Key Insights

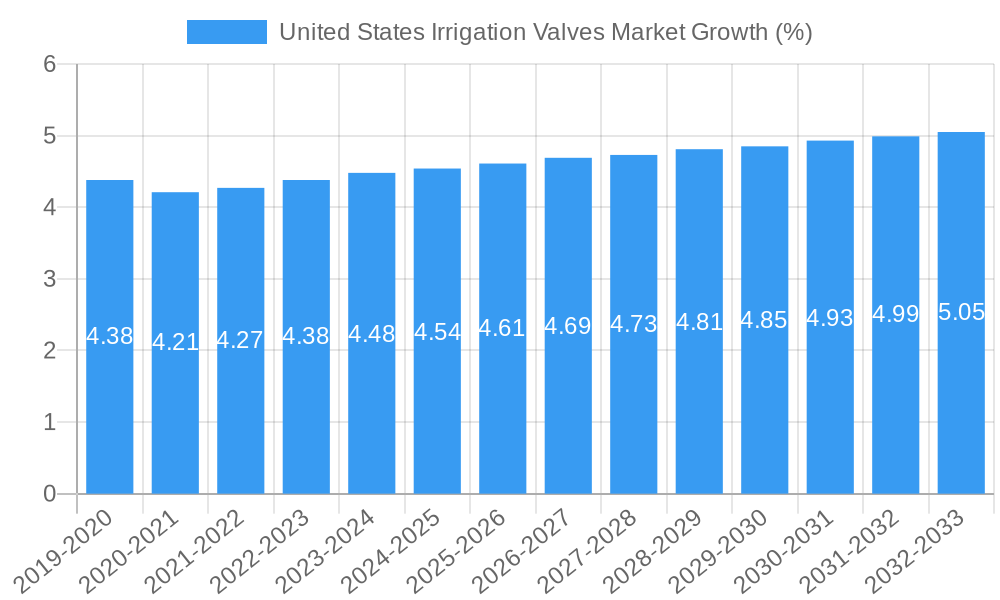

The United States irrigation valves market is projected for robust growth, driven by increasing demand for water-efficient agricultural practices and the expansion of smart irrigation technologies. With a significant market size, estimated to be in the hundreds of millions of dollars, the sector is poised for sustained expansion over the forecast period. The Compound Annual Growth Rate (CAGR) for this market is expected to be substantial, reflecting the ongoing investments in upgrading existing irrigation infrastructure and the adoption of advanced valve systems that enhance precision and reduce water wastage. Key factors fueling this growth include government initiatives promoting water conservation, the rising need for optimized crop yields through controlled water delivery, and the technological advancements in valve automation and remote monitoring capabilities. The agricultural sector, a primary consumer, is continually seeking solutions to mitigate the impacts of water scarcity and climate variability, making sophisticated irrigation valves an indispensable component.

Furthermore, the market's trajectory is also influenced by growth in non-agricultural sectors such as landscaping, sports turf management, and public parks, which are increasingly adopting automated and efficient watering systems. The development of durable, weather-resistant, and IoT-enabled irrigation valves is a significant trend, offering greater control and data-driven insights to end-users. As precision agriculture gains further traction, the demand for intelligent valves capable of integrating with soil moisture sensors, weather stations, and other farm management platforms will undoubtedly accelerate. This integration allows for real-time adjustments to irrigation schedules, ensuring optimal water application and contributing to sustainable resource management across various applications. The ongoing innovation in materials and valve designs, coupled with a growing awareness of the economic and environmental benefits of efficient water usage, solidifies a positive outlook for the United States irrigation valves market.

United States Irrigation Valves Market: Comprehensive Growth Analysis and Future Outlook (2019–2033)

This in-depth report delivers a granular analysis of the United States irrigation valves market, encompassing historical trends, current dynamics, and future projections. With a focus on key segments, leading players, and critical industry developments, this report provides actionable intelligence for stakeholders navigating the evolving landscape of agricultural and non-agricultural irrigation. Explore market drivers, barriers, emerging opportunities, and growth accelerators to inform strategic decision-making. This report is meticulously structured to offer unparalleled insights into market size, segmentation, competitive strategies, and technological advancements within the U.S. irrigation valves sector.

United States Irrigation Valves Market Market Dynamics & Structure

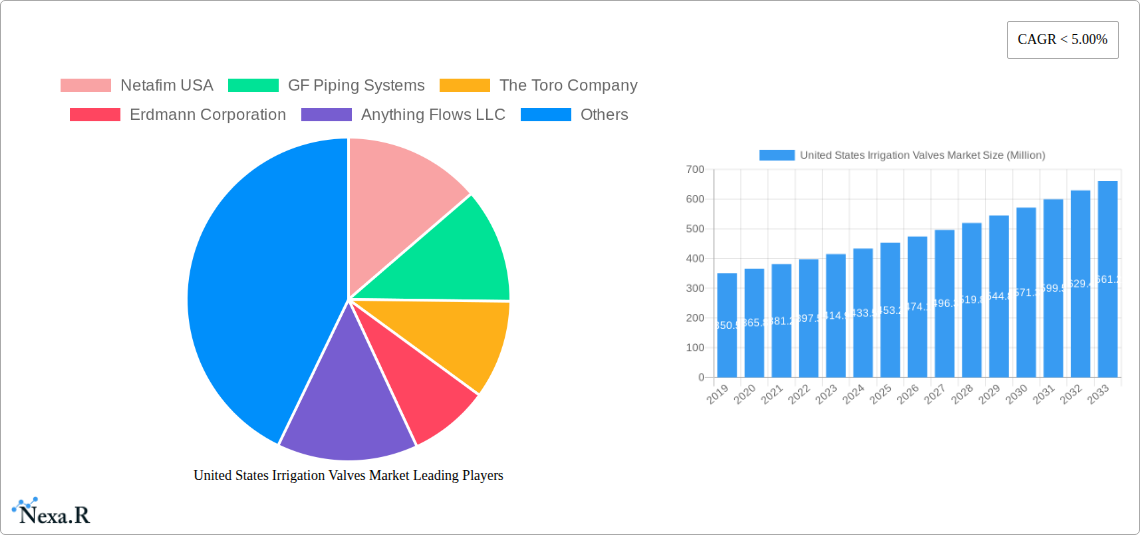

The United States irrigation valves market exhibits a moderately concentrated structure, with key players like Netafim USA, GF Piping Systems, and The Toro Company holding significant market shares. Technological innovation is a primary driver, fueled by the increasing demand for water-efficient irrigation systems and smart farming solutions. Advancements in sensor technology, IoT integration, and automated control systems are pushing the boundaries of what irrigation valves can achieve, leading to enhanced precision and reduced waste. Regulatory frameworks, particularly those promoting water conservation and sustainable agricultural practices, play a crucial role in shaping market demand. For instance, state-level water management policies and federal incentives for adopting water-saving technologies directly influence the adoption of advanced irrigation valves. Competitive product substitutes, such as manual control systems and alternative water delivery methods, pose a challenge, but the superior efficiency and remote management capabilities of modern irrigation valves are increasingly compelling. End-user demographics are shifting, with a growing adoption of precision agriculture among both large-scale commercial farms and increasingly sophisticated smaller operations. Mergers and acquisitions (M&A) are also a notable trend. For example, the formation of Aquestia through the merger of A.R.I., Dorot, and OCV in July 2021 highlights consolidation aimed at expanding product portfolios and market reach in the automatic hydraulic control valves segment. The market is characterized by a blend of established players and innovative startups, creating a dynamic competitive environment where continuous R&D and strategic partnerships are essential for sustained growth. Innovation barriers include the initial capital investment required for advanced systems and the need for skilled labor for installation and maintenance, although the long-term cost savings and efficiency gains often outweigh these initial hurdles.

United States Irrigation Valves Market Growth Trends & Insights

The United States irrigation valves market is poised for robust growth, driven by an escalating need for water conservation, increased agricultural productivity, and the pervasive adoption of smart technologies. Over the historical period of 2019–2024, the market witnessed steady expansion, underpinned by evolving agricultural practices and infrastructural investments. The base year of 2025 is estimated to represent a significant inflection point, with projected market size evolution indicating sustained year-on-year growth. This expansion is further amplified by increasing adoption rates of automated and sensor-driven irrigation solutions, moving beyond traditional manual systems. Technological disruptions, such as the integration of Artificial Intelligence (AI) and Machine Learning (ML) for predictive irrigation scheduling and the development of more durable and efficient valve materials, are fundamentally reshaping the market. Consumer behavior shifts are also playing a pivotal role, with growers increasingly prioritizing solutions that offer precise water application, reduced labor costs, and enhanced crop yields. The market penetration of smart irrigation valves, particularly in commercial agriculture, is on an upward trajectory. For instance, the increasing demand for high-value crops that require specific watering regimes necessitates the use of advanced irrigation valve systems. The forecast period of 2025–2033 is expected to see a Compound Annual Growth Rate (CAGR) of approximately xx%, reflecting the strong underlying demand drivers. This growth is not solely confined to traditional agricultural applications; non-agricultural sectors like landscaping, golf courses, and municipal water management are also contributing to market expansion as they increasingly adopt water-efficient practices. The continuous innovation in product features, such as remote monitoring and control capabilities, leak detection, and pressure regulation, further fuels market growth by offering unparalleled convenience and operational efficiency to end-users. The emphasis on sustainability and resource management by both governmental bodies and private entities acts as a significant tailwind, encouraging investment in advanced irrigation technologies.

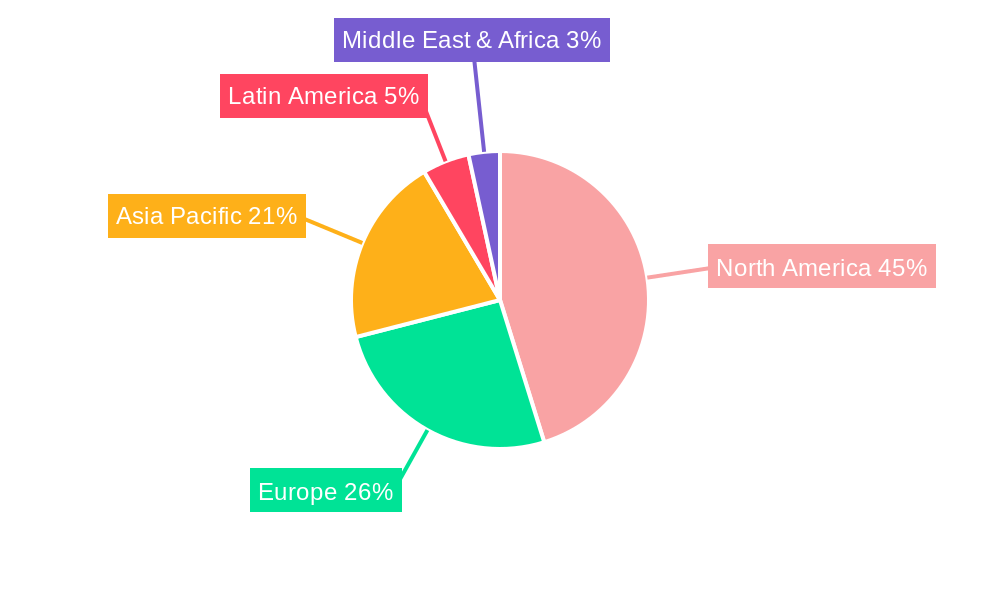

Dominant Regions, Countries, or Segments in United States Irrigation Valves Market

Within the United States irrigation valves market, Agricultural Applications emerge as the overwhelmingly dominant segment, driving a substantial portion of market growth and innovation. This dominance is propelled by the critical need for efficient water management in the nation's vast agricultural sector, particularly in water-scarce regions like the Western United States. Economic policies that encourage water conservation, coupled with federal and state incentives for adopting precision irrigation technologies, act as significant catalysts. For instance, programs aimed at improving irrigation efficiency directly translate into increased demand for advanced irrigation valves. Infrastructure development, including investments in water reclamation and distribution systems, further supports the growth of agricultural irrigation.

- Key Drivers for Agricultural Applications Dominance:

- Water Scarcity and Conservation Mandates: Arid and semi-arid regions face increasing pressure to conserve water, making efficient irrigation systems indispensable.

- Demand for Increased Crop Yields: Farmers are continuously seeking ways to optimize crop production, and precise irrigation delivered by advanced valves is crucial for this.

- Technological Advancements: The integration of smart technologies, sensors, and automation in agricultural irrigation systems enhances efficiency and reduces labor costs.

- Government Incentives and Subsidies: Programs promoting water-efficient practices often include financial support for purchasing and installing advanced irrigation equipment.

- Growth of High-Value Crops: Cultivation of crops requiring specific and controlled watering regimes further bolsters demand for sophisticated irrigation valve solutions.

The Metal Valves segment within Material Type also holds a significant market share due to its durability and suitability for high-pressure applications commonly found in large-scale agricultural operations. Similarly, Automatic Valves are leading the charge within Valve Type due to their ability to automate irrigation processes, reduce manual labor, and ensure precise water delivery based on real-time environmental data. This segment's growth is intrinsically linked to the adoption of smart farming technologies and IoT-enabled irrigation systems. The combination of these dominant segments – Agricultural Applications, Metal Valves, and Automatic Valves – creates a powerful synergy, driving significant market expansion and shaping the future trajectory of the United States irrigation valves market. Market share within these dominant segments is substantial, with agricultural applications alone accounting for an estimated xx% of the total market value in the base year of 2025. The growth potential for these segments remains high, fueled by ongoing technological advancements and increasing environmental consciousness.

United States Irrigation Valves Market Product Landscape

The United States irrigation valves market is characterized by a dynamic product landscape focused on enhancing water efficiency, automation, and system reliability. Innovations are centered on intelligent valve designs that integrate with sophisticated control systems, offering features such as precise flow control, pressure regulation, and leak detection. Metal valves, particularly those made from brass and stainless steel, continue to be prevalent for their durability in harsh agricultural environments, while advancements in plastic valve materials are offering lighter, more cost-effective alternatives with improved chemical and UV resistance. Automatic valves, including solenoid and hydraulic control valves, are at the forefront, enabling remote operation and data-driven irrigation scheduling. Unique selling propositions often revolve around seamless integration with smart irrigation platforms, energy efficiency, and extended product lifecycles, catering to the growing demand for sustainable and cost-effective water management solutions across diverse applications.

Key Drivers, Barriers & Challenges in United States Irrigation Valves Market

Key Drivers:

- Water Scarcity and Conservation: Increasing concerns over water availability, particularly in arid regions, are a primary driver for efficient irrigation solutions.

- Technological Advancements: The integration of IoT, AI, and sensor technologies is enabling smarter, more precise, and automated irrigation systems.

- Government Initiatives and Subsidies: Policies promoting water conservation and sustainable agriculture often include financial incentives for adopting advanced irrigation technologies.

- Rising Agricultural Productivity Demands: The need to increase crop yields to feed a growing population drives the adoption of technologies that optimize water and nutrient delivery.

- Growing Adoption of Smart Farming: The broader trend towards precision agriculture is creating a strong demand for connected and automated irrigation components.

Barriers & Challenges:

- Initial Capital Investment: The upfront cost of sophisticated irrigation valve systems can be a deterrent for some smaller farms or less profitable operations.

- Lack of Technical Expertise: The installation, maintenance, and operation of advanced irrigation systems require specialized knowledge, which may not be readily available in all areas.

- Infrastructure Limitations: In some rural areas, reliable power and internet connectivity for smart irrigation systems can be a challenge.

- Supply Chain Disruptions: Global events can impact the availability of raw materials and finished products, potentially leading to price volatility and delays.

- Regulatory Hurdles (in specific contexts): While many regulations promote efficiency, complex permitting processes for certain water management projects can sometimes pose challenges.

Emerging Opportunities in United States Irrigation Valves Market

Emerging opportunities in the United States irrigation valves market lie in the expansion of smart irrigation solutions for non-agricultural sectors, such as urban landscaping, public parks, and sports facilities, where water conservation is increasingly mandated. The development of highly specialized valves for micro-irrigation systems in horticulture and vertical farming presents a significant untapped market. Furthermore, the integration of advanced diagnostics and predictive maintenance capabilities within irrigation valves, powered by AI, offers a pathway to enhanced system reliability and reduced downtime for end-users. Opportunities also exist in creating interoperable valve systems that seamlessly integrate with a wider range of smart agricultural platforms, catering to the diverse needs of growers seeking integrated farm management solutions.

Growth Accelerators in the United States Irrigation Valves Market Industry

Several catalysts are accelerating growth in the United States irrigation valves market. Technological breakthroughs in material science are leading to the development of more durable, corrosion-resistant, and lightweight valves, reducing lifecycle costs. Strategic partnerships between valve manufacturers and smart agriculture technology providers are fostering integrated solutions that offer enhanced functionality and user experience. The increasing adoption of subscription-based models for smart irrigation systems, which include valve maintenance and software updates, is lowering the barrier to entry for end-users and promoting wider market penetration. Furthermore, government investments in water infrastructure modernization and climate-resilient agriculture are creating significant demand for advanced irrigation components.

Key Players Shaping the United States Irrigation Valves Market Market

- Netafim USA

- GF Piping Systems

- The Toro Company

- Erdmann Corporation

- Anything Flows LLC

- BERMAD CS Ltd

- ACE PUMP CORPORATION

- Dorot

- TVI

- Raven Industries Inc

Notable Milestones in United States Irrigation Valves Market Sector

- May 2022: Netafim U.S.A. expanded its manufacturing presence in the United States, notably in Fresno, California, to produce its innovative FlexNet piping solution for drip irrigation systems. This move enhances manufacturing efficiency and custom configuration options for customers across the Americas.

- January 2022: Netafim U.S.A. partnered with Bayer to launch the Precise Defense program. This initiative integrates crop protection products with irrigation, delivering them directly to the root zone of almond trees, thereby reducing water usage and maximizing efficacy.

- July 2021: A significant merger occurred with the formation of Aquestia, a new entity combining A.R.I., Dorot, and OCV. Specializing in automatic hydraulic control valves, this consolidation created a leading producer of solutions for water and fluid transmission systems, expanding service across waterworks, agriculture, wastewater, and industrial applications.

In-Depth United States Irrigation Valves Market Market Outlook

The United States irrigation valves market is set for sustained expansion, driven by the critical imperative for water conservation and the relentless march of technological innovation in agriculture and beyond. Growth accelerators include the development of highly intelligent and automated valve systems, which are becoming indispensable for optimizing resource utilization in both agricultural and non-agricultural applications. The increasing demand for precision irrigation, coupled with the widespread adoption of smart farming technologies, presents significant opportunities for market players. Strategic partnerships and the continuous evolution of product offerings to meet the specific needs of diverse end-users will be crucial for capturing market share. The outlook is exceptionally positive, with forecasts indicating substantial growth in the coming years, fueled by a confluence of economic, environmental, and technological factors.

United States Irrigation Valves Market Segmentation

-

1. Material Type

- 1.1. Metal Valves

- 1.2. Plastic Valves

-

2. Valve Type

- 2.1. Ball Valve

- 2.2. Butterfly Valve

- 2.3. Globe Valve

- 2.4. Automatic Valves

-

3. Application

- 3.1. Agricultural Applications

- 3.2. Non-agricultural applications

United States Irrigation Valves Market Segmentation By Geography

- 1. United States

United States Irrigation Valves Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of < 5.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Agricultural Crops; Growing Investment in Irrigation Projects

- 3.3. Market Restrains

- 3.3.1. Lack of Good Infrastructure for the Efficient Functioning of Irrigation Automation Systems; High Costs Associated with the Installation and Lack of Technical Knowledge

- 3.4. Market Trends

- 3.4.1. Plastic Valves to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Irrigation Valves Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Metal Valves

- 5.1.2. Plastic Valves

- 5.2. Market Analysis, Insights and Forecast - by Valve Type

- 5.2.1. Ball Valve

- 5.2.2. Butterfly Valve

- 5.2.3. Globe Valve

- 5.2.4. Automatic Valves

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Agricultural Applications

- 5.3.2. Non-agricultural applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Netafim USA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 GF Piping Systems

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 The Toro Company

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Erdmann Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Anything Flows LLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 BERMAD CS Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 ACE PUMP CORPORATION

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Dorot

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 TVI

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Raven Industries Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Netafim USA

List of Figures

- Figure 1: United States Irrigation Valves Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United States Irrigation Valves Market Share (%) by Company 2024

List of Tables

- Table 1: United States Irrigation Valves Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United States Irrigation Valves Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: United States Irrigation Valves Market Revenue Million Forecast, by Material Type 2019 & 2032

- Table 4: United States Irrigation Valves Market Volume K Unit Forecast, by Material Type 2019 & 2032

- Table 5: United States Irrigation Valves Market Revenue Million Forecast, by Valve Type 2019 & 2032

- Table 6: United States Irrigation Valves Market Volume K Unit Forecast, by Valve Type 2019 & 2032

- Table 7: United States Irrigation Valves Market Revenue Million Forecast, by Application 2019 & 2032

- Table 8: United States Irrigation Valves Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 9: United States Irrigation Valves Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: United States Irrigation Valves Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 11: United States Irrigation Valves Market Revenue Million Forecast, by Material Type 2019 & 2032

- Table 12: United States Irrigation Valves Market Volume K Unit Forecast, by Material Type 2019 & 2032

- Table 13: United States Irrigation Valves Market Revenue Million Forecast, by Valve Type 2019 & 2032

- Table 14: United States Irrigation Valves Market Volume K Unit Forecast, by Valve Type 2019 & 2032

- Table 15: United States Irrigation Valves Market Revenue Million Forecast, by Application 2019 & 2032

- Table 16: United States Irrigation Valves Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 17: United States Irrigation Valves Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: United States Irrigation Valves Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Irrigation Valves Market?

The projected CAGR is approximately < 5.00%.

2. Which companies are prominent players in the United States Irrigation Valves Market?

Key companies in the market include Netafim USA, GF Piping Systems, The Toro Company, Erdmann Corporation, Anything Flows LLC, BERMAD CS Ltd, ACE PUMP CORPORATION, Dorot, TVI, Raven Industries Inc.

3. What are the main segments of the United States Irrigation Valves Market?

The market segments include Material Type, Valve Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Agricultural Crops; Growing Investment in Irrigation Projects.

6. What are the notable trends driving market growth?

Plastic Valves to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Lack of Good Infrastructure for the Efficient Functioning of Irrigation Automation Systems; High Costs Associated with the Installation and Lack of Technical Knowledge.

8. Can you provide examples of recent developments in the market?

May 2022 - Netafim U.S.A., a subsidiary of Netafim Ltd., and the provider of precision irrigation solutions such as irrigation valves, sprinklers, etc., expanded its manufacturing presence in the United States. FlexNet, the company's innovative, high-performance, flexible, lightweight piping solution for above- and below-ground drip irrigation systems, would be manufacturing its products in Fresno, California. Netafim has invested in local manufacturing to produce and deliver FlexNet to customers across the Americas more efficiently and provide growers with more custom configuration options.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Irrigation Valves Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Irrigation Valves Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Irrigation Valves Market?

To stay informed about further developments, trends, and reports in the United States Irrigation Valves Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence