Key Insights

The Asia-Pacific (APAC) pet insurance market is set for robust expansion, projected to reach a market size of $96.63 billion by 2025, driven by a Compound Annual Growth Rate (CAGR) of 17.57% through 2033. This growth is attributed to increasing pet ownership, the humanization of pets, and rising awareness of pet health insurance benefits. Key drivers include growing disposable incomes, enabling greater investment in pet well-being, and the rising incidence of pet chronic conditions requiring advanced veterinary care. The availability of diverse insurance plans and the adoption of digital platforms for streamlined claims processing further enhance market accessibility and customer satisfaction.

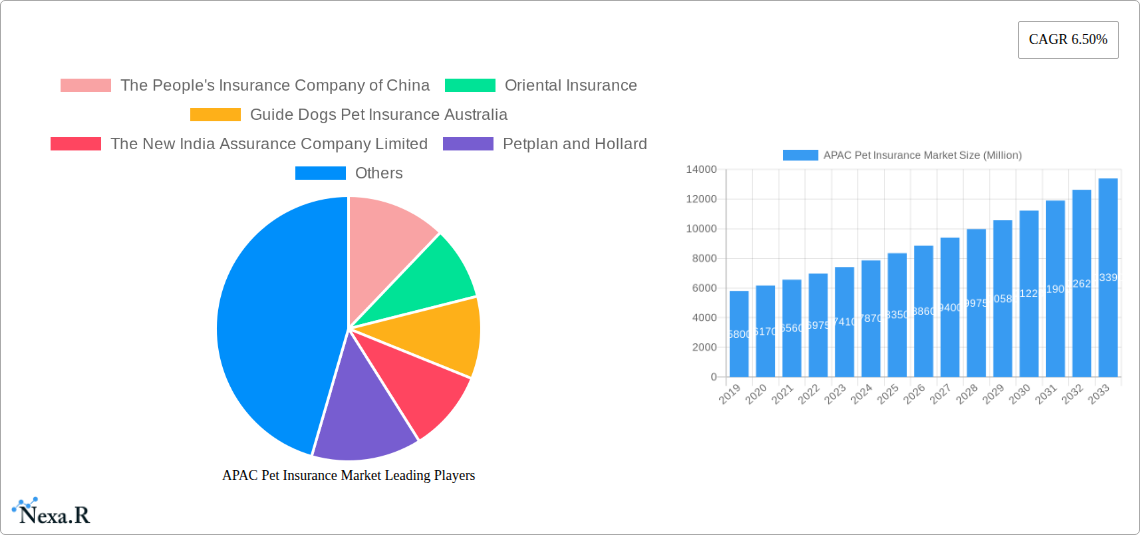

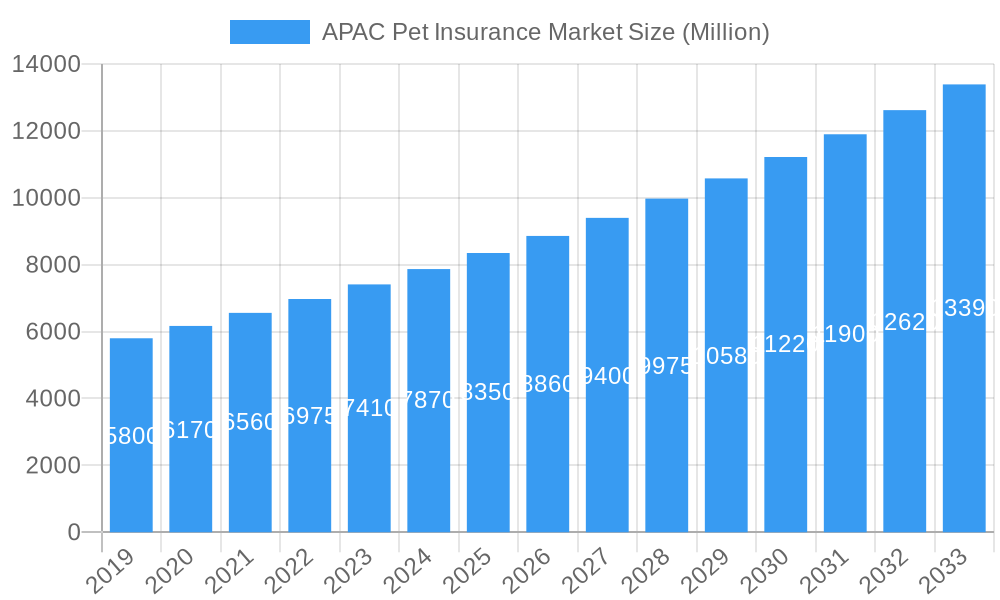

APAC Pet Insurance Market Market Size (In Billion)

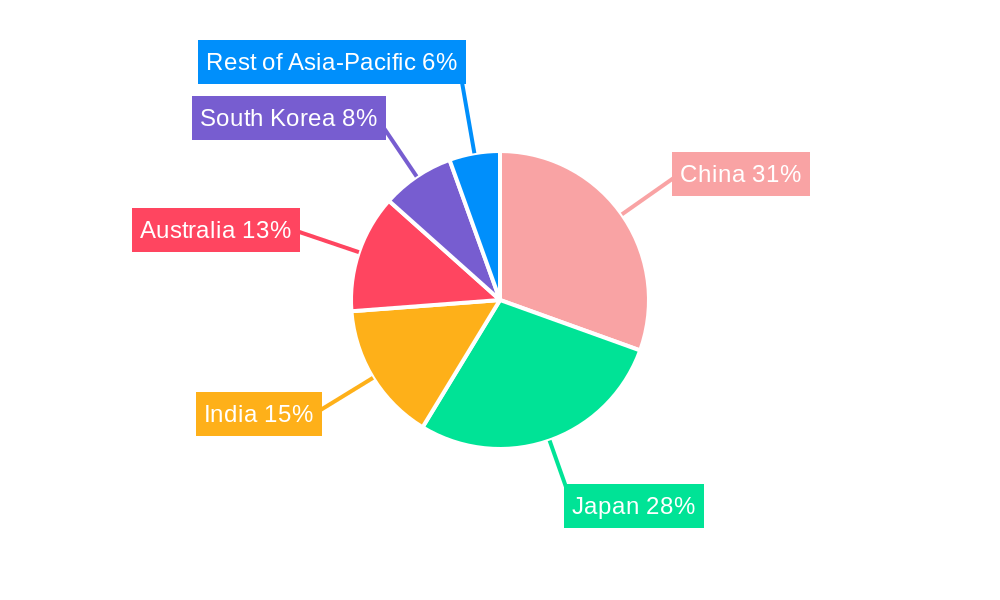

The market is segmented by policy type, with accident and chronic condition coverage in high demand. Dogs and cats remain the dominant pet segments, fueling the need for specialized insurance. Private providers are leading innovation, while public initiatives are emerging to improve accessibility. China, Japan, and Australia are expected to be the leading markets, supported by mature pet care industries. South Korea and the Rest of APAC present significant growth opportunities due to evolving pet care cultures and urbanization. Potential restraints include limited awareness in some economies, perceived high premium costs, and regulatory complexities.

APAC Pet Insurance Market Company Market Share

This comprehensive report analyzes the APAC Pet Insurance Market, offering insights into its dynamics, growth, and future outlook. Covering the historical period of 2019-2024, with a base year of 2025 and a forecast to 2033, this analysis is crucial for stakeholders. Optimized with relevant keywords, parent-child market segmentation, and precise quantitative data, the report ensures high search engine visibility and industry relevance.

APAC Pet Insurance Market Market Dynamics & Structure

The APAC Pet Insurance Market is characterized by a dynamic interplay of factors shaping its competitive landscape. Market concentration is gradually shifting from highly fragmented to a more consolidated structure, driven by strategic mergers and acquisitions and the emergence of larger, more influential players. Technological innovation remains a potent driver, with advancements in AI for claims processing, personalized policy offerings, and digital platforms revolutionizing customer engagement and operational efficiency. Regulatory frameworks are evolving to accommodate the growing pet population and increasing demand for specialized animal healthcare, albeit with regional variations in stringency and implementation. Competitive product substitutes, such as traditional veterinary financing and savings plans, are present but struggle to match the comprehensive protection offered by dedicated pet insurance policies. End-user demographics are a key influence, with a rising middle class, increasing pet humanization trends, and a growing awareness of the financial burdens associated with unexpected veterinary expenses propelling market adoption. Mergers and acquisitions are a significant trend, with larger insurers acquiring specialized pet insurance providers or smaller regional players to expand their market reach and product portfolios.

- Market Concentration: Shifting from fragmented to moderately consolidated.

- Technological Innovation: AI in claims, personalized policies, digital platforms are key drivers.

- Regulatory Frameworks: Evolving to support market growth, with regional variations.

- Competitive Substitutes: Veterinary financing and savings plans offer limited protection compared to insurance.

- End-User Demographics: Rising disposable income, pet humanization, and awareness of veterinary costs are key drivers.

- M&A Trends: Increasing consolidation through acquisitions of specialized providers and regional players.

APAC Pet Insurance Market Growth Trends & Insights

The APAC Pet Insurance Market is poised for substantial growth, fueled by a confluence of evolving consumer behaviors and increasing awareness of pet welfare. Market size evolution indicates a robust upward trajectory, with the APAC Pet Insurance Market projected to reach significant value in the coming years. Adoption rates are on the rise as pet owners increasingly recognize the financial benefits and peace of mind offered by comprehensive insurance coverage. Technological disruptions, such as the integration of IoT devices for pet health monitoring and AI-powered predictive analytics for risk assessment, are further enhancing the value proposition of pet insurance. Consumer behavior shifts are a significant underlying factor, with a growing emphasis on preventative care, extended lifespans of pets, and a willingness to invest in advanced veterinary treatments, all of which are driving demand for robust insurance solutions. The market penetration of pet insurance in APAC, while still lower than in Western markets, is experiencing a significant acceleration, indicating a strong potential for continued expansion.

The Asia-Pacific Pet Insurance Market is experiencing a paradigm shift, moving from a niche offering to a mainstream financial product. This transformation is driven by a growing number of households considering pets as integral family members, leading to a heightened willingness to secure their health and well-being. The China Pet Insurance Market, for instance, is witnessing rapid expansion due to a burgeoning pet ownership base and increasing disposable incomes. Similarly, the Japan Pet Insurance Market, with its long-standing tradition of pet companionship, continues to demonstrate stable and consistent growth. The India Pet Insurance Market is an emerging powerhouse, propelled by a young, tech-savvy population and a growing awareness of the economic implications of pet healthcare emergencies. The Australia Pet Insurance Market benefits from a mature pet care culture and high pet ownership rates, solidifying its position as a significant contributor to the regional market.

Technological advancements are not merely facilitating the purchase of pet insurance but are also transforming the claims process and policy management. Digital-first platforms and mobile applications are streamlining the user experience, making it easier for pet owners to enroll, manage their policies, and submit claims. Furthermore, the integration of tele-veterinary services is enhancing accessibility to professional advice, potentially reducing unnecessary vet visits and fostering a more proactive approach to pet health, which in turn can influence insurance premium structures and policy designs. The South Korea Pet Insurance Market is a prime example of early adoption of digital solutions, offering seamless online experiences for policyholders.

The Rest of Asia-Pacific Pet Insurance Market, encompassing countries like Southeast Asian nations and emerging economies, presents a vast untapped potential. As economic conditions improve and cultural attitudes towards pet ownership evolve, these regions are expected to witness accelerated growth in the pet insurance sector. The Global Pet Insurance Market's influence is also palpable, with international players and best practices being adopted by regional companies, further professionalizing the industry. The Parent Pet Insurance Market encompassing the overall insurance sector provides a backdrop for the growth of specialized pet insurance, highlighting the increasing diversification of insurance products to meet evolving consumer needs. The Child Pet Insurance Market, specifically focused on the APAC region, showcases unique regional dynamics and growth drivers.

The increasing sophistication of veterinary medicine, offering advanced treatments and diagnostic capabilities, necessitates robust financial planning for pet owners. Pet insurance addresses this need by mitigating the financial burden of unexpected illnesses and accidents, thereby promoting access to higher quality veterinary care. This trend is a significant market penetration driver across all key geographies within the APAC region.

Dominant Regions, Countries, or Segments in APAC Pet Insurance Market

The APAC Pet Insurance Market's dominance is sculpted by a powerful combination of economic prowess, cultural affinity for pets, and evolving regulatory landscapes, with certain regions and countries emerging as key growth engines. China stands out as a dominant force, driven by its massive pet population, rapidly expanding middle class with increasing disposable income, and a growing trend of pet humanization. The sheer scale of pet ownership in China, coupled with a developing but rapidly advancing veterinary care infrastructure, creates a fertile ground for pet insurance adoption. The China Pet Insurance Market is characterized by a high volume of new policies and a growing awareness of the financial security that insurance provides.

Japan continues to be a stalwart in the APAC pet insurance sector, boasting a long-standing culture of pet ownership and a mature understanding of insurance products. The Japan Pet Insurance Market benefits from a well-established veterinary network and a sophisticated consumer base that values comprehensive protection for their companions. While growth might be more incremental compared to some emerging markets, its stability and high penetration rate make it a consistently dominant player.

Australia represents another significant market within the APAC region, characterized by high pet ownership rates and a strong emphasis on animal welfare. The Australia Pet Insurance Market is driven by a proactive pet care culture, readily accessible veterinary services, and a growing demand for advanced treatments. The regulatory environment in Australia also supports the growth of specialized insurance products.

South Korea is emerging as a rapidly growing segment, fueled by an increasing number of single-person households and a growing emotional attachment to pets. The South Korea Pet Insurance Market is witnessing a surge in demand, supported by technological advancements in service delivery and a younger demographic more inclined to embrace digital solutions. The government's supportive stance on pet care has also played a role in market expansion.

Among the policy segments, Accidents and Chronic Conditions are driving significant market share. The rising prevalence of accidents in urban environments and the increasing incidence of chronic diseases in aging pet populations necessitate specialized coverage, making these segments highly sought after. The Dog segment, being the most popular pet animal across many APAC nations, commands a substantial portion of the market share, followed closely by the Cat segment. The "Others" animal segment, while smaller, is growing as ownership of exotic pets and smaller animals becomes more prevalent.

The Private Provider segment dominates the APAC Pet Insurance Market. Private companies are more agile in developing innovative products, leveraging technology, and adapting to market demands. While public providers exist, their scope is often more limited, and they typically do not offer the specialized coverage that private insurers are providing. The flexibility and competitive nature of private players are crucial for the market's growth and diversification.

- Dominant Countries: China, Japan, Australia, South Korea.

- Key Policy Segments: Accidents, Chronic Conditions.

- Dominant Animal Segments: Dog, Cat.

- Dominant Provider Type: Private.

- Growth Drivers: Rising disposable income, pet humanization, advanced veterinary care, digital adoption, supportive regulations.

APAC Pet Insurance Market Product Landscape

The APAC Pet Insurance Market is witnessing a surge in innovative product offerings designed to cater to diverse pet owner needs. Policy innovations are focusing on comprehensive coverage for accidents, illnesses, and even routine care, with specialized plans addressing chronic conditions and hereditary issues. Product differentiation is achieved through unique selling propositions such as customizable deductibles, lifetime coverage options, and add-on benefits like dental care and behavioral therapy. Technological advancements are enabling the integration of telemedicine services into policies, allowing for remote consultations and diagnostics, thereby enhancing accessibility and convenience. The performance metrics of these products are being closely monitored, with a focus on claims settlement ratios, customer satisfaction, and the breadth of coverage provided.

Key Drivers, Barriers & Challenges in APAC Pet Insurance Market

The APAC Pet Insurance Market is propelled by several key drivers. The increasing humanization of pets, transforming them into integral family members, is a primary catalyst. Rising disposable incomes across the region enable greater spending on pet healthcare. Technological advancements in veterinary medicine necessitate financial planning for advanced treatments, which pet insurance addresses. Furthermore, a growing awareness of the financial burden of unexpected veterinary bills is driving demand.

- Drivers: Pet humanization, rising disposable incomes, advanced veterinary care, awareness of veterinary costs.

Key barriers and challenges, however, exist. A significant restraint is the relatively low awareness of pet insurance benefits in many parts of the region, particularly in emerging economies. The affordability of premiums for a segment of the population can also be a barrier. Regulatory inconsistencies across different APAC countries can create complexities for insurers.

- Barriers & Challenges: Low awareness, affordability of premiums, regulatory inconsistencies, competitive pressures from alternative financing.

Emerging Opportunities in the APAC Pet Insurance Market

Emerging opportunities in the APAC Pet Insurance Market are abundant and diverse. Untapped markets in Southeast Asia and India present significant growth potential as disposable incomes rise and pet ownership trends accelerate. Innovative applications, such as microinsurance products for lower-income demographics and specialized policies for exotic pets, are poised to capture new customer segments. Evolving consumer preferences for digital-first services and personalized policy offerings create opportunities for tech-savvy insurers to gain market share. The development of preventative care packages integrated with insurance plans also represents a promising avenue for expansion.

Growth Accelerators in the APAC Pet Insurance Market Industry

Several catalysts are accelerating the growth of the APAC Pet Insurance Market Industry. Technological breakthroughs, including AI-powered underwriting and claims processing, are enhancing efficiency and reducing operational costs. Strategic partnerships between insurance providers, veterinary clinics, and pet supply retailers are expanding market reach and distribution channels. Market expansion strategies, such as offering tailored policies for specific breeds or lifestyle needs, are resonating with pet owners. The increasing acceptance of digital payment solutions and online policy management further simplifies the customer journey, driving higher adoption rates.

Key Players Shaping the APAC Pet Insurance Market Market

- The People's Insurance Company of China

- Oriental Insurance

- Guide Dogs Pet Insurance Australia

- The New India Assurance Company Limited

- Petplan and Hollard

- Anicom Insurance Inc

- Pet Insurance Australia

- ipet Insurance

- Rakuten Inc

- Medibank Private Limited

Notable Milestones in APAC Pet Insurance Market Sector

- August 2022: InsuranceDekho collaborated with Future Generali India Insurance Company to launch dog health insurance in India with a starting annual premium of about INR 324.

- April 2021: Oyen Sdn Bhd and MSIG Insurance (Malaysia) Bhd collaborated to develop oyen.my, a digital-only insurance platform that enables owners to purchase and manage pet medical insurance online.

In-Depth APAC Pet Insurance Market Market Outlook

The APAC Pet Insurance Market is set for a robust growth trajectory, driven by an increasingly affluent population that views pets as cherished family members. The market outlook is exceptionally positive, with growth accelerators such as the proliferation of digital platforms and strategic alliances between key industry players paving the way for expanded reach and customer accessibility. Emerging opportunities in underdeveloped regions and the increasing demand for specialized insurance products catering to chronic conditions and advanced veterinary care will further fuel this expansion. The forecast period is expected to witness a significant rise in market penetration, driven by heightened awareness and the intrinsic value proposition of financial security for pet health.

APAC Pet Insurance Market Segmentation

-

1. Policy

- 1.1. Accidents

- 1.2. Chronic Conditions

- 1.3. Others

-

2. Animal

- 2.1. Dog

- 2.2. Cat

- 2.3. Others

-

3. Provider

- 3.1. Public

- 3.2. Private

-

4. Geography

- 4.1. China

- 4.2. Japan

- 4.3. India

- 4.4. Australia

- 4.5. South Korea

- 4.6. Rest of Asia-Pacific

APAC Pet Insurance Market Segmentation By Geography

- 1. China

- 2. Japan

- 3. India

- 4. Australia

- 5. South Korea

- 6. Rest of Asia Pacific

APAC Pet Insurance Market Regional Market Share

Geographic Coverage of APAC Pet Insurance Market

APAC Pet Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 17.57% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Pet Adoption; Rising Awareness Regarding Pet Insurance

- 3.3. Market Restrains

- 3.3.1. Low Adoption in Emerging Countries

- 3.4. Market Trends

- 3.4.1. Chronic Conditions by Policy is Expected to Hold a Significant Share Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC Pet Insurance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Policy

- 5.1.1. Accidents

- 5.1.2. Chronic Conditions

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Animal

- 5.2.1. Dog

- 5.2.2. Cat

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Provider

- 5.3.1. Public

- 5.3.2. Private

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. China

- 5.4.2. Japan

- 5.4.3. India

- 5.4.4. Australia

- 5.4.5. South Korea

- 5.4.6. Rest of Asia-Pacific

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. China

- 5.5.2. Japan

- 5.5.3. India

- 5.5.4. Australia

- 5.5.5. South Korea

- 5.5.6. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Policy

- 6. China APAC Pet Insurance Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Policy

- 6.1.1. Accidents

- 6.1.2. Chronic Conditions

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Animal

- 6.2.1. Dog

- 6.2.2. Cat

- 6.2.3. Others

- 6.3. Market Analysis, Insights and Forecast - by Provider

- 6.3.1. Public

- 6.3.2. Private

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. China

- 6.4.2. Japan

- 6.4.3. India

- 6.4.4. Australia

- 6.4.5. South Korea

- 6.4.6. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Policy

- 7. Japan APAC Pet Insurance Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Policy

- 7.1.1. Accidents

- 7.1.2. Chronic Conditions

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Animal

- 7.2.1. Dog

- 7.2.2. Cat

- 7.2.3. Others

- 7.3. Market Analysis, Insights and Forecast - by Provider

- 7.3.1. Public

- 7.3.2. Private

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. China

- 7.4.2. Japan

- 7.4.3. India

- 7.4.4. Australia

- 7.4.5. South Korea

- 7.4.6. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Policy

- 8. India APAC Pet Insurance Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Policy

- 8.1.1. Accidents

- 8.1.2. Chronic Conditions

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Animal

- 8.2.1. Dog

- 8.2.2. Cat

- 8.2.3. Others

- 8.3. Market Analysis, Insights and Forecast - by Provider

- 8.3.1. Public

- 8.3.2. Private

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. China

- 8.4.2. Japan

- 8.4.3. India

- 8.4.4. Australia

- 8.4.5. South Korea

- 8.4.6. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Policy

- 9. Australia APAC Pet Insurance Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Policy

- 9.1.1. Accidents

- 9.1.2. Chronic Conditions

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Animal

- 9.2.1. Dog

- 9.2.2. Cat

- 9.2.3. Others

- 9.3. Market Analysis, Insights and Forecast - by Provider

- 9.3.1. Public

- 9.3.2. Private

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. China

- 9.4.2. Japan

- 9.4.3. India

- 9.4.4. Australia

- 9.4.5. South Korea

- 9.4.6. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Policy

- 10. South Korea APAC Pet Insurance Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Policy

- 10.1.1. Accidents

- 10.1.2. Chronic Conditions

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Animal

- 10.2.1. Dog

- 10.2.2. Cat

- 10.2.3. Others

- 10.3. Market Analysis, Insights and Forecast - by Provider

- 10.3.1. Public

- 10.3.2. Private

- 10.4. Market Analysis, Insights and Forecast - by Geography

- 10.4.1. China

- 10.4.2. Japan

- 10.4.3. India

- 10.4.4. Australia

- 10.4.5. South Korea

- 10.4.6. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Policy

- 11. Rest of Asia Pacific APAC Pet Insurance Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Policy

- 11.1.1. Accidents

- 11.1.2. Chronic Conditions

- 11.1.3. Others

- 11.2. Market Analysis, Insights and Forecast - by Animal

- 11.2.1. Dog

- 11.2.2. Cat

- 11.2.3. Others

- 11.3. Market Analysis, Insights and Forecast - by Provider

- 11.3.1. Public

- 11.3.2. Private

- 11.4. Market Analysis, Insights and Forecast - by Geography

- 11.4.1. China

- 11.4.2. Japan

- 11.4.3. India

- 11.4.4. Australia

- 11.4.5. South Korea

- 11.4.6. Rest of Asia-Pacific

- 11.1. Market Analysis, Insights and Forecast - by Policy

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 The People's Insurance Company of China

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Oriental Insurance

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Guide Dogs Pet Insurance Australia

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 The New India Assurance Company Limited

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Petplan and Hollard

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Anicom Insurance Inc

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Pet Insurance Australia

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 ipet Insurance

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Rakuten Inc

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Medibank Private Limited

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 The People's Insurance Company of China

List of Figures

- Figure 1: Global APAC Pet Insurance Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Global APAC Pet Insurance Market Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: China APAC Pet Insurance Market Revenue (billion), by Policy 2025 & 2033

- Figure 4: China APAC Pet Insurance Market Volume (K Unit), by Policy 2025 & 2033

- Figure 5: China APAC Pet Insurance Market Revenue Share (%), by Policy 2025 & 2033

- Figure 6: China APAC Pet Insurance Market Volume Share (%), by Policy 2025 & 2033

- Figure 7: China APAC Pet Insurance Market Revenue (billion), by Animal 2025 & 2033

- Figure 8: China APAC Pet Insurance Market Volume (K Unit), by Animal 2025 & 2033

- Figure 9: China APAC Pet Insurance Market Revenue Share (%), by Animal 2025 & 2033

- Figure 10: China APAC Pet Insurance Market Volume Share (%), by Animal 2025 & 2033

- Figure 11: China APAC Pet Insurance Market Revenue (billion), by Provider 2025 & 2033

- Figure 12: China APAC Pet Insurance Market Volume (K Unit), by Provider 2025 & 2033

- Figure 13: China APAC Pet Insurance Market Revenue Share (%), by Provider 2025 & 2033

- Figure 14: China APAC Pet Insurance Market Volume Share (%), by Provider 2025 & 2033

- Figure 15: China APAC Pet Insurance Market Revenue (billion), by Geography 2025 & 2033

- Figure 16: China APAC Pet Insurance Market Volume (K Unit), by Geography 2025 & 2033

- Figure 17: China APAC Pet Insurance Market Revenue Share (%), by Geography 2025 & 2033

- Figure 18: China APAC Pet Insurance Market Volume Share (%), by Geography 2025 & 2033

- Figure 19: China APAC Pet Insurance Market Revenue (billion), by Country 2025 & 2033

- Figure 20: China APAC Pet Insurance Market Volume (K Unit), by Country 2025 & 2033

- Figure 21: China APAC Pet Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: China APAC Pet Insurance Market Volume Share (%), by Country 2025 & 2033

- Figure 23: Japan APAC Pet Insurance Market Revenue (billion), by Policy 2025 & 2033

- Figure 24: Japan APAC Pet Insurance Market Volume (K Unit), by Policy 2025 & 2033

- Figure 25: Japan APAC Pet Insurance Market Revenue Share (%), by Policy 2025 & 2033

- Figure 26: Japan APAC Pet Insurance Market Volume Share (%), by Policy 2025 & 2033

- Figure 27: Japan APAC Pet Insurance Market Revenue (billion), by Animal 2025 & 2033

- Figure 28: Japan APAC Pet Insurance Market Volume (K Unit), by Animal 2025 & 2033

- Figure 29: Japan APAC Pet Insurance Market Revenue Share (%), by Animal 2025 & 2033

- Figure 30: Japan APAC Pet Insurance Market Volume Share (%), by Animal 2025 & 2033

- Figure 31: Japan APAC Pet Insurance Market Revenue (billion), by Provider 2025 & 2033

- Figure 32: Japan APAC Pet Insurance Market Volume (K Unit), by Provider 2025 & 2033

- Figure 33: Japan APAC Pet Insurance Market Revenue Share (%), by Provider 2025 & 2033

- Figure 34: Japan APAC Pet Insurance Market Volume Share (%), by Provider 2025 & 2033

- Figure 35: Japan APAC Pet Insurance Market Revenue (billion), by Geography 2025 & 2033

- Figure 36: Japan APAC Pet Insurance Market Volume (K Unit), by Geography 2025 & 2033

- Figure 37: Japan APAC Pet Insurance Market Revenue Share (%), by Geography 2025 & 2033

- Figure 38: Japan APAC Pet Insurance Market Volume Share (%), by Geography 2025 & 2033

- Figure 39: Japan APAC Pet Insurance Market Revenue (billion), by Country 2025 & 2033

- Figure 40: Japan APAC Pet Insurance Market Volume (K Unit), by Country 2025 & 2033

- Figure 41: Japan APAC Pet Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Japan APAC Pet Insurance Market Volume Share (%), by Country 2025 & 2033

- Figure 43: India APAC Pet Insurance Market Revenue (billion), by Policy 2025 & 2033

- Figure 44: India APAC Pet Insurance Market Volume (K Unit), by Policy 2025 & 2033

- Figure 45: India APAC Pet Insurance Market Revenue Share (%), by Policy 2025 & 2033

- Figure 46: India APAC Pet Insurance Market Volume Share (%), by Policy 2025 & 2033

- Figure 47: India APAC Pet Insurance Market Revenue (billion), by Animal 2025 & 2033

- Figure 48: India APAC Pet Insurance Market Volume (K Unit), by Animal 2025 & 2033

- Figure 49: India APAC Pet Insurance Market Revenue Share (%), by Animal 2025 & 2033

- Figure 50: India APAC Pet Insurance Market Volume Share (%), by Animal 2025 & 2033

- Figure 51: India APAC Pet Insurance Market Revenue (billion), by Provider 2025 & 2033

- Figure 52: India APAC Pet Insurance Market Volume (K Unit), by Provider 2025 & 2033

- Figure 53: India APAC Pet Insurance Market Revenue Share (%), by Provider 2025 & 2033

- Figure 54: India APAC Pet Insurance Market Volume Share (%), by Provider 2025 & 2033

- Figure 55: India APAC Pet Insurance Market Revenue (billion), by Geography 2025 & 2033

- Figure 56: India APAC Pet Insurance Market Volume (K Unit), by Geography 2025 & 2033

- Figure 57: India APAC Pet Insurance Market Revenue Share (%), by Geography 2025 & 2033

- Figure 58: India APAC Pet Insurance Market Volume Share (%), by Geography 2025 & 2033

- Figure 59: India APAC Pet Insurance Market Revenue (billion), by Country 2025 & 2033

- Figure 60: India APAC Pet Insurance Market Volume (K Unit), by Country 2025 & 2033

- Figure 61: India APAC Pet Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: India APAC Pet Insurance Market Volume Share (%), by Country 2025 & 2033

- Figure 63: Australia APAC Pet Insurance Market Revenue (billion), by Policy 2025 & 2033

- Figure 64: Australia APAC Pet Insurance Market Volume (K Unit), by Policy 2025 & 2033

- Figure 65: Australia APAC Pet Insurance Market Revenue Share (%), by Policy 2025 & 2033

- Figure 66: Australia APAC Pet Insurance Market Volume Share (%), by Policy 2025 & 2033

- Figure 67: Australia APAC Pet Insurance Market Revenue (billion), by Animal 2025 & 2033

- Figure 68: Australia APAC Pet Insurance Market Volume (K Unit), by Animal 2025 & 2033

- Figure 69: Australia APAC Pet Insurance Market Revenue Share (%), by Animal 2025 & 2033

- Figure 70: Australia APAC Pet Insurance Market Volume Share (%), by Animal 2025 & 2033

- Figure 71: Australia APAC Pet Insurance Market Revenue (billion), by Provider 2025 & 2033

- Figure 72: Australia APAC Pet Insurance Market Volume (K Unit), by Provider 2025 & 2033

- Figure 73: Australia APAC Pet Insurance Market Revenue Share (%), by Provider 2025 & 2033

- Figure 74: Australia APAC Pet Insurance Market Volume Share (%), by Provider 2025 & 2033

- Figure 75: Australia APAC Pet Insurance Market Revenue (billion), by Geography 2025 & 2033

- Figure 76: Australia APAC Pet Insurance Market Volume (K Unit), by Geography 2025 & 2033

- Figure 77: Australia APAC Pet Insurance Market Revenue Share (%), by Geography 2025 & 2033

- Figure 78: Australia APAC Pet Insurance Market Volume Share (%), by Geography 2025 & 2033

- Figure 79: Australia APAC Pet Insurance Market Revenue (billion), by Country 2025 & 2033

- Figure 80: Australia APAC Pet Insurance Market Volume (K Unit), by Country 2025 & 2033

- Figure 81: Australia APAC Pet Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 82: Australia APAC Pet Insurance Market Volume Share (%), by Country 2025 & 2033

- Figure 83: South Korea APAC Pet Insurance Market Revenue (billion), by Policy 2025 & 2033

- Figure 84: South Korea APAC Pet Insurance Market Volume (K Unit), by Policy 2025 & 2033

- Figure 85: South Korea APAC Pet Insurance Market Revenue Share (%), by Policy 2025 & 2033

- Figure 86: South Korea APAC Pet Insurance Market Volume Share (%), by Policy 2025 & 2033

- Figure 87: South Korea APAC Pet Insurance Market Revenue (billion), by Animal 2025 & 2033

- Figure 88: South Korea APAC Pet Insurance Market Volume (K Unit), by Animal 2025 & 2033

- Figure 89: South Korea APAC Pet Insurance Market Revenue Share (%), by Animal 2025 & 2033

- Figure 90: South Korea APAC Pet Insurance Market Volume Share (%), by Animal 2025 & 2033

- Figure 91: South Korea APAC Pet Insurance Market Revenue (billion), by Provider 2025 & 2033

- Figure 92: South Korea APAC Pet Insurance Market Volume (K Unit), by Provider 2025 & 2033

- Figure 93: South Korea APAC Pet Insurance Market Revenue Share (%), by Provider 2025 & 2033

- Figure 94: South Korea APAC Pet Insurance Market Volume Share (%), by Provider 2025 & 2033

- Figure 95: South Korea APAC Pet Insurance Market Revenue (billion), by Geography 2025 & 2033

- Figure 96: South Korea APAC Pet Insurance Market Volume (K Unit), by Geography 2025 & 2033

- Figure 97: South Korea APAC Pet Insurance Market Revenue Share (%), by Geography 2025 & 2033

- Figure 98: South Korea APAC Pet Insurance Market Volume Share (%), by Geography 2025 & 2033

- Figure 99: South Korea APAC Pet Insurance Market Revenue (billion), by Country 2025 & 2033

- Figure 100: South Korea APAC Pet Insurance Market Volume (K Unit), by Country 2025 & 2033

- Figure 101: South Korea APAC Pet Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 102: South Korea APAC Pet Insurance Market Volume Share (%), by Country 2025 & 2033

- Figure 103: Rest of Asia Pacific APAC Pet Insurance Market Revenue (billion), by Policy 2025 & 2033

- Figure 104: Rest of Asia Pacific APAC Pet Insurance Market Volume (K Unit), by Policy 2025 & 2033

- Figure 105: Rest of Asia Pacific APAC Pet Insurance Market Revenue Share (%), by Policy 2025 & 2033

- Figure 106: Rest of Asia Pacific APAC Pet Insurance Market Volume Share (%), by Policy 2025 & 2033

- Figure 107: Rest of Asia Pacific APAC Pet Insurance Market Revenue (billion), by Animal 2025 & 2033

- Figure 108: Rest of Asia Pacific APAC Pet Insurance Market Volume (K Unit), by Animal 2025 & 2033

- Figure 109: Rest of Asia Pacific APAC Pet Insurance Market Revenue Share (%), by Animal 2025 & 2033

- Figure 110: Rest of Asia Pacific APAC Pet Insurance Market Volume Share (%), by Animal 2025 & 2033

- Figure 111: Rest of Asia Pacific APAC Pet Insurance Market Revenue (billion), by Provider 2025 & 2033

- Figure 112: Rest of Asia Pacific APAC Pet Insurance Market Volume (K Unit), by Provider 2025 & 2033

- Figure 113: Rest of Asia Pacific APAC Pet Insurance Market Revenue Share (%), by Provider 2025 & 2033

- Figure 114: Rest of Asia Pacific APAC Pet Insurance Market Volume Share (%), by Provider 2025 & 2033

- Figure 115: Rest of Asia Pacific APAC Pet Insurance Market Revenue (billion), by Geography 2025 & 2033

- Figure 116: Rest of Asia Pacific APAC Pet Insurance Market Volume (K Unit), by Geography 2025 & 2033

- Figure 117: Rest of Asia Pacific APAC Pet Insurance Market Revenue Share (%), by Geography 2025 & 2033

- Figure 118: Rest of Asia Pacific APAC Pet Insurance Market Volume Share (%), by Geography 2025 & 2033

- Figure 119: Rest of Asia Pacific APAC Pet Insurance Market Revenue (billion), by Country 2025 & 2033

- Figure 120: Rest of Asia Pacific APAC Pet Insurance Market Volume (K Unit), by Country 2025 & 2033

- Figure 121: Rest of Asia Pacific APAC Pet Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 122: Rest of Asia Pacific APAC Pet Insurance Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global APAC Pet Insurance Market Revenue billion Forecast, by Policy 2020 & 2033

- Table 2: Global APAC Pet Insurance Market Volume K Unit Forecast, by Policy 2020 & 2033

- Table 3: Global APAC Pet Insurance Market Revenue billion Forecast, by Animal 2020 & 2033

- Table 4: Global APAC Pet Insurance Market Volume K Unit Forecast, by Animal 2020 & 2033

- Table 5: Global APAC Pet Insurance Market Revenue billion Forecast, by Provider 2020 & 2033

- Table 6: Global APAC Pet Insurance Market Volume K Unit Forecast, by Provider 2020 & 2033

- Table 7: Global APAC Pet Insurance Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: Global APAC Pet Insurance Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 9: Global APAC Pet Insurance Market Revenue billion Forecast, by Region 2020 & 2033

- Table 10: Global APAC Pet Insurance Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 11: Global APAC Pet Insurance Market Revenue billion Forecast, by Policy 2020 & 2033

- Table 12: Global APAC Pet Insurance Market Volume K Unit Forecast, by Policy 2020 & 2033

- Table 13: Global APAC Pet Insurance Market Revenue billion Forecast, by Animal 2020 & 2033

- Table 14: Global APAC Pet Insurance Market Volume K Unit Forecast, by Animal 2020 & 2033

- Table 15: Global APAC Pet Insurance Market Revenue billion Forecast, by Provider 2020 & 2033

- Table 16: Global APAC Pet Insurance Market Volume K Unit Forecast, by Provider 2020 & 2033

- Table 17: Global APAC Pet Insurance Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 18: Global APAC Pet Insurance Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 19: Global APAC Pet Insurance Market Revenue billion Forecast, by Country 2020 & 2033

- Table 20: Global APAC Pet Insurance Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 21: Global APAC Pet Insurance Market Revenue billion Forecast, by Policy 2020 & 2033

- Table 22: Global APAC Pet Insurance Market Volume K Unit Forecast, by Policy 2020 & 2033

- Table 23: Global APAC Pet Insurance Market Revenue billion Forecast, by Animal 2020 & 2033

- Table 24: Global APAC Pet Insurance Market Volume K Unit Forecast, by Animal 2020 & 2033

- Table 25: Global APAC Pet Insurance Market Revenue billion Forecast, by Provider 2020 & 2033

- Table 26: Global APAC Pet Insurance Market Volume K Unit Forecast, by Provider 2020 & 2033

- Table 27: Global APAC Pet Insurance Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 28: Global APAC Pet Insurance Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 29: Global APAC Pet Insurance Market Revenue billion Forecast, by Country 2020 & 2033

- Table 30: Global APAC Pet Insurance Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 31: Global APAC Pet Insurance Market Revenue billion Forecast, by Policy 2020 & 2033

- Table 32: Global APAC Pet Insurance Market Volume K Unit Forecast, by Policy 2020 & 2033

- Table 33: Global APAC Pet Insurance Market Revenue billion Forecast, by Animal 2020 & 2033

- Table 34: Global APAC Pet Insurance Market Volume K Unit Forecast, by Animal 2020 & 2033

- Table 35: Global APAC Pet Insurance Market Revenue billion Forecast, by Provider 2020 & 2033

- Table 36: Global APAC Pet Insurance Market Volume K Unit Forecast, by Provider 2020 & 2033

- Table 37: Global APAC Pet Insurance Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 38: Global APAC Pet Insurance Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 39: Global APAC Pet Insurance Market Revenue billion Forecast, by Country 2020 & 2033

- Table 40: Global APAC Pet Insurance Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 41: Global APAC Pet Insurance Market Revenue billion Forecast, by Policy 2020 & 2033

- Table 42: Global APAC Pet Insurance Market Volume K Unit Forecast, by Policy 2020 & 2033

- Table 43: Global APAC Pet Insurance Market Revenue billion Forecast, by Animal 2020 & 2033

- Table 44: Global APAC Pet Insurance Market Volume K Unit Forecast, by Animal 2020 & 2033

- Table 45: Global APAC Pet Insurance Market Revenue billion Forecast, by Provider 2020 & 2033

- Table 46: Global APAC Pet Insurance Market Volume K Unit Forecast, by Provider 2020 & 2033

- Table 47: Global APAC Pet Insurance Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 48: Global APAC Pet Insurance Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 49: Global APAC Pet Insurance Market Revenue billion Forecast, by Country 2020 & 2033

- Table 50: Global APAC Pet Insurance Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 51: Global APAC Pet Insurance Market Revenue billion Forecast, by Policy 2020 & 2033

- Table 52: Global APAC Pet Insurance Market Volume K Unit Forecast, by Policy 2020 & 2033

- Table 53: Global APAC Pet Insurance Market Revenue billion Forecast, by Animal 2020 & 2033

- Table 54: Global APAC Pet Insurance Market Volume K Unit Forecast, by Animal 2020 & 2033

- Table 55: Global APAC Pet Insurance Market Revenue billion Forecast, by Provider 2020 & 2033

- Table 56: Global APAC Pet Insurance Market Volume K Unit Forecast, by Provider 2020 & 2033

- Table 57: Global APAC Pet Insurance Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 58: Global APAC Pet Insurance Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 59: Global APAC Pet Insurance Market Revenue billion Forecast, by Country 2020 & 2033

- Table 60: Global APAC Pet Insurance Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 61: Global APAC Pet Insurance Market Revenue billion Forecast, by Policy 2020 & 2033

- Table 62: Global APAC Pet Insurance Market Volume K Unit Forecast, by Policy 2020 & 2033

- Table 63: Global APAC Pet Insurance Market Revenue billion Forecast, by Animal 2020 & 2033

- Table 64: Global APAC Pet Insurance Market Volume K Unit Forecast, by Animal 2020 & 2033

- Table 65: Global APAC Pet Insurance Market Revenue billion Forecast, by Provider 2020 & 2033

- Table 66: Global APAC Pet Insurance Market Volume K Unit Forecast, by Provider 2020 & 2033

- Table 67: Global APAC Pet Insurance Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 68: Global APAC Pet Insurance Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 69: Global APAC Pet Insurance Market Revenue billion Forecast, by Country 2020 & 2033

- Table 70: Global APAC Pet Insurance Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Pet Insurance Market?

The projected CAGR is approximately 17.57%.

2. Which companies are prominent players in the APAC Pet Insurance Market?

Key companies in the market include The People's Insurance Company of China, Oriental Insurance, Guide Dogs Pet Insurance Australia, The New India Assurance Company Limited, Petplan and Hollard, Anicom Insurance Inc, Pet Insurance Australia, ipet Insurance, Rakuten Inc, Medibank Private Limited.

3. What are the main segments of the APAC Pet Insurance Market?

The market segments include Policy, Animal, Provider, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 96.63 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Pet Adoption; Rising Awareness Regarding Pet Insurance.

6. What are the notable trends driving market growth?

Chronic Conditions by Policy is Expected to Hold a Significant Share Over the Forecast Period.

7. Are there any restraints impacting market growth?

Low Adoption in Emerging Countries.

8. Can you provide examples of recent developments in the market?

In August 2022, InsuranceDekho collaborated with Future Generali India Insurance Company to launch dog health insurance in India with a starting annual premium of about INR 324.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Pet Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Pet Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Pet Insurance Market?

To stay informed about further developments, trends, and reports in the APAC Pet Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence