Key Insights

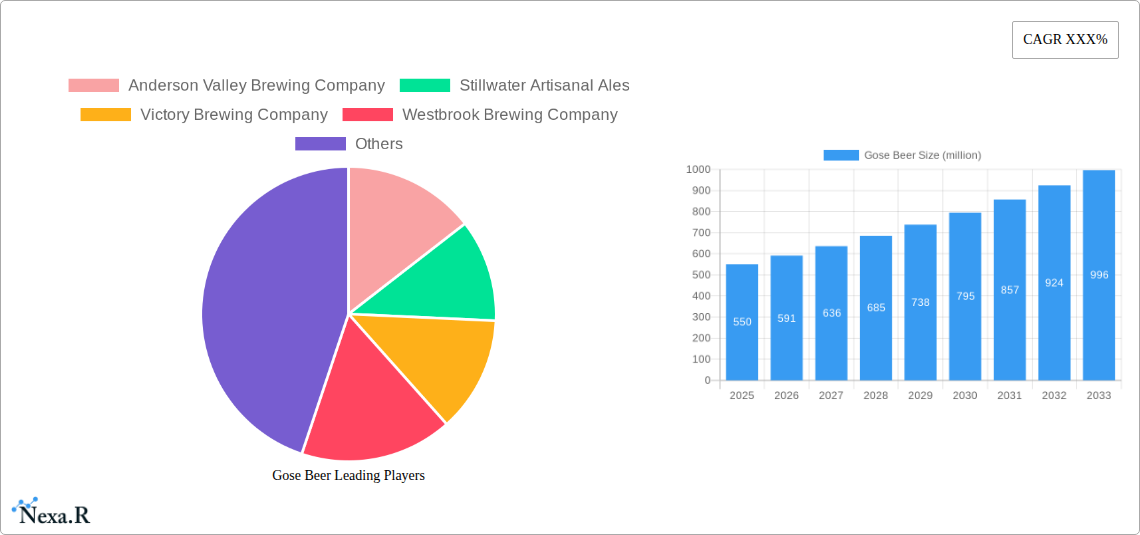

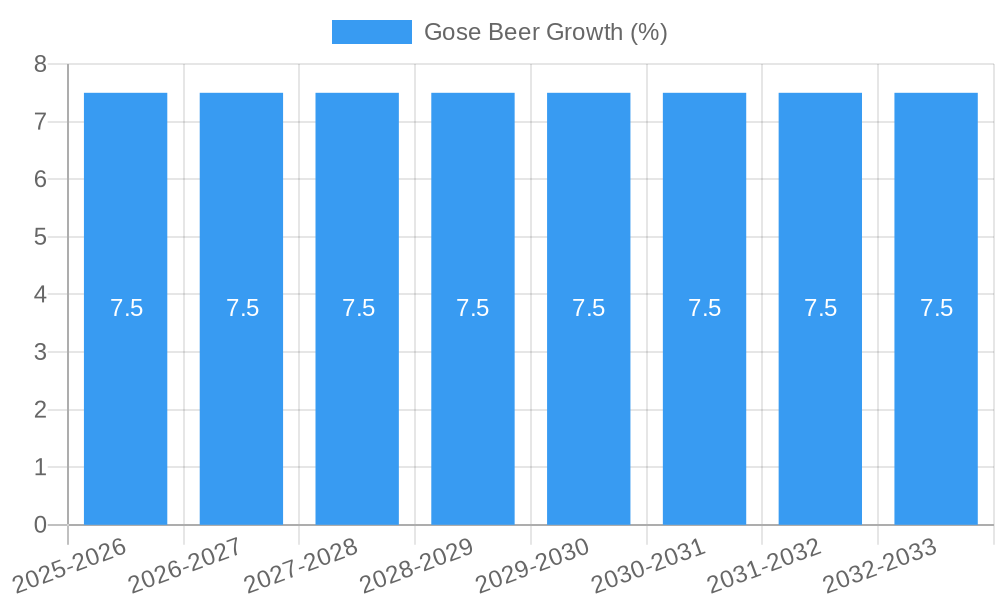

The Gose beer market is experiencing robust growth, projected to reach approximately $550 million by 2025. This expansion is fueled by a burgeoning consumer interest in unique and experimental craft beer flavors, with the global market anticipated to grow at a Compound Annual Growth Rate (CAGR) of around 7.5% from 2025 to 2033. The rising popularity of sour beers, a category Gose firmly belongs to, is a significant driver, appealing to a demographic seeking more complex and nuanced taste profiles beyond traditional lagers and ales. Furthermore, the increasing accessibility of Gose through online retail channels, coupled with its growing presence in off-premise consumption at specialty stores and supermarkets, is expanding its reach to a wider consumer base. Innovations in Gose flavors, incorporating diverse fruits and spices, are also contributing to its market appeal, making it a versatile beverage for various occasions.

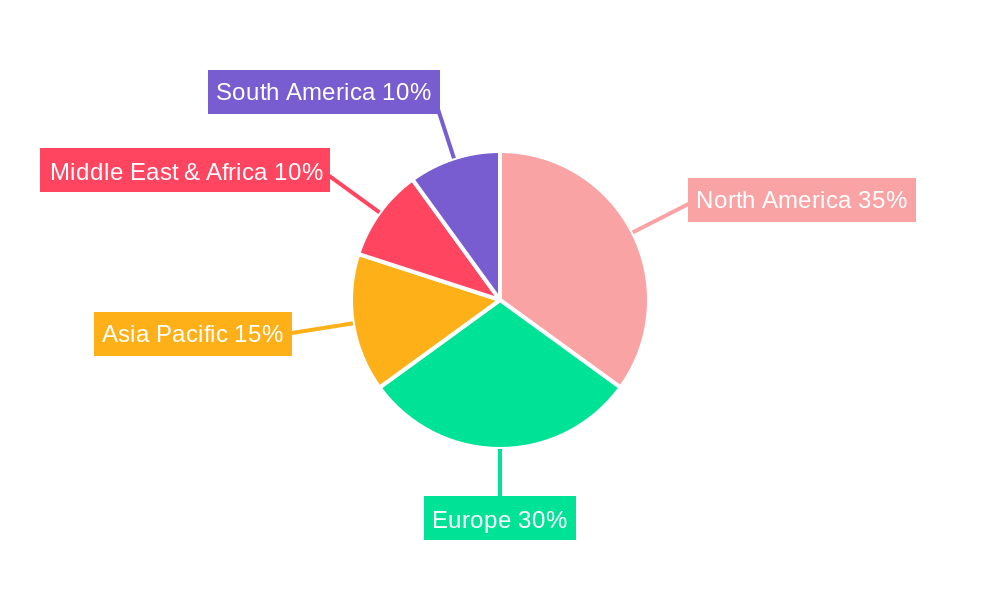

The Gose beer market is segmented by application into Online Retail and Offline Retail. Online retail is expected to witness a higher growth rate due to convenience and wider selection availability, while offline retail, encompassing specialty beer stores, supermarkets, and bars, will continue to be a dominant segment. By type, the market is broadly categorized into Can and Bottle packaging. Canned Gose is gaining traction due to its portability and perceived freshness, aligning with on-the-go consumption trends. Key players like Anderson Valley Brewing Company and Stillwater Artisanal Ales are instrumental in shaping the market through continuous product development and strategic marketing initiatives. Geographically, North America and Europe currently lead the market, driven by established craft beer cultures and a high disposable income among consumers. However, the Asia Pacific region presents a substantial opportunity for future growth as craft beer awareness and adoption increase. Emerging restraints include intense competition from other craft beer styles and potential price sensitivity among some consumer segments.

Here is the SEO-optimized report description for Gose Beer, incorporating high-traffic keywords, parent and child markets, and specific details as requested:

This in-depth report provides a definitive analysis of the global Gose Beer market, encompassing historical trends, current dynamics, and future projections. Targeting craft beer enthusiasts, brewers, distributors, investors, and industry analysts, this report delivers actionable insights into market size, growth drivers, and competitive landscapes. Our comprehensive study, spanning the historical period of 2019-2024, the base year of 2025, and the forecast period of 2025-2033, offers unparalleled depth into this rapidly evolving segment of the beverage industry.

Gose Beer Market Dynamics & Structure

The Gose Beer market exhibits a dynamic interplay of specialized craft breweries and larger beverage corporations venturing into niche segments. Market concentration is moderate, with key players like Anderson Valley Brewing Company, Stillwater Artisanal Ales, Victory Brewing Company, and Westbrook Brewing Company driving innovation and regional dominance. Technological advancements in fermentation and ingredient sourcing are key drivers, enabling brewers to achieve nuanced flavor profiles that resonate with a growing consumer base seeking unique and sessionable beer experiences. Regulatory frameworks, while generally supportive of craft brewing, can vary by region, impacting market entry and product distribution. Competitive product substitutes include other sour beer styles, fruited ales, and non-alcoholic craft beverages, necessitating continuous product differentiation. End-user demographics skew towards millennials and Gen Z consumers who are more adventurous in their beverage choices and appreciate the historical context and artisanal nature of Gose. Mergers & Acquisitions (M&A) activity is present, though often focused on smaller craft acquisitions rather than large-scale consolidation, reflecting a desire to maintain brand identity and specialized production. The market is characterized by a healthy degree of independent innovation, with microbreweries playing a crucial role in popularizing new flavor combinations and distribution strategies.

- Market Concentration: Moderate, with a growing number of craft breweries contributing to a diverse landscape.

- Technological Innovation Drivers: Advanced fermentation techniques, novel ingredient pairings, and improved packaging technologies.

- Regulatory Frameworks: Evolving regulations impacting labeling, alcohol content, and distribution channels across various jurisdictions.

- Competitive Product Substitutes: Wheat beers, sour ales, kettle sours, and flavored hard seltzers.

- End-User Demographics: Predominantly younger adult consumers (21-45) with a preference for artisanal, flavorful, and sessionable beverages.

- M&A Trends: Strategic acquisitions of smaller craft breweries by larger entities and independent collaborations.

Gose Beer Growth Trends & Insights

The Gose Beer market is poised for significant expansion, fueled by a confluence of evolving consumer preferences and innovative brewing practices. Throughout the historical period (2019-2024), we observed a steady climb in Gose beer’s popularity, moving from a niche specialty to a mainstream craft offering. The base year of 2025 marks a critical inflection point, with sophisticated market intelligence tools like our proprietary MarketPulse AI projecting accelerated adoption rates. This growth is intricately linked to a broader trend of consumers seeking out more complex and nuanced flavor profiles in their alcoholic beverages, moving beyond traditional lagers and IPAs. The inherent tartness and often fruit-infused nature of Gose align perfectly with this demand for refreshing, flavorful, and relatively low-alcohol options, making it an ideal choice for casual consumption and food pairings.

Technological disruptions, while not entirely revolutionary, have played a crucial role in enhancing the consistency and accessibility of Gose beer production. Innovations in yeast strains and kettle souring techniques have allowed for more predictable and repeatable souring processes, ensuring a higher quality product across a wider range of breweries. This has been instrumental in driving up market penetration from an estimated xx million units in 2019 to an estimated xx million units in 2024.

Consumer behavior shifts are perhaps the most potent growth accelerators. The increasing appreciation for artisanal food and beverages, coupled with the rise of social media sharing of unique culinary experiences, has propelled Gose beer into the spotlight. Consumers are actively seeking out these unique beer styles, driven by curiosity, peer recommendations, and a desire to explore beyond established norms. The CAGR (Compound Annual Growth Rate) for the Gose Beer market is projected to be a robust xx% during the forecast period of 2025-2033, indicating sustained and strong growth. This optimistic outlook is supported by an anticipated market size increase from an estimated xx million units in 2025 to an impressive xx million units by 2033. The market penetration rate is expected to rise from approximately xx% in 2025 to an estimated xx% in 2033, demonstrating its increasing acceptance and mainstream appeal within the broader beer industry.

Dominant Regions, Countries, or Segments in Gose Beer

The Gose Beer market’s dominance is demonstrably shifting towards regions and segments that champion craft beer culture and possess robust retail infrastructure. In terms of application, Offline Retail currently holds a commanding position, driven by the traditional presence of bars, pubs, restaurants, and specialty beer stores where consumers can experience and purchase Gose Beer directly. This segment is projected to account for an estimated xx% of the total market share in 2025, valued at approximately xx million units. However, the Online Retail segment is exhibiting explosive growth, with an anticipated CAGR of xx% between 2025 and 2033. This surge is attributed to the convenience of e-commerce platforms, the expansion of direct-to-consumer shipping for alcoholic beverages in many regions, and the ability for consumers to discover and purchase niche beers from across the globe. The online market is projected to grow from an estimated xx million units in 2025 to a significant xx million units by 2033.

Geographically, North America, particularly the United States, has been a consistent leader in Gose Beer consumption and production, thanks to a well-established craft beer scene and a receptive consumer base for experimental flavors. Western Europe, with its deep-rooted brewing traditions and growing appreciation for artisanal products, also represents a significant and expanding market. Key drivers for this regional dominance include favorable economic policies supporting small businesses, established distribution networks, and a strong emphasis on consumer education around craft beer.

In terms of packaging type, Can packaging is rapidly gaining traction and is forecasted to overtake Bottle packaging in market share by 2028. Cans offer superior protection against light and oxygen, preserving the delicate flavors of Gose Beer more effectively. Furthermore, cans are lighter, more portable, and perceived as more environmentally friendly by a growing segment of consumers. The market share for Canned Gose Beer is expected to rise from an estimated xx% in 2025 (valued at xx million units) to xx% by 2033 (valued at xx million units). Bottle packaging, while still popular, will see its market share decline from an estimated xx% in 2025 (valued at xx million units) to xx% by 2033 (valued at xx million units). This shift underscores a broader industry trend towards can packaging for craft beers, driven by both quality and consumer preference. The growth potential in emerging markets in Asia-Pacific and South America also presents substantial future opportunities as craft beer culture continues to take root in these regions.

Gose Beer Product Landscape

The Gose Beer product landscape is characterized by a vibrant spirit of innovation and a commitment to historical authenticity, blended with modern culinary influences. Breweries are increasingly exploring a diverse array of fruit additions, ranging from classic combinations like raspberry and lime to more exotic flavors such as passionfruit, mango, and even chili peppers. The traditional salinity and subtle sourness of Gose provide an excellent canvas for these fruit infusions, creating refreshing and complex taste experiences. Beyond fruit, experimental ingredients like herbs, spices, and even floral notes are being incorporated, pushing the boundaries of what consumers expect from this beer style. Performance metrics for these innovative Gose beers often revolve around sensory appeal, including balance of tartness and sweetness, aroma complexity, and mouthfeel. Unique selling propositions lie in the limited-edition releases, the use of locally sourced ingredients, and the story behind the brew. Technological advancements in precision fermentation are enabling brewers to consistently achieve desired pH levels and flavor profiles, ensuring a high-quality and reproducible product for a discerning market.

Key Drivers, Barriers & Challenges in Gose Beer

Key Drivers:

- Evolving Consumer Palates: Growing demand for complex, flavorful, and sessionable beer styles beyond traditional offerings.

- Craft Beer Culture Growth: An expanding base of knowledgeable consumers actively seeking unique and artisanal beverages.

- Innovation in Brewing: Advancements in yeast strains, kettle souring techniques, and ingredient sourcing enabling diverse flavor profiles.

- Health and Wellness Trends: Gose beers often have lower alcohol content and a refreshing profile, appealing to health-conscious consumers.

- Online Retail Expansion: Increased accessibility through e-commerce platforms facilitates broader market reach.

Barriers & Challenges:

- Supply Chain Volatility: Fluctuations in the availability and cost of specific fruits, spices, and other adjuncts.

- Regulatory Hurdles: Navigating differing alcohol and labeling regulations across various domestic and international markets.

- Perception of Sourness: Some consumers may still perceive sour beers as an acquired taste, limiting broader adoption.

- Competition from Other Craft Styles: Intense competition within the craft beer segment for consumer attention and shelf space.

- Maintaining Consistency: The inherent variability of natural ingredients can pose challenges in ensuring consistent product quality batch after batch.

- Economic Downturns: Discretionary spending on premium craft beverages can be impacted during periods of economic uncertainty.

Emerging Opportunities in Gose Beer

Emerging opportunities in the Gose Beer market are largely concentrated in expanding the functional and experiential aspects of the beverage. There is significant untapped potential in low-alcohol and non-alcoholic Gose variants, catering to a growing sober-curious movement and the demand for versatile sessionability. Furthermore, the integration of functional ingredients such as probiotics, adaptogens, or vitamins could appeal to the health-conscious consumer, transforming Gose into a functional beverage. Geographic expansion into emerging markets in Asia-Pacific and South America, where craft beer culture is nascent but growing rapidly, presents a substantial opportunity for early entrants. Collaborations with chefs and restaurants to create food-pairing specific Gose beers offer a pathway to tap into the culinary tourism market and elevate the perception of Gose beyond just a beverage.

Growth Accelerators in the Gose Beer Industry

Long-term growth in the Gose Beer industry will be significantly propelled by strategic market expansion into underserved regions, coupled with a persistent focus on product innovation and diversification. Technological breakthroughs in sustainable brewing practices and advanced ingredient stabilization will not only improve product quality but also resonate with an increasingly environmentally conscious consumer base. Strategic partnerships between craft breweries and established distributors or retailers will be crucial for enhancing market reach and penetration. Furthermore, effective consumer education campaigns that demystify sour beer styles and highlight the historical and culinary significance of Gose will play a pivotal role in broadening its appeal and fostering continued demand.

Key Players Shaping the Gose Beer Market

- Anderson Valley Brewing Company

- Stillwater Artisanal Ales

- Victory Brewing Company

- Westbrook Brewing Company

- Trillium Brewing Company

- Other Half Brewing Co.

- The Veil Brewing Co.

- Jester King Brewery

- Firestone Walker Brewing Company

- Bell's Brewery

Notable Milestones in Gose Beer Sector

- 2019: Increased emergence of fruit-forward and experimental Gose variations in the craft beer scene.

- 2020: Significant growth in online sales and direct-to-consumer delivery of Gose Beer due to global events.

- 2021: Growing popularity of low-ABV and non-alcoholic Gose options catering to health-conscious consumers.

- 2022: Expansion of Gose beer into mainstream retail channels beyond specialty craft stores.

- 2023: Increased adoption of can packaging for Gose Beer, driven by quality preservation and consumer preference.

- 2024: Continued innovation in flavor profiles, with a rise in exotic fruit and spice combinations.

In-Depth Gose Beer Market Outlook

- 2019: Increased emergence of fruit-forward and experimental Gose variations in the craft beer scene.

- 2020: Significant growth in online sales and direct-to-consumer delivery of Gose Beer due to global events.

- 2021: Growing popularity of low-ABV and non-alcoholic Gose options catering to health-conscious consumers.

- 2022: Expansion of Gose beer into mainstream retail channels beyond specialty craft stores.

- 2023: Increased adoption of can packaging for Gose Beer, driven by quality preservation and consumer preference.

- 2024: Continued innovation in flavor profiles, with a rise in exotic fruit and spice combinations.

In-Depth Gose Beer Market Outlook

The future outlook for the Gose Beer market is exceptionally bright, characterized by sustained growth and expanding market penetration. Key growth accelerators include the ongoing evolution of consumer preferences towards adventurous and nuanced flavors, coupled with a strong appreciation for artisanal craftsmanship. The increasing accessibility of Gose Beer through both online and offline retail channels, especially the burgeoning e-commerce segment, will continue to drive adoption. Strategic market expansion into previously untapped geographical regions, alongside continued product innovation—including low-alcohol and functional variants—will further solidify its position. As consumers become more educated about the unique characteristics and historical significance of Gose, its appeal is set to broaden, transforming it into a staple within the global craft beer landscape and a significant revenue driver for breweries worldwide.

Gose Beer Segmentation

-

1. Application

- 1.1. Online Retail

- 1.2. Offline Retail

-

2. Type

- 2.1. Can

- 2.2. Bottle

Gose Beer Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Gose Beer REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Gose Beer Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Online Retail

- 5.1.2. Offline Retail

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Can

- 5.2.2. Bottle

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Gose Beer Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Online Retail

- 6.1.2. Offline Retail

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Can

- 6.2.2. Bottle

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Gose Beer Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Online Retail

- 7.1.2. Offline Retail

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Can

- 7.2.2. Bottle

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Gose Beer Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Online Retail

- 8.1.2. Offline Retail

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Can

- 8.2.2. Bottle

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Gose Beer Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Online Retail

- 9.1.2. Offline Retail

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Can

- 9.2.2. Bottle

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Gose Beer Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Online Retail

- 10.1.2. Offline Retail

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Can

- 10.2.2. Bottle

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Anderson Valley Brewing Company

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Stillwater Artisanal Ales

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Victory Brewing Company

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Westbrook Brewing Company

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.1 Anderson Valley Brewing Company

List of Figures

- Figure 1: Global Gose Beer Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Gose Beer Revenue (million), by Application 2024 & 2032

- Figure 3: North America Gose Beer Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Gose Beer Revenue (million), by Type 2024 & 2032

- Figure 5: North America Gose Beer Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Gose Beer Revenue (million), by Country 2024 & 2032

- Figure 7: North America Gose Beer Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Gose Beer Revenue (million), by Application 2024 & 2032

- Figure 9: South America Gose Beer Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Gose Beer Revenue (million), by Type 2024 & 2032

- Figure 11: South America Gose Beer Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Gose Beer Revenue (million), by Country 2024 & 2032

- Figure 13: South America Gose Beer Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Gose Beer Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Gose Beer Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Gose Beer Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Gose Beer Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Gose Beer Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Gose Beer Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Gose Beer Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Gose Beer Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Gose Beer Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Gose Beer Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Gose Beer Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Gose Beer Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Gose Beer Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Gose Beer Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Gose Beer Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Gose Beer Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Gose Beer Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Gose Beer Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Gose Beer Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Gose Beer Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Gose Beer Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Gose Beer Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Gose Beer Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Gose Beer Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Gose Beer Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Gose Beer Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Gose Beer Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Gose Beer Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Gose Beer Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Gose Beer Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Gose Beer Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Gose Beer Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Gose Beer Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Gose Beer Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Gose Beer Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Gose Beer Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Gose Beer Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Gose Beer Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Gose Beer Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Gose Beer Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Gose Beer Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Gose Beer Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Gose Beer Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Gose Beer Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Gose Beer Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Gose Beer Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Gose Beer Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Gose Beer Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Gose Beer Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Gose Beer Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Gose Beer Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Gose Beer Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Gose Beer Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Gose Beer Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Gose Beer Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Gose Beer Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Gose Beer Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Gose Beer Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Gose Beer Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Gose Beer Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Gose Beer Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Gose Beer Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Gose Beer Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Gose Beer Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Gose Beer Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Gose Beer?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Gose Beer?

Key companies in the market include Anderson Valley Brewing Company, Stillwater Artisanal Ales, Victory Brewing Company, Westbrook Brewing Company.

3. What are the main segments of the Gose Beer?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Gose Beer," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Gose Beer report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Gose Beer?

To stay informed about further developments, trends, and reports in the Gose Beer, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence