Key Insights

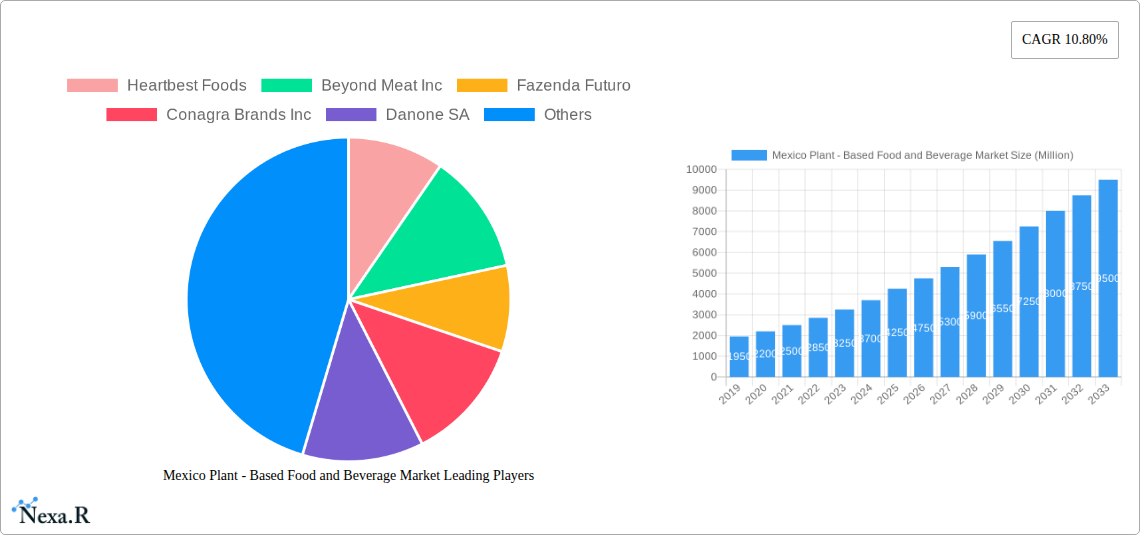

The Mexican plant-based food and beverage market is poised for substantial growth, projected to reach a market size of approximately $8,500 million by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of 10.80% from its estimated base year value of $4,250 million in 2025. This surge is primarily fueled by a confluence of evolving consumer preferences, increasing health consciousness, and growing environmental awareness. Consumers are actively seeking healthier alternatives to traditional animal-based products, driven by a desire to mitigate risks associated with chronic diseases and adopt more sustainable dietary habits. Furthermore, the rising prevalence of lactose intolerance and ethical concerns surrounding animal welfare are also significant catalysts for this market's expansion. Key product segments such as dairy alternatives, particularly milk, yogurt, and cheese, are experiencing remarkable traction. The meat substitute category is also witnessing a strong upward trajectory, as manufacturers introduce innovative and palatable plant-based options that closely mimic the taste and texture of conventional meat. This evolving landscape is supported by increased investment in research and development, leading to a wider array of high-quality and accessible plant-based products.

Mexico Plant - Based Food and Beverage Market Market Size (In Billion)

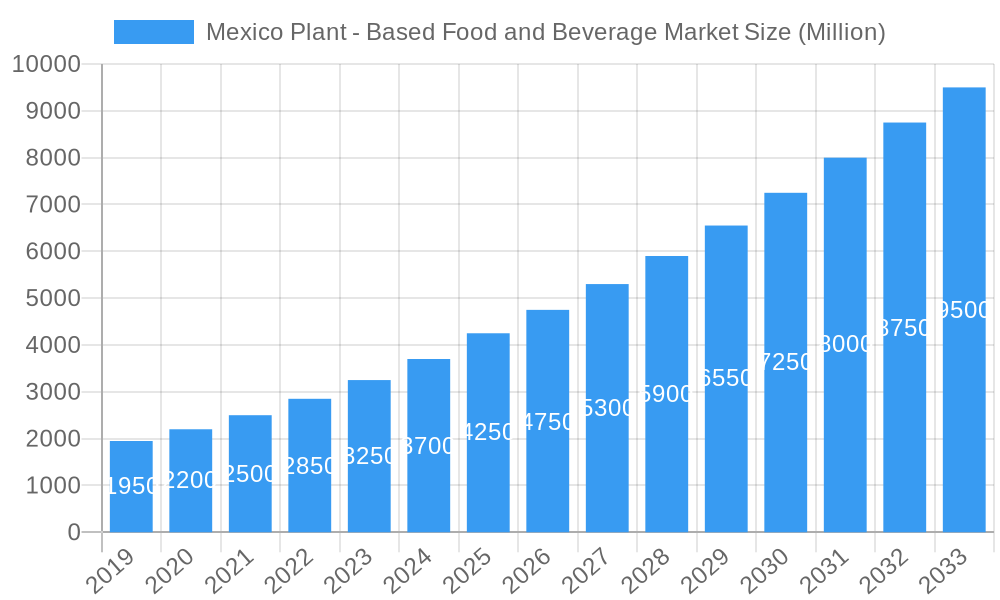

The distribution of these products is diversifying, with supermarkets and hypermarkets continuing to be dominant channels, providing broad consumer access. However, the rapid growth of online retail stores presents a significant opportunity for market players, catering to the convenience-seeking urban demographic. Major players like Conagra Brands Inc., Danone SA, Unilever Plc, and Nestle SA are actively investing in expanding their plant-based portfolios and leveraging their established distribution networks to capture a larger market share. Emerging companies such as Beyond Meat Inc., Heura, and NotCo are driving innovation with their unique product offerings and sustainable business models. Despite the promising outlook, the market faces certain restraints, including the perception of higher costs for some plant-based alternatives compared to their conventional counterparts and the need for greater consumer education regarding the nutritional benefits and versatility of these products. Nonetheless, as economies of scale improve and product innovation continues, these challenges are expected to diminish, paving the way for sustained and accelerated growth in the Mexican plant-based food and beverage sector.

Mexico Plant - Based Food and Beverage Market Company Market Share

This comprehensive report provides an in-depth analysis of the burgeoning Mexico Plant-Based Food and Beverage Market. Dive into market dynamics, growth trends, dominant segments, product innovation, key players, and strategic opportunities shaping this dynamic industry. With a study period from 2019 to 2033, including a base year of 2025, this report offers actionable insights for stakeholders seeking to capitalize on the escalating demand for plant-based alternatives in Mexico. Explore the parent and child market structures, gain a deep understanding of vegan food, dairy-free beverages, meat substitutes, and more.

Mexico Plant - Based Food and Beverage Market Market Dynamics & Structure

The Mexico Plant-Based Food and Beverage Market is characterized by a dynamic and evolving structure, driven by increasing consumer awareness of health, environmental sustainability, and ethical considerations. Market concentration is moderately fragmented, with both large multinational corporations and agile local players vying for market share. Technological innovation is a significant driver, with advancements in plant-based protein processing, flavor development, and ingredient formulation continuously enhancing the taste, texture, and nutritional profile of products. Regulatory frameworks are becoming more defined, with a growing focus on clear labeling and product standards for plant-based food products. Competitive product substitutes range from traditional animal-based products to a widening array of plant-based food and beverage options. End-user demographics are increasingly diverse, encompassing a growing segment of health-conscious millennials and Gen Z consumers, as well as individuals with lactose intolerance or dietary restrictions. Merger and acquisition (M&A) trends indicate a consolidation phase, with established food giants acquiring innovative startups to expand their plant-based portfolios.

- Market Concentration: Moderately fragmented with a mix of large players and emerging brands.

- Technological Innovation Drivers: Advancements in food science, ingredient sourcing, and processing technologies.

- Regulatory Frameworks: Evolving standards for labeling and product authenticity.

- Competitive Product Substitutes: Direct competition from traditional animal-based products and indirect competition from other plant-based food and beverage brands.

- End-User Demographics: Broadening appeal across age groups, driven by health and ethical consciousness.

- M&A Trends: Strategic acquisitions by large corporations to enhance their plant-based offerings.

Mexico Plant - Based Food and Beverage Market Growth Trends & Insights

The Mexico Plant-Based Food and Beverage Market is experiencing robust growth, fueled by shifting consumer preferences and increasing availability of diverse products. The market size evolution is projected to witness a significant upward trajectory, with an estimated Compound Annual Growth Rate (CAGR) of XX% over the forecast period. Adoption rates for plant-based diets are on the rise, driven by a growing understanding of their health benefits, such as reduced risk of chronic diseases, and their positive environmental impact, including lower carbon footprints. Technological disruptions are playing a pivotal role, with innovations in plant-based meat alternatives that mimic the taste and texture of traditional meat, and advancements in dairy-free beverage technology creating creamy and palatable options. Consumer behavior shifts are evident, with a growing segment of flexitarians actively seeking to reduce their consumption of animal products. This trend is further amplified by increased disposable incomes and greater accessibility to plant-based food options through various retail channels. The market penetration of plant-based foods and beverages is expected to deepen as more consumers embrace these sustainable and healthier alternatives. The estimated market size in 2025 is valued at approximately USD XXX million units, with projections to reach USD XXX million units by 2033.

Dominant Regions, Countries, or Segments in Mexico Plant - Based Food and Beverage Market

Within the Mexico Plant-Based Food and Beverage Market, the Meat Substitute segment is anticipated to be a dominant driver of growth. This segment's ascendancy is attributed to its ability to directly address the large existing market for conventional meat products, offering consumers a familiar yet ethically and environmentally superior alternative. The increasing innovation in plant-based burgers, sausages, and ground meat alternatives that closely replicate the sensory experience of animal meat is a key factor. Furthermore, growing consumer awareness regarding the health implications of high meat consumption and the environmental footprint of animal agriculture are propelling consumers towards these substitutes.

The Dairy Alternative Beverages segment also holds substantial market share and growth potential, driven by the widespread popularity of milk and the increasing incidence of lactose intolerance in Mexico. Advances in the formulation of almond milk, soy milk, oat milk, and coconut milk have significantly improved their taste, texture, and nutritional value, making them attractive choices for everyday consumption.

From a distribution channel perspective, Supermarkets/Hypermarkets currently dominate the market due to their extensive reach and ability to offer a wide variety of plant-based food and beverage products under one roof. However, Online Retail stores are rapidly gaining traction, offering convenience and a curated selection for consumers specifically seeking vegan and plant-based options.

- Dominant Segment (Type): Meat Substitute

- Key Drivers: Realistic texture and taste replication, health consciousness, environmental concerns.

- Market Share Potential: Significant penetration due to direct substitution.

- Strong Performing Segment (Type): Dairy Alternative Beverages

- Key Drivers: Growing lactose intolerance, versatility in consumption, improving product quality.

- Market Share Potential: High adoption for everyday use.

- Dominant Distribution Channel: Supermarket/Hypermarket

- Key Drivers: Wide product availability, convenience for mainstream shoppers.

- Growth Potential: Continued dominance with increasing plant-based product offerings.

- Emerging Distribution Channel: Online Retail stores

- Key Drivers: Convenience, specialized product discovery, growing e-commerce penetration.

- Growth Potential: Rapid expansion, especially for niche plant-based brands.

Mexico Plant - Based Food and Beverage Market Product Landscape

The product landscape of the Mexico Plant-Based Food and Beverage Market is characterized by rapid innovation and diversification. Manufacturers are focusing on enhancing the sensory attributes, nutritional profiles, and affordability of their offerings. Key product innovations include the development of advanced plant-based meat analogs that mimic the texture and juiciness of traditional meat, utilizing novel protein sources and processing techniques. In the dairy-free beverage sector, advancements have led to improved creaminess and flavor profiles in plant-based milks, yogurts, and ice creams. Applications are expanding beyond direct substitutes to incorporate plant-based ingredients into a wider range of food products, catering to diverse culinary preferences. Performance metrics such as taste, texture, shelf-life, and nutritional content are continuously being optimized to meet consumer expectations and compete effectively with conventional products. Unique selling propositions often revolve around clean labels, sustainable sourcing, and allergen-free formulations.

Key Drivers, Barriers & Challenges in Mexico Plant - Based Food and Beverage Market

The Mexico Plant-Based Food and Beverage Market is propelled by several key drivers. Growing consumer awareness regarding health and wellness benefits associated with plant-based diets, coupled with increasing concerns about the environmental impact of animal agriculture, are significant motivators. Technological advancements in food science enabling the creation of palatable and versatile plant-based alternatives are crucial. Furthermore, the growing demand for ethical and sustainable food choices, particularly among younger demographics, is a strong influencer.

However, the market faces certain barriers and challenges. High production costs for some plant-based ingredients can lead to higher retail prices, making them less accessible to a broader consumer base. Consumer perception and taste preferences, deeply ingrained with traditional animal-based products, can pose a challenge for widespread adoption. Supply chain complexities and the need for specialized processing infrastructure also present hurdles. Regulatory hurdles related to clear and standardized labeling of plant-based products can create consumer confusion. Competition from established conventional food and beverage companies, who may leverage their existing distribution networks and brand loyalty, also presents a significant challenge.

Key Drivers:

- Health and Wellness Trends: Increasing focus on nutritious and disease-preventing diets.

- Environmental Sustainability: Growing awareness of the ecological footprint of animal agriculture.

- Ethical Consumption: Demand for cruelty-free and animal welfare-friendly products.

- Technological Advancements: Improved taste, texture, and nutritional profiles of plant-based foods.

Barriers & Challenges:

- Price Sensitivity: Higher production costs potentially leading to premium pricing.

- Consumer Acceptance: Overcoming traditional taste preferences and perceptions.

- Supply Chain & Infrastructure: Need for specialized sourcing and processing capabilities.

- Regulatory Ambiguities: Lack of standardized labeling for plant-based products.

- Intense Competition: From both established and emerging players.

Emerging Opportunities in Mexico Plant - Based Food and Beverage Market

Emerging opportunities in the Mexico Plant-Based Food and Beverage Market lie in the innovation of ready-to-eat plant-based meals and snacks, catering to the on-the-go lifestyles of urban consumers. The development of allergen-free plant-based products specifically targeting individuals with common allergies (e.g., soy, gluten) presents a significant untapped market. Further expansion into foodservice channels, including restaurants and catering services, offers substantial growth potential by increasing the accessibility and visibility of plant-based options. Exploring novel plant-based protein sources like algae or fungi can lead to unique product differentiation and appeal to adventurous consumers. Moreover, leveraging e-commerce platforms for direct-to-consumer sales of specialized plant-based ingredients and meal kits can cater to a niche but growing demand.

Growth Accelerators in the Mexico Plant - Based Food and Beverage Market Industry

The Mexico Plant-Based Food and Beverage Market is set to accelerate its growth through several catalysts. Strategic partnerships between innovative plant-based food manufacturers and established food and beverage giants, such as the collaboration between NotCo and Starbucks Mexico, are crucial for expanding market reach and consumer acceptance. Investment in research and development for next-generation plant-based ingredients and technologies will drive product innovation and improve affordability. Market expansion strategies that focus on educating consumers about the benefits of plant-based diets and addressing common misconceptions will foster greater adoption. The increasing availability of a wider variety of plant-based protein sources will also fuel product development and appeal to a broader demographic.

Key Players Shaping the Mexico Plant - Based Food and Beverage Market Market

- Heartbest Foods

- Beyond Meat Inc

- Fazenda Futuro

- Conagra Brands Inc

- Danone SA

- Unilever Plc

- Nestle SA

- NotCo

- Heura

- JBS Foods- Planterra Foods

Notable Milestones in Mexico Plant - Based Food and Beverage Market Sector

- August 2022: NotCo and Starbucks Mexico announced a partnership, leading to the introduction of new plant-based menu options made with NotCo products, significantly increasing the visibility and accessibility of plant-based beverages and food items in a popular café chain.

- October 2021: Heura, a prominent producer of plant-based meat alternatives, expanded its presence in Mexico, making its products available in major retail chains like Walmart, City Market, Fresko, and La Comer. This expansion introduced four distinct, healthier, and more environmentally friendly SKUs to the Mexican market.

- June 2021: JBS Foods' brand, Planterra Foods, entered the Mexican market, announcing a supply agreement with UNFI. This strategic move aimed to increase the market penetration of its plant-based burgers, ground products, and Mexican-seasoned ground beef alternatives through a key distribution partnership.

In-Depth Mexico Plant - Based Food and Beverage Market Market Outlook

The Mexico Plant-Based Food and Beverage Market is poised for continued expansion, driven by a confluence of accelerating factors. Future market potential is exceptionally high, fueled by a growing segment of health-conscious consumers and increasing environmental awareness. Strategic opportunities lie in further product diversification to cater to a wider range of dietary needs and taste preferences, including the development of plant-based cheeses and yogurts that rival their dairy counterparts in both taste and texture. Innovation in plant-based snacks and convenience foods will also capture a significant share of the market. Continued investment in consumer education campaigns and partnerships with foodservice providers will be instrumental in driving mainstream adoption of plant-based eating. The market is expected to witness increased product launches and innovations, solidifying its position as a vital and growing sector within Mexico's food industry.

Mexico Plant - Based Food and Beverage Market Segmentation

-

1. Type

- 1.1. Meat Substitute

- 1.2. Dairy Alternative Beverages

- 1.3. Non Dairy Ice creams

- 1.4. Non Dairy Cheese

- 1.5. Non Dairy Yogurt

- 1.6. Non Dairy Spreads

- 1.7. Other Plant-based Products

-

2. Distibution Channel

- 2.1. Supermarket/ Hypermarket

- 2.2. Convenience Stores

- 2.3. Online Retail stores

- 2.4. Other Distribution Channels

Mexico Plant - Based Food and Beverage Market Segmentation By Geography

- 1. Mexico

Mexico Plant - Based Food and Beverage Market Regional Market Share

Geographic Coverage of Mexico Plant - Based Food and Beverage Market

Mexico Plant - Based Food and Beverage Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased visibility of vegan and vegetarian lifestyles is influencing consumer choices and expanding market options

- 3.3. Market Restrains

- 3.3.1 Plant-based products can be more expensive than their animal-based counterparts

- 3.3.2 which may limit their appeal in price-sensitive segments of the market.

- 3.4. Market Trends

- 3.4.1. Rapid Expansion of Vegan Culture

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mexico Plant - Based Food and Beverage Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Meat Substitute

- 5.1.2. Dairy Alternative Beverages

- 5.1.3. Non Dairy Ice creams

- 5.1.4. Non Dairy Cheese

- 5.1.5. Non Dairy Yogurt

- 5.1.6. Non Dairy Spreads

- 5.1.7. Other Plant-based Products

- 5.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 5.2.1. Supermarket/ Hypermarket

- 5.2.2. Convenience Stores

- 5.2.3. Online Retail stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Heartbest Foods

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Beyond Meat Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Fazenda Futuro

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Conagra Brands Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Danone SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Unilever Plc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Nestle SA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 NotCo

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Heura

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 JBS Foods- Planterra Foods

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Heartbest Foods

List of Figures

- Figure 1: Mexico Plant - Based Food and Beverage Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Mexico Plant - Based Food and Beverage Market Share (%) by Company 2025

List of Tables

- Table 1: Mexico Plant - Based Food and Beverage Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Mexico Plant - Based Food and Beverage Market Revenue undefined Forecast, by Distibution Channel 2020 & 2033

- Table 3: Mexico Plant - Based Food and Beverage Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Mexico Plant - Based Food and Beverage Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 5: Mexico Plant - Based Food and Beverage Market Revenue undefined Forecast, by Distibution Channel 2020 & 2033

- Table 6: Mexico Plant - Based Food and Beverage Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexico Plant - Based Food and Beverage Market?

The projected CAGR is approximately 11.9%.

2. Which companies are prominent players in the Mexico Plant - Based Food and Beverage Market?

Key companies in the market include Heartbest Foods, Beyond Meat Inc, Fazenda Futuro, Conagra Brands Inc, Danone SA, Unilever Plc, Nestle SA, NotCo, Heura, JBS Foods- Planterra Foods.

3. What are the main segments of the Mexico Plant - Based Food and Beverage Market?

The market segments include Type, Distibution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increased visibility of vegan and vegetarian lifestyles is influencing consumer choices and expanding market options.

6. What are the notable trends driving market growth?

Rapid Expansion of Vegan Culture.

7. Are there any restraints impacting market growth?

Plant-based products can be more expensive than their animal-based counterparts. which may limit their appeal in price-sensitive segments of the market..

8. Can you provide examples of recent developments in the market?

In August 2022, NotCo and Starbucks Mexico announced the partnership. Starbucks Mexico Introduces New Plant-based Menu options Made with NotCo Plant-based Products.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexico Plant - Based Food and Beverage Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexico Plant - Based Food and Beverage Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexico Plant - Based Food and Beverage Market?

To stay informed about further developments, trends, and reports in the Mexico Plant - Based Food and Beverage Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence