Key Insights

The In-Mold Labels (IML) market is projected for significant expansion, with an estimated market size of $3.8 billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of 9% from 2025 to 2033. This robust growth is propelled by escalating demand for premium, durable packaging solutions across the food & beverage, cosmetics, and pharmaceuticals sectors. Consumers increasingly favor visually appealing, high-quality packaging, which drives IML adoption. Key advantages of IML, including superior scratch and chemical resistance, exceptional durability, and resilience to extreme temperatures, position it favorably against conventional labeling methods. Advancements in IML production technology are enhancing efficiency and reducing costs, further stimulating market expansion. While initial investment in production equipment and specialized skill requirements present potential challenges, the overall market outlook remains highly positive. The food & beverage segment is anticipated to lead market share due to high production volumes and a growing need for distinctive packaging. The competitive landscape features a dynamic mix of established and emerging enterprises. Geographic expansion, particularly in the Asia Pacific region, is expected to contribute substantially to growth, fueled by rising disposable incomes and an expanding consumer base.

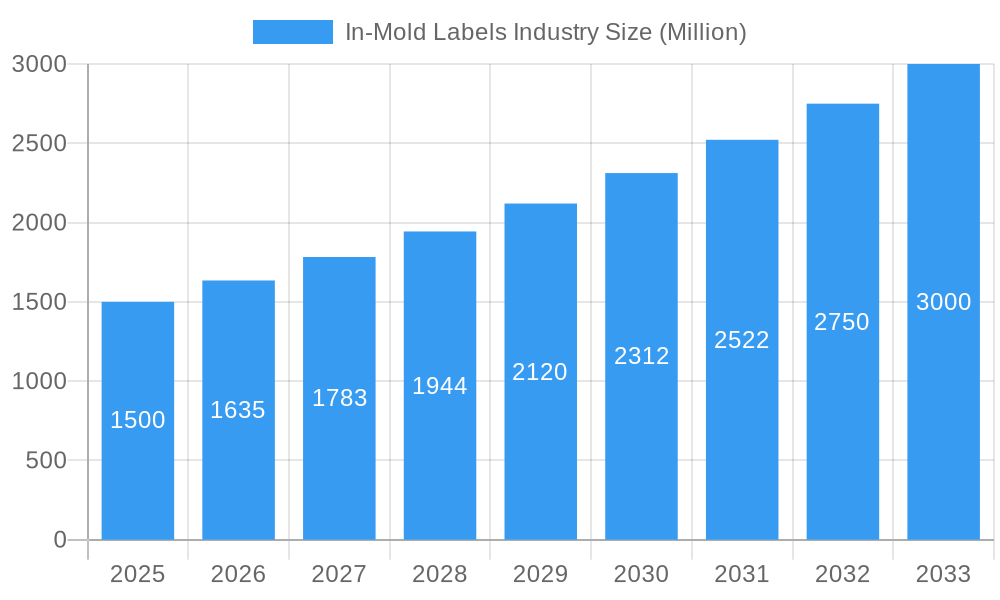

In-Mold Labels Industry Market Size (In Billion)

The IML market's trajectory over the next decade is promising, with continuous innovation in label design and materials, alongside a growing consumer preference for sustainable packaging, presenting significant growth opportunities. The development of eco-friendly IML solutions utilizing recycled or renewable materials is enhancing market appeal. The integration of smart technologies, such as RFID and NFC, within IML offers brands advanced tracking and anti-counterfeiting features, particularly for high-value products. While regional growth rates will vary based on economic conditions and consumer preferences, the global IML market is poised for substantial expansion, driven by technological advancements, evolving consumer demands, and the inherent benefits of this advanced labeling technology.

In-Mold Labels Industry Company Market Share

In-Mold Labels Market Report: 2019-2033 - A Comprehensive Analysis

This comprehensive report provides an in-depth analysis of the In-Mold Labels (IML) industry, covering market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook. The report leverages extensive market research to forecast market size from 2019 to 2033, with 2025 serving as the base and estimated year. This detailed analysis is crucial for industry professionals, investors, and strategic decision-makers seeking to understand and capitalize on opportunities within this dynamic sector. The study covers the parent market of packaging labels and the child market of in-mold labels.

Study Period: 2019-2033; Base Year: 2025; Estimated Year: 2025; Forecast Period: 2025-2033; Historical Period: 2019-2024

In-Mold Labels Industry Market Dynamics & Structure

This section analyzes the competitive landscape of the In-Mold Labels industry, examining market concentration, technological advancements, regulatory landscapes, and competitive substitutions. The analysis encompasses M&A activities and their impact on market structure. Quantitative insights, including market share percentages and M&A deal volumes (xx Million units), are provided alongside qualitative factors impacting innovation.

- Market Concentration: The IML market exhibits a moderately consolidated structure with several major players holding significant market share. xx% of the market is controlled by the top 5 players, while the remaining xx% is shared amongst numerous smaller companies.

- Technological Innovation: Technological advancements, including advancements in printing technologies (e.g., digital printing, flexographic printing) and material science, are key drivers for market growth and increased adoption of IMLs.

- Regulatory Frameworks: Government regulations regarding food safety and packaging materials impact the adoption and use of IMLs. Compliance with these regulations influences the demand and selection of IMLs.

- Competitive Substitutes: Other labeling technologies, such as pressure-sensitive labels and shrink sleeves, pose competitive challenges to IMLs. However, IMLs offer advantages in terms of durability and aesthetics, maintaining a competitive edge.

- End-User Demographics: The growing demand for attractive and durable packaging across various end-use industries contributes to the growth of the IML market. Changing consumer preferences drive the innovation in IML designs and material choices.

- M&A Trends: The IML market has witnessed a moderate level of M&A activity in recent years (xx deals in the last 5 years). These activities aim to expand market reach, enhance technological capabilities, and increase overall market share.

In-Mold Labels Industry Growth Trends & Insights

The global In-Mold Labels market is experiencing significant growth driven by factors such as the rising demand for attractive and durable packaging in diverse industries. This section analyzes market size evolution from 2019 to 2033, providing insights into the Compound Annual Growth Rate (CAGR) and market penetration. Technological disruptions and evolving consumer behavior are also examined. The adoption rate of IMLs across various end-user sectors is analyzed, providing a comprehensive view of market growth and development. The analysis includes the impact of shifting consumer preferences toward eco-friendly packaging solutions on IML demand. Furthermore, the report explores the influence of technological advancements, such as the integration of smart technologies within IMLs, on market dynamics and future growth potential. The predicted market size for 2033 is estimated at xx Million units, showing a substantial increase from the 2025 estimated size of xx Million units.

Dominant Regions, Countries, or Segments in In-Mold Labels Industry

This section identifies the leading region, country, or segment driving market growth within the In-Mold Labels industry. The analysis focuses on the "By End-User Industries" segments: Food & Beverage, Cosmetics, Pharmaceuticals, and Other End-user Industries. The factors contributing to the dominance of specific regions and segments, including market share and growth potential, are thoroughly explored. Specific drivers are identified via bullet points, with detailed paragraphs providing contextual analysis.

- Food & Beverage: The Food & Beverage segment holds the largest market share due to the significant demand for attractive and durable packaging solutions for various food and beverage products. Strong growth is predicted for this segment in developing economies.

- Cosmetics: The cosmetics sector demonstrates substantial growth due to the increasing demand for premium packaging solutions that enhance product appeal. Innovations in IML technology for cosmetics packaging are expected to drive further expansion.

- Pharmaceuticals: The pharmaceutical segment is showing steady growth, driven by regulatory compliance requirements emphasizing packaging integrity and tamper evidence.

- Other End-user Industries: This segment includes various industries like household goods, electronics and automotive components where demand for durable, eye-catching labels is increasing, albeit at a slower rate than the aforementioned industries.

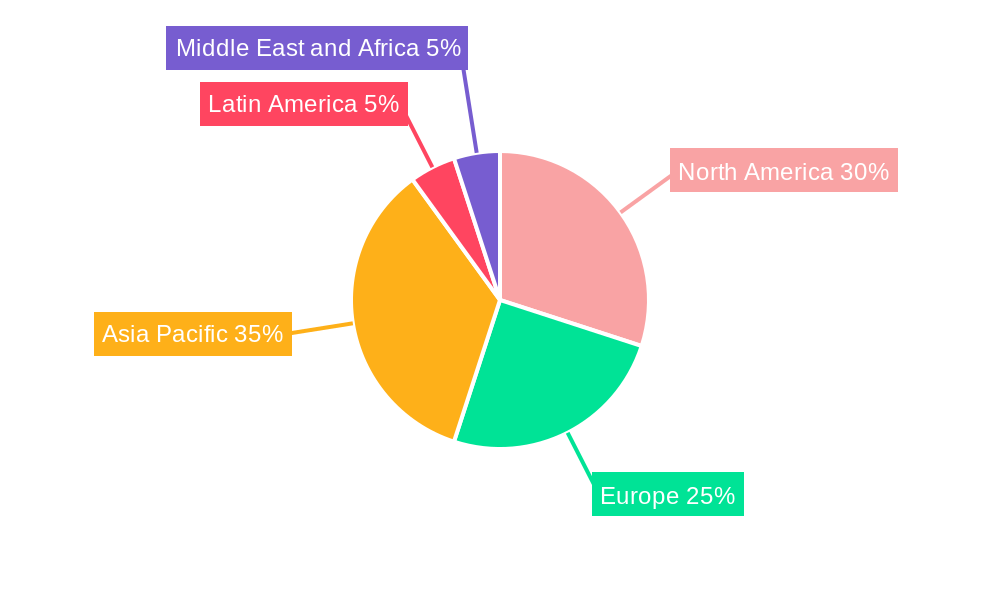

Regional Dominance: The [Region Name, e.g., North America] region currently holds the largest market share due to high consumer spending and established manufacturing infrastructure. [Country Name, e.g., USA] within this region contributes the largest volume due to [Reason, e.g. strong domestic market and established IML manufacturing capacity]. However, [Region Name, e.g., Asia Pacific] is projected to witness significant growth in the forecast period driven by [Reason, e.g., rising disposable incomes and expanding manufacturing sector].

In-Mold Labels Industry Product Landscape

The In-Mold Labels market offers a diverse range of products catering to various application requirements. These labels are differentiated based on materials (e.g., PP, PET, HDPE), printing techniques (e.g., flexography, offset, digital), and specific design features offering improved durability, enhanced aesthetics, and unique branding opportunities. Advancements in material science have led to the development of eco-friendly and recyclable IMLs, meeting the growing demand for sustainable packaging solutions.

Key Drivers, Barriers & Challenges in In-Mold Labels Industry

Key Drivers:

The In-Mold Labels market is propelled by factors such as the increasing demand for enhanced product aesthetics, the growing need for durable and tamper-evident packaging, and the rising adoption of sustainable packaging materials. Technological advancements in printing and material science are further driving market expansion.

Key Barriers and Challenges:

High initial investment costs for IML production and the availability of substitute labeling technologies pose significant challenges. Furthermore, stringent regulatory requirements and potential supply chain disruptions can impact market growth. Fluctuations in raw material prices also present a challenge to maintain stable pricing and profitability.

Emerging Opportunities in In-Mold Labels Industry

The In-Mold Labels industry presents several emerging opportunities driven by the increasing demand for specialized packaging across various niche sectors. The growing preference for sustainable and recyclable packaging materials creates opportunities for environmentally conscious IML solutions. Furthermore, the integration of smart technologies, such as RFID tags and sensors within IMLs, provides innovative solutions for enhanced product traceability and anti-counterfeiting measures. Expansion into emerging markets with growing consumer spending and increasing demand for packaged goods further offers potential for growth.

Growth Accelerators in the In-Mold Labels Industry

The In-Mold Labels industry's long-term growth is fueled by several accelerators. Advancements in digital printing technologies are enabling higher-quality, more customized labels, and the development of bio-based and recyclable IML materials is catering to the increasing demand for sustainable solutions. Strategic partnerships between IML manufacturers and brand owners are fostering innovation and expanding market reach, while investments in automation and advanced manufacturing technologies are driving efficiency improvements. These factors collectively create a strong foundation for continued expansion of the IML market.

Key Players Shaping the In-Mold Labels Industry Market

- Taghleef Industries Inc

- Inland Packaging (Inland Label and Marketing Services LLC)

- John Herrod & Associates

- Smyth Companies LLC

- Fort Dearborn Company

- CCL Industries

- Multi-Color Corporation

- Aspasie Inc

- General Press Corporation

- Huhtamaki Group

- List Not Exhaustive

Notable Milestones in In-Mold Labels Industry Sector

- 2020-03: Introduction of a new biodegradable IML material by [Company Name].

- 2021-11: CCL Industries acquires [Company Name], expanding its global presence.

- 2022-05: Launch of a new high-speed IML printing press by [Company Name]. (Add more specific milestones with dates as they become available)

In-Depth In-Mold Labels Industry Market Outlook

The In-Mold Labels industry is poised for continued growth driven by the aforementioned factors. The increasing adoption of sustainable packaging solutions and the integration of smart technologies will drive innovation and expansion into new markets. Strategic partnerships and investments in advanced manufacturing capabilities are key to maintaining a competitive edge in this growing market. The long-term outlook for the IML market is optimistic, with significant growth potential across various regions and end-use segments.

In-Mold Labels Industry Segmentation

-

1. End-User Industries

- 1.1. Food & Beverage

- 1.2. Cosmetics

- 1.3. Pharmaceuticals

- 1.4. Other End-user Industries

In-Mold Labels Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

In-Mold Labels Industry Regional Market Share

Geographic Coverage of In-Mold Labels Industry

In-Mold Labels Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.42% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Appealing and Good Asthetics; The rising Need to Withstand Temperature Fluctuations; Increased Consumption of Frozen Containerized Foods

- 3.3. Market Restrains

- 3.3.1. Tedious Mold Production Process; Interoperability Issues

- 3.4. Market Trends

- 3.4.1. Food & Beverage Industry is Expected to Hold the largest Share.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global In-Mold Labels Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-User Industries

- 5.1.1. Food & Beverage

- 5.1.2. Cosmetics

- 5.1.3. Pharmaceuticals

- 5.1.4. Other End-user Industries

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by End-User Industries

- 6. North America In-Mold Labels Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End-User Industries

- 6.1.1. Food & Beverage

- 6.1.2. Cosmetics

- 6.1.3. Pharmaceuticals

- 6.1.4. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by End-User Industries

- 7. Europe In-Mold Labels Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End-User Industries

- 7.1.1. Food & Beverage

- 7.1.2. Cosmetics

- 7.1.3. Pharmaceuticals

- 7.1.4. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by End-User Industries

- 8. Asia Pacific In-Mold Labels Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End-User Industries

- 8.1.1. Food & Beverage

- 8.1.2. Cosmetics

- 8.1.3. Pharmaceuticals

- 8.1.4. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by End-User Industries

- 9. Latin America In-Mold Labels Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End-User Industries

- 9.1.1. Food & Beverage

- 9.1.2. Cosmetics

- 9.1.3. Pharmaceuticals

- 9.1.4. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by End-User Industries

- 10. Middle East and Africa In-Mold Labels Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End-User Industries

- 10.1.1. Food & Beverage

- 10.1.2. Cosmetics

- 10.1.3. Pharmaceuticals

- 10.1.4. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by End-User Industries

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Taghleef Industries Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Inland Packaging (Inland Label and Marketing Services LLC)

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 John Herrod & Associates

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Smyth Companies LLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Fort Dearborn Company

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 CCL Industries

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Multi-Color Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Aspasie Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 General Press Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Huhtamaki Group*List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Taghleef Industries Inc

List of Figures

- Figure 1: Global In-Mold Labels Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America In-Mold Labels Industry Revenue (billion), by End-User Industries 2025 & 2033

- Figure 3: North America In-Mold Labels Industry Revenue Share (%), by End-User Industries 2025 & 2033

- Figure 4: North America In-Mold Labels Industry Revenue (billion), by Country 2025 & 2033

- Figure 5: North America In-Mold Labels Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe In-Mold Labels Industry Revenue (billion), by End-User Industries 2025 & 2033

- Figure 7: Europe In-Mold Labels Industry Revenue Share (%), by End-User Industries 2025 & 2033

- Figure 8: Europe In-Mold Labels Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: Europe In-Mold Labels Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific In-Mold Labels Industry Revenue (billion), by End-User Industries 2025 & 2033

- Figure 11: Asia Pacific In-Mold Labels Industry Revenue Share (%), by End-User Industries 2025 & 2033

- Figure 12: Asia Pacific In-Mold Labels Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Asia Pacific In-Mold Labels Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America In-Mold Labels Industry Revenue (billion), by End-User Industries 2025 & 2033

- Figure 15: Latin America In-Mold Labels Industry Revenue Share (%), by End-User Industries 2025 & 2033

- Figure 16: Latin America In-Mold Labels Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Latin America In-Mold Labels Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Middle East and Africa In-Mold Labels Industry Revenue (billion), by End-User Industries 2025 & 2033

- Figure 19: Middle East and Africa In-Mold Labels Industry Revenue Share (%), by End-User Industries 2025 & 2033

- Figure 20: Middle East and Africa In-Mold Labels Industry Revenue (billion), by Country 2025 & 2033

- Figure 21: Middle East and Africa In-Mold Labels Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global In-Mold Labels Industry Revenue billion Forecast, by End-User Industries 2020 & 2033

- Table 2: Global In-Mold Labels Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global In-Mold Labels Industry Revenue billion Forecast, by End-User Industries 2020 & 2033

- Table 4: Global In-Mold Labels Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 5: Global In-Mold Labels Industry Revenue billion Forecast, by End-User Industries 2020 & 2033

- Table 6: Global In-Mold Labels Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global In-Mold Labels Industry Revenue billion Forecast, by End-User Industries 2020 & 2033

- Table 8: Global In-Mold Labels Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Global In-Mold Labels Industry Revenue billion Forecast, by End-User Industries 2020 & 2033

- Table 10: Global In-Mold Labels Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Global In-Mold Labels Industry Revenue billion Forecast, by End-User Industries 2020 & 2033

- Table 12: Global In-Mold Labels Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the In-Mold Labels Industry?

The projected CAGR is approximately 3.42%.

2. Which companies are prominent players in the In-Mold Labels Industry?

Key companies in the market include Taghleef Industries Inc, Inland Packaging (Inland Label and Marketing Services LLC), John Herrod & Associates, Smyth Companies LLC, Fort Dearborn Company, CCL Industries, Multi-Color Corporation, Aspasie Inc, General Press Corporation, Huhtamaki Group*List Not Exhaustive.

3. What are the main segments of the In-Mold Labels Industry?

The market segments include End-User Industries.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.8 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Appealing and Good Asthetics; The rising Need to Withstand Temperature Fluctuations; Increased Consumption of Frozen Containerized Foods.

6. What are the notable trends driving market growth?

Food & Beverage Industry is Expected to Hold the largest Share..

7. Are there any restraints impacting market growth?

Tedious Mold Production Process; Interoperability Issues.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "In-Mold Labels Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the In-Mold Labels Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the In-Mold Labels Industry?

To stay informed about further developments, trends, and reports in the In-Mold Labels Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence