Key Insights

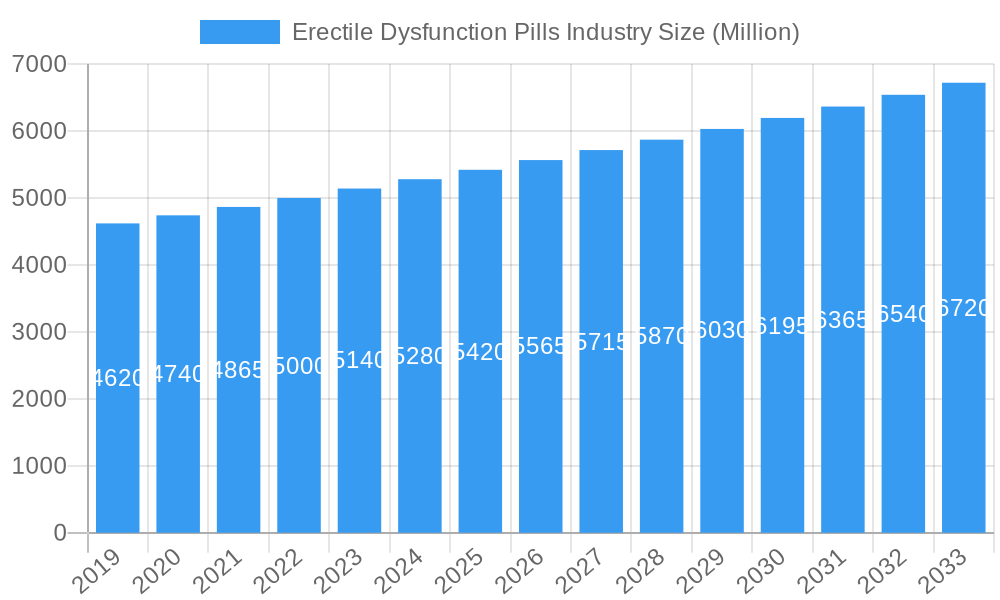

The global Erectile Dysfunction (ED) Pills market is projected for significant expansion, expected to reach a size of $3.12 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 9.2% from 2025 to 2033. Key growth drivers include the increasing prevalence of ED due to an aging population, rising chronic conditions like diabetes and cardiovascular disease, and enhanced patient awareness and treatment-seeking behavior. Market dynamics are further propelled by continuous research and development introducing novel formulations, improved treatment options, and growing accessibility via diverse distribution channels, notably online pharmacies for convenience and discretion.

Erectile Dysfunction Pills Industry Market Size (In Billion)

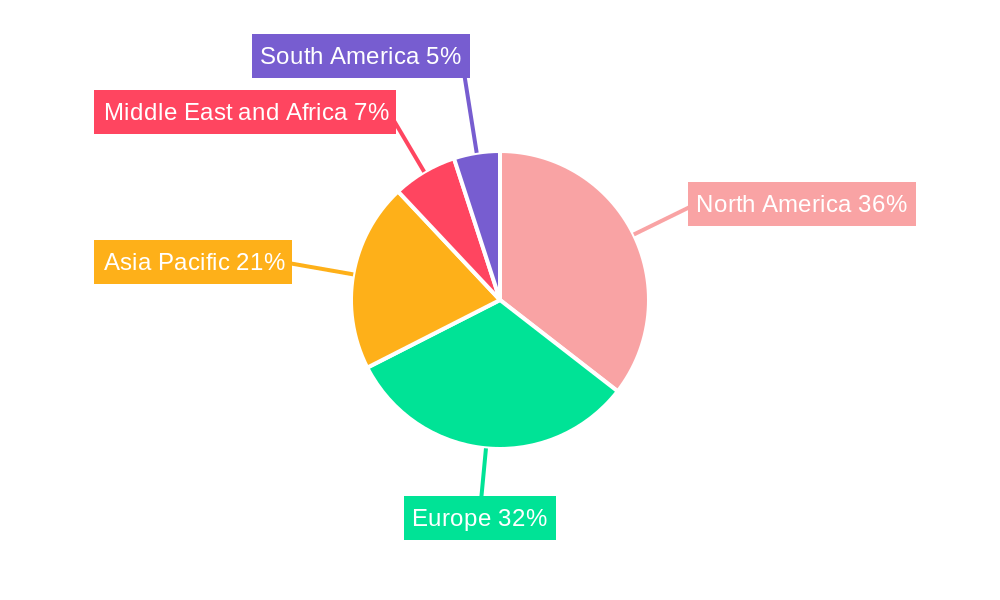

The competitive arena comprises established pharmaceutical leaders and emerging entities focused on innovation and strategic alliances. While Viagra, Cialis, and Levitra remain dominant, newer entrants like Stendra are gaining traction with distinct efficacy and safety profiles. Market restraints such as potential side effects, treatment costs, and societal stigma are being mitigated by advancements in drug delivery and patient education. The market is segmented by product type and distribution channel, with hospital pharmacies, retail pharmacies, and online platforms serving a broad patient demographic. North America and Europe currently lead market share, with the Asia Pacific region anticipated for substantial growth driven by increasing disposable incomes and healthcare investments.

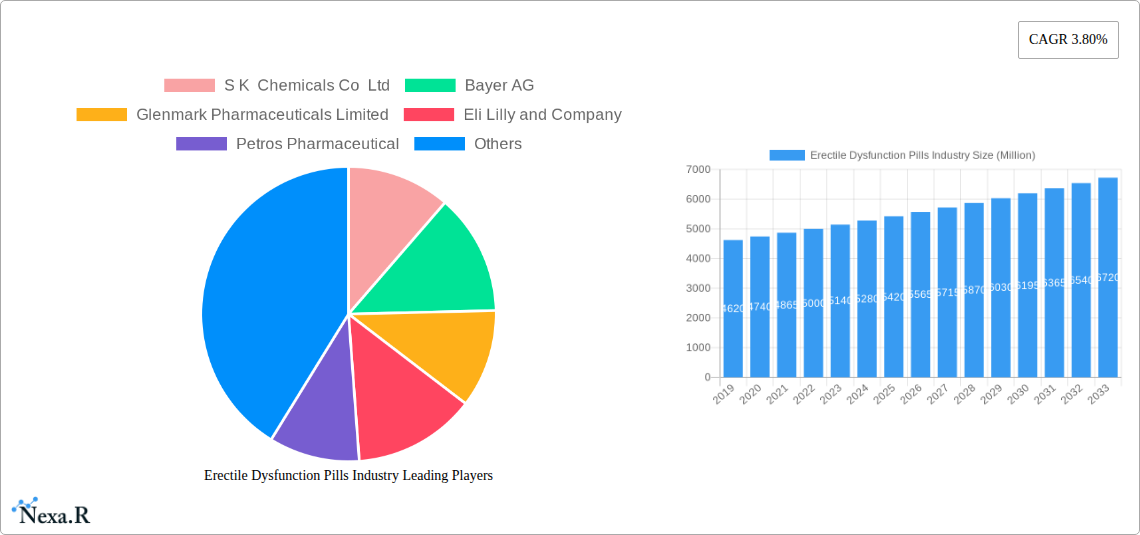

Erectile Dysfunction Pills Industry Company Market Share

This comprehensive report offers a critical analysis of the global Erectile Dysfunction (ED) Pills market, providing deep insights into its dynamics, growth trajectory, and competitive environment. Covering the historical period of 2019-2024 and a detailed forecast from 2025-2033, this study is vital for pharmaceutical manufacturers, investors, and healthcare providers aiming to understand and leverage this rapidly evolving sector. Optimized for high-traffic keywords such as "erectile dysfunction treatment," "ED pills market analysis," "sildenafil citrate market share," "tadalafil market trends," and "male sexual health solutions," this report ensures maximum search engine visibility and industry engagement. All quantitative data is presented in millions for clear, actionable intelligence.

Erectile Dysfunction Pills Industry Market Dynamics & Structure

The Erectile Dysfunction Pills industry is characterized by a moderately concentrated market structure, driven by the dominance of a few key players holding significant market share. Technological innovation remains a primary driver, with ongoing research and development focused on novel formulations and improved efficacy. Regulatory frameworks, primarily governed by health authorities like the FDA and EMA, play a crucial role in product approvals and market access. Competitive product substitutes, including alternative treatment modalities and generic versions of branded drugs, exert considerable pressure. End-user demographics reveal a growing patient pool, influenced by aging populations and increased awareness of sexual health issues. Merger and acquisition (M&A) trends, while present, are often strategic and focused on expanding product portfolios or market reach rather than consolidation.

- Market Concentration: Top 5 companies hold an estimated 75% of the global market share.

- Innovation Drivers: Focus on faster-acting formulations, longer-lasting effects, and reduced side effects.

- Regulatory Hurdles: Stringent approval processes for new active pharmaceutical ingredients (APIs) and bioequivalence testing for generics.

- Competitive Substitutes: Vacuum erection devices, penile injections, and surgical implants offering alternative treatment options.

- End-User Demographics: Predominantly men aged 40+, with a growing segment of younger individuals seeking performance enhancement.

- M&A Trends: Strategic acquisitions of smaller biotechnology firms developing novel ED therapies, and licensing agreements for geographical expansion.

Erectile Dysfunction Pills Industry Growth Trends & Insights

The Erectile Dysfunction Pills market is poised for robust growth, propelled by increasing awareness, rising prevalence of ED globally, and advancements in pharmaceutical research. The market size evolution is a testament to the growing acceptance and demand for effective ED treatments. Adoption rates are steadily climbing as stigma surrounding sexual health diminishes, encouraging more individuals to seek medical intervention. Technological disruptions, such as the development of oral disintegrating tablets and combination therapies, are enhancing patient convenience and treatment outcomes. Consumer behavior shifts are evident, with a greater emphasis on discreet purchasing options, particularly through online pharmacies, and a preference for treatments offering fewer side effects. The projected Compound Annual Growth Rate (CAGR) for the forecast period is approximately 6.5%, indicating sustained expansion. Market penetration is expected to increase from an estimated 35 million units in 2025 to over 60 million units by 2033.

Dominant Regions, Countries, or Segments in Erectile Dysfunction Pills Industry

North America currently dominates the Erectile Dysfunction Pills market, driven by high disposable incomes, advanced healthcare infrastructure, and a proactive approach to men's health. The United States, in particular, accounts for a significant portion of the regional market share, fueled by a large patient population and widespread availability of both branded and generic ED medications. The dominance is further reinforced by strong marketing efforts and a high level of public awareness regarding ED treatment options.

Product Segment Dominance:

- Viagra (sildenafil citrate): Continues to be a leading product due to its established brand recognition and proven efficacy, holding an estimated 40% market share within the branded segment.

- Cialis (Tadalafil): Exhibits strong growth due to its longer duration of action, offering a significant competitive advantage and capturing approximately 35% of the branded market.

- Other Products: This category, encompassing generics of sildenafil and tadalafil, and newer formulations, is experiencing substantial growth, projected to increase its market share by 15% in the next five years.

Distribution Channel Dominance:

- Retail Pharmacies: Remain a primary channel, facilitating easy access for patients and contributing approximately 55% to overall sales.

- Online Pharmacies: Witnessing rapid expansion due to convenience, privacy, and competitive pricing, with an estimated 25% market share and a projected growth rate of 10% annually.

- Hospital Pharmacies: Account for around 20% of the market, primarily serving patients with complex medical conditions or those undergoing post-procedure care.

Economic policies supporting healthcare access and a robust pharmaceutical distribution network are critical for sustained growth across all regions. The aging global population further bolsters the demand, making emerging economies like China and India potential growth hotspots in the coming years.

Erectile Dysfunction Pills Industry Product Landscape

The product landscape of the Erectile Dysfunction Pills industry is defined by continuous innovation aimed at enhancing efficacy, improving patient compliance, and minimizing adverse effects. Branded blockbusters like Viagra and Cialis remain cornerstones, while a burgeoning generic market offers cost-effective alternatives. Newer entrants like Stendra and Zydena are gaining traction by offering faster onset of action and distinct pharmacokinetic profiles. Topical formulations such as Vitaros provide alternative delivery methods for specific patient needs. The unique selling propositions revolve around speed of action, duration of effect, and reduced systemic side effects, driving the adoption of these advanced treatments.

Key Drivers, Barriers & Challenges in Erectile Dysfunction Pills Industry

Key Drivers:

- Increasing Prevalence of Erectile Dysfunction: Driven by factors like aging population, rising rates of diabetes, cardiovascular diseases, and obesity.

- Growing Awareness and Reduced Stigma: Improved public discourse around men's sexual health encourages more men to seek treatment.

- Technological Advancements: Development of novel drug delivery systems and improved formulations enhancing efficacy and convenience.

- Expanding Healthcare Access: Growth in emerging markets and increased insurance coverage for ED treatments.

Barriers & Challenges:

- Regulatory Hurdles: Stringent approval processes for new drugs and significant effort required for generic approvals.

- Counterfeit Products: The prevalence of illegal and substandard ED pills poses a significant threat to patient safety and legitimate market players.

- Prescription Requirements: Maintaining prescription-only status for many ED medications limits direct consumer access and can be a barrier for some individuals.

- Competitive Pressures: Intense competition from both branded and generic manufacturers, leading to price erosion.

- Supply Chain Disruptions: Potential for global supply chain issues impacting the availability of raw materials and finished products.

Emerging Opportunities in Erectile Dysfunction Pills Industry

Emerging opportunities in the Erectile Dysfunction Pills industry lie in the development of personalized treatment approaches tailored to individual patient profiles, incorporating genetic factors and comorbidities. The untapped potential of the aging male population in developing economies presents a significant growth avenue. Furthermore, the development of non-prescription or over-the-counter (OTC) ED treatments, following rigorous safety evaluations, could revolutionize market access. Innovations in combination therapies, addressing underlying causes of ED alongside symptomatic relief, also represent a promising frontier.

Growth Accelerators in the Erectile Dysfunction Pills Industry Industry

The long-term growth of the Erectile Dysfunction Pills industry is significantly propelled by ongoing technological breakthroughs in drug discovery and formulation science, leading to more effective and patient-friendly treatments. Strategic partnerships between pharmaceutical giants and smaller biotechnology firms specializing in urological health are accelerating the development pipeline. Furthermore, targeted market expansion strategies focusing on regions with a growing prevalence of ED and increasing healthcare expenditure will act as critical catalysts for sustained market expansion and revenue growth.

Key Players Shaping the Erectile Dysfunction Pills Industry Market

- S K Chemicals Co Ltd

- Bayer AG

- Glenmark Pharmaceuticals Limited

- Eli Lilly and Company

- Petros Pharmaceutical

- Teva Pharmaceutical Industries Ltd

- Apricus Biosciences Inc

- Cipla Ltd

- Lupin Limited

- VIVUS Inc

- GlaxoSmithKline PLC

- Pfizer Inc

Notable Milestones in Erectile Dysfunction Pills Industry Sector

- September 2021: iX Biopharma, through its wholly-owned subsidiary, signed an agreement with CRPCG for the licensing, supply, and distribution of Wafesil, a sublingual sildenafil wafer for the treatment of male erectile dysfunction, in China.

- September 2021: Almus announced the launch of Almus Erectile Dysfunction Relief 50mg Film-Coated Tablets to the UK pharmaceutical market.

In-Depth Erectile Dysfunction Pills Industry Market Outlook

The future outlook for the Erectile Dysfunction Pills market is exceptionally promising, driven by a confluence of expanding patient populations and continuous innovation. Growth accelerators such as the development of novel APIs, advanced drug delivery systems like oral films and sublingual wafers, and strategic geographical expansion will propel market expansion. The increasing acceptance of telehealth services will further facilitate access to ED treatments, especially in remote areas. Companies focusing on research into the underlying causes of ED, alongside symptomatic relief, are poised to capture significant market share and shape the future of male sexual health management.

Erectile Dysfunction Pills Industry Segmentation

-

1. Product

- 1.1. Viagra (sildenafil citrate)

- 1.2. Cialis (Tadalafil)

- 1.3. Levitra/Staxyn (vardenafil)

- 1.4. Stendra/Spedra (avanafil)

- 1.5. Zydena (udenafil)

- 1.6. Vitaros (Alprostadil Cream)

- 1.7. Other Products

-

2. Distribution Channel

- 2.1. Hospital Pharmacies

- 2.2. Retail Pharmacies

- 2.3. Online Pharmacies

Erectile Dysfunction Pills Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Erectile Dysfunction Pills Industry Regional Market Share

Geographic Coverage of Erectile Dysfunction Pills Industry

Erectile Dysfunction Pills Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Adoption of a Sedentary Lifestyle Along with the Associated Stress; Rising Geriatric Population; Comorbidity between Erectile Dysfunction and Heart Diseases and Diabetes

- 3.3. Market Restrains

- 3.3.1. Reluctance of Patients to Seek Treatment; Poor Patient Adherence to ED Drugs

- 3.4. Market Trends

- 3.4.1. The Viagra (sildenafil citrate) Segment is Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Erectile Dysfunction Pills Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Viagra (sildenafil citrate)

- 5.1.2. Cialis (Tadalafil)

- 5.1.3. Levitra/Staxyn (vardenafil)

- 5.1.4. Stendra/Spedra (avanafil)

- 5.1.5. Zydena (udenafil)

- 5.1.6. Vitaros (Alprostadil Cream)

- 5.1.7. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Hospital Pharmacies

- 5.2.2. Retail Pharmacies

- 5.2.3. Online Pharmacies

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Erectile Dysfunction Pills Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Viagra (sildenafil citrate)

- 6.1.2. Cialis (Tadalafil)

- 6.1.3. Levitra/Staxyn (vardenafil)

- 6.1.4. Stendra/Spedra (avanafil)

- 6.1.5. Zydena (udenafil)

- 6.1.6. Vitaros (Alprostadil Cream)

- 6.1.7. Other Products

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Hospital Pharmacies

- 6.2.2. Retail Pharmacies

- 6.2.3. Online Pharmacies

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Europe Erectile Dysfunction Pills Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Viagra (sildenafil citrate)

- 7.1.2. Cialis (Tadalafil)

- 7.1.3. Levitra/Staxyn (vardenafil)

- 7.1.4. Stendra/Spedra (avanafil)

- 7.1.5. Zydena (udenafil)

- 7.1.6. Vitaros (Alprostadil Cream)

- 7.1.7. Other Products

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Hospital Pharmacies

- 7.2.2. Retail Pharmacies

- 7.2.3. Online Pharmacies

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Asia Pacific Erectile Dysfunction Pills Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Viagra (sildenafil citrate)

- 8.1.2. Cialis (Tadalafil)

- 8.1.3. Levitra/Staxyn (vardenafil)

- 8.1.4. Stendra/Spedra (avanafil)

- 8.1.5. Zydena (udenafil)

- 8.1.6. Vitaros (Alprostadil Cream)

- 8.1.7. Other Products

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Hospital Pharmacies

- 8.2.2. Retail Pharmacies

- 8.2.3. Online Pharmacies

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Middle East and Africa Erectile Dysfunction Pills Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Viagra (sildenafil citrate)

- 9.1.2. Cialis (Tadalafil)

- 9.1.3. Levitra/Staxyn (vardenafil)

- 9.1.4. Stendra/Spedra (avanafil)

- 9.1.5. Zydena (udenafil)

- 9.1.6. Vitaros (Alprostadil Cream)

- 9.1.7. Other Products

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Hospital Pharmacies

- 9.2.2. Retail Pharmacies

- 9.2.3. Online Pharmacies

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. South America Erectile Dysfunction Pills Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Viagra (sildenafil citrate)

- 10.1.2. Cialis (Tadalafil)

- 10.1.3. Levitra/Staxyn (vardenafil)

- 10.1.4. Stendra/Spedra (avanafil)

- 10.1.5. Zydena (udenafil)

- 10.1.6. Vitaros (Alprostadil Cream)

- 10.1.7. Other Products

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Hospital Pharmacies

- 10.2.2. Retail Pharmacies

- 10.2.3. Online Pharmacies

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 S K Chemicals Co Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Bayer AG

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Glenmark Pharmaceuticals Limited

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Eli Lilly and Company

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Petros Pharmaceutical

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Teva Pharmaceutical Industries Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Apricus Biosciences Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Cipla Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Lupin Limited

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 VIVUS Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 GlaxoSmithKline PLC

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Pfizer Inc

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 S K Chemicals Co Ltd

List of Figures

- Figure 1: Global Erectile Dysfunction Pills Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Global Erectile Dysfunction Pills Industry Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Erectile Dysfunction Pills Industry Revenue (billion), by Product 2025 & 2033

- Figure 4: North America Erectile Dysfunction Pills Industry Volume (K Unit), by Product 2025 & 2033

- Figure 5: North America Erectile Dysfunction Pills Industry Revenue Share (%), by Product 2025 & 2033

- Figure 6: North America Erectile Dysfunction Pills Industry Volume Share (%), by Product 2025 & 2033

- Figure 7: North America Erectile Dysfunction Pills Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 8: North America Erectile Dysfunction Pills Industry Volume (K Unit), by Distribution Channel 2025 & 2033

- Figure 9: North America Erectile Dysfunction Pills Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 10: North America Erectile Dysfunction Pills Industry Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 11: North America Erectile Dysfunction Pills Industry Revenue (billion), by Country 2025 & 2033

- Figure 12: North America Erectile Dysfunction Pills Industry Volume (K Unit), by Country 2025 & 2033

- Figure 13: North America Erectile Dysfunction Pills Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Erectile Dysfunction Pills Industry Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Erectile Dysfunction Pills Industry Revenue (billion), by Product 2025 & 2033

- Figure 16: Europe Erectile Dysfunction Pills Industry Volume (K Unit), by Product 2025 & 2033

- Figure 17: Europe Erectile Dysfunction Pills Industry Revenue Share (%), by Product 2025 & 2033

- Figure 18: Europe Erectile Dysfunction Pills Industry Volume Share (%), by Product 2025 & 2033

- Figure 19: Europe Erectile Dysfunction Pills Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 20: Europe Erectile Dysfunction Pills Industry Volume (K Unit), by Distribution Channel 2025 & 2033

- Figure 21: Europe Erectile Dysfunction Pills Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 22: Europe Erectile Dysfunction Pills Industry Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 23: Europe Erectile Dysfunction Pills Industry Revenue (billion), by Country 2025 & 2033

- Figure 24: Europe Erectile Dysfunction Pills Industry Volume (K Unit), by Country 2025 & 2033

- Figure 25: Europe Erectile Dysfunction Pills Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Erectile Dysfunction Pills Industry Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pacific Erectile Dysfunction Pills Industry Revenue (billion), by Product 2025 & 2033

- Figure 28: Asia Pacific Erectile Dysfunction Pills Industry Volume (K Unit), by Product 2025 & 2033

- Figure 29: Asia Pacific Erectile Dysfunction Pills Industry Revenue Share (%), by Product 2025 & 2033

- Figure 30: Asia Pacific Erectile Dysfunction Pills Industry Volume Share (%), by Product 2025 & 2033

- Figure 31: Asia Pacific Erectile Dysfunction Pills Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 32: Asia Pacific Erectile Dysfunction Pills Industry Volume (K Unit), by Distribution Channel 2025 & 2033

- Figure 33: Asia Pacific Erectile Dysfunction Pills Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 34: Asia Pacific Erectile Dysfunction Pills Industry Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 35: Asia Pacific Erectile Dysfunction Pills Industry Revenue (billion), by Country 2025 & 2033

- Figure 36: Asia Pacific Erectile Dysfunction Pills Industry Volume (K Unit), by Country 2025 & 2033

- Figure 37: Asia Pacific Erectile Dysfunction Pills Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pacific Erectile Dysfunction Pills Industry Volume Share (%), by Country 2025 & 2033

- Figure 39: Middle East and Africa Erectile Dysfunction Pills Industry Revenue (billion), by Product 2025 & 2033

- Figure 40: Middle East and Africa Erectile Dysfunction Pills Industry Volume (K Unit), by Product 2025 & 2033

- Figure 41: Middle East and Africa Erectile Dysfunction Pills Industry Revenue Share (%), by Product 2025 & 2033

- Figure 42: Middle East and Africa Erectile Dysfunction Pills Industry Volume Share (%), by Product 2025 & 2033

- Figure 43: Middle East and Africa Erectile Dysfunction Pills Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 44: Middle East and Africa Erectile Dysfunction Pills Industry Volume (K Unit), by Distribution Channel 2025 & 2033

- Figure 45: Middle East and Africa Erectile Dysfunction Pills Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 46: Middle East and Africa Erectile Dysfunction Pills Industry Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 47: Middle East and Africa Erectile Dysfunction Pills Industry Revenue (billion), by Country 2025 & 2033

- Figure 48: Middle East and Africa Erectile Dysfunction Pills Industry Volume (K Unit), by Country 2025 & 2033

- Figure 49: Middle East and Africa Erectile Dysfunction Pills Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East and Africa Erectile Dysfunction Pills Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: South America Erectile Dysfunction Pills Industry Revenue (billion), by Product 2025 & 2033

- Figure 52: South America Erectile Dysfunction Pills Industry Volume (K Unit), by Product 2025 & 2033

- Figure 53: South America Erectile Dysfunction Pills Industry Revenue Share (%), by Product 2025 & 2033

- Figure 54: South America Erectile Dysfunction Pills Industry Volume Share (%), by Product 2025 & 2033

- Figure 55: South America Erectile Dysfunction Pills Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 56: South America Erectile Dysfunction Pills Industry Volume (K Unit), by Distribution Channel 2025 & 2033

- Figure 57: South America Erectile Dysfunction Pills Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 58: South America Erectile Dysfunction Pills Industry Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 59: South America Erectile Dysfunction Pills Industry Revenue (billion), by Country 2025 & 2033

- Figure 60: South America Erectile Dysfunction Pills Industry Volume (K Unit), by Country 2025 & 2033

- Figure 61: South America Erectile Dysfunction Pills Industry Revenue Share (%), by Country 2025 & 2033

- Figure 62: South America Erectile Dysfunction Pills Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Erectile Dysfunction Pills Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 2: Global Erectile Dysfunction Pills Industry Volume K Unit Forecast, by Product 2020 & 2033

- Table 3: Global Erectile Dysfunction Pills Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global Erectile Dysfunction Pills Industry Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 5: Global Erectile Dysfunction Pills Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Global Erectile Dysfunction Pills Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Global Erectile Dysfunction Pills Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 8: Global Erectile Dysfunction Pills Industry Volume K Unit Forecast, by Product 2020 & 2033

- Table 9: Global Erectile Dysfunction Pills Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 10: Global Erectile Dysfunction Pills Industry Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 11: Global Erectile Dysfunction Pills Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Global Erectile Dysfunction Pills Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: United States Erectile Dysfunction Pills Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: United States Erectile Dysfunction Pills Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 15: Canada Erectile Dysfunction Pills Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Canada Erectile Dysfunction Pills Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 17: Mexico Erectile Dysfunction Pills Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Mexico Erectile Dysfunction Pills Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Global Erectile Dysfunction Pills Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 20: Global Erectile Dysfunction Pills Industry Volume K Unit Forecast, by Product 2020 & 2033

- Table 21: Global Erectile Dysfunction Pills Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 22: Global Erectile Dysfunction Pills Industry Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 23: Global Erectile Dysfunction Pills Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Global Erectile Dysfunction Pills Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Germany Erectile Dysfunction Pills Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Germany Erectile Dysfunction Pills Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: United Kingdom Erectile Dysfunction Pills Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: United Kingdom Erectile Dysfunction Pills Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 29: France Erectile Dysfunction Pills Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: France Erectile Dysfunction Pills Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Italy Erectile Dysfunction Pills Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Italy Erectile Dysfunction Pills Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: Spain Erectile Dysfunction Pills Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Spain Erectile Dysfunction Pills Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe Erectile Dysfunction Pills Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Rest of Europe Erectile Dysfunction Pills Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Global Erectile Dysfunction Pills Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 38: Global Erectile Dysfunction Pills Industry Volume K Unit Forecast, by Product 2020 & 2033

- Table 39: Global Erectile Dysfunction Pills Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 40: Global Erectile Dysfunction Pills Industry Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 41: Global Erectile Dysfunction Pills Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 42: Global Erectile Dysfunction Pills Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 43: China Erectile Dysfunction Pills Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 44: China Erectile Dysfunction Pills Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 45: Japan Erectile Dysfunction Pills Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 46: Japan Erectile Dysfunction Pills Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 47: India Erectile Dysfunction Pills Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 48: India Erectile Dysfunction Pills Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 49: Australia Erectile Dysfunction Pills Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 50: Australia Erectile Dysfunction Pills Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 51: South Korea Erectile Dysfunction Pills Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: South Korea Erectile Dysfunction Pills Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 53: Rest of Asia Pacific Erectile Dysfunction Pills Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 54: Rest of Asia Pacific Erectile Dysfunction Pills Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 55: Global Erectile Dysfunction Pills Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 56: Global Erectile Dysfunction Pills Industry Volume K Unit Forecast, by Product 2020 & 2033

- Table 57: Global Erectile Dysfunction Pills Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 58: Global Erectile Dysfunction Pills Industry Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 59: Global Erectile Dysfunction Pills Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 60: Global Erectile Dysfunction Pills Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 61: GCC Erectile Dysfunction Pills Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 62: GCC Erectile Dysfunction Pills Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 63: South Africa Erectile Dysfunction Pills Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 64: South Africa Erectile Dysfunction Pills Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 65: Rest of Middle East and Africa Erectile Dysfunction Pills Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 66: Rest of Middle East and Africa Erectile Dysfunction Pills Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 67: Global Erectile Dysfunction Pills Industry Revenue billion Forecast, by Product 2020 & 2033

- Table 68: Global Erectile Dysfunction Pills Industry Volume K Unit Forecast, by Product 2020 & 2033

- Table 69: Global Erectile Dysfunction Pills Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 70: Global Erectile Dysfunction Pills Industry Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 71: Global Erectile Dysfunction Pills Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 72: Global Erectile Dysfunction Pills Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 73: Brazil Erectile Dysfunction Pills Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 74: Brazil Erectile Dysfunction Pills Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 75: Argentina Erectile Dysfunction Pills Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 76: Argentina Erectile Dysfunction Pills Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 77: Rest of South America Erectile Dysfunction Pills Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 78: Rest of South America Erectile Dysfunction Pills Industry Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Erectile Dysfunction Pills Industry?

The projected CAGR is approximately 9.2%.

2. Which companies are prominent players in the Erectile Dysfunction Pills Industry?

Key companies in the market include S K Chemicals Co Ltd, Bayer AG, Glenmark Pharmaceuticals Limited, Eli Lilly and Company, Petros Pharmaceutical, Teva Pharmaceutical Industries Ltd, Apricus Biosciences Inc, Cipla Ltd, Lupin Limited, VIVUS Inc, GlaxoSmithKline PLC, Pfizer Inc.

3. What are the main segments of the Erectile Dysfunction Pills Industry?

The market segments include Product, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.12 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Adoption of a Sedentary Lifestyle Along with the Associated Stress; Rising Geriatric Population; Comorbidity between Erectile Dysfunction and Heart Diseases and Diabetes.

6. What are the notable trends driving market growth?

The Viagra (sildenafil citrate) Segment is Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

Reluctance of Patients to Seek Treatment; Poor Patient Adherence to ED Drugs.

8. Can you provide examples of recent developments in the market?

In September 2021, iX Biopharma, through its wholly-owned subsidiary, signed an agreement with CRPCG for the licensing, supply, and distribution of Wafesil, a sublingual sildenafil wafer for the treatment of male erectile dysfunction, in China.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Erectile Dysfunction Pills Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Erectile Dysfunction Pills Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Erectile Dysfunction Pills Industry?

To stay informed about further developments, trends, and reports in the Erectile Dysfunction Pills Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence