Key Insights

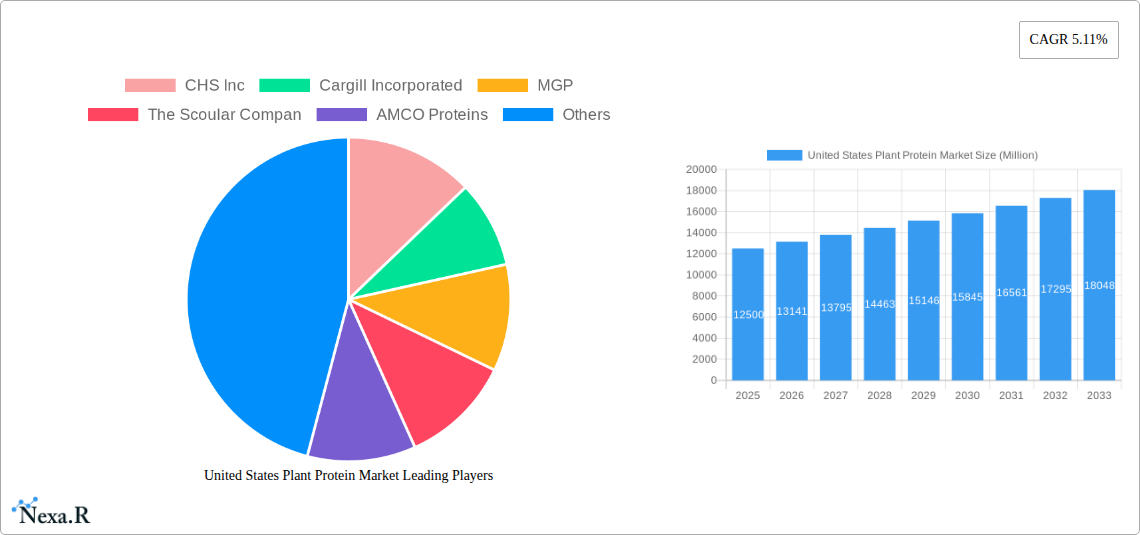

The United States plant protein market is poised for substantial growth, driven by increasing consumer demand for healthier, more sustainable, and ethically sourced food options. With a projected market size of approximately $12,500 million by 2025 and a robust CAGR of 5.11%, the sector is witnessing a significant expansion. This growth is fueled by a confluence of factors including rising health consciousness, a greater awareness of the environmental impact of animal agriculture, and the growing popularity of plant-based diets for both dietary and ethical reasons. Consumers are actively seeking alternatives to traditional animal proteins, leading to increased innovation and product development across various food and beverage categories, as well as in the supplements and personal care sectors. The increasing availability and improved taste profiles of plant-based protein products are further accelerating adoption, making plant proteins a mainstream choice for a wider demographic.

United States Plant Protein Market Market Size (In Billion)

Key drivers for this market expansion include the versatility of plant proteins, which can be incorporated into a vast array of products from bakery items and dairy alternatives to meat substitutes and infant formulas. The market is segmented across various protein types such as hemp, pea, potato, rice, soy, and wheat proteins, each offering unique nutritional benefits and functionalities. End-user industries like food and beverages, animal feed, personal care, and supplements are all contributing to the robust demand. While the market is experiencing rapid growth, potential restraints such as fluctuating raw material prices and the need for continuous innovation to meet evolving consumer preferences and palates are factors that stakeholders will need to strategically manage. The United States, as a key market, is at the forefront of this plant protein revolution, showcasing a dynamic landscape of opportunity for both established players and new entrants.

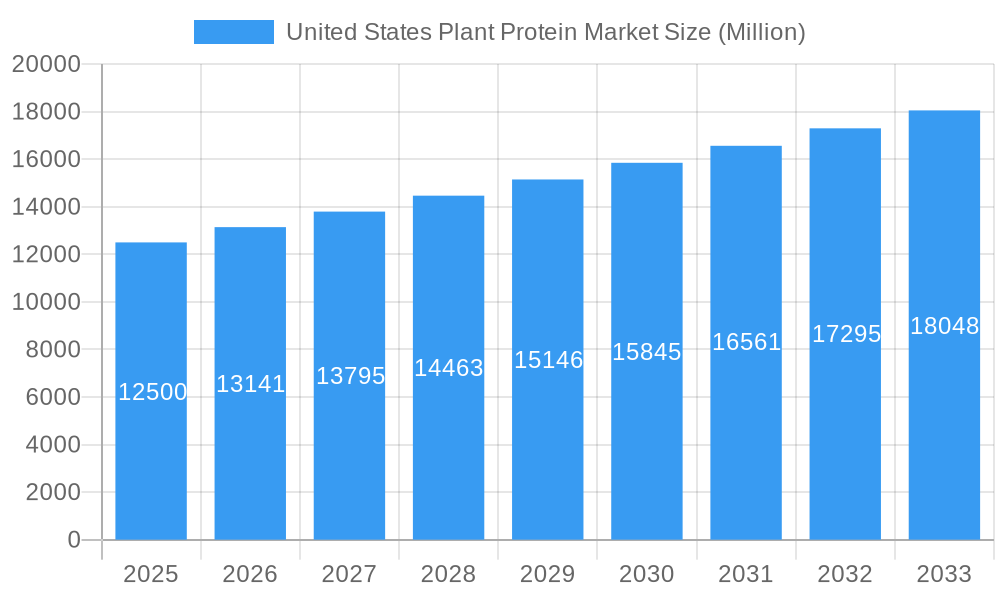

United States Plant Protein Market Company Market Share

United States Plant Protein Market: Growth, Trends, and Opportunities (2019-2033)

This comprehensive report delivers an in-depth analysis of the United States plant protein market, projected to reach a market size of USD 7,500 million in 2025. Driven by escalating consumer demand for healthier, sustainable, and ethically sourced protein alternatives, this market is poised for substantial expansion. Our analysis covers the period from 2019 to 2033, with a base year of 2025, offering critical insights into market dynamics, growth trends, dominant segments, product innovations, and the strategic landscape. We explore the market's evolution from 2019-2024 and provide a detailed forecast for 2025-2033, equipping industry professionals, investors, and stakeholders with actionable intelligence.

United States Plant Protein Market Market Dynamics & Structure

The United States plant protein market is characterized by a moderately concentrated structure, with key players like Cargill Incorporated, Archer Daniels Midland Company, and Ingredion Incorporated holding significant market share. Technological innovation is a primary driver, with continuous advancements in processing and extraction techniques enhancing the functionality, taste, and texture of plant-based proteins. Regulatory frameworks, while evolving to support innovation, also present considerations regarding labeling and product claims. Competitive product substitutes, including both other plant-based proteins and animal-derived proteins, constantly influence market dynamics. End-user demographics are shifting towards a younger, health-conscious population seeking sustainable and ethical food choices, alongside a growing interest from the animal feed industry for more sustainable protein sources. Mergers and acquisitions (M&A) trends are active, with larger companies acquiring innovative startups to expand their portfolios and gain market access.

- Market Concentration: Dominated by a few large players, but with increasing fragmentation due to new entrants and niche product development.

- Technological Innovation Drivers: Focus on improving protein functionality (solubility, emulsification), taste profiles, and cost-effectiveness of extraction and processing.

- Regulatory Frameworks: Evolving guidelines for plant-based claims and ingredient certifications are shaping product development.

- Competitive Product Substitutes: Ongoing competition from animal proteins and emerging alternative protein sources.

- End-User Demographics: Growing demand from flexitarians, vegans, vegetarians, and health-conscious consumers; increasing adoption in animal feed.

- M&A Trends: Strategic acquisitions to enhance product offerings, expand geographic reach, and secure proprietary technologies.

United States Plant Protein Market Growth Trends & Insights

The United States plant protein market has witnessed robust growth from 2019 to 2024, driven by a confluence of factors including increased consumer awareness of health benefits, growing environmental concerns, and a desire for ethical food sourcing. Projections indicate this upward trajectory will persist through 2033, with an estimated Compound Annual Growth Rate (CAGR) of 8.2% from 2025 to 2033. Market penetration for plant-based protein ingredients in the food and beverage sector has significantly increased, becoming a mainstream alternative. Technological disruptions, such as novel protein extraction methods and the development of clean-label ingredients, are further fueling adoption. Consumer behavior shifts are evident in the rising demand for plant-based meat alternatives, dairy alternatives, and protein-enhanced snacks and supplements.

The expansion is further underpinned by a deepening understanding of the nutritional advantages of plant proteins, including their role in weight management, cardiovascular health, and as allergen-friendly options. Innovation in taste and texture has been crucial, addressing historical consumer perceptions of blandness or unappealing mouthfeel. The demand for transparency in sourcing and production processes is also a significant trend, with consumers actively seeking products that align with their values. This evolution is creating a dynamic market where ingredient suppliers and manufacturers are continuously innovating to meet diverse consumer needs and preferences.

- Market Size Evolution: Significant growth observed, projected to reach USD 7,500 million by 2025.

- Adoption Rates: Increasing adoption across various food and beverage categories, driven by consumer demand and product innovation.

- Technological Disruptions: Advancements in processing technologies leading to improved ingredient functionality and sensory attributes.

- Consumer Behavior Shifts: Growing preference for plant-based diets, driven by health, environmental, and ethical considerations.

- Market Penetration: Expanding into conventional food and beverage products, beyond niche vegetarian/vegan offerings.

- Nutritional Awareness: Heightened consumer understanding of the health benefits associated with plant-based proteins.

- Sensory Improvement: Continuous innovation to enhance taste, texture, and overall palatability of plant protein products.

- Transparency & Ethical Sourcing: Growing consumer demand for clear information on ingredient origin and production methods.

Dominant Regions, Countries, or Segments in United States Plant Protein Market

Within the United States plant protein market, Soy Protein consistently emerges as a dominant segment by volume, accounting for an estimated 35% of the total market share in 2025. Its widespread availability, established processing infrastructure, and versatility across numerous food and beverage applications contribute to its leading position. The Food and Beverages end-user segment, particularly Meat/Poultry/Seafood and Meat Alternative Products, is the primary growth driver, representing approximately 40% of the market value in 2025. This sub-segment is experiencing explosive growth fueled by evolving consumer dietary habits and the demand for plant-based substitutes that mimic the taste, texture, and nutritional profile of conventional animal proteins.

The Pea Protein segment is experiencing rapid growth, driven by its high protein content, favorable amino acid profile, and appeal as a non-GMO and allergen-friendly option. Its market share is projected to increase significantly over the forecast period. The Supplements end-user segment, specifically Sport/Performance Nutrition, also plays a crucial role, as athletes and fitness enthusiasts increasingly opt for plant-based protein powders and bars for muscle recovery and growth.

- Dominant Protein Type: Soy Protein

- Market Share: Estimated 35% in 2025.

- Drivers: Established supply chain, cost-effectiveness, wide range of functional properties, and broad acceptance in food applications.

- Dominant End User: Food and Beverages

- Market Share (Overall): Approximately 40% by value in 2025.

- Leading Sub End User: Meat/Poultry/Seafood and Meat Alternative Products

- Growth Drivers: Innovation in texture and flavor, increasing consumer adoption of plant-based diets, and demand for sustainable protein sources.

- Market Potential: High growth potential due to continued innovation and expanding consumer acceptance.

- High-Growth Protein Type: Pea Protein

- Growth Drivers: Allergen-friendly profile, good nutritional value, sustainability perception, and increasing demand in various food applications.

- Key End User Segment: Supplements (Sport/Performance Nutrition)

- Growth Drivers: Rising popularity of plant-based diets among athletes, demand for clean-label and easily digestible protein sources.

- Emerging Segments: Hemp Protein and Rice Protein are gaining traction due to their unique nutritional profiles and sustainability benefits.

United States Plant Protein Market Product Landscape

The product landscape of the United States plant protein market is characterized by continuous innovation focused on enhancing functionality, improving sensory attributes, and expanding application diversity. Key product innovations include the development of novel plant protein isolates and concentrates with improved solubility, emulsification, and gelling properties, making them suitable for a wider range of food and beverage formulations. Advanced processing techniques are yielding plant proteins with cleaner taste profiles, reducing the "beany" or "earthy" notes often associated with early plant-based products. Furthermore, there is a growing emphasis on allergen-free and non-GMO plant protein ingredients, catering to specific consumer needs and preferences. The market also sees the introduction of blended plant protein formulations designed to optimize amino acid profiles for specific dietary requirements, particularly in sports nutrition and elderly nutrition.

Key Drivers, Barriers & Challenges in United States Plant Protein Market

Key Drivers: The United States plant protein market is propelled by several key drivers. The increasing consumer focus on health and wellness, fueled by concerns about chronic diseases and the desire for cleaner, more natural ingredients, is a primary catalyst. Environmental sustainability concerns, including climate change and resource depletion, are driving a shift towards plant-based diets due to their lower ecological footprint compared to animal agriculture. Furthermore, the growing awareness of ethical considerations surrounding animal welfare is influencing consumer choices. Technological advancements in processing and ingredient development are making plant proteins more palatable and functional, expanding their applications. Government initiatives promoting sustainable agriculture and food innovation also provide a supportive environment.

Barriers & Challenges: Despite its growth, the market faces several barriers and challenges. Price competitiveness compared to conventional animal proteins remains a hurdle, although this gap is narrowing. Taste and texture perception are still areas of development, with some consumers seeking closer approximations to animal-based products. Supply chain complexities for certain niche plant proteins, including scalability and consistency, can pose challenges. Regulatory uncertainty and evolving labeling laws can create complexities for manufacturers. Finally, consumer education and overcoming entrenched dietary habits are ongoing challenges that require sustained effort.

Emerging Opportunities in United States Plant Protein Market

Emerging opportunities in the United States plant protein market lie in several key areas. The expansion into new food categories, such as savory snacks, ready-to-eat meals, and convenience foods, presents significant untapped potential. The growing demand for plant-based dairy alternatives beyond milk, including cheese, yogurt, and ice cream, offers a vast and evolving market. Functional foods and beverages fortified with plant proteins for specific health benefits, such as gut health or cognitive function, are also a promising avenue. The development of novel protein sources beyond traditional ones, like fava beans, lupine, and algae, offers opportunities for differentiation and expanded product offerings. Furthermore, increasing interest in plant-based pet food and animal feed creates new market segments.

Growth Accelerators in the United States Plant Protein Market Industry

Several factors are acting as growth accelerators for the United States plant protein industry. Strategic partnerships and collaborations between ingredient suppliers and food manufacturers are speeding up product innovation and market penetration. Investments in research and development are leading to breakthroughs in protein extraction, purification, and application technologies, enhancing both quality and cost-effectiveness. Government incentives and support for sustainable agriculture and food innovation are creating a favorable business environment. The increasing acceptance and mainstreaming of plant-based diets through media influence and celebrity endorsements are broadening the consumer base. Furthermore, the continuous improvement in the sensory attributes of plant-based protein products is a key accelerator, addressing previous consumer objections and driving repeat purchases.

Key Players Shaping the United States Plant Protein Market Market

- CHS Inc

- Cargill Incorporated

- MGP

- The Scoular Compan

- AMCO Proteins

- International Flavors & Fragrances Inc

- Archer Daniels Midland Company

- Glanbia PLC

- Bunge Limited

- Roquette Frères

- Anchor Ingredients Co LLC

- Kerry Group PLC

- Farbest-Tallman Foods Corporation

- MB-Holding GmbH & Co KG

- Axiom Foods Inc

- Foodchem International Corporation

- Ingredion Incorporated

- Südzucker Group

- AGT Food and Ingredients Inc

Notable Milestones in United States Plant Protein Market Sector

- June 2022: Roquette, a plant-based protein manufacturer, released two novel rice proteins to address the market demand for meat substitute applications. The new Nutralys rice protein line includes a rice protein isolate and a rice protein concentrate, enhancing options for meat alternative formulations.

- May 2022: BENEO, a subsidiary of Südzucker, entered a purchase agreement to acquire Meatless BV, a producer of functional ingredients. BENEO is expanding its existing product offering with the acquisition to offer an even broader range of texturizing solutions for meat and fish alternatives, strengthening its position in the plant-based ingredient market.

- February 2022: MGP Ingredients announced the construction of a new extrusion plant in Kansas to manufacture its ProTerra line of texturized proteins. The USD 16.7 million facility will be located next to the company's Atchison site and will initially produce up to 10 million pounds of ProTerra annually. The new plant will assist MGP in meeting the rising demand for its ProTerra product line, which comprises pea and wheat protein ingredients used in applications such as plant-based meat substitutes, showcasing an investment in scaling production to meet market needs.

In-Depth United States Plant Protein Market Market Outlook

The United States plant protein market outlook is exceptionally bright, driven by a robust combination of accelerating growth factors. The increasing consumer adoption of flexitarian, vegetarian, and vegan diets, coupled with a growing global consciousness towards health and sustainability, forms the bedrock of this market's expansion. Technological advancements continue to refine the taste, texture, and nutritional profile of plant-based proteins, making them increasingly indistinguishable from their animal-derived counterparts. Strategic investments by key players, including mergers, acquisitions, and substantial R&D funding, are further solidifying the market's growth trajectory. Emerging opportunities in specialized nutritional supplements, pet food, and novel protein sources represent vast untapped potential, promising sustained innovation and market penetration for years to come.

United States Plant Protein Market Segmentation

-

1. Protein Type

- 1.1. Hemp Protein

- 1.2. Pea Protein

- 1.3. Potato Protein

- 1.4. Rice Protein

- 1.5. Soy Protein

- 1.6. Wheat Protein

- 1.7. Other Plant Protein

-

2. End User

- 2.1. Animal Feed

-

2.2. Food and Beverages

-

2.2.1. By Sub End User

- 2.2.1.1. Bakery

- 2.2.1.2. Breakfast Cereals

- 2.2.1.3. Condiments/Sauces

- 2.2.1.4. Confectionery

- 2.2.1.5. Dairy and Dairy Alternative Products

- 2.2.1.6. Meat/Poultry/Seafood and Meat Alternative Products

- 2.2.1.7. RTE/RTC Food Products

- 2.2.1.8. Snacks

-

2.2.1. By Sub End User

- 2.3. Personal Care and Cosmetics

-

2.4. Supplements

- 2.4.1. Baby Food and Infant Formula

- 2.4.2. Elderly Nutrition and Medical Nutrition

- 2.4.3. Sport/Performance Nutrition

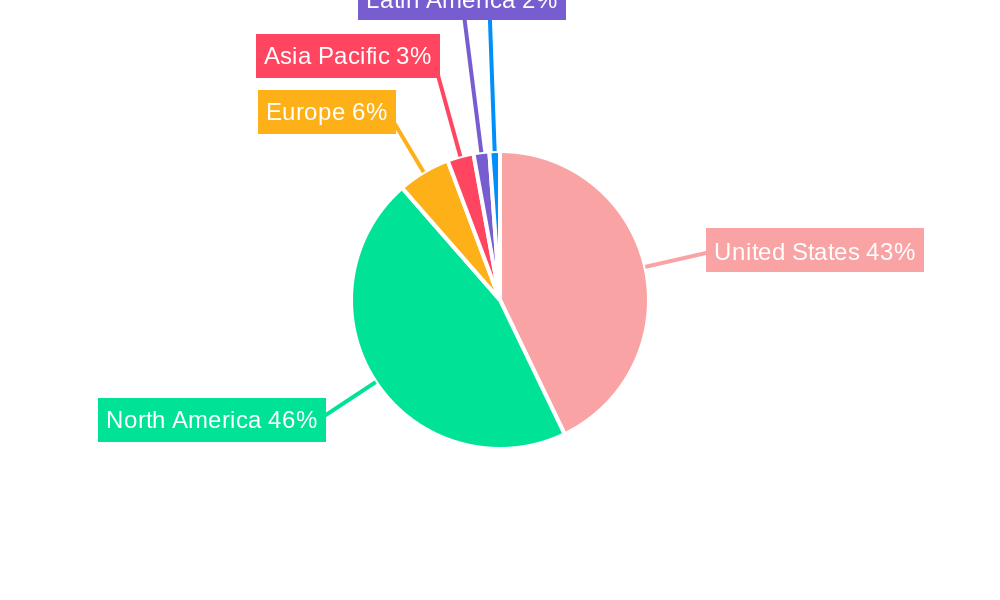

United States Plant Protein Market Segmentation By Geography

- 1. United States

United States Plant Protein Market Regional Market Share

Geographic Coverage of United States Plant Protein Market

United States Plant Protein Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.79% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing consumer health conciousness; Growing consumer inclination toward Vegan/Plant-Based Proteins

- 3.3. Market Restrains

- 3.3.1. Stringent government regulation of food labels/claims

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Plant Protein Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Protein Type

- 5.1.1. Hemp Protein

- 5.1.2. Pea Protein

- 5.1.3. Potato Protein

- 5.1.4. Rice Protein

- 5.1.5. Soy Protein

- 5.1.6. Wheat Protein

- 5.1.7. Other Plant Protein

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Animal Feed

- 5.2.2. Food and Beverages

- 5.2.2.1. By Sub End User

- 5.2.2.1.1. Bakery

- 5.2.2.1.2. Breakfast Cereals

- 5.2.2.1.3. Condiments/Sauces

- 5.2.2.1.4. Confectionery

- 5.2.2.1.5. Dairy and Dairy Alternative Products

- 5.2.2.1.6. Meat/Poultry/Seafood and Meat Alternative Products

- 5.2.2.1.7. RTE/RTC Food Products

- 5.2.2.1.8. Snacks

- 5.2.2.1. By Sub End User

- 5.2.3. Personal Care and Cosmetics

- 5.2.4. Supplements

- 5.2.4.1. Baby Food and Infant Formula

- 5.2.4.2. Elderly Nutrition and Medical Nutrition

- 5.2.4.3. Sport/Performance Nutrition

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Protein Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 CHS Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Cargill Incorporated

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 MGP

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 The Scoular Compan

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 AMCO Proteins

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 International Flavors & Fragrances Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Archer Daniels Midland Company

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Glanbia PLC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Bunge Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Roquette Frères

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Anchor Ingredients Co LLC

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Kerry Group PLC

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Farbest-Tallman Foods Corporation

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 MB-Holding GmbH & Co KG

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Axiom Foods Inc

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Foodchem International Corporation

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 Ingredion Incorporated

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.18 Südzucker Group

- 6.2.18.1. Overview

- 6.2.18.2. Products

- 6.2.18.3. SWOT Analysis

- 6.2.18.4. Recent Developments

- 6.2.18.5. Financials (Based on Availability)

- 6.2.19 AGT Food and Ingredients Inc

- 6.2.19.1. Overview

- 6.2.19.2. Products

- 6.2.19.3. SWOT Analysis

- 6.2.19.4. Recent Developments

- 6.2.19.5. Financials (Based on Availability)

- 6.2.1 CHS Inc

List of Figures

- Figure 1: United States Plant Protein Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: United States Plant Protein Market Share (%) by Company 2025

List of Tables

- Table 1: United States Plant Protein Market Revenue undefined Forecast, by Protein Type 2020 & 2033

- Table 2: United States Plant Protein Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 3: United States Plant Protein Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: United States Plant Protein Market Revenue undefined Forecast, by Protein Type 2020 & 2033

- Table 5: United States Plant Protein Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 6: United States Plant Protein Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Plant Protein Market?

The projected CAGR is approximately 3.79%.

2. Which companies are prominent players in the United States Plant Protein Market?

Key companies in the market include CHS Inc, Cargill Incorporated, MGP, The Scoular Compan, AMCO Proteins, International Flavors & Fragrances Inc, Archer Daniels Midland Company, Glanbia PLC, Bunge Limited, Roquette Frères, Anchor Ingredients Co LLC, Kerry Group PLC, Farbest-Tallman Foods Corporation, MB-Holding GmbH & Co KG, Axiom Foods Inc, Foodchem International Corporation, Ingredion Incorporated, Südzucker Group, AGT Food and Ingredients Inc.

3. What are the main segments of the United States Plant Protein Market?

The market segments include Protein Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing consumer health conciousness; Growing consumer inclination toward Vegan/Plant-Based Proteins.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Stringent government regulation of food labels/claims.

8. Can you provide examples of recent developments in the market?

June 2022: Roquette, a plant-based protein manufacturer, released two novel rice proteins to address the market demand for meat substitute applications. The new Nutralys rice protein line includes a rice protein isolate and a rice protein concentrate. May 2022: BENEO, a subsidiary of Südzucker, entered a purchase agreement to acquire Meatless BV, a producer of functional ingredients. BENEO is expanding its existing product offering with the acquisition to offer an even broader range of texturizing solutions for meat and fish alternatives.February 2022: MGP Ingredients announced the construction of a new extrusion plant in Kansas to manufacture its ProTerra line of texturized proteins. The USD 16.7 million facility will be located next to the company's Atchison site and will initially produce up to 10 million pounds of ProTerra annually. The new plant will assist MGP in meeting the rising demand for its ProTerra product line, which comprises pea and wheat protein ingredients used in applications such as plant-based meat substitutes.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Plant Protein Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Plant Protein Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Plant Protein Market?

To stay informed about further developments, trends, and reports in the United States Plant Protein Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence