Key Insights

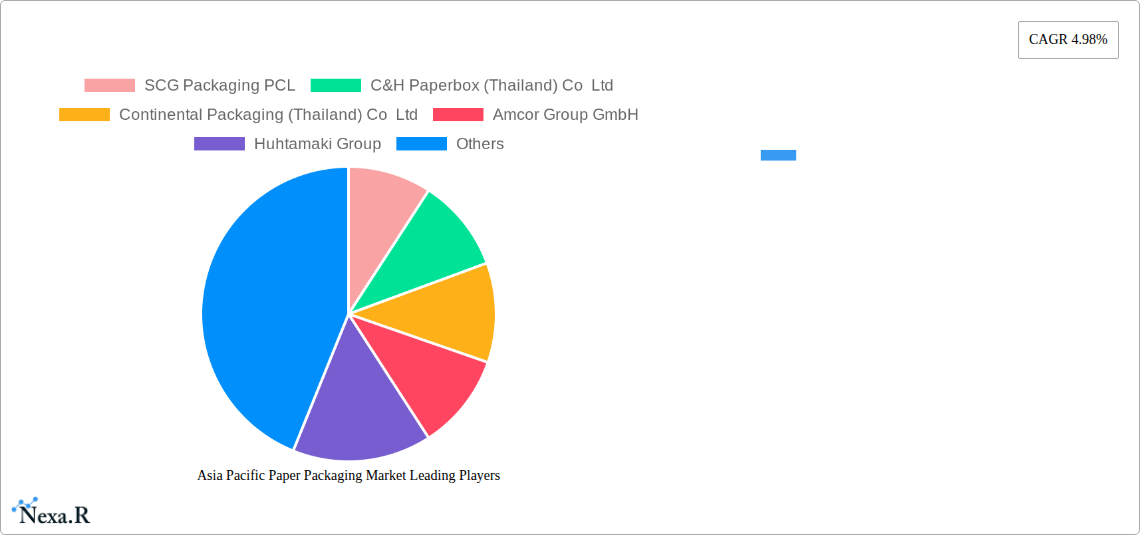

The Asia Pacific Paper Packaging Market is poised for robust expansion, with an estimated market size of USD 190.55 Million in 2025 and projected to grow at a Compound Annual Growth Rate (CAGR) of 4.98% through 2033. This significant growth is underpinned by several key drivers. Increasing consumer demand for sustainable and eco-friendly packaging solutions is a primary catalyst, as governments and businesses alike champion a shift away from single-use plastics. The burgeoning e-commerce sector across the region, particularly in emerging economies like India and Southeast Asian nations, fuels the need for efficient, protective, and cost-effective paper packaging for shipments. Furthermore, rising disposable incomes and a growing middle class are contributing to increased consumption of packaged goods, further bolstering demand for paper packaging. The region's expanding manufacturing base, especially in electronics and consumer goods, also necessitates substantial quantities of packaging materials.

Asia Pacific Paper Packaging Market Market Size (In Million)

The market's trajectory is further shaped by evolving trends and strategic initiatives from key industry players. Innovations in paper packaging technology, such as the development of stronger, lighter, and more water-resistant paperboard, are addressing previous limitations and expanding application areas. The integration of advanced printing and finishing techniques enhances product appeal and branding opportunities. While the market is largely driven by demand, certain restraints need to be considered. Fluctuations in raw material prices, particularly pulp and recycled paper, can impact profitability. Stricter environmental regulations and the need for specialized recycling infrastructure in some developing economies may also present challenges. However, the overarching commitment to sustainability and the inherent recyclability of paper-based materials position the Asia Pacific Paper Packaging Market for sustained and significant growth, driven by both consumer preference and industry innovation.

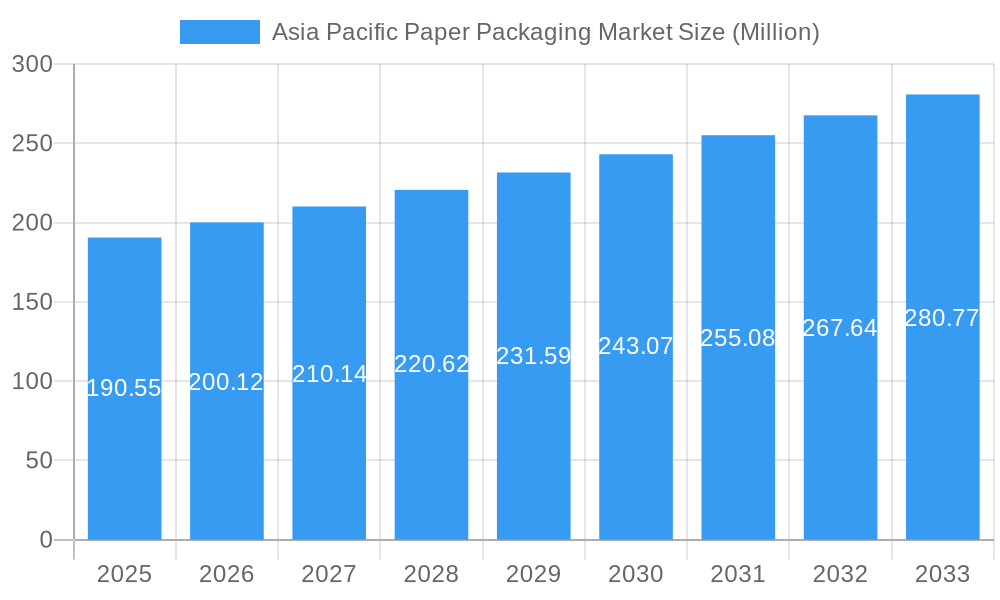

Asia Pacific Paper Packaging Market Company Market Share

This in-depth report delivers a strategic analysis of the burgeoning Asia Pacific Paper Packaging Market. Covering the historical period from 2019 to 2024, a base year of 2025, and a comprehensive forecast extending to 2033, this study provides crucial insights into market dynamics, growth trends, regional dominance, product landscape, key drivers, barriers, opportunities, and the competitive environment. Leveraging high-traffic keywords such as "paper packaging market," "sustainable packaging Asia," "corrugated packaging APAC," "food packaging paper," "e-commerce packaging solutions," and "flexible packaging Asia," this report is optimized for maximum search engine visibility and designed to engage industry professionals, investors, and decision-makers. We present all values in Million units, with detailed breakdowns of production, consumption, imports, exports, and price trends.

Asia Pacific Paper Packaging Market Market Dynamics & Structure

The Asia Pacific Paper Packaging Market is characterized by a moderate to high level of concentration, with key players continuously vying for market share through strategic acquisitions and product innovation. The increasing global emphasis on sustainability has become a primary driver, pushing technological advancements in recyclable and biodegradable paper-based solutions. Regulatory frameworks, particularly those aimed at reducing plastic waste and promoting circular economy principles, are significantly shaping market strategies and product development. While paper packaging offers a compelling eco-friendly alternative to plastics, competitive product substitutes, including advanced plastics and biodegradable films, pose a constant challenge. End-user demographics are shifting, with a growing middle class and rising disposable incomes fueling demand for packaged goods across various sectors. Mergers and acquisitions (M&A) activity remains robust, as companies seek to expand their geographical reach, diversify their product portfolios, and achieve economies of scale. For instance, the acquisition of Arjowiggins China by the Fedrigoni group signifies a strategic move to strengthen presence in the high-value specialty paper segment.

- Market Concentration: Dominated by a mix of large multinational corporations and regional players, with strategic alliances and M&A activity shaping the competitive landscape.

- Technological Innovation Drivers: Focus on enhanced barrier properties, improved printability, lightweighting, and the development of compostable and recyclable paper solutions.

- Regulatory Frameworks: Stringent environmental regulations, extended producer responsibility schemes, and bans on single-use plastics are accelerating the adoption of paper packaging.

- Competitive Product Substitutes: While paper is gaining traction, advanced bioplastics and compostable films present ongoing competition.

- End-User Demographics: Growing demand from the e-commerce sector, rising consumer awareness of sustainability, and increased consumption of packaged food and beverages are key demographic influences.

- M&A Trends: Strategic acquisitions to gain market share, expand product offerings, and enhance supply chain integration are prevalent. The State Bank of India's investment in Canpac Trends Private Limited highlights the financial sector's growing confidence in the paper packaging industry's profitability.

Asia Pacific Paper Packaging Market Growth Trends & Insights

The Asia Pacific Paper Packaging Market is on an impressive growth trajectory, projected to witness a substantial Compound Annual Growth Rate (CAGR) throughout the forecast period. This expansion is fueled by a confluence of factors, including escalating demand from the burgeoning e-commerce industry, a significant consumer shift towards sustainable and eco-friendly packaging solutions, and favorable government policies promoting the reduction of plastic waste. The adoption rate of paper-based packaging is accelerating across various end-use industries, from food and beverages to pharmaceuticals and personal care. Technological disruptions, such as the development of advanced barrier coatings and high-strength corrugated boards, are enhancing the performance and versatility of paper packaging, making it a viable alternative for an increasing array of products. Consumer behavior is increasingly influenced by environmental consciousness, with a growing preference for brands that demonstrate a commitment to sustainability through their packaging choices. The introduction of paper-based packaging for everyday consumer goods, like ITC's Aashirvad organic atta, with enhanced traceability features, exemplifies this trend. The market penetration of paper packaging is expected to deepen as innovations continue to address existing limitations and cost-competitiveness improves.

- Market Size Evolution: Expected to witness robust growth driven by increasing demand and wider adoption.

- Adoption Rates: Steadily increasing across food & beverage, e-commerce, pharmaceuticals, and consumer goods sectors.

- Technological Disruptions: Innovations in barrier coatings, printing technologies, and material science are enhancing paper packaging's capabilities.

- Consumer Behavior Shifts: Growing preference for sustainable, recyclable, and biodegradable packaging options is a significant market driver.

- Market Penetration: Deepening penetration into sectors traditionally dominated by other packaging materials due to improved functionality and sustainability credentials.

Dominant Regions, Countries, or Segments in Asia Pacific Paper Packaging Market

The Asia Pacific Paper Packaging Market's dominance is intricately linked to the economic prowess and consumption patterns of its key regions and countries. China stands out as a significant driver of both production and consumption, owing to its massive manufacturing base and a rapidly expanding domestic market. The Consumption Analysis in China is particularly strong, propelled by its vast population and the booming e-commerce sector, which heavily relies on robust and sustainable shipping solutions. In terms of Production Analysis, China, followed by India and Southeast Asian nations, accounts for a substantial share of the global paper packaging output. The Import Market Analysis reveals a growing demand for specialized and high-quality paper packaging materials in countries like Japan and South Korea, driven by their advanced manufacturing and premium product sectors. Conversely, Export Market Analysis highlights China's dominant role in supplying finished paper packaging products to the rest of the world, particularly to emerging economies within and beyond the APAC region. The Price Trend Analysis is influenced by the availability of raw materials, energy costs, and government subsidies for sustainable production, with fluctuations often seen based on global supply and demand dynamics. The corrugated cardboard segment, essential for shipping and e-commerce, consistently leads in terms of volume and value, reflecting its foundational role in modern logistics and retail.

- Production Analysis: China leads production, supported by significant capacities in India and Southeast Asia, catering to both domestic and international demand.

- Consumption Analysis: China and India exhibit the highest consumption volumes, driven by large populations and expanding e-commerce activities.

- Import Market Analysis (Value & Volume): Japan and South Korea are key importers of high-value, specialized paper packaging, while emerging economies show increasing volume imports.

- Export Market Analysis (Value & Volume): China is the primary exporter of finished paper packaging products, serving a global customer base.

- Price Trend Analysis: Influenced by raw material availability, energy costs, and trade policies, with regional variations.

- Dominant Segments: Corrugated cardboard packaging, vital for e-commerce and logistics, dominates the market in terms of volume and value.

Asia Pacific Paper Packaging Market Product Landscape

The product landscape within the Asia Pacific Paper Packaging Market is characterized by continuous innovation aimed at enhancing functionality, sustainability, and aesthetic appeal. Key product categories include corrugated boxes, folding cartons, paper bags, and specialty paper packaging for luxury goods. Innovations are focused on developing lightweight yet durable corrugated materials for efficient shipping, advanced barrier coatings for food safety and extended shelf life, and premium finishes for high-value products. The increasing demand for eco-friendly alternatives has spurred the development of compostable and biodegradable paper packaging solutions. Performance metrics are increasingly evaluated based on recyclability, carbon footprint, and resource efficiency. Unique selling propositions often lie in customized designs, superior print quality, and the integration of smart features like QR codes for enhanced traceability, as demonstrated by ITC's innovative packaging for Aashirvad's organic atta.

Key Drivers, Barriers & Challenges in Asia Pacific Paper Packaging Market

Key Drivers: The Asia Pacific Paper Packaging Market is propelled by several critical drivers. The escalating global demand for sustainable packaging solutions, driven by heightened consumer and regulatory pressure to reduce plastic waste, is a paramount force. The rapid expansion of the e-commerce sector necessitates robust and efficient shipping packaging, a role perfectly fulfilled by paper-based solutions. Favorable government initiatives and policies promoting the circular economy and penalizing single-use plastics further incentivize the adoption of paper packaging. Technological advancements in paper production and converting processes are continuously improving the performance, versatility, and cost-effectiveness of paper packaging.

Barriers & Challenges: Despite its growth, the market faces certain barriers and challenges. Fluctuations in raw material prices, particularly for pulp and recycled paper, can impact cost competitiveness. The need for significant capital investment in advanced manufacturing technologies and infrastructure can be a deterrent for smaller players. Competition from alternative packaging materials, such as advanced plastics and metal, remains a challenge in specific applications. Supply chain disruptions, influenced by global logistics and geopolitical factors, can affect the availability and timely delivery of raw materials and finished products. Navigating diverse and evolving regulatory landscapes across different countries within the Asia Pacific region also presents a challenge.

Emerging Opportunities in Asia Pacific Paper Packaging Market

Emerging opportunities in the Asia Pacific Paper Packaging Market are diverse and promising. The growing demand for specialized paper packaging for pharmaceuticals, driven by an aging population and increased healthcare spending, presents a significant avenue for growth. The rise of the "unboxing experience" in e-commerce is creating opportunities for visually appealing and innovative paper packaging designs that enhance brand perception. Untapped markets in developing economies within Southeast Asia and the Indian subcontinent offer substantial potential for market expansion as disposable incomes rise. Innovations in biodegradable and compostable paper packaging tailored for the food service industry, particularly for takeaway and delivery services, are gaining traction. Furthermore, the integration of smart technologies, such as RFID tags and NFC capabilities within paper packaging, opens doors for enhanced supply chain management and consumer engagement.

Growth Accelerators in the Asia Pacific Paper Packaging Market Industry

Several key catalysts are accelerating the growth of the Asia Pacific Paper Packaging Market. Technological breakthroughs in pulp processing and paper manufacturing are leading to the development of stronger, lighter, and more functional paper packaging materials. Strategic partnerships between paper manufacturers, converters, and end-users are fostering collaborative innovation and ensuring that packaging solutions meet specific industry needs. Market expansion strategies, including mergers, acquisitions, and joint ventures, are enabling companies to broaden their geographical reach and product portfolios. The increasing adoption of digitalization and automation in manufacturing processes is enhancing efficiency and reducing production costs. Moreover, a heightened focus on corporate social responsibility and sustainability reporting by businesses is indirectly driving demand for environmentally friendly paper packaging.

Key Players Shaping the Asia Pacific Paper Packaging Market Market

- SCG Packaging PCL

- C&H Paperbox (Thailand) Co Ltd

- Continental Packaging (Thailand) Co Ltd

- Amcor Group GmbH

- Huhtamaki Group

- Mondi Group

- Oji Holdings Corporation

- New Asia Industries Co Ltd (Rengo Co Ltd)

- International Paper Company

- Sarnti Packaging Co Ltd

- Harta Packaging Industries (Selangor) Sdn Bhd

- Hong Thai Packaging Company Limited

- West Rock Company

Notable Milestones in Asia Pacific Paper Packaging Market Sector

- January 2024: The Fedrigoni group acquired Arjowiggins China, expanding its reach in specialty papers for luxury packaging and other creative applications, including transparent papers manufactured at its Quzhou factory.

- December 2023: The State Bank of India invested INR 49.99 crore (USD 6.04 million) in Canpac Trends Private Limited, a paper-based packaging solutions provider, signaling strong confidence in the industry's growth potential.

- April 2023: ITC launched paper-based packaging for Aashirvad's organic atta, promoting sustainable living and enhancing sourcing traceability through a unique QR code.

In-Depth Asia Pacific Paper Packaging Market Market Outlook

The Asia Pacific Paper Packaging Market is poised for sustained and robust growth, driven by an unyielding global shift towards sustainability and the continuous expansion of the e-commerce landscape. Future market potential is significantly amplified by increasing consumer awareness regarding environmental impact and stringent government regulations aimed at curbing plastic pollution. Strategic opportunities lie in further developing innovative, high-performance paper packaging that caters to diverse end-user needs, from advanced barrier properties for food preservation to premium aesthetics for luxury goods. The ongoing digitalization of manufacturing processes and the pursuit of circular economy principles will continue to shape the industry's competitive dynamics, creating a favorable environment for companies that prioritize innovation, efficiency, and environmental stewardship.

Asia Pacific Paper Packaging Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Asia Pacific Paper Packaging Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific Paper Packaging Market Regional Market Share

Geographic Coverage of Asia Pacific Paper Packaging Market

Asia Pacific Paper Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.98% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Sustained Rise in E-commerce Sale to Drive Demand For Folding Cartons; Growing Emphasis on the Use of Recycled Paper by Major End Users to Aid the Transition to Paper Packaging Materials; Growing Share of Healthcare and Cosmetic Segments

- 3.3. Market Restrains

- 3.3.1. Printing Quality

- 3.4. Market Trends

- 3.4.1. Food Segment to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Paper Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 SCG Packaging PCL

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 C&H Paperbox (Thailand) Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Continental Packaging (Thailand) Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Amcor Group GmbH

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Huhtamaki Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Mondi Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Oji Holdings Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 New Asia Industries Co Ltd (Rengo Co Ltd)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 International Paper Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Sarnti Packaging Co Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Harta Packaging Industries (Selangor) Sdn Bhd

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Hong Thai Packaging Company Limited

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 West Rock Compan

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 SCG Packaging PCL

List of Figures

- Figure 1: Asia Pacific Paper Packaging Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Paper Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Paper Packaging Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Asia Pacific Paper Packaging Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Asia Pacific Paper Packaging Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Asia Pacific Paper Packaging Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Asia Pacific Paper Packaging Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Asia Pacific Paper Packaging Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Asia Pacific Paper Packaging Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: Asia Pacific Paper Packaging Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Asia Pacific Paper Packaging Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Asia Pacific Paper Packaging Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Asia Pacific Paper Packaging Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Asia Pacific Paper Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: China Asia Pacific Paper Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Japan Asia Pacific Paper Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: South Korea Asia Pacific Paper Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: India Asia Pacific Paper Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Australia Asia Pacific Paper Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: New Zealand Asia Pacific Paper Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Indonesia Asia Pacific Paper Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Malaysia Asia Pacific Paper Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Singapore Asia Pacific Paper Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Thailand Asia Pacific Paper Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Vietnam Asia Pacific Paper Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Philippines Asia Pacific Paper Packaging Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Paper Packaging Market?

The projected CAGR is approximately 4.98%.

2. Which companies are prominent players in the Asia Pacific Paper Packaging Market?

Key companies in the market include SCG Packaging PCL, C&H Paperbox (Thailand) Co Ltd, Continental Packaging (Thailand) Co Ltd, Amcor Group GmbH, Huhtamaki Group, Mondi Group, Oji Holdings Corporation, New Asia Industries Co Ltd (Rengo Co Ltd), International Paper Company, Sarnti Packaging Co Ltd, Harta Packaging Industries (Selangor) Sdn Bhd, Hong Thai Packaging Company Limited, West Rock Compan.

3. What are the main segments of the Asia Pacific Paper Packaging Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 190.55 Million as of 2022.

5. What are some drivers contributing to market growth?

Sustained Rise in E-commerce Sale to Drive Demand For Folding Cartons; Growing Emphasis on the Use of Recycled Paper by Major End Users to Aid the Transition to Paper Packaging Materials; Growing Share of Healthcare and Cosmetic Segments.

6. What are the notable trends driving market growth?

Food Segment to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Printing Quality.

8. Can you provide examples of recent developments in the market?

January 2024: The Fedrigoni group, a specialty paper manufacturer for luxury packaging and other creative applications, self-adhesive labels and materials, and RFID and connectivity solutions, acquired Arjowiggins China. The paper factory in Quzhou manufactures transparent papers sold under the Gateway and Sylvicta brands for applications such as industrial design and graphics for food, consumer electronics, or luxury packaging located in Zhejiang Province.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Paper Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Paper Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Paper Packaging Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Paper Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence