Key Insights

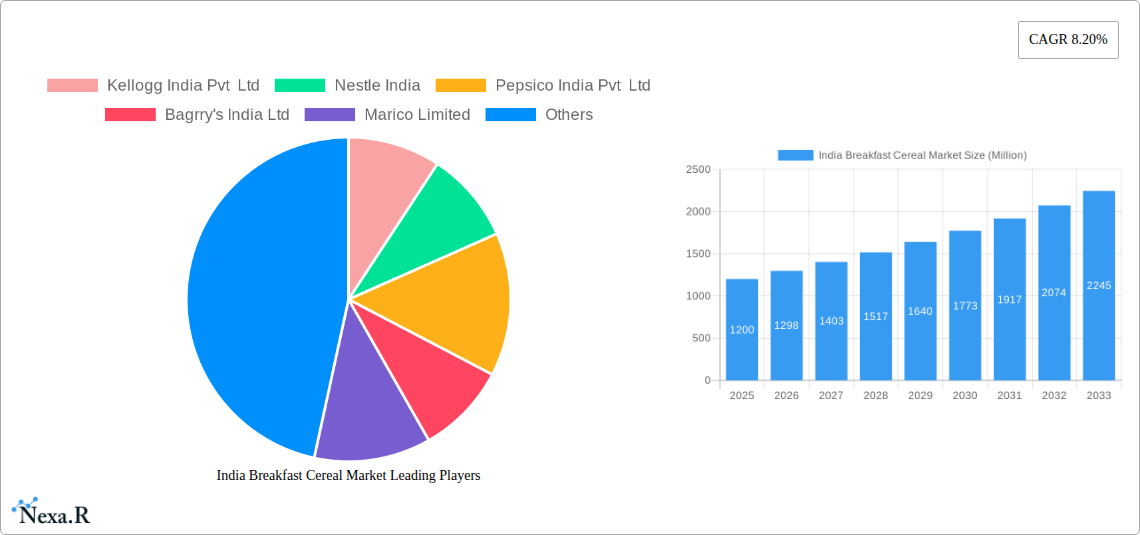

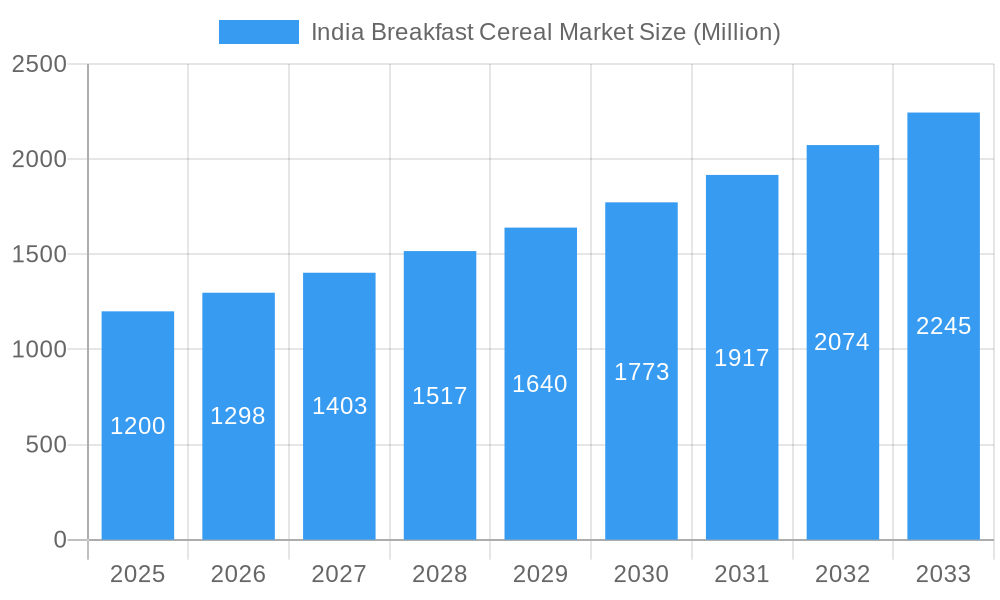

India's breakfast cereal market is set for substantial growth, with a current market size of 5.1 billion in the base year 2024, and projected to expand at a Compound Annual Growth Rate (CAGR) of 7.97%. This expansion is driven by heightened consumer focus on health and wellness, increasing disposable incomes, and a growing young demographic. The demand for convenient and nutritious breakfast solutions is rising due to increasingly busy lifestyles. Ready-to-eat cereals are particularly popular for their ease of preparation and diverse flavor profiles. The evolving retail sector, including the growth of convenience stores and online sales, is improving product accessibility in urban and semi-urban areas. Leading companies like Kellogg India, Nestle India, and Pepsico India are actively innovating their product offerings to meet market demands.

India Breakfast Cereal Market Market Size (In Billion)

Consumer preferences are shifting towards healthier ingredients such as whole grains, lower sugar content, and fortified cereals, creating opportunities for manufacturers. While strong growth is anticipated, challenges include competition from traditional Indian breakfast options and price sensitivity in some consumer segments. However, urbanization, increased media reach, and the adoption of Western dietary habits among younger generations indicate a positive market outlook. Expanding distribution networks, especially in Tier 2 and Tier 3 cities, will be vital for realizing the market's full potential and ensuring sustained growth.

India Breakfast Cereal Market Company Market Share

India Breakfast Cereal Market: Growth, Trends, and Competitive Landscape 2025-2033

This comprehensive report offers an in-depth analysis of the India breakfast cereal market, meticulously examining its dynamics, growth trajectories, and competitive environment. Focusing on the study period of 2019–2033, with 2025 as the base and estimated year, and a robust forecast period of 2025–2033, this report provides critical insights for industry stakeholders. We delve into the evolution of the Indian cereal market size, breakfast cereal consumption in India, and the burgeoning demand for healthy breakfast options. The report quantifies market evolution, adoption rates, and technological disruptions, presenting actionable intelligence for strategic decision-making.

The report segments the market by Product Type into Ready-to-cook Cereals and Ready-to-eat Cereals, and by Distribution Channel into Convenience Stores, Supermarkets/Hypermarkets, Specialty Stores, Independent Retailers, Online Retail Stores, and Other Distribution Channels. We explore the impact of parent and child markets, understanding how broader food industry trends influence the breakfast cereal segment. With a focus on high-traffic keywords such as India cereal market share, breakfast cereal brands India, and healthy cereals India, this report is optimized for maximum search engine visibility and aims to engage industry professionals seeking a detailed understanding of this dynamic sector. All values are presented in Million units to ensure comparability and precision.

India Breakfast Cereal Market Market Dynamics & Structure

The India breakfast cereal market is characterized by a dynamic interplay of established players and emerging innovators, reflecting increasing market concentration driven by brand loyalty and economies of scale. Technological innovation, particularly in product formulation and packaging, is a significant driver, with companies investing in healthier ingredients and convenient formats to cater to evolving consumer preferences. Regulatory frameworks, while supportive of food safety standards, can present challenges in terms of compliance and new product approvals. Competitive product substitutes, ranging from traditional Indian breakfast items to other convenient food options, exert constant pressure, necessitating continuous product differentiation and marketing efforts. End-user demographics play a crucial role, with a growing young population and rising disposable incomes fueling demand for convenience and health-conscious food choices. Mergers and acquisitions (M&A) trends, though less pronounced than in mature markets, are expected to shape the competitive landscape as larger players seek to expand their portfolios and market reach.

- Market Concentration: Dominated by a few key players with significant brand recognition, but with space for niche players.

- Technological Innovation: Focus on health ingredients (e.g., multigrain, protein), reduced sugar, and sustainable packaging.

- Regulatory Frameworks: Strict adherence to FSSAI guidelines for food safety and labeling.

- Competitive Product Substitutes: Traditional Indian breakfast (dosa, idli, poha), oats, and other quick meal options.

- End-User Demographics: Young urban population, working professionals, and health-conscious consumers are key targets.

- M&A Trends: Potential for consolidation as larger companies acquire smaller, innovative brands.

India Breakfast Cereal Market Growth Trends & Insights

The India breakfast cereal market is poised for significant expansion, driven by a confluence of socio-economic and lifestyle shifts. The Indian cereal market size is projected to witness robust growth, fueled by an increasing awareness of health and nutrition among consumers, particularly in urban and semi-urban areas. Adoption rates for breakfast cereals are steadily rising as busy lifestyles demand convenient and nutritious meal solutions. The market's evolution is marked by a transition from traditional breakfast habits to Westernized eating patterns, where cereals are increasingly perceived as a healthy and quick start to the day. Technological disruptions are evident in the innovation of diverse product formulations, including ready-to-eat cereals and ready-to-cook cereals, catering to varied consumer preferences.

Consumer behavior shifts are a critical determinant of market growth. There is a discernible move towards healthy cereals India, with a preference for products enriched with essential vitamins, minerals, and protein. Brands are responding by launching fortified cereals and options with natural ingredients. The rising disposable incomes and the increasing presence of organized retail formats, such as supermarkets and hypermarkets, further facilitate market penetration. The breakfast cereal consumption in India is also being influenced by digital marketing campaigns and the growing popularity of online retail stores, making these products more accessible to a wider audience. The forecast period anticipates a sustained CAGR as these trends mature and new consumer segments are tapped. For instance, the ready-to-eat cereal segment is expected to lead, driven by convenience, while the ready-to-cook cereal segment will cater to those who prefer a warm breakfast. The increasing availability of premium and specialized cereals will further accelerate market penetration across different income groups.

Dominant Regions, Countries, or Segments in India Breakfast Cereal Market

The India breakfast cereal market's dominance is primarily attributed to the North India region, driven by its large population, increasing urbanization, and a growing propensity for adopting modern dietary habits. This region exhibits the highest market share for breakfast cereals due to a combination of factors including a relatively higher disposable income in key metropolitan areas and the presence of a young demographic that is more receptive to global food trends. The accessibility of supermarkets/hypermarkets and the rapidly expanding online retail stores in major North Indian cities further bolster sales and distribution efficiency, making breakfast cereals readily available to a wider consumer base.

Within the Product Type segmentation, Ready-to-eat Cereals emerge as the dominant segment. This is primarily due to the unparalleled convenience they offer to busy urban dwellers, working professionals, and students who seek quick and hassle-free breakfast solutions. The variety of flavors, textures, and nutritional profiles available in ready-to-eat cereals further appeals to a broad spectrum of consumers, from children to adults.

- North India: Leads due to population density, urbanization, and higher disposable incomes in key cities like Delhi, Chandigarh, and Lucknow.

- Ready-to-eat Cereals: Dominant due to convenience, diverse product offerings, and strong brand marketing.

- Supermarkets/Hypermarkets & Online Retail Stores: Key distribution channels driving accessibility and sales volume, especially in urban centers.

- Economic Policies: Government initiatives promoting food processing and retail infrastructure indirectly support market growth.

- Infrastructure Development: Improved logistics and cold chain facilities in major urban centers enhance product reach and shelf life.

- Consumer Lifestyle: The fast-paced urban lifestyle and increasing female workforce participation create a strong demand for convenient breakfast options.

India Breakfast Cereal Market Product Landscape

The India breakfast cereal market is characterized by a dynamic product landscape driven by continuous innovation and a keen understanding of consumer needs. Manufacturers are focusing on developing diverse product lines, encompassing both Ready-to-cook Cereals and Ready-to-eat Cereals. Unique selling propositions often revolve around health benefits, such as high protein content, added vitamins, fiber-rich formulations, and reduced sugar. Technological advancements in processing and ingredient sourcing allow for the creation of innovative textures and appealing flavors that resonate with Indian palates. Performance metrics are increasingly benchmarked against health indicators and consumer satisfaction.

Key Drivers, Barriers & Challenges in India Breakfast Cereal Market

The India breakfast cereal market is propelled by several key drivers. The rising disposable incomes and increasing health consciousness among urban Indian consumers are paramount, creating a demand for convenient and nutritious breakfast options. The growing working population, especially women, seeks quick meal solutions. Furthermore, aggressive marketing by leading brands and the expansion of organized retail, including online platforms, are significantly boosting accessibility and adoption rates. Technological advancements in product formulation, leading to healthier and tastier cereals, also act as significant catalysts.

However, the market faces notable barriers and challenges. The deep-rooted tradition of consuming conventional Indian breakfasts presents a significant cultural hurdle. Price sensitivity among a large segment of the population remains a concern, as cereals are often perceived as more expensive than traditional alternatives. Supply chain inefficiencies and the need for effective cold chain management for certain perishable ingredients can also pose challenges. Intense competition from established brands and the emergence of private labels further intensifies the competitive pressure. Regulatory compliance and the need for continuous product innovation to stay ahead of evolving consumer preferences add to the complexity of the market.

Emerging Opportunities in India Breakfast Cereal Market

Emerging opportunities in the India breakfast cereal market lie in catering to specific dietary needs and exploring untapped rural markets. The growing demand for plant-based and vegan-friendly cereal options presents a significant niche. Innovations in gut health-focused cereals, incorporating probiotics and prebiotics, are poised for strong uptake. Furthermore, a strategic focus on smaller pack sizes and value-for-money offerings can unlock the potential of semi-urban and rural populations, where penetration is currently lower. The development of culturally relevant flavors and the integration of local ingredients can further enhance product appeal and market acceptance.

Growth Accelerators in the India Breakfast Cereal Market Industry

The India breakfast cereal market is experiencing substantial growth acceleration driven by several key factors. Technological breakthroughs in food processing allow for the creation of cereals with enhanced nutritional profiles and extended shelf life. Strategic partnerships between cereal manufacturers and health and wellness influencers are effectively creating awareness and building consumer trust. Furthermore, market expansion strategies focusing on tier 2 and tier 3 cities, coupled with aggressive digital marketing campaigns, are widening the consumer base. The increasing availability of cereals catering to specific health needs, such as high protein or gluten-free options, is also a significant growth accelerator, attracting a health-conscious segment of the population.

Key Players Shaping the India Breakfast Cereal Market Market

- Kellogg India Pvt Ltd

- Nestle India

- Pepsico India Pvt Ltd

- Bagrry's India Ltd

- Marico Limited

- Patanjali Ayurved Limited

- Shanti's

- General Mills

- Future Consumer Enterprise Ltd

- B&G Foods

Notable Milestones in India Breakfast Cereal Market Sector

- October 2022: Kellogg's India launched 'Kellogg's Pro Muesli', a high protein, 100% plant-based muesli. This product launch emphasizes the growing demand for protein-rich and plant-based food options.

- September 2022: Quacker Oats, a Pepsico brand, introduced Quacker Oats Muesli with added fruits, nuts, and seeds in two flavors: Fruit & Nut and Berries & Seeds. This move highlights the trend of fortified and flavor-enhanced muesli offerings.

- August 2021: Kellogg's launched Froot Loops, a multigrain cereal made from corn, wheat, and oats, targeting the children's segment with a popular international brand.

In-Depth India Breakfast Cereal Market Market Outlook

The India breakfast cereal market outlook is exceptionally promising, driven by a sustained surge in health consciousness and the escalating demand for convenient food solutions. The market is poised to benefit from continued innovation in product development, focusing on healthier ingredients, reduced sugar content, and enhanced nutritional value. The increasing penetration of organized retail and the robust growth of e-commerce platforms will further amplify product accessibility across diverse geographies. Strategic collaborations and aggressive marketing campaigns will play a crucial role in shaping consumer perceptions and driving adoption rates. The diversification of product portfolios to include offerings tailored for specific dietary needs and age groups will unlock new consumer segments and solidify the market's upward trajectory.

India Breakfast Cereal Market Segmentation

-

1. Product Type

- 1.1. Ready-to-cook Cereals

- 1.2. Ready-to-eat Cereals

-

2. Distribution Channel

- 2.1. Convenience Stores

- 2.2. Supermarkets/Hypermarkets

- 2.3. Specialty Stores

- 2.4. Independent Retailers

- 2.5. Online Retail Stores

- 2.6. Other Distribution Channels

India Breakfast Cereal Market Segmentation By Geography

- 1. India

India Breakfast Cereal Market Regional Market Share

Geographic Coverage of India Breakfast Cereal Market

India Breakfast Cereal Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.97% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increasing Growth of Hot Cereal Meals

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Breakfast Cereal Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Ready-to-cook Cereals

- 5.1.2. Ready-to-eat Cereals

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Convenience Stores

- 5.2.2. Supermarkets/Hypermarkets

- 5.2.3. Specialty Stores

- 5.2.4. Independent Retailers

- 5.2.5. Online Retail Stores

- 5.2.6. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Kellogg India Pvt Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Nestle India

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Pepsico India Pvt Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Bagrry's India Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Marico Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Patanjali Ayurved Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Shanti's

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 General Mills

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Future Consumer Enterprise Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 B&G Foods*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Kellogg India Pvt Ltd

List of Figures

- Figure 1: India Breakfast Cereal Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: India Breakfast Cereal Market Share (%) by Company 2025

List of Tables

- Table 1: India Breakfast Cereal Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: India Breakfast Cereal Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: India Breakfast Cereal Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: India Breakfast Cereal Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 5: India Breakfast Cereal Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: India Breakfast Cereal Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Breakfast Cereal Market?

The projected CAGR is approximately 7.97%.

2. Which companies are prominent players in the India Breakfast Cereal Market?

Key companies in the market include Kellogg India Pvt Ltd, Nestle India, Pepsico India Pvt Ltd, Bagrry's India Ltd, Marico Limited, Patanjali Ayurved Limited, Shanti's, General Mills, Future Consumer Enterprise Ltd, B&G Foods*List Not Exhaustive.

3. What are the main segments of the India Breakfast Cereal Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.1 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increasing Growth of Hot Cereal Meals.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

October 2022: Kellogg's India launched 'Kellogg's Pro Muesli', a high protein muesli that is 100% plant-based. Kellogg's Pro Muesli with 200 ml milk provides 29% of an adult's (sedentary woman's) protein requirement for the day.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Breakfast Cereal Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Breakfast Cereal Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Breakfast Cereal Market?

To stay informed about further developments, trends, and reports in the India Breakfast Cereal Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence