Key Insights

The South American sports drink market is poised for significant expansion, projected to reach $2.6 billion by 2025, with a compound annual growth rate (CAGR) of 6.4%. This upward trajectory is propelled by heightened health and fitness consciousness, driving increased athletic participation across demographics. Growing disposable incomes in leading economies, notably Brazil and Argentina, are fueling consumer expenditure on performance beverages. The influence of social media and celebrity endorsements promoting active lifestyles further stimulates demand for sports drinks, perceived as essential for peak physical performance and recovery. A notable market shift favors healthier formulations, with consumers prioritizing natural ingredients, lower sugar content, and enhanced functional benefits, aligning with broader wellness trends in the beverage sector.

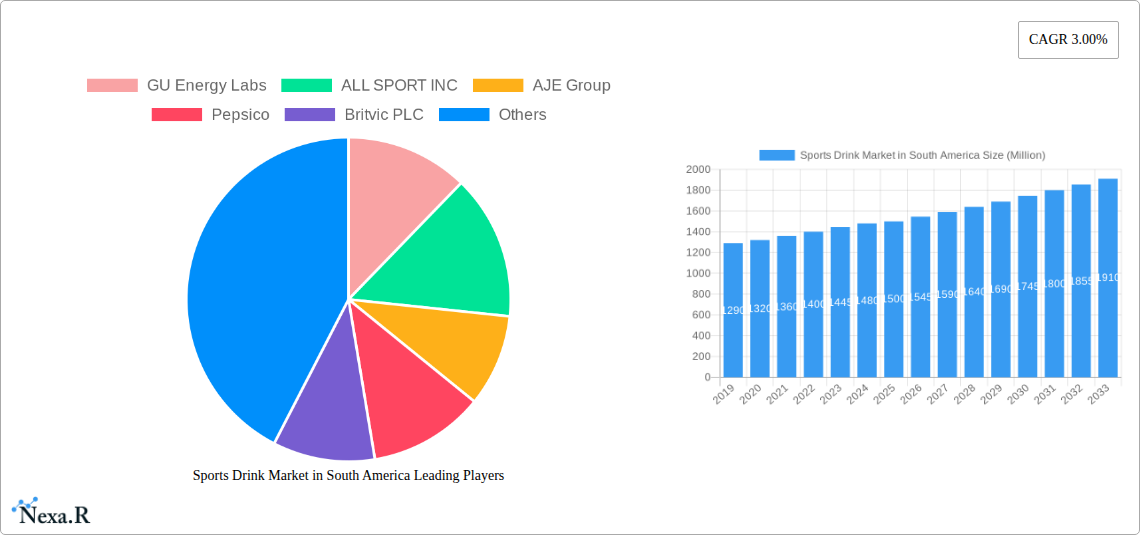

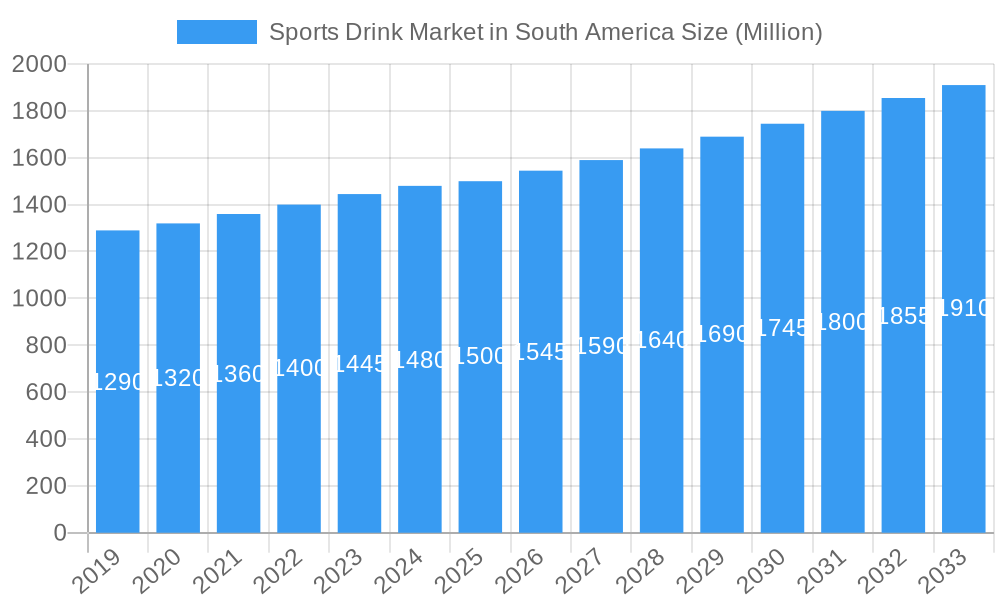

Sports Drink Market in South America Market Size (In Billion)

The competitive arena features prominent global entities like Coca-Cola Company and Pepsico, alongside established regional players such as AJE Group. These companies are actively innovating product portfolios and packaging, with PET bottles and cans leading due to convenience and portability. Distribution channels are also evolving, with e-commerce platforms gaining prominence alongside traditional retail outlets like supermarkets and hypermarkets. Emerging trends include the development of specialized sports drinks for specific athletic requirements and recovery stages, alongside the incorporation of electrolytes and vitamins. While robust growth opportunities exist, potential challenges include raw material price volatility and the rise of alternative hydration solutions.

Sports Drink Market in South America Company Market Share

South America Sports Drink Market: Comprehensive Growth Analysis and Future Outlook (2019-2033)

This in-depth report provides a definitive analysis of the South America Sports Drink Market, offering critical insights into market dynamics, growth trends, competitive landscape, and future opportunities. Covering the period from 2019 to 2033, with a base and estimated year of 2025 and a forecast period extending from 2025 to 2033, this report is essential for industry professionals, investors, and stakeholders seeking to capitalize on the burgeoning demand for sports hydration solutions in the region. We present all values in Million units.

Sports Drink Market in South America Market Dynamics & Structure

The South America sports drink market is characterized by a moderate to high concentration, with key players like Coca-Cola Company and Pepsico holding significant market share. Technological innovation is largely driven by product formulation advancements, focusing on enhanced electrolyte content, natural ingredients, and functional benefits beyond basic hydration. Regulatory frameworks, while evolving, generally permit product development and marketing, though labeling requirements and health claims are subject to scrutiny. Competitive product substitutes include energy drinks, juices, and natural beverages, posing a challenge to market dominance. End-user demographics are expanding beyond professional athletes to include a broader spectrum of active lifestyle enthusiasts, fitness-conscious individuals, and those seeking healthier beverage alternatives. Mergers and acquisitions (M&A) activity is moderate, with strategic partnerships and smaller acquisitions focused on expanding distribution or acquiring innovative product lines.

- Market Concentration: Dominated by a few large multinational corporations, but with room for niche players.

- Technological Innovation: Focus on ingredient science, functional benefits (e.g., improved focus, muscle recovery), and sustainable packaging.

- Regulatory Landscape: Navigating varying national regulations for food and beverage products, with an increasing emphasis on health and ingredient transparency.

- Competitive Substitutes: Competition from a wide array of beverage categories, requiring strong brand differentiation.

- End-User Demographics: Shifting from elite athletes to the mainstream fitness and wellness consumer.

- M&A Trends: Strategic acquisitions to gain market access, enhance product portfolios, and secure distribution networks.

Sports Drink Market in South America Growth Trends & Insights

The South America sports drink market is poised for significant expansion, driven by a confluence of factors including rising disposable incomes, increasing participation in sports and fitness activities, and growing health consciousness among consumers. The market size evolution is projected to witness a robust Compound Annual Growth Rate (CAGR) of approximately 7.2% from 2025 to 2033, reaching an estimated XX million units by 2033. Adoption rates are accelerating as sports drinks transition from niche athletic products to everyday beverages for an active lifestyle. Technological disruptions are evident in the development of advanced formulations incorporating adaptogens, probiotics, and novel electrolyte blends. Consumer behavior shifts are marked by a growing preference for natural, low-sugar, and plant-based sports drinks, along with an increasing demand for personalized hydration solutions. Online retail stores are emerging as a key distribution channel, offering convenience and a wider product selection. The penetration of sports drinks within the broader beverage market is steadily increasing, reflecting their growing acceptance and perceived benefits.

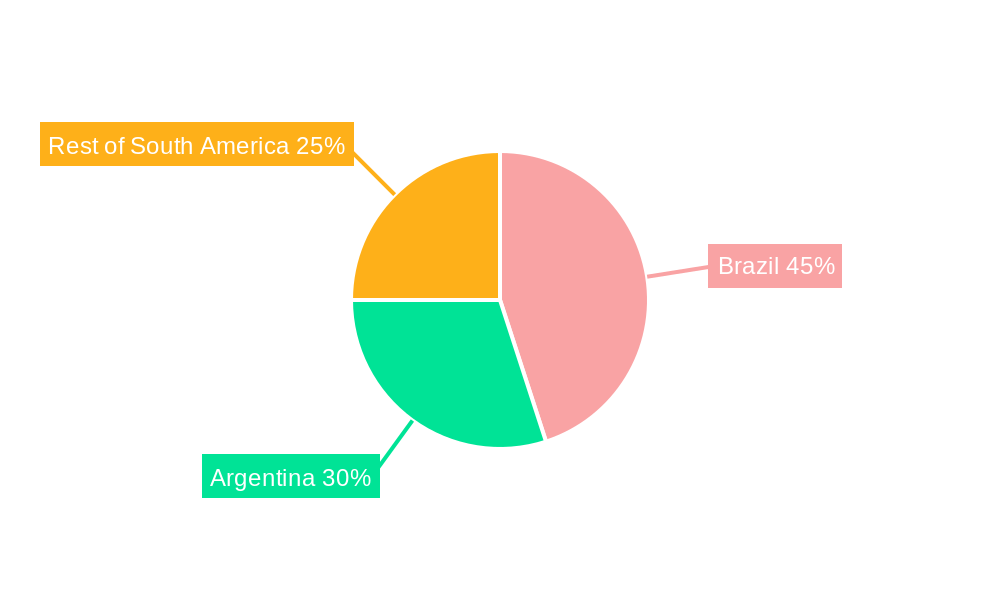

Dominant Regions, Countries, or Segments in Sports Drink Market in South America

Brazil stands out as the dominant region within the South America sports drink market, fueled by its large population, strong sporting culture, and expanding middle class. The Geography: Brazil segment is expected to account for approximately 45% of the total market share by 2025, driven by substantial investments in sports infrastructure and widespread participation in various athletic disciplines. Within Brazil, the Packaging Type: PET Bottles segment is expected to lead, owing to their convenience, affordability, and widespread availability, estimated at XX million units. The Distribution Channel: Supermarkets/Hypermarkets is the primary avenue for sports drink sales, benefiting from high foot traffic and product visibility, projected to capture XX% of sales.

Argentina also presents a significant growth opportunity, with its well-established athletic communities and increasing consumer awareness of sports nutrition. The Rest of South America, encompassing countries like Colombia, Chile, and Peru, exhibits considerable untapped potential. Economic policies in these nations are increasingly supportive of health and wellness industries, with infrastructure development facilitating wider product distribution. Growing urbanization and a rising disposable income are contributing to increased demand for sports drinks as consumers adopt more active lifestyles.

- Brazil's Dominance: Driven by population size, sporting culture, and economic growth.

- PET Bottles' Appeal: Convenience, affordability, and widespread availability make them the preferred packaging.

- Supermarket/Hypermarket Channel: Dominant due to high visibility and accessibility for consumers.

- Argentina's Potential: Strong athletic base and growing health consciousness.

- Rest of South America's Opportunity: Untapped markets and favorable economic policies supporting the beverage sector.

- Key Drivers: Economic development, infrastructure improvements, urbanization, and increased health awareness.

Sports Drink Market in South America Product Landscape

The product landscape in the South America sports drink market is dynamic, with a focus on innovation to meet evolving consumer demands. Leading companies are introducing products with enhanced electrolyte replenishment, targeted functional benefits like improved focus and muscle recovery, and the incorporation of natural ingredients such as fruit extracts and plant-based sweeteners. Performance metrics are increasingly being evaluated by efficacy in hydration, taste profiles, and ingredient transparency. Unique selling propositions often revolve around reduced sugar content, the absence of artificial colors and flavors, and specific formulations for different sports or activity levels. Technological advancements are enabling the creation of more scientifically formulated beverages that cater to specific physiological needs during physical exertion.

Key Drivers, Barriers & Challenges in Sports Drink Market in South America

The primary forces propelling the South America sports drink market include the increasing participation in sports and fitness activities across all age groups, a growing awareness of the benefits of hydration and electrolyte replenishment for performance and recovery, and rising disposable incomes enabling consumers to afford premium beverage options. The expansion of the middle class and a general shift towards healthier lifestyles are significant drivers.

Key challenges and restraints include intense competition from other beverage categories like energy drinks and functional waters, coupled with price sensitivity among a portion of the consumer base. Supply chain complexities and logistical hurdles in certain sub-regions of South America can impact product availability and cost. Regulatory hurdles related to ingredient approvals and marketing claims, though generally manageable, require careful navigation. Furthermore, concerns regarding sugar content and the perception of sports drinks as unhealthy by some consumers can act as a barrier.

Emerging Opportunities in Sports Drink Market in South America

Emerging opportunities in the South America sports drink market lie in the development of innovative, plant-based, and low-sugar formulations to cater to the growing health-conscious consumer segment. The untapped potential in smaller countries within the "Rest of South America" region presents a significant growth avenue for market expansion. Evolving consumer preferences are driving demand for functional benefits beyond simple hydration, such as enhanced cognitive function or immune support. The online retail channel offers an excellent platform for direct-to-consumer sales and reaching niche markets. Furthermore, exploring the potential for sports drinks tailored for specific activities, like endurance sports or team sports, could unlock new revenue streams.

Growth Accelerators in the Sports Drink Market in South America Industry

Growth accelerators in the South America sports drink industry are intrinsically linked to the ongoing global trends in health and wellness, coupled with the region's unique socio-economic development. Technological breakthroughs in ingredient science, leading to more effective and appealing formulations, will continue to be a key catalyst. Strategic partnerships between beverage manufacturers and sports organizations or fitness influencers can significantly enhance brand visibility and consumer adoption. Market expansion strategies, including penetrating underserved rural areas and developing region-specific product variations, will also contribute to sustained growth. The increasing focus on sustainability in packaging and production processes is also becoming a critical factor for long-term brand appeal and market success.

Key Players Shaping the Sports Drink Market in South America Market

- GU Energy Labs

- ALL SPORT INC

- AJE Group

- Pepsico

- Britvic PLC

- Otsuka Pharmaceutical Co

- Coca Cola Company

Notable Milestones in Sports Drink Market in South America Sector

- 2019: Increased focus on natural ingredients and low-sugar options by major players.

- 2020: Surge in online sales channels for sports drinks due to evolving consumer habits.

- 2021: Launch of plant-based sports drink alternatives gaining traction.

- 2022: Strategic partnerships with emerging esports organizations to tap into new demographics.

- 2023: Expansion of functional benefits beyond hydration, such as cognitive enhancement.

- 2024: Growing consumer demand for personalized nutrition and electrolyte blends.

In-Depth Sports Drink Market in South America Market Outlook

The South America sports drink market outlook remains exceptionally positive, driven by sustained growth accelerators such as technological advancements in product formulation and a deepening consumer understanding of the importance of hydration and performance enhancement. Strategic opportunities lie in leveraging the expanding middle class in various South American nations and catering to the increasing prevalence of active lifestyles. The digital transformation of retail, with online platforms becoming increasingly vital, offers a direct pathway to consumers. Furthermore, a continued focus on product innovation, including sustainable practices and the development of specialized functional beverages, will be crucial for capturing future market share and ensuring long-term success.

Sports Drink Market in South America Segmentation

-

1. Packaging Type

- 1.1. PET Bottles

- 1.2. Cans

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience Stores

- 2.3. Online Retail Stores

- 2.4. Other Distribution Channels

-

3. Geography

- 3.1. Brazil

- 3.2. Argentina

- 3.3. Rest of South America

Sports Drink Market in South America Segmentation By Geography

- 1. Brazil

- 2. Argentina

- 3. Rest of South America

Sports Drink Market in South America Regional Market Share

Geographic Coverage of Sports Drink Market in South America

Sports Drink Market in South America REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Health Consciousness Among Consumers; Increasing Demand for Vegan Food Products

- 3.3. Market Restrains

- 3.3.1. Poor Supply Chain

- 3.4. Market Trends

- 3.4.1. Improving Food Consumption Pattern

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Sports Drink Market in South America Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Packaging Type

- 5.1.1. PET Bottles

- 5.1.2. Cans

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Online Retail Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. Brazil

- 5.3.2. Argentina

- 5.3.3. Rest of South America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Brazil

- 5.4.2. Argentina

- 5.4.3. Rest of South America

- 5.1. Market Analysis, Insights and Forecast - by Packaging Type

- 6. Brazil Sports Drink Market in South America Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Packaging Type

- 6.1.1. PET Bottles

- 6.1.2. Cans

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets/Hypermarkets

- 6.2.2. Convenience Stores

- 6.2.3. Online Retail Stores

- 6.2.4. Other Distribution Channels

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. Brazil

- 6.3.2. Argentina

- 6.3.3. Rest of South America

- 6.1. Market Analysis, Insights and Forecast - by Packaging Type

- 7. Argentina Sports Drink Market in South America Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Packaging Type

- 7.1.1. PET Bottles

- 7.1.2. Cans

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets/Hypermarkets

- 7.2.2. Convenience Stores

- 7.2.3. Online Retail Stores

- 7.2.4. Other Distribution Channels

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. Brazil

- 7.3.2. Argentina

- 7.3.3. Rest of South America

- 7.1. Market Analysis, Insights and Forecast - by Packaging Type

- 8. Rest of South America Sports Drink Market in South America Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Packaging Type

- 8.1.1. PET Bottles

- 8.1.2. Cans

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets/Hypermarkets

- 8.2.2. Convenience Stores

- 8.2.3. Online Retail Stores

- 8.2.4. Other Distribution Channels

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. Brazil

- 8.3.2. Argentina

- 8.3.3. Rest of South America

- 8.1. Market Analysis, Insights and Forecast - by Packaging Type

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2025

- 9.2. Company Profiles

- 9.2.1 GU Energy Labs

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 ALL SPORT INC

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 AJE Group

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Pepsico

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Britvic PLC

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Otsuka Pharmaceutical Co*List Not Exhaustive

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Coca Cola Company

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.1 GU Energy Labs

List of Figures

- Figure 1: Sports Drink Market in South America Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Sports Drink Market in South America Share (%) by Company 2025

List of Tables

- Table 1: Sports Drink Market in South America Revenue billion Forecast, by Packaging Type 2020 & 2033

- Table 2: Sports Drink Market in South America Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Sports Drink Market in South America Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: Sports Drink Market in South America Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Sports Drink Market in South America Revenue billion Forecast, by Packaging Type 2020 & 2033

- Table 6: Sports Drink Market in South America Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 7: Sports Drink Market in South America Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: Sports Drink Market in South America Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Sports Drink Market in South America Revenue billion Forecast, by Packaging Type 2020 & 2033

- Table 10: Sports Drink Market in South America Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 11: Sports Drink Market in South America Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Sports Drink Market in South America Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Sports Drink Market in South America Revenue billion Forecast, by Packaging Type 2020 & 2033

- Table 14: Sports Drink Market in South America Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 15: Sports Drink Market in South America Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: Sports Drink Market in South America Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Sports Drink Market in South America?

The projected CAGR is approximately 6.4%.

2. Which companies are prominent players in the Sports Drink Market in South America?

Key companies in the market include GU Energy Labs, ALL SPORT INC, AJE Group, Pepsico, Britvic PLC, Otsuka Pharmaceutical Co*List Not Exhaustive, Coca Cola Company.

3. What are the main segments of the Sports Drink Market in South America?

The market segments include Packaging Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.6 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Health Consciousness Among Consumers; Increasing Demand for Vegan Food Products.

6. What are the notable trends driving market growth?

Improving Food Consumption Pattern.

7. Are there any restraints impacting market growth?

Poor Supply Chain.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Sports Drink Market in South America," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Sports Drink Market in South America report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Sports Drink Market in South America?

To stay informed about further developments, trends, and reports in the Sports Drink Market in South America, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence