Key Insights

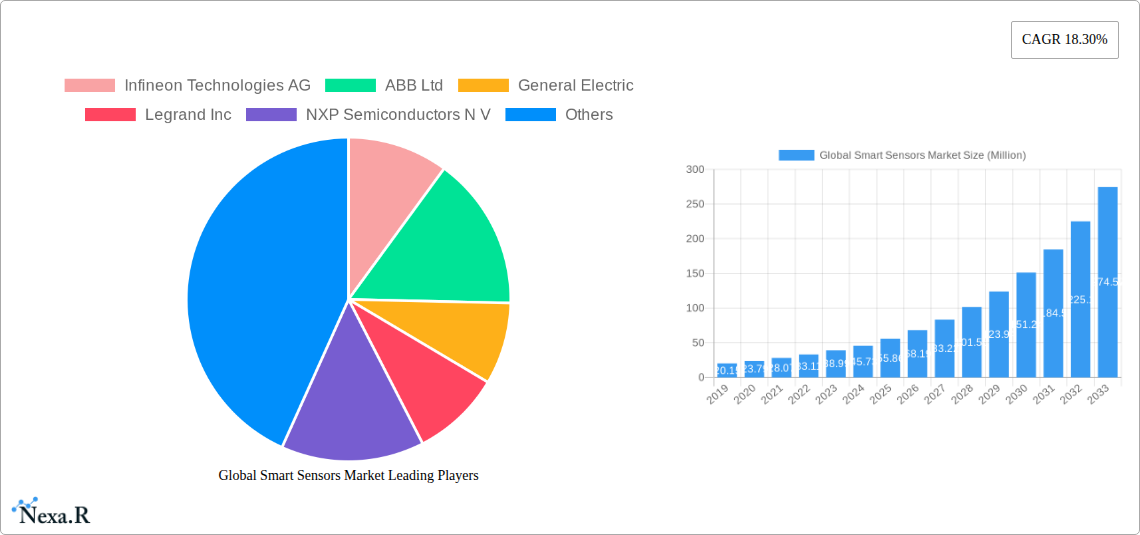

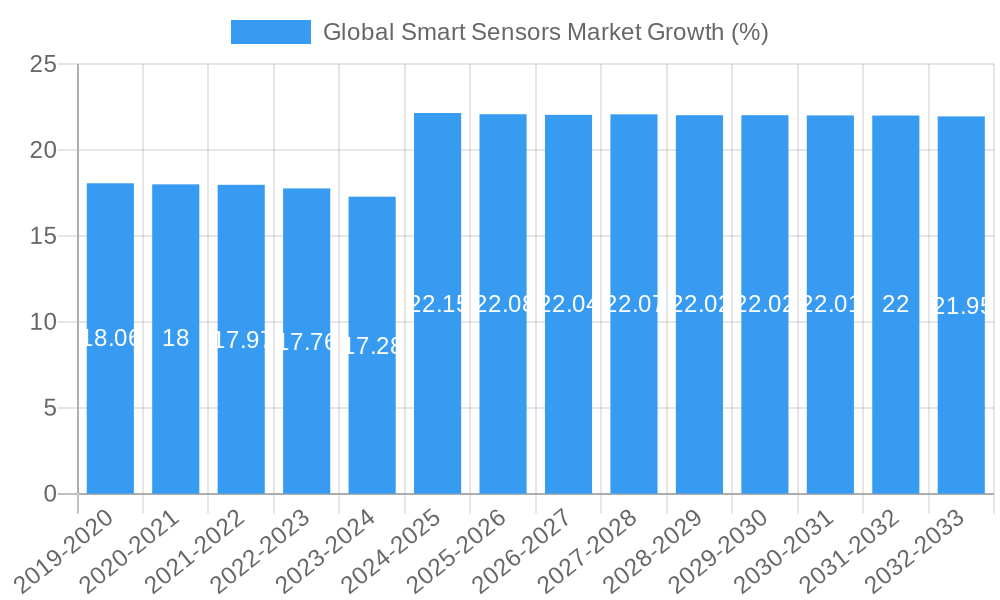

The Global Smart Sensors Market is poised for substantial growth, projected to reach approximately $55.86 million in value by 2025, with an impressive Compound Annual Growth Rate (CAGR) of 18.30% anticipated throughout the forecast period of 2025-2033. This robust expansion is fueled by an increasing demand for advanced automation across various industries, the proliferation of the Internet of Things (IoT) devices, and the continuous innovation in sensor technology. Key drivers include the escalating need for real-time data monitoring and analysis in sectors like industrial automation, healthcare, and automotive, where smart sensors are integral to improving efficiency, safety, and performance. The development of miniaturized, energy-efficient, and highly accurate sensors, particularly those leveraging MEMS and CMOS technologies, is further accelerating market adoption.

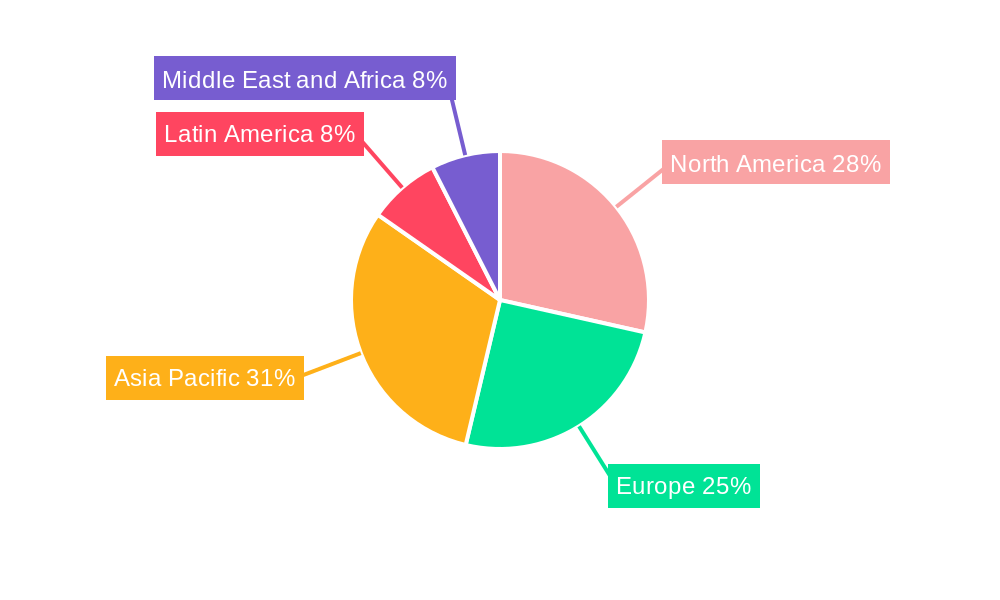

The market is segmented by sensor type, with Temperature Sensors, Pressure Sensors, and Flow Sensors expected to dominate due to their widespread applications in environmental monitoring, process control, and industrial machinery. In terms of technology, MEMS and CMOS are leading due to their cost-effectiveness and scalability for mass production, enabling widespread integration into consumer electronics and automotive systems. The component segment sees significant traction for Analog-to-Digital Converters (ADCs) and amplifiers, critical for processing sensor data. Geographically, North America and Asia Pacific are expected to be the leading regions, driven by significant investments in smart city initiatives, advanced manufacturing, and the burgeoning automotive and healthcare sectors. While market growth is strong, challenges such as data security concerns and the high initial investment cost for sophisticated sensor deployments may present some restraints.

Global Smart Sensors Market: Revolutionizing Connectivity and Automation

This comprehensive report provides an in-depth analysis of the Global Smart Sensors Market, a rapidly expanding sector driven by the proliferation of the Internet of Things (IoT), artificial intelligence (AI), and the increasing demand for automated processes across industries. The study covers a critical period from 2019 to 2033, with a base and estimated year of 2025, and a forecast period from 2025 to 2033. We delve into market dynamics, growth trends, regional dominance, product landscape, key drivers, barriers, challenges, emerging opportunities, and influential players, offering invaluable insights for stakeholders navigating this dynamic market.

Global Smart Sensors Market Market Dynamics & Structure

The Global Smart Sensors Market is characterized by a dynamic and evolving landscape, with a moderate to high level of market concentration. Key players are continuously investing in research and development to drive technological innovation, particularly in the areas of miniaturization, increased accuracy, and enhanced connectivity. The proliferation of IoT devices and the demand for real-time data analytics are primary technological innovation drivers. Regulatory frameworks, while still developing in some regions, are increasingly focusing on data privacy and security, influencing sensor deployment. Competitive product substitutes, such as traditional sensors with enhanced processing capabilities, pose a constant challenge, compelling manufacturers to innovate. End-user demographics are shifting, with a growing demand for smart solutions in consumer electronics and healthcare. Mergers and acquisitions (M&A) are a significant trend, with larger companies acquiring innovative startups to expand their product portfolios and market reach. For instance, the acquisition of companies with specialized sensor technology can significantly alter market share. Barriers to entry, such as high R&D costs and the need for specialized expertise, are being mitigated by strategic partnerships and collaborative ventures.

- Market Concentration: Moderate to High, with leading players dominating specific segments.

- Technological Innovation Drivers: IoT adoption, AI integration, demand for real-time data, miniaturization, and energy efficiency.

- Regulatory Frameworks: Increasing focus on data privacy, security, and interoperability standards.

- Competitive Product Substitutes: Advanced traditional sensors, software-based analytics.

- End-User Demographics: Growing demand from industrial automation, automotive, healthcare, and consumer electronics sectors.

- M&A Trends: Strategic acquisitions to gain market share, acquire new technologies, and expand product offerings. An estimated XX M&A deals occurred in the historical period (2019-2024).

Global Smart Sensors Market Growth Trends & Insights

The Global Smart Sensors Market is poised for significant expansion, driven by an insatiable appetite for data-driven decision-making and enhanced automation across all industries. The market size is projected to grow from approximately $XX billion in 2025 to an impressive $YY billion by 2033, exhibiting a compound annual growth rate (CAGR) of XX% during the forecast period. This robust growth is fueled by the accelerating adoption of smart technologies, particularly in developing economies, and the increasing integration of sensors into everyday devices and critical infrastructure. Technological disruptions, such as advancements in MEMS (Micro-Electro-Mechanical Systems) and CMOS (Complementary Metal-Oxide-Semiconductor) technologies, are leading to smaller, more power-efficient, and highly accurate smart sensors. These innovations are enabling novel applications in areas like predictive maintenance, personalized healthcare, and advanced driver-assistance systems (ADAS). Consumer behavior is also playing a crucial role, with a growing preference for connected devices and smart home solutions that enhance convenience and efficiency. The shift towards Industry 4.0, with its emphasis on smart factories and interconnected manufacturing processes, is a major catalyst for smart sensor adoption in industrial automation. Furthermore, the increasing demand for environmental monitoring and smart city initiatives are opening up new avenues for growth. The market penetration of smart sensors is expected to surge as costs decrease and awareness of their benefits increases. Innovations in AI and machine learning are further enhancing the value proposition of smart sensors by enabling intelligent data interpretation and autonomous decision-making.

Dominant Regions, Countries, or Segments in Global Smart Sensors Market

The Industrial Automation segment is emerging as the dominant force in the Global Smart Sensors Market, driven by the relentless pursuit of efficiency, productivity, and safety in manufacturing and processing industries. This segment's dominance is underpinned by several key factors, including significant government investments in industrial modernization, the widespread adoption of Industry 4.0 principles, and a growing emphasis on predictive maintenance to minimize downtime. The Automotive and Transportation sector is a close contender, fueled by the rapid evolution of autonomous driving technologies, the demand for enhanced safety features, and the increasing electrification of vehicles, all of which rely heavily on sophisticated sensor arrays.

Within this landscape, Asia-Pacific is projected to be the leading region, propelled by its robust manufacturing base, substantial investments in smart city initiatives, and a burgeoning consumer electronics market. Countries like China and South Korea are at the forefront, with their governments actively promoting technological innovation and the adoption of smart solutions.

Dominant Segment: Industrial Automation

- Key Drivers: Industry 4.0 adoption, predictive maintenance initiatives, government support for industrial modernization, demand for process optimization.

- Market Share: Estimated to hold XX% of the market by 2025.

- Growth Potential: High, driven by continuous technological advancements and the need for smart manufacturing.

Leading Region: Asia-Pacific

- Key Drivers: Strong manufacturing sector, significant government investments in smart cities and IoT, growing consumer electronics market, rapid technological adoption.

- Market Share: Expected to account for XX% of the global market by 2025.

- Growth Potential: Significant, fueled by ongoing infrastructure development and a large addressable market.

Dominant Technology: MEMS

- Key Drivers: Miniaturization, cost-effectiveness, low power consumption, high integration capabilities.

- Applications: Widely used across all key application segments due to their versatility and performance.

Dominant Component: Analog-to-Digital Converter (ADC)

- Key Drivers: Essential for digitizing sensor output for processing and analysis in smart devices.

- Demand: Directly correlated with the growth of smart sensor deployment across various applications.

Global Smart Sensors Market Product Landscape

The Global Smart Sensors Market is characterized by a continuous stream of innovative product launches, enhancing performance and expanding application capabilities. Companies are focusing on developing sensors with increased accuracy, faster response times, lower power consumption, and enhanced connectivity. MEMS technology continues to drive miniaturization and cost reduction, enabling the integration of smart sensors into an ever-wider array of devices. Innovations in optical spectroscopy are enabling highly precise chemical and biological sensing, opening up new possibilities in healthcare and environmental monitoring. Products are increasingly featuring embedded intelligence, allowing for edge computing and localized data processing, reducing reliance on cloud connectivity. Unique selling propositions include advanced data analytics capabilities, self-calibration features, and robust environmental resistance. Technological advancements are leading to multi-functional sensors that can detect multiple parameters simultaneously.

Key Drivers, Barriers & Challenges in Global Smart Sensors Market

Key Drivers:

- Proliferation of IoT and M2M Communication: The ever-increasing number of connected devices is a primary driver, creating a massive demand for sensors to gather data.

- Advancements in AI and Machine Learning: The integration of AI enables smart sensors to process data intelligently, leading to more sophisticated applications and automation.

- Demand for Automation and Efficiency: Industries across the board are seeking to optimize processes, reduce operational costs, and improve safety through automation, heavily relying on smart sensors.

- Growth of Smart Cities and Smart Homes: Urban development and consumer demand for convenience are driving the adoption of smart sensors for traffic management, energy efficiency, security, and environmental monitoring.

Barriers & Challenges:

- High Initial Investment Costs: The R&D and manufacturing of advanced smart sensors can be capital-intensive, posing a barrier for smaller players.

- Interoperability and Standardization Issues: A lack of universal standards can hinder seamless integration of sensors from different manufacturers, impacting system-wide deployment.

- Data Security and Privacy Concerns: The vast amounts of data collected by smart sensors raise concerns about security breaches and the privacy of individuals, requiring robust protective measures.

- Supply Chain Disruptions: Geopolitical events, raw material shortages, and logistical challenges can impact the production and availability of critical sensor components. The estimated impact of supply chain issues on market growth is xx%.

Emerging Opportunities in the Global Smart Sensors Market

The Global Smart Sensors Market presents a fertile ground for emerging opportunities, particularly in the healthcare sector with the advancement of wearable health monitoring devices and remote patient care systems. The burgeoning field of precision agriculture, utilizing sensors for soil monitoring, crop health assessment, and automated irrigation, offers significant untapped potential. Furthermore, the increasing focus on sustainability and environmental monitoring is creating demand for advanced sensors capable of detecting pollutants, monitoring resource consumption, and supporting climate change research. The expansion of Industry 5.0, which emphasizes human-robot collaboration and personalized manufacturing, will also necessitate the development of more intuitive and adaptive smart sensor technologies. The continuous evolution of AI and edge computing will unlock new applications in autonomous systems and intelligent infrastructure.

Growth Accelerators in the Global Smart Sensors Market Industry

Several key catalysts are accelerating the growth of the Global Smart Sensors Market. Technological breakthroughs in material science and semiconductor manufacturing are leading to the development of smaller, more powerful, and energy-efficient sensors. Strategic partnerships between sensor manufacturers, software developers, and end-user industries are fostering innovation and accelerating product development cycles. Market expansion strategies, including entry into emerging economies and the development of tailored solutions for specific vertical markets, are also playing a crucial role. The growing ecosystem of IoT platforms and data analytics services is further enhancing the value proposition of smart sensors by providing robust frameworks for data management and utilization.

Key Players Shaping the Global Smart Sensors Market Market

- Infineon Technologies AG

- ABB Ltd

- General Electric

- Legrand Inc

- NXP Semiconductors N V

- Siemens AG

- Honeywell International

- TE Connectivity Ltd

- ST Microelectronics

- Analog Devices Inc

- Vishay Technology Inc

- Eaton Corporation

Notable Milestones in Global Smart Sensors Market Sector

- October 2022: Optomotive unveiled two new product lines at VISION 2022, showcasing their LOM series of 3D high-speed smart sensors, featuring customizable and user-programmable laser triangulation sensors capable of inspection rates up to 10 kHz.

- November 2022: Quanergy Systems, Inc. announced enhancements to its QORTEX DTC and Q-View software solutions, supporting its Flow Management portfolio, which includes its MQ-8 family of LiDAR sensors.

In-Depth Global Smart Sensors Market Market Outlook

The Global Smart Sensors Market is on an upward trajectory, driven by transformative technological advancements and the pervasive integration of smart devices across all facets of life and industry. Future market potential is immense, fueled by the ongoing evolution of IoT, AI, and 5G technologies, which will enable more sophisticated and interconnected sensor networks. Strategic opportunities lie in developing next-generation sensors with enhanced predictive capabilities, self-learning algorithms, and seamless integration with augmented reality (AR) and virtual reality (VR) applications. The increasing focus on sustainability and the circular economy will also drive demand for sensors that monitor environmental impact and optimize resource utilization. The market's robust growth is projected to continue as industries embrace digital transformation and consumers demand smarter, more connected experiences.

Global Smart Sensors Market Segmentation

-

1. Type

- 1.1. Flow Sensor

- 1.2. Humidity Sensor

- 1.3. Position Sensor

- 1.4. Pressure Sensor

- 1.5. Temperature Sensor

- 1.6. Other Types

-

2. Technology

- 2.1. MEMS

- 2.2. CMOS

- 2.3. Optical Spectroscopy

- 2.4. Other Technologies

-

3. Component

- 3.1. Analog-to-Digital Converter

- 3.2. Digital-to-Analog Converter

- 3.3. Amplifier

- 3.4. Other components

-

4. Application

- 4.1. Aerospace and Defense

- 4.2. Automotive and Transportation

- 4.3. Healthcare

- 4.4. Industrial Automation

- 4.5. Building Automation

- 4.6. Consumer Electronics

- 4.7. Other Applications

Global Smart Sensors Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Rest Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Global Smart Sensors Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 18.30% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Energy Efficiency and Saving; Increasing Demand for Consumer Electronics Products; Higher Demand for Smart Sensors in the Healthcare and Automotive Industries; Technology Advancements in Miniaturization and Wireless Capabilities

- 3.3. Market Restrains

- 3.3.1. Relatively High Deployment Costs; Complex Design compared to Traditional Sensors

- 3.4. Market Trends

- 3.4.1. Temperature Sensors to Witness High Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Smart Sensors Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Flow Sensor

- 5.1.2. Humidity Sensor

- 5.1.3. Position Sensor

- 5.1.4. Pressure Sensor

- 5.1.5. Temperature Sensor

- 5.1.6. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. MEMS

- 5.2.2. CMOS

- 5.2.3. Optical Spectroscopy

- 5.2.4. Other Technologies

- 5.3. Market Analysis, Insights and Forecast - by Component

- 5.3.1. Analog-to-Digital Converter

- 5.3.2. Digital-to-Analog Converter

- 5.3.3. Amplifier

- 5.3.4. Other components

- 5.4. Market Analysis, Insights and Forecast - by Application

- 5.4.1. Aerospace and Defense

- 5.4.2. Automotive and Transportation

- 5.4.3. Healthcare

- 5.4.4. Industrial Automation

- 5.4.5. Building Automation

- 5.4.6. Consumer Electronics

- 5.4.7. Other Applications

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. Latin America

- 5.5.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Global Smart Sensors Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Flow Sensor

- 6.1.2. Humidity Sensor

- 6.1.3. Position Sensor

- 6.1.4. Pressure Sensor

- 6.1.5. Temperature Sensor

- 6.1.6. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Technology

- 6.2.1. MEMS

- 6.2.2. CMOS

- 6.2.3. Optical Spectroscopy

- 6.2.4. Other Technologies

- 6.3. Market Analysis, Insights and Forecast - by Component

- 6.3.1. Analog-to-Digital Converter

- 6.3.2. Digital-to-Analog Converter

- 6.3.3. Amplifier

- 6.3.4. Other components

- 6.4. Market Analysis, Insights and Forecast - by Application

- 6.4.1. Aerospace and Defense

- 6.4.2. Automotive and Transportation

- 6.4.3. Healthcare

- 6.4.4. Industrial Automation

- 6.4.5. Building Automation

- 6.4.6. Consumer Electronics

- 6.4.7. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Global Smart Sensors Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Flow Sensor

- 7.1.2. Humidity Sensor

- 7.1.3. Position Sensor

- 7.1.4. Pressure Sensor

- 7.1.5. Temperature Sensor

- 7.1.6. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Technology

- 7.2.1. MEMS

- 7.2.2. CMOS

- 7.2.3. Optical Spectroscopy

- 7.2.4. Other Technologies

- 7.3. Market Analysis, Insights and Forecast - by Component

- 7.3.1. Analog-to-Digital Converter

- 7.3.2. Digital-to-Analog Converter

- 7.3.3. Amplifier

- 7.3.4. Other components

- 7.4. Market Analysis, Insights and Forecast - by Application

- 7.4.1. Aerospace and Defense

- 7.4.2. Automotive and Transportation

- 7.4.3. Healthcare

- 7.4.4. Industrial Automation

- 7.4.5. Building Automation

- 7.4.6. Consumer Electronics

- 7.4.7. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Global Smart Sensors Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Flow Sensor

- 8.1.2. Humidity Sensor

- 8.1.3. Position Sensor

- 8.1.4. Pressure Sensor

- 8.1.5. Temperature Sensor

- 8.1.6. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Technology

- 8.2.1. MEMS

- 8.2.2. CMOS

- 8.2.3. Optical Spectroscopy

- 8.2.4. Other Technologies

- 8.3. Market Analysis, Insights and Forecast - by Component

- 8.3.1. Analog-to-Digital Converter

- 8.3.2. Digital-to-Analog Converter

- 8.3.3. Amplifier

- 8.3.4. Other components

- 8.4. Market Analysis, Insights and Forecast - by Application

- 8.4.1. Aerospace and Defense

- 8.4.2. Automotive and Transportation

- 8.4.3. Healthcare

- 8.4.4. Industrial Automation

- 8.4.5. Building Automation

- 8.4.6. Consumer Electronics

- 8.4.7. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Global Smart Sensors Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Flow Sensor

- 9.1.2. Humidity Sensor

- 9.1.3. Position Sensor

- 9.1.4. Pressure Sensor

- 9.1.5. Temperature Sensor

- 9.1.6. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Technology

- 9.2.1. MEMS

- 9.2.2. CMOS

- 9.2.3. Optical Spectroscopy

- 9.2.4. Other Technologies

- 9.3. Market Analysis, Insights and Forecast - by Component

- 9.3.1. Analog-to-Digital Converter

- 9.3.2. Digital-to-Analog Converter

- 9.3.3. Amplifier

- 9.3.4. Other components

- 9.4. Market Analysis, Insights and Forecast - by Application

- 9.4.1. Aerospace and Defense

- 9.4.2. Automotive and Transportation

- 9.4.3. Healthcare

- 9.4.4. Industrial Automation

- 9.4.5. Building Automation

- 9.4.6. Consumer Electronics

- 9.4.7. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Global Smart Sensors Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Flow Sensor

- 10.1.2. Humidity Sensor

- 10.1.3. Position Sensor

- 10.1.4. Pressure Sensor

- 10.1.5. Temperature Sensor

- 10.1.6. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Technology

- 10.2.1. MEMS

- 10.2.2. CMOS

- 10.2.3. Optical Spectroscopy

- 10.2.4. Other Technologies

- 10.3. Market Analysis, Insights and Forecast - by Component

- 10.3.1. Analog-to-Digital Converter

- 10.3.2. Digital-to-Analog Converter

- 10.3.3. Amplifier

- 10.3.4. Other components

- 10.4. Market Analysis, Insights and Forecast - by Application

- 10.4.1. Aerospace and Defense

- 10.4.2. Automotive and Transportation

- 10.4.3. Healthcare

- 10.4.4. Industrial Automation

- 10.4.5. Building Automation

- 10.4.6. Consumer Electronics

- 10.4.7. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. North America Global Smart Sensors Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 12. Europe Global Smart Sensors Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Spain

- 12.1.5 Italy

- 12.1.6 Spain

- 12.1.7 Belgium

- 12.1.8 Netherland

- 12.1.9 Nordics

- 12.1.10 Rest of Europe

- 13. Asia Pacific Global Smart Sensors Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 South Korea

- 13.1.5 Southeast Asia

- 13.1.6 Australia

- 13.1.7 Indonesia

- 13.1.8 Phillipes

- 13.1.9 Singapore

- 13.1.10 Thailandc

- 13.1.11 Rest of Asia Pacific

- 14. South America Global Smart Sensors Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Brazil

- 14.1.2 Argentina

- 14.1.3 Peru

- 14.1.4 Chile

- 14.1.5 Colombia

- 14.1.6 Ecuador

- 14.1.7 Venezuela

- 14.1.8 Rest of South America

- 15. MEA Global Smart Sensors Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 United Arab Emirates

- 15.1.2 Saudi Arabia

- 15.1.3 South Africa

- 15.1.4 Rest of Middle East and Africa

- 16. Competitive Analysis

- 16.1. Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Infineon Technologies AG

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 ABB Ltd

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 General Electric

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Legrand Inc

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 NXP Semiconductors N V

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Siemens AG

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Honeywell International

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 TE Connectivity Ltd

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 ST Microelectronics

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Analog Devices Inc

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Vishay Technology Inc

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 Eaton Corporation

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.1 Infineon Technologies AG

List of Figures

- Figure 1: Global Global Smart Sensors Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Global Smart Sensors Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Global Smart Sensors Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Global Smart Sensors Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Global Smart Sensors Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Global Smart Sensors Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Global Smart Sensors Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Global Smart Sensors Market Revenue (Million), by Country 2024 & 2032

- Figure 9: South America Global Smart Sensors Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: MEA Global Smart Sensors Market Revenue (Million), by Country 2024 & 2032

- Figure 11: MEA Global Smart Sensors Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Global Smart Sensors Market Revenue (Million), by Type 2024 & 2032

- Figure 13: North America Global Smart Sensors Market Revenue Share (%), by Type 2024 & 2032

- Figure 14: North America Global Smart Sensors Market Revenue (Million), by Technology 2024 & 2032

- Figure 15: North America Global Smart Sensors Market Revenue Share (%), by Technology 2024 & 2032

- Figure 16: North America Global Smart Sensors Market Revenue (Million), by Component 2024 & 2032

- Figure 17: North America Global Smart Sensors Market Revenue Share (%), by Component 2024 & 2032

- Figure 18: North America Global Smart Sensors Market Revenue (Million), by Application 2024 & 2032

- Figure 19: North America Global Smart Sensors Market Revenue Share (%), by Application 2024 & 2032

- Figure 20: North America Global Smart Sensors Market Revenue (Million), by Country 2024 & 2032

- Figure 21: North America Global Smart Sensors Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: Europe Global Smart Sensors Market Revenue (Million), by Type 2024 & 2032

- Figure 23: Europe Global Smart Sensors Market Revenue Share (%), by Type 2024 & 2032

- Figure 24: Europe Global Smart Sensors Market Revenue (Million), by Technology 2024 & 2032

- Figure 25: Europe Global Smart Sensors Market Revenue Share (%), by Technology 2024 & 2032

- Figure 26: Europe Global Smart Sensors Market Revenue (Million), by Component 2024 & 2032

- Figure 27: Europe Global Smart Sensors Market Revenue Share (%), by Component 2024 & 2032

- Figure 28: Europe Global Smart Sensors Market Revenue (Million), by Application 2024 & 2032

- Figure 29: Europe Global Smart Sensors Market Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Global Smart Sensors Market Revenue (Million), by Country 2024 & 2032

- Figure 31: Europe Global Smart Sensors Market Revenue Share (%), by Country 2024 & 2032

- Figure 32: Asia Pacific Global Smart Sensors Market Revenue (Million), by Type 2024 & 2032

- Figure 33: Asia Pacific Global Smart Sensors Market Revenue Share (%), by Type 2024 & 2032

- Figure 34: Asia Pacific Global Smart Sensors Market Revenue (Million), by Technology 2024 & 2032

- Figure 35: Asia Pacific Global Smart Sensors Market Revenue Share (%), by Technology 2024 & 2032

- Figure 36: Asia Pacific Global Smart Sensors Market Revenue (Million), by Component 2024 & 2032

- Figure 37: Asia Pacific Global Smart Sensors Market Revenue Share (%), by Component 2024 & 2032

- Figure 38: Asia Pacific Global Smart Sensors Market Revenue (Million), by Application 2024 & 2032

- Figure 39: Asia Pacific Global Smart Sensors Market Revenue Share (%), by Application 2024 & 2032

- Figure 40: Asia Pacific Global Smart Sensors Market Revenue (Million), by Country 2024 & 2032

- Figure 41: Asia Pacific Global Smart Sensors Market Revenue Share (%), by Country 2024 & 2032

- Figure 42: Latin America Global Smart Sensors Market Revenue (Million), by Type 2024 & 2032

- Figure 43: Latin America Global Smart Sensors Market Revenue Share (%), by Type 2024 & 2032

- Figure 44: Latin America Global Smart Sensors Market Revenue (Million), by Technology 2024 & 2032

- Figure 45: Latin America Global Smart Sensors Market Revenue Share (%), by Technology 2024 & 2032

- Figure 46: Latin America Global Smart Sensors Market Revenue (Million), by Component 2024 & 2032

- Figure 47: Latin America Global Smart Sensors Market Revenue Share (%), by Component 2024 & 2032

- Figure 48: Latin America Global Smart Sensors Market Revenue (Million), by Application 2024 & 2032

- Figure 49: Latin America Global Smart Sensors Market Revenue Share (%), by Application 2024 & 2032

- Figure 50: Latin America Global Smart Sensors Market Revenue (Million), by Country 2024 & 2032

- Figure 51: Latin America Global Smart Sensors Market Revenue Share (%), by Country 2024 & 2032

- Figure 52: Middle East and Africa Global Smart Sensors Market Revenue (Million), by Type 2024 & 2032

- Figure 53: Middle East and Africa Global Smart Sensors Market Revenue Share (%), by Type 2024 & 2032

- Figure 54: Middle East and Africa Global Smart Sensors Market Revenue (Million), by Technology 2024 & 2032

- Figure 55: Middle East and Africa Global Smart Sensors Market Revenue Share (%), by Technology 2024 & 2032

- Figure 56: Middle East and Africa Global Smart Sensors Market Revenue (Million), by Component 2024 & 2032

- Figure 57: Middle East and Africa Global Smart Sensors Market Revenue Share (%), by Component 2024 & 2032

- Figure 58: Middle East and Africa Global Smart Sensors Market Revenue (Million), by Application 2024 & 2032

- Figure 59: Middle East and Africa Global Smart Sensors Market Revenue Share (%), by Application 2024 & 2032

- Figure 60: Middle East and Africa Global Smart Sensors Market Revenue (Million), by Country 2024 & 2032

- Figure 61: Middle East and Africa Global Smart Sensors Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Smart Sensors Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Smart Sensors Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Smart Sensors Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 4: Global Smart Sensors Market Revenue Million Forecast, by Component 2019 & 2032

- Table 5: Global Smart Sensors Market Revenue Million Forecast, by Application 2019 & 2032

- Table 6: Global Smart Sensors Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Global Smart Sensors Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: United States Global Smart Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Canada Global Smart Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Global Smart Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Smart Sensors Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Germany Global Smart Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: United Kingdom Global Smart Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: France Global Smart Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Spain Global Smart Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Italy Global Smart Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Spain Global Smart Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Belgium Global Smart Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Netherland Global Smart Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Nordics Global Smart Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Rest of Europe Global Smart Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Global Smart Sensors Market Revenue Million Forecast, by Country 2019 & 2032

- Table 23: China Global Smart Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Japan Global Smart Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: India Global Smart Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: South Korea Global Smart Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Southeast Asia Global Smart Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Australia Global Smart Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Indonesia Global Smart Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Phillipes Global Smart Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Singapore Global Smart Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Thailandc Global Smart Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Rest of Asia Pacific Global Smart Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Global Smart Sensors Market Revenue Million Forecast, by Country 2019 & 2032

- Table 35: Brazil Global Smart Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Argentina Global Smart Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Peru Global Smart Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Chile Global Smart Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Colombia Global Smart Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Ecuador Global Smart Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Venezuela Global Smart Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Rest of South America Global Smart Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Global Smart Sensors Market Revenue Million Forecast, by Country 2019 & 2032

- Table 44: United Arab Emirates Global Smart Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Saudi Arabia Global Smart Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: South Africa Global Smart Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Middle East and Africa Global Smart Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Global Smart Sensors Market Revenue Million Forecast, by Type 2019 & 2032

- Table 49: Global Smart Sensors Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 50: Global Smart Sensors Market Revenue Million Forecast, by Component 2019 & 2032

- Table 51: Global Smart Sensors Market Revenue Million Forecast, by Application 2019 & 2032

- Table 52: Global Smart Sensors Market Revenue Million Forecast, by Country 2019 & 2032

- Table 53: United States Global Smart Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Canada Global Smart Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Global Smart Sensors Market Revenue Million Forecast, by Type 2019 & 2032

- Table 56: Global Smart Sensors Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 57: Global Smart Sensors Market Revenue Million Forecast, by Component 2019 & 2032

- Table 58: Global Smart Sensors Market Revenue Million Forecast, by Application 2019 & 2032

- Table 59: Global Smart Sensors Market Revenue Million Forecast, by Country 2019 & 2032

- Table 60: United Kingdom Global Smart Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 61: Germany Global Smart Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 62: France Global Smart Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 63: Rest of Europe Global Smart Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 64: Global Smart Sensors Market Revenue Million Forecast, by Type 2019 & 2032

- Table 65: Global Smart Sensors Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 66: Global Smart Sensors Market Revenue Million Forecast, by Component 2019 & 2032

- Table 67: Global Smart Sensors Market Revenue Million Forecast, by Application 2019 & 2032

- Table 68: Global Smart Sensors Market Revenue Million Forecast, by Country 2019 & 2032

- Table 69: China Global Smart Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 70: India Global Smart Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 71: Japan Global Smart Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 72: Rest Asia Pacific Global Smart Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 73: Global Smart Sensors Market Revenue Million Forecast, by Type 2019 & 2032

- Table 74: Global Smart Sensors Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 75: Global Smart Sensors Market Revenue Million Forecast, by Component 2019 & 2032

- Table 76: Global Smart Sensors Market Revenue Million Forecast, by Application 2019 & 2032

- Table 77: Global Smart Sensors Market Revenue Million Forecast, by Country 2019 & 2032

- Table 78: Global Smart Sensors Market Revenue Million Forecast, by Type 2019 & 2032

- Table 79: Global Smart Sensors Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 80: Global Smart Sensors Market Revenue Million Forecast, by Component 2019 & 2032

- Table 81: Global Smart Sensors Market Revenue Million Forecast, by Application 2019 & 2032

- Table 82: Global Smart Sensors Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Global Smart Sensors Market?

The projected CAGR is approximately 18.30%.

2. Which companies are prominent players in the Global Smart Sensors Market?

Key companies in the market include Infineon Technologies AG, ABB Ltd, General Electric, Legrand Inc, NXP Semiconductors N V, Siemens AG, Honeywell International, TE Connectivity Ltd, ST Microelectronics, Analog Devices Inc, Vishay Technology Inc , Eaton Corporation.

3. What are the main segments of the Global Smart Sensors Market?

The market segments include Type, Technology, Component, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 55.86 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Energy Efficiency and Saving; Increasing Demand for Consumer Electronics Products; Higher Demand for Smart Sensors in the Healthcare and Automotive Industries; Technology Advancements in Miniaturization and Wireless Capabilities.

6. What are the notable trends driving market growth?

Temperature Sensors to Witness High Growth.

7. Are there any restraints impacting market growth?

Relatively High Deployment Costs; Complex Design compared to Traditional Sensors.

8. Can you provide examples of recent developments in the market?

October 2022 : Optomotive, a producer of advanced, high-performance cameras and 3D smart sensors, announced the debut of two new product lines at VISION 2022. will show off its fully engineered LOM series of 3D high-speed smart sensors. High-speed laser triangulation sensors from the LOM sensor line, which is based on Optomotive's FPGA camera technology, may be fully customized and user-programmed. The series is capable of inspection rates of up to 10 kHz and is designed for high-performance examination.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Global Smart Sensors Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Global Smart Sensors Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Global Smart Sensors Market?

To stay informed about further developments, trends, and reports in the Global Smart Sensors Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence