Key Insights

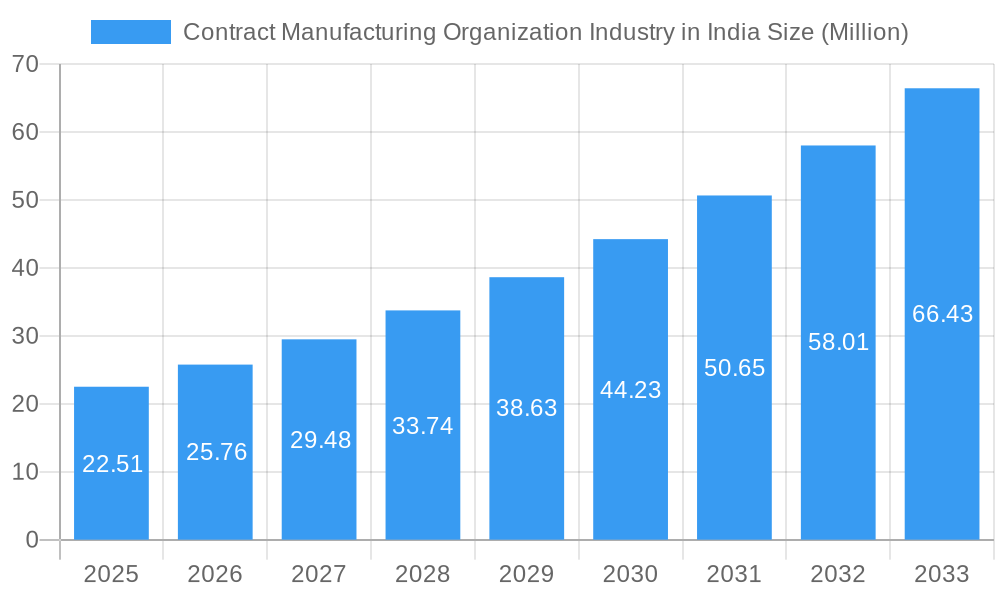

The Indian Contract Manufacturing Organization (CMO) industry is experiencing robust growth, projected to reach \$22.51 million in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 14.67% from 2025 to 2033. This expansion is driven by several factors. Firstly, the increasing demand for pharmaceutical products both domestically and globally fuels the need for efficient and cost-effective manufacturing solutions that CMOs provide. Secondly, a growing number of pharmaceutical companies are outsourcing their manufacturing processes to focus on research and development, leading to increased reliance on CMOs. Thirdly, the Indian government's initiatives to promote the pharmaceutical sector, including tax benefits and streamlined regulations, are creating a favorable environment for the industry's growth. The industry is segmented by service type, with API and intermediates and finished dosage forms being the primary segments. Prominent players such as Akums Drugs, Cipla, and Dr. Reddy's Laboratories contribute significantly to the market's competitiveness, leveraging their established infrastructure and expertise. Regional variations exist, with North, South, East, and West India contributing to the overall market size, though specific regional data is unavailable. The robust growth trajectory is expected to continue due to the ongoing expansion of the pharmaceutical sector, increasing outsourcing trends, and supportive government policies.

Contract Manufacturing Organization Industry in India Market Size (In Million)

The forecast period (2025-2033) anticipates sustained growth, with the market likely exceeding \$80 million by 2033 based on the projected CAGR. However, potential restraints include fluctuations in raw material prices, stringent regulatory compliance requirements, and competition from established global CMOs. To mitigate these challenges, Indian CMOs are increasingly investing in advanced technologies, focusing on quality control, and expanding their service offerings to cater to evolving market demands. The strategic partnerships between Indian CMOs and international pharmaceutical companies further contribute to the industry's growth and global competitiveness. The sector shows significant potential for further expansion, particularly with increased investment in innovative manufacturing processes and enhanced regulatory compliance.

Contract Manufacturing Organization Industry in India Company Market Share

Contract Manufacturing Organization (CMO) Industry in India: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Contract Manufacturing Organization (CMO) industry in India, encompassing market dynamics, growth trends, dominant segments, key players, and future outlook. The report covers the period 2019-2033, with a focus on the estimated year 2025 and a forecast period of 2025-2033. The parent market is the Pharmaceutical Industry in India, and the child market is the CMO segment within it. This report offers invaluable insights for industry professionals, investors, and stakeholders seeking to understand and capitalize on opportunities within this rapidly evolving sector. The Indian CMO market is projected to reach xx Million units by 2033.

Contract Manufacturing Organization Industry in India Market Dynamics & Structure

The Indian CMO industry is characterized by a moderately fragmented market structure, with a few large players and numerous smaller companies. Market concentration is expected to increase slightly due to mergers and acquisitions (M&A) activity. Technological innovation, particularly in areas like advanced drug delivery systems and biologics manufacturing, is a key driver of growth. Stringent regulatory frameworks, including those from the Drug Controller General of India (DCGI), significantly influence operational strategies. Generic drugs present strong competitive pressure, while the increasing demand for specialized pharmaceuticals presents opportunities for CMOs. The end-user demographics are diverse, encompassing domestic and international pharmaceutical companies.

- Market Concentration: Moderately fragmented, with increasing consolidation. Top 5 players hold approximately xx% market share (2024).

- Technological Innovation: Focus on advanced drug delivery systems, biologics, and personalized medicines. Barriers include high capital investment and skilled labor shortages.

- Regulatory Framework: Stringent regulations from DCGI influence manufacturing processes and compliance costs.

- Competitive Substitutes: Generic drug manufacturing, in-house production by large pharmaceutical firms.

- M&A Trends: Increasing consolidation, driven by economies of scale and expansion into new therapeutic areas. Approximate xx M&A deals annually (2022-2024).

- End-User Demographics: Domestic and international pharmaceutical companies, diverse therapeutic areas.

Contract Manufacturing Organization Industry in India Growth Trends & Insights

The Indian CMO market has witnessed significant growth over the past few years, driven by factors such as increasing demand for pharmaceuticals, favorable government policies, and cost advantages compared to other regions. The adoption rate of CMO services is increasing among both large and small pharmaceutical companies, as outsourcing offers flexibility and cost efficiencies. Technological disruptions, such as the rise of automation and AI-driven manufacturing, are further impacting the market. Consumer behavior shifts towards newer therapies are also driving demand for specialized CMO services.

The market size is projected to expand at a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching xx Million units by 2033 from xx Million units in 2024. Market penetration is expected to increase as more pharmaceutical companies opt for outsourcing strategies. This growth is supported by the rising demand for generic and specialized drugs, coupled with increasing investments in R&D and manufacturing capacity within the Indian pharmaceutical sector.

Dominant Regions, Countries, or Segments in Contract Manufacturing Organization Industry in India

While the CMO industry in India operates nationwide, certain regions and segments exhibit higher growth potential. The Finished Dose segment is currently experiencing faster growth than API and Intermediates, driven by increasing demand for ready-to-market formulations. Gujarat, Maharashtra, and Andhra Pradesh are key manufacturing hubs due to robust infrastructure, skilled labor, and supportive government policies.

- Key Drivers:

- Gujarat: Strong presence of pharmaceutical companies, established infrastructure, government incentives.

- Maharashtra: Large consumer base, established industrial ecosystem, and access to skilled labor.

- Andhra Pradesh: Focus on API manufacturing, lower labor costs, and government initiatives supporting growth.

- Finished Dose Segment: Higher value-added services, higher margins, and increasing demand for ready-to-market formulations.

Contract Manufacturing Organization Industry in India Product Landscape

The Indian CMO industry offers a diverse range of services, including API and intermediates manufacturing, formulation development, and packaging. Recent innovations include advanced drug delivery systems (like liposomes and nanoparticles), personalized medicine solutions, and sterile injectable formulations. These innovations enhance product efficacy, bioavailability, and patient compliance. Many CMOs focus on offering unique selling propositions, such as faster turnaround times, cost competitiveness, and compliance with stringent international quality standards.

Key Drivers, Barriers & Challenges in Contract Manufacturing Organization Industry in India

Key Drivers:

- Cost advantages: Lower manufacturing costs compared to other regions.

- Government support: Incentives and policies supporting pharmaceutical manufacturing.

- Skilled workforce: Availability of skilled labor in pharmaceutical manufacturing.

- Growing domestic market: Increase in demand for pharmaceuticals within India.

Key Challenges:

- Regulatory hurdles: Complex regulatory procedures and compliance requirements.

- Supply chain disruptions: Global supply chain vulnerabilities affecting raw material availability and cost.

- Competition: Intense competition from both domestic and international CMOs. This leads to price pressure and the need for continuous innovation.

- Infrastructure gaps: Uneven infrastructure development across different regions may limit expansion potential.

Emerging Opportunities in Contract Manufacturing Organization Industry in India

Emerging opportunities lie in specialized drug manufacturing, such as biologics and cell therapies, personalized medicine, and advanced drug delivery systems. Untapped markets include niche therapeutic areas with unmet medical needs. The growing demand for contract development and manufacturing services (CDMOs) represents a significant opportunity for expanding into higher value-added services.

Growth Accelerators in the Contract Manufacturing Organization Industry in India Industry

Technological advancements such as automation, artificial intelligence, and data analytics are set to propel growth. Strategic partnerships between CMOs and pharmaceutical companies will lead to streamlined manufacturing processes and faster product launches. Expanding into new therapeutic areas and geographical markets, as well as diversifying service offerings will further accelerate growth.

Key Players Shaping the Contract Manufacturing Organization Industry in India Market

- Akums Drugs and Pharmaceuticals Limited

- Rhydburg Pharmaceuticals Ltd

- MSN Laboratories Pvt Ltd

- BDR Pharmaceuticals International

- Eisai Pharmaceuticals India Pvt Ltd

- Ciron Drugs & Pharmaceuticals Pvt Ltd

- Wockhardt Limited

- Cipla Ltd

- Delwis Healthcare Pvt Ltd

- Unichem Laboratories Ltd

- Dr Reddy's Laboratories

- Theon Pharmaceuticals Limited

- Viatris Inc (Mylan Laboratories Ltd)

- Maxheal Pharmaceuticals India Ltd

- Medipaams India Pvt Ltd

- AMRI India Pvt Ltd

- Cadila Healthcare Limited

Notable Milestones in Contract Manufacturing Organization Industry in India Sector

- June 2022: Glenmark Pharmaceuticals launches Indamet, a cutting-edge fixed-dose combination medication for asthma.

- May 2022: Sun Pharma announces the launch of Bempedoic Acid (Brillo), a first-in-class oral drug for reducing LDL cholesterol.

- March 2022: Themis Medicare Ltd. receives DCGI approval for its antiviral medication, VIRALEX, for treating mild to moderate Covid-19.

In-Depth Contract Manufacturing Organization Industry in India Market Outlook

The Indian CMO industry is poised for robust growth, fueled by technological innovation, increasing outsourcing trends, and a growing domestic pharmaceutical market. Strategic partnerships, expansion into high-growth therapeutic areas, and investments in advanced manufacturing technologies will shape future market dynamics. The market's future potential is significant, presenting lucrative opportunities for both established and emerging players.

Contract Manufacturing Organization Industry in India Segmentation

-

1. Service Type

- 1.1. API and Intermediates

-

1.2. Finished Dose

- 1.2.1. Solids

- 1.2.2. Liquids

- 1.2.3. Semi-Solids and Injectables

Contract Manufacturing Organization Industry in India Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Contract Manufacturing Organization Industry in India Regional Market Share

Geographic Coverage of Contract Manufacturing Organization Industry in India

Contract Manufacturing Organization Industry in India REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.67% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Availability of Skilled Labor at Relatively Lower Cost; Sustained increase in outsourcing volumes by big pharma companies; Geographical advantage in the form of access to large markets in the APAC region

- 3.3. Market Restrains

- 3.3.1. The existence of stringent government restrictions and a decrease in the approval of numerous small molecules and biologics in specific regions of the nation

- 3.4. Market Trends

- 3.4.1. Generic Medicine Under Solid Finished Dose Segment Holds Significant Share in The Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Contract Manufacturing Organization Industry in India Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. API and Intermediates

- 5.1.2. Finished Dose

- 5.1.2.1. Solids

- 5.1.2.2. Liquids

- 5.1.2.3. Semi-Solids and Injectables

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. North America Contract Manufacturing Organization Industry in India Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 6.1.1. API and Intermediates

- 6.1.2. Finished Dose

- 6.1.2.1. Solids

- 6.1.2.2. Liquids

- 6.1.2.3. Semi-Solids and Injectables

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 7. South America Contract Manufacturing Organization Industry in India Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 7.1.1. API and Intermediates

- 7.1.2. Finished Dose

- 7.1.2.1. Solids

- 7.1.2.2. Liquids

- 7.1.2.3. Semi-Solids and Injectables

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 8. Europe Contract Manufacturing Organization Industry in India Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 8.1.1. API and Intermediates

- 8.1.2. Finished Dose

- 8.1.2.1. Solids

- 8.1.2.2. Liquids

- 8.1.2.3. Semi-Solids and Injectables

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 9. Middle East & Africa Contract Manufacturing Organization Industry in India Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 9.1.1. API and Intermediates

- 9.1.2. Finished Dose

- 9.1.2.1. Solids

- 9.1.2.2. Liquids

- 9.1.2.3. Semi-Solids and Injectables

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 10. Asia Pacific Contract Manufacturing Organization Industry in India Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 10.1.1. API and Intermediates

- 10.1.2. Finished Dose

- 10.1.2.1. Solids

- 10.1.2.2. Liquids

- 10.1.2.3. Semi-Solids and Injectables

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Akums Drugs and Pharmaceuticals Limited

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Rhydburg Pharmaceuticals Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 MSN Laboratories Pvt Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 BDR Pharmaceuticals International

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Eisai Pharmaceuticals India Pvt Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Ciron Drugs & Pharmaceuticals Pvt Ltd*List Not Exhaustive

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Wockhardt Limited

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Cipla Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Delwis Healthcare Pvt Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Unichem Laboratories Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Dr Reddy's Laboratories

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Theon Pharmaceuticals Limited

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Viatris Inc (Mylan Laboratories Ltd)

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Maxheal Pharmaceuticals India Ltd

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Medipaams India Pvt Ltd

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 AMRI India Pvt Ltd

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 Cadila Healthcare Limited

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.1 Akums Drugs and Pharmaceuticals Limited

List of Figures

- Figure 1: Global Contract Manufacturing Organization Industry in India Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Contract Manufacturing Organization Industry in India Revenue (Million), by Service Type 2025 & 2033

- Figure 3: North America Contract Manufacturing Organization Industry in India Revenue Share (%), by Service Type 2025 & 2033

- Figure 4: North America Contract Manufacturing Organization Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Contract Manufacturing Organization Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America Contract Manufacturing Organization Industry in India Revenue (Million), by Service Type 2025 & 2033

- Figure 7: South America Contract Manufacturing Organization Industry in India Revenue Share (%), by Service Type 2025 & 2033

- Figure 8: South America Contract Manufacturing Organization Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 9: South America Contract Manufacturing Organization Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Contract Manufacturing Organization Industry in India Revenue (Million), by Service Type 2025 & 2033

- Figure 11: Europe Contract Manufacturing Organization Industry in India Revenue Share (%), by Service Type 2025 & 2033

- Figure 12: Europe Contract Manufacturing Organization Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Contract Manufacturing Organization Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa Contract Manufacturing Organization Industry in India Revenue (Million), by Service Type 2025 & 2033

- Figure 15: Middle East & Africa Contract Manufacturing Organization Industry in India Revenue Share (%), by Service Type 2025 & 2033

- Figure 16: Middle East & Africa Contract Manufacturing Organization Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 17: Middle East & Africa Contract Manufacturing Organization Industry in India Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Contract Manufacturing Organization Industry in India Revenue (Million), by Service Type 2025 & 2033

- Figure 19: Asia Pacific Contract Manufacturing Organization Industry in India Revenue Share (%), by Service Type 2025 & 2033

- Figure 20: Asia Pacific Contract Manufacturing Organization Industry in India Revenue (Million), by Country 2025 & 2033

- Figure 21: Asia Pacific Contract Manufacturing Organization Industry in India Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Contract Manufacturing Organization Industry in India Revenue Million Forecast, by Service Type 2020 & 2033

- Table 2: Global Contract Manufacturing Organization Industry in India Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Contract Manufacturing Organization Industry in India Revenue Million Forecast, by Service Type 2020 & 2033

- Table 4: Global Contract Manufacturing Organization Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Mexico Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Global Contract Manufacturing Organization Industry in India Revenue Million Forecast, by Service Type 2020 & 2033

- Table 9: Global Contract Manufacturing Organization Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Brazil Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Argentina Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Global Contract Manufacturing Organization Industry in India Revenue Million Forecast, by Service Type 2020 & 2033

- Table 14: Global Contract Manufacturing Organization Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: France Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Italy Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Spain Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Russia Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Benelux Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Nordics Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global Contract Manufacturing Organization Industry in India Revenue Million Forecast, by Service Type 2020 & 2033

- Table 25: Global Contract Manufacturing Organization Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Turkey Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Israel Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: GCC Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: North Africa Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: South Africa Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Contract Manufacturing Organization Industry in India Revenue Million Forecast, by Service Type 2020 & 2033

- Table 33: Global Contract Manufacturing Organization Industry in India Revenue Million Forecast, by Country 2020 & 2033

- Table 34: China Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: India Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Japan Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: South Korea Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: ASEAN Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Oceania Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific Contract Manufacturing Organization Industry in India Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Contract Manufacturing Organization Industry in India?

The projected CAGR is approximately 14.67%.

2. Which companies are prominent players in the Contract Manufacturing Organization Industry in India?

Key companies in the market include Akums Drugs and Pharmaceuticals Limited, Rhydburg Pharmaceuticals Ltd, MSN Laboratories Pvt Ltd, BDR Pharmaceuticals International, Eisai Pharmaceuticals India Pvt Ltd, Ciron Drugs & Pharmaceuticals Pvt Ltd*List Not Exhaustive, Wockhardt Limited, Cipla Ltd, Delwis Healthcare Pvt Ltd, Unichem Laboratories Ltd, Dr Reddy's Laboratories, Theon Pharmaceuticals Limited, Viatris Inc (Mylan Laboratories Ltd), Maxheal Pharmaceuticals India Ltd, Medipaams India Pvt Ltd, AMRI India Pvt Ltd, Cadila Healthcare Limited.

3. What are the main segments of the Contract Manufacturing Organization Industry in India?

The market segments include Service Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 22.51 Million as of 2022.

5. What are some drivers contributing to market growth?

Availability of Skilled Labor at Relatively Lower Cost; Sustained increase in outsourcing volumes by big pharma companies; Geographical advantage in the form of access to large markets in the APAC region.

6. What are the notable trends driving market growth?

Generic Medicine Under Solid Finished Dose Segment Holds Significant Share in The Market.

7. Are there any restraints impacting market growth?

The existence of stringent government restrictions and a decrease in the approval of numerous small molecules and biologics in specific regions of the nation.

8. Can you provide examples of recent developments in the market?

In June of 2022: Glenmark Pharmaceuticals introduced the cutting-edge fixed-dose combination (FDC) medication Indacaterol + Mometasone for patients with uncontrolled asthma in India. The business introduced this FDC under the name Indamet. Glenmark is the first business in India to commercialize the ground-breaking FDC of Indacaterol, a long-acting beta-agonist, and Mometasone Furoate, an inhaled corticosteroid that has been authorized by the Drug Controller General of India (DCGI),

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Contract Manufacturing Organization Industry in India," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Contract Manufacturing Organization Industry in India report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Contract Manufacturing Organization Industry in India?

To stay informed about further developments, trends, and reports in the Contract Manufacturing Organization Industry in India, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence