Key Insights

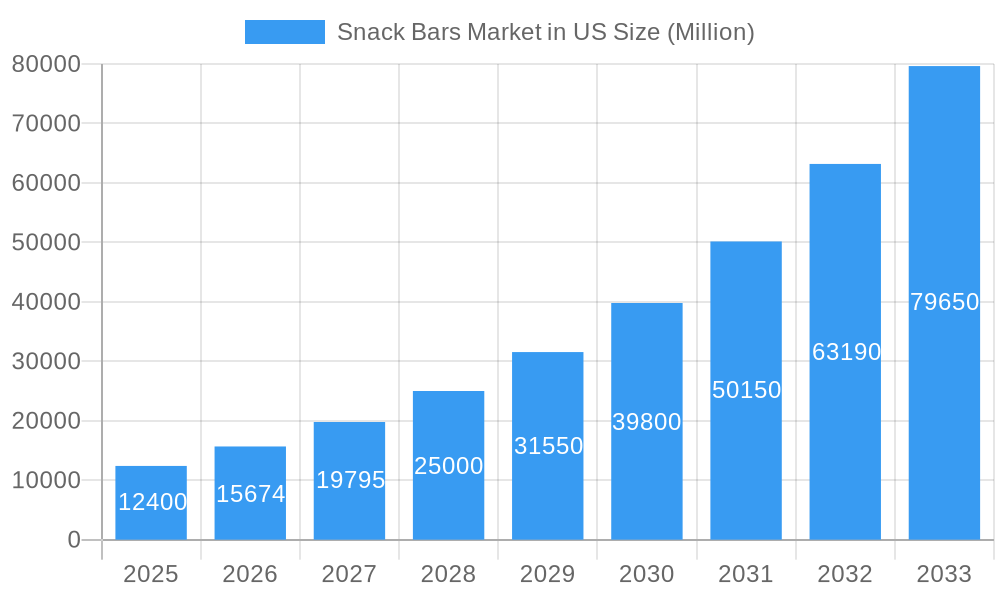

The global Snack Bars Market is poised for exceptional growth, projected to reach a substantial market size of approximately $12,400 million by 2025, with an impressive Compound Annual Growth Rate (CAGR) of 26.40%. This robust expansion is driven by a confluence of evolving consumer lifestyles and an increasing demand for convenient, health-conscious food options. The rising awareness surrounding the benefits of protein-rich and nutrient-dense snacks, coupled with a growing preference for on-the-go consumption, is fueling the demand for diverse snack bar variants. Key market drivers include the increasing prevalence of sedentary lifestyles, the demand for portable and easily consumable food items, and a growing emphasis on healthy eating habits among consumers. The market is further propelled by significant investments in research and development, leading to innovative product formulations and a wider array of flavors and ingredients to cater to diverse palates and dietary needs, from gluten-free and vegan options to those fortified with vitamins and minerals.

Snack Bars Market in US Market Size (In Billion)

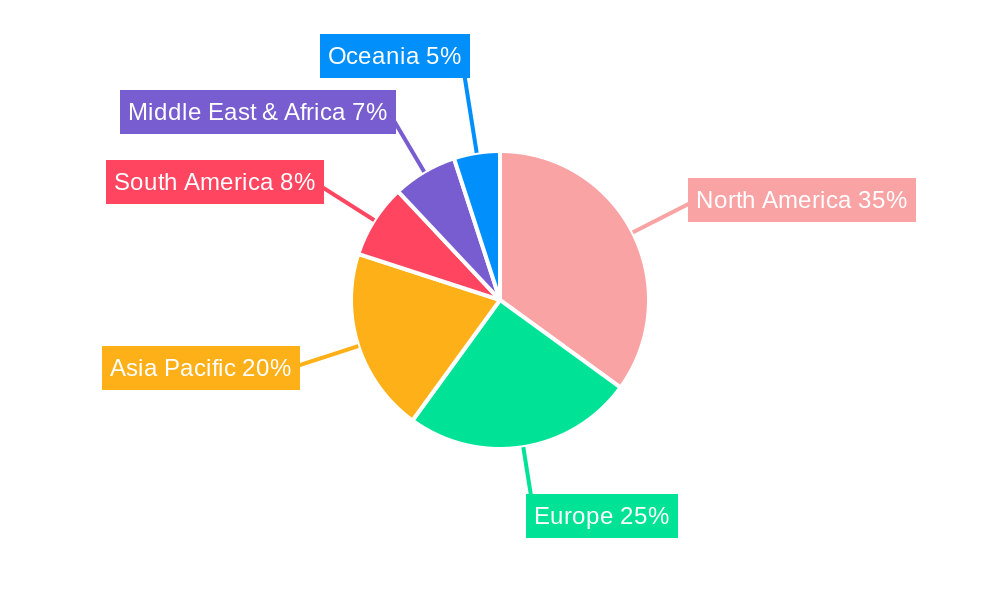

The market's trajectory is also significantly influenced by emerging trends such as the surge in online retail, offering consumers unparalleled convenience and accessibility to a broad spectrum of snack bar products. Supermarkets and hypermarkets continue to play a pivotal role, while convenience stores are strategically positioning themselves to capture impulse purchases. However, the market faces certain restraints, including the fluctuating prices of raw materials, which can impact manufacturing costs and ultimately retail prices, and intense competition from a vast array of established and emerging players. Despite these challenges, the market's growth is expected to remain strong, with Asia Pacific demonstrating particularly promising potential due to its large and growing population, increasing disposable incomes, and a rapidly expanding middle class that is increasingly adopting Western dietary habits and seeking convenient, nutritious food solutions.

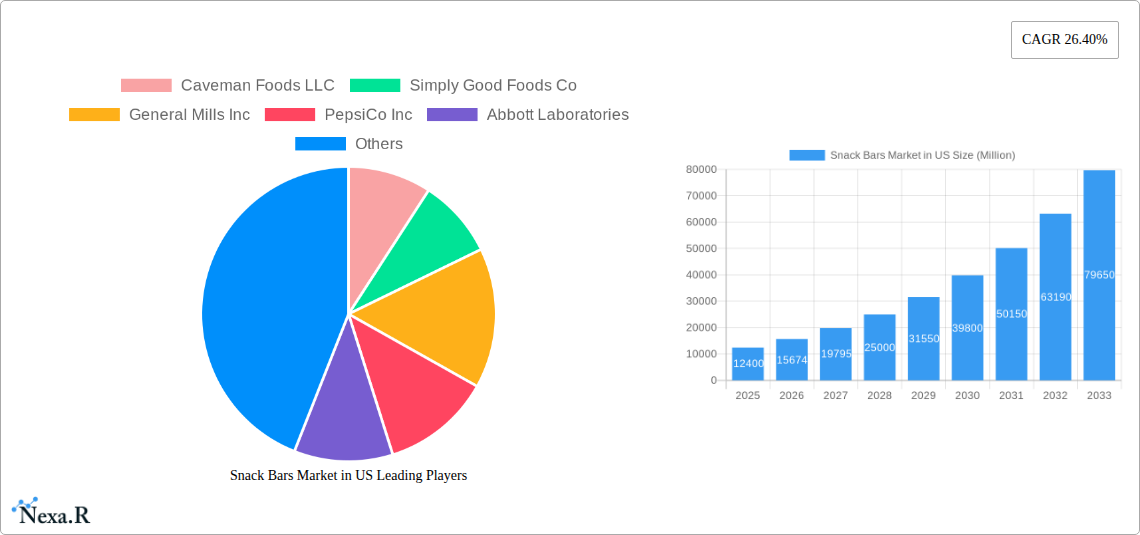

Snack Bars Market in US Company Market Share

US Snack Bars Market Analysis: Growth, Trends, and Key Players (2019-2033)

This comprehensive report delves into the dynamic US snack bars market, offering an in-depth analysis of its structure, growth trajectory, and future outlook. We explore the intricate interplay of parent and child markets, providing actionable insights for industry stakeholders, manufacturers, and investors. With a meticulous focus on high-traffic keywords and detailed segment analysis, this report aims to maximize your understanding and strategic positioning within this evolving sector. All values are presented in millions of units.

Snack Bars Market in US Market Dynamics & Structure

The US snack bars market is characterized by a moderately concentrated structure, with leading players like Mars Incorporated, Mondelēz International Inc, and General Mills Inc. holding significant market share. Technological innovation remains a key driver, particularly in areas of nutritional enhancement, allergen-free formulations, and sustainable packaging. Regulatory frameworks, such as FDA guidelines on labeling and nutritional claims, influence product development and marketing strategies. Competitive product substitutes, including traditional confectionery, fresh fruit, and other packaged snacks, pose a constant challenge, necessitating continuous product differentiation and value proposition enhancement. End-user demographics are increasingly diverse, with a growing demand for health-conscious, plant-based, and performance-oriented snack options. Mergers and acquisitions (M&A) trends indicate consolidation among larger players seeking to expand their portfolios and market reach, while also presenting opportunities for agile startups in niche segments.

- Market Concentration: Moderate, with a few dominant players and a growing number of specialized brands.

- Technological Innovation: Focus on functional ingredients, clean labels, plant-based alternatives, and sustainable practices.

- Regulatory Landscape: FDA regulations on nutrition labeling and health claims are crucial.

- Competitive Substitutes: Confectionery, fruits, yogurts, nuts, and seeds.

- End-User Demographics: Growing demand from health-conscious consumers, athletes, and those seeking convenient, on-the-go nutrition.

- M&A Trends: Strategic acquisitions to expand product portfolios and market penetration, with approximately 5-10 major M&A deals observed in the historical period (2019-2024).

Snack Bars Market in US Growth Trends & Insights

The US snack bars market is poised for robust growth, driven by evolving consumer lifestyles and a heightened focus on health and wellness. The market size is projected to witness a significant expansion from an estimated $XX,XXX million in 2025 to $YY,YYY million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately X.X% during the forecast period (2025–2033). Adoption rates for specialized snack bars, such as protein bars and those catering to specific dietary needs (e.g., gluten-free, vegan), are accelerating. Technological disruptions are manifesting in the form of novel ingredient sourcing, advanced processing techniques for enhanced texture and shelf-life, and the integration of personalized nutrition insights. Consumer behavior shifts are profoundly influencing the market, with a discernible preference for transparency in ingredient sourcing, ethical production, and functional benefits beyond basic sustenance. The increasing demand for convenient yet nutritious on-the-go options for busy lifestyles is a primary catalyst. Market penetration is expected to deepen across various demographics as awareness of the health benefits associated with strategically formulated snack bars continues to rise.

Dominant Regions, Countries, or Segments in Snack Bars Market in US

Within the US snack bars market, the Protein Bar segment is a dominant force, consistently outpacing others in growth and market share. This ascendancy is driven by an increasing consumer focus on fitness, muscle recovery, and sustained energy release. The popularity of gym culture, athleisure wear, and a general inclination towards performance-enhancing nutrition are key economic policies and lifestyle trends supporting this segment's dominance. The Supermarket/Hypermarket distribution channel also plays a pivotal role, offering broad accessibility and a wide array of product choices to a vast consumer base. Infrastructure development in retail logistics ensures these large-format stores remain primary hubs for snack bar purchases.

- Dominant Segment: Protein Bars.

- Key Drivers: Growing fitness culture, demand for post-workout recovery, sustained energy needs, increasing awareness of protein's health benefits.

- Market Share (Estimated 2025): Approximately 40-45% of the total snack bars market.

- Growth Potential: High, fueled by continued innovation in flavors and functional ingredients.

- Dominant Distribution Channel: Supermarket/Hypermarket.

- Key Drivers: Wide product selection, convenience for bulk purchases, established customer loyalty, effective in-store promotions.

- Market Share (Estimated 2025): Approximately 45-50% of the total snack bars market.

- Growth Potential: Steady, with a shift towards omnichannel strategies.

- Other Influential Segments:

- Fruit & Nut Bars: Appeal to health-conscious consumers seeking natural ingredients and energy.

- Cereal Bars: A staple for breakfast on-the-go and a more traditional snack option.

- Online Retail Store: Experiencing rapid growth due to convenience and personalized recommendations.

- Convenience Store: Essential for impulse purchases and immediate consumption needs.

Snack Bars Market in US Product Landscape

The US snack bars market is witnessing an explosion of product innovation, driven by consumer demand for healthier, more functional, and ethically sourced options. Manufacturers are introducing bars with enhanced nutritional profiles, including added vitamins, minerals, probiotics, and prebiotics. Unique selling propositions are emerging through the incorporation of superfoods, adaptogens, and plant-based protein sources. Technological advancements are enabling the development of bars with improved textures, extended shelf-life without artificial preservatives, and allergen-free formulations catering to specific dietary needs. Applications range from pre- and post-workout fuel to mid-day energy boosts and guilt-free dessert alternatives. Performance metrics are increasingly scrutinized, with consumers seeking bars that align with their fitness goals and overall wellness objectives.

Key Drivers, Barriers & Challenges in Snack Bars Market in US

Key Drivers:

- Growing Health and Wellness Trend: Increasing consumer awareness of healthy eating habits and the demand for nutritious, convenient snack options.

- Rising Disposable Incomes: Enabling consumers to spend more on premium and specialized snack products.

- Convenience and On-the-Go Consumption: The fast-paced lifestyle of US consumers necessitates portable and easily accessible food choices.

- Product Innovation: Continuous introduction of new flavors, ingredients, and functional benefits by manufacturers.

Barriers & Challenges:

- Intense Competition: A highly saturated market with numerous brands and product offerings.

- Price Sensitivity: While demand for premium products is rising, a significant portion of the market remains price-sensitive.

- Supply Chain Volatility: Fluctuations in the cost and availability of key ingredients like nuts, seeds, and fruits can impact production and pricing.

- Regulatory Scrutiny: Evolving regulations regarding health claims, labeling, and ingredient sourcing can pose compliance challenges.

- Perception of "Healthy": Differentiating genuinely healthy products from those with misleading marketing can be a challenge for consumers.

Emerging Opportunities in Snack Bars Market in US

The US snack bars market is ripe with emerging opportunities, particularly in the realm of personalized nutrition and specialized dietary needs. The growing popularity of plant-based diets presents a significant avenue for vegan and vegetarian snack bar formulations. Innovations in functional ingredients, such as adaptogens for stress relief and nootropics for cognitive enhancement, are creating new product categories. Furthermore, sustainable sourcing and eco-friendly packaging are becoming increasingly important consumer preferences, offering brands an opportunity to differentiate themselves. The "free-from" market, including gluten-free, dairy-free, and nut-free options, continues to expand, catering to a growing segment of consumers with allergies and sensitivities.

Growth Accelerators in the Snack Bars Market in US Industry

Several catalysts are driving the long-term growth of the US snack bars industry. Technological breakthroughs in ingredient processing and formulation are enabling the creation of bars with superior nutritional profiles and enhanced sensory experiences. Strategic partnerships between snack bar manufacturers and fitness influencers, as well as wellness organizations, are expanding market reach and consumer engagement. Market expansion strategies focusing on underserved demographics and developing innovative product lines for specific occasions (e.g., travel snacks, energy bars for students) are also crucial growth accelerators. The increasing adoption of e-commerce platforms by manufacturers and retailers further facilitates broader consumer access and drives sales volumes.

Key Players Shaping the Snack Bars Market in US Market

- Caveman Foods LLC

- Simply Good Foods Co

- General Mills Inc

- PepsiCo Inc

- Abbott Laboratories

- Probar Inc

- Ferrero International SA

- Power Crunch Pty Ltd

- 1440 Foods Company

- Mars Incorporated

- The Hershey Company

- Go Macro LLC

- Mondelēz International Inc

- Kellogg Company

Notable Milestones in Snack Bars Market in US Sector

- March 2023: General Mills brand Cascadian Farm launched granola bars made in a peanut-free facility, USDA-certified organic, and with 35% less sugar than original Annie’s Dipped Granola Bars.

- March 2023: General Mills expanded its Geneva facility by adding two new buildings, including a one-story 65,600-square-foot asset and a 48,600-square-foot warehouse. This expansion will support the production of snack brands like Fiber One, Nature Valley, and Fruit by the Foot for North American markets.

- March 2023: GoMacro® introduced its newest MacroBar® flavor, "Cool Endeavor™" (Mint Chocolate Chip), available in both full-size and Mini versions.

In-Depth Snack Bars Market in US Market Outlook

The future outlook for the US snack bars market is exceptionally promising, fueled by an ingrained shift towards health consciousness and the persistent demand for convenient nutrition. Growth accelerators such as advanced ingredient technologies, innovative product formulations catering to niche dietary needs, and strategic channel expansion, particularly in online retail and direct-to-consumer models, will continue to propel the market forward. The increasing integration of personalized nutrition data into product development and marketing offers a significant strategic opportunity to deepen consumer engagement and loyalty. As consumers become more discerning about ingredient transparency, sustainability, and functional benefits, brands that can authentically deliver on these aspects will thrive, solidifying the snack bars market as a vital component of the US food landscape.

Snack Bars Market in US Segmentation

-

1. Confectionery Variant

- 1.1. Cereal Bar

- 1.2. Fruit & Nut Bar

- 1.3. Protein Bar

-

2. Distribution Channel

- 2.1. Convenience Store

- 2.2. Online Retail Store

- 2.3. Supermarket/Hypermarket

- 2.4. Others

Snack Bars Market in US Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Snack Bars Market in US Regional Market Share

Geographic Coverage of Snack Bars Market in US

Snack Bars Market in US REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 26.40% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Urbanization; Growing Disposable Income

- 3.3. Market Restrains

- 3.3.1. High-price and additional delivery charges

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Snack Bars Market in US Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Confectionery Variant

- 5.1.1. Cereal Bar

- 5.1.2. Fruit & Nut Bar

- 5.1.3. Protein Bar

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Convenience Store

- 5.2.2. Online Retail Store

- 5.2.3. Supermarket/Hypermarket

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Confectionery Variant

- 6. North America Snack Bars Market in US Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Confectionery Variant

- 6.1.1. Cereal Bar

- 6.1.2. Fruit & Nut Bar

- 6.1.3. Protein Bar

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Convenience Store

- 6.2.2. Online Retail Store

- 6.2.3. Supermarket/Hypermarket

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Confectionery Variant

- 7. South America Snack Bars Market in US Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Confectionery Variant

- 7.1.1. Cereal Bar

- 7.1.2. Fruit & Nut Bar

- 7.1.3. Protein Bar

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Convenience Store

- 7.2.2. Online Retail Store

- 7.2.3. Supermarket/Hypermarket

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Confectionery Variant

- 8. Europe Snack Bars Market in US Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Confectionery Variant

- 8.1.1. Cereal Bar

- 8.1.2. Fruit & Nut Bar

- 8.1.3. Protein Bar

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Convenience Store

- 8.2.2. Online Retail Store

- 8.2.3. Supermarket/Hypermarket

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Confectionery Variant

- 9. Middle East & Africa Snack Bars Market in US Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Confectionery Variant

- 9.1.1. Cereal Bar

- 9.1.2. Fruit & Nut Bar

- 9.1.3. Protein Bar

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Convenience Store

- 9.2.2. Online Retail Store

- 9.2.3. Supermarket/Hypermarket

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Confectionery Variant

- 10. Asia Pacific Snack Bars Market in US Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Confectionery Variant

- 10.1.1. Cereal Bar

- 10.1.2. Fruit & Nut Bar

- 10.1.3. Protein Bar

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Convenience Store

- 10.2.2. Online Retail Store

- 10.2.3. Supermarket/Hypermarket

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Confectionery Variant

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Caveman Foods LLC

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Simply Good Foods Co

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 General Mills Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 PepsiCo Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Abbott Laboratories

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Probar Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Ferrero International SA

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Power Crunch Pty Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 1440 Foods Company

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Mars Incorporated

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 The Hershey Compan

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Go Macro LLC

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Mondelēz International Inc

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Kellogg Company

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Caveman Foods LLC

List of Figures

- Figure 1: Global Snack Bars Market in US Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Snack Bars Market in US Revenue (Million), by Confectionery Variant 2025 & 2033

- Figure 3: North America Snack Bars Market in US Revenue Share (%), by Confectionery Variant 2025 & 2033

- Figure 4: North America Snack Bars Market in US Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 5: North America Snack Bars Market in US Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America Snack Bars Market in US Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Snack Bars Market in US Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Snack Bars Market in US Revenue (Million), by Confectionery Variant 2025 & 2033

- Figure 9: South America Snack Bars Market in US Revenue Share (%), by Confectionery Variant 2025 & 2033

- Figure 10: South America Snack Bars Market in US Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 11: South America Snack Bars Market in US Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 12: South America Snack Bars Market in US Revenue (Million), by Country 2025 & 2033

- Figure 13: South America Snack Bars Market in US Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Snack Bars Market in US Revenue (Million), by Confectionery Variant 2025 & 2033

- Figure 15: Europe Snack Bars Market in US Revenue Share (%), by Confectionery Variant 2025 & 2033

- Figure 16: Europe Snack Bars Market in US Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 17: Europe Snack Bars Market in US Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 18: Europe Snack Bars Market in US Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Snack Bars Market in US Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Snack Bars Market in US Revenue (Million), by Confectionery Variant 2025 & 2033

- Figure 21: Middle East & Africa Snack Bars Market in US Revenue Share (%), by Confectionery Variant 2025 & 2033

- Figure 22: Middle East & Africa Snack Bars Market in US Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 23: Middle East & Africa Snack Bars Market in US Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: Middle East & Africa Snack Bars Market in US Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East & Africa Snack Bars Market in US Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Snack Bars Market in US Revenue (Million), by Confectionery Variant 2025 & 2033

- Figure 27: Asia Pacific Snack Bars Market in US Revenue Share (%), by Confectionery Variant 2025 & 2033

- Figure 28: Asia Pacific Snack Bars Market in US Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 29: Asia Pacific Snack Bars Market in US Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Asia Pacific Snack Bars Market in US Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific Snack Bars Market in US Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Snack Bars Market in US Revenue Million Forecast, by Confectionery Variant 2020 & 2033

- Table 2: Global Snack Bars Market in US Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global Snack Bars Market in US Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Snack Bars Market in US Revenue Million Forecast, by Confectionery Variant 2020 & 2033

- Table 5: Global Snack Bars Market in US Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Global Snack Bars Market in US Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Snack Bars Market in US Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Snack Bars Market in US Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Snack Bars Market in US Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Snack Bars Market in US Revenue Million Forecast, by Confectionery Variant 2020 & 2033

- Table 11: Global Snack Bars Market in US Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 12: Global Snack Bars Market in US Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil Snack Bars Market in US Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina Snack Bars Market in US Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Snack Bars Market in US Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Snack Bars Market in US Revenue Million Forecast, by Confectionery Variant 2020 & 2033

- Table 17: Global Snack Bars Market in US Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 18: Global Snack Bars Market in US Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Snack Bars Market in US Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany Snack Bars Market in US Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France Snack Bars Market in US Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy Snack Bars Market in US Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain Snack Bars Market in US Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia Snack Bars Market in US Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Benelux Snack Bars Market in US Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nordics Snack Bars Market in US Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Snack Bars Market in US Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global Snack Bars Market in US Revenue Million Forecast, by Confectionery Variant 2020 & 2033

- Table 29: Global Snack Bars Market in US Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 30: Global Snack Bars Market in US Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey Snack Bars Market in US Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Israel Snack Bars Market in US Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: GCC Snack Bars Market in US Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: North Africa Snack Bars Market in US Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa Snack Bars Market in US Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Snack Bars Market in US Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global Snack Bars Market in US Revenue Million Forecast, by Confectionery Variant 2020 & 2033

- Table 38: Global Snack Bars Market in US Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 39: Global Snack Bars Market in US Revenue Million Forecast, by Country 2020 & 2033

- Table 40: China Snack Bars Market in US Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: India Snack Bars Market in US Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan Snack Bars Market in US Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Korea Snack Bars Market in US Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Snack Bars Market in US Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Oceania Snack Bars Market in US Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Snack Bars Market in US Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Snack Bars Market in US?

The projected CAGR is approximately 26.40%.

2. Which companies are prominent players in the Snack Bars Market in US?

Key companies in the market include Caveman Foods LLC, Simply Good Foods Co, General Mills Inc, PepsiCo Inc, Abbott Laboratories, Probar Inc, Ferrero International SA, Power Crunch Pty Ltd, 1440 Foods Company, Mars Incorporated, The Hershey Compan, Go Macro LLC, Mondelēz International Inc, Kellogg Company.

3. What are the main segments of the Snack Bars Market in US?

The market segments include Confectionery Variant, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Urbanization; Growing Disposable Income.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

High-price and additional delivery charges.

8. Can you provide examples of recent developments in the market?

March 2023: General Mills brand Cascadian Farm launched granola bars that are made in a peanut-free facility. The bars are also USDA-certified organic and made with 35% less sugar compared to the original Annie’s Dipped Granola Bars.March 2023: General Mills has added two buildings to the site in Geneva: a one-story 65,600-square-foot asset and a 48,600-square-foot warehouse expansion. The Geneva factory will produce snack brands such as Fiber One, Nature Valley, and Fruit by the Foot, which will be sold across North America.March 2023: GoMacro® introduced the newest addition to its MacroBar® lineup, i.e., Cool Endeavor™. In addition to the full-size MacroBar, this Mint Chocolate Chip flavor is also available as a MacroBar® Mini.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Snack Bars Market in US," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Snack Bars Market in US report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Snack Bars Market in US?

To stay informed about further developments, trends, and reports in the Snack Bars Market in US, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence