Key Insights

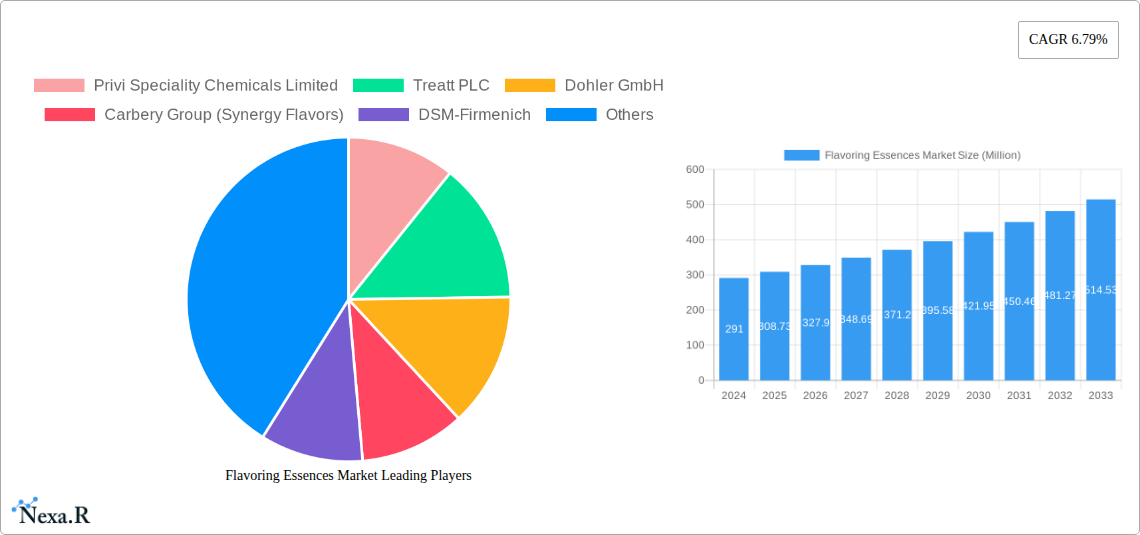

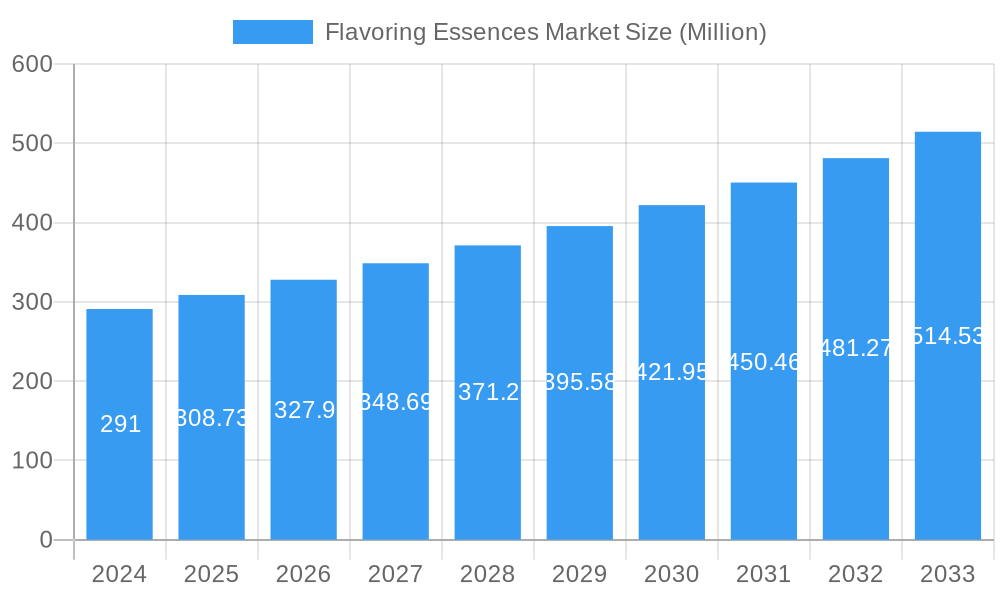

The global Flavoring Essences Market is poised for significant expansion, projected to reach a valuation of USD 308.73 million in 2025, with a robust Compound Annual Growth Rate (CAGR) of 6.79% anticipated through 2033. This growth is primarily propelled by an escalating consumer demand for diverse and authentic taste experiences across a multitude of food and beverage applications, including dairy products, bakery and confectionery items, and processed foods. The increasing consumer preference for natural and premium ingredients is a significant driver, pushing manufacturers to invest in research and development for innovative flavoring solutions. Furthermore, the burgeoning cosmetics and personal care sector, alongside the ever-evolving fragrance and flavor industries, are creating new avenues for market penetration and product diversification. The pharmaceutical sector's increasing adoption of palatable flavoring agents to improve patient compliance also contributes to the market's upward trajectory.

Flavoring Essences Market Market Size (In Million)

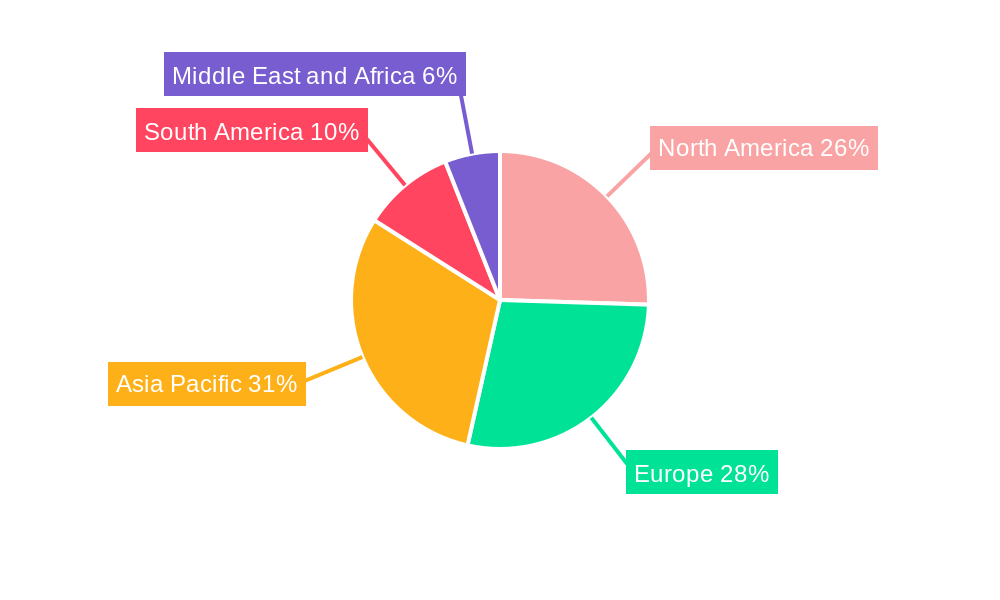

Despite the promising growth, the market encounters certain restraints. Volatility in the prices of raw materials, often derived from agricultural produce, can impact profit margins for manufacturers. Stringent regulatory frameworks surrounding food additives and flavorings in different regions necessitate continuous compliance and can slow down product launches. However, these challenges are being addressed through strategic sourcing, technological advancements in extraction and synthesis, and a proactive approach to regulatory adherence. Key players like Privi Speciality Chemicals Limited, Treatt PLC, and DSM-Firmenich are actively investing in sustainable practices and product innovation, aiming to capture a larger market share. The Asia Pacific region, with its rapidly growing economies and increasing disposable incomes, is expected to emerge as a dominant force in this market, presenting substantial opportunities for both established and emerging companies.

Flavoring Essences Market Company Market Share

Flavoring Essences Market: Comprehensive Analysis and Future Outlook (2019–2033)

This in-depth report provides a definitive analysis of the global Flavoring Essences market, offering a detailed examination of its structure, growth trajectories, and future potential. Covering the period from 2019 to 2033, with a base and estimated year of 2025, this report leverages extensive research to deliver actionable insights for industry stakeholders. We explore the intricate dynamics of parent and child markets, providing a holistic view of opportunities and challenges across diverse applications, including Food and Beverages, Cosmetics and Personal Care, Fragrance Industry, Flavor Industry, and Pharmaceuticals. This report is optimized for SEO with high-traffic keywords to maximize visibility and deliver unparalleled value.

Flavoring Essences Market Market Dynamics & Structure

The global Flavoring Essences market is characterized by a moderate level of concentration, with key players investing heavily in research and development to drive technological innovation. The demand for natural and clean-label flavoring essences is a significant driver, propelled by evolving consumer preferences for healthier and more transparent food and beverage products. Regulatory frameworks, particularly concerning food safety and ingredient labeling, play a crucial role in shaping market strategies and product formulations. Competitive product substitutes, such as artificial flavorings and natural extracts, present a constant challenge, necessitating continuous innovation and differentiation. End-user demographics are increasingly influencing product development, with a growing demand from younger, health-conscious demographics and a burgeoning middle class in emerging economies. Mergers and acquisitions (M&A) are a notable trend, as companies seek to expand their product portfolios, geographical reach, and technological capabilities. For instance, recent M&A activities indicate a strategic consolidation aimed at enhancing market share and operational efficiencies. Innovation barriers include the complexity of extracting and stabilizing delicate natural flavors and the high cost associated with sourcing premium raw materials.

- Market Concentration: Moderate, with a few key players dominating a significant share.

- Technological Innovation Drivers: Growing consumer demand for natural, organic, and clean-label ingredients.

- Regulatory Frameworks: Strict adherence to food safety standards and labeling regulations across different regions.

- Competitive Product Substitutes: Artificial flavorings, natural extracts, and other sensory enhancement ingredients.

- End-User Demographics: Influenced by health consciousness, preference for natural products, and disposable income in emerging markets.

- M&A Trends: Strategic acquisitions for portfolio expansion and market penetration.

- Innovation Barriers: High R&D costs, complexity of natural flavor extraction, and supply chain consistency.

Flavoring Essences Market Growth Trends & Insights

The Flavoring Essences market is poised for robust growth, driven by a confluence of evolving consumer preferences, technological advancements, and expanding applications across various industries. The projected market size for 2025 is substantial, with a consistent upward trajectory anticipated through the forecast period. Adoption rates of sophisticated flavoring essences are increasing as manufacturers recognize their critical role in product differentiation and consumer appeal. Technological disruptions, particularly in extraction and encapsulation techniques, are enabling the development of more stable, potent, and cost-effective flavoring solutions. These innovations are crucial for meeting the rising demand for authentic and intense flavor profiles. Consumer behavior shifts are central to this market's expansion; consumers are increasingly seeking novel taste experiences and are willing to pay a premium for high-quality, natural ingredients. This trend is particularly evident in the bakery and confectionery, dairy products, and processed foods segments, where flavor plays a pivotal role in purchasing decisions. The increasing global focus on wellness and healthier lifestyles also fuels demand for natural flavoring essences derived from fruits, vegetables, and botanicals, often positioned as alternatives to artificial additives. Furthermore, the fragrance industry's innovation in perfumery, often drawing inspiration from natural essences, contributes to the overall market dynamism. The pharmaceutical sector, too, is witnessing a growing utilization of flavoring essences to enhance the palatability of medications, thereby improving patient compliance. The CAGR for the forecast period is robust, reflecting the market's inherent growth potential. Market penetration is expected to deepen as awareness of the benefits and applications of advanced flavoring essences increases across developed and developing economies. The integration of AI and machine learning in flavor development is also emerging as a significant trend, allowing for faster and more precise creation of bespoke flavor profiles.

Dominant Regions, Countries, or Segments in Flavoring Essences Market

The Food and Beverages segment stands as the dominant force within the global Flavoring Essences market, exhibiting the highest market share and experiencing the most significant growth potential. Within this broad category, Bakery and Confectionery and Dairy Products are particularly strong drivers, owing to the inherent need for diverse and appealing flavor profiles in these product categories. The increasing consumer demand for indulgent yet healthier treats, coupled with the constant innovation in product development within these sectors, fuels the consistent demand for a wide array of flavoring essences. For example, the confectionery industry’s constant introduction of new candies, chocolates, and baked goods ensures a perpetual need for both classic and novel flavor essences. Similarly, the dairy sector, encompassing yogurts, ice creams, and flavored milk, relies heavily on flavoring essences to cater to diverse taste preferences, from fruity and sweet to savory.

- Dominant Segment: Food and Beverages

- Key Sub-Segments: Bakery and Confectionery, Dairy Products

- Drivers:

- Consumer Preference for Indulgence & Novelty: Constant demand for new and exciting taste experiences.

- Product Reformulation & Innovation: Manufacturers continuously develop new products or reformulate existing ones to meet consumer demands for natural and appealing flavors.

- Health & Wellness Trends: Growing demand for natural and perceived healthier flavoring options derived from fruits, herbs, and spices.

- Economic Growth & Disposable Income: Increased purchasing power in emerging economies leads to higher consumption of flavored food and beverage products.

- Global Trade & Distribution Networks: Efficient supply chains ensure the availability of flavoring essences across diverse geographical markets.

The Bakery and Confectionery sub-segment, in particular, benefits from the trend of premiumization, with consumers willing to pay more for products featuring high-quality, natural flavor essences. This also extends to the Processed Foods segment, where flavoring essences are essential for creating a wide range of convenience meals, snacks, and ready-to-eat products that appeal to busy lifestyles. While the Cosmetics and Personal Care, Fragrance Industry, and Pharmaceuticals segments represent significant markets for flavoring essences, their aggregate demand, while substantial, does not yet rival that of the food and beverage industry. However, these sectors offer considerable growth opportunities, especially in niche applications and the development of specialized sensory experiences.

Flavoring Essences Market Product Landscape

The Flavoring Essences market is characterized by continuous product innovation, driven by the pursuit of authenticity, naturalness, and enhanced sensory experiences. Manufacturers are developing highly concentrated essences that deliver intense flavor profiles with minimal usage, leading to cost efficiencies and cleaner product labels. There is a notable trend towards the development of natural and organic flavoring essences, catering to the growing consumer preference for ingredients perceived as healthier and more sustainable. Applications are expanding beyond traditional food and beverage uses, with increasing adoption in functional foods, beverages, and even pet food. Performance metrics are increasingly focused on stability, shelf-life extension, and the ability to withstand various processing conditions, such as high temperatures or pH variations. Unique selling propositions often revolve around the origin of the raw materials, the proprietary extraction techniques employed, and the ability to create complex, multi-layered flavor profiles. Technological advancements in microencapsulation and aroma recovery are further enhancing the efficacy and versatility of flavoring essences, enabling their use in novel product formats and applications.

Key Drivers, Barriers & Challenges in Flavoring Essences Market

Key Drivers:

- Rising Consumer Demand for Natural and Clean-Label Products: This is a paramount driver, pushing manufacturers to source and develop flavoring essences derived from natural origins, aligning with health and wellness trends.

- Growing Food & Beverage Industry: The expansion of the global food and beverage sector, particularly in emerging economies, directly correlates with increased demand for flavoring essences to enhance product appeal.

- Innovation in Flavor Profiles: Continuous innovation in developing unique, complex, and authentic flavor experiences caters to evolving consumer tastes and preferences.

- Technological Advancements: Improvements in extraction, synthesis, and encapsulation technologies enable the creation of more potent, stable, and cost-effective flavoring essences.

- Growth in Cosmetics and Personal Care: The increasing use of scents and flavors in cosmetics, toiletries, and personal care products creates a significant demand avenue.

Barriers & Challenges:

- Volatility in Raw Material Prices and Supply Chain Disruptions: Dependence on agricultural produce for natural essences makes the market susceptible to price fluctuations and supply chain interruptions due to climate change or geopolitical factors.

- Stringent Regulatory Landscape: Navigating complex and varying food safety, labeling, and import/export regulations across different countries poses a significant challenge.

- High Cost of Natural Ingredient Sourcing and Extraction: The process of sourcing premium natural ingredients and employing advanced extraction techniques can be expensive, impacting product pricing.

- Competition from Artificial Flavorings: While natural options are gaining traction, the cost-effectiveness and wider availability of artificial flavorings continue to present a competitive challenge.

- Consumer Perception and Misinformation: Negative consumer perceptions surrounding the term "flavoring" or specific ingredients can necessitate extensive marketing and education efforts.

Emerging Opportunities in Flavoring Essences Market

Emerging opportunities in the Flavoring Essences market are largely driven by the burgeoning demand for plant-based and sustainable ingredients. The expansion of the functional food and beverage sector presents a significant avenue, where flavoring essences can mask off-notes from active ingredients and enhance the overall sensory appeal. The growing popularity of the ready-to-drink (RTD) beverage category, including hard seltzers and functional drinks, offers substantial potential for innovative and exotic flavor essences. Furthermore, the increasing focus on personalized nutrition and customized flavor profiles opens doors for bespoke flavoring solutions tailored to individual consumer needs and preferences. The rise of e-commerce and direct-to-consumer models also creates opportunities for niche flavoring essence providers to reach a wider audience.

Growth Accelerators in the Flavoring Essences Market Industry

Several catalysts are accelerating long-term growth in the Flavoring Essences market. Technological breakthroughs in precision fermentation and biosynthesis are paving the way for sustainable and scalable production of complex flavor molecules, reducing reliance on traditional agricultural sources. Strategic partnerships between flavoring essence manufacturers and food/beverage companies are becoming increasingly vital, fostering co-creation and accelerating product development cycles. Market expansion strategies focusing on untapped geographical regions, particularly in Southeast Asia and Africa, where rising disposable incomes are driving increased consumption of processed foods and beverages, are crucial growth accelerators. The continuous evolution of clean-label trends and the demand for transparent ingredient sourcing will also propel the growth of natural and organic flavoring essences.

Key Players Shaping the Flavoring Essences Market Market

- Privi Speciality Chemicals Limited

- Treatt PLC

- Dohler GmbH

- Carbery Group (Synergy Flavors)

- DSM-Firmenich

- Symega Food Ingredients Limited

- S H Kelkar & Co (Keva)

- Amrut International

- Flavor Essence

- Leela Organic Herba

Notable Milestones in Flavoring Essences Market Sector

- May 2024: Döhler GmBH opened its new production site in South Africa for the development of compounds, emulsions, powdered and liquid flavor ingredients, significantly bolstering its juice concentrate processing capacity and granting customers direct access to its full compound portfolio in the region, reinforcing its leadership in the local food, beverage, and life science industries.

- April 2023: Carbery Group (Synergy Flavors Inc.) expanded its footprint in Asia with the opening of new premises in Singapore, signaling plans to expand and diversify its business, including offering flavoring essences to new customers across various end-use industries in the country.

- January 2022: Carbery Group (Synergy Flavors Inc.) expanded its R&D facilities and collaborative spaces at its US headquarters in Wauconda, Illinois, aligning with Synergy's strategy for organic growth and ensuring its facilities meet the escalating demands for internal and external collaboration.

- July 2021: Carbery Group (Synergy Flavors) launched a new collection of fruit essences and natural flavors under its Synergy Pure range, offering manufacturers a variety of natural solutions for diverse food and beverage applications, including the hard seltzer and ready-to-drink (RTD) alcohol categories.

In-Depth Flavoring Essences Market Market Outlook

The future outlook for the Flavoring Essences market is exceptionally positive, driven by sustained consumer demand for natural, healthy, and innovative taste experiences. Growth accelerators such as advanced biosynthesis techniques, strategic market expansion into emerging economies, and the increasing demand from niche sectors like functional foods and personalized nutrition will fuel market expansion. The continued focus on clean labels and sustainable sourcing will also solidify the dominance of natural flavoring essences. Companies that invest in research and development, embrace technological innovation, and strategically forge partnerships are poised to capture significant market share and lead the industry towards a future rich with diverse and appealing flavor profiles. The market is expected to witness consistent growth, driven by an expanding global population and evolving consumer preferences.

Flavoring Essences Market Segmentation

-

1. Application

-

1.1. Food and Beverages

- 1.1.1. Dairy Products

- 1.1.2. Bakery and Confectionery

- 1.1.3. Processed Foods

- 1.1.4. Other Applications

- 1.2. Cosmetics and Personal Care

- 1.3. Fragrance Industry

- 1.4. Flavor Industry

- 1.5. Pharmaceuticals

-

1.1. Food and Beverages

Flavoring Essences Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Spain

- 2.5. Italy

- 2.6. Russia

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East and Africa

Flavoring Essences Market Regional Market Share

Geographic Coverage of Flavoring Essences Market

Flavoring Essences Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.79% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Applications in Non-food Industries; Rising Demand for Clean-label Flavoring Essence Ingredients

- 3.3. Market Restrains

- 3.3.1. Increasing Applications in Non-food Industries; Rising Demand for Clean-label Flavoring Essence Ingredients

- 3.4. Market Trends

- 3.4.1. Growing Popularity of Clean-label Flavoring Essences in the Food and Beverage Industry Driving Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Flavoring Essences Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Food and Beverages

- 5.1.1.1. Dairy Products

- 5.1.1.2. Bakery and Confectionery

- 5.1.1.3. Processed Foods

- 5.1.1.4. Other Applications

- 5.1.2. Cosmetics and Personal Care

- 5.1.3. Fragrance Industry

- 5.1.4. Flavor Industry

- 5.1.5. Pharmaceuticals

- 5.1.1. Food and Beverages

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. South America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Flavoring Essences Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Food and Beverages

- 6.1.1.1. Dairy Products

- 6.1.1.2. Bakery and Confectionery

- 6.1.1.3. Processed Foods

- 6.1.1.4. Other Applications

- 6.1.2. Cosmetics and Personal Care

- 6.1.3. Fragrance Industry

- 6.1.4. Flavor Industry

- 6.1.5. Pharmaceuticals

- 6.1.1. Food and Beverages

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Flavoring Essences Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Food and Beverages

- 7.1.1.1. Dairy Products

- 7.1.1.2. Bakery and Confectionery

- 7.1.1.3. Processed Foods

- 7.1.1.4. Other Applications

- 7.1.2. Cosmetics and Personal Care

- 7.1.3. Fragrance Industry

- 7.1.4. Flavor Industry

- 7.1.5. Pharmaceuticals

- 7.1.1. Food and Beverages

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Flavoring Essences Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Food and Beverages

- 8.1.1.1. Dairy Products

- 8.1.1.2. Bakery and Confectionery

- 8.1.1.3. Processed Foods

- 8.1.1.4. Other Applications

- 8.1.2. Cosmetics and Personal Care

- 8.1.3. Fragrance Industry

- 8.1.4. Flavor Industry

- 8.1.5. Pharmaceuticals

- 8.1.1. Food and Beverages

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. South America Flavoring Essences Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Food and Beverages

- 9.1.1.1. Dairy Products

- 9.1.1.2. Bakery and Confectionery

- 9.1.1.3. Processed Foods

- 9.1.1.4. Other Applications

- 9.1.2. Cosmetics and Personal Care

- 9.1.3. Fragrance Industry

- 9.1.4. Flavor Industry

- 9.1.5. Pharmaceuticals

- 9.1.1. Food and Beverages

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East and Africa Flavoring Essences Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Food and Beverages

- 10.1.1.1. Dairy Products

- 10.1.1.2. Bakery and Confectionery

- 10.1.1.3. Processed Foods

- 10.1.1.4. Other Applications

- 10.1.2. Cosmetics and Personal Care

- 10.1.3. Fragrance Industry

- 10.1.4. Flavor Industry

- 10.1.5. Pharmaceuticals

- 10.1.1. Food and Beverages

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Privi Speciality Chemicals Limited

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Treatt PLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Dohler GmbH

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Carbery Group (Synergy Flavors)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 DSM-Firmenich

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Symega Food Ingredients Limited

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 S H Kelkar & Co (Keva)

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Amrut International

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Flavor Essence

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Leela Organic Herba

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Privi Speciality Chemicals Limited

List of Figures

- Figure 1: Global Flavoring Essences Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Flavoring Essences Market Volume Breakdown (Million, %) by Region 2025 & 2033

- Figure 3: North America Flavoring Essences Market Revenue (Million), by Application 2025 & 2033

- Figure 4: North America Flavoring Essences Market Volume (Million), by Application 2025 & 2033

- Figure 5: North America Flavoring Essences Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Flavoring Essences Market Volume Share (%), by Application 2025 & 2033

- Figure 7: North America Flavoring Essences Market Revenue (Million), by Country 2025 & 2033

- Figure 8: North America Flavoring Essences Market Volume (Million), by Country 2025 & 2033

- Figure 9: North America Flavoring Essences Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America Flavoring Essences Market Volume Share (%), by Country 2025 & 2033

- Figure 11: Europe Flavoring Essences Market Revenue (Million), by Application 2025 & 2033

- Figure 12: Europe Flavoring Essences Market Volume (Million), by Application 2025 & 2033

- Figure 13: Europe Flavoring Essences Market Revenue Share (%), by Application 2025 & 2033

- Figure 14: Europe Flavoring Essences Market Volume Share (%), by Application 2025 & 2033

- Figure 15: Europe Flavoring Essences Market Revenue (Million), by Country 2025 & 2033

- Figure 16: Europe Flavoring Essences Market Volume (Million), by Country 2025 & 2033

- Figure 17: Europe Flavoring Essences Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Flavoring Essences Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Asia Pacific Flavoring Essences Market Revenue (Million), by Application 2025 & 2033

- Figure 20: Asia Pacific Flavoring Essences Market Volume (Million), by Application 2025 & 2033

- Figure 21: Asia Pacific Flavoring Essences Market Revenue Share (%), by Application 2025 & 2033

- Figure 22: Asia Pacific Flavoring Essences Market Volume Share (%), by Application 2025 & 2033

- Figure 23: Asia Pacific Flavoring Essences Market Revenue (Million), by Country 2025 & 2033

- Figure 24: Asia Pacific Flavoring Essences Market Volume (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Flavoring Essences Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Flavoring Essences Market Volume Share (%), by Country 2025 & 2033

- Figure 27: South America Flavoring Essences Market Revenue (Million), by Application 2025 & 2033

- Figure 28: South America Flavoring Essences Market Volume (Million), by Application 2025 & 2033

- Figure 29: South America Flavoring Essences Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: South America Flavoring Essences Market Volume Share (%), by Application 2025 & 2033

- Figure 31: South America Flavoring Essences Market Revenue (Million), by Country 2025 & 2033

- Figure 32: South America Flavoring Essences Market Volume (Million), by Country 2025 & 2033

- Figure 33: South America Flavoring Essences Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America Flavoring Essences Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Middle East and Africa Flavoring Essences Market Revenue (Million), by Application 2025 & 2033

- Figure 36: Middle East and Africa Flavoring Essences Market Volume (Million), by Application 2025 & 2033

- Figure 37: Middle East and Africa Flavoring Essences Market Revenue Share (%), by Application 2025 & 2033

- Figure 38: Middle East and Africa Flavoring Essences Market Volume Share (%), by Application 2025 & 2033

- Figure 39: Middle East and Africa Flavoring Essences Market Revenue (Million), by Country 2025 & 2033

- Figure 40: Middle East and Africa Flavoring Essences Market Volume (Million), by Country 2025 & 2033

- Figure 41: Middle East and Africa Flavoring Essences Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Middle East and Africa Flavoring Essences Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Flavoring Essences Market Revenue Million Forecast, by Application 2020 & 2033

- Table 2: Global Flavoring Essences Market Volume Million Forecast, by Application 2020 & 2033

- Table 3: Global Flavoring Essences Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Flavoring Essences Market Volume Million Forecast, by Region 2020 & 2033

- Table 5: Global Flavoring Essences Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Global Flavoring Essences Market Volume Million Forecast, by Application 2020 & 2033

- Table 7: Global Flavoring Essences Market Revenue Million Forecast, by Country 2020 & 2033

- Table 8: Global Flavoring Essences Market Volume Million Forecast, by Country 2020 & 2033

- Table 9: United States Flavoring Essences Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: United States Flavoring Essences Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 11: Canada Flavoring Essences Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Canada Flavoring Essences Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 13: Mexico Flavoring Essences Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Mexico Flavoring Essences Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of North America Flavoring Essences Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Rest of North America Flavoring Essences Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 17: Global Flavoring Essences Market Revenue Million Forecast, by Application 2020 & 2033

- Table 18: Global Flavoring Essences Market Volume Million Forecast, by Application 2020 & 2033

- Table 19: Global Flavoring Essences Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: Global Flavoring Essences Market Volume Million Forecast, by Country 2020 & 2033

- Table 21: United Kingdom Flavoring Essences Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: United Kingdom Flavoring Essences Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 23: Germany Flavoring Essences Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Germany Flavoring Essences Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 25: France Flavoring Essences Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: France Flavoring Essences Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 27: Spain Flavoring Essences Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Spain Flavoring Essences Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 29: Italy Flavoring Essences Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Italy Flavoring Essences Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 31: Russia Flavoring Essences Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Russia Flavoring Essences Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 33: Rest of Europe Flavoring Essences Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Rest of Europe Flavoring Essences Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 35: Global Flavoring Essences Market Revenue Million Forecast, by Application 2020 & 2033

- Table 36: Global Flavoring Essences Market Volume Million Forecast, by Application 2020 & 2033

- Table 37: Global Flavoring Essences Market Revenue Million Forecast, by Country 2020 & 2033

- Table 38: Global Flavoring Essences Market Volume Million Forecast, by Country 2020 & 2033

- Table 39: China Flavoring Essences Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: China Flavoring Essences Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 41: Japan Flavoring Essences Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan Flavoring Essences Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 43: India Flavoring Essences Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: India Flavoring Essences Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 45: Australia Flavoring Essences Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Australia Flavoring Essences Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 47: Rest of Asia Pacific Flavoring Essences Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Rest of Asia Pacific Flavoring Essences Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 49: Global Flavoring Essences Market Revenue Million Forecast, by Application 2020 & 2033

- Table 50: Global Flavoring Essences Market Volume Million Forecast, by Application 2020 & 2033

- Table 51: Global Flavoring Essences Market Revenue Million Forecast, by Country 2020 & 2033

- Table 52: Global Flavoring Essences Market Volume Million Forecast, by Country 2020 & 2033

- Table 53: Brazil Flavoring Essences Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Brazil Flavoring Essences Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 55: Argentina Flavoring Essences Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: Argentina Flavoring Essences Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 57: Rest of South America Flavoring Essences Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: Rest of South America Flavoring Essences Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 59: Global Flavoring Essences Market Revenue Million Forecast, by Application 2020 & 2033

- Table 60: Global Flavoring Essences Market Volume Million Forecast, by Application 2020 & 2033

- Table 61: Global Flavoring Essences Market Revenue Million Forecast, by Country 2020 & 2033

- Table 62: Global Flavoring Essences Market Volume Million Forecast, by Country 2020 & 2033

- Table 63: South Africa Flavoring Essences Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: South Africa Flavoring Essences Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 65: Saudi Arabia Flavoring Essences Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 66: Saudi Arabia Flavoring Essences Market Volume (Million) Forecast, by Application 2020 & 2033

- Table 67: Rest of Middle East and Africa Flavoring Essences Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 68: Rest of Middle East and Africa Flavoring Essences Market Volume (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Flavoring Essences Market?

The projected CAGR is approximately 6.79%.

2. Which companies are prominent players in the Flavoring Essences Market?

Key companies in the market include Privi Speciality Chemicals Limited, Treatt PLC, Dohler GmbH, Carbery Group (Synergy Flavors), DSM-Firmenich, Symega Food Ingredients Limited, S H Kelkar & Co (Keva), Amrut International, Flavor Essence, Leela Organic Herba.

3. What are the main segments of the Flavoring Essences Market?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 308.73 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Applications in Non-food Industries; Rising Demand for Clean-label Flavoring Essence Ingredients.

6. What are the notable trends driving market growth?

Growing Popularity of Clean-label Flavoring Essences in the Food and Beverage Industry Driving Market Growth.

7. Are there any restraints impacting market growth?

Increasing Applications in Non-food Industries; Rising Demand for Clean-label Flavoring Essence Ingredients.

8. Can you provide examples of recent developments in the market?

May 2024: Döhler GmBH opened its new production site in South Africa for the development of compounds, emulsions, powdered and liquid flavor ingredients, which is set to significantly bolster its juice concentrate processing capacity. As per the company, this expansion will grant its customers direct access to Döhler's full compound portfolio in the country, underscoring the company's dedication to leading the regional food, beverage, and life science industries.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Flavoring Essences Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Flavoring Essences Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Flavoring Essences Market?

To stay informed about further developments, trends, and reports in the Flavoring Essences Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence