Key Insights

The German food preservatives market is projected for robust expansion, expected to reach €3.4 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 6.8% forecast through 2033. This growth is driven by escalating consumer demand for extended shelf-life food products, influenced by modern lifestyles and a preference for convenience. Stringent German food safety regulations also mandate effective food preservation, safeguarding against spoilage and contamination. The increasing consumption of processed foods, including bakery, dairy, and confectionery, further boosts demand for both natural and synthetic preservatives. Key contributing segments include meat, poultry, and seafood, alongside sauces and salad mixes, which are highly susceptible to degradation.

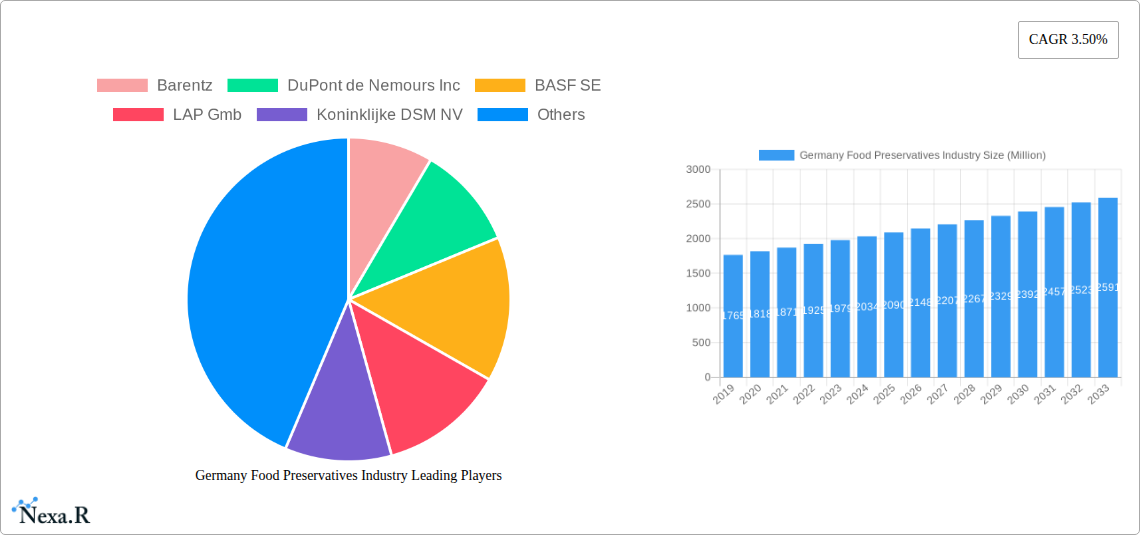

Germany Food Preservatives Industry Market Size (In Billion)

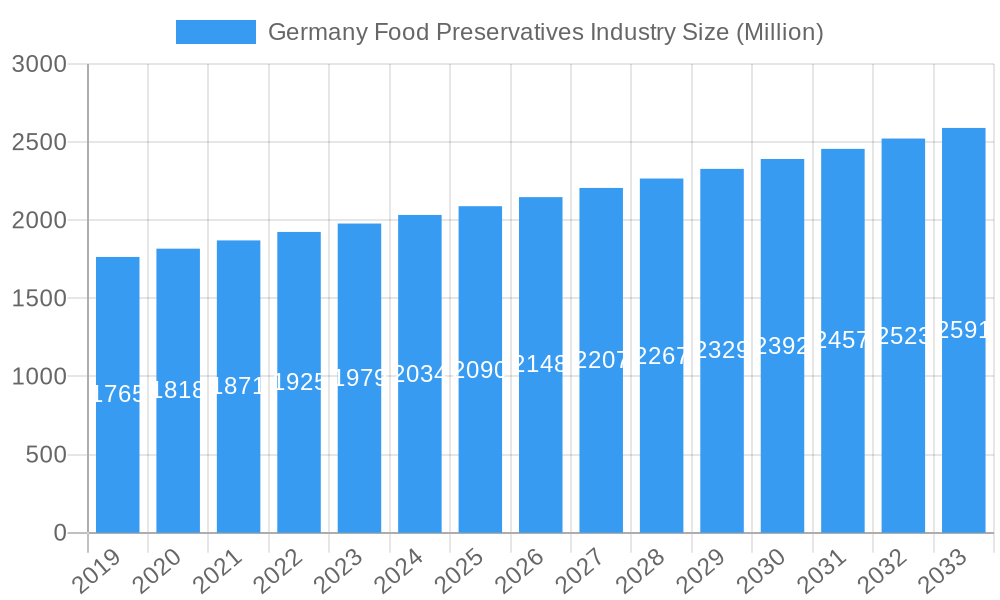

The German food preservatives market features prominent companies such as Barentz, DuPont de Nemours Inc., BASF SE, LAP GmbH, Koninklijke DSM NV, and Corbion NV. These players are actively innovating to meet evolving consumer preferences for cleaner labels and natural ingredients. While synthetic preservatives have historically led, a notable shift towards natural alternatives is evident, driven by consumer health consciousness. However, cost-effectiveness and performance remain crucial, ensuring synthetic preservatives retain a substantial market share. Potential challenges include volatile raw material costs and heightened consumer scrutiny of artificial additives. Nevertheless, the persistent demand for safe, stable, and convenient food, coupled with continuous product innovation, positions the German food preservatives market for sustained growth and development.

Germany Food Preservatives Industry Company Market Share

Germany Food Preservatives Industry Report: Market Dynamics, Growth Trends, and Future Outlook (2019-2033)

Unlock critical insights into the German food preservatives market with this comprehensive report. Spanning from 2019 to 2033, with a base and estimated year of 2025, this analysis delves into market dynamics, growth trajectories, dominant segments, product innovations, key players, and emerging opportunities within this vital sector. Utilizing high-traffic SEO keywords and a structured format, this report is designed to maximize visibility and provide actionable intelligence for industry professionals.

Germany Food Preservatives Industry Market Dynamics & Structure

The Germany food preservatives market exhibits a moderate concentration, with key players like Barentz, DuPont de Nemours Inc., BASF SE, LAP GmbH, Koninklijke DSM NV, and Corbion NV holding significant influence. Technological innovation is a primary driver, fueled by the continuous pursuit of novel preservation methods that enhance shelf-life, maintain nutritional value, and meet evolving consumer demands for cleaner labels. Regulatory frameworks, particularly those from the European Union and German authorities, play a crucial role in shaping product development and market access, with stringent approvals required for new preservatives. Competitive product substitutes, such as modified atmosphere packaging and advanced processing techniques, present a dynamic competitive landscape. End-user demographics, characterized by an aging population and increasing demand for convenience foods, indirectly influence the preservative market by driving the need for extended shelf-life solutions. Mergers and acquisitions (M&A) are notable trends, as larger companies seek to consolidate market share, acquire innovative technologies, or expand their product portfolios. For instance, M&A activity in the broader food ingredients sector has seen an estimated 15-20 deal volumes annually over the historical period, indicating strategic consolidation. Innovation barriers include the cost and time associated with regulatory approvals and the challenge of developing natural preservatives that match the efficacy of synthetic alternatives.

Germany Food Preservatives Industry Growth Trends & Insights

The Germany food preservatives market is poised for steady growth, projected to witness a Compound Annual Growth Rate (CAGR) of 5.2% between 2025 and 2033. This expansion is underpinned by a confluence of factors including escalating consumer awareness regarding food safety and quality, a growing processed food industry, and sustained demand for extended shelf-life products. The market size, estimated at $X,XXX million units in the base year 2025, is expected to reach $Y,YYY million units by 2033. Adoption rates for both natural and synthetic preservatives are evolving. While synthetic preservatives continue to dominate in terms of market share due to their cost-effectiveness and proven efficacy, there is a discernible upward trend in the adoption of natural alternatives. This shift is propelled by consumer preference for "clean label" products and increasing concerns about the potential health implications of certain synthetic compounds. Technological disruptions, such as advancements in fermentation-based preservatives and the development of novel antioxidant compounds derived from plant extracts, are reshaping the market. Consumer behavior shifts are pivotal, with a growing emphasis on health and wellness leading to a demand for minimally processed foods that require effective, yet perceived as safe, preservation methods. The market penetration of specialized preservatives for niche applications, like plant-based meat alternatives and ready-to-eat meals, is also on the rise. The increasing disposable income and a fast-paced lifestyle contribute to the higher consumption of convenience foods, thereby bolstering the demand for food preservatives that ensure product integrity and safety throughout the supply chain. Furthermore, the robust German food processing sector, a significant exporter, necessitates the use of high-performance preservatives to maintain product quality during long-distance transportation.

Dominant Regions, Countries, or Segments in Germany Food Preservatives Industry

Within the diverse landscape of the Germany food preservatives industry, the Beverage application segment is a dominant force, contributing an estimated 25% to the overall market value in 2025. This leadership is driven by the immense volume of production in the German beverage sector, encompassing soft drinks, juices, alcoholic beverages, and dairy-based drinks, all of which require effective preservation to prevent spoilage and maintain product quality and safety. The Meat, Poultry, and Seafood segment also holds substantial market share, estimated at 22%, due to the inherent perishability of these products and the stringent safety regulations governing their processing and distribution.

Key Drivers for Dominance in the Beverage Segment:

- High Consumption Volume: Germany boasts a large and consistent consumer base for a wide array of beverages, driving significant production volumes.

- Shelf-Life Requirements: Extended shelf-life is crucial for distribution and retail, making effective preservatives indispensable.

- Product Variety: The diverse range of beverages, from carbonated drinks to artisanal juices, each has specific preservation needs.

- Regulatory Compliance: Strict food safety regulations necessitate the use of approved and effective preservatives.

Key Drivers for Dominance in the Meat, Poultry, and Seafood Segment:

- Perishability: These products are highly susceptible to microbial growth and spoilage, demanding robust preservation strategies.

- Food Safety Concerns: Public health and safety are paramount, driving the use of preservatives to inhibit pathogen development.

- Extensive Supply Chains: The need to transport these products across regions and internationally requires extended shelf-life solutions.

- Consumer Demand for Convenience: Ready-to-eat and pre-packaged meat, poultry, and seafood products rely heavily on preservatives.

While Synthetic preservatives currently hold a larger market share due to their established efficacy and cost-effectiveness, the Natural preservatives segment is experiencing significant growth, projected at a CAGR of 6.5% from 2025 to 2033. This growth is fueled by rising consumer preference for "clean label" products and a heightened awareness of health and environmental concerns. The application segment of Dairy is another significant contributor, valued at approximately 18% of the market in 2025. The long shelf-life requirements for milk, cheese, yogurt, and other dairy products, coupled with their susceptibility to spoilage, make preservatives a vital component in their production. The Bakery segment, representing about 15% of the market, also relies heavily on preservatives to prevent mold and staling, ensuring product freshness and extending retail availability. The German economy's strong industrial base and export orientation further amplify the demand for preservatives that guarantee product stability throughout complex global supply chains.

Germany Food Preservatives Industry Product Landscape

The Germany food preservatives market is characterized by a dynamic product landscape featuring both established synthetic solutions and a rapidly evolving array of natural alternatives. Innovation is centered on enhancing efficacy while meeting stringent regulatory requirements and consumer demand for healthier options. Key product developments include the introduction of novel antioxidant blends derived from rosemary and green tea extracts, offering superior shelf-life extension for meat and dairy products. Advances in fermentation technology are yielding bio-based preservatives with antimicrobial properties. Synthetic preservatives, such as sorbates and benzoates, continue to be optimized for cost-effectiveness and broad-spectrum antimicrobial activity in applications like beverages and bakery goods. Performance metrics are increasingly scrutinized, with a focus on minimum inhibitory concentrations (MICs) and impact on sensory attributes. Unique selling propositions increasingly revolve around "natural origin," "clean label compliance," and "reduced allergenicity." Technological advancements are also enabling encapsulated preservative systems for controlled release, further optimizing product longevity and quality.

Key Drivers, Barriers & Challenges in Germany Food Preservatives Industry

Key Drivers:

- Growing Demand for Shelf-Stable Foods: The increasing consumption of processed and convenience foods drives the need for effective preservation.

- Stringent Food Safety Regulations: Robust regulatory frameworks necessitate the use of approved preservatives to ensure consumer safety.

- Technological Advancements: Innovations in natural preservatives and improved delivery systems are expanding market potential.

- Consumer Preference for "Clean Labels": The rising demand for minimally processed foods with recognizable ingredients is propelling the growth of natural preservatives.

Key Barriers & Challenges:

- Regulatory Hurdles: The complex and time-consuming approval process for new preservatives, especially natural ones, poses a significant challenge.

- Cost Competitiveness of Natural Preservatives: Natural alternatives often come at a higher production cost compared to synthetic options, impacting price sensitivity.

- Consumer Perception of Preservatives: Negative consumer perceptions surrounding the use of artificial preservatives can lead to market resistance.

- Supply Chain Disruptions: Global supply chain volatility can impact the availability and cost of raw materials for preservative production. Estimated impact on raw material cost: 5-10% increase during disruptions.

- Competition from Alternative Preservation Methods: Advanced processing techniques and modified atmosphere packaging offer alternatives to traditional chemical preservation.

Emerging Opportunities in Germany Food Preservatives Industry

Emerging opportunities in the Germany food preservatives industry lie in the burgeoning demand for plant-based and alternative protein products, which require tailored preservation solutions to maintain their unique textures and shelf-life. The growing popularity of fermented foods and beverages presents avenues for novel, bio-based preservative ingredients. Furthermore, the expansion of ready-to-eat meals and meal kits catering to busy lifestyles offers significant growth potential. A key opportunity also lies in the development of preservatives with added nutritional benefits, aligning with the health and wellness trend. The increasing focus on sustainable sourcing and production of food ingredients also opens doors for bio-friendly preservatives.

Growth Accelerators in the Germany Food Preservatives Industry Industry

Growth accelerators for the Germany food preservatives industry are multi-faceted. Technological breakthroughs in identifying and isolating novel natural antimicrobial compounds from food by-products and plant sources are a major catalyst. Strategic partnerships between ingredient manufacturers, food processors, and research institutions are fostering collaborative innovation and accelerating product development cycles. Market expansion strategies, particularly focusing on export markets with growing demand for safe and shelf-stable food products, are also crucial. The increasing investment in research and development (R&D) by key players, aiming to create next-generation preservatives that offer enhanced functionality and consumer appeal, is another significant growth driver.

Key Players Shaping the Germany Food Preservatives Industry Market

- Barentz

- DuPont de Nemours Inc.

- BASF SE

- LAP GmbH

- Koninklijke DSM NV

- Corbion NV

Notable Milestones in Germany Food Preservatives Industry Sector

- 2022/08: BASF SE launched a new range of natural antimicrobial solutions for meat applications, addressing clean label trends.

- 2021/03: Corbion NV expanded its fermentation-based lactic acid production capacity, enhancing its offering of natural preservatives.

- 2020/11: DuPont de Nemours Inc. acquired FMC Corporation's global chewing gum business, integrating new preservation technologies.

- 2019/07: Koninklijke DSM NV announced a strategic collaboration to develop novel plant-based preservation ingredients.

- 2019/01: European Union revised regulations on food additives, impacting the approval and use of certain synthetic preservatives.

In-Depth Germany Food Preservatives Industry Market Outlook

The future outlook for the Germany food preservatives industry is exceptionally promising, driven by persistent consumer demand for safe, convenient, and high-quality food products. Growth accelerators such as ongoing innovation in natural and bio-based preservatives, coupled with strategic collaborations, will continue to propel market expansion. The industry is expected to witness a greater integration of sustainability principles into preservative production and application. Addressing evolving consumer preferences for transparency and health-conscious food choices will remain a key strategic imperative. The market is anticipated to benefit from increased investment in R&D, leading to the development of more sophisticated and efficient preservation solutions across a wide array of food applications.

Germany Food Preservatives Industry Segmentation

-

1. Type

- 1.1. Natural

- 1.2. Synthetic

-

2. Application

- 2.1. Beverage

- 2.2. Dairy

- 2.3. Bakery

- 2.4. Confectionery

- 2.5. Meat, Poultry, and Seafood

- 2.6. Sauces and Salad Mixes

- 2.7. Other Applications

Germany Food Preservatives Industry Segmentation By Geography

- 1. Germany

Germany Food Preservatives Industry Regional Market Share

Geographic Coverage of Germany Food Preservatives Industry

Germany Food Preservatives Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Rising Awareness of the Health Benefits Associated with Collagen Consumption; Rising Sport and Fitness Trends Drives the Market Growth

- 3.3. Market Restrains

- 3.3.1. Concerns over the Source and Animal Welfare in Collagen Extraction Limit the Market Growth

- 3.4. Market Trends

- 3.4.1. Growing Market for Natural Food Preservatives in the Country

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Germany Food Preservatives Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Natural

- 5.1.2. Synthetic

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Beverage

- 5.2.2. Dairy

- 5.2.3. Bakery

- 5.2.4. Confectionery

- 5.2.5. Meat, Poultry, and Seafood

- 5.2.6. Sauces and Salad Mixes

- 5.2.7. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Barentz

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DuPont de Nemours Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 BASF SE

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 LAP Gmb

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Koninklijke DSM NV

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Corbion NV

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 Barentz

List of Figures

- Figure 1: Germany Food Preservatives Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Germany Food Preservatives Industry Share (%) by Company 2025

List of Tables

- Table 1: Germany Food Preservatives Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Germany Food Preservatives Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Germany Food Preservatives Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Germany Food Preservatives Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Germany Food Preservatives Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Germany Food Preservatives Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Germany Food Preservatives Industry?

The projected CAGR is approximately 6.8%.

2. Which companies are prominent players in the Germany Food Preservatives Industry?

Key companies in the market include Barentz, DuPont de Nemours Inc, BASF SE, LAP Gmb, Koninklijke DSM NV, Corbion NV.

3. What are the main segments of the Germany Food Preservatives Industry?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.4 billion as of 2022.

5. What are some drivers contributing to market growth?

The Rising Awareness of the Health Benefits Associated with Collagen Consumption; Rising Sport and Fitness Trends Drives the Market Growth.

6. What are the notable trends driving market growth?

Growing Market for Natural Food Preservatives in the Country.

7. Are there any restraints impacting market growth?

Concerns over the Source and Animal Welfare in Collagen Extraction Limit the Market Growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Germany Food Preservatives Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Germany Food Preservatives Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Germany Food Preservatives Industry?

To stay informed about further developments, trends, and reports in the Germany Food Preservatives Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence