Key Insights

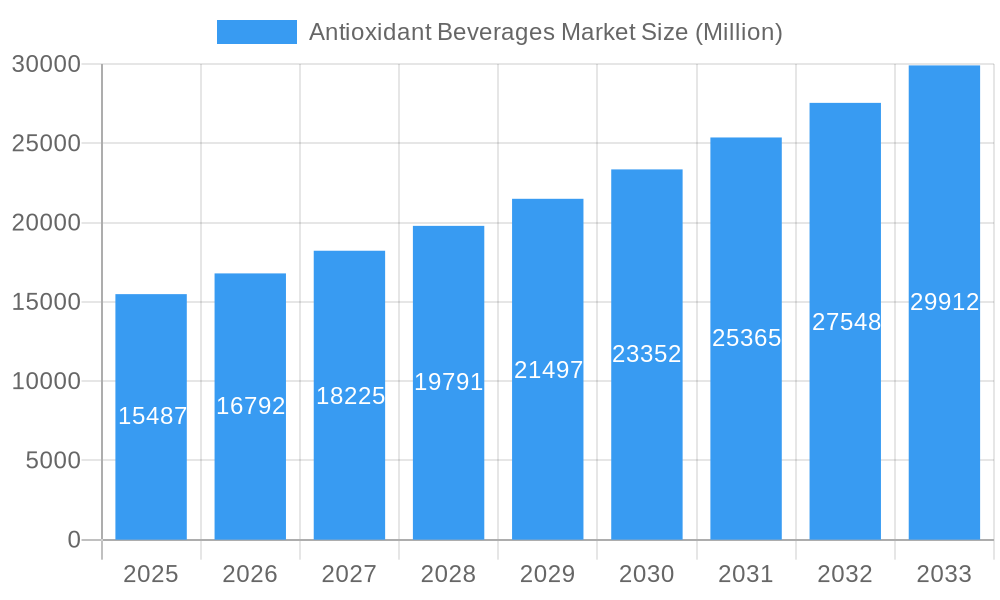

The global Antioxidant Beverages Market is projected for substantial growth, expected to reach an estimated $15.487 billion by 2025. This expansion is driven by a projected CAGR of 8.7% from 2025 to 2033, signifying a robust upward trend. Key growth catalysts include heightened consumer awareness of the health benefits of antioxidants, fueling demand for beverages that support overall well-being and disease prevention. The increasing incidence of chronic diseases and the global adoption of healthier lifestyles further accelerate market penetration. Product innovation, such as the inclusion of novel antioxidant-rich ingredients and the development of convenient ready-to-drink options, is broadening the market's appeal across diverse consumer segments. Ongoing research confirming the efficacy of antioxidants in combating oxidative stress and promoting longevity also influences market dynamics.

Antioxidant Beverages Market Market Size (In Billion)

Evolving distribution strategies, particularly the rise of online retail and continued strong performance of supermarkets and hypermarkets, are supporting market expansion. Emerging trends favor plant-based and naturally sourced ingredients, aligning with consumer demand for clean-label products. Functional beverages offering targeted health benefits are also gaining traction. Potential restraints include the higher cost of premium ingredients and consumer skepticism towards unsubstantiated health claims. However, the dominant trend of health and wellness consciousness, combined with continuous product development and strategic market penetration, positions the Antioxidant Beverages Market for significant and sustained growth throughout the forecast period.

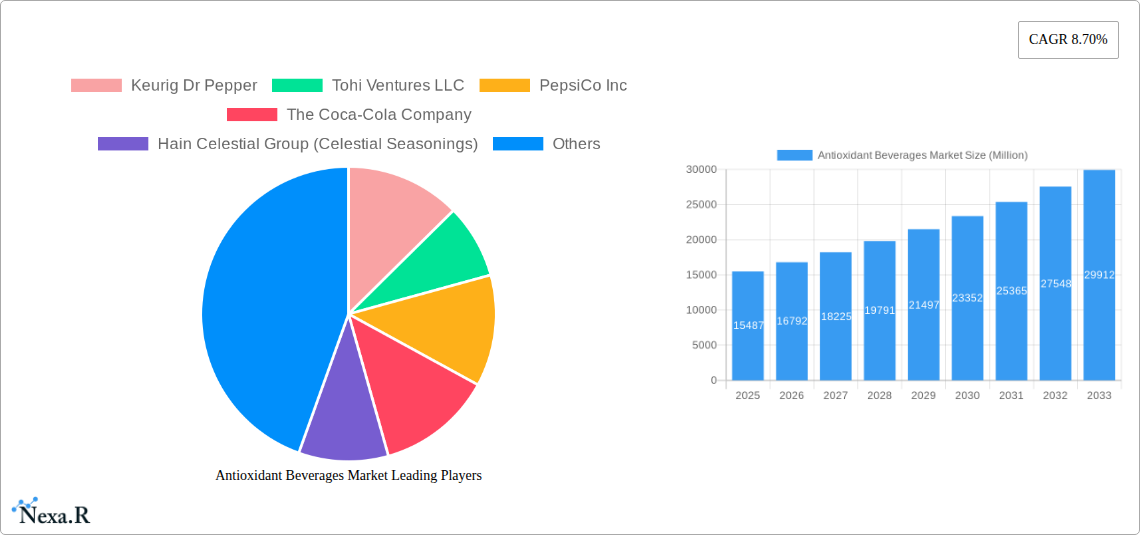

Antioxidant Beverages Market Company Market Share

This comprehensive report offers in-depth analysis of the global Antioxidant Beverages Market, providing critical insights into market dynamics, growth trends, regional dominance, product innovation, and future opportunities. Covering the historical period from 2019 to 2024, with a base year of 2025 and a forecast period extending to 2033, this report is an essential resource for industry professionals seeking to understand and capitalize on the evolving antioxidant beverage landscape. The market is segmented by Type (Green Tea, Antioxidants, Others) and Distribution Channel (Supermarkets/Hypermarkets, Specialty Stores, Online Retail Stores, Other Distribution Channels). Key market players include Keurig Dr Pepper, Tohi Ventures LLC, PepsiCo Inc, The Coca-Cola Company, Hain Celestial Group (Celestial Seasonings), Tata Global Beverage, and Unilever. All quantitative values are presented in billion units.

Antioxidant Beverages Market Dynamics & Structure

The Antioxidant Beverages Market exhibits a moderately concentrated structure, with a few key players holding significant market share. Technological innovation is a primary driver, fueled by ongoing research into the health benefits of various antioxidants and the development of novel extraction and formulation techniques. Regulatory frameworks, while generally supportive of functional foods and beverages, vary by region and can impact product labeling and marketing claims. Competitive product substitutes, including antioxidant supplements and naturally occurring antioxidants in whole foods, present a constant challenge. End-user demographics are increasingly health-conscious, with a growing demand for beverages that offer functional benefits beyond basic hydration. Mergers and acquisitions (M&A) activity has been observed as companies seek to expand their product portfolios and market reach. For instance, an estimated X M&A deals occurred between 2019 and 2024, with an average deal volume of $XX Million. Innovation barriers include the high cost of research and development, as well as the need for extensive clinical trials to substantiate health claims.

- Market Concentration: Dominated by a few major beverage corporations and specialized functional beverage brands.

- Technological Innovation Drivers: Advances in natural ingredient sourcing, bioavailability enhancement, and flavor masking technologies.

- Regulatory Frameworks: Evolving guidelines on health claims and functional ingredient approvals across major markets.

- Competitive Product Substitutes: Growing popularity of plant-based diets and a rise in the availability of antioxidant-rich supplements.

- End-User Demographics: Millennial and Gen Z consumers increasingly seeking preventative health solutions and natural wellness products.

- M&A Trends: Strategic acquisitions by larger beverage companies to enter the high-growth functional beverage segment.

Antioxidant Beverages Market Growth Trends & Insights

The global Antioxidant Beverages Market is poised for significant growth, driven by a confluence of factors including escalating consumer awareness of health and wellness, a growing preference for natural and functional ingredients, and continuous product innovation. The market size is projected to expand from an estimated $XX,XXX Million in 2025 to $XXX,XXX Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of XX% during the forecast period. Adoption rates for antioxidant beverages are steadily increasing across both developed and emerging economies, as consumers actively seek to incorporate preventative health measures into their daily routines. Technological disruptions, such as advancements in encapsulation technologies for improved antioxidant stability and bioavailability, are further enhancing product efficacy and consumer appeal. Consumer behavior shifts are evident in the move away from sugary, artificial beverages towards healthier alternatives that offer tangible health benefits. This includes a rising demand for plant-based options and beverages fortified with specific antioxidants like Vitamin C, Vitamin E, and polyphenols. The market penetration of antioxidant beverages is expected to grow by an estimated XX% between 2025 and 2033. The perceived role of these beverages in combating oxidative stress and promoting overall well-being is a key driver of this sustained market expansion.

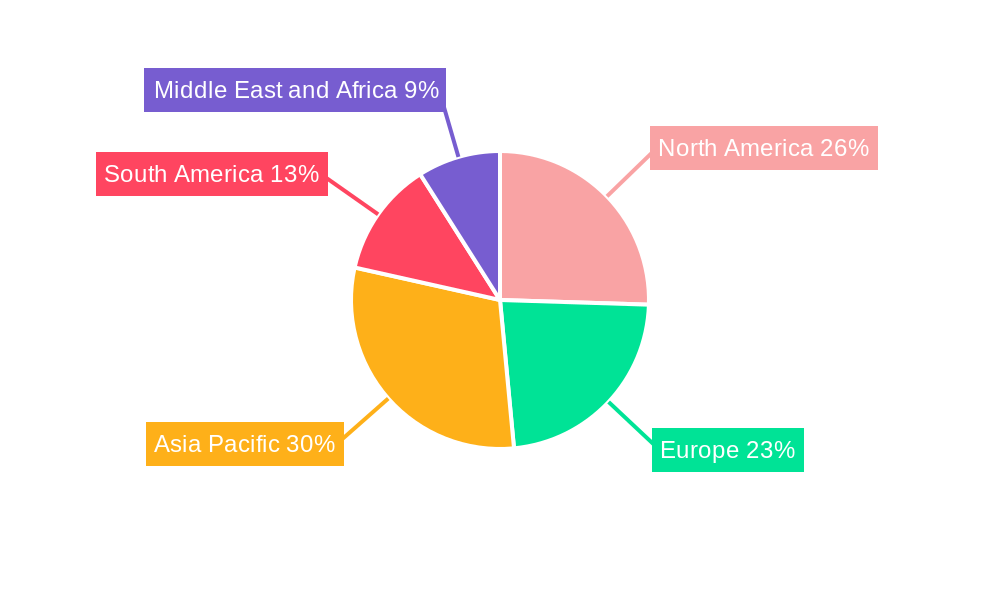

Dominant Regions, Countries, or Segments in Antioxidant Beverages Market

North America currently holds a dominant position in the global Antioxidant Beverages Market, driven by a highly health-conscious consumer base, strong disposable incomes, and a well-established functional beverage sector. The United States, in particular, is a key contributor, with a significant portion of the market share attributed to its extensive retail infrastructure and a proactive approach to product innovation.

- Dominant Region: North America, with an estimated market share of XX% in 2025.

- Key Country: United States, accounting for approximately XX% of the North American market.

- Dominant Segment (Type): Green Tea is expected to remain the leading segment within antioxidant beverages, owing to its well-recognized antioxidant properties and widespread consumer familiarity. Its market share is projected to be XX% in 2025.

- Dominant Segment (Distribution Channel): Supermarkets/Hypermarkets are anticipated to lead distribution channels, driven by their accessibility and the broad range of product offerings. This channel is expected to capture XX% of the market in 2025.

Factors contributing to North America's dominance include robust economic policies that support the growth of the health and wellness industry, advanced infrastructure for product manufacturing and distribution, and a strong presence of key market players actively engaged in product development and marketing. The high adoption rate of functional foods and beverages, coupled with increasing consumer awareness regarding the benefits of antioxidants for chronic disease prevention, further solidifies this region's leadership. The market in North America is characterized by continuous product launches and aggressive marketing campaigns that emphasize the health benefits of these beverages, thereby fueling sustained growth and market expansion.

Antioxidant Beverages Market Product Landscape

The product landscape of the Antioxidant Beverages Market is characterized by continuous innovation, with a focus on enhancing health benefits and improving consumer experience. Companies are launching beverages fortified with a diverse range of antioxidants, including vitamin C, vitamin E, polyphenols, and specific botanical extracts like acai and goji berry. Applications range from everyday functional drinks and sports recovery beverages to specialized wellness elixirs. Performance metrics are increasingly tied to scientifically substantiated health claims, with many products highlighting their role in boosting immunity, reducing inflammation, and combating cellular damage. Unique selling propositions often revolve around natural ingredients, low sugar content, and refreshing taste profiles. Technological advancements in ingredient sourcing, purification, and encapsulation are enabling the development of more potent and stable antioxidant formulations.

Key Drivers, Barriers & Challenges in Antioxidant Beverages Market

Key Drivers:

- Rising Health Consciousness: A global surge in consumer focus on preventative health and wellness.

- Demand for Natural Ingredients: Preference for beverages derived from natural sources with minimal artificial additives.

- Product Innovation: Continuous introduction of new formulations and flavor profiles catering to diverse consumer tastes.

- Growing Awareness of Oxidative Stress: Increased understanding of the role of antioxidants in combating cellular damage.

- Convenience: The appeal of functional beverages as an easy way to incorporate health benefits into daily routines.

Key Barriers & Challenges:

- High Production Costs: Sourcing premium antioxidant ingredients and advanced processing can lead to higher manufacturing expenses.

- Regulatory Scrutiny: Navigating complex and evolving regulations regarding health claims and ingredient approvals across different regions.

- Consumer Skepticism: Overcoming consumer doubt regarding the efficacy and scientific backing of certain health claims.

- Competition from Supplements: Intense competition from the established dietary supplement market offering concentrated antioxidant forms.

- Supply Chain Volatility: Potential disruptions in the sourcing of key natural ingredients due to climate change or geopolitical factors.

Emerging Opportunities in Antioxidant Beverages Market

Emerging opportunities in the Antioxidant Beverages Market lie in the development of personalized nutrition beverages, catering to specific dietary needs and health goals. The expansion of plant-based and vegan antioxidant options presents a significant untapped market. Furthermore, exploring novel antioxidant sources from underutilized botanicals and marine-derived ingredients offers unique product development avenues. The growing demand for functional beverages with added benefits beyond antioxidants, such as probiotics or adaptogens, also presents a promising area for innovation.

Growth Accelerators in the Antioxidant Beverages Market Industry

Long-term growth in the Antioxidant Beverages Market is being accelerated by ongoing scientific research that validates the health benefits of various antioxidants, leading to greater consumer trust and adoption. Strategic partnerships between beverage manufacturers and research institutions are fostering innovation and the development of science-backed products. Market expansion strategies focused on emerging economies, where health consciousness is rapidly growing, are also contributing to sustained growth. Furthermore, the integration of advanced technologies like artificial intelligence in product formulation and consumer profiling is enabling more targeted and effective product development.

Key Players Shaping the Antioxidant Beverages Market Market

- Keurig Dr Pepper

- Tohi Ventures LLC

- PepsiCo Inc

- The Coca-Cola Company

- Hain Celestial Group (Celestial Seasonings)

- Tata Global Beverage

- Unilever

Notable Milestones in Antioxidant Beverages Market Sector

- 2022: Launch of a new line of antioxidant-infused sparkling waters with scientifically backed claims.

- 2023: Acquisition of a niche functional beverage brand by a major player to expand its antioxidant portfolio.

- 2023: Introduction of novel extraction technology significantly increasing the bioavailability of key antioxidants.

- 2024: Expansion of a popular green tea-based antioxidant beverage into Southeast Asian markets.

- 2024: Significant investment in R&D for the development of adaptogen-infused antioxidant drinks.

In-Depth Antioxidant Beverages Market Market Outlook

The outlook for the Antioxidant Beverages Market remains exceptionally positive, driven by an enduring global trend towards health and wellness. Future growth will be underpinned by continued innovation in product formulation, leveraging advancements in ingredient science and processing technologies. The expansion of distribution channels, particularly online retail, will further enhance accessibility. Strategic collaborations and investments in emerging markets are anticipated to fuel broader consumer adoption. The market's trajectory indicates a sustained and robust expansion, making it a highly attractive sector for stakeholders focused on the evolving demands of health-conscious consumers.

Antioxidant Beverages Market Segmentation

-

1. Type

- 1.1. Green Tea

- 1.2. Antioxid

- 1.3. Others

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Specialty Stores

- 2.3. Online Retail Stores

- 2.4. Other Distribution Channels

Antioxidant Beverages Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Spain

- 2.2. United Kingdom

- 2.3. Germany

- 2.4. France

- 2.5. Italy

- 2.6. Russia

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. United Arab Emirates

- 5.3. Rest of Middle East and Africa

Antioxidant Beverages Market Regional Market Share

Geographic Coverage of Antioxidant Beverages Market

Antioxidant Beverages Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The Growing Demand for Healthy Hydration

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Antioxidant Beverages Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Green Tea

- 5.1.2. Antioxid

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Specialty Stores

- 5.2.3. Online Retail Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Antioxidant Beverages Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Green Tea

- 6.1.2. Antioxid

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets/Hypermarkets

- 6.2.2. Specialty Stores

- 6.2.3. Online Retail Stores

- 6.2.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Antioxidant Beverages Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Green Tea

- 7.1.2. Antioxid

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets/Hypermarkets

- 7.2.2. Specialty Stores

- 7.2.3. Online Retail Stores

- 7.2.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Antioxidant Beverages Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Green Tea

- 8.1.2. Antioxid

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets/Hypermarkets

- 8.2.2. Specialty Stores

- 8.2.3. Online Retail Stores

- 8.2.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Antioxidant Beverages Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Green Tea

- 9.1.2. Antioxid

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarkets/Hypermarkets

- 9.2.2. Specialty Stores

- 9.2.3. Online Retail Stores

- 9.2.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Antioxidant Beverages Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Green Tea

- 10.1.2. Antioxid

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Supermarkets/Hypermarkets

- 10.2.2. Specialty Stores

- 10.2.3. Online Retail Stores

- 10.2.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Keurig Dr Pepper

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Tohi Ventures LLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 PepsiCo Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 The Coca-Cola Company

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Hain Celestial Group (Celestial Seasonings)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Tata Global Beverage

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Unilever*List Not Exhaustive

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.1 Keurig Dr Pepper

List of Figures

- Figure 1: Global Antioxidant Beverages Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Antioxidant Beverages Market Revenue (billion), by Type 2025 & 2033

- Figure 3: North America Antioxidant Beverages Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Antioxidant Beverages Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 5: North America Antioxidant Beverages Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America Antioxidant Beverages Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Antioxidant Beverages Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Antioxidant Beverages Market Revenue (billion), by Type 2025 & 2033

- Figure 9: Europe Antioxidant Beverages Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Antioxidant Beverages Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 11: Europe Antioxidant Beverages Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 12: Europe Antioxidant Beverages Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Antioxidant Beverages Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Antioxidant Beverages Market Revenue (billion), by Type 2025 & 2033

- Figure 15: Asia Pacific Antioxidant Beverages Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Antioxidant Beverages Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 17: Asia Pacific Antioxidant Beverages Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 18: Asia Pacific Antioxidant Beverages Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Antioxidant Beverages Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Antioxidant Beverages Market Revenue (billion), by Type 2025 & 2033

- Figure 21: South America Antioxidant Beverages Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: South America Antioxidant Beverages Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 23: South America Antioxidant Beverages Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: South America Antioxidant Beverages Market Revenue (billion), by Country 2025 & 2033

- Figure 25: South America Antioxidant Beverages Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Antioxidant Beverages Market Revenue (billion), by Type 2025 & 2033

- Figure 27: Middle East and Africa Antioxidant Beverages Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Antioxidant Beverages Market Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 29: Middle East and Africa Antioxidant Beverages Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Middle East and Africa Antioxidant Beverages Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East and Africa Antioxidant Beverages Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Antioxidant Beverages Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Antioxidant Beverages Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global Antioxidant Beverages Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Antioxidant Beverages Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Global Antioxidant Beverages Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global Antioxidant Beverages Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Antioxidant Beverages Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Antioxidant Beverages Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Antioxidant Beverages Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Rest of North America Antioxidant Beverages Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Global Antioxidant Beverages Market Revenue billion Forecast, by Type 2020 & 2033

- Table 12: Global Antioxidant Beverages Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 13: Global Antioxidant Beverages Market Revenue billion Forecast, by Country 2020 & 2033

- Table 14: Spain Antioxidant Beverages Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: United Kingdom Antioxidant Beverages Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Germany Antioxidant Beverages Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: France Antioxidant Beverages Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Italy Antioxidant Beverages Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Russia Antioxidant Beverages Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Antioxidant Beverages Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Global Antioxidant Beverages Market Revenue billion Forecast, by Type 2020 & 2033

- Table 22: Global Antioxidant Beverages Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 23: Global Antioxidant Beverages Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: China Antioxidant Beverages Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Japan Antioxidant Beverages Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: India Antioxidant Beverages Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Australia Antioxidant Beverages Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Antioxidant Beverages Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Global Antioxidant Beverages Market Revenue billion Forecast, by Type 2020 & 2033

- Table 30: Global Antioxidant Beverages Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 31: Global Antioxidant Beverages Market Revenue billion Forecast, by Country 2020 & 2033

- Table 32: Brazil Antioxidant Beverages Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Argentina Antioxidant Beverages Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Rest of South America Antioxidant Beverages Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: Global Antioxidant Beverages Market Revenue billion Forecast, by Type 2020 & 2033

- Table 36: Global Antioxidant Beverages Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 37: Global Antioxidant Beverages Market Revenue billion Forecast, by Country 2020 & 2033

- Table 38: South Africa Antioxidant Beverages Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: United Arab Emirates Antioxidant Beverages Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Rest of Middle East and Africa Antioxidant Beverages Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Antioxidant Beverages Market?

The projected CAGR is approximately 7%.

2. Which companies are prominent players in the Antioxidant Beverages Market?

Key companies in the market include Keurig Dr Pepper, Tohi Ventures LLC, PepsiCo Inc, The Coca-Cola Company, Hain Celestial Group (Celestial Seasonings), Tata Global Beverage, Unilever*List Not Exhaustive.

3. What are the main segments of the Antioxidant Beverages Market?

The market segments include Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 15 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The Growing Demand for Healthy Hydration.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Antioxidant Beverages Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Antioxidant Beverages Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Antioxidant Beverages Market?

To stay informed about further developments, trends, and reports in the Antioxidant Beverages Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence