Key Insights

The Czech Republic's container glass market is projected for robust expansion, expected to reach $106.36 billion by 2025, driven by a Compound Annual Growth Rate (CAGR) of 8.6% through 2033. This growth is propelled by strong demand from the beverage and food sectors, significant consumers of container glass. A well-established manufacturing base and increasing consumer preference for premium, sustainable packaging solutions further support this upward trend. The rising popularity of craft beverages and specialty foods, which leverage glass for aesthetic appeal and preservation, are key growth drivers. The cosmetic and pharmaceutical industries also contribute, seeking sterile, inert, and visually appealing packaging. Glass's inherent recyclability and inert properties align with the growing emphasis on sustainable packaging, further enabling market growth.

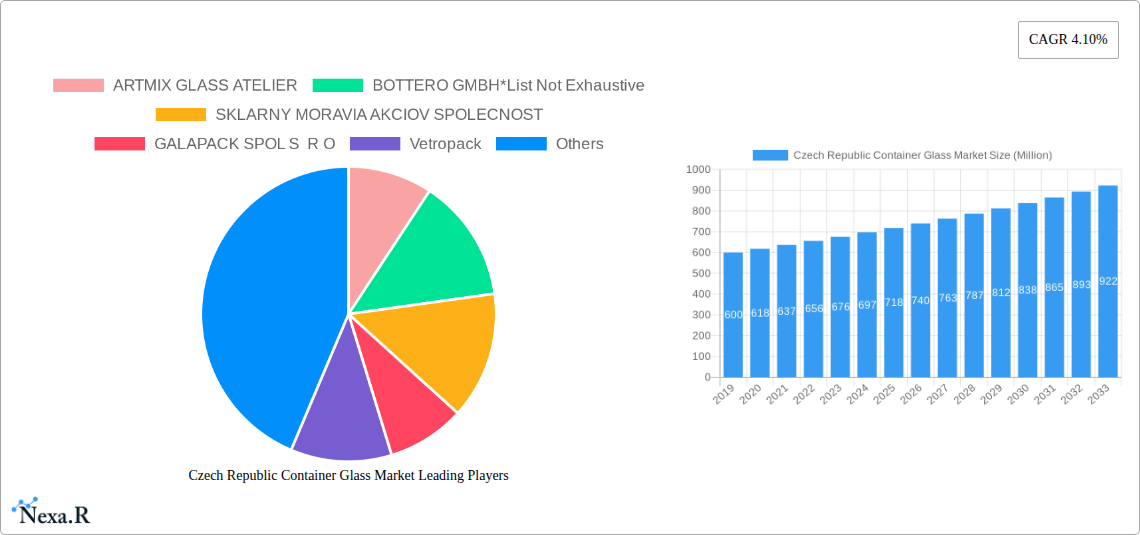

Czech Republic Container Glass Market Market Size (In Billion)

Challenges for the market include raw material price volatility, impacting production costs. Intense competition from domestic and international manufacturers, alongside the increasing adoption of alternative packaging materials like plastic and metal in specific applications, also present hurdles. Nevertheless, the Czech Republic's strategic European location, skilled workforce, and supportive industrial ecosystem are poised to foster continued market development. The forecast period anticipates market value growth, fueled by advancements in glass manufacturing technologies, such as lightweighting and enhanced strength, and the sustained emphasis on the unique branding and perceived quality offered by glass packaging, particularly in premium beverage and food segments.

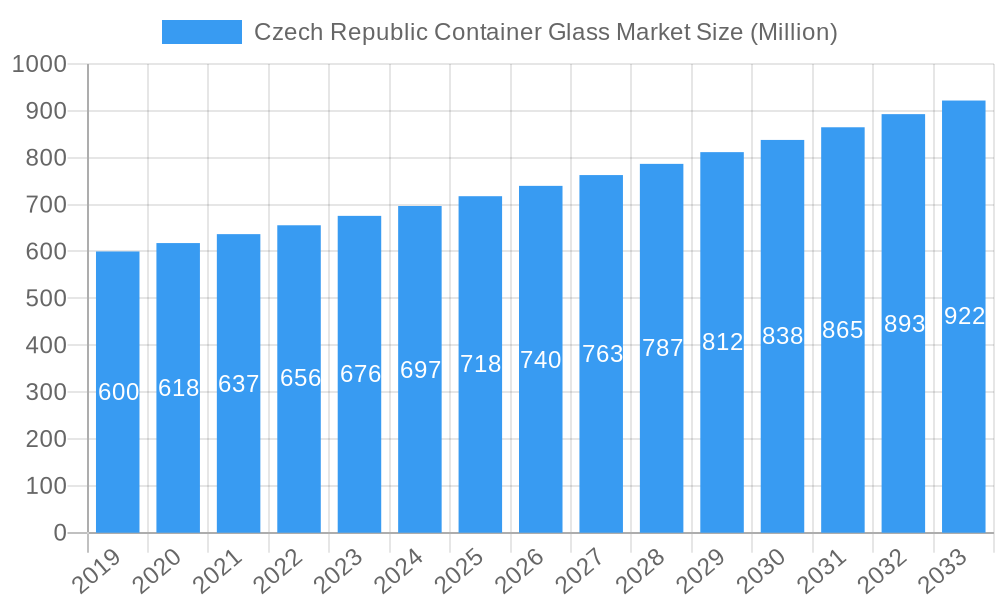

Czech Republic Container Glass Market Company Market Share

Czech Republic Container Glass Market: Comprehensive Analysis & Forecast (2019-2033)

This in-depth report provides a definitive analysis of the Czech Republic container glass market, offering a granular look at market dynamics, growth trends, key players, and future outlook. With a detailed study period spanning 2019–2033, including a base year of 2025 and a forecast period from 2025–2033, this report is indispensable for stakeholders seeking to capitalize on the evolving Czech glass packaging industry. We meticulously examine parent and child market segments, integrating high-traffic keywords like "Czech glass bottles," "container glass manufacturers Czech Republic," "beverage glass packaging," "food glass containers," and "pharmaceutical glass vials" to maximize search engine visibility and engagement. All quantitative values are presented in Million units.

Czech Republic Container Glass Market Market Dynamics & Structure

The Czech Republic container glass market is characterized by a moderate concentration, with a few key players holding significant market share. Technological innovation is primarily driven by advancements in energy efficiency, lightweighting of glass bottles, and specialized coatings for enhanced product protection. Regulatory frameworks, particularly those focusing on sustainability and circular economy initiatives, are increasingly shaping market trends. Competitive product substitutes, such as plastic and metal packaging, pose a constant challenge, necessitating continuous innovation in glass container design and functionality. End-user demographics are shifting towards a greater demand for premium, sustainable, and aesthetically pleasing packaging. Mergers and acquisitions (M&A) activity, while not rampant, plays a role in consolidating the market and expanding product portfolios. Key M&A trends observed include strategic acquisitions aimed at expanding geographical reach and enhancing manufacturing capabilities within the European container glass sector.

- Market Concentration: Moderate, with a few dominant manufacturers and a fragmented base of smaller producers.

- Technological Innovation Drivers:

- Energy-efficient manufacturing processes.

- Development of lightweight glass packaging solutions.

- Advanced coatings for barrier properties and tamper-evidence.

- Increased automation in production lines.

- Regulatory Frameworks:

- EU directives on packaging waste and recycling.

- National sustainability initiatives promoting reusable and recyclable materials.

- Food safety and pharmaceutical packaging regulations.

- Competitive Product Substitutes: Plastic bottles, aluminum cans, cartons.

- End-User Demographics: Growing preference for sustainable and premium packaging, especially in the beverage and food sectors.

- M&A Trends: Focus on vertical integration and capacity expansion.

Czech Republic Container Glass Market Growth Trends & Insights

The Czech Republic container glass market is poised for steady growth, driven by a confluence of factors including a burgeoning domestic consumption of packaged goods and robust export demand. The market size is projected to witness a healthy Compound Annual Growth Rate (CAGR) over the forecast period, reflecting increasing adoption rates of glass packaging across various end-user industries. Technological disruptions, such as the development of thinner yet stronger glass, are enhancing the competitiveness of container glass against lighter alternatives. Consumer behavior shifts are playing a pivotal role, with a growing awareness and preference for sustainable packaging solutions, positioning glass as a material of choice due to its inherent recyclability and inert nature. The Czech Republic glass packaging market is also experiencing a resurgence in demand for reusable glass bottles, fueled by eco-conscious initiatives and evolving consumer lifestyles. The market penetration of specialty glass containers for niche applications is also on an upward trajectory, contributing to overall market expansion.

- Market Size Evolution: Projected to exhibit consistent growth throughout the forecast period, driven by domestic and export markets.

- Adoption Rates: Increasing across beverage, food, and pharmaceutical sectors, with a notable rise in reusable packaging solutions.

- Technological Disruptions: Innovations in glass manufacturing enabling lighter, stronger, and more aesthetically pleasing containers.

- Consumer Behavior Shifts: Growing demand for sustainable, recyclable, and premium packaging options.

- Market Penetration: Expansion into new applications and a renewed focus on circular economy models.

- CAGR: Projected to be xx% during the forecast period (2025-2033).

- Market Penetration: Expected to reach xx% by 2033.

Dominant Regions, Countries, or Segments in Czech Republic Container Glass Market

The beverage sector stands as the dominant segment within the Czech Republic container glass market, encompassing both alcoholic and non-alcoholic beverages. This dominance is fueled by the country's strong tradition in brewing and distilling, coupled with a growing market for soft drinks and juices. The food sector follows closely, with a consistent demand for glass jars and containers for preserves, sauces, and dairy products. The pharmaceutical sector represents a critical segment, demanding high-quality, sterile glass vials and ampoules that ensure product integrity and patient safety. The cosmetics industry also contributes to market growth, with an increasing preference for glass packaging for premium skincare and fragrance products due to its perceived elegance and sustainability. Economic policies fostering industrial growth and infrastructure development in key manufacturing hubs are crucial for regional dominance. Market share within this segment is heavily influenced by the production capacity, technological sophistication, and export capabilities of Czech container glass manufacturers.

- Dominant End-User Industry: Beverage (Alcoholic, Non-Alcoholic)

- Key Drivers: Strong domestic production of beer and spirits, increasing demand for premium wines, growth in the non-alcoholic beverage market (juices, carbonated soft drinks), and consumer preference for traditional glass packaging.

- Market Share: Estimated to hold xx% of the total container glass market by 2025.

- Growth Potential: High, driven by innovation in bottle design and increasing export opportunities.

- Significant End-User Industry: Food

- Key Drivers: Demand for preserved foods, sauces, jams, baby food, and premium food products where glass offers perceived quality and freshness.

- Market Share: Estimated to hold xx% of the total container glass market by 2025.

- Growth Potential: Moderate to high, influenced by consumer trends towards healthy eating and home cooking.

- Critical End-User Industry: Pharmaceuticals

- Key Drivers: Stringent quality and safety requirements, demand for sterile vials, ampoules, and pre-filled syringes, and the inert nature of glass for drug stability.

- Market Share: Estimated to hold xx% of the total container glass market by 2025.

- Growth Potential: Stable and essential, driven by the healthcare industry's growth.

- Emerging End-User Industry: Cosmetics

- Key Drivers: Growing demand for premium and sustainable packaging for perfumes, skincare, and personal care products.

- Market Share: Estimated to hold xx% of the total container glass market by 2025.

- Growth Potential: Rising, as brands increasingly adopt glass for its aesthetic appeal and eco-credentials.

- Other End User Verticals: Including industrial chemicals and decorative items, contributing a smaller but consistent share.

Czech Republic Container Glass Market Product Landscape

The Czech Republic container glass market showcases a diverse product landscape characterized by continuous innovation in design, functionality, and sustainability. Key product innovations include the development of ultra-lightweight glass bottles that reduce material usage and transportation costs without compromising strength, alongside enhanced barrier properties for extended product shelf life. Applications range from iconic Czech beer bottles and premium spirit decanters to versatile food jars for a variety of culinary products and precision-engineered pharmaceutical glass vials for critical medicines. Performance metrics are constantly being improved, focusing on thermal shock resistance, impact strength, and aesthetic clarity. Unique selling propositions revolve around superior recyclability, inertness, and the premium perception that glass packaging imparts. Technological advancements are also enabling customization and intricate designs, catering to brand differentiation strategies.

Key Drivers, Barriers & Challenges in Czech Republic Container Glass Market

Key Drivers:

- Growing Consumer Preference for Sustainability: The inherent recyclability and reusability of glass align with increasing environmental consciousness, making it a preferred choice over single-use plastics.

- Premiumization of Products: Glass packaging conveys a sense of quality, luxury, and freshness, particularly in the beverage and food sectors.

- Technological Advancements: Innovations in glass manufacturing leading to lighter, stronger, and more aesthetically pleasing containers.

- Robust Domestic and Export Markets: Strong demand from the established Czech beverage industry and increasing export opportunities within the EU.

- Circular Economy Initiatives: Government and industry-led programs promoting reuse and recycling of glass packaging.

Barriers & Challenges:

- Competition from Lighter Packaging Materials: Plastic, aluminum, and cartons offer cost and weight advantages in certain applications, posing a continuous competitive threat.

- Energy-Intensive Manufacturing Process: High energy consumption during glass production leads to higher operating costs and environmental concerns.

- Supply Chain Volatility: Fluctuations in raw material availability and pricing can impact production costs and lead times.

- Logistical Costs: The weight of glass packaging can increase transportation expenses, particularly for long-distance distribution.

- Regulatory Compliance: Adhering to evolving environmental and safety regulations can require significant investment in technology and process upgrades. The impact of raw material cost increases can be estimated at xx% on production costs.

Emerging Opportunities in Czech Republic Container Glass Market

Emerging opportunities in the Czech Republic container glass market lie in the expanding demand for specialized glass packaging for niche products. The growing market for artisanal beverages, craft spirits, and gourmet foods presents a significant avenue for customized and aesthetically distinctive glass containers. Furthermore, advancements in glass coatings offer opportunities for enhanced functionalities, such as improved UV protection for sensitive products and tamper-evident seals, catering to evolving consumer needs. The increasing focus on circular economy models also opens doors for the development of innovative reusable glass systems and advanced recycling technologies, potentially creating new business models and revenue streams within the Czech glass packaging industry.

Growth Accelerators in the Czech Republic Container Glass Market Industry

Catalysts driving long-term growth in the Czech Republic container glass market include significant technological breakthroughs in glass manufacturing that enhance efficiency and reduce environmental impact, making glass more competitive. Strategic partnerships between glass manufacturers and beverage/food companies to co-develop innovative packaging solutions are also acting as powerful accelerators. Furthermore, the ongoing trend towards market expansion within the wider European Union, leveraging Czech Republic's central location and manufacturing expertise, presents substantial opportunities for increased export volumes of high-quality container glass. The increasing adoption of sustainable packaging mandates and consumer-driven demand for eco-friendly alternatives will continue to bolster the market.

Key Players Shaping the Czech Republic Container Glass Market Market

- ARTMIX GLASS ATELIER

- BOTTERO GMBH

- SKLARNY MORAVIA AKCIOV SPOLECNOST

- GALAPACK SPOL S R O

- Vetropack

- POPCO - SDRUZENÍ PODZIMEK - PODZIMKOVÁ

- GLASSABRASIV S R O

- BOHEMIA JIHLAVA A S

Notable Milestones in Czech Republic Container Glass Market Sector

- April 2022: Popular Czech soft drink Kofola becomes available in returnable glass bottles through the Cirkulka project, alongside Kofola Group brands Rajec and Vinea. This initiative aims to provide an alternative to traditional packaging and incentivize recycling, marking a significant step towards promoting reusable glass solutions.

In-Depth Czech Republic Container Glass Market Market Outlook

The future outlook for the Czech Republic container glass market is exceptionally promising, driven by a confluence of accelerating growth factors. Continued consumer preference for sustainable and premium packaging, coupled with ongoing technological advancements in glass production, will fuel market expansion. The strategic positioning of Czech manufacturers within the European market, coupled with increasing demand for circular economy solutions, presents significant opportunities for innovation and growth. The market is expected to witness a steady rise in demand across all key end-user segments, solidifying its importance in the region's packaging landscape.

Czech Republic Container Glass Market Segmentation

-

1. End-user Industry

-

1.1. Beverage

- 1.1.1. Alcoholic

- 1.1.2. Non-Alcoholic

- 1.2. Food

- 1.3. Cosmetics

- 1.4. Pharmaceuticals

- 1.5. Other End user verticals

-

1.1. Beverage

Czech Republic Container Glass Market Segmentation By Geography

- 1. Czech Republic

Czech Republic Container Glass Market Regional Market Share

Geographic Coverage of Czech Republic Container Glass Market

Czech Republic Container Glass Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Consumption of Alcoholic Bavarage; Growing Cosmetic Industry in Czech Republic

- 3.3. Market Restrains

- 3.3.1. Growth of Plastic Packaging as a Substitute for Glass Bottles

- 3.4. Market Trends

- 3.4.1. Growing Consumption of Alcoholic Bavarage

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Czech Republic Container Glass Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 5.1.1. Beverage

- 5.1.1.1. Alcoholic

- 5.1.1.2. Non-Alcoholic

- 5.1.2. Food

- 5.1.3. Cosmetics

- 5.1.4. Pharmaceuticals

- 5.1.5. Other End user verticals

- 5.1.1. Beverage

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Czech Republic

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 ARTMIX GLASS ATELIER

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 BOTTERO GMBH*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 SKLARNY MORAVIA AKCIOV SPOLECNOST

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 GALAPACK SPOL S R O

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Vetropack

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 POPCO - SDRUZENÍ PODZIMEK - PODZIMKOVÁ

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 GLASSABRASIV S R O

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 BOHEMIA JIHLAVA A S

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 ARTMIX GLASS ATELIER

List of Figures

- Figure 1: Czech Republic Container Glass Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Czech Republic Container Glass Market Share (%) by Company 2025

List of Tables

- Table 1: Czech Republic Container Glass Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 2: Czech Republic Container Glass Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Czech Republic Container Glass Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 4: Czech Republic Container Glass Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Czech Republic Container Glass Market?

The projected CAGR is approximately 8.6%.

2. Which companies are prominent players in the Czech Republic Container Glass Market?

Key companies in the market include ARTMIX GLASS ATELIER, BOTTERO GMBH*List Not Exhaustive, SKLARNY MORAVIA AKCIOV SPOLECNOST, GALAPACK SPOL S R O, Vetropack, POPCO - SDRUZENÍ PODZIMEK - PODZIMKOVÁ, GLASSABRASIV S R O, BOHEMIA JIHLAVA A S.

3. What are the main segments of the Czech Republic Container Glass Market?

The market segments include End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 106.36 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Consumption of Alcoholic Bavarage; Growing Cosmetic Industry in Czech Republic.

6. What are the notable trends driving market growth?

Growing Consumption of Alcoholic Bavarage.

7. Are there any restraints impacting market growth?

Growth of Plastic Packaging as a Substitute for Glass Bottles.

8. Can you provide examples of recent developments in the market?

April 2022- Popular Czech soft drink Kofola is now available in returnable glass bottles through the Cirkulka project. Kofola Group brands Rajec and Vinea are also available in returnable bottles through the project. Cirkulka aims to provide customers with an alternative to traditional packaging and give them an incentive to recycle. While some Kofola products were previously sold in glass bottles, they were not returnable.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Czech Republic Container Glass Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Czech Republic Container Glass Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Czech Republic Container Glass Market?

To stay informed about further developments, trends, and reports in the Czech Republic Container Glass Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence