Key Insights

The Asia Pacific Contract Packaging Market is projected for substantial expansion, anticipated to reach USD 8.66 billion by 2025, driven by a compelling Compound Annual Growth Rate (CAGR) of 13.95% through 2033. Key growth engines include escalating demand from the Food, Beverages, and Pharmaceuticals sectors. Factors such as evolving consumer preferences for convenience, the expansion of e-commerce necessitating specialized packaging, and manufacturers' strategic outsourcing for cost and expertise are significant contributors. The robust growth of the pharmaceutical industry in China and India, fueled by demographics and healthcare investments, further propels demand for sterile, secure, and compliant packaging. Rising disposable incomes in emerging economies are also boosting consumption of packaged goods, creating significant opportunities for contract packaging providers.

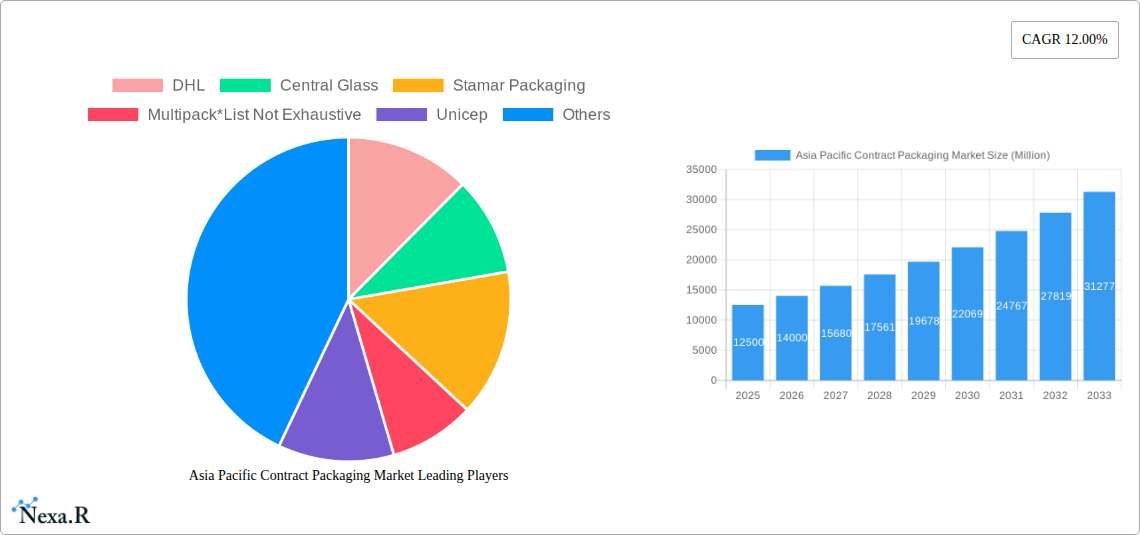

Asia Pacific Contract Packaging Market Market Size (In Billion)

The market is segmented by packaging type, with Primary Packaging leading due to its direct product contact. However, Secondary Packaging and Tertiary Packaging are experiencing strong growth, driven by multi-unit sales strategies, retail-ready presentation, and efficient logistics. Emerging trends include the adoption of sustainable packaging materials and smart packaging technologies to address environmental concerns and enhance traceability. Market challenges include volatile raw material prices and stringent regulatory frameworks. Intense competition and potential new entrants also present hurdles. Despite these challenges, investments in manufacturing and technology by key players, coupled with expansion in high-growth regions, indicate a positive market trajectory.

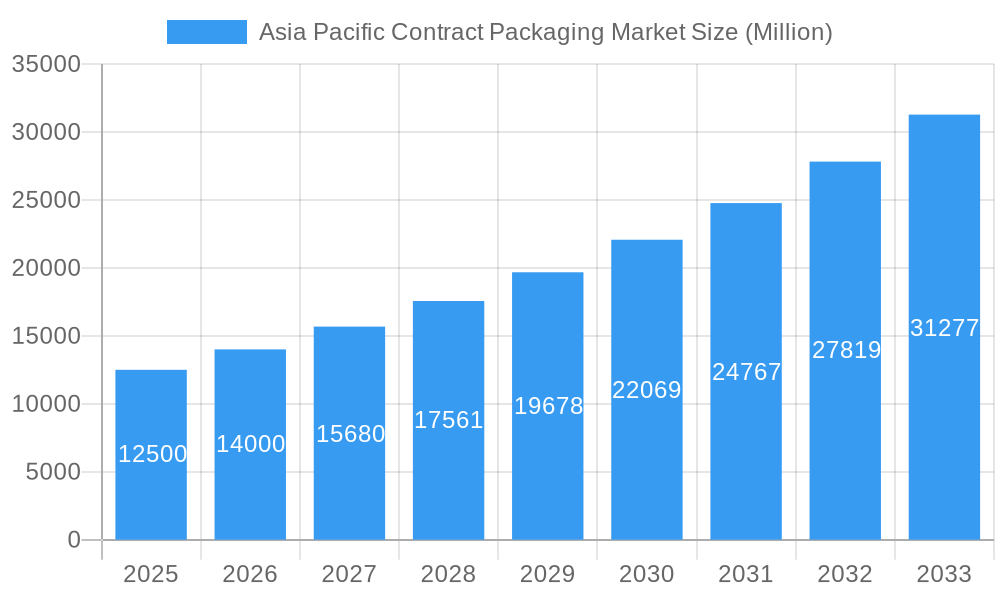

Asia Pacific Contract Packaging Market Company Market Share

This comprehensive report offers an in-depth analysis of the Asia Pacific Contract Packaging Market, covering market dynamics, growth patterns, and future projections. With a study period from 2019 to 2033, a base year of 2025, and a forecast period of 2025-2033, this report provides critical insights for stakeholders. We meticulously analyze market segments, regional dominance, product innovations, and competitive landscapes, delivering actionable intelligence for strategic decision-making. Market values are presented in billions for clarity.

Asia Pacific Contract Packaging Market Market Dynamics & Structure

The Asia Pacific contract packaging market exhibits a moderate to high degree of market concentration, with a few key players dominating specific niches and services. Technological innovation is a significant driver, particularly in automation, sustainable packaging solutions, and advanced printing techniques, enabling contract packaging companies to offer enhanced efficiency and customization. Regulatory frameworks, while evolving, are becoming more stringent regarding product safety, environmental impact, and material traceability, influencing packaging design and material choices. Competitive product substitutes, such as in-house packaging capabilities of large CPG (Consumer Packaged Goods) companies and advancements in reusable packaging systems, pose a constant challenge.

End-user demographics are diverse, with a growing middle class and increasing disposable incomes in countries like China, India, and Southeast Asian nations fueling demand across various verticals. Pharmaceutical contract packaging is experiencing robust growth due to stringent quality requirements and the need for specialized sterile packaging. The food and beverage contract packaging segment remains a cornerstone, driven by the demand for convenient, shelf-stable, and visually appealing packaging. Merger and acquisition (M&A) trends are actively shaping the market landscape as larger players seek to expand their geographic reach, service offerings, and technological capabilities. For instance, the secondary packaging segment is witnessing consolidation as companies aim to offer integrated solutions.

- Market Concentration: Dominated by established players and regional specialists.

- Technological Innovation: Focus on automation, sustainability, and smart packaging.

- Regulatory Influence: Growing emphasis on safety, sustainability, and compliance.

- Competitive Landscape: Competition from in-house operations and alternative packaging models.

- End-User Demand: Driven by demographic shifts and evolving consumer preferences.

- M&A Activity: Strategic acquisitions to enhance market position and service portfolio.

Asia Pacific Contract Packaging Market Growth Trends & Insights

The Asia Pacific contract packaging market is projected to witness substantial and sustained growth throughout the forecast period. This expansion is underpinned by a confluence of factors including rising disposable incomes, increasing urbanization, and a burgeoning middle class that demands a wider array of packaged goods. The primary packaging segment, crucial for product protection and preservation, is expected to lead this growth, propelled by innovations in material science and barrier technologies. Adoption rates for outsourced packaging services are steadily climbing as manufacturers, especially small and medium-sized enterprises (SMEs), recognize the cost efficiencies, scalability, and specialized expertise that contract packagers provide. This trend is particularly evident in the pharmaceutical contract packaging sector, where the complexities of regulatory compliance and sterile handling make outsourcing a strategically advantageous decision.

Technological disruptions are profoundly influencing market dynamics. The integration of Industry 4.0 principles, including AI-powered quality control, IoT-enabled supply chain management, and advanced robotics for automated packing lines, is enhancing operational efficiency and precision. Furthermore, the surge in e-commerce has created a significant demand for specialized tertiary packaging solutions that ensure product integrity during transit and enhance the unboxing experience for consumers. Consumer behavior shifts are also playing a pivotal role. There is a growing preference for convenience, portion-controlled packaging, and aesthetically pleasing designs, all of which are areas where contract packagers excel through their specialized capabilities and access to diverse packaging formats. The food and beverage contract packaging segment, for instance, is adapting to trends like plant-based alternatives and ready-to-eat meals, requiring flexible and innovative packaging solutions.

The market penetration of contract packaging services is expected to deepen across various industries as companies increasingly focus on core competencies and leverage external expertise for their packaging needs. The increasing demand for sustainable packaging solutions, driven by both consumer pressure and regulatory mandates, is also a significant growth catalyst. Contract packagers are investing in eco-friendly materials, recyclable solutions, and innovative designs that minimize waste, thereby aligning with the evolving environmental consciousness of consumers. The beauty care contract packaging sector, known for its trend-driven nature, is particularly responsive to sustainable and premium packaging innovations. The overall market CAGR (Compound Annual Growth Rate) is projected to remain robust, driven by these converging trends, making the Asia Pacific a critical hub for contract packaging services.

Dominant Regions, Countries, or Segments in Asia Pacific Contract Packaging Market

The food and beverage contract packaging segment stands out as a dominant force within the broader Asia Pacific contract packaging market. This leadership is attributable to several intertwined factors, including the sheer size and dynamism of the region's food and beverage industry, coupled with evolving consumer lifestyles and dietary preferences. The Beverages sub-segment, encompassing everything from soft drinks and juices to alcoholic beverages, is a significant contributor, driven by the increasing demand for convenience, single-serve options, and aesthetically appealing packaging that catches the eye on crowded retail shelves. Similarly, the Food segment benefits from the growing demand for processed foods, ready-to-eat meals, and healthy snack options, all of which require specialized contract packaging solutions for preservation, safety, and convenience.

Economically, countries like China and India, with their massive populations and rapidly expanding middle classes, represent the largest consumer bases for packaged food and beverages. Their burgeoning economies fuel continuous growth in domestic consumption, thereby driving the need for efficient and scalable contract packaging services. Furthermore, government initiatives aimed at promoting food processing industries and improving supply chain infrastructure in these nations indirectly bolster the contract packaging sector. The Pharmaceuticals segment is another high-growth area, albeit with different drivers. Strict regulatory requirements for drug safety, sterility, and traceability necessitate specialized packaging expertise, making contract packagers with robust quality control systems and certifications highly sought after. The increasing prevalence of chronic diseases and an aging population across the region further fuel the demand for pharmaceutical products and, consequently, their specialized packaging.

In terms of geographic dominance, China and India are poised to lead the market. China, with its advanced manufacturing capabilities and extensive export market, offers significant opportunities for high-volume contract packaging. The country's vast domestic market, coupled with its role as a global manufacturing hub, ensures a constant demand for diverse packaging solutions across all major verticals. India, with its rapidly growing economy, a young demographic, and increasing urbanization, presents substantial untapped potential. The country’s expanding retail landscape and the rise of modern trade formats are driving the demand for professionally packaged goods. Southeast Asian nations, including countries like Indonesia, Vietnam, and Thailand, are also emerging as significant growth pockets, fueled by increasing foreign investment in manufacturing and a rising middle class.

- Dominant Segment: Food & Beverages (particularly Beverages and Food)

- Key Verticals Driving Growth: Beverages, Food, Pharmaceuticals

- Leading Regions: China, India

- Emerging Regions: Southeast Asian nations (Indonesia, Vietnam, Thailand)

- Key Drivers of Dominance:

- Large and growing consumer base

- Increasing disposable incomes

- Evolving consumer lifestyles and dietary preferences

- Stringent regulatory requirements (especially for Pharmaceuticals)

- Growth of organized retail and e-commerce

- Government support for manufacturing and food processing industries

Asia Pacific Contract Packaging Market Product Landscape

The Asia Pacific contract packaging market's product landscape is characterized by a strong emphasis on innovation and specialization across various packaging formats. In the Primary Packaging segment, advancements focus on materials offering superior barrier properties to enhance shelf-life and preserve product integrity, particularly for food and pharmaceuticals. This includes the development of advanced films, laminates, and rigid containers with enhanced oxygen and moisture resistance. For the Beverages vertical, innovations in flexible pouches, innovative bottle designs, and advanced canning technologies are prevalent, catering to both convenience and premiumization trends. The Food segment sees a surge in sustainable and biodegradable packaging solutions, alongside intelligent packaging that indicates product freshness or temperature.

In Secondary Packaging, the focus is on creating efficient, cost-effective, and visually appealing solutions that enhance brand visibility at the point of sale. This includes sophisticated folding cartons, custom-designed trays, and shrink-wrapped multipacks. For Beauty Care products, secondary packaging often emphasizes premium aesthetics and brand storytelling. Tertiary Packaging solutions are increasingly optimized for e-commerce logistics, focusing on durability, shock absorption, and ease of handling during transit. This includes specialized corrugated boxes, protective inserts, and palletizing solutions designed to minimize damage and shipping costs. Technological advancements in printing, such as high-resolution digital printing and specialized inks, are enabling contract packagers to offer highly customized and branded packaging solutions, enhancing the unique selling propositions of their clients.

Key Drivers, Barriers & Challenges in Asia Pacific Contract Packaging Market

The Asia Pacific contract packaging market is propelled by several key drivers, including the escalating demand for convenience and ready-to-eat products across Food and Beverages, the stringent regulatory environment in the Pharmaceuticals sector mandating specialized packaging expertise, and the rapid growth of e-commerce necessitating robust and secure tertiary packaging. Furthermore, the increasing trend of outsourcing by manufacturers to focus on core competencies and benefit from economies of scale is a significant accelerator. Economic growth in emerging economies, coupled with rising disposable incomes, fuels consumer spending on packaged goods, thereby increasing the overall demand for contract packaging services.

However, the market faces considerable barriers and challenges. Supply chain disruptions, exacerbated by geopolitical events and logistical complexities, can impact the timely delivery of raw materials and finished goods. Increasing raw material costs, particularly for plastics and paper, can squeeze profit margins for contract packagers. Stringent and evolving regulatory landscapes across different countries, especially concerning food safety and environmental sustainability, require continuous adaptation and investment in compliance. Intense competition from both established players and new entrants, as well as from in-house packaging capabilities of large corporations, exerts pressure on pricing and service offerings. Technological obsolescence is another challenge, requiring constant investment in upgrading machinery and automation to remain competitive.

Emerging Opportunities in Asia Pacific Contract Packaging Market

Emerging opportunities in the Asia Pacific contract packaging market are significant and multifaceted. The growing consumer consciousness towards sustainability presents a substantial opportunity for contract packaging companies to innovate and offer eco-friendly packaging solutions, including biodegradable, compostable, and recyclable materials. The expansion of the pharmaceutical and healthcare sectors in developing economies, driven by an aging population and increased healthcare spending, will continue to fuel demand for specialized, sterile, and compliant packaging. The burgeoning e-commerce sector across the region creates a demand for customized and protective packaging designed for direct-to-consumer shipping, including anti-counterfeiting features.

Furthermore, the increasing focus on premiumization in the Beauty Care and Food and Beverages segments offers opportunities for contract packagers to provide unique, aesthetically pleasing, and value-added packaging designs. The demand for personalized and smaller portion sizes, catering to evolving consumer lifestyles, also opens avenues for flexible packaging formats and specialized filling capabilities. The development of smart packaging solutions, incorporating features like RFID tags or QR codes for enhanced traceability and consumer engagement, represents a forward-looking opportunity for differentiation and value creation.

Growth Accelerators in the Asia Pacific Contract Packaging Market Industry

Several catalysts are accelerating the long-term growth of the Asia Pacific contract packaging market. Technological breakthroughs in automation, robotics, and digital printing are enhancing operational efficiency, reducing costs, and enabling greater customization, thereby improving the value proposition for clients. Strategic partnerships and collaborations between contract packagers, raw material suppliers, and technology providers are fostering innovation and expanding service capabilities. For instance, partnerships focused on developing novel sustainable packaging materials can unlock new market segments.

Market expansion strategies, including mergers, acquisitions, and the establishment of new facilities in high-growth regions, are crucial for increasing market share and geographic reach. Companies that can offer integrated end-to-end solutions, from primary packaging to logistics and fulfillment, will gain a competitive advantage. The increasing adoption of advanced analytics and data-driven decision-making by contract packagers will lead to optimized supply chains, improved demand forecasting, and enhanced customer service. The continuous evolution of consumer preferences towards convenience, health, and sustainability will consistently drive demand for innovative and specialized packaging solutions, acting as a perpetual growth accelerator.

Key Players Shaping the Asia Pacific Contract Packaging Market Market

- DHL

- Central Glass

- Stamar Packaging

- Multipack

- Unicep

- Sharp Packaging Services

- Berkeley Contract Packaging

- Premier Packaging

- TricorBraun

- MJS Packaging

Notable Milestones in Asia Pacific Contract Packaging Market Sector

- October 2022: Mold-Tek Packaging was awarded a contract by Grasim Industries' Paints Division to supply packing materials (PAILS). This led to the initiation of a co-located plant in Panipat, with an investment of approximately Rs 30 crore (~USD 3.68 million), to meet Grasim's needs. The facility was slated to be operational by the end of the current year. Furthermore, Mold-Tek Packaging aimed to establish food and FMCG IML (In-Mould Labelling) container production facilities in Panipat to cater to the demand in Northern India.

In-Depth Asia Pacific Contract Packaging Market Market Outlook

The Asia Pacific contract packaging market is poised for significant future growth, driven by ongoing economic development, evolving consumer demands, and technological advancements. The increasing focus on sustainable packaging solutions, coupled with stringent regulatory frameworks, will continue to shape innovation and investment in the sector. Contract packagers that can offer a comprehensive suite of services, from primary to tertiary packaging, with a strong emphasis on quality, efficiency, and sustainability, will be well-positioned to capitalize on emerging opportunities. Strategic partnerships, investments in automation, and a keen understanding of regional market nuances will be critical for sustained success. The market's trajectory indicates a continued expansion, with new applications and innovative packaging formats emerging to meet the dynamic needs of industries such as food, pharmaceuticals, and consumer goods.

Asia Pacific Contract Packaging Market Segmentation

-

1. Service

- 1.1. Primary Packaging

- 1.2. Secondary Packaging

- 1.3. Tertiary Packaging

-

2. Vertical

- 2.1. Beverages

- 2.2. Food

- 2.3. Pharmaceuticals

- 2.4. Home and Fabric Care

- 2.5. Beauty Care

Asia Pacific Contract Packaging Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia Pacific Contract Packaging Market Regional Market Share

Geographic Coverage of Asia Pacific Contract Packaging Market

Asia Pacific Contract Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.95% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rapid Technology Advancements; Development in the Retail Chain

- 3.3. Market Restrains

- 3.3.1. In-house packaging

- 3.4. Market Trends

- 3.4.1. Pharmaceutical Sector is Observing Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia Pacific Contract Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Primary Packaging

- 5.1.2. Secondary Packaging

- 5.1.3. Tertiary Packaging

- 5.2. Market Analysis, Insights and Forecast - by Vertical

- 5.2.1. Beverages

- 5.2.2. Food

- 5.2.3. Pharmaceuticals

- 5.2.4. Home and Fabric Care

- 5.2.5. Beauty Care

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DHL

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Central Glass

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Stamar Packaging

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Multipack*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Unicep

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sharp Packaging Services

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Berkeley Contract Packaging

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Premier Packaging

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 TricorBraun

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 MJS Packaging

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 DHL

List of Figures

- Figure 1: Asia Pacific Contract Packaging Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia Pacific Contract Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: Asia Pacific Contract Packaging Market Revenue billion Forecast, by Service 2020 & 2033

- Table 2: Asia Pacific Contract Packaging Market Revenue billion Forecast, by Vertical 2020 & 2033

- Table 3: Asia Pacific Contract Packaging Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Asia Pacific Contract Packaging Market Revenue billion Forecast, by Service 2020 & 2033

- Table 5: Asia Pacific Contract Packaging Market Revenue billion Forecast, by Vertical 2020 & 2033

- Table 6: Asia Pacific Contract Packaging Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: China Asia Pacific Contract Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Japan Asia Pacific Contract Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: South Korea Asia Pacific Contract Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: India Asia Pacific Contract Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Australia Asia Pacific Contract Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: New Zealand Asia Pacific Contract Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Indonesia Asia Pacific Contract Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Malaysia Asia Pacific Contract Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Singapore Asia Pacific Contract Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Thailand Asia Pacific Contract Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Vietnam Asia Pacific Contract Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Philippines Asia Pacific Contract Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia Pacific Contract Packaging Market?

The projected CAGR is approximately 13.95%.

2. Which companies are prominent players in the Asia Pacific Contract Packaging Market?

Key companies in the market include DHL, Central Glass, Stamar Packaging, Multipack*List Not Exhaustive, Unicep, Sharp Packaging Services, Berkeley Contract Packaging, Premier Packaging, TricorBraun, MJS Packaging.

3. What are the main segments of the Asia Pacific Contract Packaging Market?

The market segments include Service, Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.66 billion as of 2022.

5. What are some drivers contributing to market growth?

Rapid Technology Advancements; Development in the Retail Chain.

6. What are the notable trends driving market growth?

Pharmaceutical Sector is Observing Significant Growth.

7. Are there any restraints impacting market growth?

In-house packaging.

8. Can you provide examples of recent developments in the market?

October 2022 - Mold-Tek Packaging was awarded a contract by Grasim Industries' Paints Division to supply packing materials (PAILS). As a result, a co-located plant will be built in Panipat to meet their needs. By the end of the current year, the new facility should be set up and running. A total of about Rs 30 crore (~USD 3.68 million) would be invested in the project. Further, to meet the demand for these goods in Northern India, the business wants to establish food and FMCG IML container production facilities in Panipat.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia Pacific Contract Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia Pacific Contract Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia Pacific Contract Packaging Market?

To stay informed about further developments, trends, and reports in the Asia Pacific Contract Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence