Key Insights

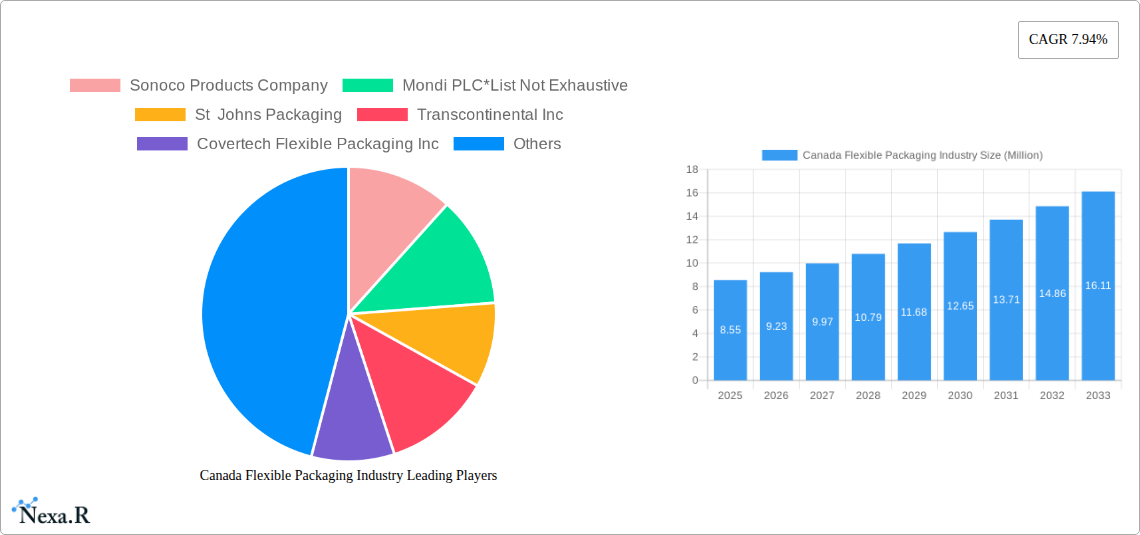

The Canadian flexible packaging market is poised for substantial growth, projected to reach $8.55 million by 2025 and expand at a robust Compound Annual Growth Rate (CAGR) of 7.94% throughout the forecast period of 2025-2033. This expansion is primarily fueled by an increasing consumer demand for convenient, sustainable, and aesthetically pleasing packaging solutions across various end-user industries. The food and beverage sector, a dominant force in the Canadian economy, continues to be the largest consumer of flexible packaging due to its excellent barrier properties, extended shelf life capabilities, and cost-effectiveness compared to rigid alternatives. Furthermore, the growing emphasis on eco-friendly packaging options is driving innovation in material types, with a notable shift towards recyclable and biodegradable alternatives.

Canada Flexible Packaging Industry Market Size (In Million)

Key drivers propelling this market forward include the escalating adoption of stand-up pouches and other innovative product formats, which offer enhanced consumer appeal and functionality. The continuous pursuit of lightweight yet durable materials, such as advanced plastics like Polyethylene (PE) and Bi-orientated Polypropylene (BOPP), alongside sustainable options like paper and aluminum foil, are central to market dynamics. While the market benefits from strong consumer demand and technological advancements, certain restraints, such as fluctuating raw material prices and increasing regulatory scrutiny regarding plastic waste, will need to be strategically managed. However, the overall outlook remains exceptionally positive, with significant opportunities in the household and personal care segments, and a burgeoning interest in specialized films and wraps catering to evolving consumer lifestyles and e-commerce trends.

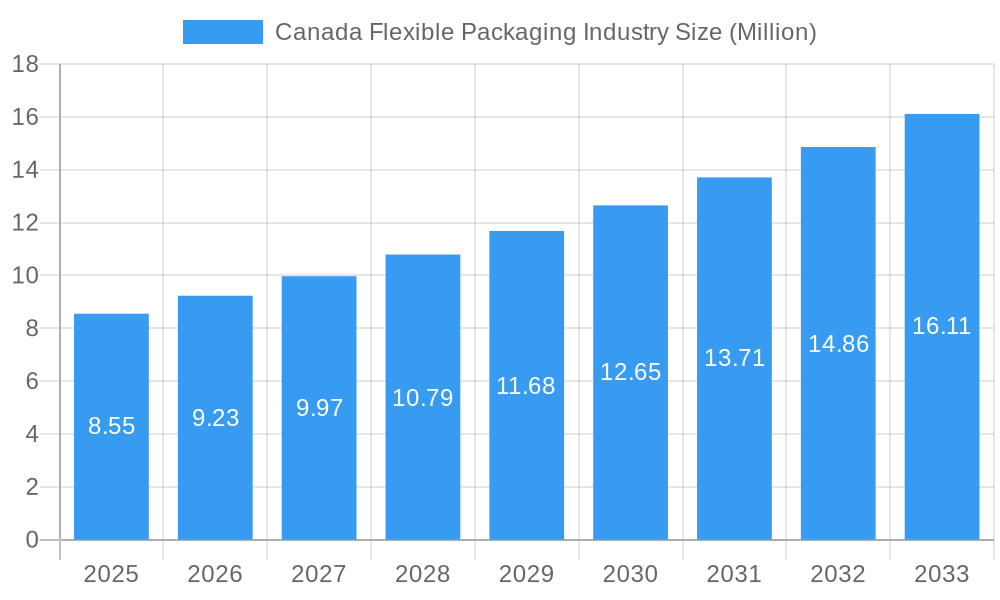

Canada Flexible Packaging Industry Company Market Share

Comprehensive Report: Canada Flexible Packaging Industry Outlook 2025-2033

This in-depth report provides a definitive analysis of the Canada Flexible Packaging Industry, offering critical insights into market dynamics, growth trends, competitive landscapes, and future opportunities. Covering the historical period of 2019–2024 and extending to a forecast period of 2025–2033, with a base year of 2025, this report is essential for stakeholders seeking to understand and capitalize on the evolving Canadian flexible packaging market.

Canada Flexible Packaging Industry Market Dynamics & Structure

The Canada Flexible Packaging Industry is characterized by a moderately concentrated market with a few dominant players and a growing number of specialized manufacturers. Technological innovation is a primary driver, with continuous advancements in material science, printing technologies, and barrier properties enhancing product performance and sustainability. Regulatory frameworks, particularly those focused on environmental impact and recyclability, are increasingly shaping market strategies and product development. Competitive product substitutes, such as rigid packaging and emerging biodegradable materials, present ongoing challenges and opportunities for innovation. End-user demographics, driven by a growing demand for convenience, health-conscious options, and sustainable products, are significantly influencing packaging design and material choices. Mergers and acquisitions (M&A) are active, with larger companies acquiring innovative smaller firms to expand their portfolios and market reach.

- Market Concentration: Highly competitive with a mix of global and local players, leading to strategic alliances and product differentiation.

- Technological Innovation: Focus on advanced barrier films, smart packaging solutions, and eco-friendly material development to meet consumer and regulatory demands.

- Regulatory Frameworks: Evolving legislation around single-use plastics and the promotion of circular economy principles are key influencing factors.

- Competitive Landscape: Intense competition from established flexible packaging providers and a rising threat from alternative packaging formats and materials.

- M&A Trends: Consolidation is expected as companies seek to gain economies of scale, acquire new technologies, and expand geographic presence.

Canada Flexible Packaging Industry Growth Trends & Insights

The Canada Flexible Packaging Industry is poised for significant growth, driven by shifting consumer preferences and the inherent advantages of flexible packaging solutions. The market size is expected to witness a robust Compound Annual Growth Rate (CAGR) as demand for lightweight, versatile, and cost-effective packaging solutions escalates across various end-user segments. Adoption rates for innovative materials and sustainable packaging formats are on the rise, influenced by increasing environmental awareness and supportive government initiatives. Technological disruptions, including advancements in high-barrier films, retortable pouches, and digital printing, are transforming product offerings and enhancing shelf life and consumer appeal. Consumer behavior shifts, such as the demand for single-serve portions, on-the-go consumption, and aesthetically pleasing packaging, are directly fueling the market's expansion. The convenience and extended shelf-life offered by flexible packaging are particularly appealing to the busy Canadian consumer, further solidifying its market penetration.

Dominant Regions, Countries, or Segments in Canada Flexible Packaging Industry

The Food segment unequivocally dominates the Canada Flexible Packaging Industry, driven by the nation's robust agricultural sector and high per capita consumption of packaged food products. Within this segment, Polyethene (PE) emerges as the most prevalent material type, owing to its excellent barrier properties, versatility, and cost-effectiveness in applications ranging from fresh produce packaging to frozen food wraps. Pouches are the leading product type, offering superior convenience, extended shelf life, and enhanced product presentation for a wide array of food items, including snacks, ready-to-eat meals, and pet food.

- Dominant End-user Industry: Food: This sector accounts for the largest share of the flexible packaging market, driven by demand for fresh, processed, and convenience foods.

- Key Drivers:

- Growth in the convenience food sector and demand for ready-to-eat meals.

- Increasing consumer preference for single-serve and portion-controlled packaging.

- Strict food safety regulations requiring high-barrier and protective packaging.

- The e-commerce boom necessitating robust and tamper-evident food packaging.

- Key Drivers:

- Dominant Material Type: Plastics (Polyethene (PE)): PE's cost-effectiveness, durability, and adaptability make it a go-to material for a vast range of food packaging.

- Market Share: Constituting over 60% of the flexible packaging materials used in the food segment.

- Growth Potential: Continued innovation in PE formulations to enhance recyclability and barrier properties will sustain its dominance.

- Dominant Product Type: Pouches: From stand-up pouches to retort pouches, this format offers superior functionality and consumer appeal.

- Application Versatility: Widely used for snacks, cereals, coffee, pet food, and ready-to-eat meals.

- Consumer Preference: Growing demand for resealable and easy-to-open pouch designs.

Canada Flexible Packaging Industry Product Landscape

The product landscape of the Canada Flexible Packaging Industry is characterized by innovation focused on enhancing functionality, sustainability, and consumer appeal. Advancements in material science are leading to the development of high-barrier films that extend shelf life for perishable goods, retortable pouches capable of withstanding high temperatures for ready-to-eat meals, and biodegradable and compostable options to address environmental concerns. Applications are diverse, spanning from the intricate packaging of premium snacks and confectionery to the robust protection of industrial goods and sensitive medical supplies. Performance metrics such as puncture resistance, oxygen and moisture barrier properties, and seal integrity are continually being improved. Unique selling propositions often lie in the integration of advanced printing techniques for enhanced brand visibility, the inclusion of re-sealable features for consumer convenience, and the development of "smart" packaging solutions that offer traceability or indicate product freshness.

Key Drivers, Barriers & Challenges in Canada Flexible Packaging Industry

Key Drivers: The Canada Flexible Packaging Industry is propelled by several key drivers. Technological advancements in material science, such as the development of enhanced barrier properties and thinner yet stronger films, are crucial. The growing consumer demand for convenience, portability, and extended shelf-life for food and beverage products significantly fuels market growth. Furthermore, the increasing adoption of sustainable and eco-friendly packaging solutions, driven by consumer pressure and regulatory mandates, acts as a powerful catalyst. The e-commerce boom also necessitates robust and protective flexible packaging for shipping and delivery.

- Technological Advancements: Innovation in high-barrier films, compostable materials, and advanced printing technologies.

- Consumer Demand: Escalating need for convenience, portability, and extended shelf life.

- Sustainability Initiatives: Growing preference for recyclable, biodegradable, and compostable packaging solutions.

- E-commerce Growth: Requirement for durable and protective packaging for online retail.

Barriers & Challenges: Despite strong growth prospects, the industry faces significant barriers and challenges. Fluctuations in raw material prices, particularly for plastics and aluminum, can impact profitability. Stringent regulatory hurdles concerning packaging waste management and the implementation of Extended Producer Responsibility (EPR) schemes pose compliance challenges. The competitive pressure from alternative packaging materials, including paper-based solutions and rigid plastics, requires continuous innovation. Supply chain disruptions, as witnessed in recent years, can lead to material shortages and increased lead times, affecting production schedules and cost management.

- Raw Material Price Volatility: Dependence on petroleum-based feedstocks exposes the industry to price fluctuations.

- Regulatory Compliance: Navigating complex regulations related to recyclability, waste management, and food contact materials.

- Competition: Intense rivalry from established flexible packaging providers and emerging alternative packaging formats.

- Supply Chain Disruptions: Vulnerability to global supply chain issues impacting raw material availability and logistics.

Emerging Opportunities in Canada Flexible Packaging Industry

Emerging opportunities within the Canada Flexible Packaging Industry lie in the burgeoning demand for sustainable packaging solutions. The development and widespread adoption of truly circular economy-compliant flexible packaging, including advanced recycling technologies and the increased use of post-consumer recycled (PCR) content, present a significant growth avenue. The expansion of e-commerce in Canada continues to drive demand for lightweight, durable, and tamper-evident packaging for a wider range of products. Furthermore, the growing health and wellness trend is creating opportunities for specialized packaging that enhances product preservation, extends shelf life, and incorporates features like freshness indicators. The demand for innovative packaging in niche markets such as pet food, pharmaceuticals, and personal care products also offers substantial potential for customized and high-performance flexible packaging solutions.

Growth Accelerators in the Canada Flexible Packaging Industry Industry

Several catalysts are accelerating the growth of the Canada Flexible Packaging Industry. Technological breakthroughs in the development of novel barrier materials that significantly extend product shelf life are a key accelerator, reducing food waste and enhancing consumer value. Strategic partnerships between raw material suppliers, packaging converters, and end-users are fostering collaborative innovation, leading to the creation of bespoke and highly efficient packaging solutions. The increasing focus on the circular economy and the development of advanced recycling infrastructure for flexible plastics are creating a more sustainable market landscape, boosting confidence and investment. Furthermore, market expansion strategies driven by companies seeking to tap into underserved regions or specific product categories are contributing to overall industry growth.

Key Players Shaping the Canada Flexible Packaging Industry Market

- Sonoco Products Company

- Mondi PLC

- St Johns Packaging

- Transcontinental Inc

- Covertech Flexible Packaging Inc

- American Packaging Corporation

- Cascades Flexible Packaging

- Flair Flexible Packaging Corporation

- Sigma Plastics Group

- Winpak Ltd

- Amcor PLC

- Emmerson Packaging

- Novolex Holdings Inc

- Constantia Flexibles

- Tetra Pak International SA

- ProAmpac LLC

- Berry Global Inc

- Printpack Inc

- Sealed Air Corporation

- Sit Group SpA

Notable Milestones in Canada Flexible Packaging Industry Sector

- June 2022: ePac Flexible Packaging expanded its Canadian presence by opening a third sales and manufacturing location in Montreal, Quebec. This move enhances their ability to serve CPG brands of all sizes with quick turn, short, and medium run-length flexible packaging solutions across Canada, including Vancouver and Toronto operations.

- April 2022: WestRock collaborated with Swiss Chalet to implement recyclable paperboard packaging across their entire restaurant chain in Canada. This initiative replaced rigid black PET trays and lids with packaging made from renewable resources like Uncoated Recycled Board (URB) and EnShield Natural Kraft, significantly improving sustainability.

In-Depth Canada Flexible Packaging Industry Market Outlook

The Canada Flexible Packaging Industry is set for robust future growth, driven by an unwavering demand for convenience and an increasing commitment to sustainability. Key growth accelerators include the continuous innovation in material science, leading to more advanced, lighter, and higher-performing packaging solutions. Strategic collaborations between industry players and a growing emphasis on the development of circular economy models for flexible packaging will further propel market expansion. The industry is well-positioned to capitalize on evolving consumer preferences for products with extended shelf life and reduced environmental impact, alongside the sustained growth of e-commerce, which necessitates efficient and protective packaging. This outlook indicates a dynamic and evolving market ripe with opportunities for innovation and investment.

Canada Flexible Packaging Industry Segmentation

-

1. Material Type

-

1.1. Plastics

- 1.1.1. Polyethene (PE)

- 1.1.2. Bi-orientated Polypropylene (BOPP)

- 1.1.3. Cast Polypropylene (CPP)

- 1.1.4. Polyvinyl Chloride (PVC)

- 1.1.5. Ethylene Vinyl Alcohol (EVOH)

- 1.2. Paper

- 1.3. Aluminum Foil

-

1.1. Plastics

-

2. Product Type

- 2.1. Pouches

- 2.2. Bags

- 2.3. Films and Wraps

- 2.4. Other Product Types

-

3. End-user Industry

- 3.1. Food

- 3.2. Beverage

- 3.3. Household and Personal Care

- 3.4. Other End-user Industries

Canada Flexible Packaging Industry Segmentation By Geography

- 1. Canada

Canada Flexible Packaging Industry Regional Market Share

Geographic Coverage of Canada Flexible Packaging Industry

Canada Flexible Packaging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.94% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Increased Demand for Convenient Packaging; Changing Demographic and Lifestyle Factors

- 3.3. Market Restrains

- 3.3.1. ; High Cost of Label Converting Equipment

- 3.4. Market Trends

- 3.4.1. Food Industry is Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Flexible Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Plastics

- 5.1.1.1. Polyethene (PE)

- 5.1.1.2. Bi-orientated Polypropylene (BOPP)

- 5.1.1.3. Cast Polypropylene (CPP)

- 5.1.1.4. Polyvinyl Chloride (PVC)

- 5.1.1.5. Ethylene Vinyl Alcohol (EVOH)

- 5.1.2. Paper

- 5.1.3. Aluminum Foil

- 5.1.1. Plastics

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Pouches

- 5.2.2. Bags

- 5.2.3. Films and Wraps

- 5.2.4. Other Product Types

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Food

- 5.3.2. Beverage

- 5.3.3. Household and Personal Care

- 5.3.4. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Sonoco Products Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Mondi PLC*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 St Johns Packaging

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Transcontinental Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Covertech Flexible Packaging Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 American Packaging Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Cascades Flexible Packaging

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Flair Flexible Packaging Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Sigma Plastics Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Winpak Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Amcor PLC

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Emmerson Packaging

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Novolex Holdings Inc

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Constantia Flexibles

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Tetra Pak International SA

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 ProAmpac LLC

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 Berry Global Inc

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.18 Printpack Inc

- 6.2.18.1. Overview

- 6.2.18.2. Products

- 6.2.18.3. SWOT Analysis

- 6.2.18.4. Recent Developments

- 6.2.18.5. Financials (Based on Availability)

- 6.2.19 Sealed Air Corporation

- 6.2.19.1. Overview

- 6.2.19.2. Products

- 6.2.19.3. SWOT Analysis

- 6.2.19.4. Recent Developments

- 6.2.19.5. Financials (Based on Availability)

- 6.2.20 Sit Group SpA

- 6.2.20.1. Overview

- 6.2.20.2. Products

- 6.2.20.3. SWOT Analysis

- 6.2.20.4. Recent Developments

- 6.2.20.5. Financials (Based on Availability)

- 6.2.1 Sonoco Products Company

List of Figures

- Figure 1: Canada Flexible Packaging Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Canada Flexible Packaging Industry Share (%) by Company 2025

List of Tables

- Table 1: Canada Flexible Packaging Industry Revenue Million Forecast, by Material Type 2020 & 2033

- Table 2: Canada Flexible Packaging Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 3: Canada Flexible Packaging Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Canada Flexible Packaging Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Canada Flexible Packaging Industry Revenue Million Forecast, by Material Type 2020 & 2033

- Table 6: Canada Flexible Packaging Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 7: Canada Flexible Packaging Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 8: Canada Flexible Packaging Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Flexible Packaging Industry?

The projected CAGR is approximately 7.94%.

2. Which companies are prominent players in the Canada Flexible Packaging Industry?

Key companies in the market include Sonoco Products Company, Mondi PLC*List Not Exhaustive, St Johns Packaging, Transcontinental Inc, Covertech Flexible Packaging Inc, American Packaging Corporation, Cascades Flexible Packaging, Flair Flexible Packaging Corporation, Sigma Plastics Group, Winpak Ltd, Amcor PLC, Emmerson Packaging, Novolex Holdings Inc, Constantia Flexibles, Tetra Pak International SA, ProAmpac LLC, Berry Global Inc, Printpack Inc, Sealed Air Corporation, Sit Group SpA.

3. What are the main segments of the Canada Flexible Packaging Industry?

The market segments include Material Type, Product Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.55 Million as of 2022.

5. What are some drivers contributing to market growth?

The Increased Demand for Convenient Packaging; Changing Demographic and Lifestyle Factors.

6. What are the notable trends driving market growth?

Food Industry is Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

; High Cost of Label Converting Equipment.

8. Can you provide examples of recent developments in the market?

June 2022: ePac Flexible Packaging, the industry player in quick turn, short, and medium run-length flexible packaging has announced it will add a third sales and manufacturing location in Canada. With the addition of operations in Vancouver and Toronto, ePac Montreal will provide CPG brands of all sizes with service throughout the province of Quebec, bringing the total number of Canadian locations to three.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Flexible Packaging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Flexible Packaging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Flexible Packaging Industry?

To stay informed about further developments, trends, and reports in the Canada Flexible Packaging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence