Key Insights

The French packaging market, projected at 31.6 billion units in 2024, is poised for significant expansion, driven by a compound annual growth rate (CAGR) of 4.6% through 2033. Key growth catalysts include the accelerating e-commerce sector, demanding advanced protective packaging, and heightened consumer focus on sustainability, spurring demand for recycled and biodegradable materials. The food and beverage industry remains a primary driver, with trends toward convenient and ready-to-eat options further amplifying market growth. While fluctuating raw material costs and environmental regulations present challenges, the rigid packaging segment, including glass, metal, and plastic, maintains a robust market share. Intense competition among industry leaders such as Ardagh Group, RPC Group PLC, and Amcor PLC underscores the importance of strategic innovation and cost efficiency. The healthcare and pharmaceutical sectors offer a stable, high-growth niche due to stringent requirements for sterile and tamper-evident packaging.

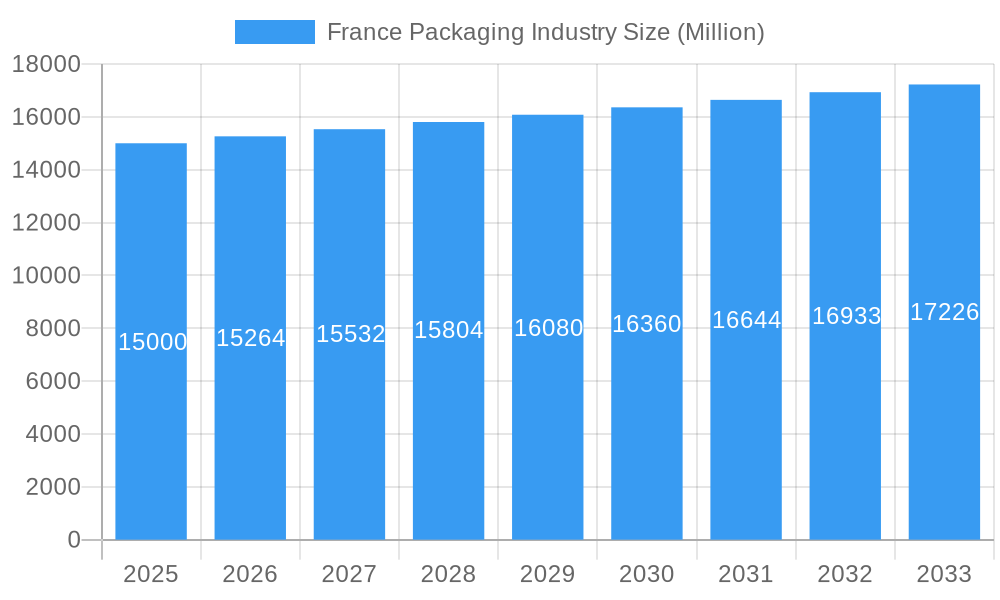

France Packaging Industry Market Size (In Billion)

The competitive environment features a mix of global corporations and specialized regional firms. Strategic diversification across materials and packaging types is a common approach to risk mitigation. Future growth hinges on the successful integration of sustainable practices, advancements in packaging technology, and responsiveness to evolving consumer demands for convenience, safety, and eco-conscious solutions. Regional market dynamics within France may require tailored strategies, influenced by local consumer habits and economic conditions. The forecast period anticipates sustained market expansion, supported by demographic trends, shifting consumer behaviors, and the vitality of the French economy.

France Packaging Industry Company Market Share

France Packaging Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the France packaging industry, encompassing market dynamics, growth trends, competitive landscape, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. This report is essential for industry professionals, investors, and strategic decision-makers seeking a clear understanding of this dynamic market. The report segments the market by material (plastic, glass, metal, other materials), packaging type (flexible, rigid), and end-user verticals (food, beverages, healthcare & pharmaceuticals, beauty & personal care, other).

Keywords: France Packaging Market, Packaging Industry France, French Packaging, Plastic Packaging France, Glass Packaging France, Metal Packaging France, Flexible Packaging France, Rigid Packaging France, Food Packaging France, Beverage Packaging France, Pharmaceutical Packaging France, Cosmetic Packaging France, Packaging Market Size France, Packaging Industry Growth France, Packaging Trends France.

France Packaging Industry Market Dynamics & Structure

The French packaging market is characterized by a moderately concentrated structure with several large multinational players and a number of smaller, specialized companies. Technological innovation, driven by sustainability concerns and evolving consumer preferences, is a key driver. Stringent environmental regulations, including the EU's Single-Use Plastics Directive, significantly influence packaging choices. Competitive substitutes, such as reusable containers and alternative packaging materials, present ongoing challenges. The market also reflects broader demographic trends, with increasing demand for convenient and sustainable packaging solutions. M&A activity remains significant; xx Million units worth of deals were recorded in the historical period.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share.

- Technological Innovation: Focus on sustainable materials (bioplastics, recycled content), lightweighting, and improved barrier properties.

- Regulatory Framework: Stringent regulations on material recyclability and single-use plastics.

- Competitive Substitutes: Growth of reusable packaging and alternative delivery systems.

- End-User Demographics: Growing demand for convenience and sustainability among consumers.

- M&A Trends: Significant consolidation, particularly in the flexible packaging segment, with xx deals completed between 2019-2024.

France Packaging Industry Growth Trends & Insights

The France packaging market exhibited a CAGR of xx% during the historical period (2019-2024), reaching a market size of xx Million units in 2024. This growth is primarily driven by increasing consumption across various end-user sectors and the ongoing adoption of innovative packaging technologies to enhance product shelf life and consumer experience. The market is expected to continue its growth trajectory, projected to reach xx Million units by 2025, with a forecast CAGR of xx% from 2025-2033. The rising popularity of e-commerce is boosting demand for protective packaging, while sustainability concerns are propelling the adoption of eco-friendly materials and packaging designs. Shifts in consumer behavior towards healthier and more convenient food and beverage options also influence packaging choices.

Dominant Regions, Countries, or Segments in France Packaging Industry

The Ile-de-France region, encompassing Paris and its surrounding areas, represents the largest segment of the French packaging market, driven by high population density, substantial industrial activity, and significant consumption. Within materials, plastic packaging dominates with a market share of xx%, followed by paper and cardboard at xx%. In packaging types, rigid packaging holds the largest share (xx%), catering to the substantial food and beverage sector. The food and beverage industry remains the largest end-user segment, accounting for xx% of total packaging demand.

- Key Regional Drivers: High population density in Ile-de-France, strong industrial presence in other regions.

- Material Dominance: Plastic packaging, driven by its versatility and cost-effectiveness.

- Packaging Type Dominance: Rigid packaging due to its suitability for various food and beverage products.

- End-User Vertical Dominance: Food and beverage, due to high consumption and diverse product offerings.

- Growth Potential: Strong potential in sustainable packaging solutions and e-commerce related packaging.

France Packaging Industry Product Landscape

The French packaging market showcases a wide array of products, from simple plastic bottles to sophisticated multi-layered flexible packaging incorporating advanced barrier technologies. Innovations center around sustainable materials, improved recyclability, enhanced barrier properties, and convenient dispensing mechanisms. Unique selling propositions often revolve around brand differentiation, consumer experience, and environmental responsibility. Technological advancements include the incorporation of smart packaging features (e.g., sensors for tracking product freshness).

Key Drivers, Barriers & Challenges in France Packaging Industry

Key Drivers:

- Robust Consumer Demand: Sustained and growing consumer demand across diverse and essential sectors such as food and beverages, pharmaceuticals, and cosmetics continues to be a primary growth engine.

- E-commerce Expansion: The persistent and significant growth of the e-commerce sector is a major driver, necessitating a greater volume of protective, efficient, and often customized packaging solutions to ensure product integrity during transit.

- Technological Advancements: Continuous innovation in materials science, automation, and smart packaging technologies is leading to the development of more functional, sustainable, and visually appealing packaging options, catering to evolving industry needs.

- Government and Industry Support for Sustainability: Proactive government initiatives, coupled with increasing industry commitment, are strongly promoting the adoption of sustainable packaging solutions, including recycled content, biodegradable materials, and reusable systems.

Challenges & Restraints:

- Volatile Raw Material Prices: Fluctuations in the cost of key raw materials, such as plastics, paper pulp, and metals, directly impact production costs and manufacturer profitability, necessitating strategic sourcing and cost management.

- Stringent Environmental Regulations: Evolving and increasingly stringent environmental regulations, including those related to recyclability, extended producer responsibility (EPR), and plastic use, require significant investment in material innovation, process adaptation, and compliance measures.

- Intense Market Competition: The French packaging market is characterized by high competition from both established domestic players and international manufacturers, leading to price pressures and a constant need for differentiation and innovation.

- Supply Chain Vulnerabilities: Global and regional supply chain disruptions, exacerbated by geopolitical events and logistical challenges, can impact the availability and timely delivery of essential raw materials and finished goods, potentially leading to increased lead times and production delays. For instance, disruptions observed in 2022 contributed to an approximate xx% increase in average lead times for certain materials.

Emerging Opportunities in France Packaging Industry

The French packaging market presents several key opportunities:

- Increased demand for sustainable and eco-friendly packaging solutions.

- Growing popularity of e-commerce creating opportunities for innovative protective packaging.

- Demand for personalized and customized packaging catering to specific consumer needs.

- Expansion into niche markets such as medical devices and pharmaceuticals.

Growth Accelerators in the France Packaging Industry

The future growth trajectory of the French packaging industry is poised for acceleration, propelled by a confluence of strategic developments. Key growth accelerators include significant technological breakthroughs in sustainable materials, such as advanced bioplastics and novel paper-based solutions, which address environmental concerns and meet consumer preferences. Furthermore, the fostering of strategic partnerships across the value chain is crucial for enhancing supply chain resilience and efficiency, optimizing logistics, and ensuring the cost-effective delivery of packaging solutions. Market expansion strategies targeting emerging sectors, including personalized medicine packaging and specialized food preservation solutions, also represent a significant growth avenue. The escalating adoption of circular economy models, emphasizing waste reduction and material reuse, alongside advancements in sophisticated recycling technologies, will further invigorate the market by creating new opportunities for material recovery and sustainable product lifecycles.

Key Players Shaping the France Packaging Industry Market

- Ardagh Group

- RPC Group PLC

- Ball Corporation (Rexam PLC)

- DS Smith PLC

- Owens Illinois Inc

- Amcor PLC

- Mondi PLC

- Constantia Flexibles GmbH

- Ametek Inc.

- Smurfit Kappa Group PLC

- Tetra Pak International SA

- AR Packaging Group AB

- Crown Holdings Inc.

Notable Milestones in France Packaging Industry Sector

- November 2022: Verallia's acquisition of 100% of Allied Glass marked a significant strategic move, substantially bolstering its capabilities and market penetration within the European glass packaging sector, particularly in France.

- June 2022: Carlsberg Group's pioneering trial of its innovative Fibre Bottle underscored the industry's burgeoning commitment to sustainable packaging alternatives. This initiative represents a potential paradigm shift, with its success having the capacity to profoundly influence market trends towards more environmentally friendly solutions.

In-Depth France Packaging Industry Market Outlook

The outlook for the France packaging industry is exceptionally positive, characterized by sustained growth fueled by dynamic shifts in consumer preferences, relentless technological innovation, and an unwavering focus on sustainability imperatives. Strategic opportunities abound in the development of cutting-edge, eco-friendly packaging solutions that balance functionality with environmental responsibility. Leveraging digital technologies, such as AI and IoT, to optimize supply chain visibility, enhance operational efficiency, and personalize customer experiences presents another critical avenue for growth. Furthermore, targeted expansion into new and emerging markets, including specialized sectors like personalized nutrition and advanced healthcare delivery systems, promises significant returns. The market's long-term potential is underpinned by a strong and resilient French economy, consistently rising consumer spending, and a deeply ingrained national commitment to environmental stewardship, positioning it for robust and sustainable development.

France Packaging Industry Segmentation

-

1. Material

- 1.1. Plastic

- 1.2. Glass

- 1.3. Metal

- 1.4. Other Materials

-

2. Packaging Type

- 2.1. Flexible Packaging

- 2.2. Rigid Packaging

-

3. End-user Verticals

- 3.1. Food

- 3.2. Beverages

- 3.3. Healthcare and Pharmaceuticals

- 3.4. Beauty and Personal Care

- 3.5. Other End-user Verticals

France Packaging Industry Segmentation By Geography

- 1. France

France Packaging Industry Regional Market Share

Geographic Coverage of France Packaging Industry

France Packaging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Macroeconomic Factors

- 3.2.2 such as Demographic Changes and Changing Consumer Preferences; Increasing Tourism in the Industry

- 3.3. Market Restrains

- 3.3.1. The existence of stringent government restrictions and a decrease in the approval of numerous small molecules and biologics in specific regions of the nation

- 3.4. Market Trends

- 3.4.1. Flexible Packaging to Have a Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. France Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Plastic

- 5.1.2. Glass

- 5.1.3. Metal

- 5.1.4. Other Materials

- 5.2. Market Analysis, Insights and Forecast - by Packaging Type

- 5.2.1. Flexible Packaging

- 5.2.2. Rigid Packaging

- 5.3. Market Analysis, Insights and Forecast - by End-user Verticals

- 5.3.1. Food

- 5.3.2. Beverages

- 5.3.3. Healthcare and Pharmaceuticals

- 5.3.4. Beauty and Personal Care

- 5.3.5. Other End-user Verticals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. France

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Ardagh Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 RPC Group PLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Ball Corporation (Rexam PLC )

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 DS Smith PLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Owens Illinois Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Amcor PLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Mondi PLC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Constantia Flexibles Gmb

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Ametek Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Smurfit Kappa Group PLC

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Tetra Pak International SA

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 AR Packaging Group AB

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Crown Holding Inc

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Ardagh Group

List of Figures

- Figure 1: France Packaging Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: France Packaging Industry Share (%) by Company 2025

List of Tables

- Table 1: France Packaging Industry Revenue billion Forecast, by Material 2020 & 2033

- Table 2: France Packaging Industry Revenue billion Forecast, by Packaging Type 2020 & 2033

- Table 3: France Packaging Industry Revenue billion Forecast, by End-user Verticals 2020 & 2033

- Table 4: France Packaging Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: France Packaging Industry Revenue billion Forecast, by Material 2020 & 2033

- Table 6: France Packaging Industry Revenue billion Forecast, by Packaging Type 2020 & 2033

- Table 7: France Packaging Industry Revenue billion Forecast, by End-user Verticals 2020 & 2033

- Table 8: France Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the France Packaging Industry?

The projected CAGR is approximately 4.6%.

2. Which companies are prominent players in the France Packaging Industry?

Key companies in the market include Ardagh Group, RPC Group PLC, Ball Corporation (Rexam PLC ), DS Smith PLC, Owens Illinois Inc, Amcor PLC, Mondi PLC, Constantia Flexibles Gmb, Ametek Inc, Smurfit Kappa Group PLC, Tetra Pak International SA, AR Packaging Group AB, Crown Holding Inc.

3. What are the main segments of the France Packaging Industry?

The market segments include Material, Packaging Type, End-user Verticals.

4. Can you provide details about the market size?

The market size is estimated to be USD 31.6 billion as of 2022.

5. What are some drivers contributing to market growth?

Macroeconomic Factors. such as Demographic Changes and Changing Consumer Preferences; Increasing Tourism in the Industry.

6. What are the notable trends driving market growth?

Flexible Packaging to Have a Significant Share.

7. Are there any restraints impacting market growth?

The existence of stringent government restrictions and a decrease in the approval of numerous small molecules and biologics in specific regions of the nation.

8. Can you provide examples of recent developments in the market?

November 2022: Verallia acquired 100% of the capital of Allied Glass. The Group had announced the signature of a binding agreement with an affiliate of Sun European Partners LLP to acquire Allied Glass.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "France Packaging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the France Packaging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the France Packaging Industry?

To stay informed about further developments, trends, and reports in the France Packaging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence