Key Insights

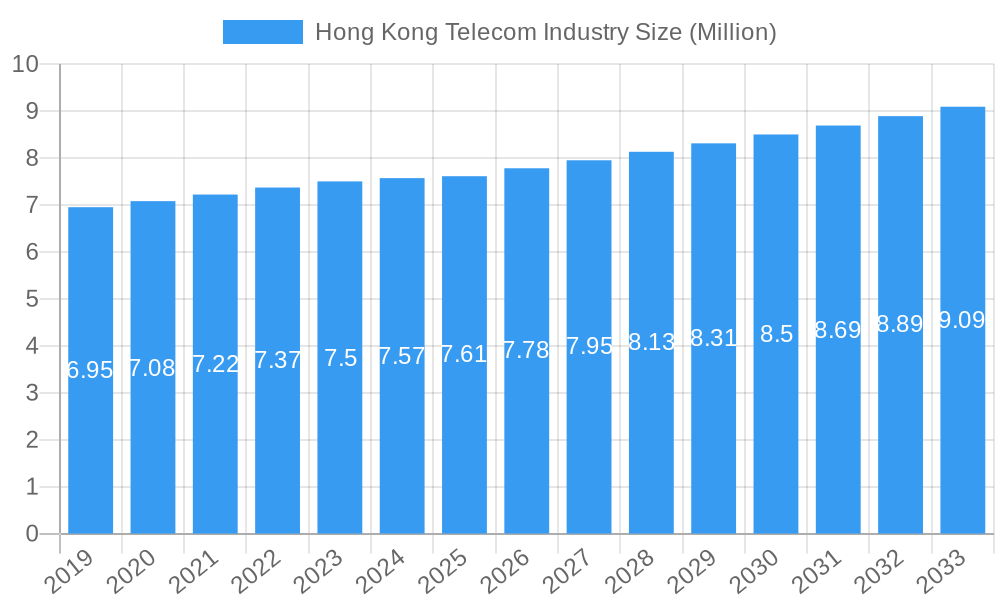

The Hong Kong telecommunications market is a mature yet dynamic landscape poised for steady growth, projected to reach approximately $7.61 million by 2025, with an anticipated Compound Annual Growth Rate (CAGR) of 2.60% through 2033. This growth, while moderate, signifies sustained demand for essential communication services. The market is primarily driven by the increasing adoption of high-speed data services and the evolving consumer preference for integrated digital experiences, encompassing Over-The-Top (OTT) and Pay-TV offerings. Companies like China Mobile Hong Kong, HKT, and China Unicom are at the forefront, actively investing in network upgrades and service diversification to capture this evolving demand. The proliferation of smartphones, coupled with a growing reliance on mobile data for entertainment, productivity, and social connectivity, forms a significant catalyst for market expansion. Furthermore, the government's continued commitment to digital infrastructure development and smart city initiatives is expected to foster an environment conducive to telco innovation and service penetration.

Hong Kong Telecom Industry Market Size (In Million)

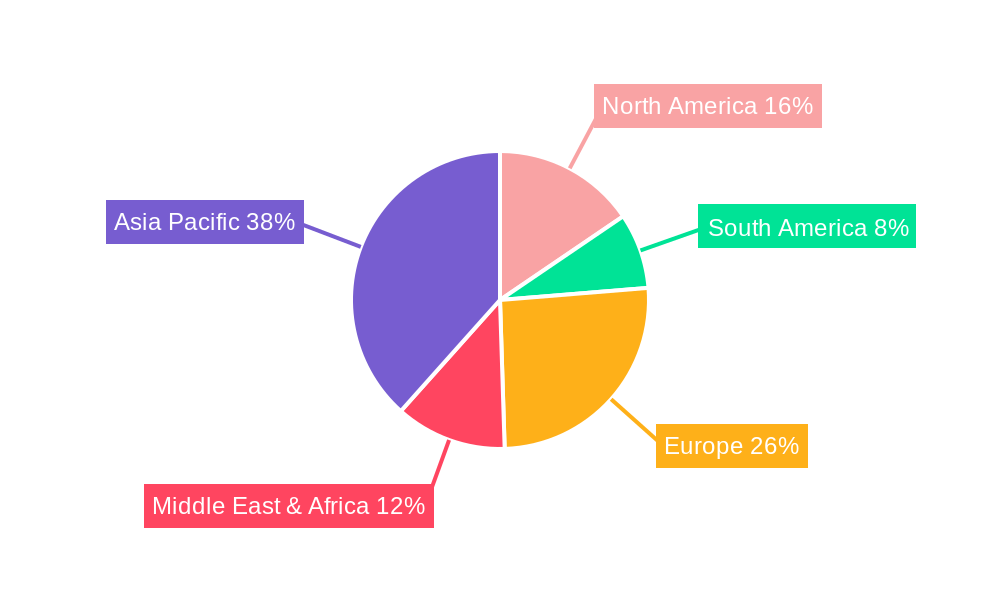

Despite the robust demand, the market faces certain restraints, including intense competition among established players and the high cost of spectrum acquisition and infrastructure deployment. The saturation of the traditional voice services market, both wired and wireless, necessitates a strategic shift towards value-added services and data-centric solutions. Emerging trends like the integration of 5G technology, the expansion of fiber optic networks, and the growing interest in enterprise solutions, such as cloud services and IoT connectivity, present significant opportunities for telcos to diversify their revenue streams. The Asia Pacific region, with China and Hong Kong at its core, is expected to lead in terms of market development and technological adoption, followed by other developed economies in North America and Europe. The continued evolution of consumer behavior, driven by the desire for seamless connectivity and an enriched digital lifestyle, will remain the central theme shaping the trajectory of the Hong Kong telecom industry.

Hong Kong Telecom Industry Company Market Share

Comprehensive Report: Hong Kong Telecom Industry Outlook 2019–2033

This in-depth report provides a holistic analysis of the Hong Kong Telecom Industry, examining market dynamics, growth trajectories, competitive landscapes, and emerging opportunities. Leveraging extensive data from 2019–2024 and projecting forward to 2033, with a base and estimated year of 2025, this report offers critical insights for industry stakeholders. It meticulously covers key segments including Voice Services (Wired, Wireless), Data and Messaging Services, and OTT and Pay-TV Services, while highlighting the strategic contributions of major players like Loop Mobility Ltd, China Unicom (Hong Kong) Limited, SmarTone Telecommunications Holdings Limited, China Mobile Hong Kong Company Limited, Hutchison Telecommunications Hong Kong Holdings Limited, CITIC Telecom International CPC Limited, Hong Kong Telecommunications (HKT) Limited, Pai Telecommunications Lt, I-cable Communications Limited, and Hong Kong Broadband Network Limited (HKBN).

Hong Kong Telecom Industry Market Dynamics & Structure

The Hong Kong Telecom Industry exhibits a moderately concentrated market structure, with a few dominant players like HKT and China Mobile Hong Kong holding significant market share, estimated to be around 50% combined in key services. Technological innovation, particularly in 5G deployment and fiber optic network expansion, serves as a primary driver, fueling demand for high-speed data and advanced communication solutions. The regulatory framework, overseen by the Office of the Communications Authority (OFCA), is designed to promote fair competition and consumer protection, though evolving regulations around data privacy and spectrum allocation continue to shape the landscape. Competitive product substitutes, especially the increasing prevalence of Over-The-Top (OTT) services, present a challenge to traditional telecom revenue streams, forcing incumbents to adapt their offerings. End-user demographics reveal a sophisticated and tech-savvy population, with a high smartphone penetration rate and an increasing demand for seamless, integrated digital experiences. Mergers and acquisitions (M&A) activity, while not consistently high, has seen strategic consolidation, for instance, the acquisition of IFPH Global’s fixed-line broadband business by HKBN in 2022, which was valued at approximately $220 million. Innovation barriers include the substantial capital expenditure required for network upgrades and the complex process of obtaining regulatory approvals for new services.

- Market Concentration: Dominated by a few key players, but with increasing competition from OTT and niche providers.

- Technological Innovation Drivers: 5G rollout, AI integration, and IoT connectivity are paramount.

- Regulatory Frameworks: Focus on fair competition, data protection, and spectrum management.

- Competitive Product Substitutes: Rise of OTT platforms for messaging and video.

- End-User Demographics: Young, digitally active population with high disposable income.

- M&A Trends: Strategic acquisitions focused on expanding service portfolios and market reach.

- Innovation Barriers: High CAPEX for infrastructure, regulatory hurdles.

Hong Kong Telecom Industry Growth Trends & Insights

The Hong Kong Telecom Industry is on a robust growth trajectory, projected to expand significantly over the forecast period. The market size is estimated to have reached approximately $12,500 million in the base year of 2025, with an anticipated Compound Annual Growth Rate (CAGR) of around 6.5% between 2025 and 2033. This growth is propelled by the escalating adoption of 5G services, with penetration rates expected to surpass 70% by 2033. Technological disruptions, such as the integration of Artificial Intelligence (AI) into network management and customer service, are enhancing operational efficiency and personalizing user experiences. Consumer behavior shifts are evident, with a growing preference for bundled services that include high-speed broadband, mobile data, and digital entertainment platforms like OTT and Pay-TV. The proliferation of smart city initiatives and the increasing demand for Internet of Things (IoT) connectivity for both consumer and enterprise applications further fuel market expansion. Data and messaging services continue to be a cornerstone, witnessing steady growth driven by increased mobile data consumption and a surge in enterprise communication solutions. The shift towards cloud-based services and the demand for robust cybersecurity infrastructure are also significant contributors to the market's evolution. The historical period (2019–2024) saw significant investment in 4G and initial 5G deployments, laying the groundwork for the accelerated growth anticipated in the coming years.

Dominant Regions, Countries, or Segments in Hong Kong Telecom Industry

Within the Hong Kong Telecom Industry, the Data and Messaging Services segment is poised to be a dominant growth driver. This segment, encompassing mobile data, fixed broadband, and various messaging platforms, is projected to capture a significant portion of market revenue, estimated to exceed $6,000 million by 2033. Key drivers for this dominance include the ubiquitous adoption of smartphones and the ever-increasing demand for high-speed internet access for both personal and professional use. Hong Kong's status as a global financial hub necessitates robust data infrastructure, supporting complex trading operations and cross-border communication. Economic policies that foster technological advancement and encourage digital transformation within businesses play a crucial role. Furthermore, government initiatives to expand broadband access and promote smart city development directly translate into increased demand for data services. The infrastructure development, spearheaded by companies like HKT and HKBN, has created a competitive environment that drives service quality and innovation.

- Key Drivers for Data and Messaging Services Dominance:

- High Smartphone Penetration: Over 90% of the population owns a smartphone, driving mobile data consumption.

- Demand for High-Speed Broadband: Essential for remote work, online education, and entertainment.

- Smart City Initiatives: Integration of IoT devices and smart solutions requires extensive data networks.

- Financial Hub Status: Critical need for reliable and high-capacity data for financial transactions and communications.

- Government Support for Digitalization: Policies promoting digital transformation and infrastructure upgrades.

- Competitive Infrastructure Development: Significant investments by leading telecom providers to enhance network capabilities.

- Market Share and Growth Potential: This segment is expected to grow at a CAGR of approximately 7% from 2025 to 2033, outpacing other segments due to its fundamental role in the digital economy. The total revenue from Data and Messaging Services is forecast to reach over $6,000 million by 2033, representing a substantial portion of the overall telecom market.

The OTT and Pay-TV Services segment is also a significant growth engine, experiencing rapid expansion driven by changing consumer entertainment preferences. The launch of new OTT apps by players like Now TV signifies a strategic pivot towards flexible, on-demand content delivery. This segment is expected to grow at a CAGR of around 8% over the forecast period, fueled by increasing demand for personalized streaming experiences and a shift away from traditional broadcast models.

- Key Drivers for OTT and Pay-TV Services Dominance:

- Changing Consumer Habits: Preference for on-demand viewing and diverse content libraries.

- Technological Advancements: Improved streaming quality and multi-device compatibility.

- Content Diversification: Availability of a wide range of local and international content.

- Bundling Strategies: Telcos integrating OTT services into their packages to enhance value proposition.

- Increased Disposable Income: Supporting subscription-based entertainment services.

- Market Share and Growth Potential: While starting from a smaller base compared to data services, its high growth rate indicates a significant future market share, potentially reaching $2,500 million by 2033.

While Voice Services (Wired and Wireless) will continue to be a foundational element, its growth is expected to be more moderate, around 2-3% CAGR, as data-centric services become increasingly prevalent for communication. However, the reliability of fixed-line voice services remains crucial for business continuity, and mobile voice remains essential for basic connectivity.

Hong Kong Telecom Industry Product Landscape

The product landscape in the Hong Kong Telecom Industry is characterized by rapid innovation and a focus on delivering seamless, high-performance digital experiences. Key product advancements include the widespread rollout of 5G-enabled devices and infrastructure, offering significantly faster speeds and lower latency, which are crucial for applications like augmented reality (AR), virtual reality (VR), and real-time cloud gaming. Telecom operators are enhancing their broadband offerings with fiber-to-the-home (FTTH) solutions delivering speeds of up to 10 Gbps. Furthermore, there's a notable push towards integrated service bundles that combine mobile, fixed broadband, and content streaming services, providing consumers with a comprehensive digital lifestyle solution. The development of specialized enterprise solutions, including secure private networks and IoT platforms, is also a significant trend, catering to the evolving needs of businesses in a digital-first economy. Performance metrics are increasingly focused on user experience, such as network uptime, data throughput, and latency, reflecting the high expectations of consumers and businesses in this competitive market.

Key Drivers, Barriers & Challenges in Hong Kong Telecom Industry

The Hong Kong Telecom Industry is propelled by several key drivers, including the relentless demand for high-speed data, the government's commitment to developing Hong Kong into a smart city, and the continuous advancements in 5G technology and network infrastructure. The strategic importance of Hong Kong as a regional business hub also necessitates robust and reliable telecommunications services, driving adoption of cutting-edge solutions.

- Key Drivers:

- 5G Network Expansion and Adoption: Driving demand for faster speeds and new use cases.

- Smart City Development: Requiring extensive IoT connectivity and data analytics.

- Growing Demand for Digital Entertainment: Fueling OTT and Pay-TV services.

- Enterprise Digital Transformation: Need for advanced communication and cloud solutions.

- Geographic Advantage: Hong Kong's role as a gateway to Mainland China and international markets.

Conversely, the industry faces significant barriers and challenges. The substantial capital expenditure required for network upgrades, particularly for 5G deployment, presents a considerable financial hurdle. Regulatory complexities and spectrum allocation processes can also lead to delays and increased costs. Intense competition among established players and the emergence of agile virtual network operators (MVNOs) and OTT service providers put pressure on pricing and margins. Supply chain disruptions for network equipment and components, exacerbated by global geopolitical factors, can impact deployment timelines and operational efficiency. Cybersecurity threats are a constant concern, requiring continuous investment in robust security measures to protect customer data and network integrity.

- Key Barriers & Challenges:

- High Capital Expenditure for 5G Rollout: Significant investment required for infrastructure.

- Intense Market Competition: Price wars and service differentiation pressures.

- Regulatory Hurdles and Spectrum Allocation: Complex and time-consuming processes.

- Cybersecurity Threats: Constant need for robust security measures.

- Supply Chain Volatility: Potential disruptions in equipment procurement.

- Evolving Consumer Preferences: Need to adapt quickly to changing demands.

Emerging Opportunities in Hong Kong Telecom Industry

Emerging opportunities in the Hong Kong Telecom Industry are vast and varied, driven by technological innovation and evolving consumer and business needs. The continued expansion of 5G presents significant opportunities for new revenue streams through enhanced mobile broadband (eMBB), ultra-reliable low-latency communication (URLLC), and massive machine-type communication (mMTC) applications. This includes the development of advanced enterprise solutions for sectors like logistics, healthcare, and smart manufacturing. The growing demand for immersive entertainment experiences, such as VR/AR content and cloud gaming, offers lucrative avenues for content providers and telecom operators alike. Furthermore, the burgeoning Internet of Things (IoT) ecosystem in Hong Kong, from smart homes to smart city infrastructure, requires robust and scalable connectivity solutions, presenting a significant growth area. The increasing focus on data analytics and AI integration within telecom networks also opens doors for service innovation and operational efficiency improvements.

Growth Accelerators in the Hong Kong Telecom Industry Industry

Several catalysts are accelerating long-term growth in the Hong Kong Telecom Industry. The sustained government support for the development of a digital economy and smart city infrastructure is a primary accelerator, creating a conducive environment for innovation and investment. Strategic partnerships between telecom operators, technology providers, and content creators are crucial for developing and deploying new services and applications that cater to evolving consumer demands. For instance, collaborations on 5G SA+VoNR roaming trials demonstrate a commitment to enhancing cross-border connectivity and unlocking new service possibilities. The ongoing expansion of fiber optic networks and the continuous upgrade of mobile networks to the latest 5G standards ensure that the foundational infrastructure is in place to support future growth. Market expansion strategies, including the development of tailored enterprise solutions and the exploration of new B2B vertical markets, also contribute significantly to sustained growth.

Key Players Shaping the Hong Kong Telecom Industry Market

- Loop Mobility Ltd

- China Unicom (Hong Kong) Limited

- SmarTone Telecommunications Holdings Limited

- China Mobile Hong Kong Company Limited

- Hutchison Telecommunications Hong Kong Holdings Limited

- CITIC Telecom International CPC Limited

- Hong Kong Telecommunications (HKT) Limited

- Pai Telecommunications Lt

- I-cable Communications Limited

- Hong Kong Broadband Network Limited (HKBN)

Notable Milestones in Hong Kong Telecom Industry Sector

- January 2024: Now TV launches an OTT app, enabling mobile access to content for subscribers and simultaneous viewing on mobile and TV. This move broadens audience reach and enhances content consumption flexibility, aligning with digital transformation trends.

- December 2023: CTM and China Mobile Hong Kong conduct the first 5G SA+VoNR roaming trial between Hong Kong and Macau via the CITIC Telecom international roaming hub (IPX) platform. This milestone enhances 5G roaming services, offering seamless, fast, and secure connections, and supports 5G integration in the Greater Bay Area's smart city development.

In-Depth Hong Kong Telecom Industry Market Outlook

The future market outlook for the Hong Kong Telecom Industry is exceptionally promising, characterized by sustained growth driven by technological advancements and evolving consumer needs. The ongoing rollout and adoption of 5G technology, coupled with the expansion of high-speed fixed broadband infrastructure, will continue to be primary growth accelerators. The increasing demand for integrated digital services, encompassing mobile, broadband, and entertainment, presents significant opportunities for telecom operators to bundle offerings and enhance customer value. Furthermore, the development of smart city initiatives and the proliferation of IoT devices will necessitate robust connectivity solutions, creating new revenue streams. Strategic collaborations and ongoing investments in network upgrades and innovation will enable the industry to capitalize on emerging trends such as AI-driven services, immersive technologies, and advanced enterprise solutions, solidifying Hong Kong's position as a leading digital hub.

Hong Kong Telecom Industry Segmentation

-

1. Services

-

1.1. Voice Services

- 1.1.1. Wired

- 1.1.2. Wireless

- 1.2. Data and Messaging Services

- 1.3. OTT and Pay-TV Services

-

1.1. Voice Services

Hong Kong Telecom Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Hong Kong Telecom Industry Regional Market Share

Geographic Coverage of Hong Kong Telecom Industry

Hong Kong Telecom Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.60% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 5G Rollout in Hong Kong; Digital Transformation Through IoT and AI; Robust Mobile Penetration

- 3.3. Market Restrains

- 3.3.1. Stiff Competition in the Market

- 3.4. Market Trends

- 3.4.1. 5G Rollout in Hong Kong Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Hong Kong Telecom Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Services

- 5.1.1. Voice Services

- 5.1.1.1. Wired

- 5.1.1.2. Wireless

- 5.1.2. Data and Messaging Services

- 5.1.3. OTT and Pay-TV Services

- 5.1.1. Voice Services

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Services

- 6. North America Hong Kong Telecom Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Services

- 6.1.1. Voice Services

- 6.1.1.1. Wired

- 6.1.1.2. Wireless

- 6.1.2. Data and Messaging Services

- 6.1.3. OTT and Pay-TV Services

- 6.1.1. Voice Services

- 6.1. Market Analysis, Insights and Forecast - by Services

- 7. South America Hong Kong Telecom Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Services

- 7.1.1. Voice Services

- 7.1.1.1. Wired

- 7.1.1.2. Wireless

- 7.1.2. Data and Messaging Services

- 7.1.3. OTT and Pay-TV Services

- 7.1.1. Voice Services

- 7.1. Market Analysis, Insights and Forecast - by Services

- 8. Europe Hong Kong Telecom Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Services

- 8.1.1. Voice Services

- 8.1.1.1. Wired

- 8.1.1.2. Wireless

- 8.1.2. Data and Messaging Services

- 8.1.3. OTT and Pay-TV Services

- 8.1.1. Voice Services

- 8.1. Market Analysis, Insights and Forecast - by Services

- 9. Middle East & Africa Hong Kong Telecom Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Services

- 9.1.1. Voice Services

- 9.1.1.1. Wired

- 9.1.1.2. Wireless

- 9.1.2. Data and Messaging Services

- 9.1.3. OTT and Pay-TV Services

- 9.1.1. Voice Services

- 9.1. Market Analysis, Insights and Forecast - by Services

- 10. Asia Pacific Hong Kong Telecom Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Services

- 10.1.1. Voice Services

- 10.1.1.1. Wired

- 10.1.1.2. Wireless

- 10.1.2. Data and Messaging Services

- 10.1.3. OTT and Pay-TV Services

- 10.1.1. Voice Services

- 10.1. Market Analysis, Insights and Forecast - by Services

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Loop Mobility Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 China Unicom (Hong Kong) Limited

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 SmarTone Telecommunications Holdings Limited

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 China Mobile Hong Kong Company Limited

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Hutchison Telecommunications Hong Kong Holdings Limited

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 CITIC Telecom International CPC Limited

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Hong Kong Telecommunications (HKT) Limited

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Pai Telecommunications Lt

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 I-cable Communications Limited

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Hong Kong Broadband Network Limited (HKBN)

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Loop Mobility Ltd

List of Figures

- Figure 1: Global Hong Kong Telecom Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Hong Kong Telecom Industry Revenue (Million), by Services 2025 & 2033

- Figure 3: North America Hong Kong Telecom Industry Revenue Share (%), by Services 2025 & 2033

- Figure 4: North America Hong Kong Telecom Industry Revenue (Million), by Country 2025 & 2033

- Figure 5: North America Hong Kong Telecom Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America Hong Kong Telecom Industry Revenue (Million), by Services 2025 & 2033

- Figure 7: South America Hong Kong Telecom Industry Revenue Share (%), by Services 2025 & 2033

- Figure 8: South America Hong Kong Telecom Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: South America Hong Kong Telecom Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Hong Kong Telecom Industry Revenue (Million), by Services 2025 & 2033

- Figure 11: Europe Hong Kong Telecom Industry Revenue Share (%), by Services 2025 & 2033

- Figure 12: Europe Hong Kong Telecom Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Hong Kong Telecom Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa Hong Kong Telecom Industry Revenue (Million), by Services 2025 & 2033

- Figure 15: Middle East & Africa Hong Kong Telecom Industry Revenue Share (%), by Services 2025 & 2033

- Figure 16: Middle East & Africa Hong Kong Telecom Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Middle East & Africa Hong Kong Telecom Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Hong Kong Telecom Industry Revenue (Million), by Services 2025 & 2033

- Figure 19: Asia Pacific Hong Kong Telecom Industry Revenue Share (%), by Services 2025 & 2033

- Figure 20: Asia Pacific Hong Kong Telecom Industry Revenue (Million), by Country 2025 & 2033

- Figure 21: Asia Pacific Hong Kong Telecom Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Hong Kong Telecom Industry Revenue Million Forecast, by Services 2020 & 2033

- Table 2: Global Hong Kong Telecom Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global Hong Kong Telecom Industry Revenue Million Forecast, by Services 2020 & 2033

- Table 4: Global Hong Kong Telecom Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States Hong Kong Telecom Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada Hong Kong Telecom Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Mexico Hong Kong Telecom Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Global Hong Kong Telecom Industry Revenue Million Forecast, by Services 2020 & 2033

- Table 9: Global Hong Kong Telecom Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Brazil Hong Kong Telecom Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Argentina Hong Kong Telecom Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America Hong Kong Telecom Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Global Hong Kong Telecom Industry Revenue Million Forecast, by Services 2020 & 2033

- Table 14: Global Hong Kong Telecom Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United Kingdom Hong Kong Telecom Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany Hong Kong Telecom Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: France Hong Kong Telecom Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Italy Hong Kong Telecom Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Spain Hong Kong Telecom Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Russia Hong Kong Telecom Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Benelux Hong Kong Telecom Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Nordics Hong Kong Telecom Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe Hong Kong Telecom Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global Hong Kong Telecom Industry Revenue Million Forecast, by Services 2020 & 2033

- Table 25: Global Hong Kong Telecom Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Turkey Hong Kong Telecom Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Israel Hong Kong Telecom Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: GCC Hong Kong Telecom Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: North Africa Hong Kong Telecom Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: South Africa Hong Kong Telecom Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa Hong Kong Telecom Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Hong Kong Telecom Industry Revenue Million Forecast, by Services 2020 & 2033

- Table 33: Global Hong Kong Telecom Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 34: China Hong Kong Telecom Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: India Hong Kong Telecom Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Japan Hong Kong Telecom Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: South Korea Hong Kong Telecom Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: ASEAN Hong Kong Telecom Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Oceania Hong Kong Telecom Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific Hong Kong Telecom Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Hong Kong Telecom Industry?

The projected CAGR is approximately 2.60%.

2. Which companies are prominent players in the Hong Kong Telecom Industry?

Key companies in the market include Loop Mobility Ltd, China Unicom (Hong Kong) Limited, SmarTone Telecommunications Holdings Limited, China Mobile Hong Kong Company Limited, Hutchison Telecommunications Hong Kong Holdings Limited, CITIC Telecom International CPC Limited, Hong Kong Telecommunications (HKT) Limited, Pai Telecommunications Lt, I-cable Communications Limited, Hong Kong Broadband Network Limited (HKBN).

3. What are the main segments of the Hong Kong Telecom Industry?

The market segments include Services.

4. Can you provide details about the market size?

The market size is estimated to be USD 7.61 Million as of 2022.

5. What are some drivers contributing to market growth?

5G Rollout in Hong Kong; Digital Transformation Through IoT and AI; Robust Mobile Penetration.

6. What are the notable trends driving market growth?

5G Rollout in Hong Kong Expected to Drive the Market.

7. Are there any restraints impacting market growth?

Stiff Competition in the Market.

8. Can you provide examples of recent developments in the market?

January 2024: Now TV, a prominent pay-TV operator in Hong Kong, rolled out an OTT app. This app enables customers and monthly subscribers to access Now TV’s content on mobile devices. Users may also enjoy the content on both their mobile devices and TV simultaneously. This strategic move is poised to broaden Now TV's audience, offering enhanced flexibility and convenience in content consumption. The feature allowing simultaneous viewing on multiple devices aligns with the modern consumer's preference for on-the-go entertainment, boosting user engagement and satisfaction. The launch of this OTT app not only underscores Now TV's forward-thinking approach but also mirrors a broader industry shift toward digital transformation.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Hong Kong Telecom Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Hong Kong Telecom Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Hong Kong Telecom Industry?

To stay informed about further developments, trends, and reports in the Hong Kong Telecom Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence