Key Insights

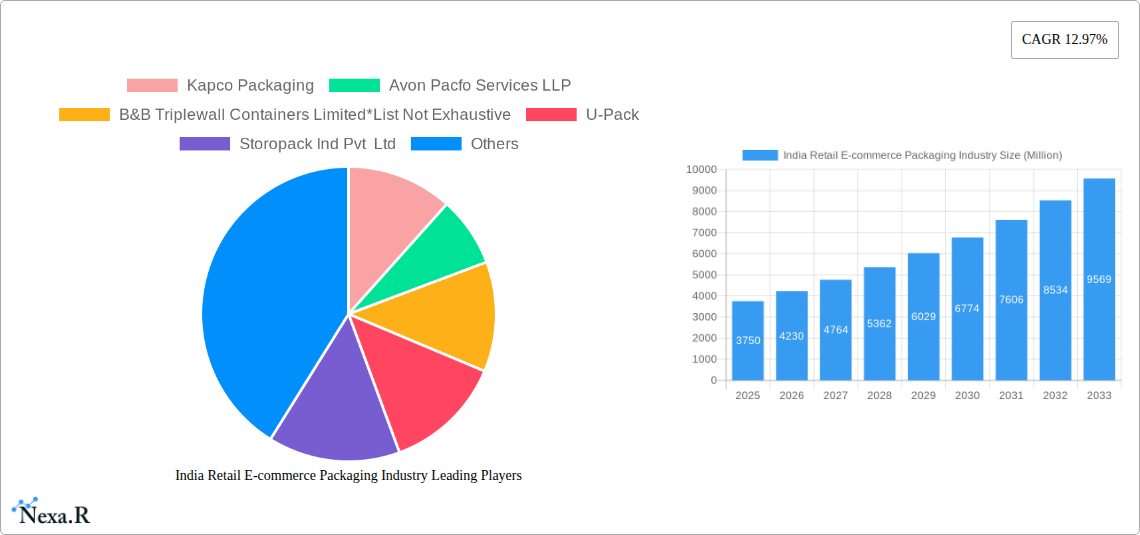

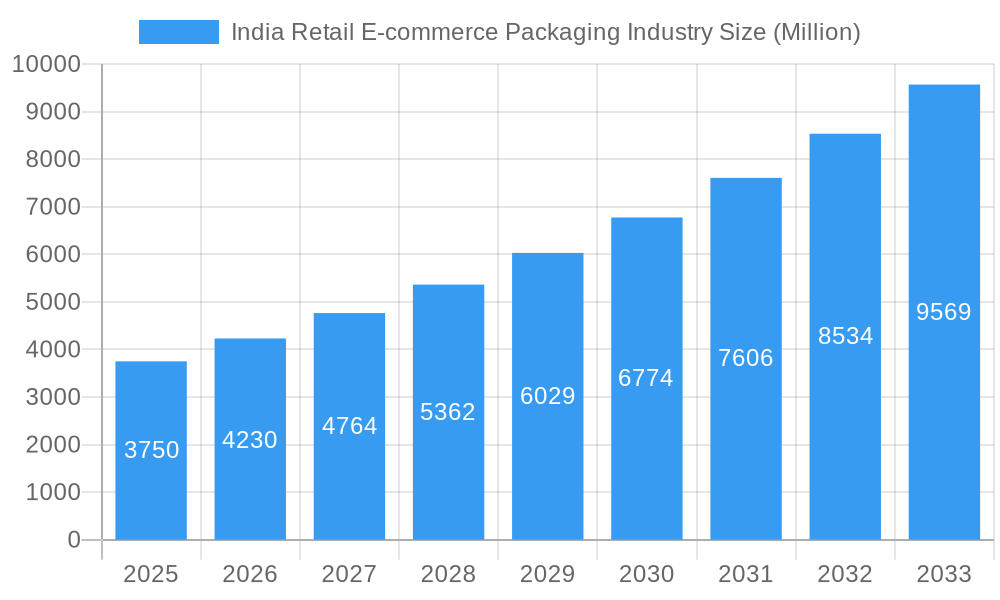

The Indian Retail E-commerce Packaging Market is poised for significant expansion, driven by the burgeoning digital commerce landscape. With a projected market size of $3.75 billion in 2025, the industry is set to witness a robust compound annual growth rate (CAGR) of 12.66% throughout the forecast period. This impressive growth is fueled by several key factors, most notably the accelerating adoption of online shopping across diverse demographics and geographies within India. The increasing disposable incomes, coupled with enhanced internet penetration and smartphone usage, have made e-commerce a convenient and accessible choice for a vast consumer base. Furthermore, the growing emphasis on product safety, presentation, and sustainability in packaging solutions is also a major catalyst, as e-commerce businesses strive to enhance customer experience and minimize product damage during transit. The demand for specialized packaging, such as protective cushioning, tamper-evident seals, and customizable branding, is on the rise, directly contributing to market value.

India Retail E-commerce Packaging Industry Market Size (In Billion)

The market is segmented across various packaging types, with "Boxes" and "Protective Packaging" emerging as dominant categories, catering to the specific needs of different product categories shipped online. The end-user industry spectrum is equally diverse, with "Fashion and Apparel," "Consumer Electronics," "Food and Beverage," and "Personal Care Products" leading the charge in packaging consumption. These sectors, inherently reliant on efficient and secure logistics, are increasingly leveraging sophisticated packaging to ensure product integrity and customer satisfaction. Key players like Kapco Packaging, Avon Pacfo Services LLP, and Storopack Ind Pvt Ltd are at the forefront of innovation, offering solutions that align with evolving market demands. While the market presents immense opportunities, challenges such as rising raw material costs and the need for sustainable packaging alternatives require strategic navigation by industry stakeholders to maintain optimal growth trajectories.

India Retail E-commerce Packaging Industry Company Market Share

India Retail E-commerce Packaging Industry: Market Size, Trends, and Forecast (2019–2033) - Comprehensive Analysis & Strategic Insights

This definitive report delivers an in-depth analysis of the India Retail E-commerce Packaging Industry, providing critical insights into market dynamics, growth trajectories, and competitive landscapes. Covering the extensive period from 2019 to 2033, with a base year of 2025 and a forecast period of 2025–2033, this research is essential for stakeholders seeking to understand the evolving needs of India's burgeoning e-commerce sector. We explore parent and child market segmentation, delivering precise data and actionable intelligence on the packaging solutions that power India's digital commerce. Gain unparalleled understanding of market size evolution, adoption rates, technological disruptions, and consumer behavior shifts. Discover dominant regions, leading segments, product innovations, key drivers, barriers, and emerging opportunities. All quantitative values are presented in billion units for clarity and comparability.

India Retail E-commerce Packaging Industry Market Dynamics & Structure

The India Retail E-commerce Packaging Industry is characterized by a dynamic interplay of factors driving its rapid expansion. Market concentration is evolving, with a blend of established players and agile startups vying for market share. Technological innovation is a significant driver, with advancements in sustainable materials, smart packaging solutions, and efficient production processes shaping the competitive landscape. Regulatory frameworks are increasingly focused on environmental sustainability and product safety, influencing packaging material choices and designs. Competitive product substitutes, ranging from traditional cardboard to advanced protective cushioning, are constantly being introduced, pushing companies to innovate. End-user demographics are shifting, with a growing online shopper base demanding convenience, durability, and aesthetic appeal in their packaging. Mergers and acquisitions (M&A) are on the rise as larger entities seek to consolidate their market position and acquire new technologies or customer bases.

- Market Concentration: A fragmented yet consolidating market with increasing M&A activity.

- Technological Innovation Drivers: Focus on sustainable materials (e.g., recycled content, biodegradable options), smart packaging (e.g., track & trace capabilities), and automated packaging solutions.

- Regulatory Frameworks: Growing emphasis on Extended Producer Responsibility (EPR), plastic waste management rules, and food-grade packaging compliance.

- Competitive Product Substitutes: Constant innovation in cushioning materials, void fill solutions, and tamper-evident packaging.

- End-User Demographics: Diverse consumer base with increasing demand for eco-friendly, aesthetically pleasing, and protective packaging.

- M&A Trends: Strategic acquisitions aimed at expanding product portfolios, enhancing technological capabilities, and gaining market access.

India Retail E-commerce Packaging Industry Growth Trends & Insights

The India Retail E-commerce Packaging Industry is experiencing robust growth, fueled by the unprecedented surge in online retail penetration across the nation. The market size evolution is a testament to this trend, with projected significant increases in demand for various packaging formats. Adoption rates for innovative and sustainable packaging solutions are accelerating as both e-commerce platforms and consumers prioritize environmental responsibility. Technological disruptions, such as the integration of AI in packaging design for optimal material usage and the development of high-barrier films for extended shelf life of packaged goods, are reshaping the industry. Consumer behavior shifts, including a heightened awareness of unboxing experiences and a preference for minimalistic yet protective packaging, are also playing a crucial role.

The industry is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 18.5% during the forecast period. Market penetration of specialized e-commerce packaging solutions, such as custom-sized boxes and enhanced protective cushioning, is rapidly increasing, moving from 45% in 2020 to an estimated 75% by 2028. The increasing digitalization of India, coupled with the expansion of logistics infrastructure, has created a fertile ground for e-commerce, consequently driving the demand for sophisticated packaging. The average spending on e-commerce packaging per order is also on an upward trajectory, reflecting the growing emphasis on brand presentation and product integrity. The rise of quick commerce and same-day delivery services further necessitates agile and efficient packaging solutions that can withstand rapid transit.

Dominant Regions, Countries, or Segments in India Retail E-commerce Packaging Industry

The Boxes segment, a core component of the India Retail E-commerce Packaging Industry, is undeniably the dominant force driving market growth. This segment encompasses a vast array of products, from standard corrugated boxes to customized folding cartons, essential for shipping virtually every category of product sold online. The Fashion and Apparel end-user industry is a significant contributor to the dominance of the boxes segment. This sector relies heavily on visually appealing, protective, and often branded boxes for its garments, footwear, and accessories, making the unboxing experience a critical part of the customer journey.

Key drivers behind the dominance of the boxes segment and the fashion and apparel end-user industry include:

- Economic Policies: Government initiatives promoting manufacturing and ease of doing business indirectly support the production and supply of packaging materials like cardboard and paperboard.

- Infrastructure Development: Expansion of road networks and warehousing facilities across major e-commerce hubs like Delhi NCR, Mumbai, Bengaluru, and Hyderabad enhances the efficient distribution of packaged goods.

- E-commerce Growth in Tier 2 & 3 Cities: The increasing internet penetration and smartphone usage in smaller cities is opening up new markets for e-commerce, further boosting the demand for basic and specialized boxes.

- Brand Differentiation: Fashion brands leverage packaging to create a premium and memorable unboxing experience, directly influencing consumer perception and loyalty. This includes the use of high-quality printing, embossing, and unique box structures.

- Versatility and Cost-Effectiveness: Corrugated boxes offer a balance of protection, affordability, and adaptability for a wide range of product sizes and shapes, making them the go-to solution for most e-commerce shipments. Market share for boxes within the overall e-commerce packaging market is estimated to be around 65%, with the fashion and apparel sector alone accounting for an estimated 30% of this. The growth potential within this segment remains substantial as e-commerce continues its upward trajectory.

India Retail E-commerce Packaging Industry Product Landscape

The product landscape of the India Retail E-commerce Packaging Industry is characterized by innovation and a growing emphasis on functionality and sustainability. Boxes, particularly corrugated ones, remain the cornerstone, evolving with enhanced structural integrity and printing capabilities for branding. Protective packaging, including bubble wrap, air pillows, foam inserts, and biodegradable cushioning materials, is crucial for safeguarding fragile items. Other types of packaging, such as mailer bags, poly bags, and specialized temperature-controlled packaging for food and pharmaceuticals, are also gaining traction. Product innovations focus on reducing material usage while maximizing protection, driven by a demand for lightweight, eco-friendly, and aesthetically pleasing solutions that enhance the customer unboxing experience.

Key Drivers, Barriers & Challenges in India Retail E-commerce Packaging Industry

Key Drivers:

- Rapid E-commerce Growth: The exponential rise of online shopping across India is the primary catalyst, creating sustained demand for packaging.

- Digitalization and Smartphone Penetration: Increased internet access and mobile device usage fuel online purchasing habits.

- Logistics and Infrastructure Development: Expanding transportation networks and warehousing capabilities enable efficient last-mile delivery.

- Consumer Demand for Convenience & Experience: A growing preference for hassle-free delivery and a positive unboxing experience drives packaging innovation.

- Technological Advancements: Innovations in sustainable materials, automation, and smart packaging enhance efficiency and appeal.

Barriers & Challenges:

- Supply Chain Volatility: Fluctuations in raw material prices (paper pulp, plastics) and availability can impact production costs and timelines.

- Regulatory Hurdles: Evolving environmental regulations and waste management policies require constant adaptation and investment in compliant solutions.

- Cost Sensitivity: While consumers desire quality packaging, there's a constant pressure to maintain cost-effectiveness for businesses.

- Competition: The market is competitive, with numerous players vying for market share, leading to price pressures.

- Infrastructure Gaps in Remote Areas: Last-mile delivery challenges in less developed regions can impact packaging needs and efficiency.

- Skilled Labor Shortage: A lack of adequately trained personnel for operating advanced packaging machinery can hinder technological adoption.

Emerging Opportunities in India Retail E-commerce Packaging Industry

Emerging opportunities in the India Retail E-commerce Packaging Industry are vast and diverse. The increasing consumer awareness and demand for sustainable packaging solutions present a significant growth avenue, with innovations in biodegradable, compostable, and recycled materials expected to capture substantial market share. The growth of quick commerce and hyper-local delivery services is creating a niche for specialized, on-demand packaging that ensures product integrity during rapid transit. Furthermore, the development of smart packaging incorporating QR codes for traceability, authentication, and enhanced customer engagement offers a promising frontier. The expansion of e-commerce into Tier 2 and Tier 3 cities will also require cost-effective yet durable packaging solutions tailored to local logistical challenges.

Growth Accelerators in the India Retail E-commerce Packaging Industry Industry

Several key factors are accelerating the growth of the India Retail E-commerce Packaging Industry. Technological breakthroughs in material science, leading to lighter, stronger, and more eco-friendly packaging options, are a major catalyst. The increasing adoption of automation and robotics in packaging processes is enhancing efficiency, reducing costs, and improving product consistency. Strategic partnerships between packaging manufacturers, e-commerce platforms, and logistics providers are fostering innovation and streamlining the supply chain. Furthermore, proactive market expansion strategies, including the development of specialized packaging for emerging product categories like fresh produce and ready-to-eat meals, are opening up new revenue streams.

Key Players Shaping the India Retail E-commerce Packaging Industry Market

- Kapco Packaging

- Avon Pacfo Services LLP

- B&B Triplewall Containers Limited

- U-Pack

- Storopack Ind Pvt Ltd

- Oji India Packaging Pvt Ltd

- TGI Packaging Pvt Ltd

- Packman Packaging

- Ecom Packaging

- Astron Packaging Ltd

- Total Pack

Notable Milestones in India Retail E-commerce Packaging Industry Sector

- April 2022: SIG, a Swiss provider of aseptic carton packaging systems, plans to invest in a new facility in India, a move expected to significantly bolster its operations in one of its fastest-growing markets. This investment is particularly relevant for the liquid food and beverage sectors.

- March 2022: Noida-based AdwayPrint Concept, a manufacturer of mono cartons, relocated its manufacturing plant from Delhi to Noida to expand its production capacities, signaling growth and investment in enhanced manufacturing capabilities for the e-commerce sector.

In-Depth India Retail E-commerce Packaging Industry Market Outlook

The India Retail E-commerce Packaging Industry is poised for continued robust growth, driven by an expanding online consumer base and evolving purchasing habits. Key growth accelerators include the ongoing advancements in sustainable packaging materials, which are increasingly becoming a non-negotiable aspect for both businesses and consumers, thus creating opportunities for innovative eco-friendly solutions. The digital transformation across various sectors, coupled with the government's push for a digital economy, will further embed e-commerce into the daily lives of Indians, consequently increasing the demand for effective and efficient packaging. Strategic initiatives by key players to enhance their manufacturing capabilities, expand their product portfolios to cater to niche markets, and forge stronger collaborations within the supply chain will be instrumental. The future market potential lies in the industry's ability to adapt to emerging trends such as personalization, smart packaging integration, and the need for specialized packaging for perishable goods, ensuring a secure, sustainable, and appealing unboxing experience for every digital transaction.

India Retail E-commerce Packaging Industry Segmentation

-

1. Type

- 1.1. Boxes

- 1.2. Protective Packaging

- 1.3. Other Types of Packaging

-

2. End-user Industry

- 2.1. Fashion and Apparel

- 2.2. Consumer Electronics

- 2.3. Food and Beverage

- 2.4. Personal Care Products

- 2.5. Other End-user Industries

India Retail E-commerce Packaging Industry Segmentation By Geography

- 1. India

India Retail E-commerce Packaging Industry Regional Market Share

Geographic Coverage of India Retail E-commerce Packaging Industry

India Retail E-commerce Packaging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.66% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Proliferation of Online Retailing and Emergence of Omnichannel Presence

- 3.3. Market Restrains

- 3.3.1. Regulation Pertaining to the Use of Plastic and Lack of Exposure to Good Manufacturing Practices

- 3.4. Market Trends

- 3.4.1. Protective Packaging to Witness Significant Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Retail E-commerce Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Boxes

- 5.1.2. Protective Packaging

- 5.1.3. Other Types of Packaging

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Fashion and Apparel

- 5.2.2. Consumer Electronics

- 5.2.3. Food and Beverage

- 5.2.4. Personal Care Products

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Kapco Packaging

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Avon Pacfo Services LLP

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 B&B Triplewall Containers Limited*List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 U-Pack

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Storopack Ind Pvt Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Oji India Packaging Pvt Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 TGI Packaging Pvt Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Packman Packaging

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Ecom Packaging

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Astron Packaging Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Total Pack

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Kapco Packaging

List of Figures

- Figure 1: India Retail E-commerce Packaging Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: India Retail E-commerce Packaging Industry Share (%) by Company 2025

List of Tables

- Table 1: India Retail E-commerce Packaging Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: India Retail E-commerce Packaging Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 3: India Retail E-commerce Packaging Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: India Retail E-commerce Packaging Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 5: India Retail E-commerce Packaging Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 6: India Retail E-commerce Packaging Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Retail E-commerce Packaging Industry?

The projected CAGR is approximately 12.66%.

2. Which companies are prominent players in the India Retail E-commerce Packaging Industry?

Key companies in the market include Kapco Packaging, Avon Pacfo Services LLP, B&B Triplewall Containers Limited*List Not Exhaustive, U-Pack, Storopack Ind Pvt Ltd, Oji India Packaging Pvt Ltd, TGI Packaging Pvt Ltd, Packman Packaging, Ecom Packaging, Astron Packaging Ltd, Total Pack.

3. What are the main segments of the India Retail E-commerce Packaging Industry?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing Proliferation of Online Retailing and Emergence of Omnichannel Presence.

6. What are the notable trends driving market growth?

Protective Packaging to Witness Significant Market Growth.

7. Are there any restraints impacting market growth?

Regulation Pertaining to the Use of Plastic and Lack of Exposure to Good Manufacturing Practices.

8. Can you provide examples of recent developments in the market?

April 2022 - SIG, a Swiss provider of aseptic carton packaging systems, plans to invest in a new facility in India. The move will be advantageous for SIG's operations in the country, which is one of its fastest-growing markets. An aseptic carton is a multilayered packaging solution created by combining layers of paperboard and plastic for the packing of liquid meals and drinks. Other firms in this industry include Tetra and UFlex.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Retail E-commerce Packaging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Retail E-commerce Packaging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Retail E-commerce Packaging Industry?

To stay informed about further developments, trends, and reports in the India Retail E-commerce Packaging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence