Key Insights

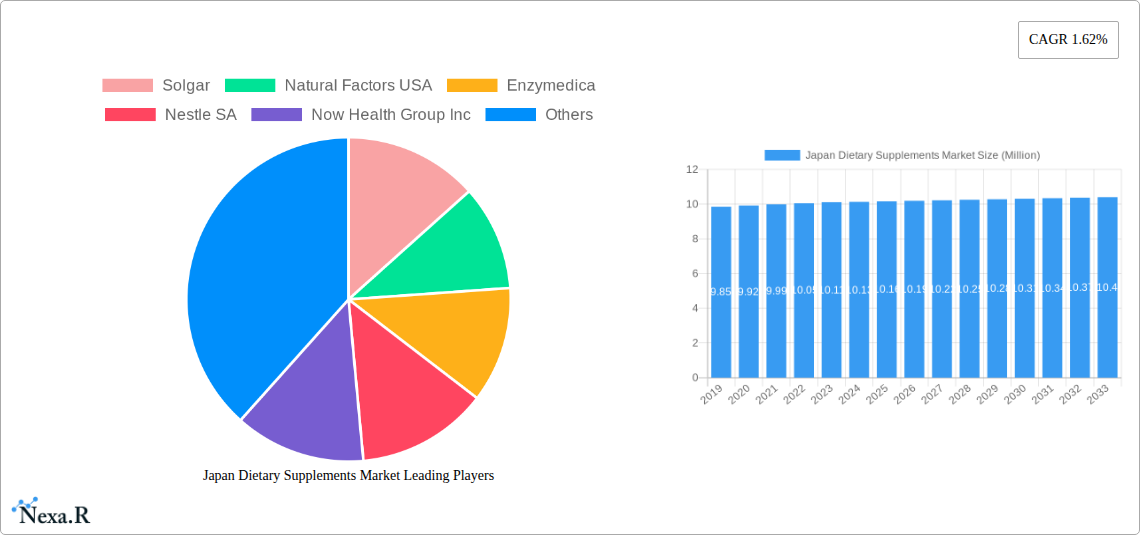

The Japanese dietary supplements market is poised for steady expansion, projected to reach a market size of approximately ¥10.16 billion by 2025, with a compound annual growth rate (CAGR) of 1.62% expected to drive its trajectory through 2033. This growth is underpinned by a confluence of factors, notably the increasing health consciousness among the Japanese population, a growing demand for preventive healthcare solutions, and a rising aging demographic that actively seeks to maintain well-being and vitality. The market's drivers include a strong emphasis on preventative health, with consumers increasingly investing in supplements to mitigate the risk of chronic diseases and enhance their quality of life. Furthermore, the robust influence of key opinion leaders and healthcare professionals in endorsing specific supplement ingredients and brands contributes significantly to consumer adoption. Trends such as the growing preference for personalized nutrition, driven by advancements in genetic testing and individual health data, are shaping product development and marketing strategies. There's also a discernible shift towards natural and organic ingredients, reflecting a broader consumer desire for cleaner labels and sustainable sourcing.

Japan Dietary Supplements Market Market Size (In Million)

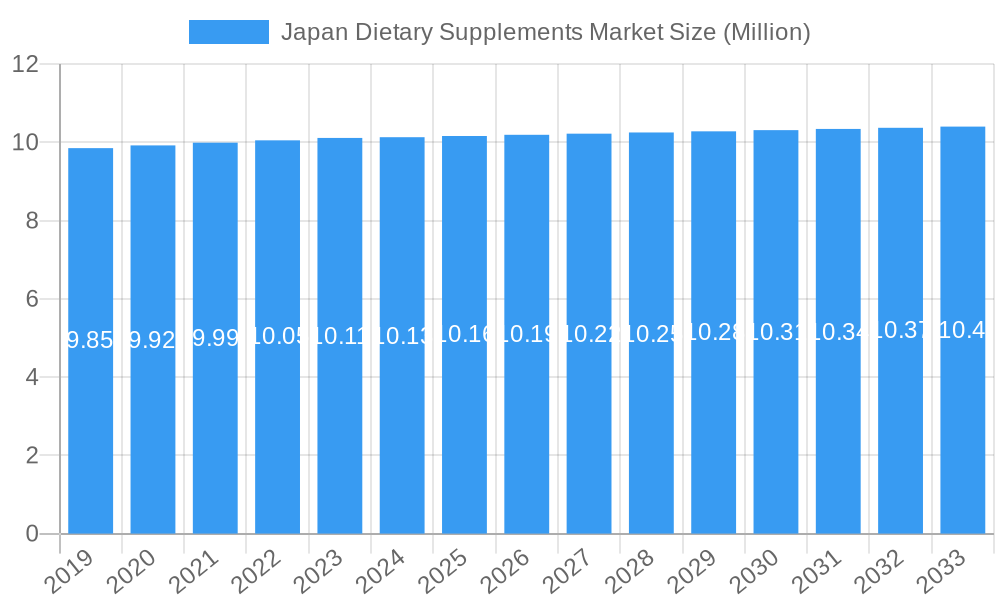

Despite the positive growth outlook, the market faces certain restraints. The high cost of some premium supplement products can pose a barrier to entry for a segment of the population. Additionally, stringent regulatory frameworks, while ensuring product safety and efficacy, can sometimes slow down the introduction of new products and innovations. However, the market's segmentation reveals robust opportunities. The Vitamins and Mineral Supplements segment, particularly Vitamin K2 supplements, is expected to see considerable traction due to its recognized benefits for bone health. Proteins and Amino Acids, Fatty Acids, and Probiotic Supplements are also key growth areas, catering to diverse wellness goals from muscle building and recovery to gut health and cognitive function. Distribution channels are evolving, with online retail channels rapidly gaining prominence due to their convenience and wider product selection, complementing traditional channels like supermarkets/hypermarkets and pharmacies/drug stores. Leading companies like Solgar, Natural Factors USA, and Nestle SA are actively competing in this dynamic market, introducing innovative products and expanding their reach.

Japan Dietary Supplements Market Company Market Share

This comprehensive report provides an in-depth analysis of the Japan Dietary Supplements Market, meticulously examining growth drivers, market dynamics, and future opportunities. Delve into critical segments such as Vitamins and Mineral Supplements (including Vitamin K2 Supplements), Proteins and Amino Acids, Fatty Acids, and Probiotic Supplements, alongside crucial distribution channels including Pharmacies/Drug Stores, Online Retail Channels, and Supermarkets/Hypermarkets. With a detailed forecast period of 2025-2033, this report is an indispensable resource for industry professionals, manufacturers, suppliers, and investors seeking to capitalize on the burgeoning demand for health and wellness products in Japan. We present all values in Million units, offering clear quantitative insights.

Japan Dietary Supplements Market Market Dynamics & Structure

The Japan Dietary Supplements Market is characterized by a moderately concentrated landscape, driven by increasing consumer awareness regarding preventative healthcare and a rapidly aging population seeking to maintain vitality. Technological innovation plays a pivotal role, with advancements in bioavailability and personalized nutrition solutions gaining traction. Regulatory frameworks, while stringent, are also evolving to accommodate novel ingredients and product formats. Competitive product substitutes exist, but the unique efficacy and targeted benefits of specialized supplements carve out distinct market niches. End-user demographics are diverse, with a significant segment comprising the elderly, followed by health-conscious millennials and Gen Z actively seeking to optimize their well-being. Mergers and acquisitions (M&A) trends are on the rise as larger corporations aim to expand their portfolios and gain access to innovative technologies and niche markets.

- Market Concentration: Moderate, with a few key players holding significant market share but ample room for specialized and innovative brands.

- Technological Innovation Drivers: Enhanced absorption technologies, personalized supplement formulations (e.g., 3D printing), and research into novel active ingredients.

- Regulatory Frameworks: The Japanese government oversees supplement quality and labeling through bodies like the Ministry of Health, Labour and Welfare (MHLW), ensuring consumer safety.

- Competitive Product Substitutes: While whole foods offer nutritional benefits, targeted supplements address specific deficiencies and health goals not easily met through diet alone.

- End-User Demographics: Predominantly the elderly population (over 65), followed by younger adults focused on fitness, beauty, and overall health maintenance.

- M&A Trends: Increasing strategic acquisitions by large conglomerates and pharmaceutical companies seeking to diversify into the lucrative health and wellness sector.

Japan Dietary Supplements Market Growth Trends & Insights

The Japan Dietary Supplements Market has witnessed substantial growth, propelled by an escalating emphasis on proactive health management and a deep-rooted cultural appreciation for natural well-being. The market size evolution reflects a consistent upward trajectory, with adoption rates for various supplement categories demonstrating increasing penetration across demographics. Technological disruptions, such as advancements in delivery mechanisms and the integration of smart technologies for personalized tracking, are significantly shaping consumer behavior shifts. The rise of personalized nutrition, driven by genetic profiling and microbiome analysis, is a particularly strong trend, allowing consumers to tailor their supplement intake to individual needs. Furthermore, the increasing prevalence of lifestyle-related diseases and the desire for enhanced immunity and mental well-being are fueling demand for specific product types like Probiotic Supplements and Vitamins and Mineral Supplements. The shift towards preventative healthcare, coupled with growing disposable incomes among key demographic groups, will continue to be a significant growth catalyst throughout the forecast period.

The market is experiencing a robust Compound Annual Growth Rate (CAGR) of approximately 5.8% (estimated) during the historical period (2019-2024), and is projected to maintain a healthy CAGR of around 6.2% from 2025 to 2033. This sustained growth is underpinned by a growing market penetration, estimated to reach over 70% of households by 2030. The Vitamins and Mineral Supplements segment, particularly Vitamin K2 Supplements, continues to lead in market share, valued at approximately $1,850 million in 2025, owing to their recognized benefits for bone health and cardiovascular well-being. The Probiotic Supplements segment is emerging as a high-growth area, with an anticipated CAGR of 7.5% during the forecast period, driven by increasing consumer awareness of gut health's impact on overall wellness. Online retail channels are projected to witness the fastest growth, expected to capture over 35% of the market share by 2030, reflecting changing consumer purchasing habits and the convenience offered by e-commerce platforms.

Dominant Regions, Countries, or Segments in Japan Dietary Supplements Market

The Japan Dietary Supplements Market is predominantly driven by the Vitamins and Mineral Supplements segment, which commands the largest market share, estimated at over 40% of the total market value in 2025, projected to be valued at $1,850 million. Within this segment, Vitamin K2 Supplements are experiencing exceptional growth due to increasing awareness of their role in bone density and cardiovascular health, particularly among the aging Japanese population. This dominance is fueled by strong scientific backing, widespread availability, and sustained marketing efforts by key manufacturers.

- Vitamins and Mineral Supplements (Vitamin K2 Supplements):

- Dominance Factors: Growing awareness of bone health benefits among the aging population, increasing prevalence of osteoporosis, and strong clinical evidence supporting efficacy.

- Market Share: Expected to hold approximately 40-45% of the total market value in 2025.

- Growth Potential: High, driven by continued research and development and increasing consumer demand for preventative health solutions.

- Key Drivers: Aging demographic, increasing disposable income, and supportive government initiatives promoting health and wellness.

The Online Retail Channels distribution segment is rapidly gaining prominence, projected to experience the highest growth rate, with an estimated CAGR of 8.5% during the forecast period. This surge is attributed to the increasing adoption of e-commerce by Japanese consumers, convenience, wider product selection, and competitive pricing offered through online platforms.

- Online Retail Channels:

- Dominance Factors: Growing internet penetration, proliferation of e-commerce platforms, convenience of home delivery, and access to a wider variety of specialized products.

- Market Share: Expected to grow from approximately 25% in 2025 to over 35% by 2030.

- Growth Potential: Very high, driven by evolving consumer shopping habits and increasing digital literacy.

- Key Drivers: Expansion of major e-commerce players, targeted digital marketing strategies, and the increasing preference for personalized online shopping experiences.

The Pharmacies/Drug Stores segment remains a significant and trusted distribution channel, maintaining a stable market share due to the perceived credibility and professional advice offered by pharmacists. However, its growth rate is projected to be more moderate compared to online channels.

- Pharmacies/Drug Stores:

- Dominance Factors: Trust and credibility associated with healthcare professionals, accessibility in local communities, and the ability to offer personalized consultations.

- Market Share: Expected to hold a stable market share of approximately 30-35% in 2025.

- Growth Potential: Moderate, driven by the convenience for consumers seeking immediate purchase and expert advice.

- Key Drivers: Established retail networks, government policies supporting pharmacist recommendations, and consumer preference for purchasing health-related products from trusted sources.

Japan Dietary Supplements Market Product Landscape

The Japan Dietary Supplements Market product landscape is dynamic, characterized by continuous innovation aimed at enhancing efficacy and consumer appeal. Key product innovations include advanced encapsulation technologies for improved nutrient absorption and sustained release, as well as the development of novel formulations targeting specific health concerns such as cognitive function, stress management, and immune support. The integration of functional ingredients, like probiotics and prebiotics, into everyday food and beverage products further expands the market's reach. Performance metrics are increasingly driven by scientific validation and clinical studies demonstrating tangible health benefits. Unique selling propositions often revolve around natural ingredients, sustainable sourcing, and personalized nutrition solutions, catering to the discerning Japanese consumer who prioritizes quality and evidence-based products.

Key Drivers, Barriers & Challenges in Japan Dietary Supplements Market

Key Drivers:

- Aging Population: Japan's rapidly aging demographic creates a significant demand for supplements that support longevity, mobility, and cognitive health.

- Health Consciousness: A growing awareness of preventative healthcare and the desire to maintain optimal well-being are driving consumer adoption.

- Technological Advancements: Innovations in bioavailability, personalized nutrition, and new delivery systems are expanding product offerings and consumer appeal.

- Government Initiatives: Support for health promotion and research into health-related products encourages market growth.

- Increasing Disposable Income: A segment of the population has the financial capacity to invest in premium health and wellness products.

Barriers & Challenges:

- Strict Regulatory Landscape: Navigating stringent regulations for product approval, labeling, and marketing can be a significant hurdle for new entrants and existing players.

- Consumer Skepticism: While generally receptive, consumers can be wary of exaggerated claims and require robust scientific evidence for product efficacy.

- Intense Competition: The market is becoming increasingly crowded, leading to price pressures and the need for strong differentiation.

- Supply Chain Volatility: Global supply chain disruptions can impact the availability and cost of raw materials.

- Perception of Supplements: Some consumers still view supplements as secondary to a healthy diet, requiring continuous education on their complementary role.

Emerging Opportunities in Japan Dietary Supplements Market

Emerging opportunities within the Japan Dietary Supplements Market lie in the burgeoning demand for personalized nutrition solutions, driven by advancements in genetic testing and microbiome analysis. The growing interest in mental well-being and stress management presents a significant avenue for supplements containing adaptogens and nootropics. Furthermore, the increasing focus on sustainable and ethically sourced ingredients opens doors for eco-conscious brands. The untapped potential in specific niche segments, such as sports nutrition for specific athletic pursuits and specialized supplements for women's health, also represents considerable growth prospects. The expansion of direct-to-consumer (DTC) models and the integration of digital health platforms offer new avenues for customer engagement and product delivery.

Growth Accelerators in the Japan Dietary Supplements Market Industry

Growth accelerators in the Japan Dietary Supplements Market are primarily driven by continuous technological breakthroughs in product formulation and delivery systems, such as nanotechnology for enhanced absorption and 3D printing for personalized gummy formulations. Strategic partnerships between supplement manufacturers and pharmaceutical companies, as well as cross-industry collaborations with food and beverage producers, are vital for expanding market reach and product innovation. Market expansion strategies, including targeting specific demographic needs and geographical regions within Japan, alongside a strong focus on digital marketing and e-commerce penetration, are crucial for sustained long-term growth. Investment in research and development to validate product claims and address evolving consumer health concerns will further propel the industry forward.

Key Players Shaping the Japan Dietary Supplements Market Market

- Solgar

- Natural Factors USA

- Enzymedica

- Nestle SA

- Now Health Group Inc

- Amway Japan

- Glanbia PLC

- Abbott Japan Co Ltd

- Bayer Japan

- Nu Skin Enterprises Inc

Notable Milestones in Japan Dietary Supplements Market Sector

- June 2024: Shiseido Company launched its new ingestible probiotic powder across Japan, featuring Bifidobacterium animalis, amla fruit, and blueberry, aimed at improving intestinal health, immune function, and oral health.

- April 2024: CURE, a New York-based brand, introduced a range of CBD-infused functional beverages and gummies in Japan, specifically targeting the sports nutrition segment.

- November 2022: Suntory Holdings invested JPY 518.8 million in Rem3dy Health's brand, Nourished, a vitamin supplement manufacturer utilizing patented 3D printing and vegan encapsulation for personalized daily nutrient gummies, to accelerate growth in the Japanese market.

In-Depth Japan Dietary Supplements Market Market Outlook

The Japan Dietary Supplements Market outlook is exceptionally promising, fueled by a confluence of demographic shifts and a deepening consumer commitment to proactive health management. Growth accelerators are robust, encompassing ongoing technological advancements in personalized nutrition, such as AI-driven recommendations and precision formulations. Strategic partnerships between established pharmaceutical giants and agile supplement innovators will unlock new product categories and distribution channels. The expansion of the online retail sector, coupled with evolving consumer preferences for holistic wellness solutions, will continue to redefine market dynamics. Future success will hinge on leveraging data analytics for personalized consumer engagement and investing in scientific validation to build enduring trust and cater to the sophisticated demands of the Japanese health-conscious population, ensuring sustained market expansion and profitability.

Japan Dietary Supplements Market Segmentation

-

1. Type

-

1.1. Vitamins and Mineral Supplements

- 1.1.1. Vitamin K2 Supplements

- 1.2. Proteins and Amino Acids

- 1.3. Fatty Acids

- 1.4. Probiotic Supplements

- 1.5. Other Dietary Supplements

-

1.1. Vitamins and Mineral Supplements

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Pharmacies/Drug Stores

- 2.3. Online Retail Channels

- 2.4. Other Distribution Channels

Japan Dietary Supplements Market Segmentation By Geography

- 1. Japan

Japan Dietary Supplements Market Regional Market Share

Geographic Coverage of Japan Dietary Supplements Market

Japan Dietary Supplements Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.62% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Health Conscious Population and Rising Demand for Sports Nutrition; Escalating Consumer Investments in Preventive Healthcare Products

- 3.3. Market Restrains

- 3.3.1. Growing Health Conscious Population and Rising Demand for Sports Nutrition; Escalating Consumer Investments in Preventive Healthcare Products

- 3.4. Market Trends

- 3.4.1. Consumption of Vitamins and Mineral Supplements Dominates the Japanese Dietary Supplements Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Dietary Supplements Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Vitamins and Mineral Supplements

- 5.1.1.1. Vitamin K2 Supplements

- 5.1.2. Proteins and Amino Acids

- 5.1.3. Fatty Acids

- 5.1.4. Probiotic Supplements

- 5.1.5. Other Dietary Supplements

- 5.1.1. Vitamins and Mineral Supplements

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Pharmacies/Drug Stores

- 5.2.3. Online Retail Channels

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Solgar

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Natural Factors USA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Enzymedica

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Nestle SA

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Now Health Group Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Amway Japan

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Glanbia PLC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Abbott Japan Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Bayer Japan

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Nu Skin Enterprises Inc *List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Solgar

List of Figures

- Figure 1: Japan Dietary Supplements Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Japan Dietary Supplements Market Share (%) by Company 2025

List of Tables

- Table 1: Japan Dietary Supplements Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Japan Dietary Supplements Market Volume Billion Forecast, by Type 2020 & 2033

- Table 3: Japan Dietary Supplements Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Japan Dietary Supplements Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 5: Japan Dietary Supplements Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Japan Dietary Supplements Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Japan Dietary Supplements Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Japan Dietary Supplements Market Volume Billion Forecast, by Type 2020 & 2033

- Table 9: Japan Dietary Supplements Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 10: Japan Dietary Supplements Market Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 11: Japan Dietary Supplements Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Japan Dietary Supplements Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Dietary Supplements Market?

The projected CAGR is approximately 1.62%.

2. Which companies are prominent players in the Japan Dietary Supplements Market?

Key companies in the market include Solgar, Natural Factors USA, Enzymedica, Nestle SA, Now Health Group Inc, Amway Japan, Glanbia PLC, Abbott Japan Co Ltd, Bayer Japan, Nu Skin Enterprises Inc *List Not Exhaustive.

3. What are the main segments of the Japan Dietary Supplements Market?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.16 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Health Conscious Population and Rising Demand for Sports Nutrition; Escalating Consumer Investments in Preventive Healthcare Products.

6. What are the notable trends driving market growth?

Consumption of Vitamins and Mineral Supplements Dominates the Japanese Dietary Supplements Market.

7. Are there any restraints impacting market growth?

Growing Health Conscious Population and Rising Demand for Sports Nutrition; Escalating Consumer Investments in Preventive Healthcare Products.

8. Can you provide examples of recent developments in the market?

June 2024: Shiseido Company launched its new ingestible probiotic powder across Japan. The product is filled with probiotic strain Bifidobacterium animalis, amla fruit, and blueberry ingredients. The product claims to improve the intestinal environment and support the immune system and oral health.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Dietary Supplements Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Dietary Supplements Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Dietary Supplements Market?

To stay informed about further developments, trends, and reports in the Japan Dietary Supplements Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence