Key Insights

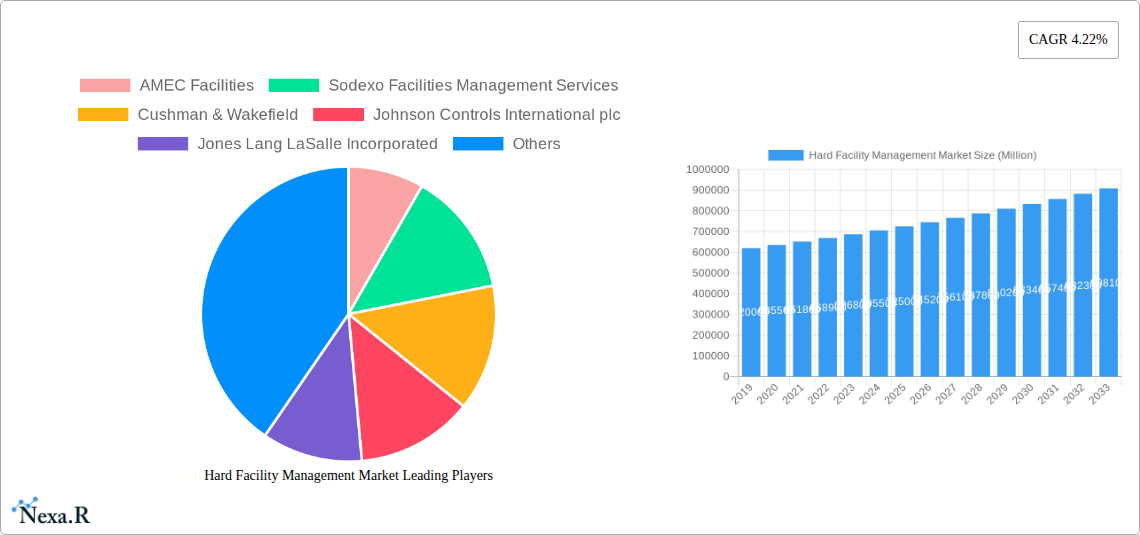

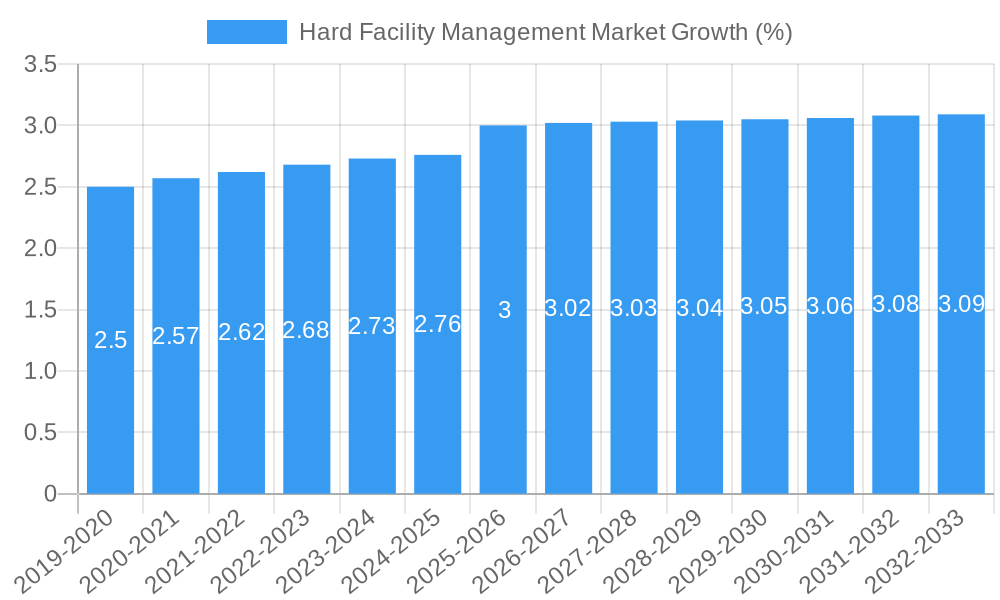

The Hard Facility Management Market is experiencing robust growth, projected to reach a substantial market size of approximately $785,000 million by 2025, expanding at a compelling Compound Annual Growth Rate (CAGR) of 4.22%. This upward trajectory is primarily fueled by increasing investments in sophisticated building technologies and the growing demand for essential maintenance, repair, and operational (MRO) services across diverse end-user industries. The emphasis on maintaining asset longevity, operational efficiency, and regulatory compliance is a significant driver. Key segments like MEP (Mechanical, Electrical, and Plumbing) services and Enterprise Asset Management are leading this expansion, reflecting the critical nature of these functions in ensuring smooth business operations and optimizing facility performance. The market's expansion is further supported by the growing trend of outsourcing non-core facility management functions by businesses seeking to reduce operational costs and enhance service quality.

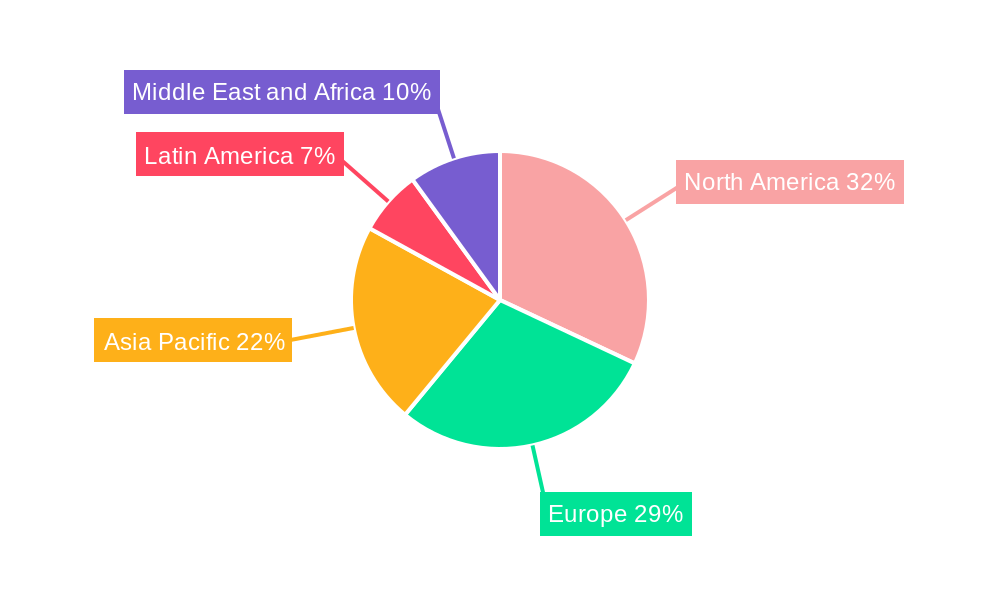

Looking ahead, the forecast period from 2025 to 2033 anticipates continued expansion, solidifying the market's importance in supporting modern infrastructure. Restraints such as the high cost of advanced technology implementation and the shortage of skilled labor in specialized MRO areas are being systematically addressed through training initiatives and technological advancements. The market landscape is characterized by the presence of major global players like Cushman & Wakefield, Johnson Controls International plc, and Jones Lang LaSalle Incorporated, who are actively engaged in strategic partnerships and acquisitions to broaden their service portfolios and geographical reach. North America and Europe currently represent the dominant regions, driven by mature economies and stringent facility management standards. However, the Asia Pacific region is emerging as a high-growth market, propelled by rapid urbanization, infrastructure development, and increasing adoption of integrated facility management solutions by both commercial and industrial sectors.

Comprehensive Report on the Global Hard Facility Management Market: Growth, Trends, and Future Outlook (2019-2033)

This in-depth report provides a definitive analysis of the global Hard Facility Management market, a critical sector supporting the operational efficiency and longevity of physical assets across diverse industries. We meticulously explore market dynamics, growth trajectories, regional dominance, product innovations, and key industry players, offering actionable insights for stakeholders. The report encompasses a comprehensive study period from 2019 to 2033, with a base and estimated year of 2025, and a forecast period from 2025 to 2033, utilizing historical data from 2019-2024. All values are presented in Million units.

Hard Facility Management Market Market Dynamics & Structure

The global Hard Facility Management market is characterized by a moderately concentrated structure, with a few key players holding significant market share, yet exhibiting increasing fragmentation due to the proliferation of specialized service providers and technological advancements. Technological innovation is a primary driver, with the integration of IoT, AI, and advanced analytics revolutionizing predictive maintenance, energy efficiency, and space utilization. Regulatory frameworks, particularly those concerning building safety, environmental standards, and labor practices, significantly influence operational strategies and service offerings. Competitive product substitutes are emerging, such as in-house management by large corporations and the rise of integrated digital platforms that streamline FM operations. End-user demographics are shifting, with a growing demand for sustainable, smart, and occupant-centric FM solutions across commercial, industrial, and institutional sectors. Mergers and Acquisitions (M&A) trends are notable, with larger entities acquiring niche service providers to expand their service portfolios and geographical reach, aiming for greater market penetration and economies of scale.

- Market Concentration: Dominated by a blend of large global providers and agile regional specialists.

- Technological Innovation Drivers: IoT for real-time monitoring, AI for predictive analytics, Building Information Modeling (BIM) for lifecycle management, and energy management systems.

- Regulatory Frameworks: Compliance with environmental regulations (e.g., emissions, waste management), health and safety standards, and building codes.

- Competitive Product Substitutes: Rise of self-performing companies, integrated facility management software, and specialized energy efficiency solutions.

- End-User Demographics: Increasing demand for integrated, sustainable, and technologically advanced FM services across all sectors.

- M&A Trends: Strategic acquisitions by major players to consolidate market share and enhance service offerings.

Hard Facility Management Market Growth Trends & Insights

The Hard Facility Management market is poised for substantial growth, driven by the increasing complexity of modern infrastructure and the growing recognition of its crucial role in operational efficiency, cost savings, and asset longevity. The market size is expected to witness a robust Compound Annual Growth Rate (CAGR) throughout the forecast period. Adoption rates for advanced FM technologies, such as Building Management Systems (BMS) and Computerized Maintenance Management Systems (CMMS), are accelerating as organizations prioritize proactive rather than reactive maintenance strategies. Technological disruptions, including the widespread deployment of the Internet of Things (IoT) for real-time asset monitoring and the integration of Artificial Intelligence (AI) for predictive maintenance, are transforming service delivery. These advancements enable more efficient resource allocation, reduced downtime, and enhanced occupant comfort. Consumer behavior shifts are also playing a pivotal role, with a growing emphasis on sustainability, smart building features, and a desire for seamless integration of services. This includes demand for energy-efficient operations, reduced environmental impact, and the creation of healthier, more productive workplaces. Market penetration is deepening across all end-user segments as organizations increasingly outsource their non-core FM functions to specialized providers who can offer expertise, economies of scale, and access to cutting-edge technologies. The evolving nature of work, including hybrid models, also necessitates flexible and adaptable facility management solutions that can optimize space utilization and enhance employee experience.

Dominant Regions, Countries, or Segments in Hard Facility Management Market

The Commercial end-user segment is currently the most dominant force driving growth in the global Hard Facility Management market. This dominance is fueled by the vast expanse of office buildings, retail spaces, and corporate headquarters that require continuous and sophisticated facility management to ensure operational continuity, employee well-being, and a positive customer experience. The increasing adoption of smart building technologies within commercial real estate, aimed at optimizing energy consumption, enhancing security, and improving space utilization, further propels demand for specialized hard FM services like MEP (Mechanical, Electrical, and Plumbing) and Enterprise Asset Management.

North America stands out as a leading region, propelled by its well-established commercial real estate sector, strong emphasis on technological innovation, and stringent regulatory frameworks that mandate efficient and sustainable building operations. The presence of major corporations and a high adoption rate of advanced FM solutions contribute significantly to its market leadership.

- Dominant Segment: Commercial End User:

- Key Drivers: Growing demand for smart buildings, energy efficiency mandates, and the need for seamless workplace operations.

- Market Share: Historically holding the largest share due to the extensive portfolio of commercial properties.

- Growth Potential: Continuous investment in upgrading existing commercial infrastructure and developing new, technologically advanced spaces.

- Leading Region: North America:

- Key Drivers: Advanced technological adoption, strong regulatory environment promoting sustainability, and a mature market for outsourced FM services.

- Economic Policies: Favorable policies supporting green building initiatives and infrastructure development.

- Infrastructure: Extensive and aging commercial and industrial infrastructure requiring ongoing maintenance and upgrades.

- Key Segment in Type: MEP (Mechanical, Electrical, and Plumbing):

- Drivers: Essential for the functioning of all buildings, with increasing complexity driven by smart technology integration and energy efficiency demands.

- Market Share: Consistently represents a significant portion of hard FM services due to its fundamental nature.

- Growth Potential: Driven by retrofitting older buildings with advanced MEP systems and the installation of sophisticated systems in new constructions.

Hard Facility Management Market Product Landscape

The Hard Facility Management market's product landscape is rapidly evolving, with a strong focus on integrated software solutions and advanced hardware for asset monitoring and control. Innovations in IoT-enabled sensors and predictive maintenance platforms are paramount, offering real-time data analytics for proactive issue identification and resolution. Building Information Modeling (BIM) integration is becoming standard, allowing for enhanced lifecycle management of assets from design to decommissioning. Performance metrics are increasingly focused on energy efficiency, reduced operational costs, and improved asset uptime. Unique selling propositions lie in the ability of solutions to offer seamless integration across various building systems, providing a holistic view of facility performance and facilitating data-driven decision-making. Technological advancements are prioritizing user-friendliness, scalability, and the ability to adapt to diverse building types and complexities.

Key Drivers, Barriers & Challenges in Hard Facility Management Market

Key Drivers:

- Technological Advancements: Integration of IoT, AI, and automation for predictive maintenance and operational efficiency.

- Cost Optimization: Growing pressure on organizations to reduce operational expenditures and improve asset lifespan.

- Sustainability Initiatives: Increasing regulatory and corporate focus on energy efficiency and environmental responsibility.

- Aging Infrastructure: Need for continuous maintenance and upgrades of existing building stock.

- Focus on Occupant Well-being: Demand for comfortable, safe, and productive working environments.

Key Barriers & Challenges:

- High Initial Investment: Significant upfront costs associated with implementing advanced FM technologies and solutions.

- Data Security and Privacy Concerns: Risks associated with collecting and managing sensitive building and operational data.

- Skilled Labor Shortage: Difficulty in finding and retaining qualified personnel with expertise in new technologies.

- Integration Complexity: Challenges in integrating disparate legacy systems with new FM platforms.

- Resistance to Change: Inertia within organizations to adopt new processes and technologies.

- Economic Downturns: Reduced capital expenditure and budget constraints can impact FM investments.

Emerging Opportunities in Hard Facility Management Market

Emerging opportunities in the Hard Facility Management market lie in the burgeoning demand for smart building solutions and the increasing adoption of sustainable practices. The rise of remote and hybrid work models presents an opportunity for FM providers to offer flexible space management and optimize building utilization. The integration of advanced data analytics and AI for hyper-personalized occupant experiences and energy management is a significant growth area. Furthermore, the focus on circular economy principles is driving opportunities in asset lifecycle management and waste reduction. Untapped markets in developing economies, coupled with the growing need for FM in renewable energy infrastructure, offer substantial expansion potential.

Growth Accelerators in the Hard Facility Management Market Industry

Long-term growth in the Hard Facility Management market is being significantly accelerated by disruptive technological breakthroughs, primarily in the realm of Artificial Intelligence and the Internet of Things (IoT). These technologies are enabling a paradigm shift from reactive maintenance to proactive and predictive strategies, leading to substantial cost savings and operational efficiencies for businesses. Strategic partnerships between technology providers, FM service providers, and building owners are fostering innovation and creating integrated solutions that cater to evolving industry needs. Furthermore, market expansion strategies, driven by globalization and the increasing demand for standardized FM services across diverse geographical locations, are fueling robust growth. The growing awareness and adoption of Environmental, Social, and Governance (ESG) principles by corporations are also compelling them to invest in sustainable and efficient facility management practices, acting as a powerful growth catalyst.

Key Players Shaping the Hard Facility Management Market Market

- AMEC Facilities

- Sodexo Facilities Management Services

- Cushman & Wakefield

- Johnson Controls International plc

- Jones Lang LaSalle Incorporated

- Mitie Group PLC

- Aramark Corporation

- CB Richard Ellis (CBRE)

- ISS A/S

- Compass Group PLC

Notable Milestones in Hard Facility Management Market Sector

- September 2022: Sodexo India announced the extension of its service avenues by incorporating employee-providing services into its portfolio, generating significant national and global publicity.

- August 2022: ISS AS, an international workplace experience and facilities management firm, revealed plans for substantial expansion of its India business over the next three years, aiming to increase its employee headcount by 25-30% to accommodate growing demand in both office and production-based sectors, driven by robust economic growth.

In-Depth Hard Facility Management Market Market Outlook

The In-Depth Hard Facility Management Market Outlook indicates a future characterized by pervasive technological integration and a heightened focus on sustainability. Growth accelerators such as AI-driven predictive maintenance and IoT-enabled smart building solutions will continue to redefine operational efficiency and asset management, leading to significant cost reductions and enhanced building performance. Strategic partnerships will be crucial in developing end-to-end integrated service offerings that cater to the complex needs of modern enterprises. The increasing global emphasis on ESG compliance will further propel the demand for green and sustainable FM practices. Market expansion strategies targeting emerging economies and specialized sectors, such as renewable energy infrastructure, will unlock new revenue streams. Overall, the future market potential is substantial, driven by an unwavering demand for optimized, resilient, and sustainable facility management solutions.

Hard Facility Management Market Segmentation

-

1. Type

- 1.1. MEP

- 1.2. Enterprise Asset Management

- 1.3. Other Hard FM Services

-

2. End User

- 2.1. Commercial

- 2.2. Institutional

- 2.3. Public/Infrastructure

- 2.4. Industrial

- 2.5. Other End Users

Hard Facility Management Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Hard Facility Management Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.22% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Robust Post-COVID Demand for HFM; Rise in Use of Enterprise Asset Management (EAM)

- 3.3. Market Restrains

- 3.3.1. Staff Shortage Across the Globe

- 3.4. Market Trends

- 3.4.1. Robust Post-COVID Demand for HFM

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Hard Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. MEP

- 5.1.2. Enterprise Asset Management

- 5.1.3. Other Hard FM Services

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Commercial

- 5.2.2. Institutional

- 5.2.3. Public/Infrastructure

- 5.2.4. Industrial

- 5.2.5. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Hard Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. MEP

- 6.1.2. Enterprise Asset Management

- 6.1.3. Other Hard FM Services

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Commercial

- 6.2.2. Institutional

- 6.2.3. Public/Infrastructure

- 6.2.4. Industrial

- 6.2.5. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Hard Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. MEP

- 7.1.2. Enterprise Asset Management

- 7.1.3. Other Hard FM Services

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Commercial

- 7.2.2. Institutional

- 7.2.3. Public/Infrastructure

- 7.2.4. Industrial

- 7.2.5. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Hard Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. MEP

- 8.1.2. Enterprise Asset Management

- 8.1.3. Other Hard FM Services

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Commercial

- 8.2.2. Institutional

- 8.2.3. Public/Infrastructure

- 8.2.4. Industrial

- 8.2.5. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Hard Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. MEP

- 9.1.2. Enterprise Asset Management

- 9.1.3. Other Hard FM Services

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Commercial

- 9.2.2. Institutional

- 9.2.3. Public/Infrastructure

- 9.2.4. Industrial

- 9.2.5. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Hard Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. MEP

- 10.1.2. Enterprise Asset Management

- 10.1.3. Other Hard FM Services

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Commercial

- 10.2.2. Institutional

- 10.2.3. Public/Infrastructure

- 10.2.4. Industrial

- 10.2.5. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. North America Hard Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 12. Europe Hard Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Spain

- 12.1.5 Italy

- 12.1.6 Spain

- 12.1.7 Belgium

- 12.1.8 Netherland

- 12.1.9 Nordics

- 12.1.10 Rest of Europe

- 13. Asia Pacific Hard Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 South Korea

- 13.1.5 Southeast Asia

- 13.1.6 Australia

- 13.1.7 Indonesia

- 13.1.8 Phillipes

- 13.1.9 Singapore

- 13.1.10 Thailandc

- 13.1.11 Rest of Asia Pacific

- 14. South America Hard Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Brazil

- 14.1.2 Argentina

- 14.1.3 Peru

- 14.1.4 Chile

- 14.1.5 Colombia

- 14.1.6 Ecuador

- 14.1.7 Venezuela

- 14.1.8 Rest of South America

- 15. North America Hard Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 United States

- 15.1.2 Canada

- 15.1.3 Mexico

- 16. MEA Hard Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1 United Arab Emirates

- 16.1.2 Saudi Arabia

- 16.1.3 South Africa

- 16.1.4 Rest of Middle East and Africa

- 17. Competitive Analysis

- 17.1. Global Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 AMEC Facilities

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 Sodexo Facilities Management Services

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 Cushman & Wakefield

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 Johnson Controls International plc

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 Jones Lang LaSalle Incorporated

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 Mitie Group PLC

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 Aramark Corporation

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 CB Richard Ellis (CBRE )

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 ISS A/S

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.10 Compass Group PLC

- 17.2.10.1. Overview

- 17.2.10.2. Products

- 17.2.10.3. SWOT Analysis

- 17.2.10.4. Recent Developments

- 17.2.10.5. Financials (Based on Availability)

- 17.2.1 AMEC Facilities

List of Figures

- Figure 1: Global Hard Facility Management Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Hard Facility Management Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Hard Facility Management Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Hard Facility Management Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Hard Facility Management Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Hard Facility Management Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Hard Facility Management Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Hard Facility Management Market Revenue (Million), by Country 2024 & 2032

- Figure 9: South America Hard Facility Management Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Hard Facility Management Market Revenue (Million), by Country 2024 & 2032

- Figure 11: North America Hard Facility Management Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: MEA Hard Facility Management Market Revenue (Million), by Country 2024 & 2032

- Figure 13: MEA Hard Facility Management Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Hard Facility Management Market Revenue (Million), by Type 2024 & 2032

- Figure 15: North America Hard Facility Management Market Revenue Share (%), by Type 2024 & 2032

- Figure 16: North America Hard Facility Management Market Revenue (Million), by End User 2024 & 2032

- Figure 17: North America Hard Facility Management Market Revenue Share (%), by End User 2024 & 2032

- Figure 18: North America Hard Facility Management Market Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Hard Facility Management Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Hard Facility Management Market Revenue (Million), by Type 2024 & 2032

- Figure 21: Europe Hard Facility Management Market Revenue Share (%), by Type 2024 & 2032

- Figure 22: Europe Hard Facility Management Market Revenue (Million), by End User 2024 & 2032

- Figure 23: Europe Hard Facility Management Market Revenue Share (%), by End User 2024 & 2032

- Figure 24: Europe Hard Facility Management Market Revenue (Million), by Country 2024 & 2032

- Figure 25: Europe Hard Facility Management Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Hard Facility Management Market Revenue (Million), by Type 2024 & 2032

- Figure 27: Asia Pacific Hard Facility Management Market Revenue Share (%), by Type 2024 & 2032

- Figure 28: Asia Pacific Hard Facility Management Market Revenue (Million), by End User 2024 & 2032

- Figure 29: Asia Pacific Hard Facility Management Market Revenue Share (%), by End User 2024 & 2032

- Figure 30: Asia Pacific Hard Facility Management Market Revenue (Million), by Country 2024 & 2032

- Figure 31: Asia Pacific Hard Facility Management Market Revenue Share (%), by Country 2024 & 2032

- Figure 32: Latin America Hard Facility Management Market Revenue (Million), by Type 2024 & 2032

- Figure 33: Latin America Hard Facility Management Market Revenue Share (%), by Type 2024 & 2032

- Figure 34: Latin America Hard Facility Management Market Revenue (Million), by End User 2024 & 2032

- Figure 35: Latin America Hard Facility Management Market Revenue Share (%), by End User 2024 & 2032

- Figure 36: Latin America Hard Facility Management Market Revenue (Million), by Country 2024 & 2032

- Figure 37: Latin America Hard Facility Management Market Revenue Share (%), by Country 2024 & 2032

- Figure 38: Middle East and Africa Hard Facility Management Market Revenue (Million), by Type 2024 & 2032

- Figure 39: Middle East and Africa Hard Facility Management Market Revenue Share (%), by Type 2024 & 2032

- Figure 40: Middle East and Africa Hard Facility Management Market Revenue (Million), by End User 2024 & 2032

- Figure 41: Middle East and Africa Hard Facility Management Market Revenue Share (%), by End User 2024 & 2032

- Figure 42: Middle East and Africa Hard Facility Management Market Revenue (Million), by Country 2024 & 2032

- Figure 43: Middle East and Africa Hard Facility Management Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Hard Facility Management Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Hard Facility Management Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Hard Facility Management Market Revenue Million Forecast, by End User 2019 & 2032

- Table 4: Global Hard Facility Management Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Hard Facility Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Hard Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada Hard Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico Hard Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Hard Facility Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Germany Hard Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: United Kingdom Hard Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: France Hard Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Spain Hard Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Italy Hard Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Spain Hard Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Belgium Hard Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Netherland Hard Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Nordics Hard Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Rest of Europe Hard Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Global Hard Facility Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 21: China Hard Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Japan Hard Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: India Hard Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: South Korea Hard Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Southeast Asia Hard Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Australia Hard Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Indonesia Hard Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Phillipes Hard Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Singapore Hard Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Thailandc Hard Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Rest of Asia Pacific Hard Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Global Hard Facility Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 33: Brazil Hard Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Argentina Hard Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Peru Hard Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Chile Hard Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Colombia Hard Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Ecuador Hard Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Venezuela Hard Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Rest of South America Hard Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Global Hard Facility Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 42: United States Hard Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Canada Hard Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Mexico Hard Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Global Hard Facility Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 46: United Arab Emirates Hard Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Saudi Arabia Hard Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: South Africa Hard Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Rest of Middle East and Africa Hard Facility Management Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Global Hard Facility Management Market Revenue Million Forecast, by Type 2019 & 2032

- Table 51: Global Hard Facility Management Market Revenue Million Forecast, by End User 2019 & 2032

- Table 52: Global Hard Facility Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 53: Global Hard Facility Management Market Revenue Million Forecast, by Type 2019 & 2032

- Table 54: Global Hard Facility Management Market Revenue Million Forecast, by End User 2019 & 2032

- Table 55: Global Hard Facility Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 56: Global Hard Facility Management Market Revenue Million Forecast, by Type 2019 & 2032

- Table 57: Global Hard Facility Management Market Revenue Million Forecast, by End User 2019 & 2032

- Table 58: Global Hard Facility Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 59: Global Hard Facility Management Market Revenue Million Forecast, by Type 2019 & 2032

- Table 60: Global Hard Facility Management Market Revenue Million Forecast, by End User 2019 & 2032

- Table 61: Global Hard Facility Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 62: Global Hard Facility Management Market Revenue Million Forecast, by Type 2019 & 2032

- Table 63: Global Hard Facility Management Market Revenue Million Forecast, by End User 2019 & 2032

- Table 64: Global Hard Facility Management Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Hard Facility Management Market?

The projected CAGR is approximately 4.22%.

2. Which companies are prominent players in the Hard Facility Management Market?

Key companies in the market include AMEC Facilities, Sodexo Facilities Management Services, Cushman & Wakefield, Johnson Controls International plc, Jones Lang LaSalle Incorporated, Mitie Group PLC, Aramark Corporation, CB Richard Ellis (CBRE ), ISS A/S, Compass Group PLC.

3. What are the main segments of the Hard Facility Management Market?

The market segments include Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Robust Post-COVID Demand for HFM; Rise in Use of Enterprise Asset Management (EAM).

6. What are the notable trends driving market growth?

Robust Post-COVID Demand for HFM.

7. Are there any restraints impacting market growth?

Staff Shortage Across the Globe.

8. Can you provide examples of recent developments in the market?

September 2022: Sodexo India announced that it was extending its service avenues by adding employee-providing services to its portfolio. This national movement provided Sodexo with global publicity.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Hard Facility Management Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Hard Facility Management Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Hard Facility Management Market?

To stay informed about further developments, trends, and reports in the Hard Facility Management Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence