Key Insights

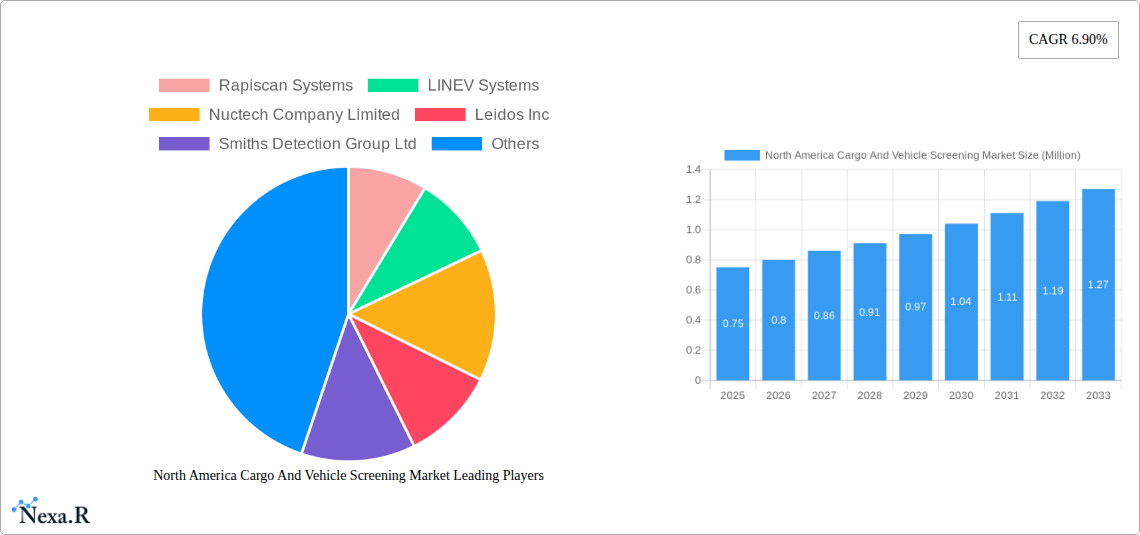

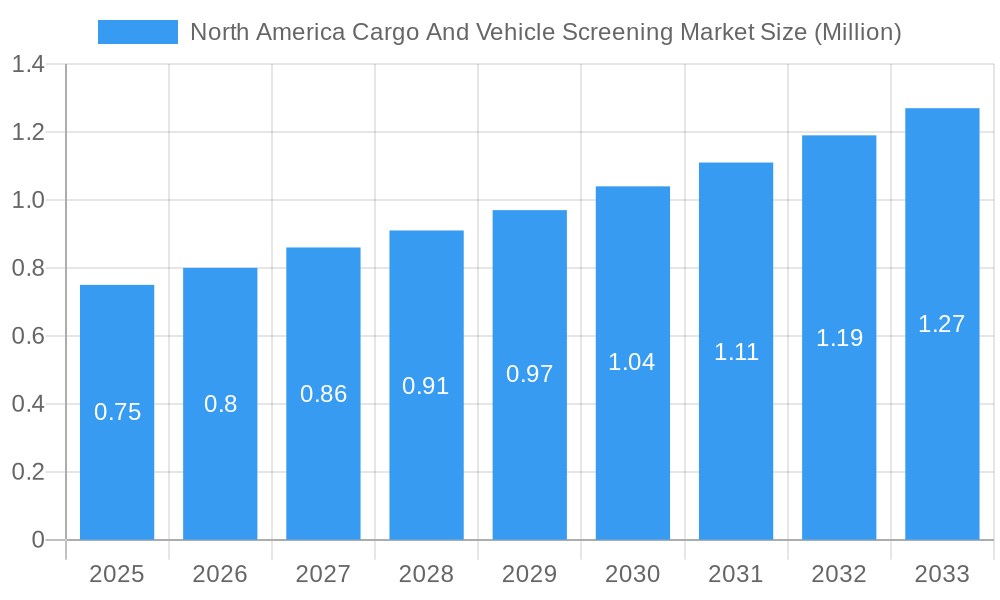

The North America Cargo and Vehicle Screening Market is poised for significant expansion, with a current market size estimated at $0.75 million and a projected Compound Annual Growth Rate (CAGR) of 6.90% between 2025 and 2033. This robust growth is fueled by escalating security concerns and the imperative to safeguard critical infrastructure, including airports, ports, and borders, against potential threats. The increasing volume of international trade and passenger traffic further necessitates advanced screening technologies to ensure swift and secure movement of goods and individuals. Government and defense sectors are substantial contributors, investing heavily in state-of-the-art solutions to enhance national security. Commercial sectors, driven by the need for efficient supply chain management and loss prevention, are also adopting these technologies at a steady pace. The market is witnessing a dynamic interplay between stationary and mobile screening systems, each offering distinct advantages for diverse operational environments.

North America Cargo And Vehicle Screening Market Market Size (In Million)

The market's trajectory is shaped by several key drivers, including the continuous evolution of security threats, demanding more sophisticated detection capabilities, and stringent regulatory frameworks mandating enhanced screening protocols. Technological advancements, such as the integration of AI and machine learning for improved threat identification and the development of faster, more accurate scanning equipment, are significant trends. However, the market faces certain restraints, including the high initial investment costs associated with advanced screening systems and the need for continuous training and maintenance. Despite these challenges, the commitment to robust security infrastructure and the ongoing innovation within the industry are expected to propel the North America Cargo and Vehicle Screening Market to new heights, offering substantial opportunities for market players.

North America Cargo And Vehicle Screening Market Company Market Share

North America Cargo and Vehicle Screening Market: Comprehensive Report Description

This in-depth report provides an exhaustive analysis of the North America Cargo and Vehicle Screening Market, essential for understanding critical security and logistics infrastructure. Covering the period from 2019 to 2033, with a base year of 2025, this research delves into market dynamics, growth trends, key players, and future opportunities. The report meticulously examines the parent market of Security and Inspection Systems, with a specific focus on the child market of Cargo and Vehicle Screening technologies. Our analysis is optimized for search engines using high-traffic keywords like "cargo screening," "vehicle inspection," "security systems," "ports and borders," "airports security," "government defense," and "critical infrastructure protection."

Report Scope:

- Study Period: 2019–2033

- Base Year: 2025

- Estimated Year: 2025

- Forecast Period: 2025–2033

- Historical Period: 2019–2024

- Values: All values presented in Million units.

Key Market Segments:

- Type of Screening System:

- Stationary Screening

- Mobile Screening

- End User Vertical:

- Airports

- Ports and Borders

- Government and Defense

- Critical Infrastructure

- Commercial

Featured Companies (List Not Exhaustive): Rapiscan Systems, LINEV Systems, Nuctech Company Limited, Leidos Inc, Smiths Detection Group Ltd, Vantage Security, Intertek Group plc, OSI Systems, UVeye Inc, ASTROPHYSICS INC.

North America Cargo And Vehicle Screening Market Market Dynamics & Structure

The North America Cargo and Vehicle Screening Market is characterized by a moderately concentrated landscape, driven by significant technological innovation and evolving regulatory frameworks aimed at enhancing national security and trade facilitation. Key drivers include advancements in X-ray, radiation, and chemical detection technologies, pushing the boundaries of threat identification. The competitive product substitute landscape features a continuous race for higher resolution imaging, faster scanning speeds, and improved artificial intelligence-driven analysis. End-user demographics are increasingly sophisticated, demanding integrated solutions that can handle diverse cargo types and vehicle sizes. Mergers and acquisitions (M&A) play a crucial role in market consolidation and technological integration, with approximately 5-7 significant M&A deals anticipated within the forecast period. Innovation barriers are primarily associated with high R&D costs and the long validation cycles required for government and defense procurements.

- Market Concentration: Moderate to High, with a few key players dominating market share.

- Technological Innovation Drivers: Increased threat complexity, demand for faster throughput, AI integration for automated threat detection.

- Regulatory Frameworks: Stringent customs regulations, national security directives, and international trade agreements.

- Competitive Product Substitutes: Rapid evolution of detection technologies, integrated software solutions, and cloud-based analytics.

- End-User Demographics: Growing demand for customized solutions, lifecycle support, and interoperability.

- M&A Trends: Focus on acquiring specialized technologies, expanding geographical reach, and vertical integration.

North America Cargo And Vehicle Screening Market Growth Trends & Insights

The North America Cargo and Vehicle Screening Market is poised for robust growth, propelled by escalating global security concerns and the imperative to secure international trade routes. Leveraging advancements in Artificial Intelligence (AI), machine learning, and sensor technology, the market size is projected to expand significantly, with an estimated CAGR of 7.5% from 2025 to 2033. Adoption rates for sophisticated screening systems are accelerating across all end-user verticals, driven by increased government investments in border security and critical infrastructure protection. Technological disruptions, such as the miniaturization of scanning components and the development of non-intrusive inspection (NII) technologies, are reshaping the market. Consumer behavior shifts, particularly within the logistics and supply chain sectors, are favoring solutions that offer enhanced efficiency, reduced operational costs, and comprehensive data analytics for risk assessment. The market penetration of advanced cargo and vehicle screening solutions is expected to rise from an estimated 65% in 2025 to over 85% by 2033. The increasing volume of international trade and the constant threat of illicit material smuggling further fuel the demand for state-of-the-art screening equipment.

Dominant Regions, Countries, or Segments in North America Cargo And Vehicle Screening Market

Within the North America Cargo and Vehicle Screening Market, the United States emerges as the dominant country, propelled by its extensive network of international airports, bustling ports, and critical infrastructure requiring continuous security upgrades. The Ports and Borders end-user vertical is a primary growth engine, driven by the sheer volume of trade and the constant need to detect smuggled goods, weapons, and contraband.

Dominant Country: United States

- Key Drivers: Extensive trade volume, robust national security initiatives, significant investment in border security technologies, large number of international airports and seaports.

- Market Share: The US is estimated to hold approximately 70% of the North American market share for cargo and vehicle screening systems.

- Growth Potential: Sustained demand due to ongoing infrastructure modernization and evolving threat landscapes.

Dominant Segment: Ports and Borders

- Key Drivers: Increased international trade, stringent customs regulations, focus on preventing illicit trafficking of drugs, weapons, and hazardous materials, high volume of containerized and vehicle traffic.

- Market Share: This segment is anticipated to account for over 35% of the total market revenue in 2025.

- Growth Potential: Continuous need for advanced inspection capabilities to ensure supply chain security and national safety.

Other significant contributors include Canada and Mexico, with their respective border security needs and trade facilitation efforts also driving demand for screening solutions. The Government and Defense sector also represents a substantial market due to ongoing defense modernization programs and the need for sophisticated screening at military installations and sensitive sites.

North America Cargo And Vehicle Screening Market Product Landscape

The North America Cargo and Vehicle Screening Market product landscape is defined by continuous innovation in detection technologies and system integration. Key product innovations include the development of higher-energy X-ray systems for deeper penetration into dense cargo, advanced spectroscopic techniques for material identification, and AI-powered image analysis for automated anomaly detection. Performance metrics such as scanning speed, detection accuracy, and system reliability are paramount. Unique selling propositions often revolve around the ability to offer non-intrusive inspection (NII) solutions that minimize cargo handling and delays, alongside robust software for real-time data management and reporting. The integration of these systems with existing port and airport infrastructure is a critical aspect of product development.

Key Drivers, Barriers & Challenges in North America Cargo And Vehicle Screening Market

Key Drivers: The North America Cargo and Vehicle Screening Market is propelled by critical factors including heightened national security mandates, the escalating volume of global trade, and significant governmental investments in advanced security infrastructure. Technological advancements in non-intrusive inspection (NII) systems, such as AI-driven threat detection and high-resolution imaging, are crucial catalysts. The increasing awareness of supply chain vulnerabilities and the persistent threat of terrorism and illicit trafficking further solidify demand for these solutions.

Key Barriers & Challenges: Significant challenges include the high capital expenditure required for advanced screening systems and the complex integration process with existing infrastructure. Regulatory hurdles and the lengthy procurement cycles, particularly for government and defense contracts, can also act as restraints. Supply chain disruptions, as experienced globally in recent years, can impact the availability of components and prolong lead times. Furthermore, the constant evolution of threats necessitates continuous upgrades and adaptation, posing an ongoing challenge for both manufacturers and end-users.

Emerging Opportunities in North America Cargo And Vehicle Screening Market

Emerging opportunities in the North America Cargo and Vehicle Screening Market lie in the development of modular and scalable screening solutions adaptable to diverse operational needs. The increasing adoption of AI and machine learning presents significant potential for predictive threat intelligence and automated anomaly detection, reducing human error and enhancing efficiency. Untapped markets include smaller commercial ports and logistics hubs that are beginning to invest in basic screening capabilities. Furthermore, the integration of screening systems with broader supply chain management platforms and the development of mobile screening solutions for rapid deployment in response to evolving security situations represent promising avenues for growth.

Growth Accelerators in the North America Cargo And Vehicle Screening Market Industry

The long-term growth of the North America Cargo and Vehicle Screening Market is accelerated by sustained technological breakthroughs, particularly in areas like artificial intelligence, advanced sensor technology, and data analytics. Strategic partnerships between technology providers and government agencies are crucial for developing bespoke solutions that address emerging threats. Market expansion strategies, including entry into new end-user verticals like critical infrastructure protection for utilities and transportation networks, will further drive growth. The ongoing need for efficient and effective cargo and vehicle inspection in a globalized world, coupled with increasing cybersecurity concerns, ensures a consistent demand for innovation and investment in this vital sector.

Key Players Shaping the North America Cargo And Vehicle Screening Market Market

- Rapiscan Systems

- LINEV Systems

- Nuctech Company Limited

- Leidos Inc

- Smiths Detection Group Ltd

- Vantage Security

- Intertek Group plc

- OSI Systems

- UVeye Inc

- ASTROPHYSICS INC

Notable Milestones in North America Cargo And Vehicle Screening Market Sector

- March 2024: OSI Systems, Inc. announced an international contract award valued at approximately $100 million for cargo and vehicle inspection systems, including ongoing maintenance and training, underscoring significant investment in the sector.

- February 2024: The CVSA's International Roadcheck (May 14-16) highlighted the ongoing importance of high-visibility commercial motor vehicle inspections across Canada, Mexico, and the United States, emphasizing regulatory compliance and the critical role of screening in transportation safety.

In-Depth North America Cargo And Vehicle Screening Market Market Outlook

The future outlook for the North America Cargo and Vehicle Screening Market is exceptionally promising, driven by an unyielding commitment to enhanced security and trade efficiency. Growth accelerators such as advancements in AI-powered threat identification, the development of integrated screening platforms, and strategic collaborations will fuel market expansion. The increasing focus on securing critical infrastructure and mitigating sophisticated security threats will create sustained demand for cutting-edge technologies. Strategic opportunities abound in offering customizable, scalable, and data-driven screening solutions that meet the evolving needs of airports, ports, borders, and defense organizations, ensuring robust market potential and continued innovation.

North America Cargo And Vehicle Screening Market Segmentation

-

1. Type of Screening System

- 1.1. Stationary Screening

- 1.2. Mobile Screening

-

2. End User Vertical

- 2.1. Airports

- 2.2. Ports and Borders

- 2.3. Government and Defense

- 2.4. Critical Infrastructure

- 2.5. Commercial

North America Cargo And Vehicle Screening Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Cargo And Vehicle Screening Market Regional Market Share

Geographic Coverage of North America Cargo And Vehicle Screening Market

North America Cargo And Vehicle Screening Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.90% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand For Advanced Screening and Inspection Systems at Borders; Expanding International Trade

- 3.3. Market Restrains

- 3.3.1. Increasing Demand For Advanced Screening and Inspection Systems at Borders; Expanding International Trade

- 3.4. Market Trends

- 3.4.1. Adoption of Advancing Technologies For Screening Promotes Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Cargo And Vehicle Screening Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Screening System

- 5.1.1. Stationary Screening

- 5.1.2. Mobile Screening

- 5.2. Market Analysis, Insights and Forecast - by End User Vertical

- 5.2.1. Airports

- 5.2.2. Ports and Borders

- 5.2.3. Government and Defense

- 5.2.4. Critical Infrastructure

- 5.2.5. Commercial

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type of Screening System

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Rapiscan Systems

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 LINEV Systems

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Nuctech Company Limited

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Leidos Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Smiths Detection Group Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Vantage Security

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Intertek Group plc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 OSI Systems

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 UVeye Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 ASTROPHYSICS INC*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Rapiscan Systems

List of Figures

- Figure 1: North America Cargo And Vehicle Screening Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Cargo And Vehicle Screening Market Share (%) by Company 2025

List of Tables

- Table 1: North America Cargo And Vehicle Screening Market Revenue Million Forecast, by Type of Screening System 2020 & 2033

- Table 2: North America Cargo And Vehicle Screening Market Volume Billion Forecast, by Type of Screening System 2020 & 2033

- Table 3: North America Cargo And Vehicle Screening Market Revenue Million Forecast, by End User Vertical 2020 & 2033

- Table 4: North America Cargo And Vehicle Screening Market Volume Billion Forecast, by End User Vertical 2020 & 2033

- Table 5: North America Cargo And Vehicle Screening Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: North America Cargo And Vehicle Screening Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: North America Cargo And Vehicle Screening Market Revenue Million Forecast, by Type of Screening System 2020 & 2033

- Table 8: North America Cargo And Vehicle Screening Market Volume Billion Forecast, by Type of Screening System 2020 & 2033

- Table 9: North America Cargo And Vehicle Screening Market Revenue Million Forecast, by End User Vertical 2020 & 2033

- Table 10: North America Cargo And Vehicle Screening Market Volume Billion Forecast, by End User Vertical 2020 & 2033

- Table 11: North America Cargo And Vehicle Screening Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: North America Cargo And Vehicle Screening Market Volume Billion Forecast, by Country 2020 & 2033

- Table 13: United States North America Cargo And Vehicle Screening Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United States North America Cargo And Vehicle Screening Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 15: Canada North America Cargo And Vehicle Screening Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada North America Cargo And Vehicle Screening Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 17: Mexico North America Cargo And Vehicle Screening Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Mexico North America Cargo And Vehicle Screening Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Cargo And Vehicle Screening Market?

The projected CAGR is approximately 6.90%.

2. Which companies are prominent players in the North America Cargo And Vehicle Screening Market?

Key companies in the market include Rapiscan Systems, LINEV Systems, Nuctech Company Limited, Leidos Inc, Smiths Detection Group Ltd, Vantage Security, Intertek Group plc, OSI Systems, UVeye Inc, ASTROPHYSICS INC*List Not Exhaustive.

3. What are the main segments of the North America Cargo And Vehicle Screening Market?

The market segments include Type of Screening System, End User Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.75 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand For Advanced Screening and Inspection Systems at Borders; Expanding International Trade.

6. What are the notable trends driving market growth?

Adoption of Advancing Technologies For Screening Promotes Growth.

7. Are there any restraints impacting market growth?

Increasing Demand For Advanced Screening and Inspection Systems at Borders; Expanding International Trade.

8. Can you provide examples of recent developments in the market?

March 2024 -OSI Systems, Inc. has announced today that its Security division, a premier global provider of security and inspection systems, has secured an international contract award valued at approximately $100 million to provide cargo and vehicle inspection systems, as well as ongoing maintenance services and training.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Cargo And Vehicle Screening Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Cargo And Vehicle Screening Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Cargo And Vehicle Screening Market?

To stay informed about further developments, trends, and reports in the North America Cargo And Vehicle Screening Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence