Key Insights

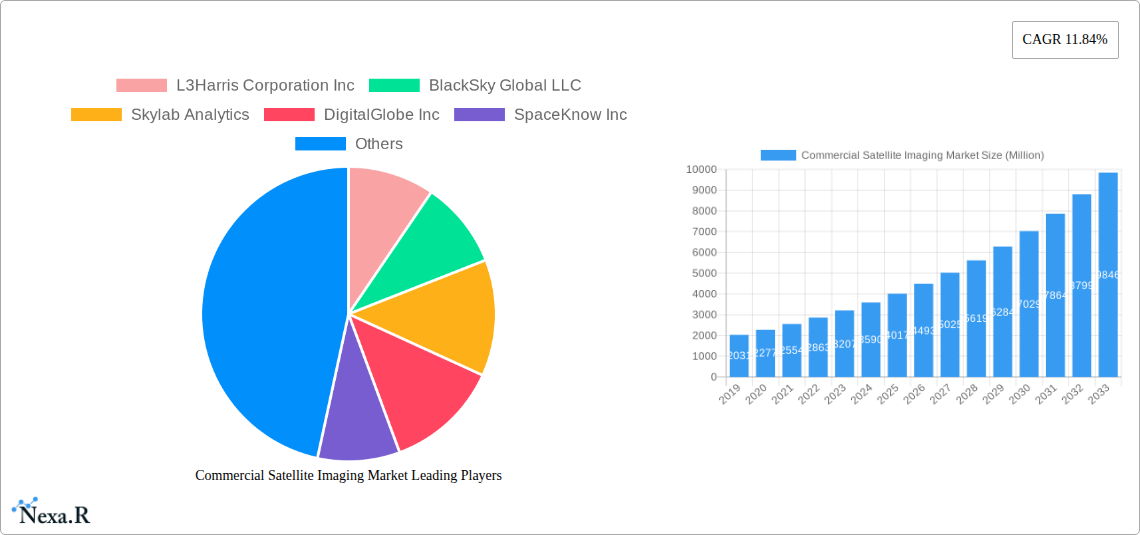

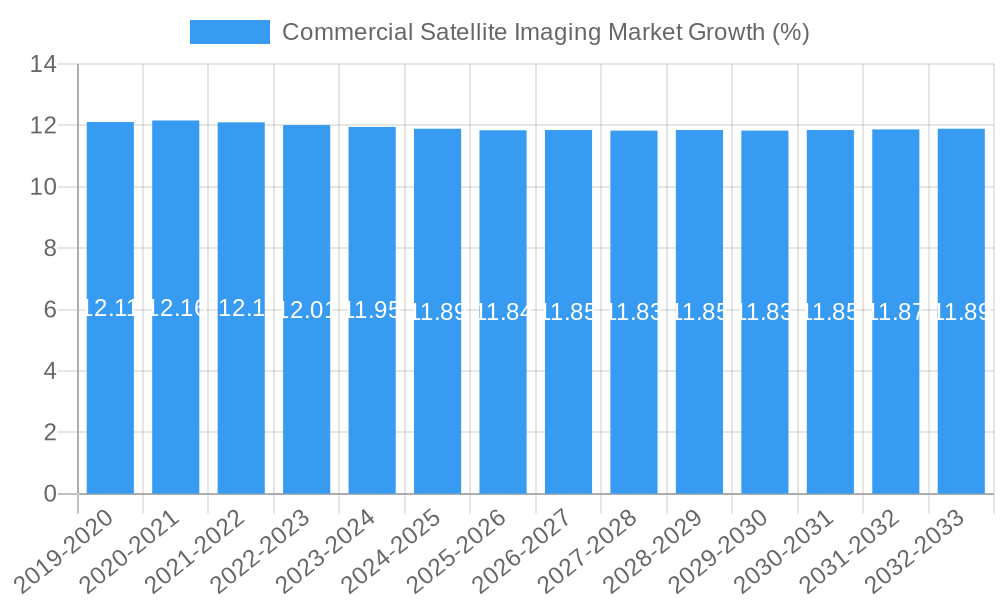

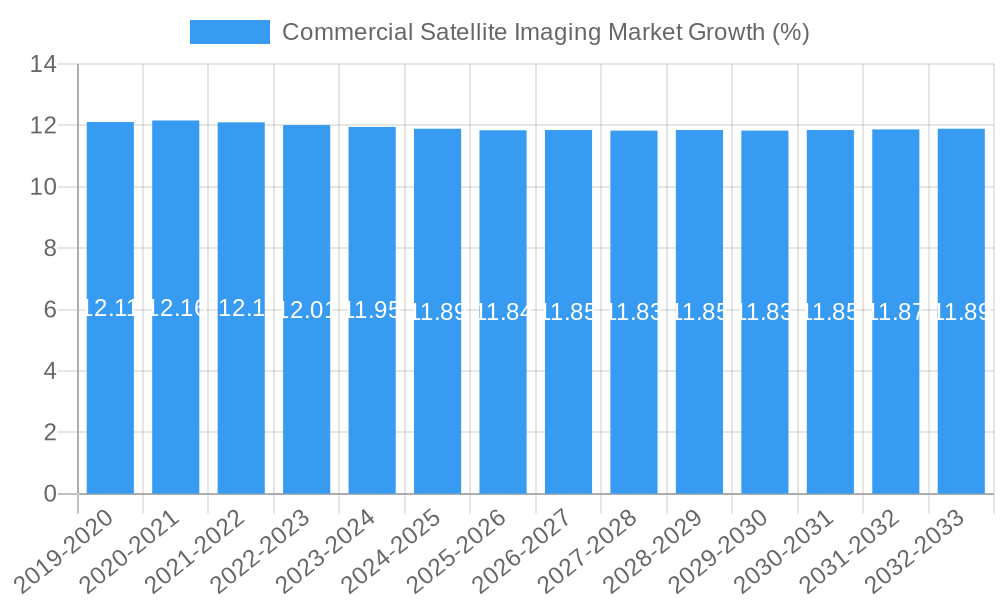

The Commercial Satellite Imaging Market is poised for substantial expansion, projected to reach a valuation of $5.04 billion, driven by an impressive Compound Annual Growth Rate (CAGR) of 11.84% from 2019 to 2033. This robust growth is fueled by a confluence of factors, including the increasing demand for high-resolution geospatial data across diverse applications and the escalating adoption of satellite imagery by various end-user verticals. Key applications like Geospatial Data Acquisition and Mapping, Natural Resource Management, and Surveillance and Security are spearheading this growth. The burgeoning need for precise environmental monitoring, efficient resource allocation, and enhanced national security initiatives are significant market drivers. Furthermore, advancements in satellite technology, leading to more frequent revisits, higher resolution imagery, and sophisticated analytical capabilities, are making satellite data more accessible and valuable than ever before. The proliferation of commercial satellite constellations and the development of advanced analytics platforms are further democratizing access to this critical information, paving the way for innovative solutions.

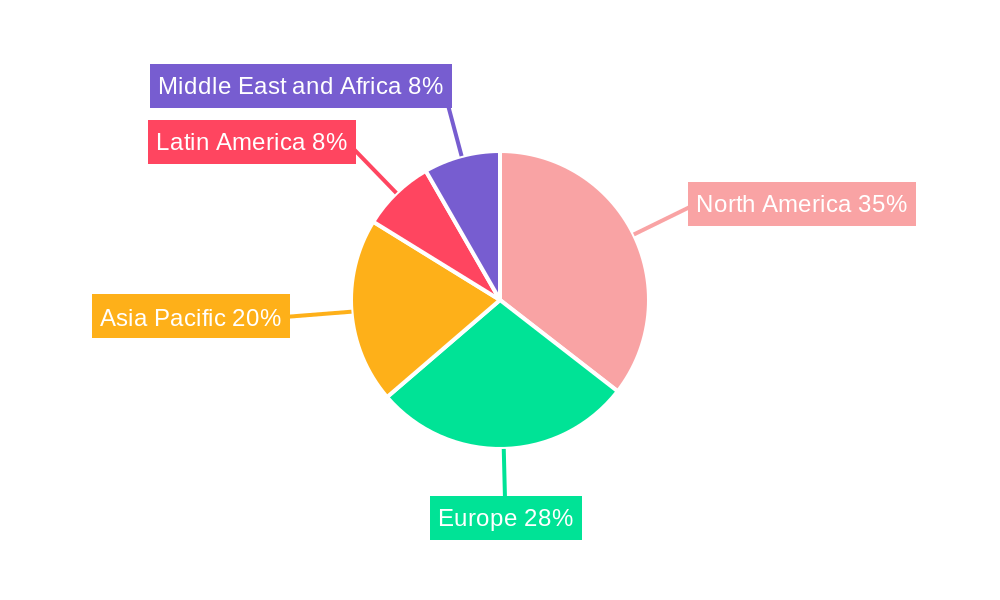

The market is segmented into numerous applications, with Geospatial Data Acquisition and Mapping, Natural Resource Management, and Surveillance and Security identified as key growth areas. The government sector, alongside construction, military, and energy industries, represent dominant end-user verticals, leveraging satellite imagery for critical decision-making and operational efficiency. While the market exhibits strong upward momentum, certain factors could present challenges. These might include the significant upfront investment required for satellite development and deployment, regulatory hurdles in data sharing and usage, and the ongoing need for skilled professionals to interpret and analyze complex geospatial data. Geographically, North America and Europe are expected to maintain their lead in market share, owing to established technological infrastructure and robust government and commercial demand. However, the Asia Pacific region is anticipated to witness the fastest growth, driven by rapid infrastructure development and increasing governmental initiatives in areas like disaster management and urban planning.

Comprehensive Report: Commercial Satellite Imaging Market - Growth, Trends, and Future Outlook (2019-2033)

This in-depth report provides a comprehensive analysis of the global Commercial Satellite Imaging Market, meticulously examining its dynamics, growth trajectory, key players, and future potential. Spanning a study period from 2019 to 2033, with a base and estimated year of 2025, this report offers critical insights for industry stakeholders, investors, and decision-makers. Discover the evolving landscape of satellite imagery services, geospatial data analytics, and their impact across diverse end-user verticals, including government, defense, energy, and agriculture.

Commercial Satellite Imaging Market Dynamics & Structure

The Commercial Satellite Imaging Market is characterized by a dynamic interplay of technological advancements, regulatory influences, and evolving end-user demands. Market concentration varies across different segments, with larger players like L3Harris Corporation Inc and Planet Labs Inc holding significant market share, particularly in high-resolution imagery and data processing. Technological innovation is a primary driver, fueled by advancements in satellite sensor technology, artificial intelligence for image analysis, and cloud-based data platforms. These innovations are crucial for enhancing resolution, frequency of revisit, and the ability to extract actionable intelligence from vast datasets. Regulatory frameworks, while sometimes presenting barriers, also create opportunities, especially in areas like data privacy and national security. Competitive product substitutes, such as drone-based imaging and aerial photography, offer localized solutions but often lack the broad coverage and consistent revisit capabilities of satellites. End-user demographics are increasingly diverse, with a growing demand from sectors beyond traditional defense and intelligence, including agriculture, urban planning, and environmental monitoring. Mergers and acquisitions (M&A) trends are reshaping the competitive landscape, with companies acquiring specialized capabilities or expanding their geographic reach. For instance, recent acquisitions have aimed to consolidate data processing expertise or expand constellation size for improved coverage.

- Market Concentration: Moderate to high in high-resolution imaging, fragmented in niche data analytics.

- Technological Innovation Drivers: Higher resolution sensors, AI-powered analytics, miniaturization of satellites, cloud infrastructure.

- Regulatory Frameworks: Data security, export controls, national space policies influencing market access and data usage.

- Competitive Product Substitutes: Drone imagery, aerial photography, ground-based sensors.

- End-User Demographics: Diversification into commercial sectors; increasing demand for frequent and detailed data.

- M&A Trends: Consolidation for technological integration, market expansion, and increased data offerings.

Commercial Satellite Imaging Market Growth Trends & Insights

The Commercial Satellite Imaging Market is poised for robust growth, driven by an escalating demand for actionable geospatial intelligence across a myriad of applications. The market size is projected to expand significantly, reflecting increased adoption rates of satellite imagery for tasks ranging from precision agriculture and natural resource management to infrastructure monitoring and urban planning. Technological disruptions, such as the proliferation of small satellite constellations and the development of advanced analytical tools, are significantly lowering the barrier to entry and enhancing the capabilities of existing solutions. This has led to a substantial shift in consumer behavior, with organizations increasingly relying on real-time or near-real-time satellite data for informed decision-making. The global satellite imagery market is experiencing a burgeoning interest from new industries, moving beyond its traditional defense and government applications. The integration of Artificial Intelligence (AI) and Machine Learning (ML) algorithms is revolutionizing the way raw satellite data is processed and interpreted, transforming it into highly valuable insights. This allows for automated object detection, change detection, and predictive analysis, which were previously manual and time-consuming. The increasing frequency of natural disasters worldwide is also a significant catalyst, driving the demand for rapid damage assessment and disaster response planning using satellite surveillance and satellite mapping services. Furthermore, the push towards sustainable development and environmental conservation is fostering the use of satellite Earth observation for monitoring deforestation, tracking climate change impacts, and managing water resources effectively. The development of synthetic aperture radar (SAR) technology, capable of penetrating cloud cover and operating in all weather conditions, is further expanding the applicability of satellite imagery, particularly in regions with persistent cloud cover. The growing accessibility and affordability of satellite data, coupled with the rise of specialized analytics platforms, are democratizing access to this powerful technology, empowering smaller businesses and research institutions to leverage its benefits. The satellite data analytics market is intrinsically linked to the growth of the commercial satellite imaging sector, as the value derived from imagery is amplified through sophisticated analytical techniques. This symbiotic relationship ensures continued innovation and market expansion as both components mature. The base year of 2025 is anticipated to witness a substantial market value of approximately \$8,500 Million, with a projected Compound Annual Growth Rate (CAGR) of around 14.5% during the forecast period of 2025–2033. This impressive growth underscores the increasing strategic importance of commercial remote sensing solutions.

Dominant Regions, Countries, or Segments in Commercial Satellite Imaging Market

The Commercial Satellite Imaging Market is witnessing significant growth across various regions and segments, with North America currently leading the charge, driven by substantial investments from government agencies and a robust technology ecosystem. The Application: Geospatial Data Acquisition and Mapping segment remains a cornerstone of market dominance, fueled by the universal need for accurate and up-to-date spatial information. However, the Application: Defense and Intelligence segment, heavily supported by government procurements, continues to be a major revenue generator. The February 2024 initiative by the National Geospatial-Intelligence Agency (NGA) to "supercharge" its use of commercial satellite imagery and analytics through its "Luno" program exemplifies this dominance and signals an accelerated demand for sophisticated satellite monitoring solutions.

North America's leadership is attributed to several key drivers:

- Government Spending: Significant budgets allocated by agencies like the NGA and NASA for satellite imagery and data analysis services, particularly for defense, national security, and scientific research. The "Luno" program is a prime example of this proactive government engagement.

- Technological Innovation Hubs: Presence of leading satellite imaging companies, research institutions, and AI development centers fostering rapid technological advancements.

- Established End-User Base: A mature market for satellite imaging for defense, satellite imaging for surveillance, and geospatial data for construction and resource management.

- Robust Infrastructure: Advanced ground stations, data processing capabilities, and cloud infrastructure supporting the seamless acquisition and analysis of satellite data.

While North America leads, the Asia-Pacific region is emerging as a rapidly growing market, propelled by increasing government initiatives for smart city development, infrastructure expansion, and disaster management. Countries like China and India are investing heavily in their own satellite capabilities and leveraging commercial services for national development projects.

Within the application segments, Geospatial Data Acquisition and Mapping remains paramount due to its foundational role in numerous other applications. However, Surveillance and Security and Defense and Intelligence are experiencing accelerated growth, directly influenced by geopolitical landscapes and the increasing recognition of the strategic importance of commercial satellite intelligence. The demand for high-resolution, frequent imagery for border monitoring, threat assessment, and situational awareness is pushing innovation in these areas.

The End-user Vertical: Government segment is the most dominant, encompassing defense, intelligence, environmental agencies, and urban planning departments. Their consistent demand for comprehensive data and analysis underpins the market's stability and growth. Following closely are Military and Defense and Energy, with the latter increasingly utilizing satellite imaging for oil and gas exploration, pipeline monitoring, and renewable energy site assessment. The Construction sector is also a significant contributor, employing satellite data for project planning, site selection, and progress monitoring.

- Dominant Region: North America, driven by significant government investment and a mature technology sector.

- Key Application Segment: Geospatial Data Acquisition and Mapping, fundamental to numerous industries.

- Accelerating Application Segment: Defense and Intelligence, propelled by geopolitical factors and government procurement programs like "Luno."

- Dominant End-User Vertical: Government, encompassing a broad spectrum of agencies.

- Emerging Growth Region: Asia-Pacific, fueled by smart city initiatives and infrastructure development.

Commercial Satellite Imaging Market Product Landscape

The Commercial Satellite Imaging Market boasts a diverse and evolving product landscape, centered on delivering high-fidelity Earth observation data and derived analytical products. Innovations focus on enhancing resolution, increasing revisit rates, and expanding spectral capabilities across various satellite platforms, including optical and radar imaging systems. Companies like Planet Labs Inc offer constellations of small satellites providing daily global coverage, ideal for applications requiring frequent monitoring. DigitalGlobe Inc (now part of Maxar Technologies) has historically been a leader in high-resolution imagery for detailed analysis. BlackSky Global LLC is known for its rapid-response imaging capabilities, catering to time-sensitive intelligence needs. Skylab Analytics and SpaceKnow Inc specialize in advanced satellite data analytics, transforming raw imagery into actionable insights for specific industries. ImageSat International NV provides intelligence solutions, while Galileo Group Inc offers various geospatial services. European Space Imaging (EUSI) GmbH and UrtheCast Corp are also key players contributing to the market's technological advancements through their specialized offerings and data processing expertise.

Key Drivers, Barriers & Challenges in Commercial Satellite Imaging Market

The Commercial Satellite Imaging Market is propelled by several key drivers that are fundamentally reshaping its trajectory. The escalating global demand for precise geospatial intelligence is a primary impetus, driven by critical needs in environmental monitoring, resource management, urban planning, and disaster response. Technological advancements, particularly in sensor resolution, data processing speeds, and the proliferation of AI-powered analytics, are making satellite imagery more accessible and insightful than ever before. The increasing adoption of cloud computing infrastructure further facilitates the storage, processing, and dissemination of vast volumes of satellite data, lowering operational costs and enhancing accessibility for a wider range of users. Government initiatives and defense procurements, as exemplified by the NGA's "Luno" program, represent a significant driver, stimulating investment and innovation in the sector.

However, the market also faces significant barriers and challenges that can impede its growth. High initial capital investment for satellite development and launch remains a considerable hurdle, though this is being mitigated by the rise of smaller, more cost-effective satellites. Data processing and interpretation complexity can be a barrier for less technically advanced organizations, requiring specialized expertise or the use of third-party analytical services. Regulatory complexities, including export controls and data privacy concerns, can impact market access and the free flow of information. The competitive landscape, while fostering innovation, also presents challenges in terms of market saturation and pricing pressures, particularly for basic imagery services. Supply chain disruptions for satellite components and launch services can also lead to delays and increased costs.

- Key Drivers:

- Growing demand for geospatial intelligence across various sectors.

- Rapid technological advancements in sensors and analytics.

- Increased adoption of cloud computing for data management.

- Significant government investments and defense contracts.

- Barriers & Challenges:

- High upfront costs for satellite development and launch.

- Complexity of data processing and interpretation.

- Navigating stringent regulatory frameworks and data privacy concerns.

- Intense market competition and pricing pressures.

- Potential supply chain disruptions impacting hardware and launch services.

Emerging Opportunities in Commercial Satellite Imaging Market

Emerging opportunities in the Commercial Satellite Imaging Market are vast and continue to expand, driven by innovative applications and evolving market needs. The burgeoning field of AI-powered satellite analytics presents a significant avenue for growth, enabling automated detection, prediction, and actionable insights for industries such as precision agriculture, intelligent transportation systems, and proactive climate change monitoring. The increasing focus on sustainable development goals is creating demand for detailed environmental monitoring services, including deforestation tracking, water resource management, and carbon emissions assessment. The "Internet of Things" (IoT) integration with satellite data offers new possibilities for real-time monitoring of distributed assets, from remote infrastructure to agricultural fields. Furthermore, the development of hyperspectral imaging capabilities is opening up new frontiers in material science, mineral exploration, and specialized environmental analysis. The growing accessibility of satellite data through APIs and cloud platforms is democratizing its use, creating opportunities for startups and SMEs to develop niche applications and services.

Growth Accelerators in the Commercial Satellite Imaging Market Industry

Several key growth accelerators are poised to significantly boost the long-term expansion of the Commercial Satellite Imaging Market. Technological breakthroughs in synthetic aperture radar (SAR) technology are crucial, offering all-weather, day-and-night imaging capabilities that dramatically expand the applicability of satellite data beyond optical limitations. Strategic partnerships between satellite operators, data analytics providers, and end-user industries are fostering the development of tailored solutions and expanding market reach. For example, collaborations focused on integrating satellite data with existing industry workflows can unlock new revenue streams. Market expansion strategies, including entering untapped geographic regions and developing specialized applications for nascent industries, will also be critical. The increasing demand for high-frequency satellite imagery driven by the need for real-time situational awareness in defense, disaster management, and commodity trading is a powerful growth catalyst. Continued investment in small satellite constellations and advanced launch capabilities is reducing deployment costs and increasing the availability of diverse imaging solutions.

Key Players Shaping the Commercial Satellite Imaging Market Market

- L3Harris Corporation Inc

- BlackSky Global LLC

- Skylab Analytics

- DigitalGlobe Inc

- SpaceKnow Inc

- ImageSat International NV

- Galileo Group Inc

- European Space Imaging (EUSI) GmbH

- Planet Labs Inc

- UrtheCast Corp

Notable Milestones in Commercial Satellite Imaging Market Sector

- February 2024: The National Geospatial-Intelligence Agency (NGA) announces the "Luno" program, aiming to significantly enhance its global monitoring capabilities by leveraging commercial satellite imagery and advanced analytics.

- 2023: Significant advancements in AI and machine learning algorithms for automated object detection and change analysis in satellite imagery, leading to more efficient data interpretation.

- 2022: Expansion of small satellite constellations by multiple companies, leading to increased revisit frequencies and broader geographic coverage for commercial satellite imagery.

- 2021: Growing adoption of Synthetic Aperture Radar (SAR) technology for applications requiring all-weather imaging capabilities, such as infrastructure monitoring and disaster response.

- 2020: Increased investment in cloud-based platforms for storing, processing, and distributing satellite data, making it more accessible to a wider range of users.

In-Depth Commercial Satellite Imaging Market Market Outlook

The future outlook for the Commercial Satellite Imaging Market is exceptionally promising, fueled by a confluence of powerful growth accelerators. The continuous evolution of sensor technology, promising higher resolutions and expanded spectral capabilities, will unlock new analytical possibilities. The pervasive integration of Artificial Intelligence and Machine Learning will transform raw data into sophisticated, actionable intelligence, driving demand across all sectors. Strategic collaborations between satellite operators, data providers, and end-users are set to foster innovation and expand market penetration, particularly in emerging economies. Furthermore, the increasing focus on global sustainability initiatives and climate change mitigation will necessitate advanced Earth observation and satellite remote sensing solutions, creating significant opportunities for market expansion. The ongoing development of more affordable launch options and the proliferation of specialized satellite constellations will further democratize access to space-based data, empowering a broader range of industries to harness its transformative potential.

Commercial Satellite Imaging Market Segmentation

-

1. Application

- 1.1. Geospatial Data Acquisition and Mapping

- 1.2. Natural Resource Management

- 1.3. Surveillance and Security

- 1.4. Conservation and Research

- 1.5. Construction and Development

- 1.6. Disaster Management

- 1.7. Defense and Intelligence

-

2. End-user Vertical

- 2.1. Government

- 2.2. Construction

- 2.3. Transportation and Logistics

- 2.4. Military and Defense

- 2.5. Energy

- 2.6. Forestry and Agriculture

- 2.7. Other End-user Verticals

Commercial Satellite Imaging Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Commercial Satellite Imaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.84% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Requirement for Efficient Monitoring of Vast Land Areas; Rising Smart City Initiatives; Big Data and Imagery Analytics

- 3.3. Market Restrains

- 3.3.1. High-resolution Images Offered by Other Imaging Technologies

- 3.4. Market Trends

- 3.4.1. Military and Defense is Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Commercial Satellite Imaging Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Geospatial Data Acquisition and Mapping

- 5.1.2. Natural Resource Management

- 5.1.3. Surveillance and Security

- 5.1.4. Conservation and Research

- 5.1.5. Construction and Development

- 5.1.6. Disaster Management

- 5.1.7. Defense and Intelligence

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. Government

- 5.2.2. Construction

- 5.2.3. Transportation and Logistics

- 5.2.4. Military and Defense

- 5.2.5. Energy

- 5.2.6. Forestry and Agriculture

- 5.2.7. Other End-user Verticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Commercial Satellite Imaging Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Geospatial Data Acquisition and Mapping

- 6.1.2. Natural Resource Management

- 6.1.3. Surveillance and Security

- 6.1.4. Conservation and Research

- 6.1.5. Construction and Development

- 6.1.6. Disaster Management

- 6.1.7. Defense and Intelligence

- 6.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 6.2.1. Government

- 6.2.2. Construction

- 6.2.3. Transportation and Logistics

- 6.2.4. Military and Defense

- 6.2.5. Energy

- 6.2.6. Forestry and Agriculture

- 6.2.7. Other End-user Verticals

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Commercial Satellite Imaging Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Geospatial Data Acquisition and Mapping

- 7.1.2. Natural Resource Management

- 7.1.3. Surveillance and Security

- 7.1.4. Conservation and Research

- 7.1.5. Construction and Development

- 7.1.6. Disaster Management

- 7.1.7. Defense and Intelligence

- 7.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 7.2.1. Government

- 7.2.2. Construction

- 7.2.3. Transportation and Logistics

- 7.2.4. Military and Defense

- 7.2.5. Energy

- 7.2.6. Forestry and Agriculture

- 7.2.7. Other End-user Verticals

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Commercial Satellite Imaging Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Geospatial Data Acquisition and Mapping

- 8.1.2. Natural Resource Management

- 8.1.3. Surveillance and Security

- 8.1.4. Conservation and Research

- 8.1.5. Construction and Development

- 8.1.6. Disaster Management

- 8.1.7. Defense and Intelligence

- 8.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 8.2.1. Government

- 8.2.2. Construction

- 8.2.3. Transportation and Logistics

- 8.2.4. Military and Defense

- 8.2.5. Energy

- 8.2.6. Forestry and Agriculture

- 8.2.7. Other End-user Verticals

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Latin America Commercial Satellite Imaging Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Geospatial Data Acquisition and Mapping

- 9.1.2. Natural Resource Management

- 9.1.3. Surveillance and Security

- 9.1.4. Conservation and Research

- 9.1.5. Construction and Development

- 9.1.6. Disaster Management

- 9.1.7. Defense and Intelligence

- 9.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 9.2.1. Government

- 9.2.2. Construction

- 9.2.3. Transportation and Logistics

- 9.2.4. Military and Defense

- 9.2.5. Energy

- 9.2.6. Forestry and Agriculture

- 9.2.7. Other End-user Verticals

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East and Africa Commercial Satellite Imaging Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Geospatial Data Acquisition and Mapping

- 10.1.2. Natural Resource Management

- 10.1.3. Surveillance and Security

- 10.1.4. Conservation and Research

- 10.1.5. Construction and Development

- 10.1.6. Disaster Management

- 10.1.7. Defense and Intelligence

- 10.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 10.2.1. Government

- 10.2.2. Construction

- 10.2.3. Transportation and Logistics

- 10.2.4. Military and Defense

- 10.2.5. Energy

- 10.2.6. Forestry and Agriculture

- 10.2.7. Other End-user Verticals

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. North America Commercial Satellite Imaging Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe Commercial Satellite Imaging Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia Pacific Commercial Satellite Imaging Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Latin America Commercial Satellite Imaging Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Middle East and Africa Commercial Satellite Imaging Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 L3Harris Corporation Inc

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 BlackSky Global LLC

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Skylab Analytics

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 DigitalGlobe Inc

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 SpaceKnow Inc

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 ImageSat International NV

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Galileo Group Inc

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 European Space Imaging (EUSI) GmbH

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Planet Labs Inc

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 UrtheCast Corp

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 L3Harris Corporation Inc

List of Figures

- Figure 1: Global Commercial Satellite Imaging Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Commercial Satellite Imaging Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Commercial Satellite Imaging Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Commercial Satellite Imaging Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Commercial Satellite Imaging Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Commercial Satellite Imaging Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Commercial Satellite Imaging Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Commercial Satellite Imaging Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Commercial Satellite Imaging Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Commercial Satellite Imaging Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Commercial Satellite Imaging Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Commercial Satellite Imaging Market Revenue (Million), by Application 2024 & 2032

- Figure 13: North America Commercial Satellite Imaging Market Revenue Share (%), by Application 2024 & 2032

- Figure 14: North America Commercial Satellite Imaging Market Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 15: North America Commercial Satellite Imaging Market Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 16: North America Commercial Satellite Imaging Market Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Commercial Satellite Imaging Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Commercial Satellite Imaging Market Revenue (Million), by Application 2024 & 2032

- Figure 19: Europe Commercial Satellite Imaging Market Revenue Share (%), by Application 2024 & 2032

- Figure 20: Europe Commercial Satellite Imaging Market Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 21: Europe Commercial Satellite Imaging Market Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 22: Europe Commercial Satellite Imaging Market Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe Commercial Satellite Imaging Market Revenue Share (%), by Country 2024 & 2032

- Figure 24: Asia Pacific Commercial Satellite Imaging Market Revenue (Million), by Application 2024 & 2032

- Figure 25: Asia Pacific Commercial Satellite Imaging Market Revenue Share (%), by Application 2024 & 2032

- Figure 26: Asia Pacific Commercial Satellite Imaging Market Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 27: Asia Pacific Commercial Satellite Imaging Market Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 28: Asia Pacific Commercial Satellite Imaging Market Revenue (Million), by Country 2024 & 2032

- Figure 29: Asia Pacific Commercial Satellite Imaging Market Revenue Share (%), by Country 2024 & 2032

- Figure 30: Latin America Commercial Satellite Imaging Market Revenue (Million), by Application 2024 & 2032

- Figure 31: Latin America Commercial Satellite Imaging Market Revenue Share (%), by Application 2024 & 2032

- Figure 32: Latin America Commercial Satellite Imaging Market Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 33: Latin America Commercial Satellite Imaging Market Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 34: Latin America Commercial Satellite Imaging Market Revenue (Million), by Country 2024 & 2032

- Figure 35: Latin America Commercial Satellite Imaging Market Revenue Share (%), by Country 2024 & 2032

- Figure 36: Middle East and Africa Commercial Satellite Imaging Market Revenue (Million), by Application 2024 & 2032

- Figure 37: Middle East and Africa Commercial Satellite Imaging Market Revenue Share (%), by Application 2024 & 2032

- Figure 38: Middle East and Africa Commercial Satellite Imaging Market Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 39: Middle East and Africa Commercial Satellite Imaging Market Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 40: Middle East and Africa Commercial Satellite Imaging Market Revenue (Million), by Country 2024 & 2032

- Figure 41: Middle East and Africa Commercial Satellite Imaging Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Commercial Satellite Imaging Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Commercial Satellite Imaging Market Revenue Million Forecast, by Application 2019 & 2032

- Table 3: Global Commercial Satellite Imaging Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 4: Global Commercial Satellite Imaging Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Commercial Satellite Imaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Commercial Satellite Imaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global Commercial Satellite Imaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Commercial Satellite Imaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Commercial Satellite Imaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Commercial Satellite Imaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Commercial Satellite Imaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Commercial Satellite Imaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Commercial Satellite Imaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Commercial Satellite Imaging Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Commercial Satellite Imaging Market Revenue Million Forecast, by Application 2019 & 2032

- Table 16: Global Commercial Satellite Imaging Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 17: Global Commercial Satellite Imaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Commercial Satellite Imaging Market Revenue Million Forecast, by Application 2019 & 2032

- Table 19: Global Commercial Satellite Imaging Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 20: Global Commercial Satellite Imaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Global Commercial Satellite Imaging Market Revenue Million Forecast, by Application 2019 & 2032

- Table 22: Global Commercial Satellite Imaging Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 23: Global Commercial Satellite Imaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Global Commercial Satellite Imaging Market Revenue Million Forecast, by Application 2019 & 2032

- Table 25: Global Commercial Satellite Imaging Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 26: Global Commercial Satellite Imaging Market Revenue Million Forecast, by Country 2019 & 2032

- Table 27: Global Commercial Satellite Imaging Market Revenue Million Forecast, by Application 2019 & 2032

- Table 28: Global Commercial Satellite Imaging Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 29: Global Commercial Satellite Imaging Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Commercial Satellite Imaging Market?

The projected CAGR is approximately 11.84%.

2. Which companies are prominent players in the Commercial Satellite Imaging Market?

Key companies in the market include L3Harris Corporation Inc, BlackSky Global LLC, Skylab Analytics, DigitalGlobe Inc, SpaceKnow Inc, ImageSat International NV, Galileo Group Inc, European Space Imaging (EUSI) GmbH, Planet Labs Inc, UrtheCast Corp.

3. What are the main segments of the Commercial Satellite Imaging Market?

The market segments include Application, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.04 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Requirement for Efficient Monitoring of Vast Land Areas; Rising Smart City Initiatives; Big Data and Imagery Analytics.

6. What are the notable trends driving market growth?

Military and Defense is Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

High-resolution Images Offered by Other Imaging Technologies.

8. Can you provide examples of recent developments in the market?

February 2024 - The National Geospatial-Intelligence Agency is supercharging its use of commercial satellite imagery and analytics with a procurement program, “Luno.” The Luno program seeks to leverage commercial satellite imagery and data analytics to enhance NGA’s global monitoring capabilities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Commercial Satellite Imaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Commercial Satellite Imaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Commercial Satellite Imaging Market?

To stay informed about further developments, trends, and reports in the Commercial Satellite Imaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence