Key Insights

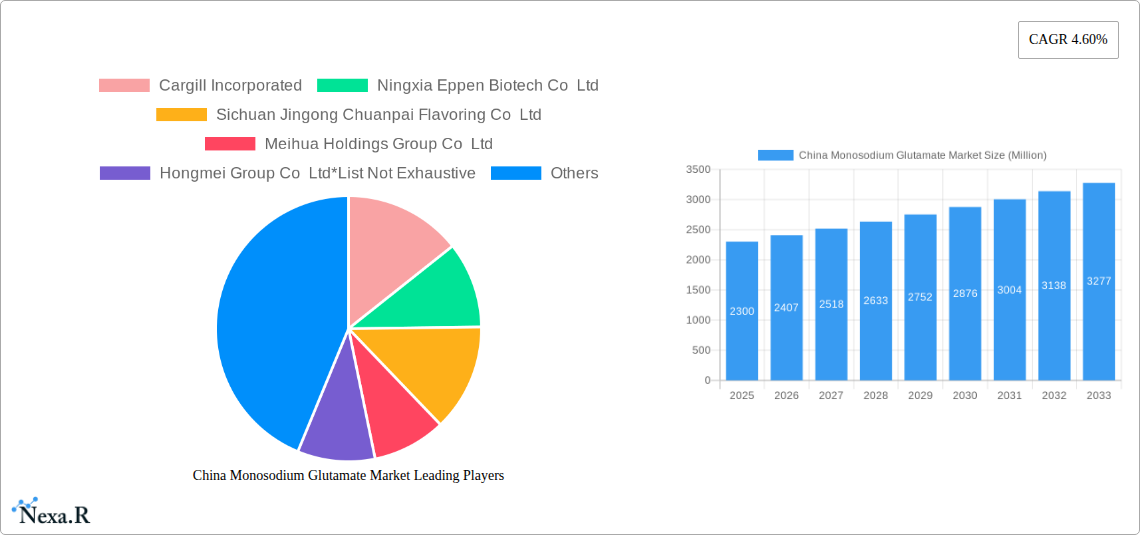

The China Monosodium Glutamate (MSG) market is projected to reach $5.92 billion by 2025, exhibiting a CAGR of 4.47% from 2025 to 2033. This growth is driven by sustained demand across key food sectors, including noodles, soups, broths, and meat products, where MSG enhances flavor profiles. Its integral role in seasonings and dressings further solidifies its position in Chinese cuisine and food processing. Emerging applications are also expected to contribute to market dynamism.

China Monosodium Glutamate Market Market Size (In Billion)

Key market drivers include the expansion of China's processed food industry, fueled by urbanization and evolving consumer preferences for convenience. Increased disposable incomes also support the consumption of diverse food products that often incorporate MSG for taste enhancement. Technological advancements in production contribute to improved quality and cost-efficiency. Potential restraints involve evolving consumer perceptions of food additives and regulatory scrutiny. Nevertheless, China's substantial food consumption and MSG's deep-rooted culinary presence indicate a robust market. Leading players like Cargill Incorporated, Ningxia Eppen Biotech Co Ltd, and Meihua Holdings Group Co Ltd are actively influencing market trends through strategic initiatives.

China Monosodium Glutamate Market Company Market Share

China Monosodium Glutamate Market Report: Growth, Trends, and Key Players (2019-2033)

This comprehensive report offers an in-depth analysis of the China Monosodium Glutamate (MSG) Market, encompassing its dynamics, growth trajectories, regional dominance, product landscape, and competitive environment. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period extending to 2033, this study provides actionable insights for stakeholders navigating this vital sector of the food additive industry. The report utilizes extensive data to project market size in Million units and CAGR for the forecast period.

China Monosodium Glutamate Market Market Dynamics & Structure

The China Monosodium Glutamate market, a significant segment within the global flavor enhancer industry, is characterized by a moderate to high level of market concentration. Key players like Meihua Holdings Group Co Ltd and Fufeng Group Shandong hold substantial market shares, though the presence of numerous smaller manufacturers contributes to a competitive landscape. Technological innovation is a primary driver, with advancements focusing on improving production efficiency, reducing environmental impact, and developing higher purity MSG grades. Regulatory frameworks, largely overseen by government bodies ensuring food safety and quality standards, play a crucial role in market entry and product development.

- Market Concentration: Dominated by a few large producers, but with a fragmented base of smaller players.

- Technological Innovation: Focus on fermentation optimization, downstream processing, and sustainable manufacturing practices.

- Regulatory Frameworks: Stringent food safety standards and quality control measures influence production and market access.

- Competitive Product Substitutes: While MSG is a dominant flavor enhancer, alternatives like yeast extract and other umami ingredients pose indirect competition.

- End-User Demographics: A broad consumer base, including households, food processing companies, and foodservice establishments.

- M&A Trends: Consolidation is observed, with larger entities acquiring smaller players to enhance market reach and operational efficiency. The volume of M&A deals in the past year was estimated at XX, indicating strategic realignment within the industry.

China Monosodium Glutamate Market Growth Trends & Insights

The China Monosodium Glutamate market is poised for steady growth, driven by evolving consumer preferences and the expansive food processing industry. The market size for MSG in China is projected to reach XX Million units by 2025 and is expected to witness a Compound Annual Growth Rate (CAGR) of XX% during the forecast period of 2025–2033. This expansion is fueled by an increasing demand for convenient and flavorful food products, particularly in the processed food and ready-to-eat segments. The adoption rate of MSG remains high across various food applications due to its cost-effectiveness and proven efficacy in enhancing taste profiles. Technological disruptions in production, such as optimized fermentation processes utilizing advanced microbial strains and more efficient purification techniques, are contributing to improved product quality and reduced production costs, further stimulating market penetration. Consumer behavior shifts towards more sophisticated palates and a greater appreciation for umami flavors are also significant growth accelerators. The increasing urbanization and a rising middle-class population contribute to a larger consumer base with greater disposable income, directly impacting the demand for food products utilizing MSG.

Dominant Regions, Countries, or Segments in China Monosodium Glutamate Market

The Noodles, Soups, and Broth segment stands out as the most dominant application driving growth in the China Monosodium Glutamate market. This segment accounts for an estimated XX% of the total MSG consumption and is projected to continue its upward trajectory due to the ubiquitous presence of noodles and soups in the Chinese diet, both as staple foods and popular convenience options. The rising demand for instant noodles and packaged soups, driven by busy lifestyles and convenience-seeking consumers, directly translates to an increased requirement for MSG as a key flavor enhancer. Economic policies that support the growth of the food processing industry, coupled with robust infrastructure for distribution and logistics, further bolster the dominance of this segment.

- Key Drivers for Noodles, Soups, and Broth Dominance:

- Deep-Rooted Culinary Culture: Noodles and soups are integral to Chinese cuisine.

- Convenience and Affordability: Instant and ready-to-eat versions cater to modern lifestyles.

- Flavor Enhancement: MSG is crucial for achieving the desired umami taste profile in these products.

- Large Production Volume: The sheer scale of noodle and soup production in China fuels significant MSG demand.

- Growing Processed Food Market: This segment is a major beneficiary of the overall expansion of processed foods.

While Noodles, Soups, and Broth lead, the Meat Products segment also represents a substantial and growing application, driven by increasing meat consumption and the demand for seasoned and processed meat items. Seasonings and Dressings form another important segment, benefiting from the growing trend of home cooking and the desire for enhanced flavor in a variety of dishes. The Other Applications category, encompassing various food products and industrial uses, also contributes to the market's diversity. The dominance of the noodles, soups, and broth segment is reinforced by its consistent demand across all economic strata and its integration into everyday life, making it a resilient and foundational market for MSG.

China Monosodium Glutamate Market Product Landscape

The China Monosodium Glutamate market showcases a diverse product landscape focused on delivering consistent flavor and quality. Innovations revolve around optimizing the purity and crystalline structure of MSG for various applications. High-purity grades cater to premium food products and pharmaceuticals, while standard grades are widely used in everyday food manufacturing. Product performance metrics primarily revolve around taste enhancement, solubility, and shelf-life stability. Unique selling propositions often include granular size consistency for even dispersion, specific flavor profiles, and adherence to stringent international food safety standards. Technological advancements in fermentation and crystallization processes ensure efficient production and a reliable supply of MSG.

Key Drivers, Barriers & Challenges in China Monosodium Glutamate Market

The China Monosodium Glutamate market is propelled by several key drivers, including the ever-present demand from the vast food processing industry, the growing popularity of convenience foods, and the fundamental role of MSG in enhancing the umami taste. Increasing disposable incomes and evolving consumer preferences for flavorful food products further fuel market expansion.

- Key Drivers:

- Robust Food Processing Industry: Extensive use in noodles, soups, processed meats, and snacks.

- Consumer Demand for Flavor: MSG's ability to deliver umami taste is highly valued.

- Convenience Food Growth: Essential for ready-to-eat meals and instant products.

- Cost-Effectiveness: A highly efficient and economical flavor enhancer.

- Favorable Regulatory Environment: Generally accepted food additive with established safety guidelines.

However, the market faces significant barriers and challenges. Negative consumer perceptions and ongoing debates surrounding MSG's health effects, though often unsubstantiated by scientific consensus, continue to be a restraint. Stricter environmental regulations on waste disposal from fermentation processes can increase operational costs for manufacturers. Intense competition among numerous players can lead to price pressures, impacting profitability. Furthermore, fluctuations in the prices of raw materials, such as corn and tapioca, can affect production costs and supply chain stability. The estimated impact of these challenges on market growth is a reduction of approximately XX% in the otherwise projected trajectory.

Emerging Opportunities in China Monosodium Glutamate Market

Emerging opportunities in the China Monosodium Glutamate market lie in the development of specialized MSG products and the exploration of novel applications. There is a growing demand for MSG derived from sustainable and traceable sources, presenting an opportunity for manufacturers to adopt greener production methods and highlight their ethical sourcing. The increasing popularity of international cuisines in China also opens avenues for MSG in diverse seasoning blends and marinades. Furthermore, exploring its potential in functional food applications or as a component in dietary supplements, where controlled release or specific purity is required, could unlock new market segments. The market is also seeing potential in the development of "clean label" MSG alternatives, which could be an opportunity for manufacturers to innovate and cater to health-conscious consumers seeking naturally derived umami enhancers.

Growth Accelerators in the China Monosodium Glutamate Market Industry

Several catalysts are accelerating long-term growth in the China Monosodium Glutamate market. Technological breakthroughs in fermentation efficiency and downstream processing are continuously improving yields and reducing production costs, making MSG more competitive. Strategic partnerships between MSG producers and large food manufacturers are crucial for ensuring consistent demand and co-developing new product applications. Market expansion strategies, including tapping into less saturated rural markets and exploring export opportunities, are also contributing to overall growth. The increasing focus on food fortification and the development of value-added food products that benefit from umami enhancement are significant growth accelerators.

Key Players Shaping the China Monosodium Glutamate Market Market

- Cargill Incorporated

- Ningxia Eppen Biotech Co Ltd

- Sichuan Jingong Chuanpai Flavoring Co Ltd

- Meihua Holdings Group Co Ltd

- Hongmei Group Co Ltd

- COFCO

- Fufeng Group Shandong

- Shandong Qilu Bio-Technology Group Co Ltd

Notable Milestones in China Monosodium Glutamate Market Sector

- 2019: Significant investment in R&D by major players to enhance fermentation efficiency.

- 2020: Increased focus on sustainable production practices and waste management solutions.

- 2021: Introduction of higher purity MSG grades for specialized food and pharmaceutical applications.

- 2022: Strategic acquisitions to consolidate market share and expand product portfolios.

- 2023: Development of novel flavor enhancer blends incorporating MSG for diverse culinary applications.

- 2024: Enhanced compliance with evolving international food safety standards.

In-Depth China Monosodium Glutamate Market Market Outlook

The China Monosodium Glutamate market outlook remains robust, driven by a confluence of sustained consumer demand and continuous innovation. Growth accelerators such as advancements in biotechnological production processes and strategic collaborations with downstream food industries are set to fortify the market's expansion. The increasing integration of MSG into a wider array of convenience food products, coupled with its inherent cost-effectiveness, positions it for continued relevance. Future market potential lies in embracing sustainable production and catering to the evolving preferences of a discerning consumer base. Strategic opportunities include exploring niche applications and leveraging technological advancements to enhance product offerings and market reach.

China Monosodium Glutamate Market Segmentation

-

1. Application

- 1.1. Noodles, Soups, and Broth

- 1.2. Meat Products

- 1.3. Seasonings and Dressings

- 1.4. Other Applications

China Monosodium Glutamate Market Segmentation By Geography

- 1. China

China Monosodium Glutamate Market Regional Market Share

Geographic Coverage of China Monosodium Glutamate Market

China Monosodium Glutamate Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.47% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Protein-Rich Food; Increasing Demand for Plant-Based and Organic Ingredients

- 3.3. Market Restrains

- 3.3.1. Presence of Alternative Proteins

- 3.4. Market Trends

- 3.4.1. Growing Demand of Processed Foods in the Country

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Monosodium Glutamate Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Noodles, Soups, and Broth

- 5.1.2. Meat Products

- 5.1.3. Seasonings and Dressings

- 5.1.4. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. China

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Cargill Incorporated

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ningxia Eppen Biotech Co Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Sichuan Jingong Chuanpai Flavoring Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Meihua Holdings Group Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Hongmei Group Co Ltd*List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 COFCO

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Fufeng Group Shandong

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Shandong Qilu Bio-Technology Group Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Cargill Incorporated

List of Figures

- Figure 1: China Monosodium Glutamate Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: China Monosodium Glutamate Market Share (%) by Company 2025

List of Tables

- Table 1: China Monosodium Glutamate Market Revenue billion Forecast, by Application 2020 & 2033

- Table 2: China Monosodium Glutamate Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: China Monosodium Glutamate Market Revenue billion Forecast, by Application 2020 & 2033

- Table 4: China Monosodium Glutamate Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Monosodium Glutamate Market?

The projected CAGR is approximately 4.47%.

2. Which companies are prominent players in the China Monosodium Glutamate Market?

Key companies in the market include Cargill Incorporated, Ningxia Eppen Biotech Co Ltd, Sichuan Jingong Chuanpai Flavoring Co Ltd, Meihua Holdings Group Co Ltd, Hongmei Group Co Ltd*List Not Exhaustive, COFCO, Fufeng Group Shandong, Shandong Qilu Bio-Technology Group Co Ltd.

3. What are the main segments of the China Monosodium Glutamate Market?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.92 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Protein-Rich Food; Increasing Demand for Plant-Based and Organic Ingredients.

6. What are the notable trends driving market growth?

Growing Demand of Processed Foods in the Country.

7. Are there any restraints impacting market growth?

Presence of Alternative Proteins.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Monosodium Glutamate Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Monosodium Glutamate Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Monosodium Glutamate Market?

To stay informed about further developments, trends, and reports in the China Monosodium Glutamate Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence