Key Insights

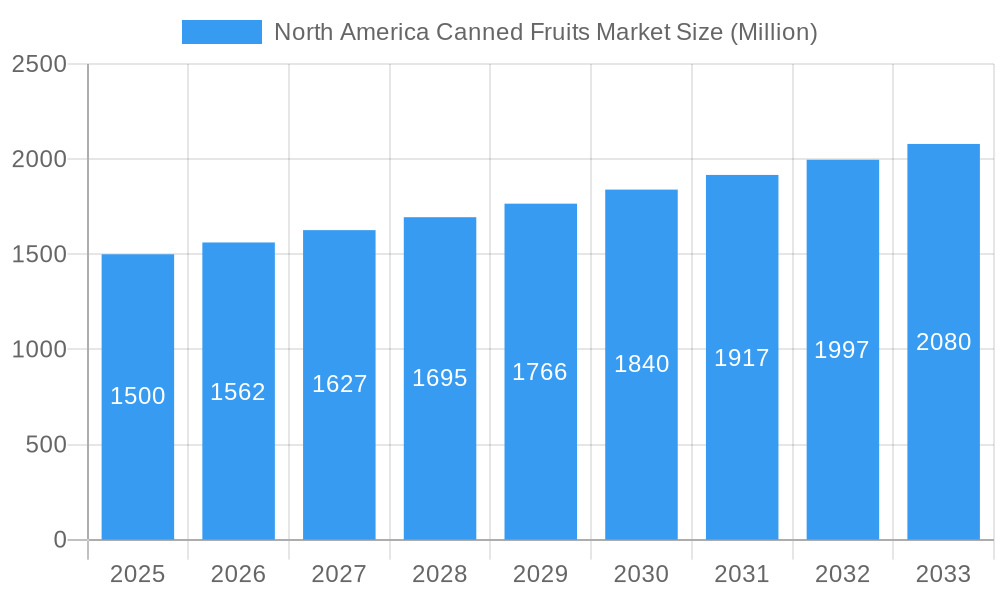

The North American canned fruits market is poised for steady growth, projected to reach a market size of approximately $1.5 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 4.16% expected to extend through 2033. This expansion is primarily driven by the increasing demand for convenient and long-shelf-life food options, particularly among busy households and individuals seeking healthy snack alternatives. The market's resilience is further bolstered by factors such as the rising popularity of tropical fruits like pineapple and mandarin oranges, which offer a taste of exotic flavors in a readily accessible format. Furthermore, ongoing innovations in packaging and product formulation, including reduced sugar content and the introduction of organic varieties, are catering to evolving consumer preferences and health consciousness, thereby stimulating market penetration. The overall positive outlook is underpinned by a strong consumer preference for the perceived value and year-round availability that canned fruits provide, making them a staple in many North American kitchens.

North America Canned Fruits Market Market Size (In Billion)

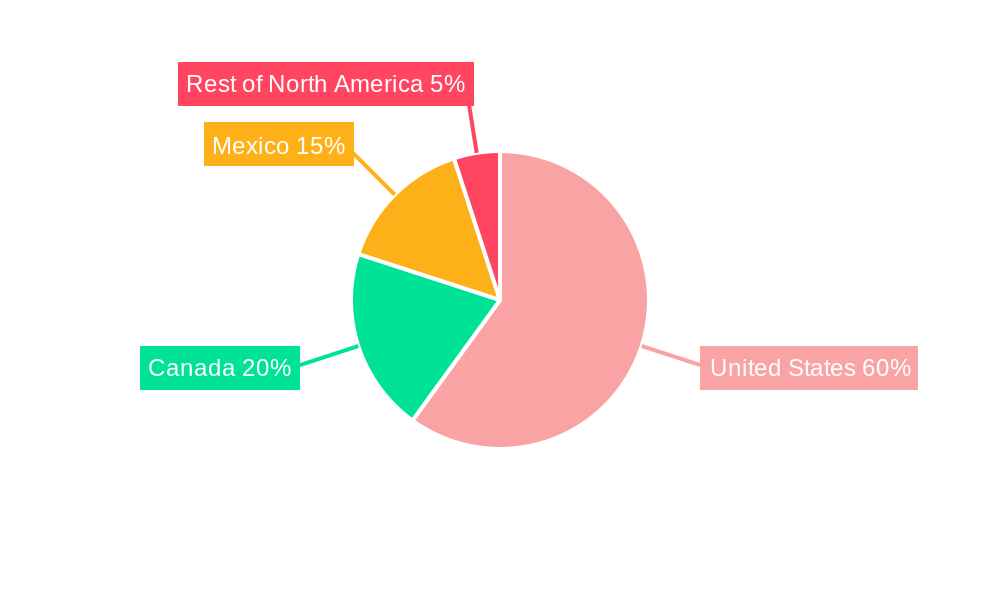

The market's growth trajectory is also influenced by evolving consumption patterns and distribution strategies. The rise of online retail platforms is playing an increasingly significant role in expanding the reach of canned fruit products, offering consumers greater convenience and a wider selection. Supermarkets and hypermarkets continue to be dominant channels, but convenience stores are also witnessing growth as consumers seek immediate gratification for their snack needs. While whole fruits remain a popular segment, cut fruits are gaining traction, offering added convenience for meal preparation. Geographically, the United States represents the largest market within North America, followed by Canada and Mexico, with the "Rest of North America" segment showing promising potential for future development. Key players like Dole Food Company, Del Monte Foods Inc., and The Kraft Heinz Company are actively investing in product development and marketing to capitalize on these trends and maintain their competitive edge in this dynamic market.

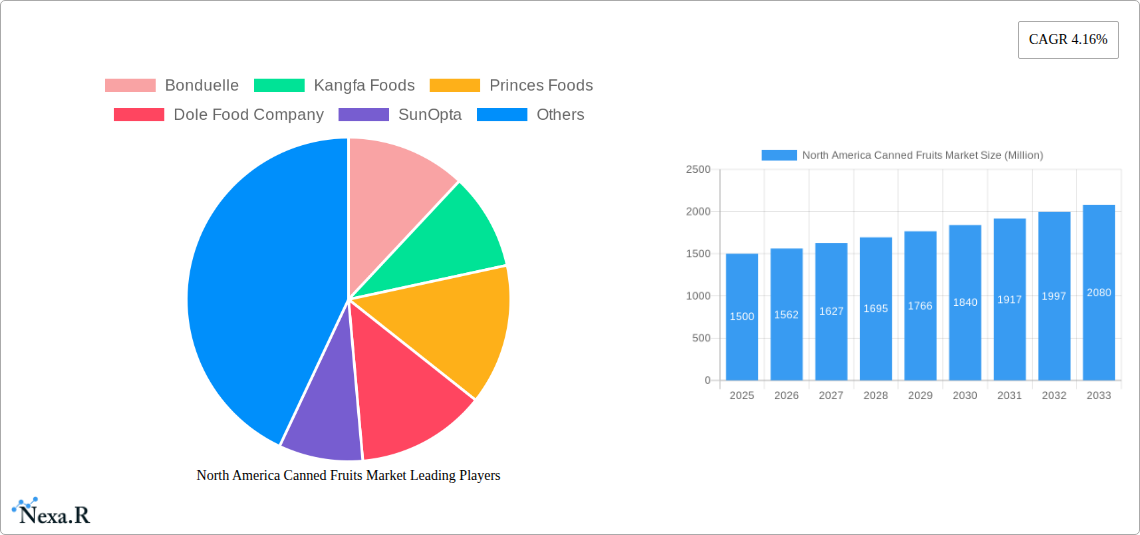

North America Canned Fruits Market Company Market Share

North America Canned Fruits Market: Comprehensive Market Analysis and Forecast (2019–2033)

This in-depth report provides a thorough analysis of the North America canned fruits market, encompassing market dynamics, growth trends, regional dominance, product landscape, key drivers, challenges, emerging opportunities, and a detailed outlook. With a study period spanning from 2019 to 2033, this report offers critical insights into market evolution, consumer behavior shifts, and strategic opportunities for industry stakeholders. All quantitative data is presented in Million units.

North America Canned Fruits Market Market Dynamics & Structure

The North America canned fruits market exhibits a moderately concentrated structure, with a few major players holding significant market share. Technological innovation drivers are primarily focused on enhancing shelf life, improving nutritional value, and developing convenient packaging solutions. Regulatory frameworks, such as food safety standards and labeling requirements, play a crucial role in shaping market operations. Competitive product substitutes, including fresh fruits, frozen fruits, and dried fruits, exert pressure on the canned fruits market, necessitating continuous product differentiation and value proposition enhancement. End-user demographics are increasingly driven by convenience-seeking consumers, health-conscious individuals, and budget-aware households. Mergers and acquisitions (M&A) trends indicate strategic consolidation and expansion efforts by key companies aiming to strengthen their market presence and portfolio.

- Market Concentration: Dominated by a mix of large multinational corporations and regional players, with significant market share held by the top 5-7 companies.

- Technological Innovation: Focus on retort pouch technology, improved canning processes, and fortification with vitamins and minerals.

- Regulatory Landscape: Strict adherence to FDA regulations in the US and Health Canada standards in Canada.

- Product Substitutes: High availability and increasing consumer preference for fresh, frozen, and dried fruit alternatives.

- End-User Demographics: Growing demand from busy households, elderly populations, and food service industries.

- M&A Trends: Strategic acquisitions to gain market access, expand product lines, and enhance distribution networks. For instance, the acquisition of Del Monte's Canadian operations by Bonduelle Group highlights this trend.

North America Canned Fruits Market Growth Trends & Insights

The North America canned fruits market is poised for steady growth, driven by evolving consumer preferences and increasing demand for convenient, shelf-stable fruit options. The market size is projected to witness a compound annual growth rate (CAGR) of approximately 4.5% over the forecast period (2025–2033). Adoption rates for canned fruits remain robust, particularly among households seeking to supplement their diets with readily available fruit servings. Technological disruptions are emerging in processing and packaging, focusing on reducing sugar content, maintaining natural fruit integrity, and offering sustainable packaging solutions. Consumer behavior shifts indicate a growing interest in healthy snacking and convenient meal components, where canned fruits play a significant role. The penetration of canned fruits remains high, especially in value-conscious segments and in regions with limited access to fresh produce.

The market size evolution showcases a consistent upward trajectory. From an estimated market size of $6,500 Million units in 2025, it is projected to reach over $9,500 Million units by 2033. This growth is underpinned by several factors: the increasing demand for convenience in food preparation, the perceived affordability and long shelf life of canned fruits, and their role as a versatile ingredient in various culinary applications. Adoption rates are particularly strong in urban areas where busy lifestyles necessitate quick and easy food solutions. While fresh produce remains a preferred choice for many, the accessibility and consistent quality of canned fruits ensure their continued relevance.

Technological advancements are not only enhancing the quality of canned fruits but also broadening their appeal. Innovations in processing, such as minimal processing techniques and advanced sterilization methods, help preserve the natural taste, texture, and nutritional value of fruits. This counters some of the negative perceptions associated with canned goods. Furthermore, the development of BPA-free cans and more sustainable packaging options is aligning with growing environmental consciousness among consumers.

Consumer behavior shifts are a significant growth catalyst. There's a discernible trend towards healthier eating, and while the perception of canned fruits can sometimes be linked to high sugar content, manufacturers are actively addressing this. The introduction of products with no added sugar, reduced syrup, or those packed in natural fruit juice is resonating with health-conscious consumers. Additionally, the convenience factor remains paramount. Canned fruits are ideal for quick snacks, additions to yogurt or cereals, and as ingredients in desserts and savory dishes, fitting seamlessly into modern, time-constrained lifestyles. The market penetration of canned fruits is further strengthened by their widespread availability across various retail channels, from large hypermarkets to small convenience stores.

Dominant Regions, Countries, or Segments in North America Canned Fruits Market

The United States stands as the dominant region within the North America canned fruits market, driven by its large consumer base, established retail infrastructure, and a mature market for processed foods. Within the Product Type segment, Pineapple and Peaches consistently lead in demand due to their versatility, widespread use in both sweet and savory dishes, and significant import volumes. In terms of Form, Cut fruits are gaining traction over whole fruits, catering to the increasing demand for convenience and ready-to-eat options. The Supermarkets/Hypermarkets distribution channel remains the primary avenue for canned fruit sales, owing to their extensive reach and the ability to offer a wide variety of brands and product types.

- Dominant Geography: The United States accounts for over 70% of the North American canned fruits market share, supported by a robust economy and high per capita consumption of processed foods.

- Leading Product Type: Pineapple and Peaches command significant market share, driven by their popularity in culinary applications and their availability as primary ingredients in various canned fruit mixes.

- Preferred Form: Cut fruits are experiencing higher growth rates than whole fruits, reflecting consumer preference for convenience and reduced preparation time.

- Primary Distribution Channel: Supermarkets/Hypermarkets are the most significant channel, offering economies of scale and broad product selection, thus attracting the largest consumer base.

- Growth Potential in Mexico: While currently smaller, Mexico presents substantial growth potential due to its expanding middle class and increasing adoption of Western dietary habits.

The dominance of the United States in the canned fruits market is a multifaceted phenomenon. Its sheer population size translates into a larger consumer base for all food products, including canned fruits. The well-developed retail network, comprising numerous supermarkets and hypermarkets, ensures widespread availability and accessibility for consumers across the country. Furthermore, a strong emphasis on convenience in American lifestyles contributes to the sustained demand for shelf-stable and ready-to-use food items like canned fruits.

Within the product types, pineapple and peaches have long been staples in the North American diet. Their appeal is enhanced by their consistent quality, availability year-round in canned form, and their adaptability in various recipes, from desserts and salads to main courses and beverages. The preference for cut fruits over whole fruits is a clear indicator of evolving consumer habits. In today's fast-paced world, consumers are seeking products that require minimal to no preparation. Diced peaches, pineapple chunks, and sliced pears offer immediate usability, fitting seamlessly into breakfast routines, lunchboxes, and quick snacks.

Supermarkets and hypermarkets remain the cornerstone of canned fruit distribution. Their ability to stock a vast array of brands, sizes, and product variations allows consumers to make informed choices based on price, brand loyalty, and specific product needs. The promotional activities and attractive shelf placement within these large format stores further drive sales. While online retail is growing, traditional brick-and-mortar stores continue to hold the largest market share for everyday grocery purchases, including canned goods.

North America Canned Fruits Market Product Landscape

The North America canned fruits market is characterized by continuous product innovation, focusing on enhancing nutritional value, reducing added sugars, and improving taste profiles. Applications range from direct consumption as a healthy snack and breakfast accompaniment to incorporation into desserts, salads, and savory dishes. Performance metrics emphasize extended shelf life, consistent quality, and convenience. Unique selling propositions include the convenience of ready-to-eat fruit, year-round availability, and affordability compared to fresh counterparts. Technological advancements are evident in improved canning techniques that preserve fruit integrity and in the development of diverse syrup and juice pack options.

Key Drivers, Barriers & Challenges in North America Canned Fruits Market

Key Drivers:

- Convenience and Shelf Stability: The long shelf life and ease of preparation make canned fruits an attractive option for busy consumers and for stocking pantries.

- Affordability: Canned fruits often offer a more budget-friendly alternative to fresh fruits, especially during off-seasons.

- Versatility in Culinary Applications: They serve as a convenient ingredient for a wide range of dishes, from desserts and salads to main courses.

- Growing Health Consciousness (with modifications): Manufacturers are responding to demand for healthier options by offering fruits in natural juice or water, with no added sugar.

Barriers & Challenges:

- Perception of Lower Nutritional Value: Despite advancements, some consumers perceive canned fruits as less nutritious than fresh or frozen options due to processing.

- Competition from Fresh and Frozen Fruits: The increasing availability and quality of fresh and frozen fruits pose significant competition.

- Sugar Content Concerns: Products packed in heavy syrup can deter health-conscious consumers, necessitating a shift towards healthier alternatives.

- Supply Chain Volatility: Fluctuations in raw material availability and transportation costs can impact pricing and product availability.

- Regulatory Scrutiny: Adherence to stringent food safety and labeling regulations requires ongoing investment and compliance efforts.

Emerging Opportunities in North America Canned Fruits Market

Emerging opportunities lie in the development of premium and exotic canned fruit varieties, catering to evolving consumer palates. The demand for "no added sugar" and "packed in natural juice" options continues to grow, presenting a significant avenue for market expansion. Furthermore, exploring innovative applications in ready-to-eat meal kits and convenience foods can tap into new consumer segments. The growing trend of plant-based diets also presents an opportunity for canned fruits as a versatile ingredient in vegan desserts and snacks.

Growth Accelerators in the North America Canned Fruits Market Industry

Growth accelerators for the North America canned fruits market include strategic product diversification towards healthier options, such as fruits packed in water or natural fruit juice, and the introduction of value-added products like fruit salads and fruit cups with enhanced nutritional profiles. Technological advancements in packaging that improve convenience and sustainability, coupled with effective marketing campaigns that highlight the nutritional benefits and versatility of canned fruits, are crucial for driving long-term growth. Collaborations between manufacturers and retailers to promote seasonal fruits and offer bundled deals also act as significant growth catalysts.

Key Players Shaping the North America Canned Fruits Market Market

- Bonduelle

- Kangfa Foods

- Princes Foods

- Dole Food Company

- SunOpta

- The Kraft Heinz Company

- CHB Group

- Del Monte Foods Inc

- Native Forest

- Seneca Foods

Notable Milestones in North America Canned Fruits Market Sector

- May 2022: Bonduelle Group secured new investors for its North American business unit, Bonduelle Americas Long Life (BALL), to finance future growth. BALL operates processing plants in Canada and the US for canned and frozen fruits, primarily private-label.

- July 2021: Dole Packaged Foods, LLC launched Dole Essentials fruit cups, a new functional fruit-based line featuring gluten-free, non-GMO options with no added sugars and 50% of daily Vitamin C.

- April 2021: The Del Monte brand in Canada became part of the Bonduelle Group, with a strategy to provide Canadian families with nutritious canned fruits and on-the-go fruit cups year-round.

In-Depth North America Canned Fruits Market Market Outlook

The North America canned fruits market is projected to experience sustained growth, fueled by increasing consumer demand for convenient, affordable, and shelf-stable fruit options. Key growth accelerators include the ongoing shift towards healthier product formulations, such as fruits packed in natural juices and water, and the expansion of product lines to include ready-to-eat fruit cups and innovative fruit-based snacks. Strategic collaborations and partnerships between manufacturers and retailers will further enhance market penetration. The market's outlook is positive, with opportunities for companies to innovate in product development, sustainable packaging, and targeted marketing to cater to evolving consumer preferences and capitalize on emerging trends in the food industry.

North America Canned Fruits Market Segmentation

-

1. Product Type

- 1.1. Peaches

- 1.2. Pineapple

- 1.3. Mandarin oranges

- 1.4. Pears

- 1.5. Other Fruit Types

-

2. Form

- 2.1. Whole fruits

- 2.2. Cut fruits

-

3. Distribution Channel

- 3.1. Supermarkets/Hypermarkets

- 3.2. Convenience Stores

- 3.3. Online Retail Stores

- 3.4. Other Distribution Channels

-

4. Geography

- 4.1. United States

- 4.2. Canada

- 4.3. Mexico

- 4.4. Rest of North America

North America Canned Fruits Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

- 4. Rest of North America

North America Canned Fruits Market Regional Market Share

Geographic Coverage of North America Canned Fruits Market

North America Canned Fruits Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.16% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Awareness of Functional Benefits of Carotenoids; Consumption of Health and Wellness Products

- 3.3. Market Restrains

- 3.3.1. High Processing Cost and Low Yield of Natural Food Colors

- 3.4. Market Trends

- 3.4.1. Rising trend of on-the-go consumption

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Canned Fruits Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Peaches

- 5.1.2. Pineapple

- 5.1.3. Mandarin oranges

- 5.1.4. Pears

- 5.1.5. Other Fruit Types

- 5.2. Market Analysis, Insights and Forecast - by Form

- 5.2.1. Whole fruits

- 5.2.2. Cut fruits

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Supermarkets/Hypermarkets

- 5.3.2. Convenience Stores

- 5.3.3. Online Retail Stores

- 5.3.4. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.4.4. Rest of North America

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United States

- 5.5.2. Canada

- 5.5.3. Mexico

- 5.5.4. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. United States North America Canned Fruits Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Peaches

- 6.1.2. Pineapple

- 6.1.3. Mandarin oranges

- 6.1.4. Pears

- 6.1.5. Other Fruit Types

- 6.2. Market Analysis, Insights and Forecast - by Form

- 6.2.1. Whole fruits

- 6.2.2. Cut fruits

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Supermarkets/Hypermarkets

- 6.3.2. Convenience Stores

- 6.3.3. Online Retail Stores

- 6.3.4. Other Distribution Channels

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. United States

- 6.4.2. Canada

- 6.4.3. Mexico

- 6.4.4. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Canada North America Canned Fruits Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Peaches

- 7.1.2. Pineapple

- 7.1.3. Mandarin oranges

- 7.1.4. Pears

- 7.1.5. Other Fruit Types

- 7.2. Market Analysis, Insights and Forecast - by Form

- 7.2.1. Whole fruits

- 7.2.2. Cut fruits

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Supermarkets/Hypermarkets

- 7.3.2. Convenience Stores

- 7.3.3. Online Retail Stores

- 7.3.4. Other Distribution Channels

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. United States

- 7.4.2. Canada

- 7.4.3. Mexico

- 7.4.4. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Mexico North America Canned Fruits Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Peaches

- 8.1.2. Pineapple

- 8.1.3. Mandarin oranges

- 8.1.4. Pears

- 8.1.5. Other Fruit Types

- 8.2. Market Analysis, Insights and Forecast - by Form

- 8.2.1. Whole fruits

- 8.2.2. Cut fruits

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Supermarkets/Hypermarkets

- 8.3.2. Convenience Stores

- 8.3.3. Online Retail Stores

- 8.3.4. Other Distribution Channels

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. United States

- 8.4.2. Canada

- 8.4.3. Mexico

- 8.4.4. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of North America North America Canned Fruits Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Peaches

- 9.1.2. Pineapple

- 9.1.3. Mandarin oranges

- 9.1.4. Pears

- 9.1.5. Other Fruit Types

- 9.2. Market Analysis, Insights and Forecast - by Form

- 9.2.1. Whole fruits

- 9.2.2. Cut fruits

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Supermarkets/Hypermarkets

- 9.3.2. Convenience Stores

- 9.3.3. Online Retail Stores

- 9.3.4. Other Distribution Channels

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. United States

- 9.4.2. Canada

- 9.4.3. Mexico

- 9.4.4. Rest of North America

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Bonduelle

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Kangfa Foods

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Princes Foods

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Dole Food Company

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 SunOpta

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 The Kraft Heinz Company

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 CHB Group

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Del Monte Foods Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Native Forest*List Not Exhaustive

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Seneca Foods

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Bonduelle

List of Figures

- Figure 1: North America Canned Fruits Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Canned Fruits Market Share (%) by Company 2025

List of Tables

- Table 1: North America Canned Fruits Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: North America Canned Fruits Market Revenue Million Forecast, by Form 2020 & 2033

- Table 3: North America Canned Fruits Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: North America Canned Fruits Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 5: North America Canned Fruits Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: North America Canned Fruits Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 7: North America Canned Fruits Market Revenue Million Forecast, by Form 2020 & 2033

- Table 8: North America Canned Fruits Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 9: North America Canned Fruits Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 10: North America Canned Fruits Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: North America Canned Fruits Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 12: North America Canned Fruits Market Revenue Million Forecast, by Form 2020 & 2033

- Table 13: North America Canned Fruits Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 14: North America Canned Fruits Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 15: North America Canned Fruits Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: North America Canned Fruits Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 17: North America Canned Fruits Market Revenue Million Forecast, by Form 2020 & 2033

- Table 18: North America Canned Fruits Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 19: North America Canned Fruits Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 20: North America Canned Fruits Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: North America Canned Fruits Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 22: North America Canned Fruits Market Revenue Million Forecast, by Form 2020 & 2033

- Table 23: North America Canned Fruits Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 24: North America Canned Fruits Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 25: North America Canned Fruits Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Canned Fruits Market?

The projected CAGR is approximately 4.16%.

2. Which companies are prominent players in the North America Canned Fruits Market?

Key companies in the market include Bonduelle, Kangfa Foods, Princes Foods, Dole Food Company, SunOpta, The Kraft Heinz Company, CHB Group, Del Monte Foods Inc, Native Forest*List Not Exhaustive, Seneca Foods.

3. What are the main segments of the North America Canned Fruits Market?

The market segments include Product Type, Form, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Awareness of Functional Benefits of Carotenoids; Consumption of Health and Wellness Products.

6. What are the notable trends driving market growth?

Rising trend of on-the-go consumption.

7. Are there any restraints impacting market growth?

High Processing Cost and Low Yield of Natural Food Colors.

8. Can you provide examples of recent developments in the market?

In May 2022, Bonduelle Group added new investors to its North American business unit Bonduelle Americas Long Life (BALL) in an effort to secure financing for its future growth plans. BALL has six processing plants in Canada and four in the United States that process canned and frozen fruits sold primarily by private-label brands in North America.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Canned Fruits Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Canned Fruits Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Canned Fruits Market?

To stay informed about further developments, trends, and reports in the North America Canned Fruits Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence