Key Insights

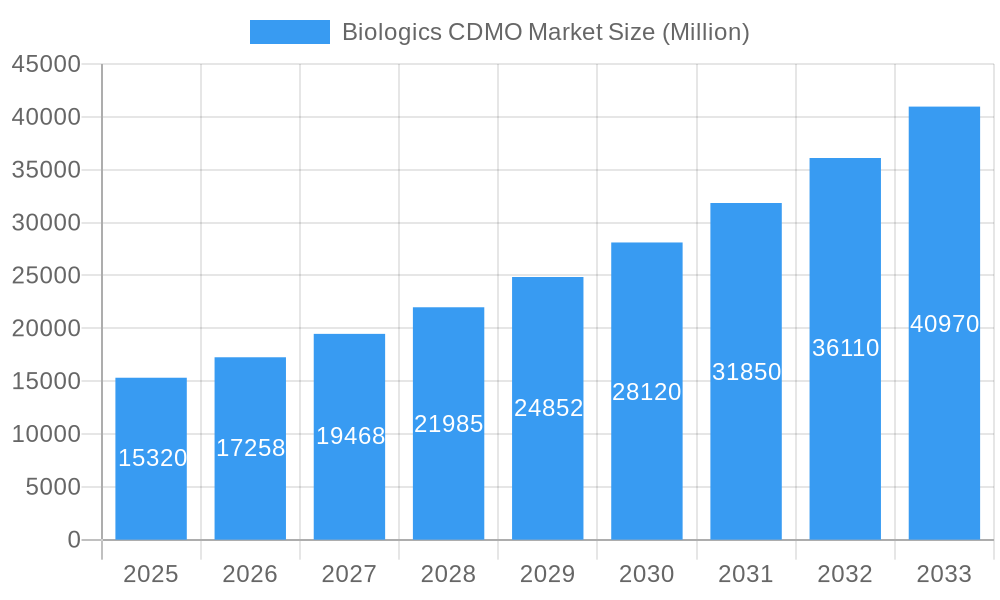

The Biologics Contract Development and Manufacturing Organization (CDMO) market is experiencing robust growth, projected to reach \$15.32 billion in 2025 and exhibiting a Compound Annual Growth Rate (CAGR) of 12.78% from 2025 to 2033. This expansion is driven by several key factors. The increasing prevalence of chronic diseases globally necessitates a higher demand for biologics, fueling the need for efficient and reliable CDMO services. Furthermore, the rising adoption of advanced technologies like cell line development, process optimization, and analytical testing within CDMOs enhances production efficiency and reduces development timelines, attracting more pharmaceutical and biotechnology companies. The market is also witnessing a surge in outsourcing activities, as companies focus on core competencies and leverage the specialized expertise and economies of scale offered by CDMOs. Growth is particularly strong in the mammalian-derived biologics segment due to their superior efficacy and safety profiles compared to microbial-derived counterparts. Finally, the significant investments in research and development by leading CDMO companies are driving innovation and expanding capacity, ultimately shaping the future of biologics manufacturing.

Biologics CDMO Market Market Size (In Billion)

The Biologics CDMO market is segmented by various factors, including the type of biologics (mammalian and non-mammalian/microbial), the product type (biosimilars, other biologics), and geographic region. While precise regional market share data is unavailable, it's reasonable to assume that North America and Europe currently hold the largest market shares, given their established pharmaceutical industries and regulatory frameworks. However, the Asia-Pacific region is expected to witness the fastest growth due to increasing healthcare spending and the rising presence of pharmaceutical and biotechnology companies in emerging economies. Competition is intense, with numerous established players and emerging CDMOs vying for market share. Key players like Samsung Biologics, Lonza Group, and Wuxi Biologics are continuously investing in capacity expansion and technological advancements to maintain their competitive edge. The market landscape reflects a trend towards consolidation, with mergers and acquisitions occurring frequently as companies seek to expand their service offerings and geographic reach. The future of the Biologics CDMO market hinges on continued technological advancements, increasing demand for biosimilars, and the ongoing evolution of global regulatory landscapes.

Biologics CDMO Market Company Market Share

Biologics CDMO Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Biologics CDMO (Contract Development and Manufacturing Organization) market, offering valuable insights for industry professionals, investors, and strategic decision-makers. The study period covers 2019-2033, with a focus on the forecast period of 2025-2033, using 2025 as the base year and estimated year. The report analyzes market dynamics, growth trends, key players, and emerging opportunities across various segments, including Biosimilars, Mammalian and Non-mammalian (Microbial) biologics, and various product types. The market size is presented in million units.

Biologics CDMO Market Dynamics & Structure

The Biologics CDMO market is characterized by a moderately concentrated structure, with several large players commanding significant market share. However, the market also accommodates numerous smaller specialized CDMOs catering to niche therapeutic areas. Technological innovation, driven by advancements in cell line engineering, process development, and analytical techniques, significantly shapes market dynamics. Stringent regulatory frameworks, particularly regarding Good Manufacturing Practices (GMP) compliance, add complexity, but also contribute to market stability. Competitive product substitutes are limited due to the complex nature of biologics manufacturing, and the emergence of biosimilars presents both opportunities and challenges. End-user demographics heavily influence market growth, with a focus on pharmaceutical and biotechnology companies. M&A activity is considerable, reflecting industry consolidation and expansion strategies.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2025.

- Technological Innovation: Significant advancements in single-use technologies, continuous manufacturing, and process analytical technology (PAT) are driving efficiency and reducing costs.

- Regulatory Landscape: Stringent GMP compliance and regulatory approvals create barriers to entry but ensure product quality and safety.

- M&A Activity: High volume of mergers and acquisitions, with approximately xx deals annually during the historical period.

- Innovation Barriers: High capital investment requirements and lengthy development timelines pose challenges for smaller companies.

Biologics CDMO Market Growth Trends & Insights

The Biologics CDMO market exhibits robust growth, driven by factors such as the increasing demand for biologics, the rise of biosimilars, and the outsourcing trend among pharmaceutical and biotechnology companies. The market is expected to witness a compound annual growth rate (CAGR) of xx% during the forecast period (2025-2033), expanding from an estimated market size of xx million units in 2025 to xx million units by 2033. Technological disruptions, such as the adoption of continuous manufacturing and advanced analytics, are accelerating process optimization and efficiency gains. Shifting consumer preferences towards innovative therapies and personalized medicine are fueling market expansion. Market penetration continues to grow, with xx% of biopharmaceutical companies utilizing CDMO services in 2025, expected to increase to xx% by 2033. The market is witnessing increased adoption of advanced technologies such as cell line development and process optimization, contributing to higher efficiency and reduced production costs.

Dominant Regions, Countries, or Segments in Biologics CDMO Market

North America currently dominates the Biologics CDMO market, holding approximately xx% market share in 2025, followed by Europe and Asia-Pacific. The strong presence of major pharmaceutical companies, advanced research infrastructure, and established regulatory frameworks drive this dominance. Within segments, Mammalian-derived biologics holds the largest share, but the Non-mammalian (Microbial) segment is growing rapidly driven by advancements in microbial cell culture and cost-effectiveness. The Biosimilars segment also demonstrates significant growth potential, due to patent expirations for blockbuster biologics and increased demand for affordable alternatives.

- Key Drivers for North America: Established infrastructure, stringent regulatory framework, and a high concentration of pharmaceutical and biotechnology companies.

- Asia-Pacific Growth Drivers: Increasing government investments in healthcare infrastructure, growing domestic pharmaceutical industry, and lower manufacturing costs.

- European Market Dynamics: Strong focus on innovation and research, stringent regulatory compliance, and access to skilled workforce.

- Mammalian Dominance: High efficacy and safety profile of mammalian-derived biologics.

- Non-Mammalian Growth: Lower cost of production and scalability potential.

Biologics CDMO Market Product Landscape

The Biologics CDMO market offers a diverse range of services, including process development, analytical testing, and large-scale manufacturing for various biologics, including monoclonal antibodies, recombinant proteins, and vaccines. Innovations focus on enhancing efficiency, reducing production costs, and accelerating timelines. Technological advancements, such as single-use systems and continuous processing, are key drivers of improved quality, productivity, and flexibility. Unique selling propositions for CDMOs often include specialized expertise in specific therapeutic areas, advanced technologies, and strong regulatory compliance capabilities.

Key Drivers, Barriers & Challenges in Biologics CDMO Market

Key Drivers:

- Increasing demand for biologics due to their efficacy in treating various diseases.

- Outsourcing trend among pharmaceutical and biotechnology companies seeking cost-effective manufacturing solutions.

- Advancements in technology leading to increased efficiency and reduced production costs.

Challenges & Restraints:

- Stringent regulatory requirements and compliance procedures.

- Supply chain disruptions impacting raw material availability and logistics.

- Intense competition among established players and emerging CDMOs. The market experiences price pressure due to competitive bidding, impacting profitability margins.

Emerging Opportunities in Biologics CDMO Market

- Growing demand for cell and gene therapies presents significant opportunities for specialized CDMOs.

- Expansion into emerging markets with high growth potential, like Asia-Pacific and Latin America.

- Development of novel technologies, like continuous manufacturing and process intensification.

Growth Accelerators in the Biologics CDMO Market Industry

Technological breakthroughs in upstream and downstream processing, particularly continuous manufacturing, are key growth catalysts. Strategic partnerships between CDMOs and pharmaceutical companies create strong synergies, ensuring efficient production and market penetration. Market expansion strategies, including geographic diversification and expansion into emerging therapeutic areas, will drive long-term growth.

Key Players Shaping the Biologics CDMO Market Market

- Toyobo Co Limited

- AGC Biologics

- Lonza Group

- Binex Co Limited

- Rentschler Biotechnologies

- Wuxi Biologics

- AbbVie Contract Manufacturing

- Parexel International Corporation

- Sandoz Biopharmaceuticals (Novartis AG)

- Catalent Inc

- JRS Pharma

- Fujifilm Diosynth Biotechnologies USA Inc

- Samsung Biologics

- Boehringer Ingelheim Group

- Icon PLC

Notable Milestones in Biologics CDMO Market Sector

- December 2021: AstraZeneca and Samsung Biologics formed a strategic biopharmaceutical manufacturing partnership, with Samsung Biologics securing a USD 380 million contract for cancer immunotherapy production.

- March 2022: Oasmia Pharmaceutical AB and Lonza signed a large-scale manufacturing agreement for a drug candidate.

- April 2022: FUJIFILM Corporation acquired a cell therapy manufacturing facility, expanding its CDMO capabilities.

In-Depth Biologics CDMO Market Outlook

The Biologics CDMO market holds significant promise, with continued growth driven by technological advancements, increasing outsourcing, and expanding demand for biologics. Strategic opportunities exist in areas such as cell and gene therapy manufacturing, personalized medicine, and emerging markets. CDMOs that adapt to evolving technological advancements, focus on quality and compliance, and establish robust partnerships will be best positioned to capitalize on future market potential.

Biologics CDMO Market Segmentation

-

1. Type

- 1.1. Mammalian

- 1.2. Non-mammalian (Microbial)

-

2. Product Type

-

2.1. Biologics

- 2.1.1. Monoclon

- 2.1.2. Recombinant Proteins

- 2.1.3. Antisense and Molecular Therapy

- 2.1.4. Vaccines

- 2.1.5. Other Biologics

- 2.2. Biosimilars

-

2.1. Biologics

Biologics CDMO Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Biologics CDMO Market Regional Market Share

Geographic Coverage of Biologics CDMO Market

Biologics CDMO Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.78% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Access to New Technologies and Higher Speed of Execution Realized by CDMOs; Need for High Capital Investments to Develop Capabilities Has Led to Firms Choosing the Outsourcing Model; Lack of In-house Capacity among Emerging Drug Development Companies

- 3.3. Market Restrains

- 3.3.1. Presence of Alternative Printing Technology

- 3.4. Market Trends

- 3.4.1. CDMOs’ Access to New Technologies and Higher Speed of Execution Driving Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Biologics CDMO Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Mammalian

- 5.1.2. Non-mammalian (Microbial)

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Biologics

- 5.2.1.1. Monoclon

- 5.2.1.2. Recombinant Proteins

- 5.2.1.3. Antisense and Molecular Therapy

- 5.2.1.4. Vaccines

- 5.2.1.5. Other Biologics

- 5.2.2. Biosimilars

- 5.2.1. Biologics

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Australia and New Zealand

- 5.3.5. Latin America

- 5.3.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Biologics CDMO Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Mammalian

- 6.1.2. Non-mammalian (Microbial)

- 6.2. Market Analysis, Insights and Forecast - by Product Type

- 6.2.1. Biologics

- 6.2.1.1. Monoclon

- 6.2.1.2. Recombinant Proteins

- 6.2.1.3. Antisense and Molecular Therapy

- 6.2.1.4. Vaccines

- 6.2.1.5. Other Biologics

- 6.2.2. Biosimilars

- 6.2.1. Biologics

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Biologics CDMO Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Mammalian

- 7.1.2. Non-mammalian (Microbial)

- 7.2. Market Analysis, Insights and Forecast - by Product Type

- 7.2.1. Biologics

- 7.2.1.1. Monoclon

- 7.2.1.2. Recombinant Proteins

- 7.2.1.3. Antisense and Molecular Therapy

- 7.2.1.4. Vaccines

- 7.2.1.5. Other Biologics

- 7.2.2. Biosimilars

- 7.2.1. Biologics

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Biologics CDMO Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Mammalian

- 8.1.2. Non-mammalian (Microbial)

- 8.2. Market Analysis, Insights and Forecast - by Product Type

- 8.2.1. Biologics

- 8.2.1.1. Monoclon

- 8.2.1.2. Recombinant Proteins

- 8.2.1.3. Antisense and Molecular Therapy

- 8.2.1.4. Vaccines

- 8.2.1.5. Other Biologics

- 8.2.2. Biosimilars

- 8.2.1. Biologics

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Australia and New Zealand Biologics CDMO Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Mammalian

- 9.1.2. Non-mammalian (Microbial)

- 9.2. Market Analysis, Insights and Forecast - by Product Type

- 9.2.1. Biologics

- 9.2.1.1. Monoclon

- 9.2.1.2. Recombinant Proteins

- 9.2.1.3. Antisense and Molecular Therapy

- 9.2.1.4. Vaccines

- 9.2.1.5. Other Biologics

- 9.2.2. Biosimilars

- 9.2.1. Biologics

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Latin America Biologics CDMO Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Mammalian

- 10.1.2. Non-mammalian (Microbial)

- 10.2. Market Analysis, Insights and Forecast - by Product Type

- 10.2.1. Biologics

- 10.2.1.1. Monoclon

- 10.2.1.2. Recombinant Proteins

- 10.2.1.3. Antisense and Molecular Therapy

- 10.2.1.4. Vaccines

- 10.2.1.5. Other Biologics

- 10.2.2. Biosimilars

- 10.2.1. Biologics

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Middle East and Africa Biologics CDMO Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Mammalian

- 11.1.2. Non-mammalian (Microbial)

- 11.2. Market Analysis, Insights and Forecast - by Product Type

- 11.2.1. Biologics

- 11.2.1.1. Monoclon

- 11.2.1.2. Recombinant Proteins

- 11.2.1.3. Antisense and Molecular Therapy

- 11.2.1.4. Vaccines

- 11.2.1.5. Other Biologics

- 11.2.2. Biosimilars

- 11.2.1. Biologics

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Toyobo Co Limited

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 AGC Biologics

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Lonza Group

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Binex Co Limited

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Rentschler Biotechnologies

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Wuxi Biologics

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 AbbVie Contract Manufacturing*List Not Exhaustive

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Parexel International Corporation

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Sandoz Biopharmaceuticals (Novartis AG)

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Catalent Inc

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 JRS Pharma

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Fujifilm Diosynth Biotechnologies USA Inc

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 Samsung Biologics

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.14 Boehringer Ingelheim Group

- 12.2.14.1. Overview

- 12.2.14.2. Products

- 12.2.14.3. SWOT Analysis

- 12.2.14.4. Recent Developments

- 12.2.14.5. Financials (Based on Availability)

- 12.2.15 Icon PLC

- 12.2.15.1. Overview

- 12.2.15.2. Products

- 12.2.15.3. SWOT Analysis

- 12.2.15.4. Recent Developments

- 12.2.15.5. Financials (Based on Availability)

- 12.2.1 Toyobo Co Limited

List of Figures

- Figure 1: Global Biologics CDMO Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Biologics CDMO Market Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Biologics CDMO Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Biologics CDMO Market Revenue (Million), by Product Type 2025 & 2033

- Figure 5: North America Biologics CDMO Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: North America Biologics CDMO Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Biologics CDMO Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Biologics CDMO Market Revenue (Million), by Type 2025 & 2033

- Figure 9: Europe Biologics CDMO Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Biologics CDMO Market Revenue (Million), by Product Type 2025 & 2033

- Figure 11: Europe Biologics CDMO Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: Europe Biologics CDMO Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Biologics CDMO Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Biologics CDMO Market Revenue (Million), by Type 2025 & 2033

- Figure 15: Asia Biologics CDMO Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Biologics CDMO Market Revenue (Million), by Product Type 2025 & 2033

- Figure 17: Asia Biologics CDMO Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 18: Asia Biologics CDMO Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Biologics CDMO Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Australia and New Zealand Biologics CDMO Market Revenue (Million), by Type 2025 & 2033

- Figure 21: Australia and New Zealand Biologics CDMO Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Australia and New Zealand Biologics CDMO Market Revenue (Million), by Product Type 2025 & 2033

- Figure 23: Australia and New Zealand Biologics CDMO Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 24: Australia and New Zealand Biologics CDMO Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Australia and New Zealand Biologics CDMO Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Biologics CDMO Market Revenue (Million), by Type 2025 & 2033

- Figure 27: Latin America Biologics CDMO Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Latin America Biologics CDMO Market Revenue (Million), by Product Type 2025 & 2033

- Figure 29: Latin America Biologics CDMO Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 30: Latin America Biologics CDMO Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Latin America Biologics CDMO Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East and Africa Biologics CDMO Market Revenue (Million), by Type 2025 & 2033

- Figure 33: Middle East and Africa Biologics CDMO Market Revenue Share (%), by Type 2025 & 2033

- Figure 34: Middle East and Africa Biologics CDMO Market Revenue (Million), by Product Type 2025 & 2033

- Figure 35: Middle East and Africa Biologics CDMO Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 36: Middle East and Africa Biologics CDMO Market Revenue (Million), by Country 2025 & 2033

- Figure 37: Middle East and Africa Biologics CDMO Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Biologics CDMO Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Biologics CDMO Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 3: Global Biologics CDMO Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Biologics CDMO Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global Biologics CDMO Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 6: Global Biologics CDMO Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Biologics CDMO Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Global Biologics CDMO Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 9: Global Biologics CDMO Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Biologics CDMO Market Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Global Biologics CDMO Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 12: Global Biologics CDMO Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Biologics CDMO Market Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Global Biologics CDMO Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 15: Global Biologics CDMO Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Biologics CDMO Market Revenue Million Forecast, by Type 2020 & 2033

- Table 17: Global Biologics CDMO Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 18: Global Biologics CDMO Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Global Biologics CDMO Market Revenue Million Forecast, by Type 2020 & 2033

- Table 20: Global Biologics CDMO Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 21: Global Biologics CDMO Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Biologics CDMO Market?

The projected CAGR is approximately 12.78%.

2. Which companies are prominent players in the Biologics CDMO Market?

Key companies in the market include Toyobo Co Limited, AGC Biologics, Lonza Group, Binex Co Limited, Rentschler Biotechnologies, Wuxi Biologics, AbbVie Contract Manufacturing*List Not Exhaustive, Parexel International Corporation, Sandoz Biopharmaceuticals (Novartis AG), Catalent Inc, JRS Pharma, Fujifilm Diosynth Biotechnologies USA Inc, Samsung Biologics, Boehringer Ingelheim Group, Icon PLC.

3. What are the main segments of the Biologics CDMO Market?

The market segments include Type, Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 15.32 Million as of 2022.

5. What are some drivers contributing to market growth?

Access to New Technologies and Higher Speed of Execution Realized by CDMOs; Need for High Capital Investments to Develop Capabilities Has Led to Firms Choosing the Outsourcing Model; Lack of In-house Capacity among Emerging Drug Development Companies.

6. What are the notable trends driving market growth?

CDMOs’ Access to New Technologies and Higher Speed of Execution Driving Market Growth.

7. Are there any restraints impacting market growth?

Presence of Alternative Printing Technology.

8. Can you provide examples of recent developments in the market?

April 2022 - FUJIFILM Corporation announced that it had completed the acquisition of a dedicated cell therapy manufacturing facility from Atara Biotherapeutics Inc. The facility, located in Thousand Oaks, California, will be operated as part of FUJIFILM DiosynthBiotechnologies' global network, a subsidiary of FUJIFILM Corporation and a world-leading contract development and manufacturing organization (CDMO).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Biologics CDMO Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Biologics CDMO Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Biologics CDMO Market?

To stay informed about further developments, trends, and reports in the Biologics CDMO Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence