Key Insights

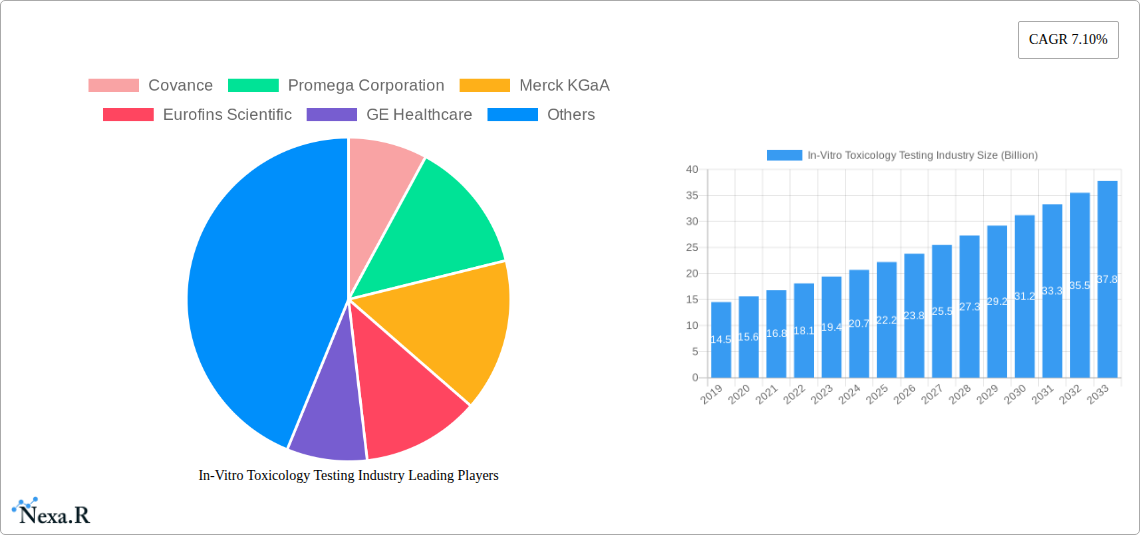

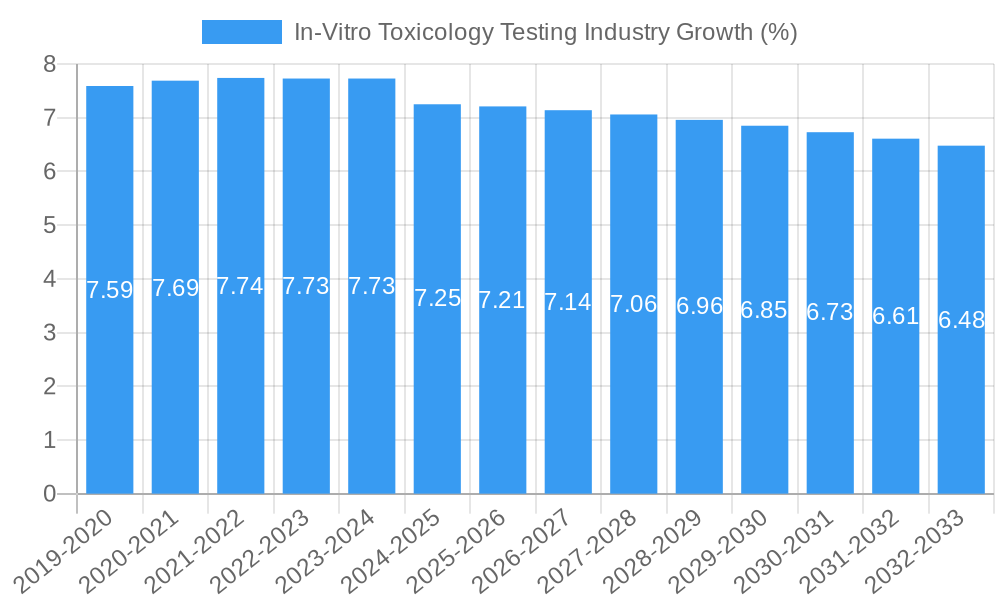

The In-Vitro Toxicology Testing market is poised for significant expansion, projected to reach approximately $20.7 billion by 2025 and exhibiting a robust Compound Annual Growth Rate (CAGR) of 7.10% through 2033. This growth is primarily fueled by the increasing demand for safer and more ethical alternatives to traditional animal testing across the pharmaceutical, biotechnology, and chemical industries. Key drivers include stringent regulatory requirements for drug development and chemical safety, coupled with advancements in sophisticated technologies like cell culture, high-throughput screening, and omics technologies. These innovations enable more accurate, cost-effective, and faster toxicological assessments, reducing the reliance on animal models. Furthermore, the growing emphasis on personalized medicine and the development of novel therapeutics necessitate comprehensive in-vitro evaluation to predict potential adverse effects in human subjects. The expanding scope of applications, from systemic and dermal toxicity to endocrine disruption and ocular toxicity, underscores the market's breadth and evolving capabilities.

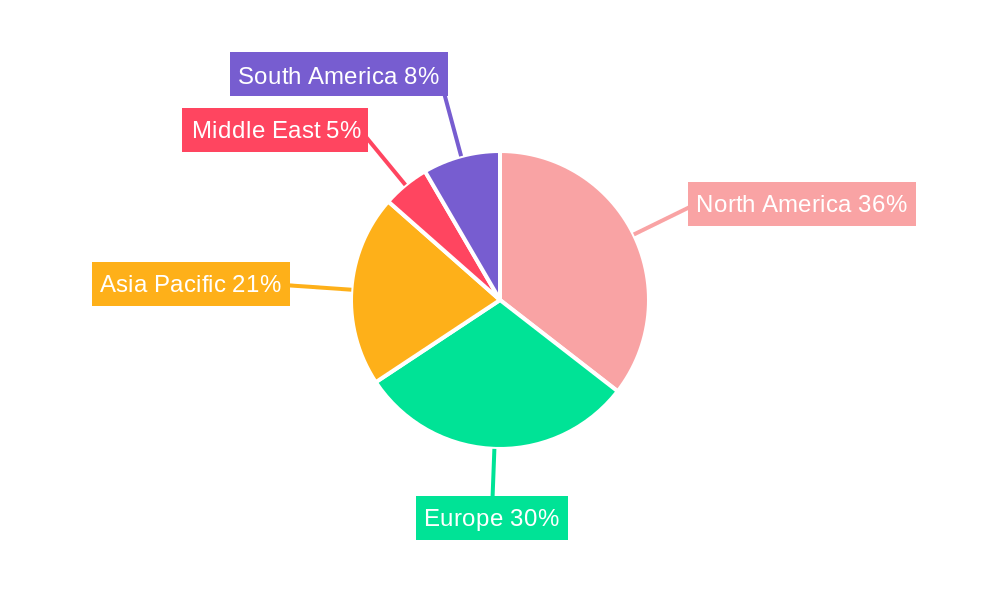

The market's trajectory is also shaped by key trends such as the integration of artificial intelligence and machine learning for predictive toxicology, the rise of organ-on-a-chip technologies offering more physiologically relevant models, and the increasing adoption of multi-omics approaches for a deeper understanding of cellular responses. However, certain restraints, including the high initial investment for advanced technologies and the need for standardized validation protocols for novel in-vitro methods, could pose challenges. Despite these, the collaborative efforts between research institutions, regulatory bodies, and industry players are continuously working to overcome these hurdles. North America and Europe are expected to remain dominant regions due to established regulatory frameworks and significant R&D investments. The Asia Pacific region is anticipated to witness substantial growth, driven by increasing R&D activities and a growing focus on product safety. Leading companies such as Thermo Fisher Scientific, Merck KGaA, and Eurofins Scientific are at the forefront, investing in research and development to expand their portfolios and capitalize on the burgeoning demand for reliable in-vitro toxicology solutions.

Report Title: Global In-Vitro Toxicology Testing Market Outlook 2024-2033: Driving Innovation in Drug Discovery and Safety Assessment

This comprehensive report provides an in-depth analysis of the global in-vitro toxicology testing market, forecast to reach an impressive value of $35.5 Billion by 2033, growing at a CAGR of 9.8% from 2025 to 2033. Driven by the increasing demand for safer and more effective pharmaceuticals and the growing emphasis on animal welfare, the market is experiencing robust expansion. The report meticulously examines market dynamics, growth trends, regional dominance, product landscape, key drivers, challenges, opportunities, and the strategic moves of leading industry players. It offers actionable insights for stakeholders seeking to capitalize on the evolving landscape of drug development and chemical safety assessment.

In-Vitro Toxicology Testing Industry Market Dynamics & Structure

The in-vitro toxicology testing industry is characterized by a moderately concentrated market structure, with key players like Thermo Fisher Scientific, Merck KGaA, and Eurofins Scientific holding significant market shares. Technological innovation is a primary driver, with advancements in cell culture, high-throughput screening, molecular imaging, and OMICS technologies continuously enhancing the accuracy and efficiency of toxicity assessments. The stringent regulatory frameworks established by bodies like the FDA and EMA are pivotal, mandating the use of validated in-vitro methods to reduce reliance on traditional animal testing. Competitive product substitutes, while present, are increasingly being superseded by sophisticated in-vitro alternatives due to their ethical, cost-effective, and predictive advantages. End-user demographics are largely dominated by the pharmaceutical and biotechnology sectors, followed by diagnostics and research institutions. Mergers and acquisitions (M&A) are a significant trend, with companies consolidating their portfolios and expanding their service offerings to gain a competitive edge. For instance, the acquisition of specialized CROs by larger entities aims to integrate novel testing platforms and expand geographical reach. Innovation barriers include the cost of developing and validating new assays and the need for extensive regulatory approval for novel methods. However, the increasing adoption of AI and machine learning in predictive toxicology is poised to further revolutionize the market. The estimated market share for advanced in-vitro toxicology solutions is projected to reach 70% by 2027, highlighting a shift away from traditional methods.

In-Vitro Toxicology Testing Industry Growth Trends & Insights

The global in-vitro toxicology testing market is on a significant upward trajectory, fueled by a confluence of scientific, ethical, and regulatory forces. The market size, valued at an estimated $20.2 Billion in 2025, is projected to witness sustained growth throughout the forecast period (2025–2033). This expansion is underpinned by a rising adoption rate of in-vitro methodologies in drug discovery and development pipelines, driven by their inherent advantages over conventional animal testing. These advantages include enhanced predictive accuracy, reduced development costs, faster screening times, and significant ethical considerations. Technological disruptions are playing a crucial role, with the integration of Artificial Intelligence (AI) and Machine Learning (ML) into toxicology workflows enabling more sophisticated data analysis and predictive modeling. High-throughput screening (HTS) technologies are enabling the simultaneous testing of thousands of compounds, dramatically accelerating the identification of potential drug candidates and flagging toxic substances early in the development process. Molecular imaging and OMICS technologies, such as genomics, transcriptomics, and proteomics, are providing deeper insights into cellular mechanisms of toxicity, allowing for more targeted and reliable assessments. Consumer behavior shifts, influenced by increasing awareness of animal welfare and a demand for safer products, are also indirectly contributing to the market's growth as companies proactively seek ethically sound and scientifically robust testing solutions. The market penetration of in-vitro toxicology testing in preclinical drug development is expected to surpass 85% by 2030. The compound annual growth rate (CAGR) of the market is estimated to be around 9.8% during the forecast period, indicating a robust and consistent expansion. The increasing complexity of novel drug modalities, such as biologics and gene therapies, necessitates advanced in-vitro testing approaches that can accurately assess their safety profiles. Furthermore, the growing scrutiny of chemical safety in consumer products and environmental regulations is expanding the application scope for in-vitro toxicology beyond pharmaceuticals. The transition from traditional, animal-based testing to in-vitro alternatives is not merely a trend but a fundamental paradigm shift driven by scientific advancement and societal expectations.

Dominant Regions, Countries, or Segments in In-Vitro Toxicology Testing Industry

The global in-vitro toxicology testing market exhibits distinct regional dominance and segment leadership, driven by a complex interplay of economic policies, infrastructure development, research capabilities, and regulatory landscapes. North America, particularly the United States, currently leads the market, driven by its robust pharmaceutical and biotechnology industry, substantial R&D investments, and a well-established regulatory framework that encourages the adoption of novel in-vitro testing methods. The presence of major pharmaceutical companies and contract research organizations (CROs) with extensive in-vitro toxicology capabilities significantly contributes to this regional dominance. Europe follows closely, with countries like Germany, the UK, and France being key contributors, propelled by stringent regulatory requirements (e.g., REACH) that mandate the use of in-vitro alternatives for chemical safety assessments and a strong ethical stance against animal testing. Asia-Pacific is emerging as a high-growth region, fueled by a rapidly expanding pharmaceutical sector in China and India, increasing governmental support for R&D, and a growing awareness of safety standards.

Within the Technology segment, Cell Culture remains the dominant force, as it forms the foundation for most in-vitro assays. However, High Throughput technologies are experiencing rapid growth due to their efficiency in screening large compound libraries. OMICS technologies are gaining significant traction for their ability to provide deep mechanistic insights into toxicity.

In terms of Method, Cellular Assays are the most prevalent, offering direct insights into cellular responses to toxic substances. Biochemical Assays are also widely used for specific target-based toxicity evaluations. The increasing sophistication of computational power is driving the growth of In Silica methods, which are gaining acceptance for their cost-effectiveness and speed in preliminary assessments.

By Application, Systemic Toxicology accounts for the largest share, reflecting its broad applicability in drug development and chemical risk assessment. Dermal Toxicity and Endocrine Disruption testing are also significant due to the increasing focus on these specific endpoints and regulatory mandates.

The End User landscape is dominated by the Pharmaceutical and Biotechnology sector, which invests heavily in in-vitro toxicology for drug discovery and safety evaluation. The Diagnostics sector is also a growing user, particularly for toxicological screening of diagnostic reagents and kits.

Key drivers of dominance in North America include significant venture capital funding for biotech startups and extensive government-funded research initiatives in toxicology. In Europe, the proactive regulatory environment and established CRO infrastructure are paramount. For the Asia-Pacific region, the growth is propelled by increasing domestic pharmaceutical production, contract manufacturing opportunities, and a gradual alignment with international regulatory standards. The market share of North America in the global in-vitro toxicology testing market is estimated to be around 38%, followed by Europe at 32%. The increasing adoption of advanced cellular models like organoids and microphysiological systems (MPS) is a key factor driving the growth of the cellular assay segment.

In-Vitro Toxicology Testing Industry Product Landscape

The in-vitro toxicology testing industry is characterized by a dynamic product landscape focused on enhancing the accuracy, efficiency, and predictive capabilities of toxicity assessments. Innovations revolve around advanced cell-based assays, including 3D cell cultures, organ-on-a-chip technologies, and induced pluripotent stem cell (iPSC)-derived models, which better mimic human physiology than traditional 2D cultures. High-throughput screening (HTS) platforms integrated with sophisticated detection instruments and data analysis software are enabling rapid screening of vast chemical libraries. OMICS technologies, such as transcriptomics and proteomics, are offering deeper mechanistic insights into cellular responses to toxicants. Furthermore, the development of advanced bioinformatics tools and AI algorithms is revolutionizing the interpretation of complex in-vitro data, leading to more reliable predictions of human toxicity. Unique selling propositions of these products lie in their ability to reduce animal use, improve cost-effectiveness, and accelerate drug development timelines, while providing more human-relevant data.

Key Drivers, Barriers & Challenges in In-Vitro Toxicology Testing Industry

Key Drivers:

- Ethical Considerations and Animal Welfare: Growing societal concern and legislative pressure to reduce and replace animal testing.

- Technological Advancements: Innovations in cell culture, OMICS, high-throughput screening, and AI are enhancing assay accuracy and efficiency.

- Regulatory Mandates: Increasing reliance on in-vitro methods by regulatory bodies like the FDA, EMA, and EPA for safety assessments.

- Cost-Effectiveness and Speed: In-vitro tests are generally faster and less expensive than traditional animal studies.

- Improved Predictive Value: Development of human-relevant in-vitro models leading to better prediction of human responses.

Barriers & Challenges:

- Validation and Standardization: The need for extensive validation and standardization of new in-vitro assays to gain regulatory acceptance.

- Complexity of Biological Systems: Replicating the complexity of in-vivo systems and systemic effects in an in-vitro setting remains a challenge.

- Data Interpretation: Interpreting large volumes of complex data generated by advanced in-vitro technologies requires specialized expertise and robust bioinformatics tools.

- Initial Investment Costs: High initial investment required for advanced in-vitro testing equipment and infrastructure.

- Regulatory Hurdles for Novel Methods: Gaining regulatory approval for novel or complex in-vitro testing strategies can be a lengthy process.

- Supply Chain Disruptions: Potential for disruptions in the supply of specialized reagents and cell culture components. The global supply chain for specialized cell culture media, for example, faced challenges during recent global events, impacting turnaround times for certain studies.

Emerging Opportunities in In-Vitro Toxicology Testing Industry

Emerging opportunities in the in-vitro toxicology testing industry are primarily focused on leveraging cutting-edge technologies for novel applications. The development and commercialization of organ-on-a-chip and microphysiological systems (MPS) represent a significant frontier, offering unprecedented physiological relevance for drug efficacy and toxicity testing. The integration of AI and machine learning for predictive toxicology is another key area, enabling the identification of potential safety liabilities earlier in the drug development process and optimizing compound design. Untapped markets include the growing demand for in-vitro testing in cosmetic ingredient safety, food additive testing, and environmental toxicology assessments, driven by evolving consumer preferences and regulatory demands. Furthermore, the personalized medicine movement is creating opportunities for developing patient-specific in-vitro models to predict individual drug responses and toxicities.

Growth Accelerators in the In-Vitro Toxicology Testing Industry Industry

Several catalysts are accelerating the growth of the in-vitro toxicology testing industry. Technological breakthroughs, such as the development of more sophisticated 3D cell culture models and the refinement of high-throughput screening assays, are continuously expanding the capabilities and applications of in-vitro testing. Strategic partnerships between academic institutions, technology providers, and pharmaceutical companies are fostering innovation and accelerating the translation of research into commercially viable solutions. Market expansion strategies, including the establishment of specialized in-vitro toxicology service centers in emerging economies and the offering of comprehensive assay development services, are also contributing to industry growth. The increasing focus on personalized medicine and the development of novel therapeutic modalities like gene and cell therapies are creating a demand for highly specific and sensitive in-vitro safety assessment tools.

Key Players Shaping the In-Vitro Toxicology Testing Industry Market

- Covance

- Promega Corporation

- Merck KGaA

- Eurofins Scientific

- GE Healthcare

- Abbott Laboratories

- Quest Diagnostics

- Thermo Fisher Scientific

- Bio-Rad Laboratories

- Agilent Technologies

Notable Milestones in In-Vitro Toxicology Testing Industry Sector

- 2020: Launch of advanced organ-on-a-chip platforms by several biotech firms, offering improved physiological relevance for drug testing.

- 2021: Significant investment in AI-powered predictive toxicology software by major pharmaceutical companies, enhancing early-stage safety assessments.

- 2022: Publication of new OECD guidelines for several in-vitro test methods, further standardizing their use in regulatory submissions.

- 2023: Major CROs expand their offerings to include comprehensive iPSC-based toxicity testing services.

- Early 2024: Increased adoption of microphysiological systems (MPS) for preclinical drug development pipelines, leading to better prediction of in-vivo outcomes.

In-Depth In-Vitro Toxicology Testing Industry Market Outlook

The future outlook for the in-vitro toxicology testing industry is exceptionally bright, poised for continued innovation and market expansion. The ongoing convergence of advanced cellular models, AI-driven data analytics, and increasingly stringent regulatory landscapes will solidify the position of in-vitro methods as the cornerstone of modern drug safety assessment. Growth accelerators such as the development of complex human-relevant tissue models and the refinement of predictive toxicology algorithms will enable more precise identification of potential adverse effects, thereby reducing late-stage attrition in drug development. Strategic partnerships and collaborations will continue to be crucial for disseminating these advanced technologies and ensuring their widespread adoption across pharmaceutical, biotechnology, and chemical industries. The industry is set to play an indispensable role in ensuring the safety and efficacy of novel therapeutics and chemicals, contributing significantly to global health and environmental protection.

In-Vitro Toxicology Testing Industry Segmentation

-

1. Technology

- 1.1. Cell Culture

- 1.2. High Throughput

- 1.3. Molecular Imaging

- 1.4. OMICS

-

2. Method

- 2.1. Cellular Assay

- 2.2. Biochemical Assay

- 2.3. In Silica

- 2.4. Ex-vivo

-

3. Application

- 3.1. Systemic Toxicology

- 3.2. Dermal Toxicity

- 3.3. Endorine Disruption

- 3.4. Occular Toxicity

- 3.5. Other Applications

-

4. End User

- 4.1. Pharmaceutical and Biotechnology

- 4.2. Diagnostics

- 4.3. Other End User

In-Vitro Toxicology Testing Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

- 4. Middle East

-

5. GCC

- 5.1. South Africa

- 5.2. Rest of Middle East

-

6. South America

- 6.1. Brazil

- 6.2. Argentina

- 6.3. Rest of South America

In-Vitro Toxicology Testing Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Opposition to the Usage of Animals in Pre-clinical Research; Significant Advancements In-vitro Toxicology Assays; Increasing Awareness Regarding Drug Product Safety

- 3.3. Market Restrains

- 3.3.1. ; Incapability of In-vitro Models to Determine Autoimmunity and Immunostimulation; Stringent Regulatory Framework for the In-vitro Tests

- 3.4. Market Trends

- 3.4.1. Cell Culture is Expected to Hold Significant Market Share in the Technology Type

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global In-Vitro Toxicology Testing Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Cell Culture

- 5.1.2. High Throughput

- 5.1.3. Molecular Imaging

- 5.1.4. OMICS

- 5.2. Market Analysis, Insights and Forecast - by Method

- 5.2.1. Cellular Assay

- 5.2.2. Biochemical Assay

- 5.2.3. In Silica

- 5.2.4. Ex-vivo

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Systemic Toxicology

- 5.3.2. Dermal Toxicity

- 5.3.3. Endorine Disruption

- 5.3.4. Occular Toxicity

- 5.3.5. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by End User

- 5.4.1. Pharmaceutical and Biotechnology

- 5.4.2. Diagnostics

- 5.4.3. Other End User

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. Middle East

- 5.5.5. GCC

- 5.5.6. South America

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. North America In-Vitro Toxicology Testing Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Cell Culture

- 6.1.2. High Throughput

- 6.1.3. Molecular Imaging

- 6.1.4. OMICS

- 6.2. Market Analysis, Insights and Forecast - by Method

- 6.2.1. Cellular Assay

- 6.2.2. Biochemical Assay

- 6.2.3. In Silica

- 6.2.4. Ex-vivo

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Systemic Toxicology

- 6.3.2. Dermal Toxicity

- 6.3.3. Endorine Disruption

- 6.3.4. Occular Toxicity

- 6.3.5. Other Applications

- 6.4. Market Analysis, Insights and Forecast - by End User

- 6.4.1. Pharmaceutical and Biotechnology

- 6.4.2. Diagnostics

- 6.4.3. Other End User

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. Europe In-Vitro Toxicology Testing Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Cell Culture

- 7.1.2. High Throughput

- 7.1.3. Molecular Imaging

- 7.1.4. OMICS

- 7.2. Market Analysis, Insights and Forecast - by Method

- 7.2.1. Cellular Assay

- 7.2.2. Biochemical Assay

- 7.2.3. In Silica

- 7.2.4. Ex-vivo

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Systemic Toxicology

- 7.3.2. Dermal Toxicity

- 7.3.3. Endorine Disruption

- 7.3.4. Occular Toxicity

- 7.3.5. Other Applications

- 7.4. Market Analysis, Insights and Forecast - by End User

- 7.4.1. Pharmaceutical and Biotechnology

- 7.4.2. Diagnostics

- 7.4.3. Other End User

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Asia Pacific In-Vitro Toxicology Testing Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Cell Culture

- 8.1.2. High Throughput

- 8.1.3. Molecular Imaging

- 8.1.4. OMICS

- 8.2. Market Analysis, Insights and Forecast - by Method

- 8.2.1. Cellular Assay

- 8.2.2. Biochemical Assay

- 8.2.3. In Silica

- 8.2.4. Ex-vivo

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Systemic Toxicology

- 8.3.2. Dermal Toxicity

- 8.3.3. Endorine Disruption

- 8.3.4. Occular Toxicity

- 8.3.5. Other Applications

- 8.4. Market Analysis, Insights and Forecast - by End User

- 8.4.1. Pharmaceutical and Biotechnology

- 8.4.2. Diagnostics

- 8.4.3. Other End User

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. Middle East In-Vitro Toxicology Testing Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. Cell Culture

- 9.1.2. High Throughput

- 9.1.3. Molecular Imaging

- 9.1.4. OMICS

- 9.2. Market Analysis, Insights and Forecast - by Method

- 9.2.1. Cellular Assay

- 9.2.2. Biochemical Assay

- 9.2.3. In Silica

- 9.2.4. Ex-vivo

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Systemic Toxicology

- 9.3.2. Dermal Toxicity

- 9.3.3. Endorine Disruption

- 9.3.4. Occular Toxicity

- 9.3.5. Other Applications

- 9.4. Market Analysis, Insights and Forecast - by End User

- 9.4.1. Pharmaceutical and Biotechnology

- 9.4.2. Diagnostics

- 9.4.3. Other End User

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. GCC In-Vitro Toxicology Testing Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 10.1.1. Cell Culture

- 10.1.2. High Throughput

- 10.1.3. Molecular Imaging

- 10.1.4. OMICS

- 10.2. Market Analysis, Insights and Forecast - by Method

- 10.2.1. Cellular Assay

- 10.2.2. Biochemical Assay

- 10.2.3. In Silica

- 10.2.4. Ex-vivo

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Systemic Toxicology

- 10.3.2. Dermal Toxicity

- 10.3.3. Endorine Disruption

- 10.3.4. Occular Toxicity

- 10.3.5. Other Applications

- 10.4. Market Analysis, Insights and Forecast - by End User

- 10.4.1. Pharmaceutical and Biotechnology

- 10.4.2. Diagnostics

- 10.4.3. Other End User

- 10.1. Market Analysis, Insights and Forecast - by Technology

- 11. South America In-Vitro Toxicology Testing Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Technology

- 11.1.1. Cell Culture

- 11.1.2. High Throughput

- 11.1.3. Molecular Imaging

- 11.1.4. OMICS

- 11.2. Market Analysis, Insights and Forecast - by Method

- 11.2.1. Cellular Assay

- 11.2.2. Biochemical Assay

- 11.2.3. In Silica

- 11.2.4. Ex-vivo

- 11.3. Market Analysis, Insights and Forecast - by Application

- 11.3.1. Systemic Toxicology

- 11.3.2. Dermal Toxicity

- 11.3.3. Endorine Disruption

- 11.3.4. Occular Toxicity

- 11.3.5. Other Applications

- 11.4. Market Analysis, Insights and Forecast - by End User

- 11.4.1. Pharmaceutical and Biotechnology

- 11.4.2. Diagnostics

- 11.4.3. Other End User

- 11.1. Market Analysis, Insights and Forecast - by Technology

- 12. North Americ In-Vitro Toxicology Testing Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 United States

- 12.1.2 Canada

- 12.1.3 Mexico

- 13. South America In-Vitro Toxicology Testing Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 Brazil

- 13.1.2 Mexico

- 13.1.3 Rest of South America

- 14. Europe In-Vitro Toxicology Testing Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Germany

- 14.1.2 United Kingdom

- 14.1.3 France

- 14.1.4 Italy

- 14.1.5 Spain

- 14.1.6 Rest of Europe

- 15. Asia Pacific In-Vitro Toxicology Testing Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 China

- 15.1.2 Japan

- 15.1.3 India

- 15.1.4 South Korea

- 15.1.5 Taiwan

- 15.1.6 Australia

- 15.1.7 Rest of Asia-Pacific

- 16. MEA In-Vitro Toxicology Testing Industry Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1 Middle East

- 16.1.2 Africa

- 17. Competitive Analysis

- 17.1. Global Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 Covance

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 Promega Corporation

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 Merck KGaA

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 Eurofins Scientific

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 GE Healthcare

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 Abbott Laboratories

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 Quest Diagnostics

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 Thermo Fisher Scientific*List Not Exhaustive

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 Bio-Rad Laboratories

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.10 Agilent Technologies

- 17.2.10.1. Overview

- 17.2.10.2. Products

- 17.2.10.3. SWOT Analysis

- 17.2.10.4. Recent Developments

- 17.2.10.5. Financials (Based on Availability)

- 17.2.1 Covance

List of Figures

- Figure 1: Global In-Vitro Toxicology Testing Industry Revenue Breakdown (Billion, %) by Region 2024 & 2032

- Figure 2: North Americ In-Vitro Toxicology Testing Industry Revenue (Billion), by Country 2024 & 2032

- Figure 3: North Americ In-Vitro Toxicology Testing Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: South America In-Vitro Toxicology Testing Industry Revenue (Billion), by Country 2024 & 2032

- Figure 5: South America In-Vitro Toxicology Testing Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Europe In-Vitro Toxicology Testing Industry Revenue (Billion), by Country 2024 & 2032

- Figure 7: Europe In-Vitro Toxicology Testing Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Asia Pacific In-Vitro Toxicology Testing Industry Revenue (Billion), by Country 2024 & 2032

- Figure 9: Asia Pacific In-Vitro Toxicology Testing Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: MEA In-Vitro Toxicology Testing Industry Revenue (Billion), by Country 2024 & 2032

- Figure 11: MEA In-Vitro Toxicology Testing Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America In-Vitro Toxicology Testing Industry Revenue (Billion), by Technology 2024 & 2032

- Figure 13: North America In-Vitro Toxicology Testing Industry Revenue Share (%), by Technology 2024 & 2032

- Figure 14: North America In-Vitro Toxicology Testing Industry Revenue (Billion), by Method 2024 & 2032

- Figure 15: North America In-Vitro Toxicology Testing Industry Revenue Share (%), by Method 2024 & 2032

- Figure 16: North America In-Vitro Toxicology Testing Industry Revenue (Billion), by Application 2024 & 2032

- Figure 17: North America In-Vitro Toxicology Testing Industry Revenue Share (%), by Application 2024 & 2032

- Figure 18: North America In-Vitro Toxicology Testing Industry Revenue (Billion), by End User 2024 & 2032

- Figure 19: North America In-Vitro Toxicology Testing Industry Revenue Share (%), by End User 2024 & 2032

- Figure 20: North America In-Vitro Toxicology Testing Industry Revenue (Billion), by Country 2024 & 2032

- Figure 21: North America In-Vitro Toxicology Testing Industry Revenue Share (%), by Country 2024 & 2032

- Figure 22: Europe In-Vitro Toxicology Testing Industry Revenue (Billion), by Technology 2024 & 2032

- Figure 23: Europe In-Vitro Toxicology Testing Industry Revenue Share (%), by Technology 2024 & 2032

- Figure 24: Europe In-Vitro Toxicology Testing Industry Revenue (Billion), by Method 2024 & 2032

- Figure 25: Europe In-Vitro Toxicology Testing Industry Revenue Share (%), by Method 2024 & 2032

- Figure 26: Europe In-Vitro Toxicology Testing Industry Revenue (Billion), by Application 2024 & 2032

- Figure 27: Europe In-Vitro Toxicology Testing Industry Revenue Share (%), by Application 2024 & 2032

- Figure 28: Europe In-Vitro Toxicology Testing Industry Revenue (Billion), by End User 2024 & 2032

- Figure 29: Europe In-Vitro Toxicology Testing Industry Revenue Share (%), by End User 2024 & 2032

- Figure 30: Europe In-Vitro Toxicology Testing Industry Revenue (Billion), by Country 2024 & 2032

- Figure 31: Europe In-Vitro Toxicology Testing Industry Revenue Share (%), by Country 2024 & 2032

- Figure 32: Asia Pacific In-Vitro Toxicology Testing Industry Revenue (Billion), by Technology 2024 & 2032

- Figure 33: Asia Pacific In-Vitro Toxicology Testing Industry Revenue Share (%), by Technology 2024 & 2032

- Figure 34: Asia Pacific In-Vitro Toxicology Testing Industry Revenue (Billion), by Method 2024 & 2032

- Figure 35: Asia Pacific In-Vitro Toxicology Testing Industry Revenue Share (%), by Method 2024 & 2032

- Figure 36: Asia Pacific In-Vitro Toxicology Testing Industry Revenue (Billion), by Application 2024 & 2032

- Figure 37: Asia Pacific In-Vitro Toxicology Testing Industry Revenue Share (%), by Application 2024 & 2032

- Figure 38: Asia Pacific In-Vitro Toxicology Testing Industry Revenue (Billion), by End User 2024 & 2032

- Figure 39: Asia Pacific In-Vitro Toxicology Testing Industry Revenue Share (%), by End User 2024 & 2032

- Figure 40: Asia Pacific In-Vitro Toxicology Testing Industry Revenue (Billion), by Country 2024 & 2032

- Figure 41: Asia Pacific In-Vitro Toxicology Testing Industry Revenue Share (%), by Country 2024 & 2032

- Figure 42: Middle East In-Vitro Toxicology Testing Industry Revenue (Billion), by Technology 2024 & 2032

- Figure 43: Middle East In-Vitro Toxicology Testing Industry Revenue Share (%), by Technology 2024 & 2032

- Figure 44: Middle East In-Vitro Toxicology Testing Industry Revenue (Billion), by Method 2024 & 2032

- Figure 45: Middle East In-Vitro Toxicology Testing Industry Revenue Share (%), by Method 2024 & 2032

- Figure 46: Middle East In-Vitro Toxicology Testing Industry Revenue (Billion), by Application 2024 & 2032

- Figure 47: Middle East In-Vitro Toxicology Testing Industry Revenue Share (%), by Application 2024 & 2032

- Figure 48: Middle East In-Vitro Toxicology Testing Industry Revenue (Billion), by End User 2024 & 2032

- Figure 49: Middle East In-Vitro Toxicology Testing Industry Revenue Share (%), by End User 2024 & 2032

- Figure 50: Middle East In-Vitro Toxicology Testing Industry Revenue (Billion), by Country 2024 & 2032

- Figure 51: Middle East In-Vitro Toxicology Testing Industry Revenue Share (%), by Country 2024 & 2032

- Figure 52: GCC In-Vitro Toxicology Testing Industry Revenue (Billion), by Technology 2024 & 2032

- Figure 53: GCC In-Vitro Toxicology Testing Industry Revenue Share (%), by Technology 2024 & 2032

- Figure 54: GCC In-Vitro Toxicology Testing Industry Revenue (Billion), by Method 2024 & 2032

- Figure 55: GCC In-Vitro Toxicology Testing Industry Revenue Share (%), by Method 2024 & 2032

- Figure 56: GCC In-Vitro Toxicology Testing Industry Revenue (Billion), by Application 2024 & 2032

- Figure 57: GCC In-Vitro Toxicology Testing Industry Revenue Share (%), by Application 2024 & 2032

- Figure 58: GCC In-Vitro Toxicology Testing Industry Revenue (Billion), by End User 2024 & 2032

- Figure 59: GCC In-Vitro Toxicology Testing Industry Revenue Share (%), by End User 2024 & 2032

- Figure 60: GCC In-Vitro Toxicology Testing Industry Revenue (Billion), by Country 2024 & 2032

- Figure 61: GCC In-Vitro Toxicology Testing Industry Revenue Share (%), by Country 2024 & 2032

- Figure 62: South America In-Vitro Toxicology Testing Industry Revenue (Billion), by Technology 2024 & 2032

- Figure 63: South America In-Vitro Toxicology Testing Industry Revenue Share (%), by Technology 2024 & 2032

- Figure 64: South America In-Vitro Toxicology Testing Industry Revenue (Billion), by Method 2024 & 2032

- Figure 65: South America In-Vitro Toxicology Testing Industry Revenue Share (%), by Method 2024 & 2032

- Figure 66: South America In-Vitro Toxicology Testing Industry Revenue (Billion), by Application 2024 & 2032

- Figure 67: South America In-Vitro Toxicology Testing Industry Revenue Share (%), by Application 2024 & 2032

- Figure 68: South America In-Vitro Toxicology Testing Industry Revenue (Billion), by End User 2024 & 2032

- Figure 69: South America In-Vitro Toxicology Testing Industry Revenue Share (%), by End User 2024 & 2032

- Figure 70: South America In-Vitro Toxicology Testing Industry Revenue (Billion), by Country 2024 & 2032

- Figure 71: South America In-Vitro Toxicology Testing Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global In-Vitro Toxicology Testing Industry Revenue Billion Forecast, by Region 2019 & 2032

- Table 2: Global In-Vitro Toxicology Testing Industry Revenue Billion Forecast, by Technology 2019 & 2032

- Table 3: Global In-Vitro Toxicology Testing Industry Revenue Billion Forecast, by Method 2019 & 2032

- Table 4: Global In-Vitro Toxicology Testing Industry Revenue Billion Forecast, by Application 2019 & 2032

- Table 5: Global In-Vitro Toxicology Testing Industry Revenue Billion Forecast, by End User 2019 & 2032

- Table 6: Global In-Vitro Toxicology Testing Industry Revenue Billion Forecast, by Region 2019 & 2032

- Table 7: Global In-Vitro Toxicology Testing Industry Revenue Billion Forecast, by Country 2019 & 2032

- Table 8: United States In-Vitro Toxicology Testing Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 9: Canada In-Vitro Toxicology Testing Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 10: Mexico In-Vitro Toxicology Testing Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 11: Global In-Vitro Toxicology Testing Industry Revenue Billion Forecast, by Country 2019 & 2032

- Table 12: Brazil In-Vitro Toxicology Testing Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 13: Mexico In-Vitro Toxicology Testing Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 14: Rest of South America In-Vitro Toxicology Testing Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 15: Global In-Vitro Toxicology Testing Industry Revenue Billion Forecast, by Country 2019 & 2032

- Table 16: Germany In-Vitro Toxicology Testing Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 17: United Kingdom In-Vitro Toxicology Testing Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 18: France In-Vitro Toxicology Testing Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 19: Italy In-Vitro Toxicology Testing Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 20: Spain In-Vitro Toxicology Testing Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 21: Rest of Europe In-Vitro Toxicology Testing Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 22: Global In-Vitro Toxicology Testing Industry Revenue Billion Forecast, by Country 2019 & 2032

- Table 23: China In-Vitro Toxicology Testing Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 24: Japan In-Vitro Toxicology Testing Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 25: India In-Vitro Toxicology Testing Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 26: South Korea In-Vitro Toxicology Testing Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 27: Taiwan In-Vitro Toxicology Testing Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 28: Australia In-Vitro Toxicology Testing Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 29: Rest of Asia-Pacific In-Vitro Toxicology Testing Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 30: Global In-Vitro Toxicology Testing Industry Revenue Billion Forecast, by Country 2019 & 2032

- Table 31: Middle East In-Vitro Toxicology Testing Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 32: Africa In-Vitro Toxicology Testing Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 33: Global In-Vitro Toxicology Testing Industry Revenue Billion Forecast, by Technology 2019 & 2032

- Table 34: Global In-Vitro Toxicology Testing Industry Revenue Billion Forecast, by Method 2019 & 2032

- Table 35: Global In-Vitro Toxicology Testing Industry Revenue Billion Forecast, by Application 2019 & 2032

- Table 36: Global In-Vitro Toxicology Testing Industry Revenue Billion Forecast, by End User 2019 & 2032

- Table 37: Global In-Vitro Toxicology Testing Industry Revenue Billion Forecast, by Country 2019 & 2032

- Table 38: United States In-Vitro Toxicology Testing Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 39: Canada In-Vitro Toxicology Testing Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 40: Mexico In-Vitro Toxicology Testing Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 41: Global In-Vitro Toxicology Testing Industry Revenue Billion Forecast, by Technology 2019 & 2032

- Table 42: Global In-Vitro Toxicology Testing Industry Revenue Billion Forecast, by Method 2019 & 2032

- Table 43: Global In-Vitro Toxicology Testing Industry Revenue Billion Forecast, by Application 2019 & 2032

- Table 44: Global In-Vitro Toxicology Testing Industry Revenue Billion Forecast, by End User 2019 & 2032

- Table 45: Global In-Vitro Toxicology Testing Industry Revenue Billion Forecast, by Country 2019 & 2032

- Table 46: Germany In-Vitro Toxicology Testing Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 47: United Kingdom In-Vitro Toxicology Testing Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 48: France In-Vitro Toxicology Testing Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 49: Italy In-Vitro Toxicology Testing Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 50: Spain In-Vitro Toxicology Testing Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 51: Rest of Europe In-Vitro Toxicology Testing Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 52: Global In-Vitro Toxicology Testing Industry Revenue Billion Forecast, by Technology 2019 & 2032

- Table 53: Global In-Vitro Toxicology Testing Industry Revenue Billion Forecast, by Method 2019 & 2032

- Table 54: Global In-Vitro Toxicology Testing Industry Revenue Billion Forecast, by Application 2019 & 2032

- Table 55: Global In-Vitro Toxicology Testing Industry Revenue Billion Forecast, by End User 2019 & 2032

- Table 56: Global In-Vitro Toxicology Testing Industry Revenue Billion Forecast, by Country 2019 & 2032

- Table 57: China In-Vitro Toxicology Testing Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 58: Japan In-Vitro Toxicology Testing Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 59: India In-Vitro Toxicology Testing Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 60: Australia In-Vitro Toxicology Testing Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 61: South Korea In-Vitro Toxicology Testing Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 62: Rest of Asia Pacific In-Vitro Toxicology Testing Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 63: Global In-Vitro Toxicology Testing Industry Revenue Billion Forecast, by Technology 2019 & 2032

- Table 64: Global In-Vitro Toxicology Testing Industry Revenue Billion Forecast, by Method 2019 & 2032

- Table 65: Global In-Vitro Toxicology Testing Industry Revenue Billion Forecast, by Application 2019 & 2032

- Table 66: Global In-Vitro Toxicology Testing Industry Revenue Billion Forecast, by End User 2019 & 2032

- Table 67: Global In-Vitro Toxicology Testing Industry Revenue Billion Forecast, by Country 2019 & 2032

- Table 68: Global In-Vitro Toxicology Testing Industry Revenue Billion Forecast, by Technology 2019 & 2032

- Table 69: Global In-Vitro Toxicology Testing Industry Revenue Billion Forecast, by Method 2019 & 2032

- Table 70: Global In-Vitro Toxicology Testing Industry Revenue Billion Forecast, by Application 2019 & 2032

- Table 71: Global In-Vitro Toxicology Testing Industry Revenue Billion Forecast, by End User 2019 & 2032

- Table 72: Global In-Vitro Toxicology Testing Industry Revenue Billion Forecast, by Country 2019 & 2032

- Table 73: South Africa In-Vitro Toxicology Testing Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East In-Vitro Toxicology Testing Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 75: Global In-Vitro Toxicology Testing Industry Revenue Billion Forecast, by Technology 2019 & 2032

- Table 76: Global In-Vitro Toxicology Testing Industry Revenue Billion Forecast, by Method 2019 & 2032

- Table 77: Global In-Vitro Toxicology Testing Industry Revenue Billion Forecast, by Application 2019 & 2032

- Table 78: Global In-Vitro Toxicology Testing Industry Revenue Billion Forecast, by End User 2019 & 2032

- Table 79: Global In-Vitro Toxicology Testing Industry Revenue Billion Forecast, by Country 2019 & 2032

- Table 80: Brazil In-Vitro Toxicology Testing Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 81: Argentina In-Vitro Toxicology Testing Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 82: Rest of South America In-Vitro Toxicology Testing Industry Revenue (Billion) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the In-Vitro Toxicology Testing Industry?

The projected CAGR is approximately 7.10%.

2. Which companies are prominent players in the In-Vitro Toxicology Testing Industry?

Key companies in the market include Covance, Promega Corporation, Merck KGaA, Eurofins Scientific, GE Healthcare, Abbott Laboratories, Quest Diagnostics, Thermo Fisher Scientific*List Not Exhaustive, Bio-Rad Laboratories, Agilent Technologies.

3. What are the main segments of the In-Vitro Toxicology Testing Industry?

The market segments include Technology, Method, Application, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Billion as of 2022.

5. What are some drivers contributing to market growth?

; Opposition to the Usage of Animals in Pre-clinical Research; Significant Advancements In-vitro Toxicology Assays; Increasing Awareness Regarding Drug Product Safety.

6. What are the notable trends driving market growth?

Cell Culture is Expected to Hold Significant Market Share in the Technology Type.

7. Are there any restraints impacting market growth?

; Incapability of In-vitro Models to Determine Autoimmunity and Immunostimulation; Stringent Regulatory Framework for the In-vitro Tests.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "In-Vitro Toxicology Testing Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the In-Vitro Toxicology Testing Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the In-Vitro Toxicology Testing Industry?

To stay informed about further developments, trends, and reports in the In-Vitro Toxicology Testing Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence