Key Insights

Germany's rigid plastic packaging market is projected to reach 67.9 million in 2025, with a Compound Annual Growth Rate (CAGR) of 3.6% from 2025 to 2033. This expansion is driven by increasing demand for convenient and cost-effective packaging solutions across the food & beverage, pharmaceutical, and consumer goods sectors. Advances in material science, offering lighter, more durable, and recyclable plastic options, further bolster market growth. The surge in e-commerce also necessitates robust shipping packaging, contributing to positive market prospects. Key restraints include growing environmental concerns over plastic waste and evolving regulations to mitigate plastic pollution. The market is segmented by packaging type, application, and material, with segment growth influenced by consumer trends and regulatory landscapes. The competitive environment features established global players and specialized niche companies, fostering both intense competition and innovation opportunities. Mergers and acquisitions are expected to shape the competitive landscape as companies pursue market share and sustainability initiatives.

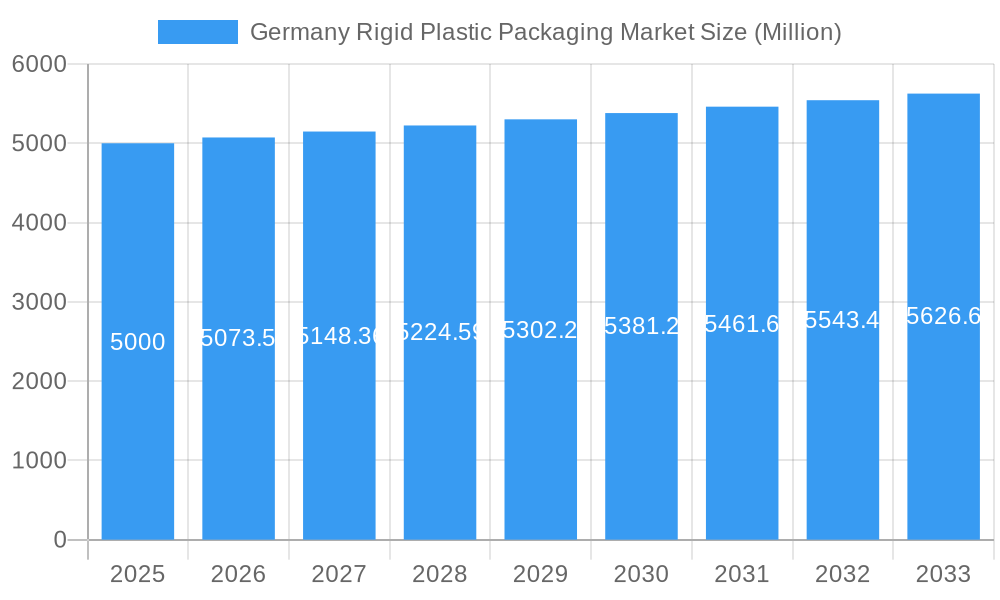

Germany Rigid Plastic Packaging Market Market Size (In Million)

The forecast period (2025-2033) indicates continued moderate expansion for the German rigid plastic packaging market. This growth will be influenced by economic factors, shifting consumer preferences, and an increasing emphasis on sustainable packaging. Key stakeholders are prioritizing R&D for eco-friendly alternatives, including biodegradable and recyclable plastics. This commitment to sustainability is crucial for long-term market viability, addressing regulatory pressures and consumer demand for environmentally responsible products. While regional variations may exist within Germany, the overall market trend points to consistent expansion, balanced by the challenges associated with environmental considerations.

Germany Rigid Plastic Packaging Market Company Market Share

Germany Rigid Plastic Packaging Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Germany rigid plastic packaging market, encompassing market dynamics, growth trends, competitive landscape, and future outlook. The study covers the period 2019-2033, with a focus on the forecast period 2025-2033, and utilizes 2025 as the base year. The report offers valuable insights for industry professionals, investors, and stakeholders seeking to understand and capitalize on opportunities within this dynamic market. Parent markets include the broader European packaging industry and the German manufacturing sector, while child markets include pharmaceutical packaging, food and beverage packaging, and consumer goods packaging. The market size is presented in Million units.

Germany Rigid Plastic Packaging Market Dynamics & Structure

This section analyzes the structure and dynamics of the German rigid plastic packaging market. The market is characterized by a moderately concentrated landscape, with several major players and a number of smaller, specialized firms. Technological innovation, driven by sustainability concerns and evolving consumer preferences, is a key driver. Strict regulatory frameworks concerning material recyclability and plastic waste are shaping market trends. The emergence of bio-based plastics and other sustainable alternatives is posing a challenge to traditional rigid plastic packaging, while increased e-commerce activity fuels demand for protective packaging. Mergers and acquisitions (M&A) activity, as illustrated by recent transactions, are consolidating market share and driving innovation.

- Market Concentration: Moderately concentrated, with a top 5 market share of xx%.

- Technological Innovation: Significant focus on sustainable materials (bioplastics, recycled content) and improved recyclability.

- Regulatory Framework: Stringent regulations on plastic waste management and recyclability are influencing material selection and packaging design.

- Competitive Substitutes: Growing competition from alternative packaging materials (e.g., paperboard, glass, bio-based plastics).

- End-User Demographics: Driven by shifts in consumer behavior, including rising demand for convenience and sustainable products.

- M&A Activity: xx M&A deals recorded in the historical period (2019-2024), indicating consolidation and strategic growth.

Germany Rigid Plastic Packaging Market Growth Trends & Insights

The German rigid plastic packaging market has experienced [mention growth trend - e.g., steady growth/significant expansion] over the historical period (2019-2024), with a CAGR of xx%. This growth is attributed to [mention key factors, e.g., expanding consumer goods sector, e-commerce boom, and increasing demand for convenience packaging]. The adoption rate of sustainable and recyclable packaging is steadily increasing, driven by stringent environmental regulations and growing consumer awareness. Technological disruptions, such as advancements in lightweighting and improved barrier properties, are influencing market trends. Shifting consumer behaviors, including a preference for eco-friendly products and convenience packaging, are further driving market growth. The market is expected to maintain a healthy growth trajectory in the forecast period (2025-2033), with a projected CAGR of xx%, reaching a market size of xx million units by 2033.

Dominant Regions, Countries, or Segments in Germany Rigid Plastic Packaging Market

The [mention region/country/segment, e.g., western Germany/Bavaria/food and beverage packaging] segment exhibits the highest growth rate and market share within the German rigid plastic packaging market. This dominance is driven by several factors, including:

- Economic Strength: Strong economic activity in this region contributes to higher demand for packaged goods.

- Industrial Hubs: The presence of major manufacturing and distribution centers enhances market activity.

- Infrastructure: Efficient logistics networks and transportation infrastructure facilitate seamless supply chain operations.

- Consumer Demand: High consumer spending power and changing consumption patterns influence the demand for packaged goods.

This segment holds an estimated xx% market share in 2025, and is projected to experience significant growth, driven by [mention specific factors, e.g., increasing demand for ready-to-eat meals and convenience foods].

Germany Rigid Plastic Packaging Market Product Landscape

The German market features a diverse range of rigid plastic packaging products, encompassing bottles, containers, jars, tubs, and closures. Product innovation focuses on improving sustainability features like lightweight designs, increased recycled content, and enhanced recyclability. Advancements in barrier technology enhance product shelf life and protection. Key selling propositions include convenience, durability, cost-effectiveness, and improved sustainability profiles. Technological advancements include the integration of smart packaging solutions, enabling product traceability and consumer interaction.

Key Drivers, Barriers & Challenges in Germany Rigid Plastic Packaging Market

Key Drivers:

- Growing demand for packaged goods across various sectors, fueled by increasing consumer spending and e-commerce growth.

- Stringent regulations promoting the use of sustainable and recyclable packaging.

- Technological advancements in materials science and packaging design.

Key Challenges and Restraints:

- Fluctuating raw material prices. A xx% increase in raw material costs in 2024 led to a xx% increase in final product price.

- Strict environmental regulations and increasing pressure to reduce plastic waste.

- Intense competition from alternative packaging materials.

Emerging Opportunities in Germany Rigid Plastic Packaging Market

The market presents exciting opportunities for businesses adopting sustainable practices, developing innovative packaging solutions, and focusing on niche applications. Untapped markets include specialized packaging for medical devices and pharmaceuticals, demanding stringent quality and safety standards. Emerging trends include bio-based and compostable plastics, offering sustainable alternatives to traditional rigid plastic materials. Furthermore, smart packaging solutions and improved traceability are promising growth avenues.

Growth Accelerators in the Germany Rigid Plastic Packaging Market Industry

Long-term growth will be driven by several factors, including technological breakthroughs in lightweighting and barrier technologies, leading to cost-effective and eco-friendly solutions. Strategic partnerships between packaging producers and brand owners to accelerate the adoption of sustainable packaging will significantly impact market expansion. Expansion into new market segments, such as personalized packaging and premium packaging solutions, will also spur growth.

Key Players Shaping the Germany Rigid Plastic Packaging Market Market

- Amcor Group Gmbh

- Berry Global Inc

- Aptar Group Inc

- Alpla Group

- Frapak Packaging

- Retal Group

- Mauser Packaging Solutions

- Berlin Packaging

- Pinard Beauty Pack

- Schutz GmbH & Co KGaA

- AST Kunststoffverarbeitung GmbH

Notable Milestones in Germany Rigid Plastic Packaging Market Sector

- June 2024: Alpla Group acquires Heinlein Plastik-Technik, expanding its presence in the pharmaceutical and medical packaging sector.

- January 2024: IFCO launches 'Dora,' a reusable plastic pallet designed to improve sustainability and efficiency in the fresh grocery supply chain.

In-Depth Germany Rigid Plastic Packaging Market Market Outlook

The German rigid plastic packaging market is poised for continued growth, driven by innovation in sustainable materials, technological advancements, and strategic partnerships. Opportunities abound for companies focusing on eco-friendly packaging solutions, customized packaging options, and value-added services. The market's long-term potential is strong, particularly for companies adapting to evolving regulatory landscapes and consumer preferences.

Germany Rigid Plastic Packaging Market Segmentation

-

1. Product

- 1.1. Bottles and Jars

- 1.2. Trays and Containers

- 1.3. Caps and Closures

- 1.4. Intermediate Bulk Containers (IBCs)

- 1.5. Drums

- 1.6. Pallets

- 1.7. Other Pr

-

2. Material

-

2.1. Polyethylene (PE)

- 2.1.1. LDPE & LLDPE

- 2.1.2. HDPE

- 2.2. Polyethylene terephthalate (PET)

- 2.3. Polypropylene (PP)

- 2.4. Polystyrene (PS) and Expanded polystyrene (EPS)

- 2.5. Polyvinyl chloride (PVC)

- 2.6. Other Ri

-

2.1. Polyethylene (PE)

-

3. End-use Industry

-

3.1. Food

- 3.1.1. Candy and Confectionery

- 3.1.2. Frozen Foods

- 3.1.3. Fresh Produce

- 3.1.4. Dairy Products

- 3.1.5. Dry Foods

- 3.1.6. Meat, Poultry, and Seafood

- 3.1.7. Pet Food

- 3.1.8. Other Fo

-

3.2. Foodservice

- 3.2.1. Quick Service Restaurants (QSRs)

- 3.2.2. Full-Service Restaurants (FSRs)

- 3.2.3. Coffee and Snack Outlets

- 3.2.4. Retail Establishments

- 3.2.5. Institutional

- 3.2.6. Hospitality

- 3.2.7. Other Foodservice End Uses

- 3.3. Beverage

- 3.4. Healthcare

- 3.5. Cosmetics and Personal Care

- 3.6. Industri

- 3.7. Building and Construction

- 3.8. Automotive

- 3.9. Other En

-

3.1. Food

Germany Rigid Plastic Packaging Market Segmentation By Geography

- 1. Germany

Germany Rigid Plastic Packaging Market Regional Market Share

Geographic Coverage of Germany Rigid Plastic Packaging Market

Germany Rigid Plastic Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Adoption in Food and Beverage Sector; Increasing Rigid Plastic Packaging Solutions Demand Across the Industrial Sector

- 3.3. Market Restrains

- 3.3.1. Growing Adoption in Food and Beverage Sector; Increasing Rigid Plastic Packaging Solutions Demand Across the Industrial Sector

- 3.4. Market Trends

- 3.4.1. Industrial Sector Drives Demand For Rigid Plastic Packaging Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Rigid Plastic Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Bottles and Jars

- 5.1.2. Trays and Containers

- 5.1.3. Caps and Closures

- 5.1.4. Intermediate Bulk Containers (IBCs)

- 5.1.5. Drums

- 5.1.6. Pallets

- 5.1.7. Other Pr

- 5.2. Market Analysis, Insights and Forecast - by Material

- 5.2.1. Polyethylene (PE)

- 5.2.1.1. LDPE & LLDPE

- 5.2.1.2. HDPE

- 5.2.2. Polyethylene terephthalate (PET)

- 5.2.3. Polypropylene (PP)

- 5.2.4. Polystyrene (PS) and Expanded polystyrene (EPS)

- 5.2.5. Polyvinyl chloride (PVC)

- 5.2.6. Other Ri

- 5.2.1. Polyethylene (PE)

- 5.3. Market Analysis, Insights and Forecast - by End-use Industry

- 5.3.1. Food

- 5.3.1.1. Candy and Confectionery

- 5.3.1.2. Frozen Foods

- 5.3.1.3. Fresh Produce

- 5.3.1.4. Dairy Products

- 5.3.1.5. Dry Foods

- 5.3.1.6. Meat, Poultry, and Seafood

- 5.3.1.7. Pet Food

- 5.3.1.8. Other Fo

- 5.3.2. Foodservice

- 5.3.2.1. Quick Service Restaurants (QSRs)

- 5.3.2.2. Full-Service Restaurants (FSRs)

- 5.3.2.3. Coffee and Snack Outlets

- 5.3.2.4. Retail Establishments

- 5.3.2.5. Institutional

- 5.3.2.6. Hospitality

- 5.3.2.7. Other Foodservice End Uses

- 5.3.3. Beverage

- 5.3.4. Healthcare

- 5.3.5. Cosmetics and Personal Care

- 5.3.6. Industri

- 5.3.7. Building and Construction

- 5.3.8. Automotive

- 5.3.9. Other En

- 5.3.1. Food

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Amcor Group Gmbh

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Berry Global Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Aptar Group Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Alpla Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Frapak Packaging

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Retal Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Mauser Packaging Solutions

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Berlin Packaging

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Pinard Beauty Pack

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Schutz GmbH & Co KGaA

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 AST Kunststoffverarbeitung GmbH7 2 Heat Map Analysis7 3 Competitor Analysis - Emerging Vs Established Player

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Amcor Group Gmbh

List of Figures

- Figure 1: Germany Rigid Plastic Packaging Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Germany Rigid Plastic Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: Germany Rigid Plastic Packaging Market Revenue million Forecast, by Product 2020 & 2033

- Table 2: Germany Rigid Plastic Packaging Market Revenue million Forecast, by Material 2020 & 2033

- Table 3: Germany Rigid Plastic Packaging Market Revenue million Forecast, by End-use Industry 2020 & 2033

- Table 4: Germany Rigid Plastic Packaging Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: Germany Rigid Plastic Packaging Market Revenue million Forecast, by Product 2020 & 2033

- Table 6: Germany Rigid Plastic Packaging Market Revenue million Forecast, by Material 2020 & 2033

- Table 7: Germany Rigid Plastic Packaging Market Revenue million Forecast, by End-use Industry 2020 & 2033

- Table 8: Germany Rigid Plastic Packaging Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Rigid Plastic Packaging Market?

The projected CAGR is approximately 3.6%.

2. Which companies are prominent players in the Germany Rigid Plastic Packaging Market?

Key companies in the market include Amcor Group Gmbh, Berry Global Inc, Aptar Group Inc, Alpla Group, Frapak Packaging, Retal Group, Mauser Packaging Solutions, Berlin Packaging, Pinard Beauty Pack, Schutz GmbH & Co KGaA, AST Kunststoffverarbeitung GmbH7 2 Heat Map Analysis7 3 Competitor Analysis - Emerging Vs Established Player.

3. What are the main segments of the Germany Rigid Plastic Packaging Market?

The market segments include Product, Material, End-use Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 67.9 million as of 2022.

5. What are some drivers contributing to market growth?

Growing Adoption in Food and Beverage Sector; Increasing Rigid Plastic Packaging Solutions Demand Across the Industrial Sector.

6. What are the notable trends driving market growth?

Industrial Sector Drives Demand For Rigid Plastic Packaging Products.

7. Are there any restraints impacting market growth?

Growing Adoption in Food and Beverage Sector; Increasing Rigid Plastic Packaging Solutions Demand Across the Industrial Sector.

8. Can you provide examples of recent developments in the market?

June 2024: Alpla Group, a packaging producer and recycler headquartered in Austria, has taken over Heinlein Plastik-Technik. Heinlein, situated in Ansbach, Germany, specializes in manufacturing closure systems, dosing systems, and application aids tailored for the pharmaceutical and medical sectors. The facility encompasses development and construction, featuring the company's proprietary mold construction and mechanical engineering. It also houses production, molding, and assembly operations.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Rigid Plastic Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Rigid Plastic Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Rigid Plastic Packaging Market?

To stay informed about further developments, trends, and reports in the Germany Rigid Plastic Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence