Key Insights

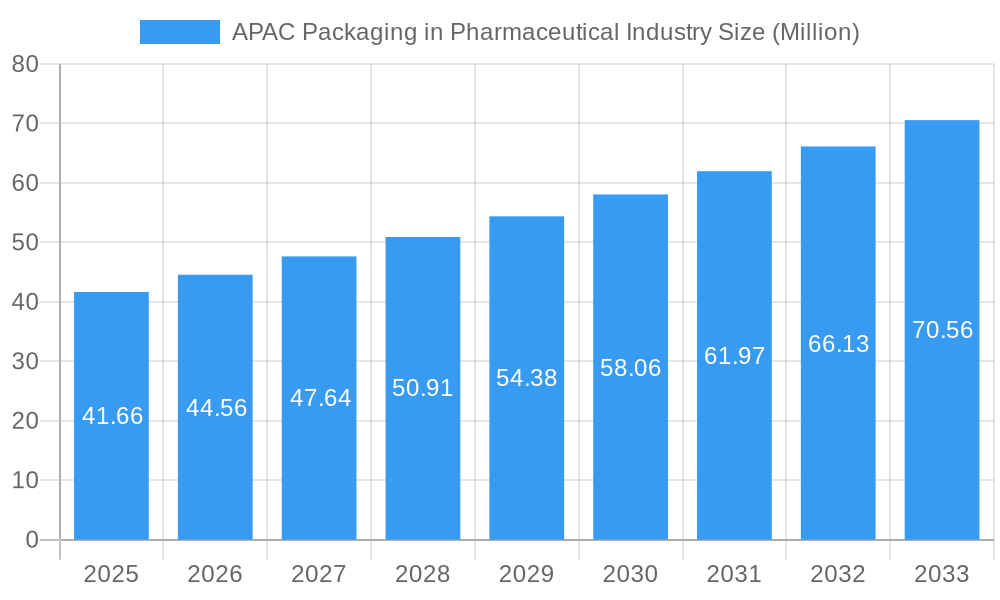

The APAC Pharmaceutical Packaging market is poised for robust growth, driven by a confluence of factors that are reshaping the healthcare landscape across the region. With a current market size of approximately USD 41.66 million and a projected Compound Annual Growth Rate (CAGR) of 6.99%, this sector is expected to witness substantial expansion. The primary drivers fueling this growth include the increasing prevalence of chronic diseases, a burgeoning geriatric population, and a significant rise in healthcare expenditure across major APAC nations. Furthermore, the expanding pharmaceutical manufacturing base, coupled with a growing demand for innovative drug delivery systems and advanced packaging solutions that ensure product integrity and patient safety, is acting as a significant catalyst. The region's commitment to improving healthcare access and the continuous introduction of new generics and biosimilars also contribute to the sustained demand for pharmaceutical packaging.

APAC Packaging in Pharmaceutical Industry Market Size (In Million)

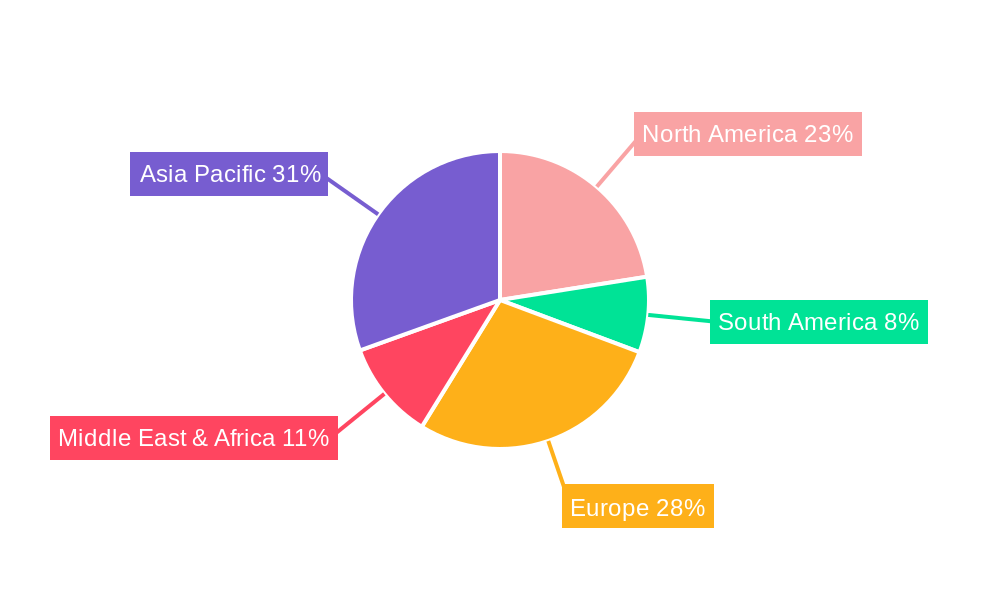

The market segmentation reveals a dynamic interplay between materials, types, and drug delivery modes. Plastic packaging, including bottles and blister packs, is likely to dominate due to its versatility, cost-effectiveness, and durability. However, there's a growing emphasis on sustainable materials like paper and paperboard, aligning with global environmental concerns. Ampoules, vials, and syringes are critical for injectable drug packaging, a segment experiencing rapid growth owing to advancements in biopharmaceuticals and vaccines. Oral drug packaging remains a cornerstone, but the focus is shifting towards child-resistant and tamper-evident solutions. The geographical distribution highlights the dominance of Asia Pacific countries, particularly China and India, in both production and consumption, fueled by their vast populations and expanding pharmaceutical industries. This region is anticipated to be the fastest-growing market, capturing a significant share. Emerging trends also include the adoption of smart packaging solutions with features like track-and-trace capabilities and temperature monitoring, enhancing supply chain efficiency and combating counterfeiting.

APAC Packaging in Pharmaceutical Industry Company Market Share

APAC Packaging in Pharmaceutical Industry: Comprehensive Market Analysis and Future Outlook (2019-2033)

This in-depth report offers a strategic analysis of the APAC Packaging in Pharmaceutical Industry, providing critical insights for stakeholders navigating this dynamic market. Covering the period from 2019 to 2033, with a base and estimated year of 2025, this research delves into market dynamics, growth trends, regional dominance, product landscape, key drivers, emerging opportunities, and leading players. The report integrates high-traffic keywords such as "pharmaceutical packaging APAC," "drug delivery packaging Asia," "medical packaging solutions," and "biopharmaceutical packaging market" to maximize search engine visibility. It further breaks down the market by parent and child segments including materials (Plastic, Paper and Paper Board, Glass, Aluminum Foil), types (Ampoules, Blister Packs, Plastic Bottles, Syringes, Vials, IV fluids, Other Types), and drug delivery modes (Oral Drug packaging, Injectable Drug packaging, Pulmonary Drug Packaging, Other Drug Delivery Modes). All quantitative values are presented in Million units.

APAC Packaging in Pharmaceutical Industry Market Dynamics & Structure

The APAC pharmaceutical packaging market is characterized by a moderate concentration of key players, with a growing emphasis on technological innovation to meet evolving regulatory demands and patient needs. Drivers of innovation include the increasing prevalence of chronic diseases, the rising demand for biologics and biosimilars, and the adoption of advanced drug delivery systems. Stringent regulatory frameworks across the APAC region, focusing on child-resistant packaging, serialization, and tamper-evident features, significantly influence product development and market entry strategies. Competitive product substitutes are emerging, particularly in advanced polymer-based packaging offering enhanced barrier properties and reduced weight compared to traditional glass. End-user demographics are shifting, with an aging population in many APAC countries and a growing middle class demanding more convenient and accessible healthcare solutions. Mergers and acquisitions (M&A) are a notable trend, as companies seek to expand their geographic reach, acquire technological capabilities, and consolidate market share. For instance, the estimated $15,000 million market is witnessing strategic acquisitions aimed at bolstering specialized packaging solutions.

- Market Concentration: Moderate, with a few global leaders and numerous regional players.

- Technological Innovation Drivers: Biologics, biosimilars, advanced drug delivery, serialization, cold chain logistics.

- Regulatory Frameworks: Growing stringency in child-resistant packaging, track-and-trace, and sustainability mandates.

- Competitive Product Substitutes: Advanced polymers, smart packaging, and sustainable materials are challenging traditional options.

- End-User Demographics: Aging populations, rising middle class, increasing chronic disease prevalence.

- M&A Trends: Strategic acquisitions for market expansion, technology integration, and supply chain optimization. Estimated M&A deal volume in the last two years stands at approximately 35 million units.

APAC Packaging in Pharmaceutical Industry Growth Trends & Insights

The APAC pharmaceutical packaging market is poised for robust expansion, driven by an increasing healthcare expenditure and a burgeoning demand for sophisticated drug containment solutions. The market size is projected to witness significant evolution, moving from an estimated $15,000 million in 2025 to an anticipated $25,000 million by 2033, reflecting a Compound Annual Growth Rate (CAGR) of approximately 5.5% during the forecast period (2025-2033). Adoption rates for innovative packaging formats, such as pre-filled syringes and advanced blister packaging, are accelerating across the region, driven by their ability to enhance patient compliance and ensure drug efficacy. Technological disruptions, including the integration of smart packaging for real-time monitoring and the development of sustainable packaging materials, are reshaping the market landscape. Consumer behavior shifts are also playing a crucial role, with patients and healthcare providers increasingly prioritizing convenience, safety, and eco-friendly options. The estimated market penetration for advanced drug delivery packaging is expected to grow from 40% in 2025 to 60% by 2033. The historical period (2019-2024) saw a steady growth of 4.8% CAGR, laying a strong foundation for future expansion.

Dominant Regions, Countries, or Segments in APAC Packaging in Pharmaceutical Industry

The Plastic segment, particularly within Injectable Drug packaging (specifically Syringes and Vials), is the dominant force driving growth in the APAC pharmaceutical packaging market. This dominance is attributed to several key factors including the region's burgeoning pharmaceutical manufacturing capabilities, a substantial increase in the production and consumption of injectable medications, and the inherent advantages of plastics like their lightweight nature, shatter resistance, and cost-effectiveness for mass production. Countries such as China, India, and South Korea are leading this charge due to favorable government policies supporting pharmaceutical manufacturing and R&D, coupled with significant investments in advanced healthcare infrastructure.

The widespread adoption of pre-filled syringes and vials for vaccines, biologics, and novel therapies directly contributes to the supremacy of plastic packaging. For instance, the estimated market share of plastic packaging within the overall APAC pharmaceutical packaging market is approximately 45%, with injectable drug packaging alone accounting for nearly 30% of this. The growth potential within this segment remains exceptionally high, fueled by the ongoing global demand for pharmaceutical products and the region's competitive pricing advantage in manufacturing.

- Dominant Material: Plastic (approx. 45% market share)

- Dominant Type: Syringes and Vials (within the broader category of Injectable Drug Packaging, contributing ~30% of total market)

- Dominant Drug Delivery Mode: Injectable Drug packaging (consistently high demand for vaccines and biologics)

- Key Driving Countries: China, India, South Korea

- Key Drivers:

- Economic Policies: Government incentives for pharmaceutical manufacturing and export.

- Infrastructure: Advanced manufacturing facilities and expanding cold chain logistics.

- R&D Investment: Increasing focus on biologics and novel injectable therapies.

- Cost-Effectiveness: Plastic offers a competitive edge in large-scale production.

- Technological Advancements: Innovations in polymer science enhancing barrier properties and safety.

The market share for plastic packaging is projected to grow by an additional 5% by 2030, driven by sustained demand for injectable drugs and increased adoption of advanced drug delivery systems.

APAC Packaging in Pharmaceutical Industry Product Landscape

The APAC pharmaceutical packaging market is witnessing a surge in product innovations focused on enhanced safety, extended shelf-life, and improved patient convenience. Advanced plastic materials are being developed to offer superior barrier properties against moisture and oxygen, crucial for sensitive biologic drugs. Innovations in pre-filled syringe designs, incorporating features like needle-safety mechanisms and advanced plunger stoppers, are improving user experience and reducing accidental needlestick injuries. Furthermore, the development of tamper-evident seals and serialization technologies embedded in blister packs and bottles are crucial for combating counterfeiting and ensuring product integrity throughout the supply chain. The integration of smart features, such as temperature indicators, is also gaining traction, particularly for cold chain logistics.

Key Drivers, Barriers & Challenges in APAC Packaging in Pharmaceutical Industry

Key Drivers:

The APAC pharmaceutical packaging market is propelled by a confluence of strong drivers. The escalating global demand for pharmaceuticals, particularly in emerging economies within APAC, fuels the need for robust and efficient packaging solutions. Advancements in drug formulations, including the rise of biologics and personalized medicines, necessitate specialized packaging that maintains product integrity and efficacy. Furthermore, increasing healthcare expenditure across the region, coupled with government initiatives to boost domestic pharmaceutical manufacturing, acts as a significant catalyst. Technological innovations in packaging materials and designs, such as smart packaging and sustainable alternatives, are also driving market growth by offering enhanced safety and patient convenience. The growing prevalence of chronic diseases globally also necessitates a steady supply of medications, further boosting packaging demand.

Barriers & Challenges:

Despite the positive growth trajectory, the APAC pharmaceutical packaging market faces several significant barriers and challenges. Stringent and varied regulatory requirements across different APAC countries can create complexities for manufacturers seeking to achieve market access. Supply chain disruptions, exacerbated by geopolitical factors and raw material price volatility, pose a constant threat to production and delivery schedules. The intense competitive landscape, characterized by both global players and numerous local manufacturers, often leads to price pressures. Furthermore, the high cost associated with implementing advanced packaging technologies and the need for specialized infrastructure for sterile packaging can be a barrier for smaller players. Environmental concerns and increasing pressure for sustainable packaging solutions also present a challenge, requiring significant investment in research and development of eco-friendly alternatives. The threat of counterfeiting, while being addressed by serialization, still poses a considerable challenge to product integrity and consumer safety.

Emerging Opportunities in APAC Packaging in Pharmaceutical Industry

Emerging opportunities in the APAC pharmaceutical packaging market are centered around the growing demand for personalized medicine packaging, which requires smaller batch sizes and specialized handling. The increasing adoption of biologics and advanced therapies presents a significant opportunity for the development of high-barrier, inert packaging solutions. Furthermore, the push for sustainability is creating a demand for innovative biodegradable and recyclable packaging materials, presenting a chance for companies to lead in eco-friendly solutions. The expansion of e-pharmacies and telemedicine is also driving the need for secure, temperature-controlled, and tamper-evident packaging for direct-to-consumer distribution. The development of intelligent packaging with embedded sensors for real-time monitoring of drug conditions represents another significant growth avenue.

Growth Accelerators in the APAC Packaging in Pharmaceutical Industry Industry

Several key factors are accelerating growth in the APAC pharmaceutical packaging industry. Technological breakthroughs in material science are enabling the development of lighter, stronger, and more sustainable packaging options that offer superior protection for sensitive pharmaceuticals. Strategic partnerships between packaging manufacturers, pharmaceutical companies, and logistics providers are crucial for optimizing cold chain management and ensuring the efficient delivery of temperature-sensitive drugs across vast geographic regions. Market expansion strategies, including the establishment of manufacturing facilities in emerging APAC markets and the acquisition of local players, are allowing companies to tap into new customer bases and cater to specific regional demands. The increasing focus on patient-centric design, leading to more user-friendly and compliant packaging solutions, is also a significant growth accelerator.

Key Players Shaping the APAC Packaging in Pharmaceutical Industry Market

- West Pharmaceutical Services Inc

- Catalent Pharma Solutions Inc

- Wihuri Group

- Klockner Pentaplast Group

- Schott AG

- NIPRO Corporation

- CCL Industries Inc

- Gerresheimer AG

- Berry Global Group Inc

- Amcor Ltd

Notable Milestones in APAC Packaging in Pharmaceutical Industry Sector

- October 2023: Sonoco ThermoSafe's branded product, the Pegasus ULD, has played a role in increasing pharmaceutical shipments in/out of the Asia Pacific (APAC) region. The Pegasus ULD provides temperature control for 2-8°C payloads for up to 300+ hours (13 days) without human intervention, enhancing cold chain logistics.

- February 2023: Gerresheimer AG agreed with Corning Incorporated to improve access to Corning’s branded vial tech platform, Velocity Vials. This collaboration aims to enable Gerresheimer to convert Corning’s platform into glass form, enhancing product quality, lowering manufacturing costs, and speeding the delivery of injectable therapies. Vials are expected to be immediately available in North America, Europe, and Asia.

In-Depth APAC Packaging in Pharmaceutical Industry Market Outlook

The future market potential for APAC pharmaceutical packaging is exceptionally bright, driven by sustained demographic shifts, escalating healthcare needs, and continuous technological advancements. Growth accelerators such as smart packaging for enhanced traceability and patient adherence, alongside the increasing demand for sterile and high-barrier packaging for biologics and vaccines, will define the next decade. Strategic opportunities lie in catering to the specific needs of emerging economies within APAC, developing cost-effective and sustainable packaging solutions, and forging robust collaborations across the pharmaceutical value chain. The market is poised for significant expansion as companies invest in innovation and adapt to evolving global health challenges and regulatory landscapes.

APAC Packaging in Pharmaceutical Industry Segmentation

-

1. Material

- 1.1. Plastic

- 1.2. Paper and Paper Board

- 1.3. Glass

- 1.4. Aluminum Foil

-

2. Type

- 2.1. Ampoules

- 2.2. Blister Packs

- 2.3. Plastic Bottles

- 2.4. Syringes

- 2.5. Vials

- 2.6. IV fluids

- 2.7. Other Types

-

3. Drug Delivery Mode

- 3.1. Oral Drug packaging

- 3.2. Injectable Drug packaging

- 3.3. Pulmonary Drug Packaging

- 3.4. Other Drug Delivery Modes

APAC Packaging in Pharmaceutical Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

APAC Packaging in Pharmaceutical Industry Regional Market Share

Geographic Coverage of APAC Packaging in Pharmaceutical Industry

APAC Packaging in Pharmaceutical Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.99% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of Pharmaceutical Packaging in Emerging Economies

- 3.3. Market Restrains

- 3.3.1. Fluctuations in Raw Material Cost

- 3.4. Market Trends

- 3.4.1. Glass Packaging is Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC Packaging in Pharmaceutical Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Plastic

- 5.1.2. Paper and Paper Board

- 5.1.3. Glass

- 5.1.4. Aluminum Foil

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Ampoules

- 5.2.2. Blister Packs

- 5.2.3. Plastic Bottles

- 5.2.4. Syringes

- 5.2.5. Vials

- 5.2.6. IV fluids

- 5.2.7. Other Types

- 5.3. Market Analysis, Insights and Forecast - by Drug Delivery Mode

- 5.3.1. Oral Drug packaging

- 5.3.2. Injectable Drug packaging

- 5.3.3. Pulmonary Drug Packaging

- 5.3.4. Other Drug Delivery Modes

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. North America APAC Packaging in Pharmaceutical Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Material

- 6.1.1. Plastic

- 6.1.2. Paper and Paper Board

- 6.1.3. Glass

- 6.1.4. Aluminum Foil

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Ampoules

- 6.2.2. Blister Packs

- 6.2.3. Plastic Bottles

- 6.2.4. Syringes

- 6.2.5. Vials

- 6.2.6. IV fluids

- 6.2.7. Other Types

- 6.3. Market Analysis, Insights and Forecast - by Drug Delivery Mode

- 6.3.1. Oral Drug packaging

- 6.3.2. Injectable Drug packaging

- 6.3.3. Pulmonary Drug Packaging

- 6.3.4. Other Drug Delivery Modes

- 6.1. Market Analysis, Insights and Forecast - by Material

- 7. South America APAC Packaging in Pharmaceutical Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Material

- 7.1.1. Plastic

- 7.1.2. Paper and Paper Board

- 7.1.3. Glass

- 7.1.4. Aluminum Foil

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Ampoules

- 7.2.2. Blister Packs

- 7.2.3. Plastic Bottles

- 7.2.4. Syringes

- 7.2.5. Vials

- 7.2.6. IV fluids

- 7.2.7. Other Types

- 7.3. Market Analysis, Insights and Forecast - by Drug Delivery Mode

- 7.3.1. Oral Drug packaging

- 7.3.2. Injectable Drug packaging

- 7.3.3. Pulmonary Drug Packaging

- 7.3.4. Other Drug Delivery Modes

- 7.1. Market Analysis, Insights and Forecast - by Material

- 8. Europe APAC Packaging in Pharmaceutical Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Material

- 8.1.1. Plastic

- 8.1.2. Paper and Paper Board

- 8.1.3. Glass

- 8.1.4. Aluminum Foil

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Ampoules

- 8.2.2. Blister Packs

- 8.2.3. Plastic Bottles

- 8.2.4. Syringes

- 8.2.5. Vials

- 8.2.6. IV fluids

- 8.2.7. Other Types

- 8.3. Market Analysis, Insights and Forecast - by Drug Delivery Mode

- 8.3.1. Oral Drug packaging

- 8.3.2. Injectable Drug packaging

- 8.3.3. Pulmonary Drug Packaging

- 8.3.4. Other Drug Delivery Modes

- 8.1. Market Analysis, Insights and Forecast - by Material

- 9. Middle East & Africa APAC Packaging in Pharmaceutical Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Material

- 9.1.1. Plastic

- 9.1.2. Paper and Paper Board

- 9.1.3. Glass

- 9.1.4. Aluminum Foil

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Ampoules

- 9.2.2. Blister Packs

- 9.2.3. Plastic Bottles

- 9.2.4. Syringes

- 9.2.5. Vials

- 9.2.6. IV fluids

- 9.2.7. Other Types

- 9.3. Market Analysis, Insights and Forecast - by Drug Delivery Mode

- 9.3.1. Oral Drug packaging

- 9.3.2. Injectable Drug packaging

- 9.3.3. Pulmonary Drug Packaging

- 9.3.4. Other Drug Delivery Modes

- 9.1. Market Analysis, Insights and Forecast - by Material

- 10. Asia Pacific APAC Packaging in Pharmaceutical Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Material

- 10.1.1. Plastic

- 10.1.2. Paper and Paper Board

- 10.1.3. Glass

- 10.1.4. Aluminum Foil

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Ampoules

- 10.2.2. Blister Packs

- 10.2.3. Plastic Bottles

- 10.2.4. Syringes

- 10.2.5. Vials

- 10.2.6. IV fluids

- 10.2.7. Other Types

- 10.3. Market Analysis, Insights and Forecast - by Drug Delivery Mode

- 10.3.1. Oral Drug packaging

- 10.3.2. Injectable Drug packaging

- 10.3.3. Pulmonary Drug Packaging

- 10.3.4. Other Drug Delivery Modes

- 10.1. Market Analysis, Insights and Forecast - by Material

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 West Pharmaceutical Services Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Catalent Pharma Solutions Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Wihuri Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Klockner Pentaplast Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Schott AG

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 NIPRO Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 CCL Industries Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Gerresheimer AG

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Berry Global Group Inc *List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Amcor Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 West Pharmaceutical Services Inc

List of Figures

- Figure 1: Global APAC Packaging in Pharmaceutical Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America APAC Packaging in Pharmaceutical Industry Revenue (Million), by Material 2025 & 2033

- Figure 3: North America APAC Packaging in Pharmaceutical Industry Revenue Share (%), by Material 2025 & 2033

- Figure 4: North America APAC Packaging in Pharmaceutical Industry Revenue (Million), by Type 2025 & 2033

- Figure 5: North America APAC Packaging in Pharmaceutical Industry Revenue Share (%), by Type 2025 & 2033

- Figure 6: North America APAC Packaging in Pharmaceutical Industry Revenue (Million), by Drug Delivery Mode 2025 & 2033

- Figure 7: North America APAC Packaging in Pharmaceutical Industry Revenue Share (%), by Drug Delivery Mode 2025 & 2033

- Figure 8: North America APAC Packaging in Pharmaceutical Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America APAC Packaging in Pharmaceutical Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America APAC Packaging in Pharmaceutical Industry Revenue (Million), by Material 2025 & 2033

- Figure 11: South America APAC Packaging in Pharmaceutical Industry Revenue Share (%), by Material 2025 & 2033

- Figure 12: South America APAC Packaging in Pharmaceutical Industry Revenue (Million), by Type 2025 & 2033

- Figure 13: South America APAC Packaging in Pharmaceutical Industry Revenue Share (%), by Type 2025 & 2033

- Figure 14: South America APAC Packaging in Pharmaceutical Industry Revenue (Million), by Drug Delivery Mode 2025 & 2033

- Figure 15: South America APAC Packaging in Pharmaceutical Industry Revenue Share (%), by Drug Delivery Mode 2025 & 2033

- Figure 16: South America APAC Packaging in Pharmaceutical Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: South America APAC Packaging in Pharmaceutical Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe APAC Packaging in Pharmaceutical Industry Revenue (Million), by Material 2025 & 2033

- Figure 19: Europe APAC Packaging in Pharmaceutical Industry Revenue Share (%), by Material 2025 & 2033

- Figure 20: Europe APAC Packaging in Pharmaceutical Industry Revenue (Million), by Type 2025 & 2033

- Figure 21: Europe APAC Packaging in Pharmaceutical Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: Europe APAC Packaging in Pharmaceutical Industry Revenue (Million), by Drug Delivery Mode 2025 & 2033

- Figure 23: Europe APAC Packaging in Pharmaceutical Industry Revenue Share (%), by Drug Delivery Mode 2025 & 2033

- Figure 24: Europe APAC Packaging in Pharmaceutical Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe APAC Packaging in Pharmaceutical Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa APAC Packaging in Pharmaceutical Industry Revenue (Million), by Material 2025 & 2033

- Figure 27: Middle East & Africa APAC Packaging in Pharmaceutical Industry Revenue Share (%), by Material 2025 & 2033

- Figure 28: Middle East & Africa APAC Packaging in Pharmaceutical Industry Revenue (Million), by Type 2025 & 2033

- Figure 29: Middle East & Africa APAC Packaging in Pharmaceutical Industry Revenue Share (%), by Type 2025 & 2033

- Figure 30: Middle East & Africa APAC Packaging in Pharmaceutical Industry Revenue (Million), by Drug Delivery Mode 2025 & 2033

- Figure 31: Middle East & Africa APAC Packaging in Pharmaceutical Industry Revenue Share (%), by Drug Delivery Mode 2025 & 2033

- Figure 32: Middle East & Africa APAC Packaging in Pharmaceutical Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: Middle East & Africa APAC Packaging in Pharmaceutical Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific APAC Packaging in Pharmaceutical Industry Revenue (Million), by Material 2025 & 2033

- Figure 35: Asia Pacific APAC Packaging in Pharmaceutical Industry Revenue Share (%), by Material 2025 & 2033

- Figure 36: Asia Pacific APAC Packaging in Pharmaceutical Industry Revenue (Million), by Type 2025 & 2033

- Figure 37: Asia Pacific APAC Packaging in Pharmaceutical Industry Revenue Share (%), by Type 2025 & 2033

- Figure 38: Asia Pacific APAC Packaging in Pharmaceutical Industry Revenue (Million), by Drug Delivery Mode 2025 & 2033

- Figure 39: Asia Pacific APAC Packaging in Pharmaceutical Industry Revenue Share (%), by Drug Delivery Mode 2025 & 2033

- Figure 40: Asia Pacific APAC Packaging in Pharmaceutical Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Asia Pacific APAC Packaging in Pharmaceutical Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global APAC Packaging in Pharmaceutical Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 2: Global APAC Packaging in Pharmaceutical Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 3: Global APAC Packaging in Pharmaceutical Industry Revenue Million Forecast, by Drug Delivery Mode 2020 & 2033

- Table 4: Global APAC Packaging in Pharmaceutical Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global APAC Packaging in Pharmaceutical Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 6: Global APAC Packaging in Pharmaceutical Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 7: Global APAC Packaging in Pharmaceutical Industry Revenue Million Forecast, by Drug Delivery Mode 2020 & 2033

- Table 8: Global APAC Packaging in Pharmaceutical Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States APAC Packaging in Pharmaceutical Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada APAC Packaging in Pharmaceutical Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico APAC Packaging in Pharmaceutical Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global APAC Packaging in Pharmaceutical Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 13: Global APAC Packaging in Pharmaceutical Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Global APAC Packaging in Pharmaceutical Industry Revenue Million Forecast, by Drug Delivery Mode 2020 & 2033

- Table 15: Global APAC Packaging in Pharmaceutical Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Brazil APAC Packaging in Pharmaceutical Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Argentina APAC Packaging in Pharmaceutical Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America APAC Packaging in Pharmaceutical Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global APAC Packaging in Pharmaceutical Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 20: Global APAC Packaging in Pharmaceutical Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 21: Global APAC Packaging in Pharmaceutical Industry Revenue Million Forecast, by Drug Delivery Mode 2020 & 2033

- Table 22: Global APAC Packaging in Pharmaceutical Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 23: United Kingdom APAC Packaging in Pharmaceutical Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Germany APAC Packaging in Pharmaceutical Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: France APAC Packaging in Pharmaceutical Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Italy APAC Packaging in Pharmaceutical Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Spain APAC Packaging in Pharmaceutical Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Russia APAC Packaging in Pharmaceutical Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Benelux APAC Packaging in Pharmaceutical Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Nordics APAC Packaging in Pharmaceutical Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe APAC Packaging in Pharmaceutical Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global APAC Packaging in Pharmaceutical Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 33: Global APAC Packaging in Pharmaceutical Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 34: Global APAC Packaging in Pharmaceutical Industry Revenue Million Forecast, by Drug Delivery Mode 2020 & 2033

- Table 35: Global APAC Packaging in Pharmaceutical Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Turkey APAC Packaging in Pharmaceutical Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Israel APAC Packaging in Pharmaceutical Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: GCC APAC Packaging in Pharmaceutical Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: North Africa APAC Packaging in Pharmaceutical Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: South Africa APAC Packaging in Pharmaceutical Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa APAC Packaging in Pharmaceutical Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Global APAC Packaging in Pharmaceutical Industry Revenue Million Forecast, by Material 2020 & 2033

- Table 43: Global APAC Packaging in Pharmaceutical Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 44: Global APAC Packaging in Pharmaceutical Industry Revenue Million Forecast, by Drug Delivery Mode 2020 & 2033

- Table 45: Global APAC Packaging in Pharmaceutical Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 46: China APAC Packaging in Pharmaceutical Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: India APAC Packaging in Pharmaceutical Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Japan APAC Packaging in Pharmaceutical Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: South Korea APAC Packaging in Pharmaceutical Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: ASEAN APAC Packaging in Pharmaceutical Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Oceania APAC Packaging in Pharmaceutical Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific APAC Packaging in Pharmaceutical Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Packaging in Pharmaceutical Industry?

The projected CAGR is approximately 6.99%.

2. Which companies are prominent players in the APAC Packaging in Pharmaceutical Industry?

Key companies in the market include West Pharmaceutical Services Inc, Catalent Pharma Solutions Inc, Wihuri Group, Klockner Pentaplast Group, Schott AG, NIPRO Corporation, CCL Industries Inc, Gerresheimer AG, Berry Global Group Inc *List Not Exhaustive, Amcor Ltd.

3. What are the main segments of the APAC Packaging in Pharmaceutical Industry?

The market segments include Material, Type, Drug Delivery Mode.

4. Can you provide details about the market size?

The market size is estimated to be USD 41.66 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of Pharmaceutical Packaging in Emerging Economies.

6. What are the notable trends driving market growth?

Glass Packaging is Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Fluctuations in Raw Material Cost.

8. Can you provide examples of recent developments in the market?

October 2023 - Sonoco ThermoSafe’s branded product has played a role in increasing pharmaceutical shipments in/out of the Asia Pacific (APAC) region. According to the temperature assurance packaging company, the Pegasus ULD performs up to 300+ hours, equivalent to 13 days without human intervention, providing temperature control for 2-8°C payloads.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Packaging in Pharmaceutical Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Packaging in Pharmaceutical Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Packaging in Pharmaceutical Industry?

To stay informed about further developments, trends, and reports in the APAC Packaging in Pharmaceutical Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence