Key Insights

The African Food Enzyme Market is projected for substantial growth, expected to reach $2.98 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 7.2% through 2033. This expansion is driven by increasing demand for processed and convenience foods, fueled by a growing middle class, urbanization, and a shift towards healthier, sustainable food options. Manufacturers are increasingly recognizing the benefits of enzymes in enhancing food quality, texture, shelf-life, and nutritional value. Government initiatives supporting food processing and advancements in enzyme technology are also key drivers. The demand for clean-label products is further accelerating the adoption of natural food enzymes.

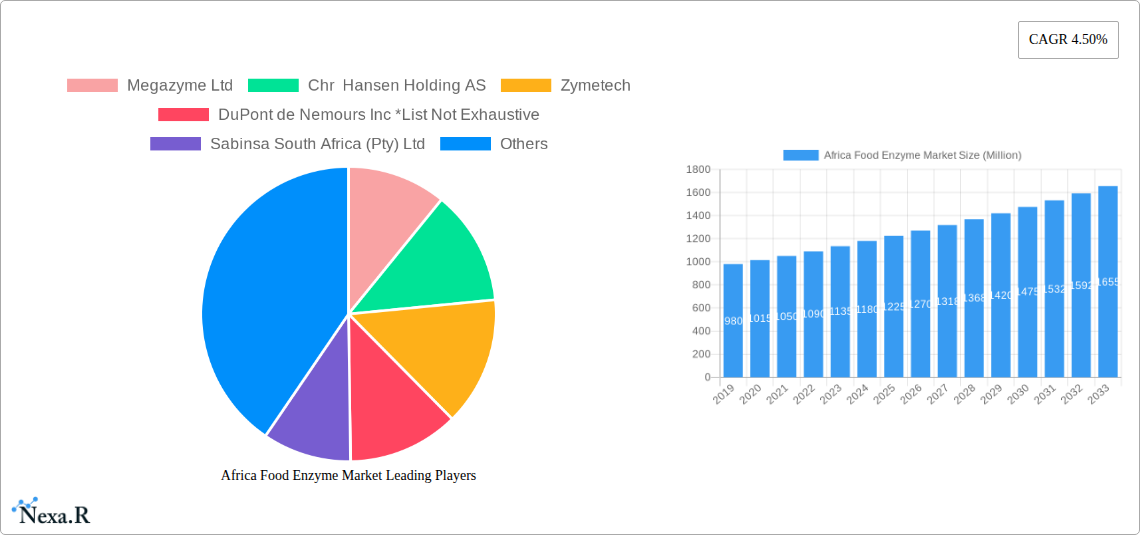

Africa Food Enzyme Market Market Size (In Billion)

The market is segmented by enzyme type, with Carbohydrase and Protease anticipated to lead due to their widespread use in baking and meat processing, respectively. The Bakery segment is a significant contributor, utilizing enzymes to improve dough characteristics and final product quality. Dairy, Frozen Desserts, and Meat, Poultry, and Seafood segments also represent substantial application areas, benefiting from enzymatic improvements in texture, flavor, and processing efficiency. While challenges like the cost of specialized enzymes and the requirement for technical expertise exist, the expanding food processing infrastructure in key nations such as Nigeria, South Africa, and Egypt, along with strategic industry investments, are expected to overcome these restraints and ensure sustained market growth.

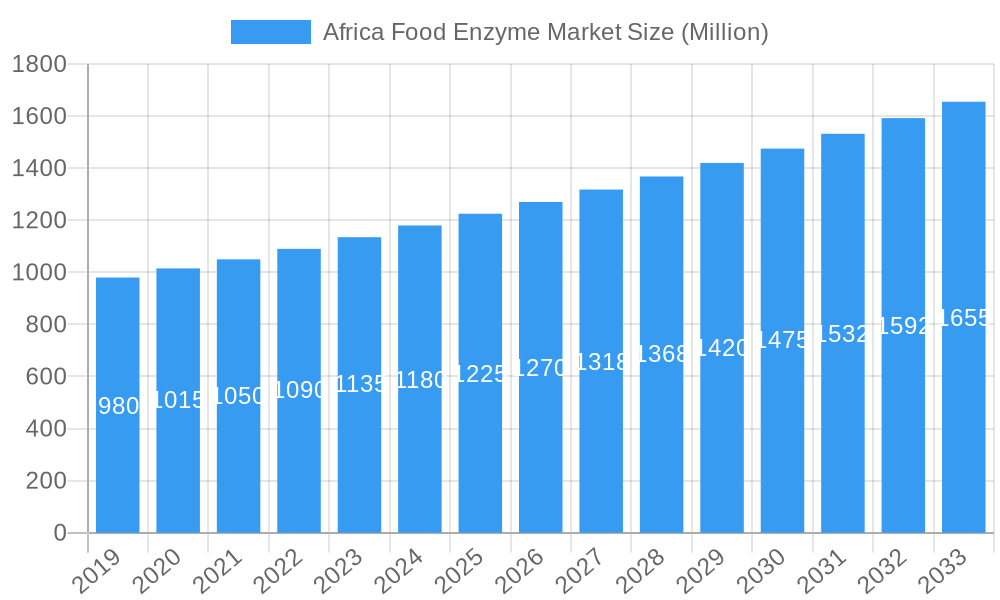

Africa Food Enzyme Market Company Market Share

This comprehensive report offers a definitive analysis of the Africa Food Enzyme Market, forecasting significant growth from 2019 to 2033. With a base year of 2025, the study details market dynamics, growth trends, key segments, product innovations, and strategic opportunities, providing actionable insights for industry professionals navigating the evolving food enzyme landscape in Africa.

Africa Food Enzyme Market Market Dynamics & Structure

The Africa Food Enzyme Market is characterized by a moderately concentrated structure, with key players like Megazyme Ltd, Chr Hansen Holding AS, Zymetech, DuPont de Nemours Inc, Sabinsa South Africa (Pty) Ltd, and AEB Africa (PTY) LTD holding substantial market share. Technological innovation is a primary driver, with ongoing research and development focused on enhancing enzyme efficacy, stability, and cost-effectiveness. Robust regulatory frameworks, though varying across nations, are increasingly emphasizing food safety and quality, indirectly boosting the adoption of high-performance food enzymes. Competitive product substitutes, such as chemical additives, exist but are gradually being displaced by the superior functionality and consumer appeal of enzyme-based solutions. End-user demographics are shifting towards a growing middle class with increasing disposable income and a greater demand for processed and convenience foods, directly influencing enzyme consumption. Mergers and acquisitions (M&A) are a notable trend, with companies strategically consolidating to expand their product portfolios and geographical reach. For instance, the past two years have seen at least 3 significant M&A deals in the broader food ingredients sector, indicating a trend towards market consolidation. The market faces innovation barriers such as the high cost of R&D and the need for extensive regulatory approvals for novel enzyme formulations.

- Market Concentration: Moderate, with key global and regional players dominating.

- Technological Innovation: Driven by the need for improved functionality, cost-efficiency, and sustainable production methods.

- Regulatory Frameworks: Increasing emphasis on food safety and quality standards across the continent.

- Competitive Substitutes: Chemical additives are gradually being replaced by enzyme-based alternatives.

- End-User Demographics: Rising middle class and demand for processed foods are key drivers.

- M&A Trends: Strategic consolidation to enhance market presence and product offerings.

- Innovation Barriers: High R&D costs and lengthy regulatory approval processes.

Africa Food Enzyme Market Growth Trends & Insights

The Africa Food Enzyme Market is poised for remarkable expansion, driven by a confluence of factors that are reshaping the food processing industry. From a historical market size of approximately $850 million in 2019, the market is projected to reach an estimated $1,500 million by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 8.5% during the forecast period of 2025–2033. This growth trajectory is fueled by the escalating demand for processed foods, improved shelf-life, enhanced nutritional profiles, and reduced waste in food production. Consumer preferences are shifting towards healthier, more natural ingredients, and food enzymes align perfectly with these evolving expectations. Technological advancements in enzyme engineering and biotechnology are leading to the development of more efficient, specific, and cost-effective enzyme solutions, further accelerating their adoption. The rising disposable incomes across various African nations are translating into increased consumption of value-added food products, where enzymes play a crucial role in optimizing taste, texture, and appearance. Furthermore, a growing awareness among food manufacturers regarding the sustainability benefits of enzymes, such as reduced energy consumption and ingredient optimization, is a significant growth catalyst. The penetration of enzyme technology in traditionally less developed food sectors is also expanding, opening new avenues for market growth. The increasing focus on fortified foods and beverages to address nutritional deficiencies presents another substantial opportunity for enzyme applications. For example, specific enzymes are vital in the production of infant formula and fortified cereals. The liberalization of trade policies and improved logistics infrastructure within Africa are also facilitating wider market access for enzyme suppliers. The projected market size for 2033 is estimated to be around $2,800 million.

Dominant Regions, Countries, or Segments in Africa Food Enzyme Market

The African continent's food enzyme market is experiencing varied growth patterns across its diverse regions and application segments. South Africa consistently emerges as the dominant country, driven by its well-established food processing industry, advanced infrastructure, and higher adoption rates of innovative food technologies. The country's robust regulatory environment and its role as a gateway to other African markets contribute significantly to its leadership. Within the Type segment, Carbohydrase enzymes hold the largest market share, primarily due to their extensive application in the bakery industry, contributing to dough conditioning, bread volume, and crust browning. Protease enzymes follow closely, finding widespread use in meat tenderization, dairy processing (cheese production), and the beverage industry for clarifying purposes. Lipase enzymes are gaining traction, particularly in dairy and bakery applications, for flavor enhancement and texture modification. The "Others" category, encompassing enzymes like amylases and cellulases, also shows potential. In terms of Application, the Bakery segment is the largest and fastest-growing contributor to the Africa Food Enzyme Market. This dominance is attributed to the widespread consumption of baked goods, the need for consistent quality, and the ability of enzymes to improve texture, shelf-life, and processing efficiency. The Dairy and Frozen Desserts segment is also a significant market, with enzymes crucial for cheese ripening, yogurt texture, and ice cream stabilization. The Meat, Poultry and Sea Food Products segment is experiencing robust growth as consumers demand more processed and convenient meat products, where enzymes aid in tenderization and flavor development. The Beverages segment, while smaller, is expanding due to the use of enzymes in juice clarification, brewing, and wine production.

- Dominant Country: South Africa, due to established industry and infrastructure.

- Leading Enzyme Type: Carbohydrase, driven by bakery applications.

- Key Application Segment: Bakery, due to high consumption and functional benefits.

- Growth Drivers in Dominant Segments:

- South Africa: Advanced food processing, favorable regulations, and import/export hub.

- Carbohydrase: Demand for improved bread texture, volume, and shelf-life.

- Bakery: Staple food, need for consistent quality and efficiency.

- Dairy: Cheese production, yogurt texture, and frozen dessert stability.

Africa Food Enzyme Market Product Landscape

The Africa Food Enzyme Market is witnessing a surge in innovative product development, focusing on enhanced specificity, improved thermostability, and cost-effectiveness. Manufacturers are actively developing enzyme formulations tailored to specific African culinary traditions and processing conditions. For instance, new generation amylases are being introduced to improve the texture and shelf-life of staple African baked goods. Proteases are being engineered for greater efficiency in meat tenderization, catering to a growing demand for convenient protein sources. Lipases are being optimized for flavor development in dairy products, aligning with evolving consumer tastes. Unique selling propositions often revolve around improved yield, reduced processing time, and the ability to achieve desired sensory attributes with minimal intervention. Technological advancements in fermentation and genetic engineering are enabling the production of highly pure and potent enzymes.

Key Drivers, Barriers & Challenges in Africa Food Enzyme Market

Key Drivers:

- Growing demand for processed and convenience foods: This is a primary growth driver as African economies develop.

- Increasing consumer awareness of health and nutrition: Enzymes contribute to the production of healthier food options.

- Technological advancements in enzyme production: Leading to more efficient and cost-effective solutions.

- Government initiatives promoting food security and value addition: Encouraging local food processing.

- Sustainability focus in food manufacturing: Enzymes help reduce waste and energy consumption.

Barriers & Challenges:

- High cost of imported enzymes and raw materials: Affecting affordability for smaller manufacturers.

- Limited R&D infrastructure and technical expertise: Hindering local innovation and adaptation.

- Fragmented supply chains and logistics challenges: Impacting accessibility and timely delivery.

- Stricter regulatory requirements and varying standards across countries: Creating compliance hurdles.

- Lack of consumer education on the benefits of food enzymes: Leading to hesitancy in adoption.

- Competition from established chemical additives: Though diminishing, still a factor.

- Fluctuations in foreign exchange rates: Affecting the cost of imported enzymes.

Emerging Opportunities in Africa Food Enzyme Market

Emerging opportunities in the Africa Food Enzyme Market lie in the untapped potential of niche applications and evolving consumer preferences. The growing demand for plant-based foods presents a significant avenue for enzyme innovation, particularly in improving texture and protein functionality in meat alternatives. The development of enzymes for bioremediation in the food industry, focusing on waste reduction and valorization, is another promising area. Furthermore, the expanding market for fortified foods and beverages, aimed at addressing micronutrient deficiencies, offers substantial scope for specialized enzyme applications. There is also an increasing interest in enzymes for enhancing the digestibility and bioavailability of nutrients in traditional African staples. The potential for localized enzyme production and formulation, catering to specific regional needs and reducing reliance on imports, represents a strategic growth opportunity.

Growth Accelerators in the Africa Food Enzyme Market Industry

The Africa Food Enzyme Market is being propelled by significant growth accelerators, including relentless technological breakthroughs in enzyme discovery and engineering, leading to more potent and versatile biocatalysts. Strategic partnerships between global enzyme manufacturers and local African distributors are crucial for expanding market reach and understanding regional needs. Furthermore, aggressive market expansion strategies by key players, focusing on underserved regions and emerging food processing sectors, are vital catalysts. The increasing adoption of advanced food processing technologies, such as precision fermentation for enzyme production, is also a key accelerator. Investment in research and development focused on adapting enzymes for the unique challenges of African food processing, such as varying climatic conditions and ingredient types, will further fuel long-term growth.

Key Players Shaping the Africa Food Enzyme Market Market

- Megazyme Ltd

- Chr Hansen Holding AS

- Zymetech

- DuPont de Nemours Inc

- Sabinsa South Africa (Pty) Ltd

- AEB Africa (PTY) LTD

Notable Milestones in Africa Food Enzyme Market Sector

- 2023: Chr Hansen Holding AS launches a new range of specialized proteases for the African dairy sector, enhancing cheese yield and quality.

- 2023: DuPont de Nemours Inc announces a strategic partnership with a leading African food manufacturer to develop tailored enzyme solutions for the bakery market.

- 2022: Sabinsa South Africa (Pty) Ltd expands its distribution network, increasing the accessibility of its enzyme portfolio across East Africa.

- 2021: AEB Africa (PTY) LTD introduces innovative enzyme blends for the African wine and brewing industries, improving clarity and fermentation efficiency.

- 2020: Megazyme Ltd develops a novel carbohydrase with enhanced thermal stability, specifically designed for high-temperature baking processes prevalent in some African regions.

In-Depth Africa Food Enzyme Market Market Outlook

The future outlook for the Africa Food Enzyme Market is exceptionally bright, characterized by sustained high growth fueled by robust demand for processed foods, escalating consumer focus on health and nutrition, and ongoing technological advancements. Growth accelerators such as strategic collaborations, expansion into untapped markets, and localized enzyme development will be pivotal in shaping this trajectory. The increasing adoption of sustainable food production practices will further solidify the role of enzymes as essential tools for efficiency and waste reduction. Industry professionals should focus on understanding regional nuances, investing in localized R&D, and building strong distribution networks to capitalize on the immense opportunities present in this dynamic market. The estimated market size by 2033 is projected to be around $2,800 million, underscoring the significant growth potential.

Africa Food Enzyme Market Segmentation

-

1. Type

- 1.1. Carbohydrase

- 1.2. Protease

- 1.3. Lipase

- 1.4. Others

-

2. Application

- 2.1. Bakery

- 2.2. Confectionery

- 2.3. Dairy and Frozen Desserts

- 2.4. Meat, Poultry and Sea Food Products

- 2.5. Beverages

- 2.6. Others

Africa Food Enzyme Market Segmentation By Geography

-

1. Africa

- 1.1. Nigeria

- 1.2. South Africa

- 1.3. Egypt

- 1.4. Kenya

- 1.5. Ethiopia

- 1.6. Morocco

- 1.7. Ghana

- 1.8. Algeria

- 1.9. Tanzania

- 1.10. Ivory Coast

Africa Food Enzyme Market Regional Market Share

Geographic Coverage of Africa Food Enzyme Market

Africa Food Enzyme Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Health Consciousness among consumer

- 3.3. Market Restrains

- 3.3.1. High Cost of natural Ingredients

- 3.4. Market Trends

- 3.4.1. Acquisitive Demand of Carbohydrases in Food Industries

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Food Enzyme Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Carbohydrase

- 5.1.2. Protease

- 5.1.3. Lipase

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Bakery

- 5.2.2. Confectionery

- 5.2.3. Dairy and Frozen Desserts

- 5.2.4. Meat, Poultry and Sea Food Products

- 5.2.5. Beverages

- 5.2.6. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Megazyme Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Chr Hansen Holding AS

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Zymetech

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 DuPont de Nemours Inc *List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sabinsa South Africa (Pty) Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 AEB Africa (PTY) LTD

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 Megazyme Ltd

List of Figures

- Figure 1: Africa Food Enzyme Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Africa Food Enzyme Market Share (%) by Company 2025

List of Tables

- Table 1: Africa Food Enzyme Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Africa Food Enzyme Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Africa Food Enzyme Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Africa Food Enzyme Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Africa Food Enzyme Market Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Africa Food Enzyme Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Nigeria Africa Food Enzyme Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: South Africa Africa Food Enzyme Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Egypt Africa Food Enzyme Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Kenya Africa Food Enzyme Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Ethiopia Africa Food Enzyme Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Morocco Africa Food Enzyme Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Ghana Africa Food Enzyme Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Algeria Africa Food Enzyme Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Tanzania Africa Food Enzyme Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Ivory Coast Africa Food Enzyme Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Food Enzyme Market?

The projected CAGR is approximately 7.2%.

2. Which companies are prominent players in the Africa Food Enzyme Market?

Key companies in the market include Megazyme Ltd, Chr Hansen Holding AS, Zymetech, DuPont de Nemours Inc *List Not Exhaustive, Sabinsa South Africa (Pty) Ltd, AEB Africa (PTY) LTD.

3. What are the main segments of the Africa Food Enzyme Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.98 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Health Consciousness among consumer.

6. What are the notable trends driving market growth?

Acquisitive Demand of Carbohydrases in Food Industries.

7. Are there any restraints impacting market growth?

High Cost of natural Ingredients.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Food Enzyme Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Food Enzyme Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Food Enzyme Market?

To stay informed about further developments, trends, and reports in the Africa Food Enzyme Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence