Key Insights

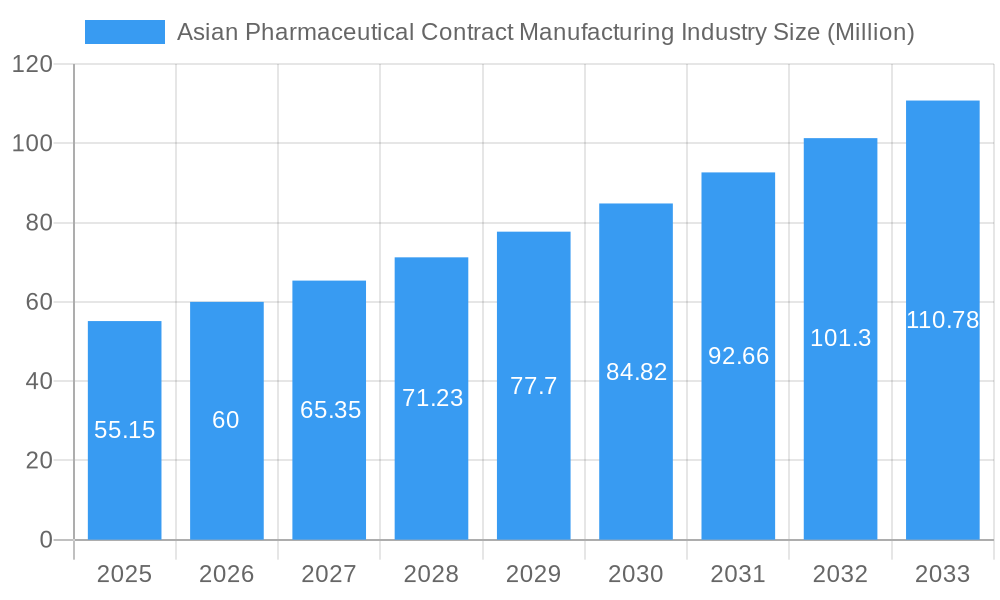

The Asian pharmaceutical contract manufacturing market, valued at $55.15 million in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 8.74% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, the increasing prevalence of chronic diseases and rising demand for pharmaceutical products across the region create a significant need for efficient and cost-effective manufacturing solutions. Secondly, the burgeoning generics market in countries like India and China presents lucrative opportunities for contract manufacturers. Thirdly, a growing preference for outsourcing non-core activities allows pharmaceutical companies to focus on research and development, further boosting the contract manufacturing sector. The market is segmented by formulation (Injectable Dose, Finished Dosage Formulation), service type (API manufacturing, HPAPI development & manufacturing), and geography (China, India, Japan, Australia, and the Rest of Asia-Pacific). China and India are expected to dominate the market due to their large populations, established manufacturing infrastructure, and cost advantages. However, regulatory hurdles and varying quality standards across the region present challenges. The presence of established players like Lonza, Catalent, and Jubilant Life Sciences, along with emerging regional companies, fosters competition and innovation.

Asian Pharmaceutical Contract Manufacturing Industry Market Size (In Million)

The forecast period (2025-2033) anticipates continued growth, driven by increasing investments in advanced technologies like High Potency API (HPAPI) manufacturing and a focus on improving supply chain resilience. Stringent regulatory compliance and a focus on quality control will be crucial for sustained success. The market will likely witness further consolidation as larger players acquire smaller companies to expand their capabilities and geographic reach. The ongoing development of novel therapies and the increasing adoption of biologics will also shape future market trends. Japan and South Korea, with their advanced healthcare infrastructure, present significant growth potential, though their markets might develop at a slightly slower pace compared to the faster-growing economies of India and China.

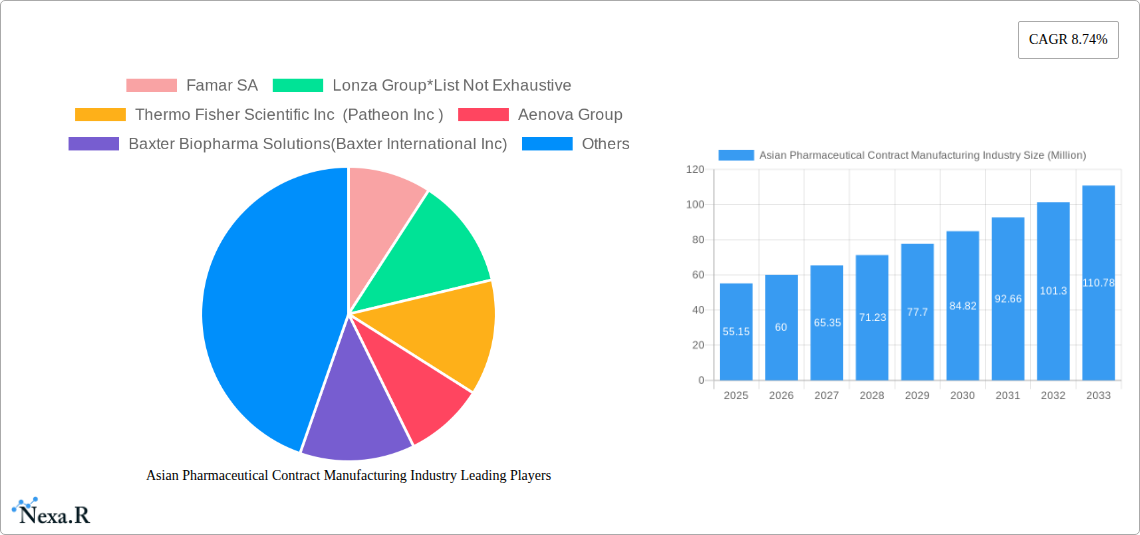

Asian Pharmaceutical Contract Manufacturing Industry Company Market Share

Asian Pharmaceutical Contract Manufacturing Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Asian pharmaceutical contract manufacturing industry, covering market dynamics, growth trends, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report segments the market by country (China, India, Japan, Australia, Rest of Asia-Pacific), service type (Active Pharmaceutical Ingredient (API) Manufacturing, High Potency API (HPAPI), Finished Dosage Formulation (FDF) Development and Manufacturing), and specific dosage formulation like Injectable Dose Formulation: Secondary Packaging. The report quantifies market size in Million units and offers valuable insights for industry professionals, investors, and strategic decision-makers.

Asian Pharmaceutical Contract Manufacturing Industry Market Dynamics & Structure

The Asian pharmaceutical contract manufacturing market is experiencing significant growth driven by factors including increasing outsourcing by pharmaceutical companies, rising demand for generic drugs, and technological advancements. Market concentration is moderate, with several large players and numerous smaller contract manufacturers competing. Technological innovation, particularly in areas like advanced drug delivery systems and HPAPI handling, is a key driver. Stringent regulatory frameworks, varying across countries, pose both challenges and opportunities. Competitive product substitutes are limited, as specialized manufacturing capabilities and regulatory approvals create high barriers to entry. The end-user demographics are dominated by large multinational pharmaceutical companies and growing numbers of smaller biotech firms. M&A activity is considerable, with larger players consolidating their market share.

- Market Concentration: Moderately concentrated, with top 10 players holding approximately xx% market share in 2025.

- Technological Innovation: Focus on automation, continuous manufacturing, and AI-driven process optimization.

- Regulatory Landscape: Stringent regulations vary significantly across countries, requiring significant compliance investments.

- Competitive Substitutes: Limited due to high barriers to entry, specialized skills and technology required.

- M&A Activity: High volume of mergers and acquisitions, with xx deals recorded between 2019 and 2024. Value of these deals totaled approximately xx Million units.

- Innovation Barriers: High capital expenditure requirements, skilled labor shortages, and regulatory hurdles.

Asian Pharmaceutical Contract Manufacturing Industry Growth Trends & Insights

The Asian pharmaceutical contract manufacturing market has demonstrated exceptional and sustained growth over the historical period (2019-2024). This robust expansion has been propelled by a confluence of key drivers. Pharmaceutical companies are significantly increasing their R&D investments, leading to a greater demand for specialized manufacturing expertise. Simultaneously, the burgeoning global generic drug market, with its emphasis on cost-effective production, presents a fertile ground for contract manufacturers. Furthermore, the escalating demand for sophisticated and niche manufacturing services, including complex molecule synthesis and specialized biologics, is fueling market penetration. Looking ahead, the market is projected to continue its impressive trajectory, exhibiting a significant Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033). This sustained growth will be further amplified by rapid technological advancements. Innovations in areas such as continuous manufacturing, which promises enhanced efficiency and quality, and the application of advanced analytics for process optimization and predictive maintenance, are becoming increasingly integral. Concurrently, evolving consumer preferences for more convenient, patient-centric, and highly effective drug delivery systems are directly influencing the types of manufacturing services in demand. As pharmaceutical firms increasingly prioritize their core competencies in drug discovery and marketing, the strategic outsourcing of manufacturing operations to specialized contract manufacturing organizations (CMOs) is expected to see a steady and substantial increase in market penetration. The overall market size is anticipated to reach an impressive xx Million units by 2033, a substantial increase from xx Million units in 2025.

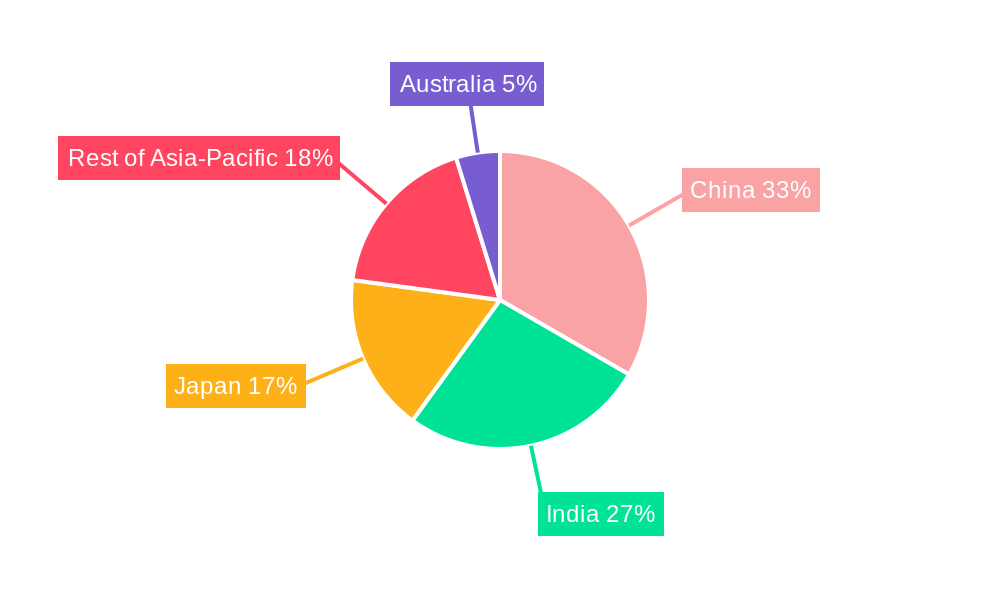

Dominant Regions, Countries, or Segments in Asian Pharmaceutical Contract Manufacturing Industry

Within the dynamic Asian pharmaceutical contract manufacturing landscape, China and India stand out as the preeminent regions. Their dominance is underpinned by several critical factors: the sheer size and rapid expansion of their domestic pharmaceutical industries, their well-established reputation for cost-effective and scalable manufacturing capabilities, and proactive government policies that foster investment and innovation. These nations have successfully positioned themselves as global hubs for pharmaceutical production. Examining specific segments, API (Active Pharmaceutical Ingredient) manufacturing continues to command the largest market share, reflecting the fundamental need for these core components in drug production and the increasing trend of outsourcing API synthesis. Following closely is the development and manufacturing of Finished Dosage Forms (FDFs), driven by the constant need for new and improved drug formulations. A particularly high-growth sub-segment is injectable dose formulation and secondary packaging. This surge is directly attributed to the escalating global demand for injectable medications, which require specialized sterile manufacturing processes and meticulous packaging. Beyond these broad categories, Japan occupies a distinct and crucial position, excelling in high-value, specialized services that demand cutting-edge technology and adherence to the most stringent regulatory standards.

- China: Boasts a vast domestic pharmaceutical market, leveraging low labor costs and significant government incentives to drive unparalleled growth and market share. Estimated Market share in 2025: xx%.

- India: A global powerhouse in generic drug manufacturing, renowned for its cost competitiveness, robust supply chain, and rapidly expanding expertise in complex and specialized drug formulations. Estimated Market share in 2025: xx%.

- Japan: Focuses on advanced, high-value, and specialized contract manufacturing services, underpinned by exceptionally stringent regulatory frameworks and sophisticated technological capabilities. Estimated Market share in 2025: xx%.

- API Manufacturing: Remains the largest and most critical segment by value, driven by consistent high demand and the strategic outsourcing of API production by global pharmaceutical players.

- FDF Development and Manufacturing: Exhibits substantial growth potential, fueled by the increasing complexity of drug formulations and the evolving therapeutic needs of patients.

- Injectable Dose Formulation & Secondary Packaging: Experiencing rapid expansion due to the accelerating demand for injectable medications, necessitating specialized sterile manufacturing and advanced packaging solutions.

Asian Pharmaceutical Contract Manufacturing Industry Product Landscape

The product and service landscape within the Asian pharmaceutical contract manufacturing industry is remarkably diverse and comprehensive, catering to every stage of the drug lifecycle. Key offerings include the meticulous manufacturing of Active Pharmaceutical Ingredients (APIs), specialized handling of High Potency Active Pharmaceutical Ingredients (HPAPIs) which require stringent containment protocols, advanced formulation development for a wide array of dosage forms, and sophisticated packaging solutions. Innovation is a constant driving force, with a sharp focus on optimizing manufacturing efficiency, ensuring unwavering product quality that meets global pharmacopeial standards, and developing next-generation advanced drug delivery systems that enhance patient compliance and therapeutic outcomes. A significant trend is the increasing provision of integrated, end-to-end services, where CMOs manage multiple stages of the drug development and manufacturing process, offering a seamless and streamlined experience for their clients. The primary selling propositions for these services revolve around highly competitive cost-effectiveness, accelerated timelines to market, and unwavering compliance with stringent global regulatory standards such as those set by the FDA, EMA, and other international bodies. The adoption of cutting-edge technologies like continuous manufacturing, which allows for uninterrupted production, and real-time process monitoring, which enables proactive quality control and immediate issue resolution, are significantly enhancing both operational efficiency and the overall quality assurance of manufactured products.

Key Drivers, Barriers & Challenges in Asian Pharmaceutical Contract Manufacturing Industry

Key Drivers:

- Rising demand for generic drugs

- Increasing outsourcing by pharmaceutical companies

- Technological advancements in drug manufacturing

- Government support and incentives

Key Challenges and Restraints:

- Stringent regulatory requirements (e.g., GMP compliance) leading to increased costs.

- Supply chain disruptions impacting raw material availability and delivery times.

- Intense competition from established and emerging players.

- Skilled labor shortages impacting production capacity.

Emerging Opportunities in Asian Pharmaceutical Contract Manufacturing Industry

- Growth of the biologics and biosimilars market.

- Increasing demand for personalized medicine and advanced therapies.

- Expansion into new therapeutic areas such as cell and gene therapy.

- Development of innovative drug delivery systems.

Growth Accelerators in the Asian Pharmaceutical Contract Manufacturing Industry

Technological breakthroughs in areas such as continuous manufacturing and process automation are key growth catalysts. Strategic partnerships between contract manufacturers and pharmaceutical companies are also driving expansion. Aggressive market expansion strategies into new regions and therapeutic areas are enhancing market penetration and overall growth.

Key Players Shaping the Asian Pharmaceutical Contract Manufacturing Market

Notable Milestones in Asian Pharmaceutical Contract Manufacturing Industry Sector

- 2021: Catalent expands its manufacturing capacity in China.

- 2022: Lonza announces a significant investment in its HPAPI manufacturing facility in Singapore.

- 2023: Several major M&A deals reshape the market landscape.

- 2024: New regulations on API manufacturing come into effect in India.

In-Depth Asian Pharmaceutical Contract Manufacturing Industry Market Outlook

The outlook for the Asian pharmaceutical contract manufacturing market is exceptionally positive, with a clear trajectory towards continued and robust growth. This optimistic forecast is underpinned by several powerful and interconnected drivers. The relentless pace of technological advancement within the industry, the persistent and growing trend of outsourcing by pharmaceutical companies seeking specialized expertise and cost efficiencies, and the overall expansion of the pharmaceutical sector across Asia all contribute to this strong growth momentum. The future landscape will be significantly shaped by strategic partnerships that foster collaboration and knowledge sharing, substantial investments in expanding manufacturing capacities to meet rising demand, and the continuous development of innovative, value-added services that differentiate CMOs in a competitive market. Companies that prioritize and excel in delivering high-quality, exceptionally efficient, and fully compliant manufacturing services will be best positioned to capture significant and sustainable market share. The market is anticipated to experience a sustained and prolonged period of expansion, driven by both the established, leading players and the emergence of dynamic new entrants with specialized capabilities and innovative approaches.

Asian Pharmaceutical Contract Manufacturing Industry Segmentation

-

1. Service Type

-

1.1. Active P

- 1.1.1. Small Molecule

- 1.1.2. Large Molecule

- 1.1.3. High Potency API (HPAPI)

-

1.2. Finished

- 1.2.1. Solid Dose Formulation

- 1.2.2. Liquid Dose Formulation

- 1.2.3. Injectable Dose Formulation

- 1.3. Secondary Packaging

-

1.1. Active P

Asian Pharmaceutical Contract Manufacturing Industry Segmentation By Geography

-

1. Asia

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Indonesia

- 1.6. Malaysia

- 1.7. Singapore

- 1.8. Thailand

- 1.9. Vietnam

- 1.10. Philippines

- 1.11. Bangladesh

- 1.12. Pakistan

Asian Pharmaceutical Contract Manufacturing Industry Regional Market Share

Geographic Coverage of Asian Pharmaceutical Contract Manufacturing Industry

Asian Pharmaceutical Contract Manufacturing Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.74% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Outsourcing Volume by Pharmaceutical Companies

- 3.3. Market Restrains

- 3.3.1. ; Increasing Lead Time and Logistics Costs; Stringent Regulatory Requirements; Capacity Utilization Issues Affecting the Profitability of CMOs

- 3.4. Market Trends

- 3.4.1. Injectable Dose Formulations Holds Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asian Pharmaceutical Contract Manufacturing Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. Active P

- 5.1.1.1. Small Molecule

- 5.1.1.2. Large Molecule

- 5.1.1.3. High Potency API (HPAPI)

- 5.1.2. Finished

- 5.1.2.1. Solid Dose Formulation

- 5.1.2.2. Liquid Dose Formulation

- 5.1.2.3. Injectable Dose Formulation

- 5.1.3. Secondary Packaging

- 5.1.1. Active P

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Asia

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Famar SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Lonza Group*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Thermo Fisher Scientific Inc (Patheon Inc )

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Aenova Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Baxter Biopharma Solutions(Baxter International Inc)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Pfizer CentreSource (Pfizer Inc)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Jubilant Life Sciences Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Catalent Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Boehringer Ingelheim Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Recipharm AB

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Famar SA

List of Figures

- Figure 1: Asian Pharmaceutical Contract Manufacturing Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asian Pharmaceutical Contract Manufacturing Industry Share (%) by Company 2025

List of Tables

- Table 1: Asian Pharmaceutical Contract Manufacturing Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 2: Asian Pharmaceutical Contract Manufacturing Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Asian Pharmaceutical Contract Manufacturing Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 4: Asian Pharmaceutical Contract Manufacturing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: China Asian Pharmaceutical Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Japan Asian Pharmaceutical Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: South Korea Asian Pharmaceutical Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: India Asian Pharmaceutical Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Indonesia Asian Pharmaceutical Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Malaysia Asian Pharmaceutical Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Singapore Asian Pharmaceutical Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Thailand Asian Pharmaceutical Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Vietnam Asian Pharmaceutical Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Philippines Asian Pharmaceutical Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Bangladesh Asian Pharmaceutical Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Pakistan Asian Pharmaceutical Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asian Pharmaceutical Contract Manufacturing Industry?

The projected CAGR is approximately 8.74%.

2. Which companies are prominent players in the Asian Pharmaceutical Contract Manufacturing Industry?

Key companies in the market include Famar SA, Lonza Group*List Not Exhaustive, Thermo Fisher Scientific Inc (Patheon Inc ), Aenova Group, Baxter Biopharma Solutions(Baxter International Inc), Pfizer CentreSource (Pfizer Inc), Jubilant Life Sciences Ltd, Catalent Inc, Boehringer Ingelheim Group, Recipharm AB.

3. What are the main segments of the Asian Pharmaceutical Contract Manufacturing Industry?

The market segments include Service Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 55.15 Million as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Outsourcing Volume by Pharmaceutical Companies.

6. What are the notable trends driving market growth?

Injectable Dose Formulations Holds Significant Market Share.

7. Are there any restraints impacting market growth?

; Increasing Lead Time and Logistics Costs; Stringent Regulatory Requirements; Capacity Utilization Issues Affecting the Profitability of CMOs.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asian Pharmaceutical Contract Manufacturing Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asian Pharmaceutical Contract Manufacturing Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asian Pharmaceutical Contract Manufacturing Industry?

To stay informed about further developments, trends, and reports in the Asian Pharmaceutical Contract Manufacturing Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence