Key Insights

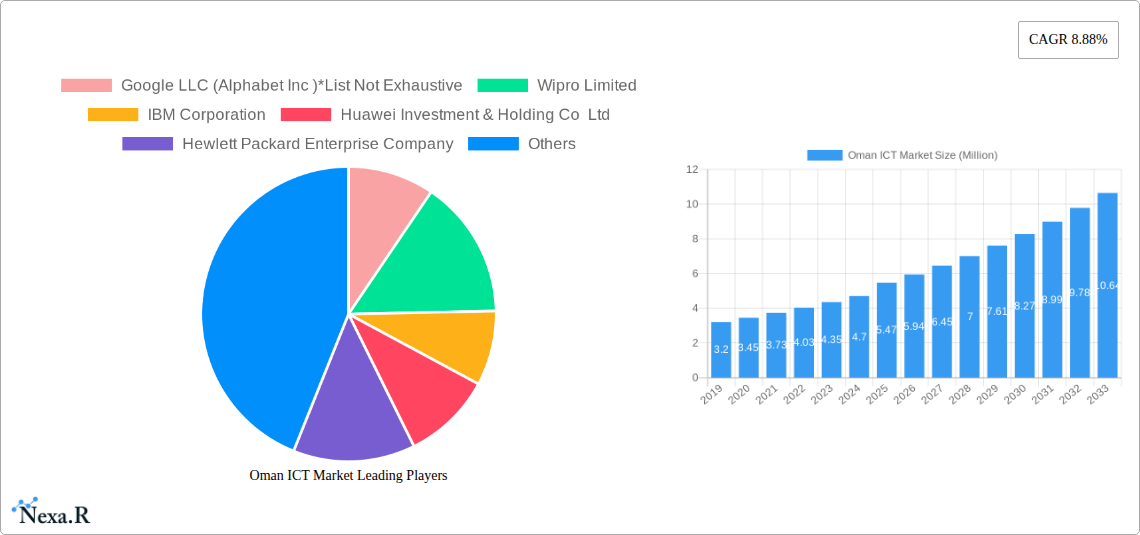

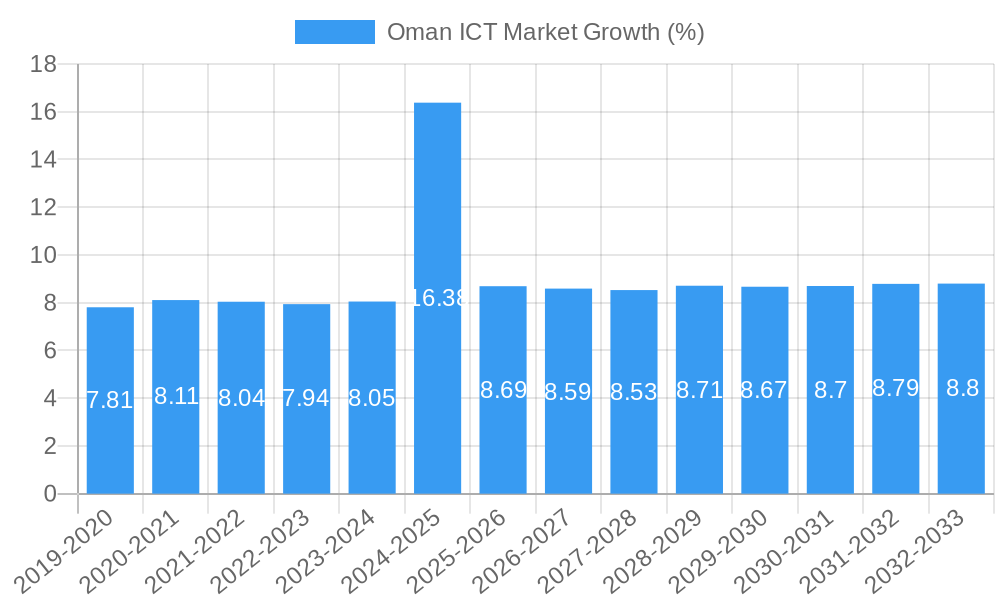

The Oman ICT market is poised for significant expansion, projecting a substantial valuation of USD 5.47 billion by 2025, driven by a robust Compound Annual Growth Rate (CAGR) of 8.88%. This growth is fueled by the nation's strategic initiatives aimed at digital transformation across various sectors. Key drivers include the increasing adoption of cloud computing solutions, the proliferation of big data analytics for informed decision-making, and the expanding digital infrastructure supporting the growing demand for high-speed internet and advanced telecommunication services. The surge in government investments in e-government services and smart city projects further propels market expansion. Furthermore, the burgeoning retail and e-commerce sector, coupled with the critical needs of the BFSI and energy sectors for secure and efficient IT solutions, are significant contributors to this upward trajectory. The market is also benefiting from the ongoing digital upskilling of the workforce and the increasing focus on cybersecurity to protect digital assets.

The competitive landscape in Oman's ICT market is characterized by a dynamic interplay between established global players and emerging local entities. Segmentation analysis reveals strong growth across all categories, with Hardware, Software, IT Services, and Telecommunication Services each capturing significant market share. Small and Medium Enterprises (SMEs) are increasingly investing in digital solutions to enhance productivity and reach, while Large Enterprises are focusing on sophisticated IT infrastructure upgrades and digital transformation programs. Key industry verticals such as BFSI, IT and Telecom, Government, Retail and E-commerce, Manufacturing, and Energy and Utilities are actively integrating advanced ICT solutions. Trends like the adoption of Artificial Intelligence (AI) and Machine Learning (ML) for automation and predictive analytics, alongside the expansion of 5G networks, are set to reshape the market. While significant growth is anticipated, potential challenges such as cybersecurity threats and the need for continuous talent development in specialized IT fields will require strategic attention from stakeholders to maintain this positive momentum.

Oman ICT Market Report: Comprehensive Analysis & Future Outlook (2019-2033)

This in-depth report provides a detailed examination of the Oman Information and Communication Technology (ICT) market, offering critical insights into its current landscape and projected trajectory. Spanning the Historical Period (2019-2024), Base Year (2025), and Forecast Period (2025-2033), this analysis is essential for understanding market dynamics, identifying growth opportunities, and navigating the competitive environment. Leveraging proprietary methodologies, we deliver precise quantitative data and strategic qualitative assessments to empower your decision-making in the rapidly evolving Omani digital economy. Explore parent and child market trends, segment analysis, and a comprehensive player landscape to gain a holistic view.

Oman ICT Market Market Dynamics & Structure

The Oman ICT market exhibits a moderately concentrated structure, driven by the strategic investments of global technology giants and the emergence of strong local players. Technological innovation serves as a primary driver, fueled by government initiatives promoting digital transformation and a growing demand for advanced solutions across all enterprise sizes. Regulatory frameworks are evolving to support this growth, with a focus on data privacy and cybersecurity. Competitive product substitutes are prevalent, particularly in the cloud computing and software-as-a-service (SaaS) segments, forcing companies to differentiate through service quality and specialized offerings. End-user demographics are increasingly tech-savvy, with a growing adoption of digital services across both Small and Medium Enterprises (SMEs) and Large Enterprises. Mergers and acquisitions (M&A) activity, while not yet at peak levels, is expected to increase as companies seek to consolidate market share and acquire complementary technologies.

- Market Concentration: Dominated by a few key international players and a growing number of specialized local providers.

- Technological Innovation Drivers: Government digital transformation agendas, smart city initiatives, and the increasing adoption of AI and IoT.

- Regulatory Frameworks: Evolving policies aimed at fostering innovation while ensuring data security and digital inclusion.

- Competitive Product Substitutes: Strong competition in cloud infrastructure, SaaS solutions, and cybersecurity services.

- End-User Demographics: Growing digital literacy and demand for sophisticated ICT solutions across all business sectors.

- M&A Trends: Anticipated increase in strategic acquisitions to gain market access and technological capabilities.

Oman ICT Market Growth Trends & Insights

The Oman ICT market is poised for substantial growth, driven by a confluence of factors including robust government support, increasing digital adoption, and a burgeoning ecosystem of technology providers. The market size is projected to expand significantly, with Hardware segment leading the charge in terms of absolute value, followed closely by IT Services and Telecommunication Services. The adoption rates for advanced technologies like cloud computing, artificial intelligence (AI), and the Internet of Things (IoT) are accelerating across BFSI, Government, and IT and Telecom verticals. These sectors are increasingly leveraging digital solutions to enhance operational efficiency, improve customer engagement, and drive innovation.

Technological disruptions, such as the widespread implementation of 5G networks and advancements in generative AI, are reshaping the competitive landscape. Consumer behavior shifts are evident, with businesses and individuals alike demanding more seamless, personalized, and secure digital experiences. The government's vision for a digital economy, coupled with strategic investments in infrastructure and talent development, is creating a fertile ground for sustained growth. The report forecasts a Compound Annual Growth Rate (CAGR) of approximately xx% for the overall Oman ICT market during the forecast period. Market penetration for digital services is expected to reach xx% by 2033, underscoring the transformative impact of ICT on the Omani economy.

Specific metrics such as the projected market size for Hardware reaching $xxx Million by 2033, Software segment valued at $xxx Million, and IT Services at $xxx Million highlight the significant investment and expansion anticipated. Telecommunication Services, a foundational element, is expected to contribute $xxx Million by the same year. The adoption of cloud services, both public and private, is a key driver, with the market for cloud solutions alone estimated to reach $xxx Million by 2033. This growth is further propelled by the increasing demand for cybersecurity solutions, projected to be valued at $xxx Million by 2033, as businesses prioritize data protection in an increasingly digitalized environment.

Dominant Regions, Countries, or Segments in Oman ICT Market

The Oman ICT market's dominance is primarily dictated by its IT Services segment, which consistently outperforms other categories in terms of growth potential and revenue generation. This segment benefits immensely from the increasing demand for digital transformation services, cloud migration, cybersecurity solutions, and managed IT services across various Industry Verticals. Large Enterprises represent a significant portion of the market's spending power, driving demand for complex, integrated ICT solutions that enhance operational efficiency and competitive advantage.

However, Small and Medium Enterprises (SMEs) are emerging as a crucial growth engine, with their increasing adoption of scalable and cost-effective ICT solutions. This is particularly evident in sectors like Retail and E-commerce, where digitalization is critical for reaching a wider customer base and optimizing sales processes. The Government sector also plays a pivotal role, with ongoing initiatives to digitize public services and implement smart city projects, creating substantial demand for hardware, software, and telecommunication services.

The BFSI sector continues to be a major contributor, driven by the need for secure, efficient, and customer-centric digital banking solutions and fintech innovations. The IT and Telecom sector itself, as a provider and consumer of ICT, significantly influences market dynamics. While Hardware remains essential, its growth is often tied to the broader implementation of IT Services and Telecommunication Services. The Energy and Utilities sector is also showing increased adoption of IoT and data analytics for optimizing operations and improving safety.

- Dominant Segment - IT Services: Characterized by high demand for cloud computing, cybersecurity, data analytics, and digital transformation consulting.

- Key Drivers: Need for operational efficiency, cost optimization, enhanced customer experience, and regulatory compliance.

- Market Share Potential: Projected to capture xx% of the total ICT market by 2033.

- Key Enterprise Segment - Large Enterprises: Leading the adoption of sophisticated, integrated ICT solutions.

- Drivers: Strategic digital initiatives, global expansion, and the need for robust infrastructure.

- Growth Potential: Significant investment in custom software development and complex IT service deployments.

- Emerging Growth Engine - SMEs: Rapidly adopting cloud-based solutions, software-as-a-service (SaaS), and digital marketing tools.

- Drivers: Cost-effectiveness, scalability, and the imperative to compete in a digital landscape.

- Impact: Driving demand for readily available and user-friendly ICT products.

- Pivotal Industry Vertical - Government: Implementing nationwide digital transformation projects and smart city initiatives.

- Drivers: Enhancing public service delivery, improving national security, and fostering economic development.

- Influence: Significant procurement of telecommunication services, hardware, and specialized software.

- Strong Contributor - BFSI: Leading adoption of digital banking, fintech solutions, and robust cybersecurity measures.

- Drivers: Customer demand for seamless digital experiences, regulatory compliance, and fraud prevention.

Oman ICT Market Product Landscape

The Oman ICT market product landscape is characterized by a dynamic infusion of cutting-edge technologies and evolving applications. Global players are introducing advanced Hardware solutions, including high-performance computing, secure networking equipment, and cloud-ready infrastructure, catering to the demands of both large enterprises and SMEs. The Software segment is experiencing a surge in demand for cloud-based platforms, AI-powered analytics tools, cybersecurity solutions, and enterprise resource planning (ERP) systems. Unique selling propositions often lie in the integration of AI and machine learning capabilities for predictive analytics and automation.

IT Services encompass a wide range of offerings, from system integration and managed services to digital transformation consulting and cloud migration expertise. Performance metrics are increasingly focused on agility, scalability, security, and cost-effectiveness. Telecommunication Services are rapidly advancing with the widespread rollout of 5G, enabling new applications in areas like IoT and enhanced mobile broadband. Technological advancements are geared towards providing faster speeds, lower latency, and greater connectivity, fostering innovation across all market segments.

Key Drivers, Barriers & Challenges in Oman ICT Market

Key Drivers

The Oman ICT market is propelled by a strong impetus from government digital transformation agendas and a commitment to economic diversification. Key drivers include:

- Government Vision and Investment: Strategic initiatives like Oman Vision 2040 prioritize digital transformation, fostering significant investment in ICT infrastructure and services.

- Growing Demand for Digital Services: Increased adoption of cloud computing, AI, big data analytics, and IoT across all industry verticals, from BFSI to Energy & Utilities, to enhance efficiency and innovation.

- Technological Advancements: The continuous evolution of global technologies, such as 5G, advanced cybersecurity solutions, and AI-driven platforms, creates opportunities for market growth.

- Startup Ecosystem Growth: A burgeoning startup scene is introducing innovative solutions and driving competition, further stimulating market development.

Barriers & Challenges

Despite robust growth drivers, the Oman ICT market faces several significant barriers and challenges:

- Talent Shortage and Skill Gaps: A persistent challenge is the availability of skilled ICT professionals, particularly in specialized areas like cybersecurity and AI.

- Cybersecurity Threats: The increasing sophistication of cyber threats necessitates continuous investment in advanced security measures, posing a significant financial and operational challenge.

- Infrastructure Development: While improving, the need for advanced and widespread digital infrastructure, especially in remote areas, remains a barrier to universal digital adoption.

- Regulatory Complexity: Navigating evolving data privacy and cybersecurity regulations can be complex for businesses, requiring substantial compliance efforts.

- Cost of Advanced Technologies: The high initial investment required for cutting-edge hardware and software solutions can be a restraint for SMEs.

- Supply Chain Disruptions: Global supply chain issues can impact the availability and cost of ICT hardware, affecting project timelines and budgets.

Emerging Opportunities in Oman ICT Market

The Oman ICT market is brimming with emerging opportunities driven by digital evolution and a progressive economic vision. The expansion of cloud computing services, particularly hybrid and multi-cloud solutions, presents a significant avenue for growth, catering to diverse business needs for flexibility and scalability. The increasing adoption of Artificial Intelligence (AI) and Machine Learning (ML) across sectors like BFSI and retail is creating demand for data analytics platforms, AI-powered customer service solutions, and predictive modeling tools.

The Internet of Things (IoT) offers substantial potential, especially in smart city initiatives, energy management, and industrial automation within the manufacturing and energy sectors. The growing emphasis on cybersecurity due to rising threats creates ongoing opportunities for advanced security solutions, threat intelligence, and compliance services. Furthermore, the Digital Transformation of SMEs is a key opportunity, as these businesses increasingly seek cost-effective and accessible ICT solutions to enhance their competitiveness.

Growth Accelerators in the Oman ICT Market Industry

Several key catalysts are accelerating the growth of the Oman ICT market. The Omani government's strong commitment to digital transformation through initiatives like Oman Vision 2040, coupled with substantial infrastructure investments, forms a foundational accelerator. The rapid adoption of cloud computing and SaaS solutions by businesses of all sizes, driven by the need for agility and cost-efficiency, is a major growth stimulant. Furthermore, the increasing penetration of 5G networks is paving the way for innovative applications in IoT, smart cities, and advanced telecommunications services, driving demand for related hardware and software. Strategic partnerships between global technology providers and local Omani companies are also fostering innovation and market expansion, enabling the localized delivery of advanced ICT solutions.

Key Players Shaping the Oman ICT Market Market

- Google LLC (Alphabet Inc.)

- Wipro Limited

- IBM Corporation

- Huawei Investment & Holding Co Ltd

- Hewlett Packard Enterprise Company

- Oman Computer Services LLC (OCS Infotech)

- Cisco Systems Inc

- Microsoft Corporation

- Oracle Corporation

- Cognizant Technology Solutions Corporation

- Infoline LLC

- SAP SE

Notable Milestones in Oman ICT Market Sector

- June 2023: SAP invested in building a private cloud data center in Oman by collaborating with Oman's Ministry of Transport, Communications, and Information Technology, which would support the growth of cloud-based services in the country.

- May 2023: Cognizant announced that Cognizant Neuro AI is a new enterprise-wide platform designed to give organizations a holistic strategy to accelerate generative AI technology adoption and harness its economic value in a flexible, secure, scalable, and ethical manner.

In-Depth Oman ICT Market Market Outlook

The Oman ICT market is poised for robust and sustained growth, driven by ongoing government digital transformation efforts and increasing private sector investment. The future market potential is immense, with significant opportunities in the expansion of cloud infrastructure, advanced analytics, and cybersecurity solutions. Strategic partnerships between global technology leaders and local entities will be crucial for unlocking this potential, fostering innovation, and ensuring the localized delivery of cutting-edge ICT services. The increasing demand for digital solutions across all industry verticals, coupled with the government's vision for a diversified digital economy, positions Oman as a key emerging market for ICT innovation and adoption in the coming years.

Oman ICT Market Segmentation

-

1. Type

- 1.1. Hardware

- 1.2. Software

- 1.3. IT Services

- 1.4. Telecommunication Services

-

2. Size of Enterprise

- 2.1. Small and Medium Enterprises

- 2.2. Large Enterprises

-

3. Industry Vertical

- 3.1. BFSI

- 3.2. IT and Telecom

- 3.3. Government

- 3.4. Retail and E-commerce

- 3.5. Manufacturing

- 3.6. Energy and Utilities

- 3.7. Other Industry Verticals

Oman ICT Market Segmentation By Geography

- 1. Oman

Oman ICT Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.88% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Consistent Digital Transformation Initiatives; Robust Telecommunication Network

- 3.3. Market Restrains

- 3.3.1. Lack of Awareness Regarding Blockchain Functionality is Hindering the Market Growth

- 3.4. Market Trends

- 3.4.1. Consistent Digital Transformation Initiatives to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Oman ICT Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hardware

- 5.1.2. Software

- 5.1.3. IT Services

- 5.1.4. Telecommunication Services

- 5.2. Market Analysis, Insights and Forecast - by Size of Enterprise

- 5.2.1. Small and Medium Enterprises

- 5.2.2. Large Enterprises

- 5.3. Market Analysis, Insights and Forecast - by Industry Vertical

- 5.3.1. BFSI

- 5.3.2. IT and Telecom

- 5.3.3. Government

- 5.3.4. Retail and E-commerce

- 5.3.5. Manufacturing

- 5.3.6. Energy and Utilities

- 5.3.7. Other Industry Verticals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Oman

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Google LLC (Alphabet Inc )*List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Wipro Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 IBM Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Huawei Investment & Holding Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Hewlett Packard Enterprise Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Oman Computer Services LLC (OCS Infotech)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Cisco Systems Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Microsoft Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Oracle Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Cognizant Technology Solutions Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Infoline LLC

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 SAP SE

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Google LLC (Alphabet Inc )*List Not Exhaustive

List of Figures

- Figure 1: Oman ICT Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Oman ICT Market Share (%) by Company 2024

List of Tables

- Table 1: Oman ICT Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Oman ICT Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Oman ICT Market Revenue Million Forecast, by Size of Enterprise 2019 & 2032

- Table 4: Oman ICT Market Revenue Million Forecast, by Industry Vertical 2019 & 2032

- Table 5: Oman ICT Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Oman ICT Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Oman ICT Market Revenue Million Forecast, by Type 2019 & 2032

- Table 8: Oman ICT Market Revenue Million Forecast, by Size of Enterprise 2019 & 2032

- Table 9: Oman ICT Market Revenue Million Forecast, by Industry Vertical 2019 & 2032

- Table 10: Oman ICT Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Oman ICT Market?

The projected CAGR is approximately 8.88%.

2. Which companies are prominent players in the Oman ICT Market?

Key companies in the market include Google LLC (Alphabet Inc )*List Not Exhaustive, Wipro Limited, IBM Corporation, Huawei Investment & Holding Co Ltd, Hewlett Packard Enterprise Company, Oman Computer Services LLC (OCS Infotech), Cisco Systems Inc, Microsoft Corporation, Oracle Corporation, Cognizant Technology Solutions Corporation, Infoline LLC, SAP SE.

3. What are the main segments of the Oman ICT Market?

The market segments include Type, Size of Enterprise, Industry Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.47 Million as of 2022.

5. What are some drivers contributing to market growth?

Consistent Digital Transformation Initiatives; Robust Telecommunication Network.

6. What are the notable trends driving market growth?

Consistent Digital Transformation Initiatives to Drive the Market.

7. Are there any restraints impacting market growth?

Lack of Awareness Regarding Blockchain Functionality is Hindering the Market Growth.

8. Can you provide examples of recent developments in the market?

June 2023: SAP invested in building a private cloud data center in Oman by collaborating with Oman's Ministry of Transport, Communications, and Information Technology, which would support the growth of cloud-based services in the country.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Oman ICT Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Oman ICT Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Oman ICT Market?

To stay informed about further developments, trends, and reports in the Oman ICT Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence