Key Insights

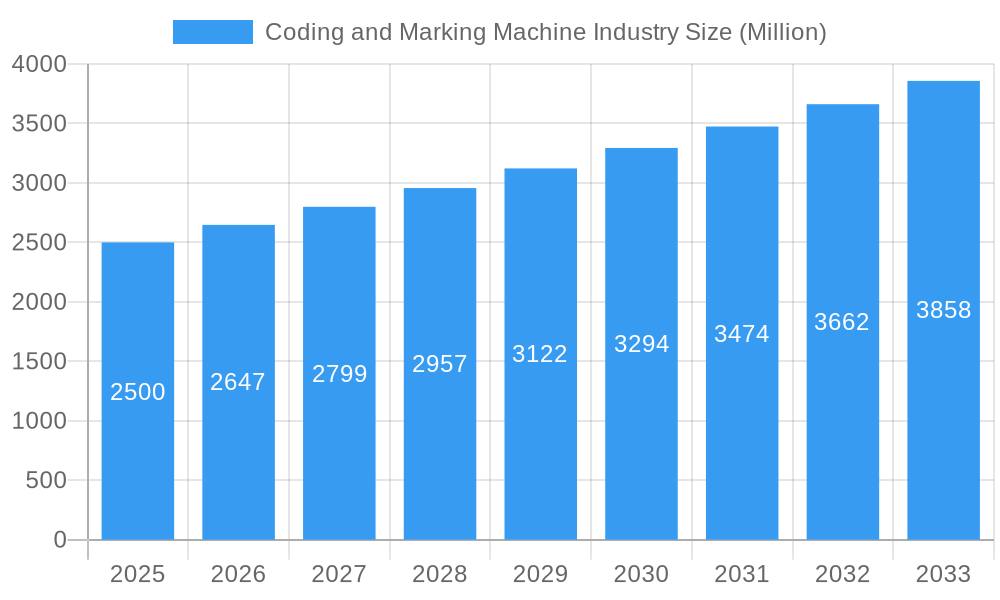

The global coding and marking machine market is experiencing robust growth, driven by increasing automation across diverse industries and stringent regulatory requirements for product traceability. The market, valued at approximately $XX million in 2025 (assuming a logical estimation based on the provided CAGR and a reasonable starting point for 2019), is projected to maintain a Compound Annual Growth Rate (CAGR) of 5.64% from 2025 to 2033. This expansion is fueled by several key factors. The pharmaceutical and food and beverage sectors are leading adopters, driven by the need for accurate and tamper-evident product labeling to ensure consumer safety and compliance with traceability regulations. Growth in e-commerce and rising demand for personalized products further contribute to market expansion. The adoption of advanced technologies like thermal inkjet (TIJ) and continuous inkjet (CIJ) printing, offering high-speed and high-resolution marking capabilities, is also a significant driver. Furthermore, the increasing integration of coding and marking systems with other manufacturing technologies, enabling seamless data management and traceability throughout the supply chain, is bolstering market growth.

Coding and Marking Machine Industry Market Size (In Billion)

Despite the positive outlook, market growth faces some challenges. The high initial investment costs associated with sophisticated coding and marking equipment can be a barrier for small and medium-sized enterprises (SMEs). Furthermore, the need for skilled personnel to operate and maintain these systems might limit adoption in regions with limited technical expertise. However, the long-term benefits of improved efficiency, reduced errors, and enhanced product traceability are likely to outweigh these challenges. The market segmentation reveals strong demand across various end-user industries, with pharmaceutical and food and beverage leading the way, followed by construction and cosmetics. Within the solution segment, equipment and fluids/ribbons dominate, indicating a significant market for both hardware and consumables. The competitive landscape comprises both established players and emerging companies, fostering innovation and technological advancements. This dynamic mix is expected to continue driving market growth in the coming years.

Coding and Marking Machine Industry Company Market Share

Coding and Marking Machine Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Coding and Marking Machine industry, encompassing market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook. The report covers the period 2019-2033, with a focus on the forecast period 2025-2033 and a base year of 2025. The market is segmented by end-user industry (Pharmaceutical, Construction, Food and Beverage, Cosmetics, Others), solution (Equipment, Fluids and Ribbons, Spares), and equipment type (Thermal Inkjet (TIJ) Printer, Continuous Inkjet (CIJ) Printer, Laser Printer, Others). The global market size is projected to reach xx Million units by 2033.

Coding and Marking Machine Industry Market Dynamics & Structure

The Coding and Marking Machine industry is characterized by moderate concentration, with key players such as Keyence Corporation, Leibinger Group, REA Elektronik GmbH, Hitachi Ltd, Domino Printing Sciences plc, Koenig & Bauer Coding GmbH, Danaher Corporation, Dover Corporation, Control Print Ltd, and Matthews International Corporation holding significant market share. However, the presence of numerous smaller players fosters competition.

Technological innovation, particularly in inkjet and laser technologies, is a crucial driver. Stringent regulatory frameworks concerning product traceability and labeling in various industries significantly influence market demand. The industry faces competition from alternative marking methods, albeit limited. Consolidation through mergers and acquisitions (M&A) is a notable trend, with xx M&A deals recorded between 2019 and 2024, resulting in a xx% increase in market concentration.

- Market Concentration: Moderately concentrated, with top 10 players holding approximately xx% market share in 2024.

- Innovation Drivers: Advancements in inkjet, laser, and other printing technologies; increasing demand for high-resolution coding and traceability.

- Regulatory Framework: Stringent regulations related to product traceability and labeling in industries like pharmaceuticals and food & beverage drive market growth.

- Competitive Substitutes: Limited substitutes, mainly traditional labeling methods; however, digital printing technologies pose a potential threat.

- M&A Trends: Increasing consolidation through mergers and acquisitions, leading to enhanced market share for larger players.

- Innovation Barriers: High R&D costs, stringent regulatory approvals, and the need for specialized expertise.

Coding and Marking Machine Industry Growth Trends & Insights

The Coding and Marking Machine market experienced robust growth during the historical period (2019-2024), with a CAGR of xx%. This growth is attributed to several factors, including the increasing adoption of automated packaging and labeling systems across various industries, the growing need for enhanced product traceability and supply chain visibility, and the rising demand for high-quality coding and marking solutions. Technological advancements, such as the introduction of high-speed, high-resolution printers, have further fueled market expansion. The market is expected to continue its growth trajectory during the forecast period (2025-2033), driven by increasing adoption in emerging economies and the growing preference for advanced coding technologies. Consumer behavior shifts towards increased brand awareness and product authenticity are also boosting demand. The market penetration rate is expected to reach xx% by 2033.

- Market Size Evolution: Steady growth from xx Million units in 2019 to xx Million units in 2024, projected to reach xx Million units by 2033.

- Adoption Rates: High adoption rates in developed regions, with increasing penetration in developing markets.

- Technological Disruptions: Continuous inkjet (CIJ), thermal inkjet (TIJ), and laser technologies are driving market innovation.

- Consumer Behavior Shifts: Growing preference for high-quality, traceable products is boosting demand.

Dominant Regions, Countries, or Segments in Coding and Marking Machine Industry

North America and Europe currently dominate the Coding and Marking Machine market, driven by strong regulatory frameworks, high adoption rates, and established industrial infrastructure. However, Asia-Pacific is expected to witness significant growth during the forecast period, fueled by rapid industrialization and rising demand from emerging economies like China and India. Within the segments, the Food and Beverage industry holds the largest market share, followed by Pharmaceuticals and Cosmetics. Equipment constitutes the largest segment by solution type, with CIJ printers being the most widely adopted equipment.

- Key Drivers by Region:

- North America: Stringent regulatory compliance, high adoption rates in developed industries.

- Europe: Similar to North America, with emphasis on advanced technologies.

- Asia-Pacific: Rapid industrialization, growing consumer base, increasing demand from emerging markets.

- Key Drivers by Segment:

- Food & Beverage: Stringent food safety regulations and demand for enhanced product traceability.

- Pharmaceuticals: Strict regulations requiring detailed product information and traceability for drug safety.

- Equipment (By Solution): High demand for advanced and reliable coding and marking equipment.

- CIJ Printers (By Equipment): Wide applicability and cost-effectiveness across various industries.

Coding and Marking Machine Industry Product Landscape

The Coding and Marking Machine industry offers a diverse range of products, including continuous inkjet (CIJ), thermal inkjet (TIJ), and laser printers, catering to varied industrial needs. Recent innovations focus on enhanced print quality, increased speed, reduced maintenance, and improved traceability features. Manufacturers highlight unique selling propositions such as high-resolution printing, user-friendly interfaces, and robust designs. Technological advancements, particularly in inkjet technology and laser coding, are driving the development of more efficient and versatile solutions.

Key Drivers, Barriers & Challenges in Coding and Marking Machine Industry

Key Drivers: Stringent regulatory requirements for product traceability, increasing demand for automated packaging solutions, technological advancements in printing technologies, and the growing need for efficient and cost-effective coding solutions.

Challenges: High initial investment costs, complex integration with existing production lines, stringent regulatory compliance requirements, and intense competition among numerous players, leading to price pressures. Supply chain disruptions due to global events have also impacted availability and cost.

Emerging Opportunities in Coding and Marking Machine Industry

Untapped markets in developing economies present significant growth opportunities. The rising demand for customized coding solutions and the integration of advanced technologies like AI and IoT into coding and marking systems offer further potential. Expanding into new applications, such as the coding of electronics and medical devices, provides additional avenues for market expansion.

Growth Accelerators in the Coding and Marking Machine Industry

Technological advancements in high-resolution printing, increased speed, and user-friendly interfaces will fuel market growth. Strategic partnerships and collaborations between coding machine manufacturers and end-users will facilitate wider adoption. Expansion into new and emerging markets with favorable regulatory environments will significantly drive market expansion in the coming years.

Key Players Shaping the Coding and Marking Machine Market

- Keyence Corporation

- Leibinger Group

- REA Elektronik GmbH

- Hitachi Ltd

- Domino Printing Sciences plc

- Koenig & Bauer Coding GmbH

- Danaher Corporation

- Dover Corporation

- Control Print Ltd

- Matthews International Corporation

Notable Milestones in Coding and Marking Machine Industry Sector

- September 2021: Linx Printing Technologies launches the Linx SL3 laser coder, offering versatile coding options and customizable user interfaces.

- May 2022: Markem-Imaje (Dover Corporation) launches the 9750 continuous inkjet printer, enabling robust traceability coding on various packaging types.

In-Depth Coding and Marking Machine Industry Market Outlook

The Coding and Marking Machine industry is poised for continued growth, driven by technological advancements, increasing regulatory compliance requirements, and expanding applications across various industries. Strategic partnerships and market expansion into emerging economies will further contribute to market expansion. The focus on enhancing traceability and supply chain visibility will remain a key driver for long-term growth and sustained market potential.

Coding and Marking Machine Industry Segmentation

-

1. Solution

- 1.1. Equipment

- 1.2. Fluids and Ribbons

- 1.3. Spares

-

2. Equipment

- 2.1. Thermal Inkjet (TIJ) Printer

- 2.2. Continuous Inkjet (CIJ) Printer

- 2.3. Laser Printer

- 2.4. Others

-

3. End-user Industry

- 3.1. Pharmaceutical

- 3.2. Construction

- 3.3. Food and Beverage

- 3.4. Cosmetics

- 3.5. Others

Coding and Marking Machine Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Coding and Marking Machine Industry Regional Market Share

Geographic Coverage of Coding and Marking Machine Industry

Coding and Marking Machine Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.64% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Expansion of the production and packaging industry and increasing adoption of creative packaging techniques; Increasing demand for product traceability solutions across supply chain of various industries

- 3.3. Market Restrains

- 3.3.1. High upfront and operational cost for deploying coding and making equipment

- 3.4. Market Trends

- 3.4.1. Food and Beverage Industry is Analyzed To Hold Highest Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Coding and Marking Machine Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Solution

- 5.1.1. Equipment

- 5.1.2. Fluids and Ribbons

- 5.1.3. Spares

- 5.2. Market Analysis, Insights and Forecast - by Equipment

- 5.2.1. Thermal Inkjet (TIJ) Printer

- 5.2.2. Continuous Inkjet (CIJ) Printer

- 5.2.3. Laser Printer

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Pharmaceutical

- 5.3.2. Construction

- 5.3.3. Food and Beverage

- 5.3.4. Cosmetics

- 5.3.5. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Solution

- 6. North America Coding and Marking Machine Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Solution

- 6.1.1. Equipment

- 6.1.2. Fluids and Ribbons

- 6.1.3. Spares

- 6.2. Market Analysis, Insights and Forecast - by Equipment

- 6.2.1. Thermal Inkjet (TIJ) Printer

- 6.2.2. Continuous Inkjet (CIJ) Printer

- 6.2.3. Laser Printer

- 6.2.4. Others

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Pharmaceutical

- 6.3.2. Construction

- 6.3.3. Food and Beverage

- 6.3.4. Cosmetics

- 6.3.5. Others

- 6.1. Market Analysis, Insights and Forecast - by Solution

- 7. Europe Coding and Marking Machine Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Solution

- 7.1.1. Equipment

- 7.1.2. Fluids and Ribbons

- 7.1.3. Spares

- 7.2. Market Analysis, Insights and Forecast - by Equipment

- 7.2.1. Thermal Inkjet (TIJ) Printer

- 7.2.2. Continuous Inkjet (CIJ) Printer

- 7.2.3. Laser Printer

- 7.2.4. Others

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Pharmaceutical

- 7.3.2. Construction

- 7.3.3. Food and Beverage

- 7.3.4. Cosmetics

- 7.3.5. Others

- 7.1. Market Analysis, Insights and Forecast - by Solution

- 8. Asia Pacific Coding and Marking Machine Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Solution

- 8.1.1. Equipment

- 8.1.2. Fluids and Ribbons

- 8.1.3. Spares

- 8.2. Market Analysis, Insights and Forecast - by Equipment

- 8.2.1. Thermal Inkjet (TIJ) Printer

- 8.2.2. Continuous Inkjet (CIJ) Printer

- 8.2.3. Laser Printer

- 8.2.4. Others

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Pharmaceutical

- 8.3.2. Construction

- 8.3.3. Food and Beverage

- 8.3.4. Cosmetics

- 8.3.5. Others

- 8.1. Market Analysis, Insights and Forecast - by Solution

- 9. Latin America Coding and Marking Machine Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Solution

- 9.1.1. Equipment

- 9.1.2. Fluids and Ribbons

- 9.1.3. Spares

- 9.2. Market Analysis, Insights and Forecast - by Equipment

- 9.2.1. Thermal Inkjet (TIJ) Printer

- 9.2.2. Continuous Inkjet (CIJ) Printer

- 9.2.3. Laser Printer

- 9.2.4. Others

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Pharmaceutical

- 9.3.2. Construction

- 9.3.3. Food and Beverage

- 9.3.4. Cosmetics

- 9.3.5. Others

- 9.1. Market Analysis, Insights and Forecast - by Solution

- 10. Middle East and Africa Coding and Marking Machine Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Solution

- 10.1.1. Equipment

- 10.1.2. Fluids and Ribbons

- 10.1.3. Spares

- 10.2. Market Analysis, Insights and Forecast - by Equipment

- 10.2.1. Thermal Inkjet (TIJ) Printer

- 10.2.2. Continuous Inkjet (CIJ) Printer

- 10.2.3. Laser Printer

- 10.2.4. Others

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Pharmaceutical

- 10.3.2. Construction

- 10.3.3. Food and Beverage

- 10.3.4. Cosmetics

- 10.3.5. Others

- 10.1. Market Analysis, Insights and Forecast - by Solution

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Keyence Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Leibinger Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 REA Elektronik GmbH

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Hitachi Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Domino Printing Sciences plc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Koenig & Bauer Coding GmbH*List Not Exhaustive

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Danaher Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Dover Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Control Print Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Matthews International Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Keyence Corporation

List of Figures

- Figure 1: Global Coding and Marking Machine Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Coding and Marking Machine Industry Revenue (Million), by Solution 2025 & 2033

- Figure 3: North America Coding and Marking Machine Industry Revenue Share (%), by Solution 2025 & 2033

- Figure 4: North America Coding and Marking Machine Industry Revenue (Million), by Equipment 2025 & 2033

- Figure 5: North America Coding and Marking Machine Industry Revenue Share (%), by Equipment 2025 & 2033

- Figure 6: North America Coding and Marking Machine Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 7: North America Coding and Marking Machine Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: North America Coding and Marking Machine Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Coding and Marking Machine Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Coding and Marking Machine Industry Revenue (Million), by Solution 2025 & 2033

- Figure 11: Europe Coding and Marking Machine Industry Revenue Share (%), by Solution 2025 & 2033

- Figure 12: Europe Coding and Marking Machine Industry Revenue (Million), by Equipment 2025 & 2033

- Figure 13: Europe Coding and Marking Machine Industry Revenue Share (%), by Equipment 2025 & 2033

- Figure 14: Europe Coding and Marking Machine Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 15: Europe Coding and Marking Machine Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: Europe Coding and Marking Machine Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Coding and Marking Machine Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Coding and Marking Machine Industry Revenue (Million), by Solution 2025 & 2033

- Figure 19: Asia Pacific Coding and Marking Machine Industry Revenue Share (%), by Solution 2025 & 2033

- Figure 20: Asia Pacific Coding and Marking Machine Industry Revenue (Million), by Equipment 2025 & 2033

- Figure 21: Asia Pacific Coding and Marking Machine Industry Revenue Share (%), by Equipment 2025 & 2033

- Figure 22: Asia Pacific Coding and Marking Machine Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: Asia Pacific Coding and Marking Machine Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Asia Pacific Coding and Marking Machine Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Coding and Marking Machine Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Coding and Marking Machine Industry Revenue (Million), by Solution 2025 & 2033

- Figure 27: Latin America Coding and Marking Machine Industry Revenue Share (%), by Solution 2025 & 2033

- Figure 28: Latin America Coding and Marking Machine Industry Revenue (Million), by Equipment 2025 & 2033

- Figure 29: Latin America Coding and Marking Machine Industry Revenue Share (%), by Equipment 2025 & 2033

- Figure 30: Latin America Coding and Marking Machine Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 31: Latin America Coding and Marking Machine Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 32: Latin America Coding and Marking Machine Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: Latin America Coding and Marking Machine Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Coding and Marking Machine Industry Revenue (Million), by Solution 2025 & 2033

- Figure 35: Middle East and Africa Coding and Marking Machine Industry Revenue Share (%), by Solution 2025 & 2033

- Figure 36: Middle East and Africa Coding and Marking Machine Industry Revenue (Million), by Equipment 2025 & 2033

- Figure 37: Middle East and Africa Coding and Marking Machine Industry Revenue Share (%), by Equipment 2025 & 2033

- Figure 38: Middle East and Africa Coding and Marking Machine Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 39: Middle East and Africa Coding and Marking Machine Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 40: Middle East and Africa Coding and Marking Machine Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Coding and Marking Machine Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Coding and Marking Machine Industry Revenue Million Forecast, by Solution 2020 & 2033

- Table 2: Global Coding and Marking Machine Industry Revenue Million Forecast, by Equipment 2020 & 2033

- Table 3: Global Coding and Marking Machine Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Global Coding and Marking Machine Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Coding and Marking Machine Industry Revenue Million Forecast, by Solution 2020 & 2033

- Table 6: Global Coding and Marking Machine Industry Revenue Million Forecast, by Equipment 2020 & 2033

- Table 7: Global Coding and Marking Machine Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 8: Global Coding and Marking Machine Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Coding and Marking Machine Industry Revenue Million Forecast, by Solution 2020 & 2033

- Table 10: Global Coding and Marking Machine Industry Revenue Million Forecast, by Equipment 2020 & 2033

- Table 11: Global Coding and Marking Machine Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 12: Global Coding and Marking Machine Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Coding and Marking Machine Industry Revenue Million Forecast, by Solution 2020 & 2033

- Table 14: Global Coding and Marking Machine Industry Revenue Million Forecast, by Equipment 2020 & 2033

- Table 15: Global Coding and Marking Machine Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 16: Global Coding and Marking Machine Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Global Coding and Marking Machine Industry Revenue Million Forecast, by Solution 2020 & 2033

- Table 18: Global Coding and Marking Machine Industry Revenue Million Forecast, by Equipment 2020 & 2033

- Table 19: Global Coding and Marking Machine Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 20: Global Coding and Marking Machine Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Global Coding and Marking Machine Industry Revenue Million Forecast, by Solution 2020 & 2033

- Table 22: Global Coding and Marking Machine Industry Revenue Million Forecast, by Equipment 2020 & 2033

- Table 23: Global Coding and Marking Machine Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 24: Global Coding and Marking Machine Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Coding and Marking Machine Industry?

The projected CAGR is approximately 5.64%.

2. Which companies are prominent players in the Coding and Marking Machine Industry?

Key companies in the market include Keyence Corporation, Leibinger Group, REA Elektronik GmbH, Hitachi Ltd, Domino Printing Sciences plc, Koenig & Bauer Coding GmbH*List Not Exhaustive, Danaher Corporation, Dover Corporation, Control Print Ltd, Matthews International Corporation.

3. What are the main segments of the Coding and Marking Machine Industry?

The market segments include Solution, Equipment, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Expansion of the production and packaging industry and increasing adoption of creative packaging techniques; Increasing demand for product traceability solutions across supply chain of various industries.

6. What are the notable trends driving market growth?

Food and Beverage Industry is Analyzed To Hold Highest Share.

7. Are there any restraints impacting market growth?

High upfront and operational cost for deploying coding and making equipment.

8. Can you provide examples of recent developments in the market?

May 2022- Markem-Imaje, a subsidiary of Dover and a global provider of end-to-end supply chain solutions and industrial marking and coding systems, has announced the launch of the 9750 continuous inkjet printer. The 9750 is the first of a new generation of printers that can print robust traceability coding on a wide range of packaging, including up to five-line text messages, logos, and high-resolution 1D and 2D codes.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Coding and Marking Machine Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Coding and Marking Machine Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Coding and Marking Machine Industry?

To stay informed about further developments, trends, and reports in the Coding and Marking Machine Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence