Key Insights

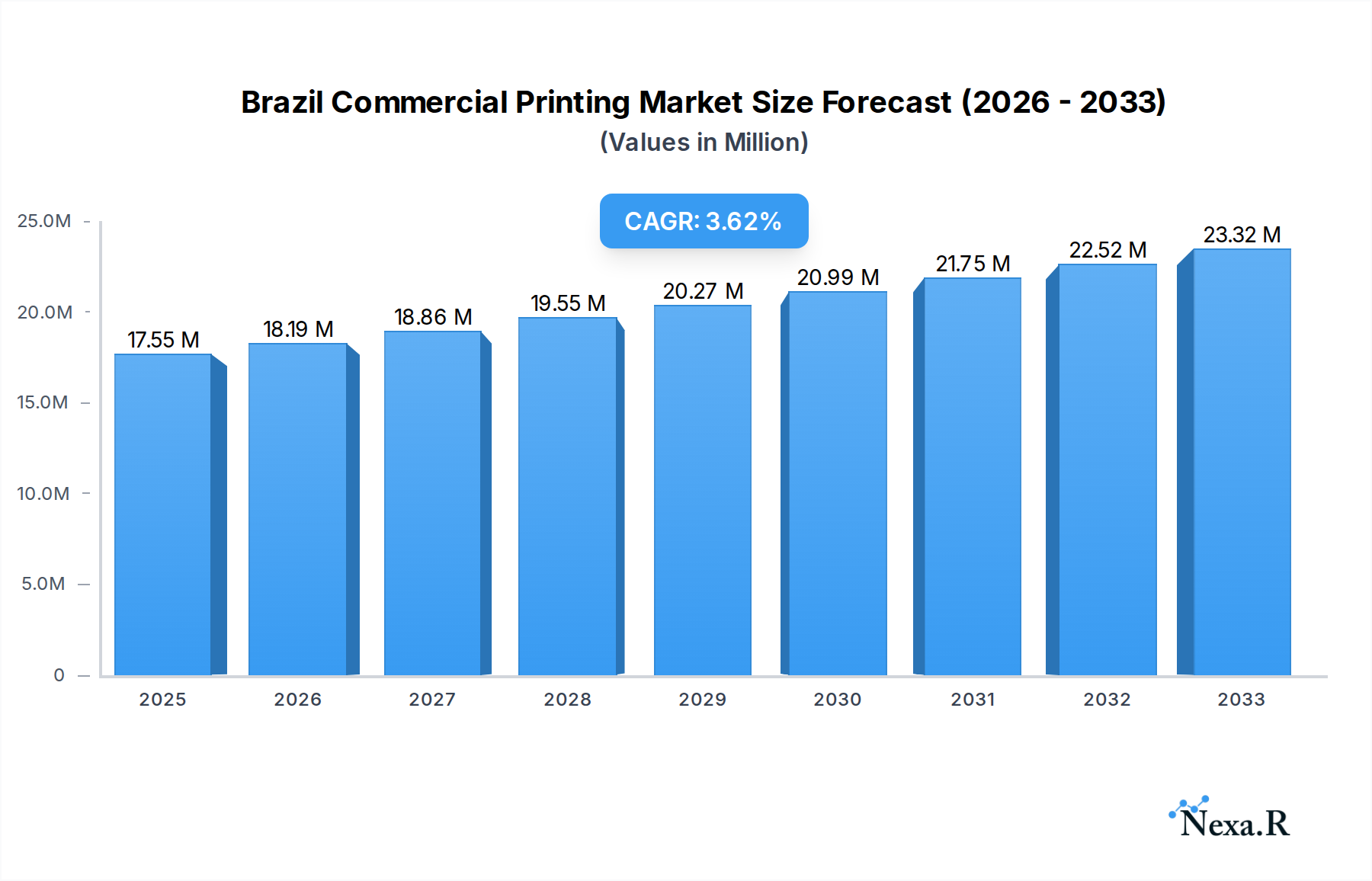

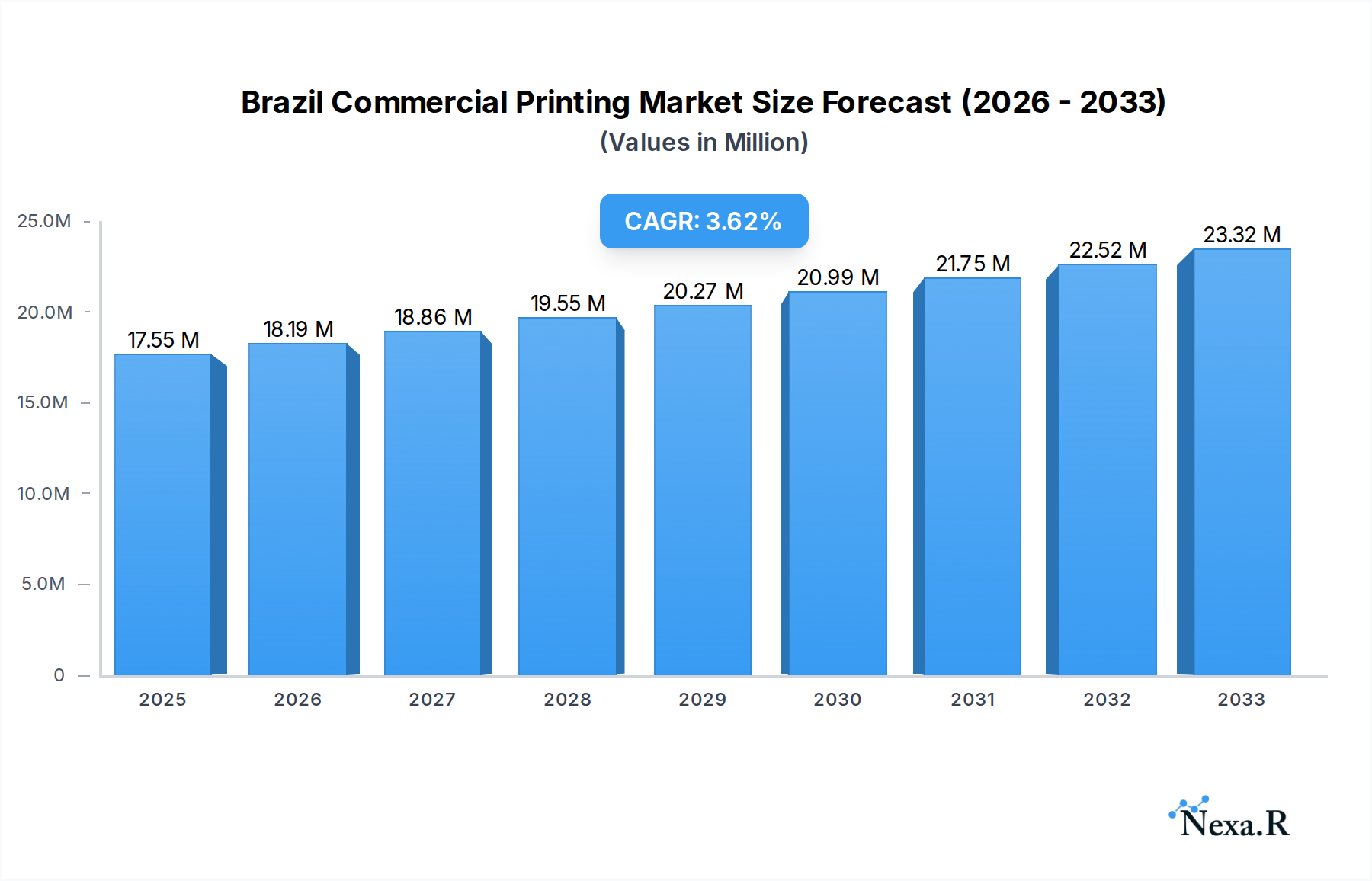

The Brazilian commercial printing market is poised for steady expansion, projected to reach 17.55 million in value by 2025. This growth is fueled by an estimated Compound Annual Growth Rate (CAGR) of 3.64% over the forecast period. While specific drivers were not provided, the market's trajectory suggests a robust demand for printed materials across various sectors, including packaging, advertising, publishing, and transactional printing. The increasing adoption of digital printing technologies like Inkjet and Flexographic is a significant trend, offering enhanced personalization, faster turnaround times, and cost-effectiveness for shorter print runs. This shift is particularly relevant for segments like flexible packaging and labels, where customization and efficiency are paramount. Furthermore, the growing e-commerce sector in Brazil is indirectly contributing to the demand for high-quality commercial printing for product packaging and promotional materials.

Brazil Commercial Printing Market Market Size (In Million)

While the market demonstrates a positive outlook, certain factors may present challenges. High operational costs, including raw material prices and energy expenses, could act as a restraint on profitability. The ongoing digital transformation and the shift towards paperless communication in some traditional areas of commercial printing also pose a long-term consideration. However, the inherent value of tangible marketing materials and the continued need for packaging solutions in a large consumer market like Brazil are expected to outweigh these restraints. Key players such as Heidelberger Druckmaschinen AG, Avery Dennison, and 3M Company, alongside prominent local entities like Pancrom Indústria Gráfica Ltda and Gráfica Gonçalves, are likely to drive innovation and cater to the evolving needs of the Brazilian commercial printing landscape. The market's segmentation by technology, with Offset Lithography, Inkjet, Flexographic, and Screen printing being prominent, indicates a diverse technological adoption.

Brazil Commercial Printing Market Company Market Share

Explore the dynamic Brazil Commercial Printing Market with this in-depth report, designed to provide industry professionals with critical insights, market dynamics, and future growth projections. Covering the period from 2019 to 2033, with a base year of 2025, this analysis delves into market trends, competitive landscapes, and technological advancements shaping the Brazilian printing industry. Uncover opportunities within parent and child markets to maximize your strategic advantage.

Brazil Commercial Printing Market Market Dynamics & Structure

The Brazil Commercial Printing Market exhibits a moderately concentrated structure, with a blend of large multinational corporations and agile local players vying for market share. Technological innovation remains a pivotal driver, fueled by increasing demand for high-quality, personalized, and sustainable printing solutions. The adoption of digital technologies, particularly Inkjet printing and advancements in Flexographic printing, is reshaping production processes. Regulatory frameworks, while evolving, generally support industry growth by promoting fair competition and environmental standards. Competitive product substitutes, such as digital media, present a constant challenge, necessitating continuous innovation in traditional printing methods. End-user demographics are shifting, with a growing preference for eco-friendly printing options and demand from sectors like packaging, publishing, and advertising. Mergers and acquisitions (M&A) activity, though not at peak levels, are strategically driven by companies seeking to expand their service offerings and market reach. Key players are investing in R&D to develop more efficient and cost-effective printing technologies. For instance, the increasing demand for specialty printing solutions is opening new avenues for growth. The overall market is expected to see a steady rise in demand for commercial print services in the coming years.

- Market Concentration: Moderate, with a mix of large international and domestic entities.

- Technological Innovation: Driven by digital printing advancements (Inkjet, Flexographic) and Industry 4.0 integration.

- Regulatory Frameworks: Supportive of sustainable practices and fair competition.

- Competitive Substitutes: Digital media remains a key challenge.

- End-User Demographics: Growing demand for sustainable and personalized printing.

- M&A Trends: Strategic acquisitions aimed at service expansion.

- Investment Focus: R&D in efficiency and cost-effectiveness.

- Emerging Demand: Specialty printing solutions and packaging graphics are key growth areas.

Brazil Commercial Printing Market Growth Trends & Insights

The Brazil Commercial Printing Market is poised for significant growth, driven by evolving consumer behaviors and technological advancements. The market size is projected to expand steadily, with adoption rates of advanced printing technologies like Inkjet and Flexographic printing increasing. These technologies offer greater efficiency, faster turnaround times, and enhanced print quality, meeting the demands of diverse industries. Consumer behavior is shifting towards more personalized and sustainable printed materials, prompting printers to invest in eco-friendly inks and substrates. Digitalization is not only transforming print production but also influencing how printing services are marketed and consumed, with an increasing reliance on online platforms for ordering and design. The commercial printing Brazil sector is witnessing a rise in demand for packaging printing, driven by a growing e-commerce sector and increased consumer spending on packaged goods. Furthermore, the label printing Brazil segment is experiencing robust growth due to the demand for product differentiation and regulatory compliance. Offset Lithography, while mature, continues to hold a significant market share, particularly for high-volume, high-quality print runs. The CAGR for the forecast period is projected to be around 4.5%, indicating a healthy and consistent expansion. The market penetration of advanced digital printing solutions is expected to accelerate as businesses recognize their cost-effectiveness and versatility. This evolution is underpinned by a continuous drive towards enhancing print production efficiency and exploring new applications for printed materials. The overall outlook for printing services in Brazil is optimistic, reflecting the industry's adaptability and innovation.

Dominant Regions, Countries, or Segments in Brazil Commercial Printing Market

Within the Brazil Commercial Printing Market, the Inkjet printing segment is emerging as a dominant force, driven by its versatility, speed, and ability to handle variable data printing. This technology is rapidly gaining traction across various applications, from wide-format signage and packaging to commercial publications. The economic policies in Brazil, which encourage investment in technological upgrades and support small and medium-sized enterprises (SMEs), further accelerate the adoption of advanced printing solutions like Inkjet. Infrastructure development, particularly in logistics and communication networks, ensures that printing services can reach a wider customer base across the country, including remote regions. The packaging printing sub-segment, heavily reliant on technologies like Flexographic and Inkjet, is experiencing exceptional growth. This dominance is fueled by Brazil's large consumer market, the expansion of the food and beverage industry, and the increasing consumer demand for visually appealing and informative packaging. The publishing and advertising segments, historically reliant on Offset Lithography, are also witnessing a shift towards hybrid printing solutions that combine the cost-effectiveness of offset with the flexibility of digital printing. The market share for Inkjet printing within commercial printing is projected to grow by an estimated 6% annually over the forecast period, surpassing traditional methods in specific applications. Flexographic printing also holds a strong position, especially in the flexible packaging printing market, catering to the demands of the FMCG sector. The increasing focus on sustainable printing practices is further boosting segments that offer eco-friendly solutions. The adoption of Industry 4.0 principles in print operations management is also a significant factor, enhancing efficiency and competitiveness across all dominant segments.

- Dominant Technology: Inkjet printing, driven by its versatility and variable data capabilities.

- Key Industry Segments: Packaging printing (flexible and rigid), Publishing, Advertising.

- Economic Drivers: Supportive investment policies for SMEs and technological upgrades.

- Infrastructure Impact: Improved logistics and communication networks expand reach.

- Growth Potential: Significant for Inkjet and Flexographic printing in packaging applications.

- Market Share Evolution: Inkjet's share is expected to see accelerated growth.

- Sustainability Focus: Boosting segments offering eco-friendly printing solutions.

- Operational Efficiency: Industry 4.0 integration enhances competitiveness.

Brazil Commercial Printing Market Product Landscape

The Brazil Commercial Printing Market is characterized by continuous product innovation focused on enhancing print quality, speed, and sustainability. Manufacturers are introducing advanced digital printing presses equipped with features like high-resolution print heads, wider color gamuts, and faster processing speeds. Applications range from high-volume marketing collateral and personalized direct mail to intricate specialty packaging printing and vibrant large-format graphics. Performance metrics are consistently improving, with faster print speeds and reduced ink consumption becoming standard. Unique selling propositions often revolve around environmental certifications, energy efficiency, and the ability to print on diverse substrates. Technological advancements in UV printing and water-based inks are meeting the growing demand for eco-conscious printing solutions.

Key Drivers, Barriers & Challenges in Brazil Commercial Printing Market

Key Drivers:

- Technological Advancements: The continuous evolution of digital printing technologies, such as Inkjet printing, offering greater speed, flexibility, and cost-effectiveness.

- Growing Demand for Packaging: The expansion of the e-commerce sector and the food & beverage industry fuels demand for innovative and visually appealing packaging solutions.

- Personalization and Customization: Increasing consumer preference for personalized products and marketing materials drives the need for variable data printing capabilities.

- Sustainability Initiatives: A growing emphasis on eco-friendly printing practices, including the use of sustainable inks and recyclable materials.

Barriers & Challenges:

- Economic Volatility: Fluctuations in the Brazilian economy can impact business investment in new printing equipment and overall demand for print services.

- Supply Chain Disruptions: Global and local supply chain issues can affect the availability and cost of raw materials like inks, paper, and printing components.

- Competition from Digital Media: The ongoing shift towards digital communication channels presents a persistent challenge for traditional print media.

- Skilled Labor Shortage: A lack of adequately trained personnel to operate and maintain advanced printing technologies can hinder adoption and efficiency.

- High Initial Investment Costs: The capital outlay for state-of-the-art printing machinery can be a significant barrier for smaller printing businesses.

Emerging Opportunities in Brazil Commercial Printing Market

Emerging opportunities within the Brazil Commercial Printing Market lie in the growing demand for sustainable printing solutions and specialty printing applications. The rise of e-commerce continues to fuel the need for innovative and durable packaging printing, particularly in the flexible packaging segment. Furthermore, the increasing use of Inkjet printing in industrial applications, such as printing on textiles and building materials, presents a significant untapped market. The demand for personalized direct mail and customized promotional materials also offers avenues for growth for service providers equipped with variable data printing capabilities.

Growth Accelerators in the Brazil Commercial Printing Market Industry

Growth in the Brazil Commercial Printing Market is being accelerated by significant technological breakthroughs, particularly in the realm of digital printing and automation. Strategic partnerships between printing technology providers and local service bureaus are expanding access to advanced solutions. Furthermore, market expansion strategies, including the development of niche printing services and the exploration of new end-user industries, are proving instrumental in driving long-term growth. The increasing adoption of Industry 4.0 principles is enhancing print production efficiency and enabling businesses to offer more competitive services.

Key Players Shaping the Brazil Commercial Printing Market Market

- Heidelberger Druckmaschinen AG

- Pancrom Indústria Gráfica Ltda

- Avery Dennison

- CCL Industries

- Facility Print

- Gráfica Gonçalves

- Nilpeter

- FastPrint

- Copy House a Gráfica Digital do Rio

- 3M Company

Notable Milestones in Brazil Commercial Printing Market Sector

- June 2023: Etirama, a Brazilian flexographic printing manufacturer, launched its new SPS3 flexo press, featuring Industry 4.0 connectivity for real-time production monitoring and remote technical assistance, offering a modular configuration for flexible investment.

- May 2023: Agfa, a multinational printing company operating in Brazil, announced the development of new inks for its Onset and Avinci inkjet printers. The new ink set for the Onset 560 offers high-quality print, a broad color gamut, and reduced ink consumption, potentially saving up to 20% more ink.

In-Depth Brazil Commercial Printing Market Market Outlook

The Brazil Commercial Printing Market is set for robust expansion, driven by technological innovation and evolving market demands. Growth accelerators include the increasing adoption of Inkjet printing for its versatility and the continued demand for advanced packaging printing solutions. Strategic investments in automation and sustainable printing practices will further bolster the market. Opportunities abound in niche applications and the digitalization of print services, positioning the market for sustained growth and innovation throughout the forecast period.

Brazil Commercial Printing Market Segmentation

-

1. Technology

- 1.1. Offset Lithography

- 1.2. Inkjet

- 1.3. Flexographic

- 1.4. Screen

- 1.5. Gravure

- 1.6. Other Technologies

Brazil Commercial Printing Market Segmentation By Geography

- 1. Brazil

Brazil Commercial Printing Market Regional Market Share

Geographic Coverage of Brazil Commercial Printing Market

Brazil Commercial Printing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.64% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Demand-side Driver Analysis; Supply-side Driver Analysis

- 3.3. Market Restrains

- 3.3.1. Barriers to Adoption and Industry Challenges

- 3.4. Market Trends

- 3.4.1. Supply-side Drivers to Boost the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Commercial Printing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Offset Lithography

- 5.1.2. Inkjet

- 5.1.3. Flexographic

- 5.1.4. Screen

- 5.1.5. Gravure

- 5.1.6. Other Technologies

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Heidelberger Druckmaschinen AG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Pancrom Indústria Gráfica Ltda

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Avery Dennsion

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 CCL Industries*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Facility Print

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Gráfica Gonçalves

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Nilpeter

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 FastPrint

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Copy House a Gráfica Digital do Rio

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 3M Company

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Heidelberger Druckmaschinen AG

List of Figures

- Figure 1: Brazil Commercial Printing Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Brazil Commercial Printing Market Share (%) by Company 2025

List of Tables

- Table 1: Brazil Commercial Printing Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 2: Brazil Commercial Printing Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Brazil Commercial Printing Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 4: Brazil Commercial Printing Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Commercial Printing Market?

The projected CAGR is approximately 3.64%.

2. Which companies are prominent players in the Brazil Commercial Printing Market?

Key companies in the market include Heidelberger Druckmaschinen AG, Pancrom Indústria Gráfica Ltda, Avery Dennsion, CCL Industries*List Not Exhaustive, Facility Print, Gráfica Gonçalves, Nilpeter, FastPrint, Copy House a Gráfica Digital do Rio, 3M Company.

3. What are the main segments of the Brazil Commercial Printing Market?

The market segments include Technology.

4. Can you provide details about the market size?

The market size is estimated to be USD 17.55 Million as of 2022.

5. What are some drivers contributing to market growth?

Demand-side Driver Analysis; Supply-side Driver Analysis.

6. What are the notable trends driving market growth?

Supply-side Drivers to Boost the Market.

7. Are there any restraints impacting market growth?

Barriers to Adoption and Industry Challenges.

8. Can you provide examples of recent developments in the market?

June 2023 - Etirama, a flexographic printing manufacturer based in Brazil, launched its new SPS3 flexo press. The press has Industry 4.0 connectivity, with remote technical assistance and the ability to inform about its production in real time. According to the Brazilian CEO of the manufacturing company, like all other Etirama presses in general, the SPS3 has a high rate of return on investment (ROI) built into its DNA. The modular configuration of the SPS3 gives flexibility to converters willing to invest less upfront.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Commercial Printing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Commercial Printing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Commercial Printing Market?

To stay informed about further developments, trends, and reports in the Brazil Commercial Printing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence