Key Insights

The Asia-Pacific pharmaceutical packaging machinery market is projected for significant expansion, with an estimated market size of $174.85 billion by 2025, and is anticipated to grow at a CAGR of 15.8% through 2033. This growth is driven by several factors: the rapidly expanding pharmaceutical sector in the region, characterized by an increasing prevalence of chronic diseases, an aging demographic, and rising disposable incomes that improve healthcare access. Additionally, stringent regulations mandating drug safety, traceability, and tamper-evidence are compelling pharmaceutical companies to invest in advanced packaging solutions, thereby boosting demand for sophisticated machinery. The market is segmented into primary packaging (aseptic filling, bottle filling, blister packaging), secondary packaging (cartoning, case packing, wrapping, tray packing), and labeling and serialization equipment, all experiencing substantial technological advancements and increased adoption.

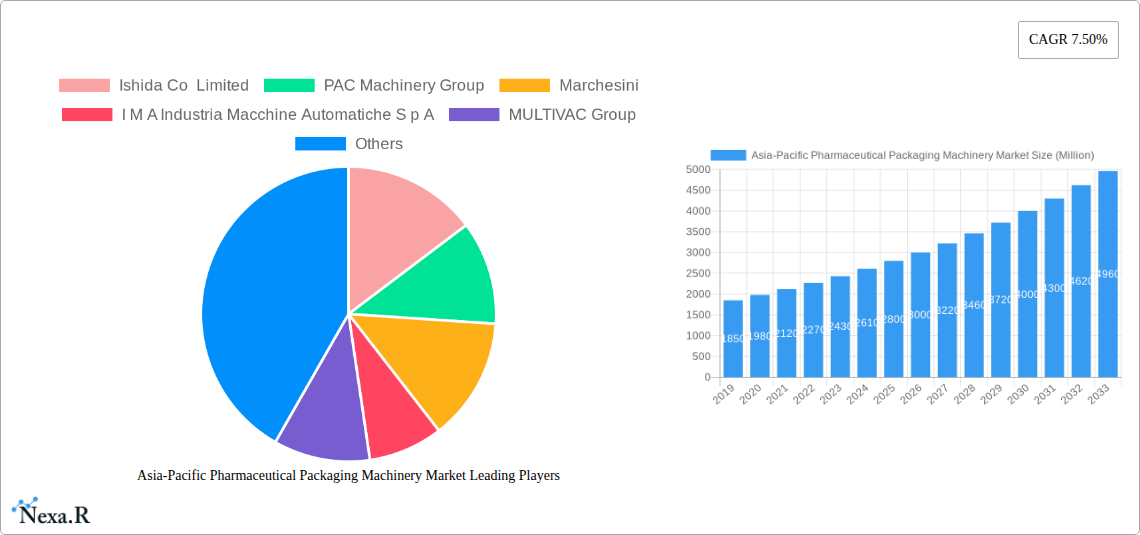

Asia-Pacific Pharmaceutical Packaging Machinery Market Market Size (In Billion)

Key trends influencing the Asia-Pacific pharmaceutical packaging machinery sector include a strong emphasis on automation and Industry 4.0 integration, leading to the adoption of smart, connected machinery offering real-time data analytics, predictive maintenance, and enhanced operational efficiency. The escalating demand for sterile and aseptic packaging solutions, particularly due to public health concerns and the growth of the biologics sector, is fostering innovation in aseptic filling and sealing equipment. Furthermore, the growing necessity for serialization and track-and-trace capabilities to combat counterfeit drugs and ensure supply chain integrity presents significant opportunities for labeling and serialization equipment manufacturers. While the market shows robust growth, potential challenges include the substantial capital investment required for advanced machinery, the need for skilled labor to operate and maintain complex systems, and potential supply chain disruptions for critical components. Leading companies such as Ishida Co. Limited, Marchesini, I.M.A. Industria Macchine Automatiche S.p.A., and MULTIVAC Group are actively innovating and expanding their presence to leverage the burgeoning opportunities in this dynamic market.

Asia-Pacific Pharmaceutical Packaging Machinery Market Company Market Share

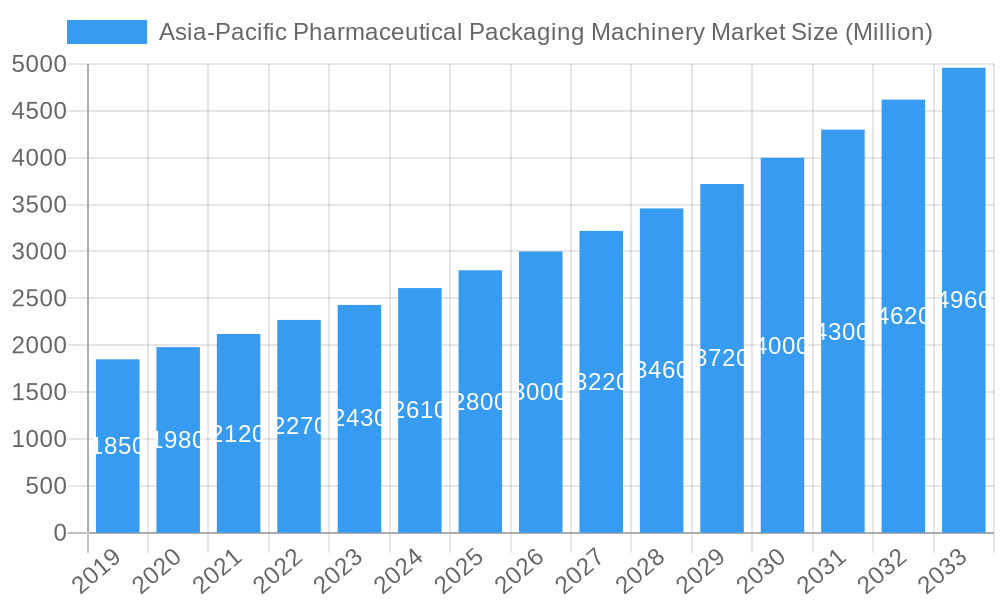

This comprehensive report provides an in-depth analysis of the Asia-Pacific Pharmaceutical Packaging Machinery Market, a vital sector supporting the region's burgeoning pharmaceutical industry. The study period covers 2019 to 2033, with base year data from 2025 and forecasts for 2025–2033, building upon historical performance from 2019–2024. It examines market dynamics, growth trends, dominant regions, product landscapes, key drivers, barriers, challenges, emerging opportunities, growth accelerators, and the pivotal players shaping this market. Quantified insights, including values in billion units, are provided for a clear understanding of market evolution.

Asia-Pacific Pharmaceutical Packaging Machinery Market Market Dynamics & Structure

The Asia-Pacific Pharmaceutical Packaging Machinery Market is characterized by a moderately concentrated structure, with key players investing heavily in technological innovation to meet stringent regulatory demands and evolving end-user preferences for advanced drug delivery systems. Technological innovation drivers are predominantly focused on enhancing automation, serialization capabilities for counterfeit prevention, and the development of machinery for sterile and aseptic packaging solutions. Regulatory frameworks across APAC nations, such as GMP compliance and evolving serialization mandates, significantly influence machinery adoption. Competitive product substitutes are emerging in the form of advanced material science for packaging, indirectly impacting machinery requirements. End-user demographics are shifting towards a greater demand for specialized packaging for biologics, personalized medicines, and an aging population requiring advanced drug formulations. Merger and acquisition (M&A) trends are evident as larger players seek to expand their product portfolios and geographical reach within this high-growth region. For instance, the market anticipates approximately 15-20 M&A deals annually within the broader packaging machinery sector, with a notable portion focused on pharmaceutical applications.

- Market Concentration: Moderate, with top 5-7 players holding approximately 40-50% market share.

- Technological Innovation Drivers: Automation, serialization, aseptic packaging, high-barrier material compatibility.

- Regulatory Frameworks: GMP, serialization mandates, import/export regulations.

- Competitive Product Substitutes: Advanced flexible packaging materials, novel drug delivery systems.

- End-User Demographics: Aging population, rise in chronic diseases, demand for biologics and personalized medicine.

- M&A Trends: Strategic acquisitions for portfolio expansion and market penetration.

Asia-Pacific Pharmaceutical Packaging Machinery Market Growth Trends & Insights

The Asia-Pacific Pharmaceutical Packaging Machinery Market is poised for robust growth, driven by an expanding pharmaceutical manufacturing base, increasing healthcare expenditure, and a growing emphasis on patient safety and product integrity. The market size is projected to reach an estimated value of $XX,XXX Million units by 2025, with a Compound Annual Growth Rate (CAGR) of approximately 7.5% anticipated between 2025 and 2033. Adoption rates for advanced packaging machinery are accelerating, particularly for serialization and track-and-trace solutions, spurred by regulatory requirements in major economies like China, India, and Southeast Asian nations. Technological disruptions are continuously shaping the market, with a significant rise in demand for high-speed, automated, and intelligent machinery capable of handling diverse drug forms and packaging materials. Consumer behavior shifts, including a growing preference for convenience and single-dose packaging, are also influencing machinery innovation. Furthermore, the increasing prevalence of chronic diseases and the development of novel therapeutics, including biosimilars and gene therapies, necessitate sophisticated packaging solutions, further fueling market expansion. The penetration of Industry 4.0 technologies, such as AI-driven quality control and predictive maintenance, is also on the rise, promising enhanced efficiency and reduced downtime for pharmaceutical manufacturers.

Dominant Regions, Countries, or Segments in Asia-Pacific Pharmaceutical Packaging Machinery Market

Within the Asia-Pacific Pharmaceutical Packaging Machinery Market, China stands out as the dominant country, driven by its vast pharmaceutical manufacturing capacity, significant government investment in healthcare infrastructure, and stringent regulatory enforcement that mandates advanced packaging solutions. This dominance is further amplified by the country's position as a global hub for Active Pharmaceutical Ingredient (API) production and finished drug manufacturing. The Primary Packaging segment, specifically Aseptic Filling and Sealing Equipment, exhibits substantial growth and market share due to the increasing demand for sterile injectables, vaccines, and biologics, which require specialized, high-precision machinery to maintain product sterility and efficacy. The estimated market share for Aseptic Filling and Sealing Equipment within the primary packaging segment is approximately 35-40% as of 2025.

Key drivers contributing to China's and Aseptic Filling and Sealing Equipment's dominance include:

- Economic Policies: Favorable government policies supporting the pharmaceutical and manufacturing sectors, including incentives for technology adoption and localization.

- Infrastructure Development: Extensive development of industrial parks and manufacturing facilities equipped with advanced technological capabilities.

- Market Size and Demand: The sheer volume of pharmaceutical production in China creates immense demand for packaging machinery.

- Regulatory Compliance: Increasing emphasis on product safety and quality compliance, driving the adoption of high-standard packaging equipment.

- Technological Advancement: Local manufacturers are increasingly investing in R&D and collaborating with international players to enhance their offerings in aseptic and specialized packaging.

In terms of specific machinery types within Primary Packaging, Bottle Filling and Capping Equipment and Blister Packaging Equipment also hold significant market share, catering to the high volume production of solid dosage forms and liquid medications. The Secondary Packaging segment, particularly Cartoning Equipment, plays a crucial role in ensuring product protection and providing essential information, experiencing steady growth alongside primary packaging advancements.

Asia-Pacific Pharmaceutical Packaging Machinery Market Product Landscape

The product landscape of the Asia-Pacific Pharmaceutical Packaging Machinery Market is characterized by continuous innovation aimed at enhancing efficiency, safety, and compliance. Manufacturers are offering advanced solutions such as high-speed aseptic filling and sealing equipment designed for biologics and vaccines, intelligent blister packaging machines with integrated vision inspection systems, and sophisticated cartoning equipment capable of handling complex pack formats. Serialization-ready machinery, equipped with advanced printing and verification technology, is becoming a standard offering. Unique selling propositions include modular designs for flexibility, energy-efficient operations, and user-friendly interfaces with advanced data logging capabilities. Technological advancements are focusing on precision engineering for reduced product wastage, enhanced barrier properties in packaging materials enabled by specialized machinery, and seamless integration with upstream and downstream processes.

Key Drivers, Barriers & Challenges in Asia-Pacific Pharmaceutical Packaging Machinery Market

Key Drivers: The Asia-Pacific Pharmaceutical Packaging Machinery Market is propelled by several significant drivers. Growing healthcare expenditure across the region, coupled with an increasing prevalence of chronic diseases, fuels demand for pharmaceutical products and, consequently, packaging machinery. Stringent government regulations mandating serialization and track-and-trace capabilities to combat counterfeit drugs are a major catalyst for adopting advanced packaging solutions. Technological advancements in automation and robotics are leading to the development of more efficient, high-speed, and precise packaging machinery. The expanding pharmaceutical manufacturing base, particularly in emerging economies, also represents a substantial growth driver.

Barriers & Challenges: Despite the robust growth, the market faces several barriers and challenges. High initial investment costs for sophisticated pharmaceutical packaging machinery can be a deterrent for smaller manufacturers. The complex and evolving regulatory landscape across different APAC countries can create compliance challenges and necessitate costly machine upgrades. Skilled labor shortages for operating and maintaining advanced machinery are also a concern. Furthermore, intense price competition from local and international players can put pressure on profit margins. Supply chain disruptions and the fluctuating availability of raw materials for machinery components can also pose significant challenges.

Emerging Opportunities in Asia-Pacific Pharmaceutical Packaging Machinery Market

Emerging opportunities within the Asia-Pacific Pharmaceutical Packaging Machinery Market are diverse and promising. The burgeoning demand for biologics and specialty pharmaceuticals, including gene and cell therapies, presents a significant opportunity for manufacturers of highly specialized aseptic filling and containment machinery. The increasing adoption of personalized medicine will drive demand for flexible and scalable packaging solutions capable of handling smaller batch sizes and individualized dosages. The growing e-commerce sector for pharmaceuticals in APAC countries is creating a need for robust and tamper-evident secondary and tertiary packaging machinery that ensures product integrity during transit. Furthermore, the focus on sustainable packaging solutions is opening doors for machinery that can efficiently process biodegradable and recyclable materials, aligning with environmental regulations and consumer preferences.

Growth Accelerators in the Asia-Pacific Pharmaceutical Packaging Machinery Market Industry

Several factors are acting as growth accelerators for the Asia-Pacific Pharmaceutical Packaging Machinery Market. Strategic partnerships and collaborations between machinery manufacturers and pharmaceutical companies are fostering innovation and ensuring the development of tailored solutions. The increasing adoption of Industry 4.0 technologies, such as artificial intelligence (AI) for quality control and predictive maintenance, is enhancing operational efficiency and reducing downtime for pharmaceutical manufacturers. Market expansion strategies, including increased investment in research and development by key players and the exploration of untapped emerging markets within APAC, are also contributing to accelerated growth. Furthermore, a growing awareness and demand for high-quality, safe, and authentic medicines are indirectly pushing the adoption of advanced packaging machinery.

Key Players Shaping the Asia-Pacific Pharmaceutical Packaging Machinery Market Market

- Ishida Co Limited

- PAC Machinery Group

- Marchesini

- I M A Industria Macchine Automatiche S p A

- MULTIVAC Group

- Robert Bosch GmbH

- Romaco Pharmatechnik GmbH

- Mesoblast

- Optima Packaging Group GmbH

- Uhlmann Group

Notable Milestones in Asia-Pacific Pharmaceutical Packaging Machinery Market Sector

- October 2021: ATS Packaging Machinery launched a new Gemini capping machine integrating its high-precision tightening technology. The machine is available with CGMP, FDA, Ex, and UL certifications and is suitable across packaging applications such as pharmaceuticals, cosmetics, food and beverages, and others.

- July 2021: ACG, an integrated pharmaceutical supplier, unveiled its strategic collaboration with Danapak Flexibles A/S, which specializes in packaging for high-barrier transdermal drug delivery systems. The partnership is expected to translate into better services to new and existing customers of Danapak Flexibles in India.

- March 2021: Scholle IPN completed the acquisition of Bossar, a global supplier of flexible horizontal form-fill-seal packaging equipment.

In-Depth Asia-Pacific Pharmaceutical Packaging Machinery Market Market Outlook

The future outlook for the Asia-Pacific Pharmaceutical Packaging Machinery Market is exceptionally bright, driven by sustained economic growth, increasing healthcare access, and a persistent focus on product safety and regulatory compliance. Key growth accelerators, including the ongoing digital transformation in manufacturing (Industry 4.0) and the development of advanced packaging for biologics and personalized medicines, will continue to shape market dynamics. Strategic partnerships and a focus on sustainable packaging technologies are expected to foster further innovation. The market's potential lies in its ability to adapt to evolving patient needs and the increasing demand for highly reliable and efficient pharmaceutical packaging solutions.

Asia-Pacific Pharmaceutical Packaging Machinery Market Segmentation

-

1. Machi

-

1.1. Primary Packaging

- 1.1.1. Aseptic Filling and Sealing Equipment

- 1.1.2. Bottle Filling and Capping Equipment

- 1.1.3. Blister Packaging Equipment

- 1.1.4. Others

-

1.2. Secondary Packaging

- 1.2.1. Cartoning Equipment

- 1.2.2. Case packaging Equipment

- 1.2.3. Wrapping Equipment

- 1.2.4. Tray Packing Equipment

-

1.3. Labelling and Serialization

- 1.3.1. Bottle a

- 1.3.2. Carton Labelling and Serialization Equipment

-

1.1. Primary Packaging

Asia-Pacific Pharmaceutical Packaging Machinery Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Pharmaceutical Packaging Machinery Market Regional Market Share

Geographic Coverage of Asia-Pacific Pharmaceutical Packaging Machinery Market

Asia-Pacific Pharmaceutical Packaging Machinery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. High demand in key end-user markets; Ongoing technological developments; Impact of Safety Standards and Regulations in the pharmaceutical industry

- 3.3. Market Restrains

- 3.3.1. High costs and import duties pose a challenge for new customers; Capital Intensive manufacturing process

- 3.4. Market Trends

- 3.4.1. The Presence of Safety Standards & Regulations in the Pharmaceutical Industry Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Pharmaceutical Packaging Machinery Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Machi

- 5.1.1. Primary Packaging

- 5.1.1.1. Aseptic Filling and Sealing Equipment

- 5.1.1.2. Bottle Filling and Capping Equipment

- 5.1.1.3. Blister Packaging Equipment

- 5.1.1.4. Others

- 5.1.2. Secondary Packaging

- 5.1.2.1. Cartoning Equipment

- 5.1.2.2. Case packaging Equipment

- 5.1.2.3. Wrapping Equipment

- 5.1.2.4. Tray Packing Equipment

- 5.1.3. Labelling and Serialization

- 5.1.3.1. Bottle a

- 5.1.3.2. Carton Labelling and Serialization Equipment

- 5.1.1. Primary Packaging

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Machi

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Ishida Co Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 PAC Machinery Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Marchesini

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 I M A Industria Macchine Automatiche S p A

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 MULTIVAC Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Robert Bosch GmbH

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Romaco Pharmatechnik GmbH

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Mesoblast

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Optima Packaging Group GmbH

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Uhlmann Group*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Ishida Co Limited

List of Figures

- Figure 1: Asia-Pacific Pharmaceutical Packaging Machinery Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Pharmaceutical Packaging Machinery Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Pharmaceutical Packaging Machinery Market Revenue billion Forecast, by Machi 2020 & 2033

- Table 2: Asia-Pacific Pharmaceutical Packaging Machinery Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Asia-Pacific Pharmaceutical Packaging Machinery Market Revenue billion Forecast, by Machi 2020 & 2033

- Table 4: Asia-Pacific Pharmaceutical Packaging Machinery Market Revenue billion Forecast, by Country 2020 & 2033

- Table 5: China Asia-Pacific Pharmaceutical Packaging Machinery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Japan Asia-Pacific Pharmaceutical Packaging Machinery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: South Korea Asia-Pacific Pharmaceutical Packaging Machinery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: India Asia-Pacific Pharmaceutical Packaging Machinery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Australia Asia-Pacific Pharmaceutical Packaging Machinery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: New Zealand Asia-Pacific Pharmaceutical Packaging Machinery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Indonesia Asia-Pacific Pharmaceutical Packaging Machinery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Malaysia Asia-Pacific Pharmaceutical Packaging Machinery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Singapore Asia-Pacific Pharmaceutical Packaging Machinery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Thailand Asia-Pacific Pharmaceutical Packaging Machinery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Vietnam Asia-Pacific Pharmaceutical Packaging Machinery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Philippines Asia-Pacific Pharmaceutical Packaging Machinery Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Pharmaceutical Packaging Machinery Market?

The projected CAGR is approximately 15.8%.

2. Which companies are prominent players in the Asia-Pacific Pharmaceutical Packaging Machinery Market?

Key companies in the market include Ishida Co Limited, PAC Machinery Group, Marchesini, I M A Industria Macchine Automatiche S p A, MULTIVAC Group, Robert Bosch GmbH, Romaco Pharmatechnik GmbH, Mesoblast, Optima Packaging Group GmbH, Uhlmann Group*List Not Exhaustive.

3. What are the main segments of the Asia-Pacific Pharmaceutical Packaging Machinery Market?

The market segments include Machi.

4. Can you provide details about the market size?

The market size is estimated to be USD 174.85 billion as of 2022.

5. What are some drivers contributing to market growth?

High demand in key end-user markets; Ongoing technological developments; Impact of Safety Standards and Regulations in the pharmaceutical industry.

6. What are the notable trends driving market growth?

The Presence of Safety Standards & Regulations in the Pharmaceutical Industry Expected to Drive the Market.

7. Are there any restraints impacting market growth?

High costs and import duties pose a challenge for new customers; Capital Intensive manufacturing process.

8. Can you provide examples of recent developments in the market?

In October 2021, ATS Packaging Machinery launched a new Gemini capping machine integrating its high-precision tightening technology. The machine is available with CGMP, FDA, Ex, and UL certifications and is suitable across packaging applications such as pharmaceuticals, cosmetics, food and beverages, and others.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Pharmaceutical Packaging Machinery Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Pharmaceutical Packaging Machinery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Pharmaceutical Packaging Machinery Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Pharmaceutical Packaging Machinery Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence