A Trends: Strategic acquisitions to gain market share, technological expertise, and product diversification.

Middle-East and Africa Corrugated Packaging Market Growth Trends & Insights

The Middle-East and Africa corrugated packaging market is projected to experience robust growth, driven by a confluence of economic, demographic, and technological factors. The market size is estimated to have reached approximately 15,500 million units in 2024 and is forecasted to expand at a Compound Annual Growth Rate (CAGR) of 6.8% from 2025 to 2033, reaching an estimated 26,000 million units by the end of the forecast period. Adoption rates for corrugated packaging are steadily increasing across diverse industries, bolstered by its inherent sustainability and cost-effectiveness. Technological disruptions, such as advancements in paperboard manufacturing and printing technologies, are enabling the creation of more sophisticated and functional packaging solutions. Consumer behavior shifts are playing a pivotal role, with a growing preference for e-commerce driving demand for durable and protective shipping containers. The "unboxing experience" is also becoming a significant factor, leading to increased demand for aesthetically pleasing and innovative corrugated designs. Furthermore, the growing awareness of environmental issues is compelling both businesses and consumers to opt for eco-friendly packaging alternatives, thereby propelling the adoption of corrugated materials. The increasing penetration of smartphones and internet connectivity across the MEA region is further accelerating e-commerce growth, consequently boosting the demand for corrugated boxes for logistics and last-mile delivery. The food and beverage sector, a consistent large-scale consumer of packaging, continues to be a primary growth engine, with demand for secondary and tertiary packaging solutions on the rise. The personal care and household care segments are also witnessing significant growth, driven by product innovation and expanding market reach. The electric goods segment, while subject to fluctuations in consumer spending, also represents a substantial area of opportunity for robust corrugated packaging solutions due to the need for effective product protection during transit.

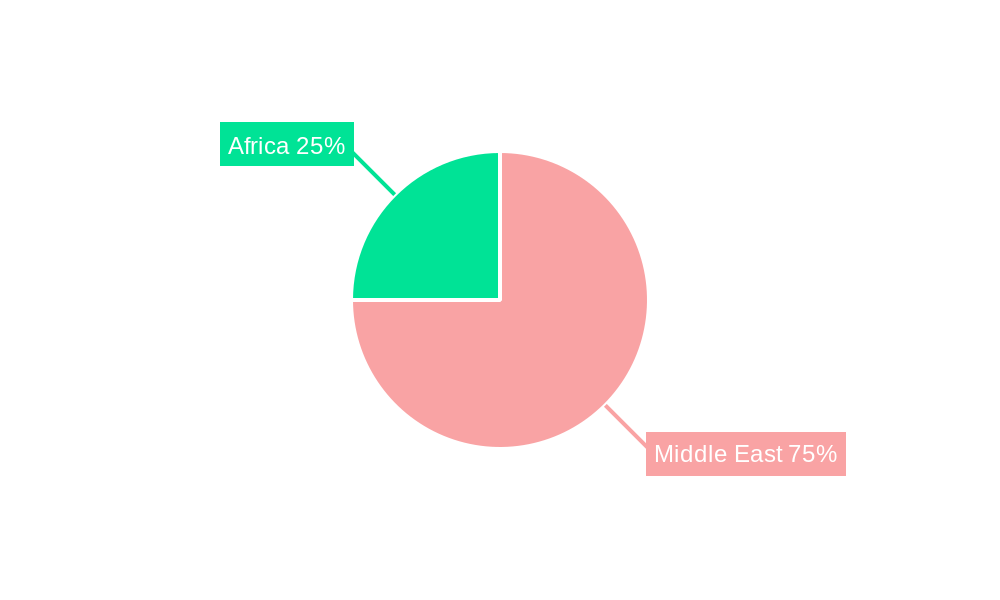

Dominant Regions, Countries, or Segments in Middle-East and Africa Corrugated Packaging Market

The Middle-East and Africa corrugated packaging market is characterized by a varied landscape of regional dominance and segment leadership. Among the various segments, Slotted Containers currently hold the largest market share, estimated to be around 45% of the total market in 2025, due to their versatility and widespread application in logistics and shipping across all end-user industries. The Food end-user segment is also a dominant force, accounting for approximately 30% of the market in 2025, driven by the region's substantial food production and consumption, coupled with the growing demand for packaged food products. Geographically, the Middle East region, particularly countries like Saudi Arabia, the UAE, and Egypt, currently leads the market. This dominance is attributed to several factors including robust economic development, significant investments in manufacturing and infrastructure, and a growing e-commerce ecosystem. Saudi Arabia, with its large population and ambitious Vision 2030 initiatives, is a prime example of a key country driving growth through industrial expansion and increased consumer spending. The UAE, a major trade and logistics hub, benefits from its strategic location and advanced infrastructure, facilitating the import and export of goods requiring reliable packaging. Egypt's large population and developing industrial base also contribute significantly to the region's overall demand for corrugated packaging.

- Dominant Segment (Type): Slotted Containers

- Key Drivers: High versatility, cost-effectiveness, suitability for diverse product types, established manufacturing processes.

- Market Share (2025): ~45%

- Dominant Segment (End User): Food

- Key Drivers: Growing food processing industry, increasing demand for packaged goods, stringent food safety regulations requiring protective packaging, expansion of retail chains.

- Market Share (2025): ~30%

- Dominant Region: Middle East (Saudi Arabia, UAE, Egypt)

- Key Drivers: Economic diversification, significant investments in infrastructure and logistics, burgeoning e-commerce sector, growing disposable incomes, supportive government policies for manufacturing.

- Market Share (2025): ~55% (estimated for the Middle East region)

Middle-East and Africa Corrugated Packaging Market Product Landscape

The product landscape within the MEA corrugated packaging market is increasingly sophisticated, moving beyond basic containment to offering enhanced functionality and branding opportunities. Innovations focus on developing lightweight yet strong corrugated board for reduced shipping costs and improved sustainability. Advancements in printing technologies, including high-resolution digital printing, enable vibrant branding and customization, transforming corrugated boxes into effective marketing tools. Performance metrics are being rigorously optimized for improved crush resistance, moisture resistance, and stacking strength, critical for protecting goods during transit and storage. Unique selling propositions are emerging around sustainable sourcing, post-consumer recycled content, and the development of specialized packaging for niche applications like sensitive electronics or perishable goods. Technological advancements are also facilitating the integration of smart features, such as QR codes for supply chain traceability and anti-counterfeiting measures.

Key Drivers, Barriers & Challenges in Middle-East and Africa Corrugated Packaging Market

The MEA corrugated packaging market is propelled by several key drivers. The rapid expansion of e-commerce across the region is a primary growth catalyst, necessitating efficient and cost-effective shipping solutions. Economic growth and industrialization, particularly in sectors like food & beverage, FMCG, and construction, directly translate to increased demand for packaging. Growing consumer awareness and regulatory push towards sustainable packaging solutions favor the inherent recyclability of corrugated materials. Technological advancements in papermaking and printing are enabling higher quality and more specialized packaging.

- Key Drivers:

- E-commerce boom and associated logistics needs.

- Economic development and industrial diversification.

- Rising demand for sustainable and eco-friendly packaging.

- Technological advancements in manufacturing and printing.

- Growing population and urbanization.

However, the market faces significant barriers and challenges. Volatility in raw material prices, primarily paper pulp, can impact profitability and pricing strategies. Intense competition from alternative packaging materials, such as plastics, poses a constant threat. Inadequate infrastructure and logistics networks in some parts of Africa can hinder efficient distribution. Stringent environmental regulations, while a driver for sustainable packaging, can also impose compliance costs on manufacturers. Supply chain disruptions, exacerbated by geopolitical factors, can affect the availability of raw materials and finished goods.

- Barriers & Challenges:

- Fluctuations in raw material prices (paper pulp).

- Competition from plastic and other packaging alternatives.

- Inadequate infrastructure in certain regions.

- Evolving and sometimes complex regulatory landscapes.

- Supply chain vulnerabilities and disruptions.

- Skilled labor shortages in some segments.

Emerging Opportunities in Middle-East and Africa Corrugated Packaging Market

Emerging opportunities in the MEA corrugated packaging market are diverse and promising. The growing demand for customized and premium packaging for e-commerce luxury goods presents a significant avenue for growth, requiring innovative designs and high-quality printing. The expansion of the pharmaceutical and healthcare sectors, especially post-pandemic, will drive the need for specialized, sterile, and tamper-evident corrugated packaging solutions. Untapped markets within sub-Saharan Africa, with their rapidly growing populations and developing economies, offer substantial potential for market penetration. The increasing focus on food safety and traceability will fuel demand for smart packaging solutions with integrated tracking and authentication features. Furthermore, the development of innovative corrugated materials with enhanced barrier properties for food preservation and the growing interest in direct-to-consumer (DTC) models across various industries are creating new avenues for corrugated packaging applications.

- E-commerce Premiumization: Demand for sophisticated, branded packaging for online retail.

- Healthcare & Pharmaceutical: Need for specialized, sterile, and tamper-evident solutions.

- Untapped African Markets: Rapidly growing populations and developing economies.

- Smart & Traceable Packaging: Integration of technology for supply chain visibility and anti-counterfeiting.

- Enhanced Barrier Properties: Development of corrugated materials for extended product shelf life.

Growth Accelerators in the Middle-East and Africa Corrugated Packaging Market Industry

Several catalysts are accelerating long-term growth within the MEA corrugated packaging industry. The ongoing digital transformation and the widespread adoption of e-commerce platforms are creating sustained demand for robust and efficient logistics packaging. Strategic partnerships between packaging manufacturers, logistics providers, and e-commerce giants are optimizing supply chains and fostering innovation. Government initiatives focused on promoting local manufacturing, reducing import dependency, and encouraging sustainable industrial practices are providing a conducive environment for market expansion. The increasing adoption of advanced manufacturing technologies, such as automation and AI, is enhancing production efficiency and enabling greater customization. Furthermore, the growing awareness and preference for circular economy principles are positioning corrugated packaging as a preferred choice due to its high recyclability and biodegradability, acting as a significant growth accelerator.

Key Players Shaping the Middle-East and Africa Corrugated Packaging Market Market

- Arabian Packaging Co LLC

- Queenex Corrugated Carton Factory

- United Carton Industries Company (UCIC)

- Napco National

- Cepack Group

- Falcon Pack

- World Pack Industries LLC

- Universal Carton Industries Group

- Express Pack Print

- Green Packaging Boxes IND LLC

- Tarboosh Packaging Co LLC

- Unipack Containers & Carton Products LLC

- Al Rumanah Packaging

- NBM Pack

Notable Milestones in Middle-East and Africa Corrugated Packaging Market Sector

- August 2022: International Trade Administration highlighted that increasing e-commerce adoption in Kenya would aid the market's growth. Consumer demand for e-commerce was accelerated mainly during the COVID-19 pandemic. The government is pushing for 4G universal coverage, and smartphone ownership is accelerating, making Kenya one of the fastest-growing e-commerce markets.

- July 2022: Pizza Hut restaurants were developed and run throughout Saudi Arabia, except for Jeddah city, by Americana Restaurants, the top restaurant platform in the MENA region, under a franchise agreement signed with Yum!, the largest restaurant company in the world, with headquarters in the United States. This event underscores the significant growth and expansion within the food service industry, a major consumer of corrugated packaging for delivery and operational needs.

In-Depth Middle-East and Africa Corrugated Packaging Market Market Outlook

The outlook for the Middle-East and Africa corrugated packaging market is exceptionally positive, driven by sustained economic development, a burgeoning e-commerce sector, and a strong global shift towards sustainable packaging solutions. The region's increasing population, coupled with rising disposable incomes and urbanization, will continue to fuel demand across key end-user segments like food, beverages, and personal care. Strategic investments in manufacturing capabilities and the adoption of advanced technologies will further enhance production efficiency and product innovation, catering to the evolving needs of businesses. As governments across the MEA region increasingly prioritize environmental regulations and circular economy initiatives, corrugated packaging's inherent recyclability positions it for significant market share gains. The ongoing expansion of logistics and supply chain infrastructure will also bolster the demand for reliable and cost-effective packaging solutions. Future growth will likely be characterized by a focus on specialized packaging, enhanced digital printing for branding, and the integration of smart technologies for improved traceability and sustainability reporting, ensuring a dynamic and promising trajectory for the market.

Middle-East and Africa Corrugated Packaging Market Segmentation

-

1. Type

- 1.1. Slotted Containers

- 1.2. Die-cut Containers

- 1.3. Five-panel Folder Boxes

- 1.4. Other Types

-

2. End User

- 2.1. Food

- 2.2. Beverages

- 2.3. Electric Goods

- 2.4. Personal Care and Household Care

- 2.5. Other End Users

Middle-East and Africa Corrugated Packaging Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle-East and Africa Corrugated Packaging Market Regional Market Share

Geographic Coverage of Middle-East and Africa Corrugated Packaging Market

Middle-East and Africa Corrugated Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.28% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Demand from the E-commerce Sector; Growing Demand for Lightweight Materials and Scope for Growth in End-user Segments

- 3.3. Market Restrains

- 3.3.1. Increased Demand from the E-commerce Sector; Growing Demand for Lightweight Materials and Scope for Growth in End-user Segments

- 3.4. Market Trends

- 3.4.1. Increased Demand from the E-commerce Sector to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle-East and Africa Corrugated Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Slotted Containers

- 5.1.2. Die-cut Containers

- 5.1.3. Five-panel Folder Boxes

- 5.1.4. Other Types

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Food

- 5.2.2. Beverages

- 5.2.3. Electric Goods

- 5.2.4. Personal Care and Household Care

- 5.2.5. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Arabian Packaging Co LLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Queenex Corrugated Carton Factory

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 United Carton Industries Company (UCIC)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Napco National

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Cepack Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Falcon Pack

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 World Pack Industries LLC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Universal Carton Industries Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Express Pack Print

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Green Packaging Boxes IND LLC

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Tarboosh Packaging Co LLC

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Unipack Containers & Carton Products LLC

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Al Rumanah Packaging

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 NBM Pack*List Not Exhaustive

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.1 Arabian Packaging Co LLC

List of Figures

- Figure 1: Middle-East and Africa Corrugated Packaging Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Middle-East and Africa Corrugated Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: Middle-East and Africa Corrugated Packaging Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Middle-East and Africa Corrugated Packaging Market Volume Billion Forecast, by Type 2020 & 2033

- Table 3: Middle-East and Africa Corrugated Packaging Market Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Middle-East and Africa Corrugated Packaging Market Volume Billion Forecast, by End User 2020 & 2033

- Table 5: Middle-East and Africa Corrugated Packaging Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Middle-East and Africa Corrugated Packaging Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Middle-East and Africa Corrugated Packaging Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Middle-East and Africa Corrugated Packaging Market Volume Billion Forecast, by Type 2020 & 2033

- Table 9: Middle-East and Africa Corrugated Packaging Market Revenue Million Forecast, by End User 2020 & 2033

- Table 10: Middle-East and Africa Corrugated Packaging Market Volume Billion Forecast, by End User 2020 & 2033

- Table 11: Middle-East and Africa Corrugated Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Middle-East and Africa Corrugated Packaging Market Volume Billion Forecast, by Country 2020 & 2033

- Table 13: Saudi Arabia Middle-East and Africa Corrugated Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Saudi Arabia Middle-East and Africa Corrugated Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 15: United Arab Emirates Middle-East and Africa Corrugated Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: United Arab Emirates Middle-East and Africa Corrugated Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 17: Israel Middle-East and Africa Corrugated Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Israel Middle-East and Africa Corrugated Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Qatar Middle-East and Africa Corrugated Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Qatar Middle-East and Africa Corrugated Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Kuwait Middle-East and Africa Corrugated Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Kuwait Middle-East and Africa Corrugated Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: Oman Middle-East and Africa Corrugated Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Oman Middle-East and Africa Corrugated Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Bahrain Middle-East and Africa Corrugated Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Bahrain Middle-East and Africa Corrugated Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Jordan Middle-East and Africa Corrugated Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Jordan Middle-East and Africa Corrugated Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Lebanon Middle-East and Africa Corrugated Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Lebanon Middle-East and Africa Corrugated Packaging Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle-East and Africa Corrugated Packaging Market?

The projected CAGR is approximately 2.28%.

2. Which companies are prominent players in the Middle-East and Africa Corrugated Packaging Market?

Key companies in the market include Arabian Packaging Co LLC, Queenex Corrugated Carton Factory, United Carton Industries Company (UCIC), Napco National, Cepack Group, Falcon Pack, World Pack Industries LLC, Universal Carton Industries Group, Express Pack Print, Green Packaging Boxes IND LLC, Tarboosh Packaging Co LLC, Unipack Containers & Carton Products LLC, Al Rumanah Packaging, NBM Pack*List Not Exhaustive.

3. What are the main segments of the Middle-East and Africa Corrugated Packaging Market?

The market segments include Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.83 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand from the E-commerce Sector; Growing Demand for Lightweight Materials and Scope for Growth in End-user Segments.

6. What are the notable trends driving market growth?

Increased Demand from the E-commerce Sector to Drive the Market.

7. Are there any restraints impacting market growth?

Increased Demand from the E-commerce Sector; Growing Demand for Lightweight Materials and Scope for Growth in End-user Segments.

8. Can you provide examples of recent developments in the market?

August 2022 - International Trade Administration stated that the increasing e-commerce adoption in Kenya would aid the market's growth. Consumer demand for e-commerce was accelerated mainly during the COVID-19 pandemic. The government is pushing for 4G universal coverage, and smartphone ownership is accelerating, making Kenya one of the fastest-growing e-commerce markets.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle-East and Africa Corrugated Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle-East and Africa Corrugated Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle-East and Africa Corrugated Packaging Market?

To stay informed about further developments, trends, and reports in the Middle-East and Africa Corrugated Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence