Key Insights

The Asia-Pacific Sweet Biscuits Market is projected for robust expansion, anticipating a market size of USD 29.41 billion by 2024. This growth is driven by rising disposable incomes in major economies like China and India, alongside a growing consumer demand for convenient and premium snack options. The market is forecast to grow at a Compound Annual Growth Rate (CAGR) of 5.1%, reflecting sustained upward momentum. Key growth catalysts include an expanding middle class with increased spending power, a rising preference for healthier biscuit formulations, and strategic marketing initiatives from global and regional manufacturers. The proliferation of e-commerce channels is further enhancing product accessibility and boosting sales, particularly in urban areas.

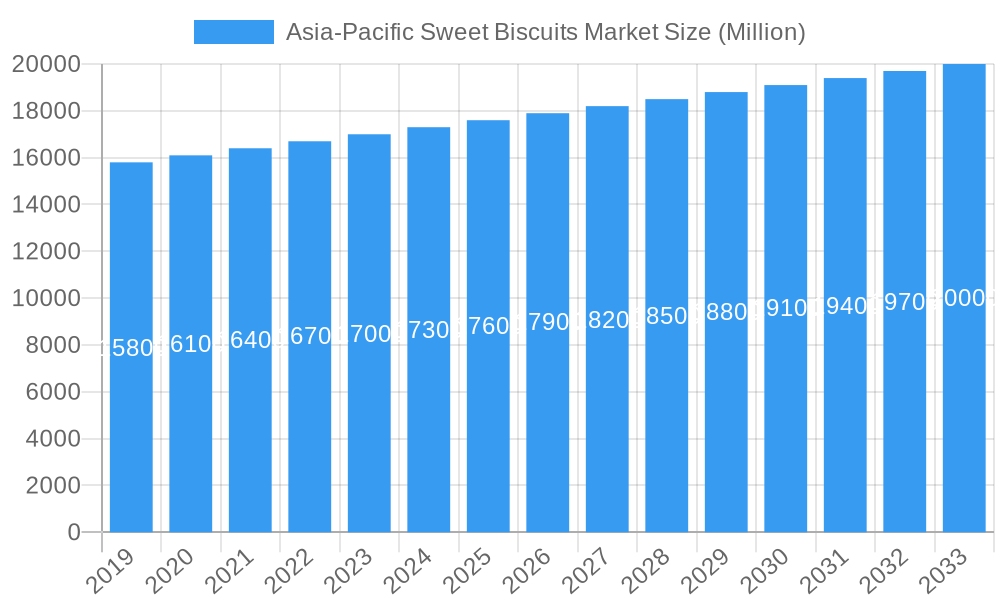

Asia-Pacific Sweet Biscuits Market Market Size (In Billion)

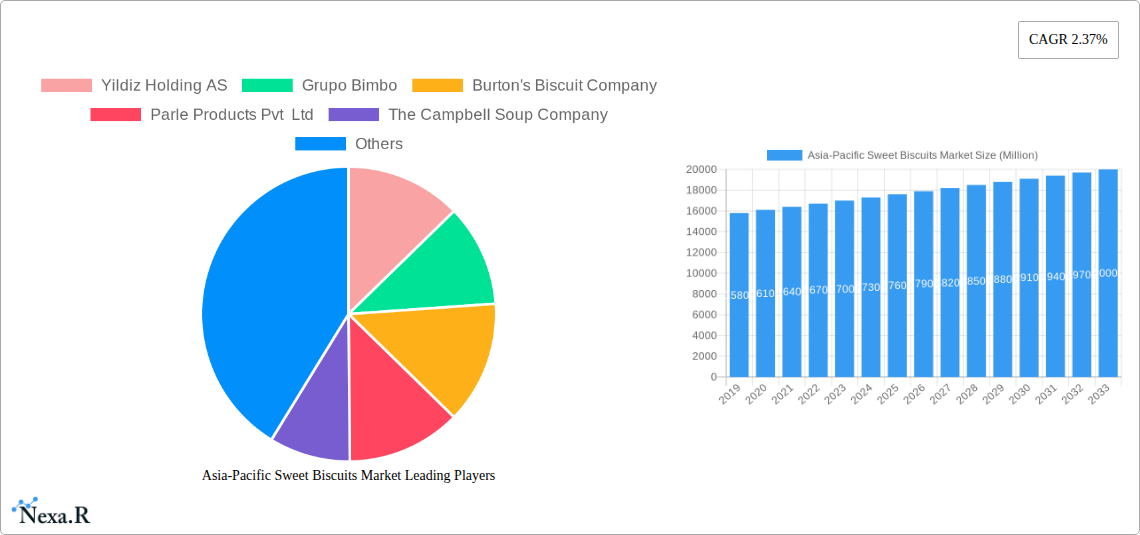

Market segmentation indicates a strong preference for Cookies and Chocolate-coated Biscuits, driven by popular flavor profiles. Concurrently, a growing emphasis on health and wellness is spurring demand for Plain Biscuits featuring reduced sugar content and added nutritional value. Supermarkets and hypermarkets continue to be the dominant sales channels due to their extensive product selection and convenience. However, the rapid expansion of online retail and specialty food stores signals a significant evolution in consumer purchasing behavior. Leading companies such as Mondelez International Inc., Britannia Industries, and Yildiz Holding AS are actively pursuing product innovation, expanding distribution networks, and implementing localized strategies to secure market share. While strong consumer demand underpins market growth, factors such as raw material price volatility and competitive pressures may present some challenges.

Asia-Pacific Sweet Biscuits Market Company Market Share

Unveiling the Asia-Pacific Sweet Biscuits Market: Trends, Innovations, and Future Trajectory (2019-2033)

Report Description:

Dive deep into the dynamic Asia-Pacific Sweet Biscuits Market, a lucrative sector poised for substantial growth. This comprehensive report offers an in-depth analysis of the market from 2019 to 2033, with a base year of 2025 and a detailed forecast period of 2025-2033. Gain unparalleled insights into market size evolution, key growth drivers, emerging opportunities, and the competitive landscape shaping the future of sweet biscuits across the Asia-Pacific region. This report is essential for manufacturers, distributors, ingredient suppliers, investors, and industry stakeholders seeking to capitalize on this expanding market. With a focus on high-traffic keywords like "Asia Pacific biscuit market," "sweet biscuits market share," "cookie market growth," and "sandwich biscuits demand," this report is optimized for maximum search engine visibility and engagement. We meticulously break down market segmentation by Product Type (Plain Biscuits, Cookies, Sandwich Biscuits, Chocolate-coated Biscuits, Other Sweet Biscuits) and Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores, Online Retail Stores, Other Distribution Channels), providing granular data in Million units.

Asia-Pacific Sweet Biscuits Market Market Dynamics & Structure

The Asia-Pacific sweet biscuits market is characterized by a moderately concentrated competitive landscape, with a few key global players holding significant market share alongside a robust presence of regional and local manufacturers. Technological innovation is a primary driver, with companies investing heavily in advanced production techniques, novel flavor profiles, and healthier ingredient formulations to cater to evolving consumer preferences. Regulatory frameworks, while varying across countries, generally focus on food safety, labeling standards, and, increasingly, on promoting healthier options with reduced sugar and fat content. Competitive product substitutes, such as confectionery, snacks, and other baked goods, exert pressure, necessitating continuous product differentiation and value-added offerings. End-user demographics are diverse, with a growing middle class, increasing disposable incomes, and a younger, health-conscious consumer base influencing product development. Mergers and acquisitions (M&A) trends are notable, as larger entities seek to consolidate market presence, acquire innovative technologies, and expand their product portfolios. For instance, the estimated M&A deal volume in the APAC food and beverage sector averaged at over 150 deals annually between 2020-2023, with biscuit manufacturers actively participating. Innovation barriers include the high cost of research and development for novel ingredients and the challenge of meeting diverse regional taste preferences and dietary restrictions.

- Market Concentration: Dominated by a mix of global giants and agile local players.

- Technological Innovation: Focus on automation, new product development, and ingredient science.

- Regulatory Influence: Growing emphasis on health, safety, and sustainability.

- Competitive Substitutes: Constant innovation required to differentiate from snacks and confectionery.

- End-User Demographics: Shifting towards health-conscious, premium, and convenience-oriented preferences.

- M&A Trends: Strategic acquisitions for market expansion and portfolio diversification.

Asia-Pacific Sweet Biscuits Market Growth Trends & Insights

The Asia-Pacific sweet biscuits market is on a robust growth trajectory, driven by a confluence of escalating economic prosperity, evolving consumer lifestyles, and a burgeoning demand for convenient and indulgent snack options. The market size evolution demonstrates a consistent upward trend, transitioning from an estimated XXX Million units in 2019 to a projected XXX Million units in the base year of 2025. This growth is further underscored by an anticipated Compound Annual Growth Rate (CAGR) of XX% during the forecast period of 2025–2033. Adoption rates for various biscuit categories are influenced by regional palates and disposable incomes. For instance, the penetration of premium and health-oriented biscuits is rapidly increasing in developed markets like Australia and Japan, while mass-market staples continue to dominate in emerging economies such as India and Indonesia. Technological disruptions, including advancements in automation, packaging innovations for extended shelf life and convenience, and the integration of digital platforms for enhanced consumer engagement and direct-to-consumer sales, are significantly reshaping the industry. Consumer behavior shifts are predominantly observed in a growing preference for healthier alternatives, such as whole-grain, low-sugar, and plant-based biscuits, driven by increasing health awareness. Simultaneously, the demand for indulgent, gourmet, and novel flavor experiences remains strong, particularly among younger demographics. The convenience factor also plays a crucial role, with single-serve packs and ready-to-eat formats gaining traction, aligning with the fast-paced lifestyles prevalent across many Asia-Pacific nations. The online retail channel is witnessing accelerated growth, providing consumers with wider accessibility to a diverse range of products and facilitating impulse purchases. Market penetration for sweet biscuits is estimated to be around XX% of the total snack market, with significant room for expansion.

Dominant Regions, Countries, or Segments in Asia-Pacific Sweet Biscuits Market

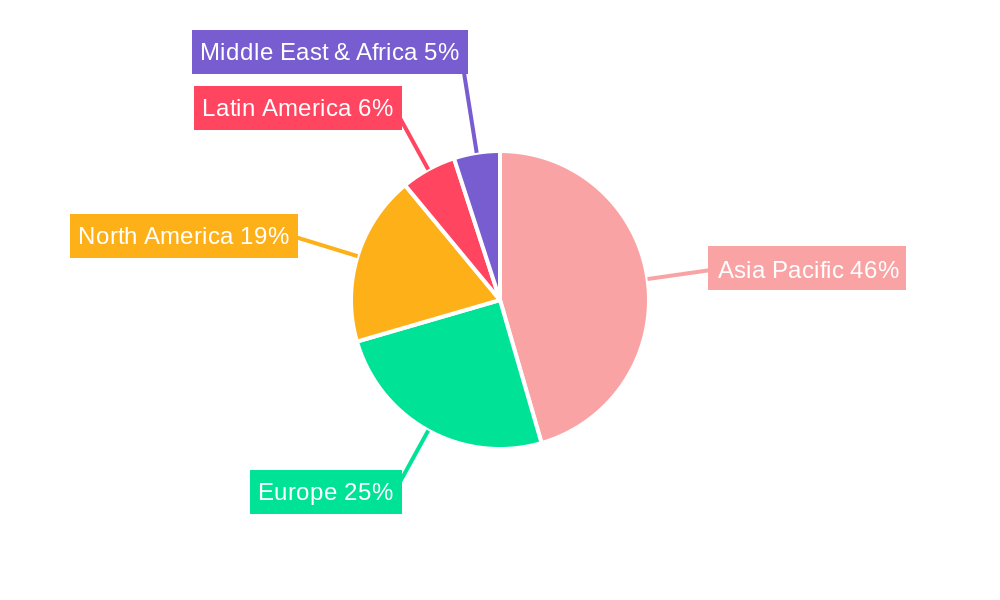

The Asia-Pacific Sweet Biscuits Market's dominance is intricately linked to the economic prowess, population density, and evolving consumer preferences within its key regions and countries. China emerges as a leading force, driven by its massive population, rapidly expanding middle class, and a strong appetite for both traditional and Western-style confectionery and baked goods. The country's robust retail infrastructure, encompassing vast supermarket/hypermarket networks and a rapidly growing online retail presence, facilitates widespread accessibility to sweet biscuits.

India stands as another pivotal market, characterized by its sheer volume and a burgeoning demand for affordable yet satisfying snack options. The increasing disposable incomes, coupled with a growing awareness of global food trends, are fueling the consumption of various biscuit types. The "Other Sweet Biscuits" segment, encompassing traditional Indian sweets and cookies, holds significant sway, alongside a growing interest in sandwich and chocolate-coated variants.

Among the Product Types, Cookies and Sandwich Biscuits are consistently outperforming other segments, largely due to their versatility, appeal to a broad age demographic, and the constant innovation in flavors and fillings. Cookies, with their diverse textures and taste profiles, and sandwich biscuits, offering a delightful combination of crispness and creamy fillings, are highly sought after for their indulgent and convenient nature.

In terms of Distribution Channels, Supermarkets/Hypermarkets continue to be the dominant channel, providing consumers with a wide selection and convenient one-stop shopping experience. However, Online Retail Stores are exhibiting the most rapid growth, driven by e-commerce penetration, the convenience of home delivery, and the ability to access niche and international brands. This channel is particularly influential in urban centers and among younger consumers.

- Dominant Regions: China and India are key growth engines.

- Key Countries: Australia and Japan also contribute significantly with premium and niche markets.

- Leading Product Segments: Cookies and Sandwich Biscuits lead in consumption and innovation.

- Fastest Growing Product Segment: Chocolate-coated Biscuits and novel "Other Sweet Biscuits" are gaining traction.

- Dominant Distribution Channel: Supermarkets/Hypermarkets provide broad reach.

- Fastest Growing Distribution Channel: Online Retail Stores are transforming accessibility and purchasing habits.

- Key Drivers: Rising disposable incomes, urbanization, growing middle class, and Westernization of food habits.

Asia-Pacific Sweet Biscuits Market Product Landscape

The Asia-Pacific sweet biscuits market is characterized by a vibrant product landscape driven by continuous innovation and a keen understanding of consumer desires. Product innovations range from the introduction of unique flavor fusions, such as matcha-infused cookies in Japan and chili-chocolate biscuits in Southeast Asia, to the development of functional biscuits incorporating probiotics, omega-3 fatty acids, and reduced sugar formulations to cater to the health-conscious demographic. Applications are diverse, spanning everyday snacking, impulse purchases, gifting, and as accompaniments to beverages like tea and coffee. Performance metrics are closely monitored, with companies focusing on enhanced taste profiles, improved texture, extended shelf life through advanced packaging technologies, and attractive branding to capture consumer attention. Unique selling propositions often revolve around premium ingredients, artisanal craftsmanship, and ethical sourcing. Technological advancements in baking processes, such as controlled atmospheric baking and the use of natural preservatives, are also contributing to superior product quality and consumer appeal.

Key Drivers, Barriers & Challenges in Asia-Pacific Sweet Biscuits Market

Key Drivers:

The Asia-Pacific sweet biscuits market is propelled by several significant forces. Rising disposable incomes across numerous developing nations within the region are a primary driver, enabling consumers to spend more on discretionary items like sweet biscuits. Urbanization and the consequent adoption of Westernized dietary habits have further fueled demand. Technological advancements in manufacturing processes contribute to increased efficiency, product quality, and variety. Furthermore, the growing popularity of e-commerce platforms has expanded market reach and accessibility, driving sales. The introduction of innovative flavors and healthier options, such as gluten-free and low-sugar biscuits, caters to evolving consumer preferences and health consciousness. For example, the XX% increase in online grocery sales for food products between 2020 and 2023 highlights this driver.

Barriers & Challenges:

Despite the positive outlook, the market faces several hurdles. Intense competition from local and international players leads to price wars and pressure on profit margins. Fluctuating raw material costs, particularly for ingredients like wheat, sugar, and dairy, can impact production expenses and profitability. Stringent food safety regulations and evolving labeling requirements in different countries necessitate continuous compliance efforts and can increase operational costs. Supply chain disruptions, exacerbated by geopolitical events or natural disasters, can affect the availability of raw materials and the timely delivery of finished products. The growing consumer demand for healthier options also presents a challenge for manufacturers of traditional, indulgent biscuits, requiring significant investment in product reformulation or the development of new product lines. The estimated XX% volatility in wheat prices over the past two years exemplifies this challenge.

Emerging Opportunities in Asia-Pacific Sweet Biscuits Market

The Asia-Pacific sweet biscuits market presents several exciting emerging opportunities for growth and innovation. The increasing demand for premium and artisanal biscuits made with high-quality ingredients and unique flavor profiles, particularly in urban centers, offers a lucrative niche. The plant-based and vegan biscuit segment is gaining significant traction as consumer awareness regarding health and environmental sustainability grows. Furthermore, the functional foods trend is opening doors for biscuits fortified with vitamins, minerals, and other health-enhancing ingredients, targeting specific consumer needs like digestive health or energy boost. The expansion of convenience store and small-format retail outlets in densely populated urban areas creates opportunities for smaller, single-serve packaging formats. Developing countries within ASEAN and South Asia represent significant untapped markets with immense potential for market penetration.

Growth Accelerators in the Asia-Pacific Sweet Biscuits Market Industry

Long-term growth in the Asia-Pacific sweet biscuits market will be significantly accelerated by a combination of strategic initiatives and market dynamics. Technological breakthroughs in processing and packaging will enable more efficient production, extended shelf life, and enhanced product appeal, thereby reducing waste and improving cost-effectiveness. Strategic partnerships and collaborations between local manufacturers and international brands can facilitate knowledge transfer, market access, and the introduction of globally recognized product lines tailored for regional tastes. Market expansion strategies focusing on underserved rural areas and emerging economies will tap into new consumer bases. The increasing disposable incomes and the growing middle class across the region will continue to be a fundamental growth accelerator, driving higher consumption of value-added and premium biscuit products. Furthermore, the growing trend of health and wellness will accelerate the adoption of innovative, healthier biscuit options.

Key Players Shaping the Asia-Pacific Sweet Biscuits Market Market

- Yildiz Holding AS

- Grupo Bimbo

- Burton's Biscuit Company

- Parle Products Pvt Ltd

- The Campbell Soup Company

- Bahlsen GmbH & Co KG

- Mondelez International Inc

- Britannia Industries

- ITC Limited

- Kellogg Company

Notable Milestones in Asia-Pacific Sweet Biscuits Market Sector

- March 2022: Ludhiana-based Bonn Group launched premium digestive minis biscuits under its 'Americana range of product line. These Premium Digestive Minis come with no artificial colors or artificial flavors, a permanent feature of many Bonn products. Also, this new range of biscuits will be available in 65 grams pack, while costing INR 10.

- January 2022: OREO, one of the world's major cookie brands, launched its globally existing variant 'OREO Double Stuf' in India. Promising double the fun and decadence with more crème between the two scrumptious layers of its classic cookie. The company claims that this latest innovation brings to its consumers a new indulgent eating experience.

- March 2021: Nestle Japan launched KitKat's new whole-wheat chocolate biscuit. It is made with the familiar KitKat chocolate and is coated in whole-wheat biscuits. The packaging shows a biscuit that looks like a graham cracker or a digestive biscuit.

In-Depth Asia-Pacific Sweet Biscuits Market Market Outlook

The Asia-Pacific sweet biscuits market is poised for a sustained period of robust growth, driven by powerful macroeconomic trends and evolving consumer preferences. The increasing disposable incomes across developing nations will continue to be a primary catalyst, expanding the addressable market for sweet biscuits significantly. The ongoing urbanization trend will further amplify demand for convenient and readily available snack options. Growth accelerators will predominantly stem from innovation in product development, particularly in the realms of healthier alternatives (low-sugar, whole-grain, plant-based) and indulgent, premium offerings catering to sophisticated palates. Strategic market expansion into untapped rural and semi-urban areas, coupled with the increasing adoption of online retail channels, will unlock new consumer segments and enhance market penetration. Companies that can effectively leverage technological advancements in production and packaging, while staying attuned to regional taste nuances and dietary trends, are best positioned to capitalize on the immense future potential of this dynamic market.

Asia-Pacific Sweet Biscuits Market Segmentation

-

1. Product Type

- 1.1. Plain Biscuits

- 1.2. Cookies

- 1.3. Sandwich Biscuits

- 1.4. Chocolate-coated Biscuits

- 1.5. Other Sweet Biscuits

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience Stores

- 2.3. Specialty Stores

- 2.4. Online Retail Stores

- 2.5. Other Distribution Channels

Asia-Pacific Sweet Biscuits Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Sweet Biscuits Market Regional Market Share

Geographic Coverage of Asia-Pacific Sweet Biscuits Market

Asia-Pacific Sweet Biscuits Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Innovation in Vanillin Synthesis; Diverse Functionality of Vanillin In End-use Industries

- 3.3. Market Restrains

- 3.3.1. Supply Chain Variability Impacting Vanilla Bean Availability For Flavor Production

- 3.4. Market Trends

- 3.4.1. Product Innovation with New Formulations Is Attracting Consumers

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Sweet Biscuits Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Plain Biscuits

- 5.1.2. Cookies

- 5.1.3. Sandwich Biscuits

- 5.1.4. Chocolate-coated Biscuits

- 5.1.5. Other Sweet Biscuits

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Specialty Stores

- 5.2.4. Online Retail Stores

- 5.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Yildiz Holding AS

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Grupo Bimbo

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Burton's Biscuit Company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Parle Products Pvt Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 The Campbell Soup Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Bahlsen GmbH & Co KG*List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Mondelez International Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Britannia Industries

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 ITC Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Kellogg Company

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Yildiz Holding AS

List of Figures

- Figure 1: Asia-Pacific Sweet Biscuits Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Sweet Biscuits Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Sweet Biscuits Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Asia-Pacific Sweet Biscuits Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Asia-Pacific Sweet Biscuits Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Asia-Pacific Sweet Biscuits Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 5: Asia-Pacific Sweet Biscuits Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: Asia-Pacific Sweet Biscuits Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: China Asia-Pacific Sweet Biscuits Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Japan Asia-Pacific Sweet Biscuits Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: South Korea Asia-Pacific Sweet Biscuits Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: India Asia-Pacific Sweet Biscuits Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Australia Asia-Pacific Sweet Biscuits Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: New Zealand Asia-Pacific Sweet Biscuits Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Indonesia Asia-Pacific Sweet Biscuits Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Malaysia Asia-Pacific Sweet Biscuits Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Singapore Asia-Pacific Sweet Biscuits Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Thailand Asia-Pacific Sweet Biscuits Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Vietnam Asia-Pacific Sweet Biscuits Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Philippines Asia-Pacific Sweet Biscuits Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Sweet Biscuits Market?

The projected CAGR is approximately 5.1%.

2. Which companies are prominent players in the Asia-Pacific Sweet Biscuits Market?

Key companies in the market include Yildiz Holding AS, Grupo Bimbo, Burton's Biscuit Company, Parle Products Pvt Ltd, The Campbell Soup Company, Bahlsen GmbH & Co KG*List Not Exhaustive, Mondelez International Inc, Britannia Industries, ITC Limited, Kellogg Company.

3. What are the main segments of the Asia-Pacific Sweet Biscuits Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 29.41 billion as of 2022.

5. What are some drivers contributing to market growth?

Innovation in Vanillin Synthesis; Diverse Functionality of Vanillin In End-use Industries.

6. What are the notable trends driving market growth?

Product Innovation with New Formulations Is Attracting Consumers.

7. Are there any restraints impacting market growth?

Supply Chain Variability Impacting Vanilla Bean Availability For Flavor Production.

8. Can you provide examples of recent developments in the market?

In March 2022, Ludhiana-based Bonn Group launched premium digestive minis biscuits under its 'Americana range of product line. These Premium Digestive Minis come with no artificial colors or artificial flavors, a permanent feature of many Bonn products. Also, this new range of biscuits will be available in 65 grams pack, while costing INR 10.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Sweet Biscuits Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Sweet Biscuits Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Sweet Biscuits Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Sweet Biscuits Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence