Key Insights

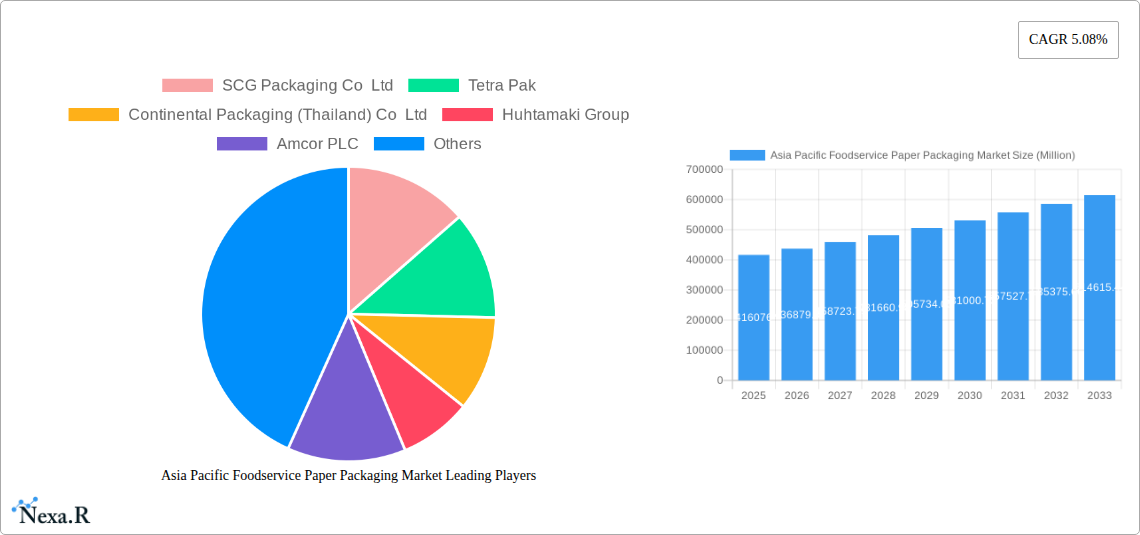

The Asia Pacific Foodservice Paper Packaging Market is poised for significant expansion, projected to reach USD 416.076 billion by 2025. This robust growth is underpinned by a compelling CAGR of 5% over the forecast period from 2025 to 2033. Several key drivers are fueling this upward trajectory. The burgeoning foodservice industry across Asia Pacific, encompassing rapid urbanization and a growing middle class with increasing disposable incomes, is a primary catalyst. This demographic shift is translating into higher demand for convenient and accessible food options, thereby boosting the consumption of foodservice paper packaging. Furthermore, a rising awareness and preference for sustainable and eco-friendly packaging solutions are increasingly influencing consumer choices and regulatory frameworks. This trend strongly favors paper-based packaging as a viable alternative to plastics, aligning with global environmental initiatives and corporate sustainability goals. The market is also experiencing dynamic trends, including innovation in product design for enhanced functionality and branding, the adoption of advanced printing technologies for aesthetic appeal, and the development of specialized packaging for specific food types, such as insulated containers for hot foods and grease-resistant options for fried items.

Asia Pacific Foodservice Paper Packaging Market Market Size (In Billion)

Despite the optimistic outlook, certain restraints could temper growth. Fluctuations in raw material prices, particularly pulp and paper, can impact manufacturing costs and profitability. Intense competition among a multitude of players, ranging from large multinational corporations to smaller regional manufacturers, can also lead to price pressures. Moreover, the evolving regulatory landscape concerning packaging waste management and recycling infrastructure across different countries within the Asia Pacific region can present challenges in terms of compliance and operational adjustments. Nevertheless, the inherent advantages of paper packaging, including its biodegradability, recyclability, and availability, coupled with continuous innovation in material science and design, are expected to drive market resilience. Key application segments such as fruits and vegetables, dairy products, and bakery & confectionery are anticipated to witness substantial demand, further propelled by the expanding reach of quick-service restaurants and retail establishments that rely heavily on efficient and presentable packaging solutions.

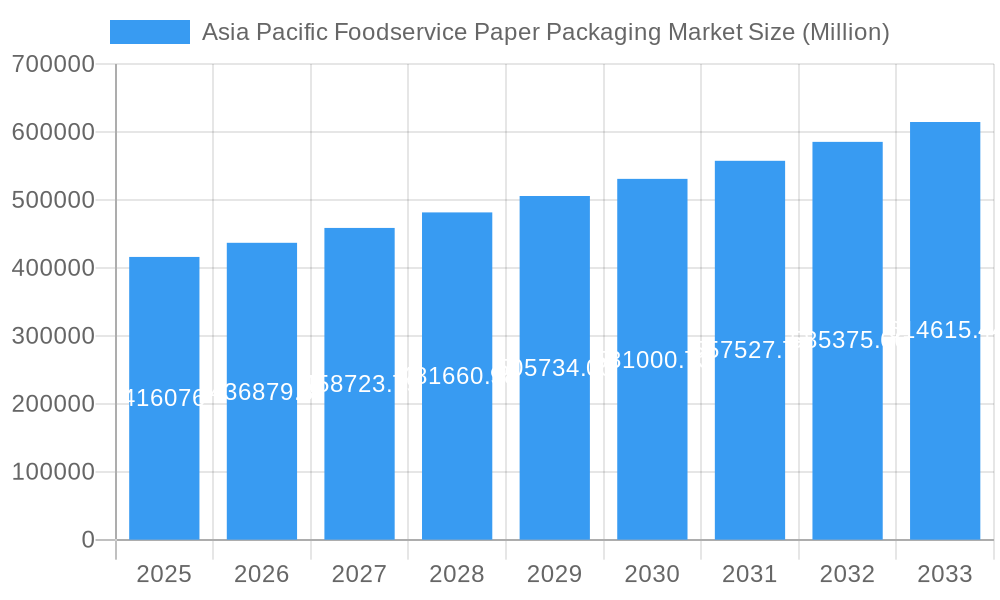

Asia Pacific Foodservice Paper Packaging Market Company Market Share

Unlock invaluable insights into the dynamic Asia Pacific Foodservice Paper Packaging Market with this comprehensive report. Discover market size, growth drivers, regional dominance, and key player strategies for the period 2019–2033, with a focus on the Base Year 2025 and Forecast Period 2025–2033. This report leverages high-traffic keywords like "foodservice packaging," "paper packaging," "Asia Pacific market," "sustainable packaging," and specific segment terms to ensure maximum visibility.

This in-depth analysis covers crucial market segments including Cups & Lids, Boxes & Cartons, and applications such as Fruits and Vegetables, Dairy Products, Bakery & Confectionery, Beverages, Meat & Poultry, and Others. It also examines end-user dynamics across Restaurants (Quick & Full-service based), Retail establishments, Institutional, and Other End-user Applications.

Asia Pacific Foodservice Paper Packaging Market Market Dynamics & Structure

The Asia Pacific foodservice paper packaging market is characterized by a moderately concentrated structure, with a few key global players alongside a growing number of regional and local manufacturers. Technological innovation is a significant driver, with a continuous push towards developing more sustainable, recyclable, and biodegradable packaging solutions. Regulatory frameworks, particularly concerning single-use plastics and waste management, are increasingly shaping market strategies and product development. Competitive product substitutes, including plastic and other biodegradable materials, present a constant challenge, necessitating innovation in paper-based alternatives. End-user demographics, influenced by urbanization, rising disposable incomes, and a growing preference for convenient food options, are fueling demand. Mergers and acquisitions (M&A) are observed as companies seek to expand their market reach, enhance their product portfolios, and gain a competitive edge.

- Market Concentration: Dominated by a blend of multinational corporations and agile local players.

- Technological Innovation: Focus on eco-friendly materials, barrier properties, and printing technologies.

- Regulatory Frameworks: Stringent environmental regulations driving demand for sustainable paper packaging.

- Competitive Substitutes: Ongoing competition from plastic, bioplastics, and other packaging materials.

- End-User Demographics: Growing middle class and fast-paced lifestyles increasing demand for convenience.

- M&A Trends: Strategic acquisitions to consolidate market share and expand geographical presence.

Asia Pacific Foodservice Paper Packaging Market Growth Trends & Insights

The Asia Pacific foodservice paper packaging market is poised for significant expansion, driven by escalating consumer demand for convenient and sustainable food options. Market size evolution is expected to witness a robust upward trajectory throughout the forecast period 2025–2033. Adoption rates of paper-based packaging are accelerating, particularly in urban centers, as environmental consciousness among consumers and businesses rises. Technological disruptions, such as advancements in paper coating and barrier technologies, are enabling paper packaging to compete more effectively with traditional plastic alternatives in terms of performance and functionality for various food applications. Consumer behavior shifts are profoundly impacting the market; a greater willingness to pay a premium for eco-friendly products and a preference for brands that demonstrate environmental responsibility are key influencing factors. The increasing penetration of food delivery services and the growth of the quick-service restaurant (QSR) sector further amplify the demand for efficient and sustainable foodservice packaging solutions. Market penetration is projected to deepen as regulatory pressures on single-use plastics intensify and as manufacturers invest in localized production capabilities to meet the diverse needs of the region.

Dominant Regions, Countries, or Segments in Asia Pacific Foodservice Paper Packaging Market

The Beverages application segment is a dominant force within the Asia Pacific foodservice paper packaging market, driven by the region's massive and growing consumption of both hot and cold beverages. The ubiquitous presence of coffee shops, tea houses, and the expanding soft drink and juice markets create a constant and substantial demand for cups, lids, and cartons. China and India emerge as leading countries due to their sheer population size and rapidly urbanizing economies, coupled with increasing disposable incomes that fuel both out-of-home dining and beverage consumption.

- Dominant Segment (Application): Beverages

- Massive demand from coffee, tea, soft drinks, and juice sectors.

- Increasing popularity of on-the-go consumption.

- Significant market share projected to grow steadily.

- Leading Countries:

- China: Largest market driven by population, economic growth, and a burgeoning foodservice industry.

- India: Rapidly growing market with increasing disposable incomes and a large youth population.

- Southeast Asian Nations (e.g., Indonesia, Vietnam): Emerging markets with expanding urban populations and a rising adoption of convenience food services.

- Key Drivers for Dominance:

- Economic Policies: Favorable trade agreements and government initiatives supporting the foodservice industry.

- Infrastructure Development: Enhanced logistics and supply chains facilitating wider distribution of packaged goods.

- Urbanization: Concentration of population in cities leading to higher demand for convenience and away-from-home food and beverage consumption.

- Consumer Trends: Growing awareness of sustainability and demand for eco-friendly packaging solutions.

- Foodservice Sector Growth: Expansion of QSRs, cafes, and delivery services directly correlates with paper packaging demand.

Asia Pacific Foodservice Paper Packaging Market Product Landscape

Product innovation in the Asia Pacific foodservice paper packaging market is intensely focused on enhancing sustainability and functionality. Key developments include advanced barrier coatings that provide excellent grease and moisture resistance, crucial for applications like bakery and fast food packaging. Recyclable and compostable materials are gaining traction, with manufacturers investing in research to improve the performance and cost-effectiveness of these alternatives. Customizable printing technologies allow for enhanced branding and consumer engagement. Performance metrics such as durability, thermal insulation for hot beverages, and ease of disposal are critical selling propositions.

Key Drivers, Barriers & Challenges in Asia Pacific Foodservice Paper Packaging Market

Key Drivers:

- Growing Demand for Sustainable Packaging: Increasing environmental awareness and regulatory pressure on plastics.

- Expansion of Foodservice Sector: Growth in QSRs, cafes, and food delivery services.

- Rising Disposable Incomes: Increased consumer spending on convenience and away-from-home food.

- Technological Advancements: Development of improved paper-based barrier properties and recyclability.

Barriers & Challenges:

- Cost Competitiveness: Paper packaging can be more expensive than conventional plastic packaging.

- Performance Limitations: Achieving the same level of moisture and grease resistance as some plastics can be challenging.

- Infrastructure for Recycling: Inadequate collection and recycling infrastructure in certain regions hinders the circular economy for paper packaging.

- Supply Chain Volatility: Fluctuations in raw material prices and availability can impact production costs.

- Consumer Acceptance: In some segments, consumers may still perceive plastic as more durable or convenient.

Emerging Opportunities in Asia Pacific Foodservice Paper Packaging Market

Emerging opportunities lie in the development of innovative, high-performance biodegradable and compostable paper packaging solutions tailored for specific food applications, such as microwaveable containers and extended shelf-life packaging. The burgeoning e-commerce sector for food and the increasing popularity of meal kit delivery services present untapped markets for specialized paper packaging designs. Furthermore, focusing on developing customized packaging for smaller, niche foodservice operators and exploring opportunities in emerging economies with nascent but rapidly growing foodservice industries offers significant growth potential.

Growth Accelerators in the Asia Pacific Foodservice Paper Packaging Market Industry

Key catalysts driving long-term growth include significant investments in research and development to create more advanced paper-based materials with enhanced functional properties, such as improved heat resistance and barrier capabilities. Strategic partnerships between paper packaging manufacturers and major foodservice chains are crucial for co-developing and implementing innovative solutions. Furthermore, market expansion strategies targeting underserved regions within the Asia Pacific, coupled with a proactive approach to adapting to evolving regulatory landscapes and consumer preferences, will accelerate sustainable growth.

Key Players Shaping the Asia Pacific Foodservice Paper Packaging Market Market

- SCG Packaging Co Ltd

- Tetra Pak

- Continental Packaging (Thailand) Co Ltd

- Huhtamaki Group

- Amcor PLC

- Pura Group

- Oji Holdings Corporation

- International Paper Company

- Toppan Inc

- Sarnti Packaging Co Ltd

Notable Milestones in Asia Pacific Foodservice Paper Packaging Market Sector

- August 2022: Amcor added a new location in Jiangyin, China, to its network of Innovation Centers, enhancing access to expertise for faster development of environmentally friendly packaging solutions in the region.

- March 2022: The Food Safety and Standards Authority of India (FSSAI) released new regulations to control the use of recycled plastic for food packaging, a move aimed at improving the handling of plastic waste and encouraging the adoption of more sustainable alternatives.

In-Depth Asia Pacific Foodservice Paper Packaging Market Market Outlook

The future market outlook for Asia Pacific foodservice paper packaging is exceptionally promising, driven by the sustained global shift towards sustainability and the region's dynamic economic growth. Continued innovation in biodegradable and recyclable materials, coupled with supportive regulatory environments, will propel market expansion. Strategic collaborations, a focus on expanding into emerging economies, and a keen understanding of evolving consumer demands for convenience and eco-consciousness will solidify the growth trajectory. The market is set to witness substantial growth in volume, with a strong emphasis on value-added products and sustainable solutions.

Asia Pacific Foodservice Paper Packaging Market Segmentation

-

1. Type

- 1.1. Cups & Lids

- 1.2. Boxes & Cartons

-

2. Application

- 2.1. Fruits and vegetables

- 2.2. Dairy products

- 2.3. Bakery & Confectionery

- 2.4. Beverages

- 2.5. Meat & Poultry

- 2.6. Others

-

3. End User

- 3.1. Restaurants (Quick & Full-service based)

- 3.2. Retail establishments

- 3.3. Institutional

- 3.4. Other End-user Applications

Asia Pacific Foodservice Paper Packaging Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific Foodservice Paper Packaging Market Regional Market Share

Geographic Coverage of Asia Pacific Foodservice Paper Packaging Market

Asia Pacific Foodservice Paper Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Shift in Consumer Preferences toward Recyclable and Eco-friendly Materials; Online Food Ordering Services are Expected to Drive the Market

- 3.3. Market Restrains

- 3.3.1. Increasing Price Volatility of Raw Materials

- 3.4. Market Trends

- 3.4.1. Online Food Ordering Services are Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Foodservice Paper Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Cups & Lids

- 5.1.2. Boxes & Cartons

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Fruits and vegetables

- 5.2.2. Dairy products

- 5.2.3. Bakery & Confectionery

- 5.2.4. Beverages

- 5.2.5. Meat & Poultry

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Restaurants (Quick & Full-service based)

- 5.3.2. Retail establishments

- 5.3.3. Institutional

- 5.3.4. Other End-user Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 SCG Packaging Co Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Tetra Pak

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Continental Packaging (Thailand) Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Huhtamaki Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Amcor PLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Pura Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Oji Holdings Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 International Paper Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Toppan Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Sarnti Packaging Co Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 SCG Packaging Co Ltd

List of Figures

- Figure 1: Asia Pacific Foodservice Paper Packaging Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Foodservice Paper Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Foodservice Paper Packaging Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Asia Pacific Foodservice Paper Packaging Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: Asia Pacific Foodservice Paper Packaging Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 4: Asia Pacific Foodservice Paper Packaging Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Asia Pacific Foodservice Paper Packaging Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 6: Asia Pacific Foodservice Paper Packaging Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 7: Asia Pacific Foodservice Paper Packaging Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 8: Asia Pacific Foodservice Paper Packaging Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: China Asia Pacific Foodservice Paper Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Japan Asia Pacific Foodservice Paper Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: South Korea Asia Pacific Foodservice Paper Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: India Asia Pacific Foodservice Paper Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Australia Asia Pacific Foodservice Paper Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: New Zealand Asia Pacific Foodservice Paper Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Indonesia Asia Pacific Foodservice Paper Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Malaysia Asia Pacific Foodservice Paper Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Singapore Asia Pacific Foodservice Paper Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Thailand Asia Pacific Foodservice Paper Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Vietnam Asia Pacific Foodservice Paper Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Philippines Asia Pacific Foodservice Paper Packaging Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Foodservice Paper Packaging Market?

The projected CAGR is approximately 5.4%.

2. Which companies are prominent players in the Asia Pacific Foodservice Paper Packaging Market?

Key companies in the market include SCG Packaging Co Ltd, Tetra Pak, Continental Packaging (Thailand) Co Ltd, Huhtamaki Group, Amcor PLC, Pura Group, Oji Holdings Corporation, International Paper Company, Toppan Inc, Sarnti Packaging Co Ltd.

3. What are the main segments of the Asia Pacific Foodservice Paper Packaging Market?

The market segments include Type, Application, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Shift in Consumer Preferences toward Recyclable and Eco-friendly Materials; Online Food Ordering Services are Expected to Drive the Market.

6. What are the notable trends driving market growth?

Online Food Ordering Services are Expected to Drive the Market.

7. Are there any restraints impacting market growth?

Increasing Price Volatility of Raw Materials.

8. Can you provide examples of recent developments in the market?

August 2022: Amcor added a new location in Jiangyin, China, to its network of Innovation Centers. Customers in the area now have access to Amcor's expertise through the new facility in China. This speeds up the development of packaging solutions that are better for the environment.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Foodservice Paper Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Foodservice Paper Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Foodservice Paper Packaging Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Foodservice Paper Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence