Key Insights

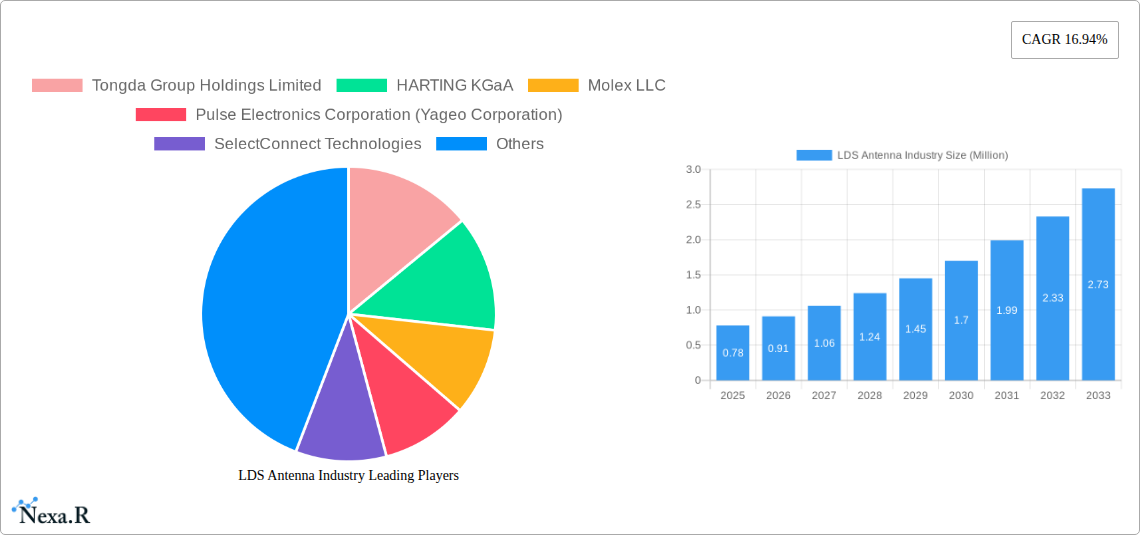

The global LDS (Laser Direct Structuring) antenna market is poised for significant expansion, with a current market size of approximately USD 0.78 million and a projected Compound Annual Growth Rate (CAGR) of 16.94% from 2025 to 2033. This robust growth is primarily fueled by the escalating demand for miniaturized, high-performance antennas across a spectrum of rapidly evolving industries. The healthcare sector, driven by the proliferation of wearable medical devices and remote patient monitoring systems, is a key adopter of LDS antenna technology due to its ability to integrate antennas directly onto plastic components, saving space and improving device aesthetics. Similarly, the consumer electronics industry, with its insatiable appetite for smartphones, smartwatches, IoT devices, and augmented/virtual reality headsets, is a major growth engine, demanding compact and efficient antenna solutions for seamless connectivity.

LDS Antenna Industry Market Size (In Million)

Further bolstering the market are advancements in automotive technology, particularly the integration of advanced driver-assistance systems (ADAS), in-car infotainment, and the burgeoning connected car ecosystem, all of which rely heavily on reliable wireless communication facilitated by sophisticated antenna designs. The networking sector, encompassing 5G infrastructure and Wi-Fi devices, also contributes substantially to the demand for LDS antennas, owing to their flexibility in design and cost-effectiveness for mass production. Emerging trends like the increasing adoption of smart home devices and industrial IoT (IIoT) applications are expected to create new avenues for market penetration. However, challenges such as stringent regulatory compliance for certain applications and the initial investment costs for LDS manufacturing equipment can act as moderating factors, though the overwhelming technological advantages and market demand are expected to outweigh these restraints.

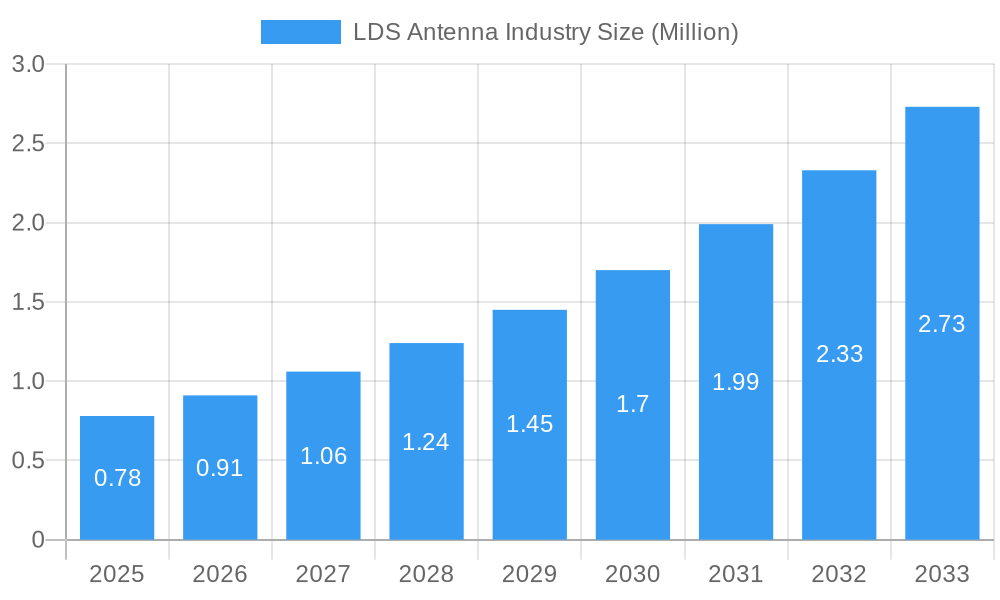

LDS Antenna Industry Company Market Share

This in-depth market research report offers a definitive analysis of the LDS antenna market, exploring its intricate dynamics, growth trajectory, and future potential. Covering the historical period from 2019 to 2024, with a base and estimated year of 2025, and a robust forecast period extending to 2033, this report provides actionable insights for stakeholders in the antennas for consumer electronics, automotive antennas, and IoT antennas sectors. We delve into parent and child market segmentation, analyzing key trends, drivers, and challenges impacting the global LDS antenna industry.

LDS Antenna Industry Market Dynamics & Structure

The LDS antenna industry is characterized by a moderately concentrated market structure, with a few key players dominating global market share, alongside a growing number of specialized manufacturers. Technological innovation remains a primary driver, fueled by the relentless demand for miniaturization, enhanced performance, and integration of wireless capabilities across diverse end-user industries. Regulatory frameworks, particularly concerning electromagnetic compatibility (EMC) and radiation safety, subtly influence product development and market entry. Competitive product substitutes include traditional PCB antennas and external antennas, though LDS technology offers distinct advantages in terms of design flexibility and integration. End-user demographics are increasingly sophisticated, demanding seamless connectivity and advanced functionality in their devices. Mergers and acquisitions (M&A) activity, while not rampant, is a significant factor in market consolidation and strategic positioning.

- Market Concentration: Dominated by a blend of large, diversified technology companies and specialized LDS antenna manufacturers, contributing to approximately 75% of the global market.

- Technological Innovation Drivers: Miniaturization, 5G/6G integration, advanced IoT connectivity, and demand for multi-band antennas.

- Regulatory Frameworks: Focus on EMC standards, RF performance regulations, and material safety compliance.

- Competitive Product Substitutes: Traditional PCB antennas (estimated 30% market overlap), external antennas (estimated 20% market overlap).

- End-User Demographics: Growing demand from younger demographics for connected devices and evolving needs in industrial automation.

- M&A Trends: Strategic acquisitions to gain access to new technologies, expand product portfolios, and secure market share. An estimated 3-5 significant M&A deals annually within the broader antenna component market.

LDS Antenna Industry Growth Trends & Insights

The LDS antenna market is poised for significant expansion, projected to witness a Compound Annual Growth Rate (CAGR) of approximately 10.5% during the forecast period (2025–2033). This growth is propelled by the escalating adoption rates of smart devices across consumer electronics, automotive, and healthcare sectors. Technological disruptions, such as the proliferation of 5G networks, the increasing complexity of IoT ecosystems, and advancements in material science for antenna fabrication, are fundamentally reshaping the market. Consumer behavior shifts towards more integrated, connected, and aesthetically pleasing devices are directly fueling the demand for compact and high-performance LDS antennas. The penetration of LDS antennas in emerging applications, particularly in wearable technology and advanced medical devices, is expected to be a key growth accelerator. The market size is projected to grow from an estimated $1.8 billion in 2025 to over $4.2 billion by 2033, underscoring a robust growth trajectory.

- Market Size Evolution: Expected to grow from an estimated $1.8 billion (2025) to over $4.2 billion (2033).

- Adoption Rates: High adoption in smartphones, wearables, and automotive infotainment systems, with increasing penetration in industrial IoT and medical devices.

- Technological Disruptions: 5G/6G deployment, advancements in antenna-on-package (AoP) solutions, and the rise of millimeter-wave frequencies.

- Consumer Behavior Shifts: Demand for sleek device designs, seamless wireless connectivity, and personalized user experiences.

- Market Penetration: Expected to reach over 60% in premium smartphone segments and over 40% in automotive applications by 2033.

Dominant Regions, Countries, or Segments in LDS Antenna Industry

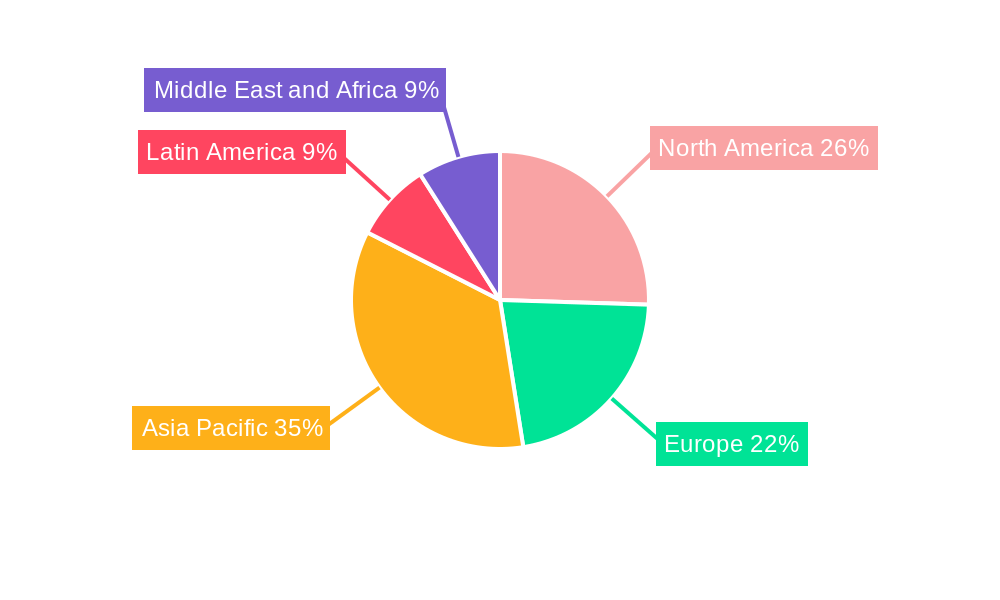

The Consumer Electronics segment is currently the dominant force driving growth in the LDS antenna industry, accounting for an estimated 45% of the global market share. This dominance is fueled by the ubiquitous demand for smartphones, tablets, wearables, and smart home devices, all of which increasingly integrate compact and high-performance antennas. North America and Asia Pacific are the leading regions, with Asia Pacific exhibiting the fastest growth due to its robust manufacturing capabilities and a rapidly expanding consumer base for electronic devices. China, in particular, stands out as a critical country due to its leadership in consumer electronics production and a significant domestic market. Key drivers for this segment's dominance include increasing disposable incomes, the continuous innovation cycle in consumer gadgetry, and the widespread adoption of advanced wireless communication standards.

- Dominant Segment: Consumer Electronics (estimated 45% market share).

- Key Drivers: High volume production of smartphones, wearables, and smart home devices.

- Market Share: Expected to maintain dominance with consistent innovation and demand.

- Leading Regions:

- Asia Pacific: Fastest growth, driven by manufacturing hubs like China and South Korea, and a large consumer base.

- North America: Strong demand for premium electronic devices and advanced automotive applications.

- Dominant Countries:

- China: Leading manufacturing hub for electronic components and a massive domestic market.

- United States: Significant demand for advanced wireless technologies and IoT solutions.

- Growth Potential: Continued innovation in product features and miniaturization will sustain growth in this segment.

LDS Antenna Industry Product Landscape

The LDS antenna product landscape is characterized by continuous innovation focused on enhanced performance, miniaturization, and multi-functionality. Key product developments include ultra-compact 5G/4G antennas, dual-band GNSS antennas for precise positioning, and integrated antenna solutions for IoT devices. These antennas are increasingly designed for seamless integration into complex device architectures, offering unique selling propositions such as improved signal strength, reduced form factors, and wider operating bandwidths. Technological advancements in laser direct structuring (LDS) processes enable intricate antenna designs with precise conductor patterns, leading to superior RF performance and reduced manufacturing costs. The market is witnessing a trend towards highly customized antenna solutions tailored to specific device requirements and end-user applications.

Key Drivers, Barriers & Challenges in LDS Antenna Industry

Key Drivers:

- Ubiquitous 5G/6G Rollout: The expansion of next-generation wireless networks necessitates advanced antenna solutions.

- Growth of IoT Ecosystems: Billions of connected devices require compact, efficient, and reliable antennas.

- Miniaturization Trend: Demand for smaller, sleeker electronic devices drives the need for integrated antenna designs.

- Advancements in Automotive Connectivity: Self-driving cars and in-car infotainment systems rely heavily on robust antenna performance.

- Technological Innovation: Continuous improvements in LDS technology enable more complex and high-performance antenna designs.

Barriers & Challenges:

- Supply Chain Volatility: Global supply chain disruptions can impact raw material availability and component lead times.

- High Development Costs: Research and development for specialized LDS antennas can be capital-intensive.

- Stringent Regulatory Compliance: Meeting evolving EMC and RF performance standards across different regions.

- Intense Competition: Pressure from alternative antenna technologies and price sensitivity in certain market segments.

- Talent Shortage: A need for skilled engineers and technicians in advanced manufacturing and RF design.

Emerging Opportunities in LDS Antenna Industry

Emerging opportunities in the LDS antenna industry lie in the burgeoning fields of augmented reality (AR) and virtual reality (VR) devices, where compact and high-performance antennas are crucial for immersive experiences. The expansion of the industrial IoT (IIoT) sector, including smart manufacturing and logistics, presents a significant market for robust and specialized LDS antennas. Furthermore, the increasing adoption of connected health devices and telemedicine is opening avenues for miniature, high-reliability medical-grade antennas. The development of intelligent antennas capable of dynamic beamforming and adaptive signal management also represents a promising area for innovation and market growth. The integration of LDS technology with other advanced materials and manufacturing techniques will further unlock novel applications.

Growth Accelerators in the LDS Antenna Industry Industry

Growth in the LDS antenna industry is being significantly accelerated by breakthroughs in material science, enabling antennas with enhanced durability and broader frequency spectrum capabilities. Strategic partnerships between antenna manufacturers and semiconductor companies are fostering the development of integrated solutions that streamline device design and reduce time-to-market. Furthermore, market expansion strategies focusing on underserved geographical regions and niche application areas, such as advanced drone technology and satellite communication terminals, are contributing to sustained growth. The increasing investment in research and development by leading players, coupled with favorable government initiatives promoting technological advancements in wireless communications, are key catalysts.

Key Players Shaping the LDS Antenna Industry Market

- Tongda Group Holdings Limited

- HARTING KGaA

- Molex LLC

- Pulse Electronics Corporation (Yageo Corporation)

- SelectConnect Technologies

- Shenzhen Sunway Communication Co Ltd

- Amphenol Corporation

- TE Connectivity Ltd

- Multiple Dimensions AG

- Taoglas Limited

- Luxshare Precision Industry Co Ltd

- Huizhou Speed Wireless Technology Co Ltd

- LPKF Laser & Electronics AG

Notable Milestones in LDS Antenna Industry Sector

- July 2022: TE Connectivity constructed a new, larger production facility in Hermosillo, Mexico, to support its data and devices business line. The site's increased capacity will support TE's IoT portfolio of products, which includes cables and connectors for high-speed communications. The new facility will enable TE to develop new capabilities, including bulk cable manufacturing and antenna assembly.

- Feb 2022: Taoglas, a leading provider of advanced technology for a smarter world, announced its new industry's first and smallest 9-in-1 combination antenna with dual-band GNSS and high-performance 5G/4G, miniature IoT speakers, and 38 new superior-performance radio frequency (RF) connectors. The portfolio expansion is designed to provide device original equipment manufacturers (OEMs) with a one-stop shop for quickly and cost-effectively adding wireless connectivity, positioning, and other tightly integrated capabilities, such as audio, to their products.

In-Depth LDS Antenna Industry Market Outlook

The LDS antenna industry's future outlook is exceptionally promising, driven by continuous technological advancements and expanding market applications. Future growth will be significantly propelled by the increasing demand for higher bandwidth and lower latency services fueled by the widespread adoption of 5G and the anticipated rollout of 6G technologies. The burgeoning Internet of Things (IoT) market, encompassing smart homes, industrial automation, and connected vehicles, represents a vast untapped potential for LDS antenna solutions. Strategic opportunities also lie in the development of specialized antennas for emerging sectors like autonomous driving, advanced medical implants, and satellite-based internet services. Continued investment in R&D, coupled with collaborative efforts across the value chain, will be crucial for players to capitalize on these growth accelerators and solidify their market positions.

LDS Antenna Industry Segmentation

-

1. End-user Industry

- 1.1. Healthcare

- 1.2. Consumer Electronics

- 1.3. Automotive

- 1.4. Networking

- 1.5. Other End-user Industries

LDS Antenna Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

LDS Antenna Industry Regional Market Share

Geographic Coverage of LDS Antenna Industry

LDS Antenna Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 16.94% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand For Miniaturization In Consumer Electronics Industry; Growth of IoT and Devices With Higher Antenna Ranges

- 3.3. Market Restrains

- 3.3.1. High complexity in designing and manufacturing emerging non-volatile memory devices

- 3.4. Market Trends

- 3.4.1. Automotive is expected to register a Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global LDS Antenna Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 5.1.1. Healthcare

- 5.1.2. Consumer Electronics

- 5.1.3. Automotive

- 5.1.4. Networking

- 5.1.5. Other End-user Industries

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6. North America LDS Antenna Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End-user Industry

- 6.1.1. Healthcare

- 6.1.2. Consumer Electronics

- 6.1.3. Automotive

- 6.1.4. Networking

- 6.1.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by End-user Industry

- 7. Europe LDS Antenna Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End-user Industry

- 7.1.1. Healthcare

- 7.1.2. Consumer Electronics

- 7.1.3. Automotive

- 7.1.4. Networking

- 7.1.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by End-user Industry

- 8. Asia Pacific LDS Antenna Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End-user Industry

- 8.1.1. Healthcare

- 8.1.2. Consumer Electronics

- 8.1.3. Automotive

- 8.1.4. Networking

- 8.1.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by End-user Industry

- 9. Latin America LDS Antenna Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End-user Industry

- 9.1.1. Healthcare

- 9.1.2. Consumer Electronics

- 9.1.3. Automotive

- 9.1.4. Networking

- 9.1.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by End-user Industry

- 10. Middle East and Africa LDS Antenna Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End-user Industry

- 10.1.1. Healthcare

- 10.1.2. Consumer Electronics

- 10.1.3. Automotive

- 10.1.4. Networking

- 10.1.5. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by End-user Industry

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Tongda Group Holdings Limited

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 HARTING KGaA

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Molex LLC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Pulse Electronics Corporation (Yageo Corporation)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 SelectConnect Technologies

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Shenzhen Sunway Communication Co Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Amphenol Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 TE Connectivity Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Multiple Dimensions AG

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Taoglas Limited

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Luxshare Precision Industry Co Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Huizhou Speed Wireless Technology Co Ltd

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 LPKF Laser & Electronics AG*List Not Exhaustive

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Tongda Group Holdings Limited

List of Figures

- Figure 1: Global LDS Antenna Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America LDS Antenna Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 3: North America LDS Antenna Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 4: North America LDS Antenna Industry Revenue (Million), by Country 2025 & 2033

- Figure 5: North America LDS Antenna Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe LDS Antenna Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 7: Europe LDS Antenna Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: Europe LDS Antenna Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: Europe LDS Antenna Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific LDS Antenna Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 11: Asia Pacific LDS Antenna Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: Asia Pacific LDS Antenna Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Asia Pacific LDS Antenna Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America LDS Antenna Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 15: Latin America LDS Antenna Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: Latin America LDS Antenna Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: Latin America LDS Antenna Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa LDS Antenna Industry Revenue (Million), by End-user Industry 2025 & 2033

- Figure 19: Middle East and Africa LDS Antenna Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 20: Middle East and Africa LDS Antenna Industry Revenue (Million), by Country 2025 & 2033

- Figure 21: Middle East and Africa LDS Antenna Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global LDS Antenna Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 2: Global LDS Antenna Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global LDS Antenna Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Global LDS Antenna Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 5: Global LDS Antenna Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Global LDS Antenna Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global LDS Antenna Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 8: Global LDS Antenna Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global LDS Antenna Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 10: Global LDS Antenna Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Global LDS Antenna Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 12: Global LDS Antenna Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the LDS Antenna Industry?

The projected CAGR is approximately 16.94%.

2. Which companies are prominent players in the LDS Antenna Industry?

Key companies in the market include Tongda Group Holdings Limited, HARTING KGaA, Molex LLC, Pulse Electronics Corporation (Yageo Corporation), SelectConnect Technologies, Shenzhen Sunway Communication Co Ltd, Amphenol Corporation, TE Connectivity Ltd, Multiple Dimensions AG, Taoglas Limited, Luxshare Precision Industry Co Ltd, Huizhou Speed Wireless Technology Co Ltd, LPKF Laser & Electronics AG*List Not Exhaustive.

3. What are the main segments of the LDS Antenna Industry?

The market segments include End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.78 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand For Miniaturization In Consumer Electronics Industry; Growth of IoT and Devices With Higher Antenna Ranges.

6. What are the notable trends driving market growth?

Automotive is expected to register a Significant Growth.

7. Are there any restraints impacting market growth?

High complexity in designing and manufacturing emerging non-volatile memory devices.

8. Can you provide examples of recent developments in the market?

July 2022: TE Connectivity constructed a new, larger production facility in Hermosillo, Mexico, to support its data and devices business line. The site's increased capacity will support TE's IoT portfolio of products, which includes cables and connectors for high-speed communications. The new facility will enable TE to develop new capabilities, including bulk cable manufacturing and antenna assembly.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "LDS Antenna Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the LDS Antenna Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the LDS Antenna Industry?

To stay informed about further developments, trends, and reports in the LDS Antenna Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence