Key Insights

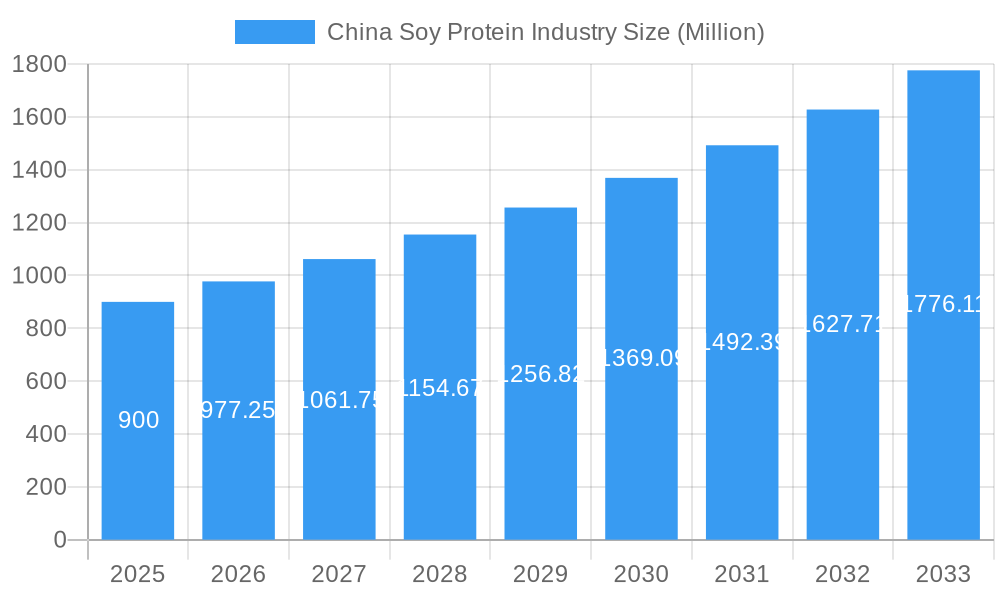

The China Soy Protein Industry is poised for significant expansion, with a current market size estimated at $900 million. This robust growth is underpinned by a projected Compound Annual Growth Rate (CAGR) of 8.49% over the forecast period of 2025-2033. This upward trajectory is primarily driven by increasing consumer demand for plant-based protein alternatives, fueled by health consciousness and a growing awareness of the environmental impact of traditional animal agriculture. Furthermore, the expanding applications of soy protein across various sectors, including animal feed, personal care, and a diverse range of food and beverage products, are acting as powerful catalysts for market expansion. The versatility of soy protein, available in forms such as concentrates, isolates, and textured/hydrolyzed varieties, allows for its seamless integration into numerous product formulations, meeting the evolving preferences of both consumers and manufacturers.

China Soy Protein Industry Market Size (In Million)

The market is further propelled by strong trends favoring the adoption of functional ingredients and clean-label products, where soy protein often plays a crucial role. Within the food and beverage segment, bakery, meat and seafood alternatives, dairy and dairy alternatives, and snacks are emerging as particularly dynamic sub-segments. The supplement sector, encompassing baby food, elderly nutrition, and sports nutrition, also presents substantial growth opportunities. While the industry benefits from these drivers and trends, it faces certain restraints. These likely include fluctuating raw material prices, potential consumer perceptions regarding genetically modified organisms (GMOs) if not clearly communicated, and stringent regulatory landscapes in specific application areas. Despite these challenges, the sheer scale of the Chinese market and the increasing acceptance of soy protein as a sustainable and nutritious ingredient position it for sustained and accelerated growth.

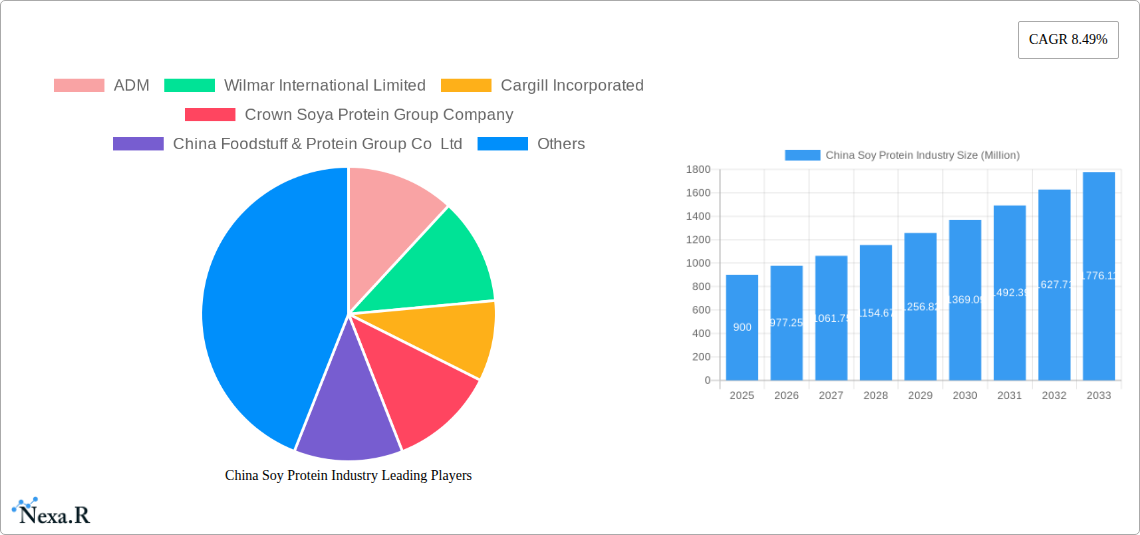

China Soy Protein Industry Company Market Share

This in-depth report provides a thorough analysis of the China soy protein industry, covering market dynamics, growth trends, regional dominance, product landscape, key drivers, barriers, emerging opportunities, growth accelerators, and a detailed outlook for the period of 2019–2033. With a base year of 2025 and a forecast period extending to 2033, this report leverages a wealth of data to offer actionable insights for industry professionals seeking to capitalize on the burgeoning plant-based protein market in China. We delve into parent and child market segments, providing a granular understanding of the industry's intricate structure and future trajectory. All values are presented in Million units.

China Soy Protein Industry Market Dynamics & Structure

The China soy protein industry is characterized by a moderate to high market concentration, with leading players such as ADM, Wilmar International Limited, Cargill Incorporated, Crown Soya Protein Group Company, and China Foodstuff & Protein Group Co Ltd holding significant market shares. Technological innovation is a key driver, fueled by ongoing research and development in extraction and processing techniques to enhance soy protein functionality and appeal, particularly in the food and beverages and supplements segments. Regulatory frameworks, including food safety standards and labeling requirements, play a crucial role in shaping product development and market entry. Competitive product substitutes, such as pea protein and other plant-based alternatives, present a dynamic competitive landscape, pushing soy protein manufacturers to emphasize product differentiation and superior quality. End-user demographics are increasingly favoring plant-based options, driven by health consciousness and environmental concerns, particularly among younger consumers. Mergers and acquisitions (M&A) trends are notable, with companies like Bunge and Cargill strategically aligning to strengthen their global supply chains and expand their product portfolios in response to evolving market demands.

- Market Concentration: Dominated by a mix of multinational corporations and strong domestic players.

- Technological Innovation: Focus on improved functionality, taste, and texture for wider food applications.

- Regulatory Landscape: Stringent food safety regulations and evolving labeling standards.

- Competitive Substitutes: Growing presence of pea protein, fava bean protein, and others.

- End-User Trends: Rising demand for plant-based alternatives across all age groups.

- M&A Activity: Strategic consolidations to enhance market presence and supply chain efficiency.

China Soy Protein Industry Growth Trends & Insights

The China soy protein market size is projected to experience robust growth over the forecast period, driven by escalating consumer demand for healthier and more sustainable protein sources. The food and beverages segment, encompassing bakery, dairy and dairy alternative products, meat and meat alternative products, and snacks, is anticipated to be a primary growth engine. Furthermore, the supplements sector, particularly sport/performance nutrition and baby food and infant formula, is witnessing significant adoption rates due to increasing awareness of the nutritional benefits of soy protein. Technological disruptions, including advancements in enzyme hydrolysis and texturization, are enabling the creation of novel soy protein ingredients that closely mimic animal-derived products, thereby accelerating market penetration. Consumer behavior shifts towards flexitarian and vegetarian diets, coupled with a growing preference for natural and minimally processed ingredients, are profoundly impacting purchasing decisions. The increasing availability of diversified soy protein products, from concentrates to highly functional isolates and textured/hydrolyzed forms, caters to a broader spectrum of applications and consumer needs. Market penetration is expected to deepen as awareness of soy protein's health and environmental advantages continues to rise across the Chinese population. The CAGR for the China soy protein industry is estimated to be a strong XX% between 2025 and 2033, reflecting sustained expansion.

Dominant Regions, Countries, or Segments in China Soy Protein Industry

The Food and Beverages segment emerges as the dominant force within the China soy protein industry, showcasing the most significant growth potential and market share. Within this broad segment, Dairy and Dairy Alternative Products and Meat/Poultry/Seafood and Meat Alternative Products are particularly influential, driven by the immense popularity of plant-based milk, yogurt, cheese alternatives, and the rapidly expanding market for meat analogues. The Supplements sector, especially Sport/Performance Nutrition, is also a key driver, fueled by the growing fitness culture and demand for convenient protein sources. The Animal Feed segment, while a significant consumer of soy protein, experiences more stable, albeit substantial, growth.

- Dominant Segment: Food and Beverages, with a strong focus on:

- Dairy and Dairy Alternative Products: Driven by increasing demand for plant-based milk, yogurt, and cheese.

- Meat/Poultry/Seafood and Meat Alternative Products: Capitalizing on the burgeoning vegetarian and flexitarian consumer base seeking meat substitutes.

- Key Growth Segment: Supplements, particularly:

- Sport/Performance Nutrition: Aided by the rising health and fitness consciousness.

- Baby Food and Infant Formula: Reflecting a growing trend towards plant-based nutrition for infants.

- Regional Dominance: While specific regional data is proprietary, major economic hubs like Eastern China (e.g., Shanghai, Jiangsu, Zhejiang) are expected to lead due to higher disposable incomes, greater consumer awareness of health and wellness trends, and well-developed food processing infrastructure. These regions benefit from robust supply chains and a concentration of major food manufacturers. Economic policies supporting food innovation and sustainable agriculture further bolster these regions' dominance.

- Market Share & Growth Potential: The Food and Beverages segment currently holds an estimated XX% of the market and is projected to grow at a CAGR of XX% over the forecast period. The Supplements segment is expected to follow with an XX% market share and a CAGR of XX%.

China Soy Protein Industry Product Landscape

The China soy protein industry is witnessing a surge in product innovation and diverse applications. Soy protein concentrates (SPC), offering a balance of protein and other soy components, are widely used in bakery and meat applications. Soy protein isolates (SPI), with their high protein purity (often exceeding 90%), are favored in sports nutrition, infant formulas, and specialized food products demanding minimal carbohydrates and fats. Textured soy protein (TSP) and hydrolyzed soy protein (HSP) are revolutionizing the meat alternative market, providing realistic textures and savory flavors, and are also finding utility in condiments and sauces. Innovations focus on improving solubility, emulsification, and gelling properties, enhancing sensory attributes, and developing allergen-friendly variants to broaden consumer appeal and expand applications across the food and beverages, personal care and cosmetics, and supplements sectors.

Key Drivers, Barriers & Challenges in China Soy Protein Industry

Key Drivers:

- Rising Health Consciousness: Growing consumer awareness of the health benefits of plant-based proteins, including reduced risk of chronic diseases.

- Environmental Sustainability Concerns: Increasing preference for plant-based diets due to their lower environmental footprint compared to animal agriculture.

- Government Support for Plant-Based Diets: Policies encouraging healthy eating and sustainable food production.

- Innovation in Food Technology: Development of highly functional and palatable soy protein ingredients for diverse food applications.

- Growing Vegetarian and Flexitarian Population: An expanding demographic actively seeking meat and dairy alternatives.

Barriers & Challenges:

- Consumer Perception and Taste Preferences: Some consumers still associate soy protein with distinct flavors or textures that may not appeal to all.

- Allergen Concerns: Soy is a common allergen, necessitating clear labeling and the development of alternative protein sources for sensitive consumers.

- Supply Chain Volatility: Fluctuations in soybean prices and availability due to agricultural factors, trade policies, and global demand.

- Competition from Other Plant Proteins: Increasing market penetration of pea, fava bean, and other emerging plant-based protein sources.

- Regulatory Hurdles: Navigating evolving food safety regulations and ingredient approvals.

Emerging Opportunities in China Soy Protein Industry

Emerging opportunities in the China soy protein industry lie in the continued expansion of functional ingredients and novel applications. The demand for clean-label, non-GMO, and organic soy protein is on the rise, presenting a niche market for premium products. The personal care and cosmetics segment is increasingly incorporating soy-derived ingredients for their emollient and antioxidant properties, offering a new avenue for growth. Furthermore, the development of specialized soy protein formulations for elderly nutrition and medical nutrition is an untapped market with significant potential, addressing the dietary needs of an aging population. The integration of soy protein into convenient, ready-to-eat (RTE) and ready-to-cook (RTC) food products also represents a lucrative opportunity.

Growth Accelerators in the China Soy Protein Industry Industry

Several growth accelerators are propelling the China soy protein industry forward. Technological breakthroughs in processing, such as advanced isolation techniques and enzymatic modifications, are yielding higher-quality, more versatile soy protein ingredients. Strategic partnerships between ingredient manufacturers and food product developers are fostering innovation and speeding up the introduction of new soy-based products to the market. Market expansion strategies, including targeted marketing campaigns highlighting the health and environmental benefits of soy protein, are crucial in driving consumer acceptance and adoption. The increasing integration of soy protein into mainstream food products, beyond traditional vegetarian options, is a significant accelerator, making it more accessible and appealing to a wider consumer base.

Key Players Shaping the China Soy Protein Industry Market

- ADM

- Wilmar International Limited

- Cargill Incorporated

- Crown Soya Protein Group Company

- China Foodstuff & Protein Group Co Ltd

- International Flavours and Fragrance Inc

- CJ Group

- DuPont de Nemours Inc

- Bunge Limited

- Kerry Group

Notable Milestones in China Soy Protein Industry Sector

- June 2023: Bunge merged with Viterra, solidifying its position as one of the world's foremost grain companies. This strategic union is expected to expedite Bunge's mission of connecting farmers to consumers and facilitating the delivery of essential food, feed, and fuel to people around the globe.

- August 2022: Cargill entered into a transformative partnership with Benson Hill to amplify the production of cutting-edge Ultra-High Protein Soy. This long-term collaboration is designed to meet the surging demand for plant-based proteins by scaling up innovative soy ingredients.

- February 2021: DuPont orchestrated a merger of its Nutrition Business with International Flavors & Fragrances (IFF), forming a formidable company poised to become a preeminent supplier of ingredients to the food industry.

In-Depth China Soy Protein Industry Market Outlook

The in-depth China soy protein industry market outlook indicates a future characterized by sustained growth and diversification. Key growth accelerators, including advancements in food technology, strategic industry collaborations, and proactive market expansion initiatives, will continue to fuel this upward trajectory. The increasing demand for clean-label and functional ingredients, coupled with the evolving dietary preferences of Chinese consumers towards healthier and more sustainable options, presents a fertile ground for innovation. The report anticipates a significant expansion in the application of soy protein across various food and beverage categories, as well as a growing presence in the personal care and specialized nutrition markets. Strategic investments in research and development, alongside robust supply chain management, will be critical for companies to capitalize on the immense future market potential and secure a competitive edge in this dynamic industry.

China Soy Protein Industry Segmentation

-

1. Form

- 1.1. Concentrates

- 1.2. Isolates

- 1.3. Textured/Hydrolyzed

-

2. End-User

- 2.1. Animal Feed

- 2.2. Personal Care and Cosmetics

-

2.3. Food and Beverages

- 2.3.1. Bakery

- 2.3.2. Breakfast Cereals

- 2.3.3. Condiments/Sauces

- 2.3.4. Dairy and Dairy Alternative Products

- 2.3.5. Meat/Poultry/Seafood and Meat Alternative Products

- 2.3.6. RTE/RTC Food Products

- 2.3.7. Snacks

-

2.4. Supplements

- 2.4.1. Baby Food and Infant Formula

- 2.4.2. Elderly Nutrition and Medical Nutrition

- 2.4.3. Sport/Performance Nutrition

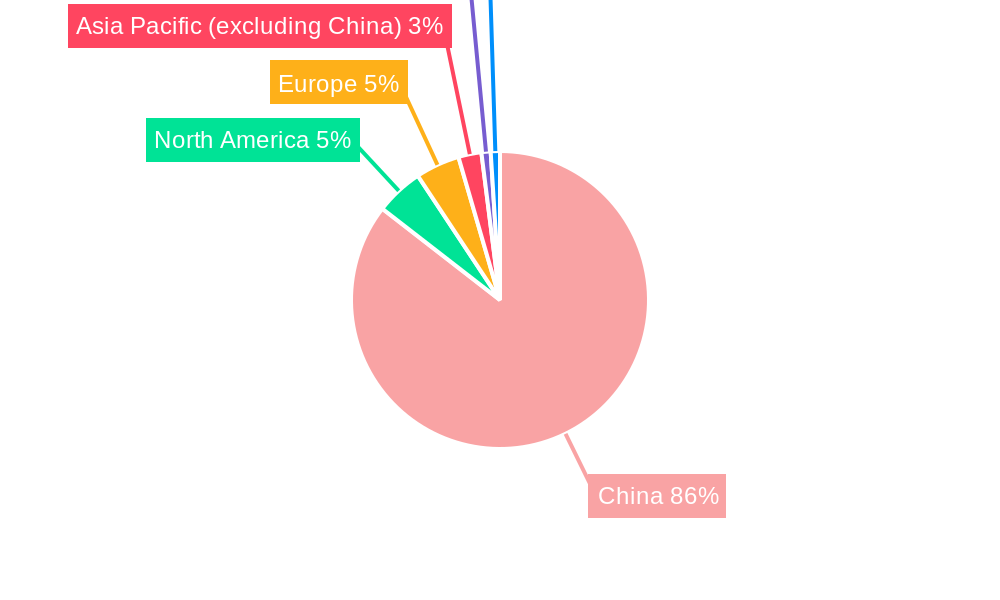

China Soy Protein Industry Segmentation By Geography

- 1. China

China Soy Protein Industry Regional Market Share

Geographic Coverage of China Soy Protein Industry

China Soy Protein Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.49% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Health and Wellness Trends Drives the Market; Rising Demand for functional Food Drives the Market

- 3.3. Market Restrains

- 3.3.1. High Competition from Other Protein Sources

- 3.4. Market Trends

- 3.4.1. Growing Demand for Protein Rich Food Increases the Soybean Meal Consumption

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Soy Protein Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Form

- 5.1.1. Concentrates

- 5.1.2. Isolates

- 5.1.3. Textured/Hydrolyzed

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Animal Feed

- 5.2.2. Personal Care and Cosmetics

- 5.2.3. Food and Beverages

- 5.2.3.1. Bakery

- 5.2.3.2. Breakfast Cereals

- 5.2.3.3. Condiments/Sauces

- 5.2.3.4. Dairy and Dairy Alternative Products

- 5.2.3.5. Meat/Poultry/Seafood and Meat Alternative Products

- 5.2.3.6. RTE/RTC Food Products

- 5.2.3.7. Snacks

- 5.2.4. Supplements

- 5.2.4.1. Baby Food and Infant Formula

- 5.2.4.2. Elderly Nutrition and Medical Nutrition

- 5.2.4.3. Sport/Performance Nutrition

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Form

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 ADM

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Wilmar International Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Cargill Incorporated

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Crown Soya Protein Group Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 China Foodstuff & Protein Group Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 International Flavours and Fragrance Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 CJ Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 DuPont de Nemours Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Bunge Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Kerry Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 ADM

List of Figures

- Figure 1: China Soy Protein Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: China Soy Protein Industry Share (%) by Company 2025

List of Tables

- Table 1: China Soy Protein Industry Revenue Million Forecast, by Form 2020 & 2033

- Table 2: China Soy Protein Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 3: China Soy Protein Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: China Soy Protein Industry Revenue Million Forecast, by Form 2020 & 2033

- Table 5: China Soy Protein Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 6: China Soy Protein Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Soy Protein Industry?

The projected CAGR is approximately 8.49%.

2. Which companies are prominent players in the China Soy Protein Industry?

Key companies in the market include ADM, Wilmar International Limited, Cargill Incorporated, Crown Soya Protein Group Company, China Foodstuff & Protein Group Co Ltd, International Flavours and Fragrance Inc, CJ Group, DuPont de Nemours Inc, Bunge Limited, Kerry Group.

3. What are the main segments of the China Soy Protein Industry?

The market segments include Form, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.9 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Health and Wellness Trends Drives the Market; Rising Demand for functional Food Drives the Market.

6. What are the notable trends driving market growth?

Growing Demand for Protein Rich Food Increases the Soybean Meal Consumption.

7. Are there any restraints impacting market growth?

High Competition from Other Protein Sources.

8. Can you provide examples of recent developments in the market?

June 2023: Bunge merged with Viterra, solidifying its position as one of the world's foremost grain companies. This strategic union is expected to expedite Bunge's mission of connecting farmers to consumers and facilitating the delivery of essential food, feed, and fuel to people around the globe.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Soy Protein Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Soy Protein Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Soy Protein Industry?

To stay informed about further developments, trends, and reports in the China Soy Protein Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence