Key Insights

The Indian Food Acidulants Market is projected to achieve a size of $3.6 billion by 2024, with a Compound Annual Growth Rate (CAGR) of 4.85% through 2033. This expansion is driven by increasing consumer demand for processed foods, beverages, and convenience products, where acidulants are essential for flavor, preservation, and pH control. Rising disposable incomes and evolving dietary habits in India are boosting consumption of bakery items, confectionery, dairy, and meat products, key application areas for food acidulants. Citric, phosphoric, and lactic acids are expected to lead due to their broad applicability. Advancements in food processing technologies and a focus on food safety standards also contribute to market growth.

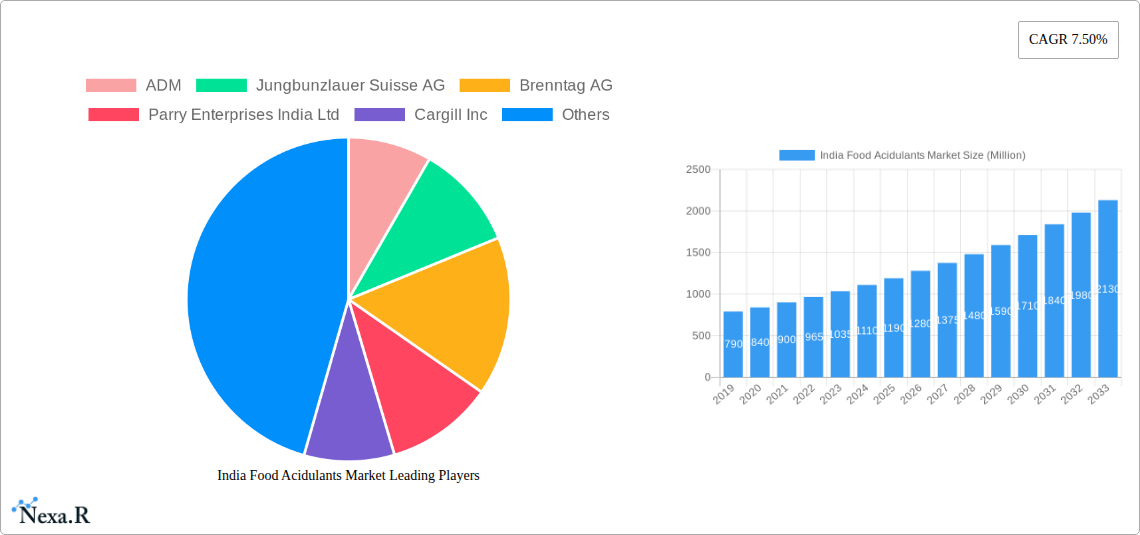

India Food Acidulants Market Market Size (In Billion)

The market is further influenced by consumer preference for clean labels and natural ingredients, encouraging the development of naturally derived acidulants. Challenges include raw material price volatility and stringent regulatory compliance. Key players such as ADM, Cargill Inc., and Tate & Lyle are actively participating through strategic initiatives. The Indian Food Acidulants Market is undergoing significant transformation, presenting substantial opportunities for stakeholders due to evolving consumer behavior and industry practices.

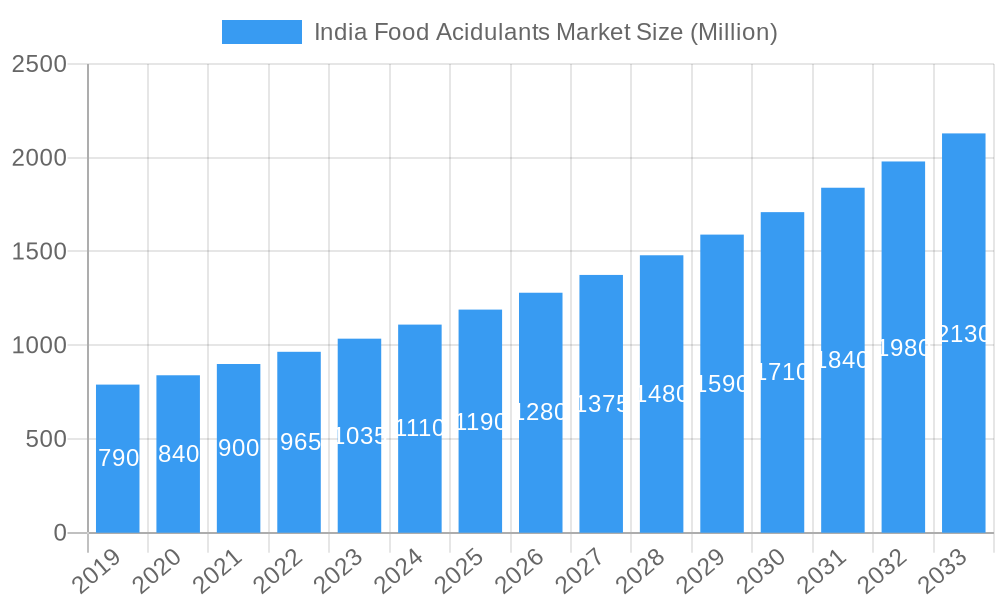

India Food Acidulants Market Company Market Share

India Food Acidulants Market Report 2024-2033: Comprehensive Analysis & Future Outlook

This in-depth report provides a comprehensive analysis of the India Food Acidulants Market, offering critical insights for stakeholders looking to navigate this dynamic sector. Covering the historical period of 2019–2024, a base year of 2025, and a forecast period extending to 2033, this study delves into market dynamics, growth trends, regional dominance, product landscape, key drivers, barriers, emerging opportunities, and the strategic landscape shaped by key players. Values are presented in Million units.

India Food Acidulants Market Market Dynamics & Structure

The India Food Acidulants Market is characterized by a moderate to high concentration, driven by a blend of established multinational corporations and increasingly capable domestic players. Technological innovation is a significant driver, with ongoing research focused on enhancing production efficiency, purity, and exploring novel applications for acidulants. Regulatory frameworks, overseen by bodies like the Food Safety and Standards Authority of India (FSSAI), play a crucial role in dictating product safety standards and permissible usage levels. Competitive product substitutes, such as natural acidulants derived from fruits, are gaining traction, posing a challenge to synthetic counterparts. End-user demographics are evolving, with a growing middle class, increased health consciousness, and a preference for convenience foods fueling demand. Mergers and Acquisitions (M&A) are an active component of the market's structure, with larger entities acquiring smaller, specialized companies to expand their product portfolios and geographical reach. For instance, over the historical period (2019-2024), an estimated 8 M&A deals were recorded, indicating consolidation trends. Innovation barriers, while present, are being addressed through strategic R&D investments and collaborations.

- Market Concentration: Moderate to High, with key players holding significant shares.

- Technological Innovation Drivers: Enhanced purity, sustainable production, and novel food applications.

- Regulatory Frameworks: FSSAI compliance, stringent quality control, and evolving safety standards.

- Competitive Product Substitutes: Growing demand for natural acidulants like citric acid from fruits.

- End-User Demographics: Rising middle class, health-conscious consumers, and demand for processed foods.

- M&A Trends: Strategic acquisitions to enhance market presence and product diversification.

- Innovation Barriers: High R&D costs, patent protection, and scalability challenges.

India Food Acidulants Market Growth Trends & Insights

The India Food Acidulants Market has witnessed a robust growth trajectory, propelled by a confluence of economic, demographic, and industry-specific factors. The market size has evolved significantly, driven by increasing per capita consumption of processed foods and beverages. Adoption rates for various acidulants are directly correlated with their application in popular food categories. Technological disruptions, including advancements in fermentation processes for citric and lactic acid production, have improved efficiency and reduced costs, thereby enhancing market penetration. Consumer behavior shifts are profoundly impacting demand. There's a discernible trend towards cleaner labels and natural ingredients, prompting manufacturers to explore bio-based acidulant production. Furthermore, the growing awareness of the functional benefits of acidulants beyond mere flavor enhancement, such as preservation and pH control, is contributing to their wider adoption. The estimated market size in the base year 2025 is projected to be USD 1,500 Million. The Compound Annual Growth Rate (CAGR) for the forecast period 2025–2033 is estimated at a healthy 7.8%.

- Market Size Evolution: Steady expansion driven by increasing processed food consumption.

- Adoption Rates: High for citric and phosphoric acid, with growing interest in lactic acid.

- Technological Disruptions: Advancements in fermentation and bio-production processes.

- Consumer Behavior Shifts: Preference for natural ingredients and functional food benefits.

- Market Penetration: Increasing across diverse food and beverage segments.

- Estimated Market Size (2025): USD 1,500 Million

- CAGR (2025-2033): 7.8%

Dominant Regions, Countries, or Segments in India Food Acidulants Market

Within the India Food Acidulants Market, Citric Acid stands out as the dominant segment by Type, driven by its versatile applications across the food and beverage industry. Its widespread use in beverages as an acidulant and flavor enhancer, in dairy and frozen products for texture and preservation, and in bakery for leavening and flavor, cements its leadership position. The Beverages segment emerges as the leading application, accounting for approximately 35% of the total market share in 2025, due to the immense popularity of soft drinks, fruit juices, and alcoholic beverages.

Key drivers for the dominance of Citric Acid and the Beverages segment include:

- Cost-Effectiveness: Citric acid is relatively cost-effective to produce, making it an economically viable choice for large-scale food manufacturing.

- Versatile Functionality: Its ability to provide tartness, enhance flavor profiles, act as a preservative, and chelate metal ions makes it indispensable in a wide array of food formulations.

- Consumer Preference: Consumers have a high familiarity and acceptance of citric acid in their daily food and beverage intake.

- Favorable Regulatory Landscape: Citric acid is generally recognized as safe (GRAS) by regulatory bodies, facilitating its widespread use.

- Economic Policies: Government initiatives promoting food processing and exports further boost demand for key ingredients like citric acid.

- Infrastructure: Well-developed supply chains and logistics networks ensure efficient distribution of citric acid across India.

- Growth Potential: The burgeoning Indian beverage market, with its increasing demand for flavored and functional drinks, presents significant growth opportunities for citric acid manufacturers. The estimated market share of Citric Acid in 2025 is projected at 48%. The estimated market share for the Beverages segment in 2025 is projected at 35%.

India Food Acidulants Market Product Landscape

The India Food Acidulants Market is characterized by a dynamic product landscape with continuous innovation aimed at enhancing functionality and sustainability. Citric acid remains the cornerstone, with advancements focusing on higher purity grades and bio-based production methods. Phosphoric acid, crucial for cola-type beverages, sees ongoing efforts to improve its environmental footprint during production. Lactic acid, with its growing popularity in dairy, confectionery, and as a natural preservative, is benefiting from refined fermentation techniques. Acetic acid finds its niche in pickled products and condiments, while malic acid is increasingly used in sugar-free confectionery and beverages for its taste profile. Unique selling propositions often revolve around certifications, such as organic or non-GMO, and tailored solutions for specific food applications, demonstrating technological advancements in creating specialized acidulant blends.

Key Drivers, Barriers & Challenges in India Food Acidulants Market

Key Drivers:

- Growing Processed Food & Beverage Industry: Increased demand for convenience foods and a burgeoning beverage sector are primary growth engines.

- Rising Disposable Incomes: Higher purchasing power enables consumers to opt for a wider range of processed food products.

- Health and Wellness Trends: Demand for acidulants that contribute to shelf-life extension and improved texture in health-focused products.

- Technological Advancements: Efficient production methods and innovative applications are expanding market reach.

- Export Potential: India's growing role as a food exporter necessitates high-quality acidulants for international markets.

Key Barriers & Challenges:

- Raw Material Price Volatility: Fluctuations in the prices of agricultural commodities used in acidulant production can impact profitability.

- Stringent Regulatory Compliance: Adhering to evolving food safety standards requires continuous investment in quality control and infrastructure.

- Competition from Natural Alternatives: Increasing consumer preference for natural ingredients poses a challenge to synthetic acidulants.

- Supply Chain Disruptions: Geopolitical events or natural calamities can impact the availability and timely delivery of raw materials and finished products.

- Infrastructure Deficiencies: While improving, some regions still face logistical challenges in efficient product distribution. The estimated impact of supply chain disruptions can lead to a 5-7% increase in production costs.

Emerging Opportunities in India Food Acidulants Market

Emerging opportunities in the India Food Acidulants Market lie in the burgeoning demand for clean-label ingredients and bio-based acidulants. The rising health consciousness among Indian consumers is creating a significant appetite for products with natural preservatives and minimal artificial additives. This presents a substantial opening for the increased production and application of lactic acid derived from fermentation processes, and also for citric acid sourced from natural fermentation of molasses or corn. Furthermore, the expanding market for functional foods and beverages offers a platform for acidulants that contribute beyond taste, such as aiding in nutrient absorption or providing antioxidant properties. The untapped potential in niche food applications like plant-based meat alternatives and specialized bakery products also presents lucrative avenues for growth.

Growth Accelerators in the India Food Acidulants Market Industry

Long-term growth in the India Food Acidulants Market is being significantly accelerated by strategic partnerships and collaborations between acidulant manufacturers and food processing companies. These alliances foster co-development of innovative food formulations and ensure a stable supply chain. Furthermore, continuous investment in R&D for sustainable production technologies, particularly in bio-fermentation, is a key catalyst, reducing environmental impact and improving cost-efficiency. Market expansion strategies, including entering new geographical regions within India and increasing export penetration, are also playing a crucial role. The integration of advanced analytical techniques for quality assurance and the development of specialized acidulant blends tailored to specific consumer preferences further contribute to sustained market expansion.

Key Players Shaping the India Food Acidulants Market Market

- ADM

- Jungbunzlauer Suisse AG

- Brenntag AG

- Parry Enterprises India Ltd

- Cargill Inc

- Acuro Organics Limited

- Corbion NV

- Tate & Lyle

Notable Milestones in India Food Acidulants Market Sector

- 2020: FSSAI revises and strengthens its guidelines for food additives, including acidulants, enhancing consumer safety.

- 2021: Major players invest in expanding their fermentation capacity to meet rising domestic demand for citric and lactic acid.

- 2022: Launch of new bio-based lactic acid production facilities, emphasizing sustainability and cleaner labels.

- 2023: Increased focus on R&D for natural acidulant alternatives and their integration into confectionery and dairy products.

- 2024: Growing M&A activity as larger companies acquire niche players to broaden their product portfolios and market reach.

In-Depth India Food Acidulants Market Market Outlook

The India Food Acidulants Market is poised for sustained growth, driven by a confluence of strong domestic demand and evolving consumer preferences. Key growth accelerators, including advancements in bio-fermentation technologies, strategic market expansions, and the development of specialized acidulant applications for emerging food categories like plant-based alternatives, will continue to fuel market expansion. The increasing emphasis on clean labels and natural ingredients presents a significant opportunity for lactic acid and bio-derived citric acid. As disposable incomes rise and the processed food industry continues its upward trajectory, the demand for high-quality, safe, and functional acidulants will remain robust. Strategic partnerships and a commitment to innovation will be paramount for companies seeking to capitalize on the immense potential within this dynamic Indian market.

India Food Acidulants Market Segmentation

-

1. Type

- 1.1. Citric Acid

- 1.2. Phosphoric Acid

- 1.3. Lactic Acid

- 1.4. Acetic Acid

- 1.5. Malic Acid

- 1.6. Other Types

-

2. Application

- 2.1. Beverages

- 2.2. Dairy and Frozen Products

- 2.3. Bakery

- 2.4. Meat Industry

- 2.5. Confectionery

- 2.6. Other Applications

India Food Acidulants Market Segmentation By Geography

- 1. India

India Food Acidulants Market Regional Market Share

Geographic Coverage of India Food Acidulants Market

India Food Acidulants Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.85% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Application in Dietary Supplements

- 3.3. Market Restrains

- 3.3.1. Disruptions in the Supply Chain Such as Raw Material Shortages or Logistical Challenges

- 3.4. Market Trends

- 3.4.1. Growing Demand for Convenience Food

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Food Acidulants Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Citric Acid

- 5.1.2. Phosphoric Acid

- 5.1.3. Lactic Acid

- 5.1.4. Acetic Acid

- 5.1.5. Malic Acid

- 5.1.6. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Beverages

- 5.2.2. Dairy and Frozen Products

- 5.2.3. Bakery

- 5.2.4. Meat Industry

- 5.2.5. Confectionery

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 ADM

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Jungbunzlauer Suisse AG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Brenntag AG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Parry Enterprises India Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Cargill Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Acuro Organics Limited*List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Corbion NV

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Tate & Lyle

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 ADM

List of Figures

- Figure 1: India Food Acidulants Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: India Food Acidulants Market Share (%) by Company 2025

List of Tables

- Table 1: India Food Acidulants Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: India Food Acidulants Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 3: India Food Acidulants Market Revenue billion Forecast, by Application 2020 & 2033

- Table 4: India Food Acidulants Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 5: India Food Acidulants Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: India Food Acidulants Market Volume K Tons Forecast, by Region 2020 & 2033

- Table 7: India Food Acidulants Market Revenue billion Forecast, by Type 2020 & 2033

- Table 8: India Food Acidulants Market Volume K Tons Forecast, by Type 2020 & 2033

- Table 9: India Food Acidulants Market Revenue billion Forecast, by Application 2020 & 2033

- Table 10: India Food Acidulants Market Volume K Tons Forecast, by Application 2020 & 2033

- Table 11: India Food Acidulants Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: India Food Acidulants Market Volume K Tons Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Food Acidulants Market?

The projected CAGR is approximately 4.85%.

2. Which companies are prominent players in the India Food Acidulants Market?

Key companies in the market include ADM, Jungbunzlauer Suisse AG, Brenntag AG, Parry Enterprises India Ltd, Cargill Inc, Acuro Organics Limited*List Not Exhaustive, Corbion NV, Tate & Lyle.

3. What are the main segments of the India Food Acidulants Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.6 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Application in Dietary Supplements.

6. What are the notable trends driving market growth?

Growing Demand for Convenience Food.

7. Are there any restraints impacting market growth?

Disruptions in the Supply Chain Such as Raw Material Shortages or Logistical Challenges.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Tons.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Food Acidulants Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Food Acidulants Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Food Acidulants Market?

To stay informed about further developments, trends, and reports in the India Food Acidulants Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence