Key Insights

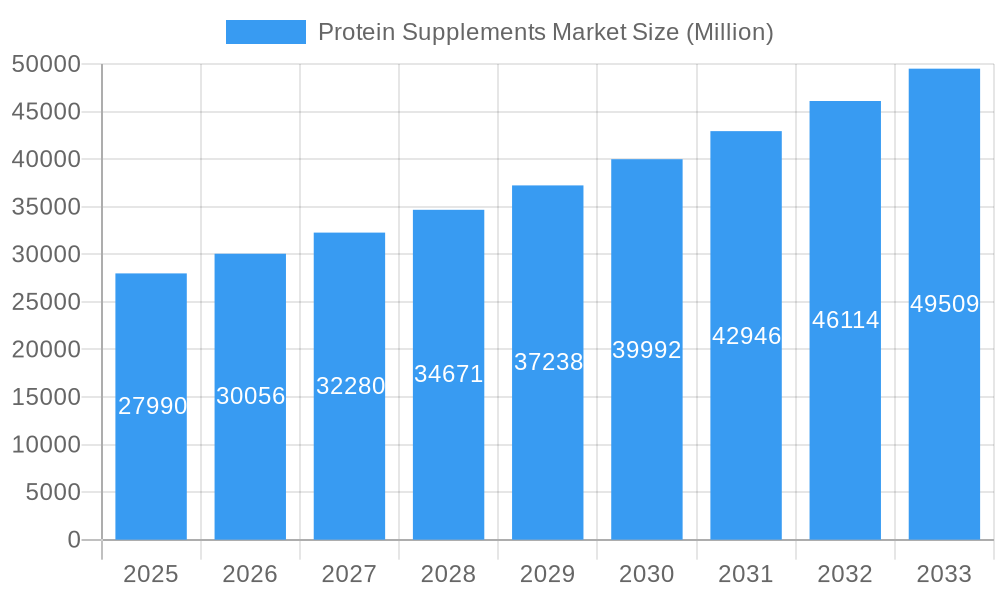

The global Protein Supplements Market is poised for robust expansion, with an estimated current market size of USD 27.99 billion in 2025. This growth is projected to continue at a Compound Annual Growth Rate (CAGR) of 7.45% through 2033, signaling a dynamic and expanding industry. The market's upward trajectory is primarily driven by a confluence of factors, including the increasing global awareness of health and fitness, the rising prevalence of chronic diseases necessitating better nutritional intake, and the growing demand for convenient dietary solutions. Consumers are actively seeking protein supplements to support muscle building, weight management, and overall well-being, further fueling market demand. The surging popularity of plant-based diets and a greater emphasis on sustainable and ethical sourcing are also significant contributors, leading to a diversification in product offerings. The market is segmented by form, with Powder and Ready-to-Drink formats holding significant shares due to their ease of use and versatility. Animal-based protein sources continue to dominate, but plant-based alternatives are witnessing substantial growth. Distribution channels are also evolving, with online retail stores emerging as a crucial avenue for market penetration, alongside traditional supermarkets and specialized health and wellness stores.

Protein Supplements Market Market Size (In Billion)

Key trends shaping the Protein Supplements Market include the innovation of novel protein sources, such as insect protein and algae-based proteins, catering to niche markets and sustainability concerns. The development of specialized protein formulations tailored for specific demographics like athletes, aging populations, and individuals with dietary restrictions (e.g., lactose intolerance) is also gaining momentum. Personalized nutrition solutions, leveraging advancements in genetic and lifestyle data, are another emerging trend promising to enhance product efficacy and consumer engagement. However, the market faces certain restraints, including fluctuating raw material prices, particularly for whey and soy, which can impact production costs and profit margins. Stringent regulatory frameworks governing product claims and ingredients in certain regions can also pose challenges for market participants. Furthermore, the increasing availability of protein-rich whole foods and the potential for overconsumption concerns necessitate a balanced approach to marketing and product education. Despite these challenges, the overarching positive sentiment towards health and wellness, coupled with continuous product innovation, ensures a promising future for the Protein Supplements Market.

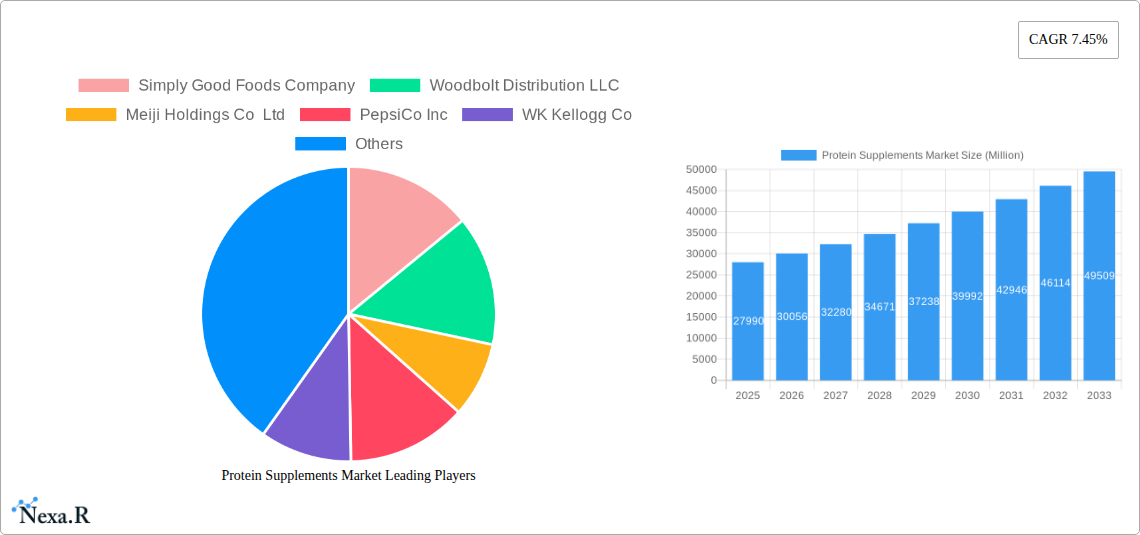

Protein Supplements Market Company Market Share

Protein Supplements Market: Comprehensive Growth Analysis, Trends, and Future Outlook (2019-2033)

This in-depth report provides a critical analysis of the global Protein Supplements Market, examining its current state and forecasting its trajectory through 2033. Delve into the market dynamics, growth trends, regional dominance, product innovations, and key players shaping this rapidly evolving industry. Understand the strategic imperatives, emerging opportunities, and growth accelerators that will define the future of protein supplementation. The report covers parent market and child market segments, offering a holistic view of the competitive landscape. All values are presented in Million units.

Protein Supplements Market Market Dynamics & Structure

The protein supplements market exhibits a moderately concentrated structure, with a few dominant players holding significant market share, alongside a growing number of specialized and regional brands. Technological innovation serves as a key driver, particularly in the development of novel protein sources, improved bioavailability, and enhanced delivery systems. Regulatory frameworks, while generally supportive, can vary by region, impacting product formulations and marketing claims. The market is characterized by intense competition, with competitive product substitutes such as whole foods, meal replacement shakes, and fortified beverages constantly challenging market share. End-user demographics are diversifying beyond traditional athletes to include health-conscious individuals, aging populations seeking muscle maintenance, and those with specific dietary needs. Merger and acquisition (M&A) trends are notable, as larger corporations aim to expand their portfolios and gain access to innovative technologies and consumer bases. For instance, the market has seen numerous strategic acquisitions aimed at consolidating market presence and expanding product offerings. The overall market size was approximately $18,500 Million in 2025, with projections indicating robust growth.

- Market Concentration: Dominated by established brands, but with increasing fragmentation due to new entrants.

- Technological Innovation: Focus on plant-based protein advancements, clean label formulations, and personalized nutrition.

- Regulatory Frameworks: Growing scrutiny on label claims and ingredient sourcing, particularly for plant-based protein and specialized formulations.

- Competitive Landscape: Intense competition from both specialized protein brands and broader health and wellness product categories.

- End-User Demographics: Expanding beyond athletes to include fitness enthusiasts, elderly individuals, and the general health-conscious population.

- M&A Activity: Driven by the desire for portfolio expansion and market consolidation, with an estimated 15-20 M&A deals annually in the past three years.

Protein Supplements Market Growth Trends & Insights

The protein supplements market is poised for substantial expansion, driven by an increasing global awareness of health and wellness, coupled with a growing demand for convenient and effective nutritional solutions. The market size, estimated at $18,500 Million in 2025, is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 7.5% during the forecast period of 2025–2033. This growth is fueled by a rising adoption rate of protein supplements across diverse demographics, extending beyond professional athletes to fitness enthusiasts, aging individuals, and those seeking to manage weight or improve overall well-being. Technological disruptions are playing a crucial role, with continuous advancements in protein sources, including novel plant-based protein alternatives like pea, soy, and hemp, gaining significant traction due to ethical and environmental concerns. Furthermore, innovations in delivery formats, such as ready-to-drink shakes and convenient protein bars, are enhancing product accessibility and consumer convenience. Consumer behavior shifts towards proactive health management and personalized nutrition are further propelling market growth. The penetration of protein supplements within the broader dietary supplements market is steadily increasing, indicating a strong and sustained demand. The market witnessed a significant increase in online sales, contributing to its accessibility and reach.

- Market Size Evolution: From an estimated $17,000 Million in 2019 to $18,500 Million in 2025, with a projected value exceeding $30,000 Million by 2033.

- Adoption Rates: Increasing adoption across all age groups and fitness levels, with a significant surge in the 30-50 age bracket.

- Technological Disruptions: Advancements in plant-based protein extraction and formulation, leading to improved taste and texture.

- Consumer Behavior Shifts: Growing preference for natural ingredients, clean labels, and sustainable sourcing.

- Market Penetration: Continued growth in penetration within the broader health and wellness consumer base.

- CAGR: Estimated at 7.5% from 2025 to 2033.

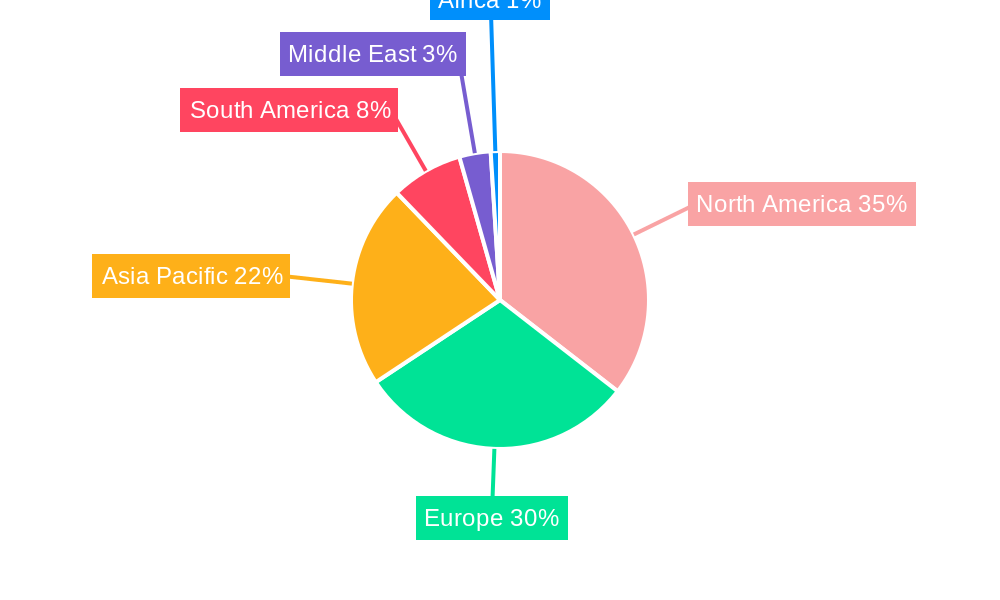

Dominant Regions, Countries, or Segments in Protein Supplements Market

The protein supplements market is experiencing robust growth across various regions and segments, with North America and Europe currently leading in market share due to a well-established health and wellness culture and high disposable incomes. However, the Asia Pacific region is emerging as a significant growth engine, driven by increasing health consciousness, rising urbanization, and a growing middle class with greater purchasing power. Within product forms, Powder continues to dominate the market, accounting for over 55% of the total revenue, owing to its versatility, cost-effectiveness, and widespread availability. Ready To Drink formats are witnessing rapid expansion, driven by convenience and on-the-go consumption trends.

In terms of protein sources, Animal-based proteins, particularly whey and casein, still hold a substantial market share due to their established reputation for efficacy and complete amino acid profiles. However, Plant-based proteins are experiencing an accelerated growth rate, fueled by the rising popularity of veganism, vegetarianism, and a general preference for sustainable and ethically sourced products. This segment is projected to capture a significant portion of market share in the coming years.

The Distribution Channel landscape is increasingly diversified. Supermarkets & Hypermarkets remain a strong channel, but Online Retail Stores are rapidly gaining prominence, offering consumers wider selection, competitive pricing, and convenient home delivery. Health and Wellness Stores cater to a niche segment seeking specialized products and expert advice.

- Dominant Regions: North America (USA, Canada) and Europe (UK, Germany, France) lead in market value, with the Asia Pacific (China, India, Japan) exhibiting the highest growth potential.

- Leading Segment by Form: Powder holds the largest market share, followed by a rapidly growing Ready To Drink segment.

- Leading Segment by Source: Animal-based proteins remain dominant, but Plant-based proteins are the fastest-growing segment, driven by ethical and health-conscious consumers.

- Dominant Distribution Channel: Online Retail Stores are experiencing exceptional growth, complementing established Supermarkets & Hypermarkets and specialized Health and Wellness Stores.

- Key Growth Drivers (Asia Pacific): Increasing disposable income, rising health awareness, and growing penetration of fitness culture.

- Market Share (Plant-based Protein): Projected to grow from approximately 25% in 2025 to over 40% by 2033.

Protein Supplements Market Product Landscape

The protein supplements market is characterized by a dynamic product landscape driven by continuous innovation aimed at enhancing efficacy, palatability, and consumer convenience. Key product innovations include the development of novel plant-based protein blends that offer complete amino acid profiles and improved digestibility, catering to the growing vegan and vegetarian consumer base. The evolution of Ready To Drink formats has seen the introduction of a wider variety of flavors, textures, and functional ingredients, making them ideal for on-the-go consumption. Furthermore, advancements in powdered protein formulations focus on faster absorption rates, reduced bloating, and the incorporation of digestive enzymes and probiotics for gut health. Products are increasingly formulated with clean labels, emphasizing natural ingredients, and free from artificial sweeteners, colors, and preservatives. The performance metrics of protein supplements are continuously being refined, with a focus on protein content per serving, bioavailability, and the spectrum of essential amino acids. Unique selling propositions often revolve around specific dietary needs (e.g., keto-friendly, gluten-free), performance enhancement, or recovery benefits.

Key Drivers, Barriers & Challenges in Protein Supplements Market

Key Drivers:

- Growing health consciousness: Increased consumer awareness regarding the importance of protein for muscle health, weight management, and overall well-being.

- Rising popularity of fitness and sports: Expanding participation in physical activities drives demand for performance-enhancing supplements.

- Increasing adoption of plant-based diets: Growing preference for vegan and vegetarian protein sources fuels innovation and demand for plant-based protein.

- Convenience and accessibility: The availability of ready-to-drink and protein bar formats caters to busy lifestyles.

- Product innovation: Continuous development of new flavors, formulations, and delivery systems.

Barriers & Challenges:

- Regulatory scrutiny: Stringent regulations regarding product claims and ingredient sourcing can pose challenges.

- Counterfeit products: The prevalence of fake or substandard products erodes consumer trust.

- Price sensitivity: For some consumer segments, the cost of premium protein supplements can be a barrier.

- Competition from whole foods: Whole food sources of protein remain a significant alternative for many consumers.

- Supply chain disruptions: Global events can impact the availability and cost of raw materials for animal-based and plant-based protein.

Emerging Opportunities in Protein Supplements Market

The protein supplements market is ripe with emerging opportunities. The burgeoning demand for personalized nutrition presents a significant avenue, with companies exploring customized protein blends based on individual dietary needs, fitness goals, and genetic predispositions. The burgeoning demand for sports nutrition in developing economies, particularly in Asia Pacific, offers substantial untapped potential. Furthermore, the development of innovative protein sources derived from sustainable and novel ingredients, such as algae or insects, could revolutionize the market. The integration of protein supplements into functional foods and beverages, beyond traditional shake and bar formats, is another area with considerable growth potential. Companies focusing on ethically sourced and environmentally friendly plant-based protein options are likely to capture a growing segment of the market.

Growth Accelerators in the Protein Supplements Market Industry

Several catalysts are accelerating the growth of the protein supplements market. Technological breakthroughs in ingredient sourcing and processing, particularly for plant-based protein, are leading to more palatable and effective products. Strategic partnerships between supplement manufacturers and fitness influencers, sports organizations, and health and wellness platforms are expanding market reach and consumer engagement. The increasing availability of product information through digital channels and e-commerce platforms is educating consumers and driving purchasing decisions. Furthermore, the growing trend of proactive health management and preventative healthcare is leading more individuals to invest in nutritional supplements, including protein, to support their well-being. The expansion of distribution networks, including an increased online presence and penetration into emerging markets, is also a significant growth accelerator.

Key Players Shaping the Protein Supplements Market Market

- Simply Good Foods Company

- Woodbolt Distribution LLC

- Meiji Holdings Co Ltd

- PepsiCo Inc

- WK Kellogg Co

- Iovate Health Sciences International Inc

- 1440 Foods

- Mondelez International Inc

- The Hut Group

- Glanbia Plc

Notable Milestones in Protein Supplements Market Sector

- March 2024: Optimum Nutrition partnered with Spartan, bringing together two industry leaders for a significant collaboration. These brands joined forces for a multi-year partnership expected to span activities across 90 events in 29 countries.

- March 2024: Perfect Snacks launched a Perfect Bar line-up of refrigerated protein bars in Chocolate Brownie flavor. The new variant is a blend of freshly ground peanut butter, cashew butter, and cocoa, topped with dark chocolate chips. The new bar is claimed to be an organic and gluten-free brownie-flavored protein bar containing more than 20 superfoods as ingredients.

- December 2023: Sports nutrition company MyProtein launched a new flavor of its clear whey protein, Iron Brute, described as 'undeniably Scottish.'

In-Depth Protein Supplements Market Market Outlook

The protein supplements market is on an upward trajectory, driven by a confluence of enduring consumer trends and strategic industry advancements. The sustained focus on health and wellness, coupled with an increasing demand for convenient and performance-enhancing nutritional solutions, forms the bedrock of this growth. Emerging opportunities in personalized nutrition and the expanding market for plant-based protein are set to redefine the competitive landscape. Strategic partnerships, technological innovations in product development, and the increasing accessibility through online channels will continue to act as powerful growth accelerators. The market is well-positioned for continued expansion, offering significant potential for stakeholders across the value chain.

Protein Supplements Market Segmentation

-

1. Form

- 1.1. Powder

- 1.2. Ready To Drink

- 1.3. Bars

- 1.4. Other Forms

-

2. Source

- 2.1. Animal-based

- 2.2. Plant-based

-

3. Distribution Channel

- 3.1. Supermarkets & Hypermarkets

- 3.2. Online Retail Stores

- 3.3. Health and Wellness Stores

- 3.4. Other Distribution Channels

Protein Supplements Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Italy

- 2.5. Russia

- 2.6. Spain

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

- 5. Middle East

-

6. Saudi Arabia

- 6.1. South Africa

- 6.2. Rest of Middle East

Protein Supplements Market Regional Market Share

Geographic Coverage of Protein Supplements Market

Protein Supplements Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.45% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Product Diversity and Innovation Propelling Protein Supplement Demand; Growing Adoption Of Active Lifestyle

- 3.3. Market Restrains

- 3.3.1. Presence Of Counterfeit Products

- 3.4. Market Trends

- 3.4.1. Market Diversity & Product Innovation Propelling Protein Supplement Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Protein Supplements Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Form

- 5.1.1. Powder

- 5.1.2. Ready To Drink

- 5.1.3. Bars

- 5.1.4. Other Forms

- 5.2. Market Analysis, Insights and Forecast - by Source

- 5.2.1. Animal-based

- 5.2.2. Plant-based

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Supermarkets & Hypermarkets

- 5.3.2. Online Retail Stores

- 5.3.3. Health and Wellness Stores

- 5.3.4. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. South America

- 5.4.5. Middle East

- 5.4.6. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Form

- 6. North America Protein Supplements Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Form

- 6.1.1. Powder

- 6.1.2. Ready To Drink

- 6.1.3. Bars

- 6.1.4. Other Forms

- 6.2. Market Analysis, Insights and Forecast - by Source

- 6.2.1. Animal-based

- 6.2.2. Plant-based

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Supermarkets & Hypermarkets

- 6.3.2. Online Retail Stores

- 6.3.3. Health and Wellness Stores

- 6.3.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Form

- 7. Europe Protein Supplements Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Form

- 7.1.1. Powder

- 7.1.2. Ready To Drink

- 7.1.3. Bars

- 7.1.4. Other Forms

- 7.2. Market Analysis, Insights and Forecast - by Source

- 7.2.1. Animal-based

- 7.2.2. Plant-based

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Supermarkets & Hypermarkets

- 7.3.2. Online Retail Stores

- 7.3.3. Health and Wellness Stores

- 7.3.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Form

- 8. Asia Pacific Protein Supplements Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Form

- 8.1.1. Powder

- 8.1.2. Ready To Drink

- 8.1.3. Bars

- 8.1.4. Other Forms

- 8.2. Market Analysis, Insights and Forecast - by Source

- 8.2.1. Animal-based

- 8.2.2. Plant-based

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Supermarkets & Hypermarkets

- 8.3.2. Online Retail Stores

- 8.3.3. Health and Wellness Stores

- 8.3.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Form

- 9. South America Protein Supplements Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Form

- 9.1.1. Powder

- 9.1.2. Ready To Drink

- 9.1.3. Bars

- 9.1.4. Other Forms

- 9.2. Market Analysis, Insights and Forecast - by Source

- 9.2.1. Animal-based

- 9.2.2. Plant-based

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Supermarkets & Hypermarkets

- 9.3.2. Online Retail Stores

- 9.3.3. Health and Wellness Stores

- 9.3.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Form

- 10. Middle East Protein Supplements Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Form

- 10.1.1. Powder

- 10.1.2. Ready To Drink

- 10.1.3. Bars

- 10.1.4. Other Forms

- 10.2. Market Analysis, Insights and Forecast - by Source

- 10.2.1. Animal-based

- 10.2.2. Plant-based

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Supermarkets & Hypermarkets

- 10.3.2. Online Retail Stores

- 10.3.3. Health and Wellness Stores

- 10.3.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Form

- 11. Saudi Arabia Protein Supplements Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Form

- 11.1.1. Powder

- 11.1.2. Ready To Drink

- 11.1.3. Bars

- 11.1.4. Other Forms

- 11.2. Market Analysis, Insights and Forecast - by Source

- 11.2.1. Animal-based

- 11.2.2. Plant-based

- 11.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 11.3.1. Supermarkets & Hypermarkets

- 11.3.2. Online Retail Stores

- 11.3.3. Health and Wellness Stores

- 11.3.4. Other Distribution Channels

- 11.1. Market Analysis, Insights and Forecast - by Form

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Simply Good Foods Company

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Woodbolt Distribution LLC

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Meiji Holdings Co Ltd

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 PepsiCo Inc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 WK Kellogg Co

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Iovate Health Sciences International Inc *List Not Exhaustive

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 1440 Foods

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Mondelez International Inc

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 The Hut Group

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Glanbia Plc

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Simply Good Foods Company

List of Figures

- Figure 1: Global Protein Supplements Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Protein Supplements Market Revenue (Million), by Form 2025 & 2033

- Figure 3: North America Protein Supplements Market Revenue Share (%), by Form 2025 & 2033

- Figure 4: North America Protein Supplements Market Revenue (Million), by Source 2025 & 2033

- Figure 5: North America Protein Supplements Market Revenue Share (%), by Source 2025 & 2033

- Figure 6: North America Protein Supplements Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 7: North America Protein Supplements Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 8: North America Protein Supplements Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Protein Supplements Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Protein Supplements Market Revenue (Million), by Form 2025 & 2033

- Figure 11: Europe Protein Supplements Market Revenue Share (%), by Form 2025 & 2033

- Figure 12: Europe Protein Supplements Market Revenue (Million), by Source 2025 & 2033

- Figure 13: Europe Protein Supplements Market Revenue Share (%), by Source 2025 & 2033

- Figure 14: Europe Protein Supplements Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 15: Europe Protein Supplements Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 16: Europe Protein Supplements Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Protein Supplements Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Protein Supplements Market Revenue (Million), by Form 2025 & 2033

- Figure 19: Asia Pacific Protein Supplements Market Revenue Share (%), by Form 2025 & 2033

- Figure 20: Asia Pacific Protein Supplements Market Revenue (Million), by Source 2025 & 2033

- Figure 21: Asia Pacific Protein Supplements Market Revenue Share (%), by Source 2025 & 2033

- Figure 22: Asia Pacific Protein Supplements Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 23: Asia Pacific Protein Supplements Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: Asia Pacific Protein Supplements Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Protein Supplements Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Protein Supplements Market Revenue (Million), by Form 2025 & 2033

- Figure 27: South America Protein Supplements Market Revenue Share (%), by Form 2025 & 2033

- Figure 28: South America Protein Supplements Market Revenue (Million), by Source 2025 & 2033

- Figure 29: South America Protein Supplements Market Revenue Share (%), by Source 2025 & 2033

- Figure 30: South America Protein Supplements Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 31: South America Protein Supplements Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 32: South America Protein Supplements Market Revenue (Million), by Country 2025 & 2033

- Figure 33: South America Protein Supplements Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East Protein Supplements Market Revenue (Million), by Form 2025 & 2033

- Figure 35: Middle East Protein Supplements Market Revenue Share (%), by Form 2025 & 2033

- Figure 36: Middle East Protein Supplements Market Revenue (Million), by Source 2025 & 2033

- Figure 37: Middle East Protein Supplements Market Revenue Share (%), by Source 2025 & 2033

- Figure 38: Middle East Protein Supplements Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 39: Middle East Protein Supplements Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 40: Middle East Protein Supplements Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East Protein Supplements Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Saudi Arabia Protein Supplements Market Revenue (Million), by Form 2025 & 2033

- Figure 43: Saudi Arabia Protein Supplements Market Revenue Share (%), by Form 2025 & 2033

- Figure 44: Saudi Arabia Protein Supplements Market Revenue (Million), by Source 2025 & 2033

- Figure 45: Saudi Arabia Protein Supplements Market Revenue Share (%), by Source 2025 & 2033

- Figure 46: Saudi Arabia Protein Supplements Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 47: Saudi Arabia Protein Supplements Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 48: Saudi Arabia Protein Supplements Market Revenue (Million), by Country 2025 & 2033

- Figure 49: Saudi Arabia Protein Supplements Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Protein Supplements Market Revenue Million Forecast, by Form 2020 & 2033

- Table 2: Global Protein Supplements Market Revenue Million Forecast, by Source 2020 & 2033

- Table 3: Global Protein Supplements Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global Protein Supplements Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Protein Supplements Market Revenue Million Forecast, by Form 2020 & 2033

- Table 6: Global Protein Supplements Market Revenue Million Forecast, by Source 2020 & 2033

- Table 7: Global Protein Supplements Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 8: Global Protein Supplements Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Protein Supplements Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Protein Supplements Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Protein Supplements Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Rest of North America Protein Supplements Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Global Protein Supplements Market Revenue Million Forecast, by Form 2020 & 2033

- Table 14: Global Protein Supplements Market Revenue Million Forecast, by Source 2020 & 2033

- Table 15: Global Protein Supplements Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 16: Global Protein Supplements Market Revenue Million Forecast, by Country 2020 & 2033

- Table 17: United Kingdom Protein Supplements Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Germany Protein Supplements Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: France Protein Supplements Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Italy Protein Supplements Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Russia Protein Supplements Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Spain Protein Supplements Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe Protein Supplements Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global Protein Supplements Market Revenue Million Forecast, by Form 2020 & 2033

- Table 25: Global Protein Supplements Market Revenue Million Forecast, by Source 2020 & 2033

- Table 26: Global Protein Supplements Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 27: Global Protein Supplements Market Revenue Million Forecast, by Country 2020 & 2033

- Table 28: China Protein Supplements Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Japan Protein Supplements Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: India Protein Supplements Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Australia Protein Supplements Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Rest of Asia Pacific Protein Supplements Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: Global Protein Supplements Market Revenue Million Forecast, by Form 2020 & 2033

- Table 34: Global Protein Supplements Market Revenue Million Forecast, by Source 2020 & 2033

- Table 35: Global Protein Supplements Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 36: Global Protein Supplements Market Revenue Million Forecast, by Country 2020 & 2033

- Table 37: Brazil Protein Supplements Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Argentina Protein Supplements Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Rest of South America Protein Supplements Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Global Protein Supplements Market Revenue Million Forecast, by Form 2020 & 2033

- Table 41: Global Protein Supplements Market Revenue Million Forecast, by Source 2020 & 2033

- Table 42: Global Protein Supplements Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 43: Global Protein Supplements Market Revenue Million Forecast, by Country 2020 & 2033

- Table 44: Global Protein Supplements Market Revenue Million Forecast, by Form 2020 & 2033

- Table 45: Global Protein Supplements Market Revenue Million Forecast, by Source 2020 & 2033

- Table 46: Global Protein Supplements Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 47: Global Protein Supplements Market Revenue Million Forecast, by Country 2020 & 2033

- Table 48: South Africa Protein Supplements Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: Rest of Middle East Protein Supplements Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Protein Supplements Market?

The projected CAGR is approximately 7.45%.

2. Which companies are prominent players in the Protein Supplements Market?

Key companies in the market include Simply Good Foods Company, Woodbolt Distribution LLC, Meiji Holdings Co Ltd, PepsiCo Inc, WK Kellogg Co, Iovate Health Sciences International Inc *List Not Exhaustive, 1440 Foods, Mondelez International Inc, The Hut Group, Glanbia Plc.

3. What are the main segments of the Protein Supplements Market?

The market segments include Form, Source, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 27.99 Million as of 2022.

5. What are some drivers contributing to market growth?

Product Diversity and Innovation Propelling Protein Supplement Demand; Growing Adoption Of Active Lifestyle.

6. What are the notable trends driving market growth?

Market Diversity & Product Innovation Propelling Protein Supplement Demand.

7. Are there any restraints impacting market growth?

Presence Of Counterfeit Products.

8. Can you provide examples of recent developments in the market?

March 2024: Optimum Nutrition partnered with Spartan, bringing together two industry leaders for a significant collaboration. These brands joined forces for a multi-year partnership expected to span activities across 90 events in 29 countries.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Protein Supplements Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Protein Supplements Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Protein Supplements Market?

To stay informed about further developments, trends, and reports in the Protein Supplements Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence